Professional Documents

Culture Documents

E - Tutorial TDS TCS Demand Payment With Challan ITNS 281

Uploaded by

Prasad IyengarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E - Tutorial TDS TCS Demand Payment With Challan ITNS 281

Uploaded by

Prasad IyengarCopyright:

Available Formats

E-Tutorial

1. Important Information for “Online TDS/TCS/Demand Payment With

Challan ITNS 281”.

2. Brief steps for “Online TDS/TCS/Demand Payment With Challan

ITNS 281”.

3. Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan

ITNS 281”.

Copyright © 2016 Income Tax Department 1

• Challan No. ITNS 281 is used by the Deductors to deposit Tax Deducted at source/Tax Collected Source (TDS/TCS)

and Demand Payment.

• User should have Internet Banking Account in order to avail facility of Online payment of Challans.

• Following details required to be filled while payment of Challan ITNS-281:

1. Tax Applicable:-This column has two options:

0020: This is applicable in the case of income tax of companies ( If Deductee is company).

0021: This is applicable to income tax for other than companies (If Deductee is not a company i.e. an individual, HUF,

partnership firm, etc.).

2. Assessment Year.

3. TAN No., Name and Address

4. Type of Payment:

200 ( TDS/TCS payable by Taxpayer)

400 ( TDS/TCS payable regular Assessment).

Note : In case of Online Demand Payment Deductor can select Minor Head 400 ( TDS/TCS Regular Assessment ).

For TDS/TCS payment Deductor can select Minor Head 200 ( TDS/TCS payable by Taxpayer).

5. Nature of Payment: Deductor has to select Section Code as per the section under which TDS/TCS is deducted.

Copyright © 2016 Income Tax Department 2

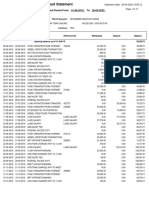

2. Brief Steps for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Go to www.tin –nsdl .com website .

Step 1: Click on “ e- payment Pay Taxes Online” available at home page under “Services” tab.

Step 2: Select Challan ITNS 281 for Demand payment from the list. Challan ITNS-281 Form will appear.

Step 3: Select Major Head (0020/0021), Enter valid 10-digit Tax Deduction and Collection Account Number (TAN), Assessment

Year, Address. Minor Head/Type of Payment (200/400), Nature of payment, Mode of Payment & Bank Name then Click on

“Proceed” button.

Step 4: Confirmation Screen will appear to confirm the details entered in Challan . On Confirming the details entered in Challan.

Click on “Submit to Bank” button.

Step 5: Deductor will be re-directed to the Internet- Banking site of the bank. Enter the User- ID and Password provided by the

bank.

Step 6: Enter payment details at Bank website and make the TDS payment.

Note: On Successful payment , A Challan counterfoil will be generated containing Challan Identification Number (CIN),

payment details and Bank Name through which e- Payment has been made. This counterfoil is proof of payment being

made.

Copyright © 2016 Income Tax Department 3

3. Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Go to www.tin –nsdl .com website . Home page will be displayed.

Home Page of

“tin-nsdl” site

Copyright © 2016 Income Tax Department 4

3. Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 1: Click on “ e- payment Pay Taxes Online” available at home page and under “Services” tab.

Click on

“Services” tab

Click on “e-payment

Pay Taxes Online”

option available under

“Services” tab .

Copyright © 2016 Income Tax Department 5

3.Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 2: Select Challan ITNS 281 for TDS/TCS/Demand payment from the list.

Select Challan ITNS

281 from the list.

Copyright © 2016 Income Tax Department 6

3.Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 2 (Contd..) : Challan ITNS-281 Form will appear.

Challan ITNS-281

Form will appear.

Copyright © 2016 Income Tax Department 7

3.Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 3: Fill in the required details such as Major Head, TAN No., Address, Assessment Year, Minor Head, Nature of

Payment Mode of Payment and Bank Name then Click on “Proceed”.

Fill in the required details

such as Major Head, TAN no.,

Address, Assessment Year,

Minor Head, Nature of

Payment Mode of Payment

and Bank Name then Click on

“Proceed”.

Click on

“Proceed”.

Copyright © 2016 Income Tax Department 8

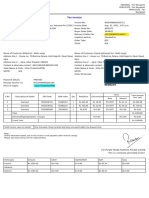

3.Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 4: Confirmation Screen will appear to confirm the details entered in Challan . On Confirming the details entered in

Challan click on “Submit to Bank”.

Confirmation Screen

will appear to

confirm the details

On Confirming the entered in Challan.

details entered Click

on “Submit to Bank”

Click on “Edit” to

edit the details

entered in Challan.

Copyright © 2016 Income Tax Department 9

3.Pictorial Guide for “Online Payment With Challan ITNS 281”.

Step 5: After clicking on “Submit to the Bank” button, Deductor will be re-directed to the Internet- Banking site of the Chosen bank. Enter

the User- ID and Password provided by the bank.

Enter the User- ID

and Password

provided by the

bank.

Copyright © 2016 Income Tax Department 10

3.Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Step 6: Enter payment details at Bank website and make the Demand Payment.

Enter payment

Click on

details at

Continue to

Bank website.

Click on “Calculate make the

Total Amount” button payment.

Click on “Reject” to

to get Total Amount reject the payment.

mentioned

Note: On Successful payment , A Challan counterfoil will be generated containing “Challan Identification

Number” (CIN), payment details and Bank Name through which e- Payment has been made. This

counterfoil is proof of payment being made.

Copyright © 2016 Income Tax Department 11

THANK YOU

Please Note:

1) For Feedback : You can share your feedback on contactus@tdscpc.gov.in

2) For any Query : You can raise your concern on “Request for Resolution” as Online Grievance on

TRACES Website.

3) For any query related to website: You can raise your concern on below mentioned numbers

Toll Free Number - 1800103 0344

Land Line Number - 0120 4814600

Copyright © 2016 Income Tax Department 12

You might also like

- Epayment Syndicate BankDocument2 pagesEpayment Syndicate BankCommerce Adda ConsultancyNo ratings yet

- E-Tutorial - RefundDocument33 pagesE-Tutorial - RefundPrasad IyengarNo ratings yet

- E-Living - Part IDocument7 pagesE-Living - Part IGanesh BalagurunathanNo ratings yet

- User Manual For Direct Tax Online Payments: Author: Electronic Banking Solutions Team Date: 23/02/2008Document12 pagesUser Manual For Direct Tax Online Payments: Author: Electronic Banking Solutions Team Date: 23/02/2008HeliumByBGC AccountsNo ratings yet

- Steps To Pay Income Tax OnlineDocument6 pagesSteps To Pay Income Tax OnlineSarthak AroraNo ratings yet

- 20 - Proof Submission User ManualDocument18 pages20 - Proof Submission User ManualkalpNo ratings yet

- FIRS TCC PortalUser ManualDocument18 pagesFIRS TCC PortalUser ManualJOSEPH REGINALDNo ratings yet

- 15 - Proof Submission User ManualDocument19 pages15 - Proof Submission User ManualJIH KazipetNo ratings yet

- Dos and Dont's For Depositing Tax: Tax Deduction at SourceDocument2 pagesDos and Dont's For Depositing Tax: Tax Deduction at Sourcesalonid17No ratings yet

- E Pay Eng Procedure FinalDocument14 pagesE Pay Eng Procedure FinalpavanNo ratings yet

- COC 101 PrintingofBirthCertificateDocument12 pagesCOC 101 PrintingofBirthCertificateSathya HariNo ratings yet

- NTN Procedure FinalDocument5 pagesNTN Procedure FinalTalhaNo ratings yet

- User Guide: Etax PaymentDocument15 pagesUser Guide: Etax PaymentBhargav BhutNo ratings yet

- ITR1 - Part 5 (E-Pay Income Tax)Document1 pageITR1 - Part 5 (E-Pay Income Tax)gaurav gargNo ratings yet

- Guidance Note On TDS On Property, Payment Procedure & Points To RememberDocument6 pagesGuidance Note On TDS On Property, Payment Procedure & Points To RememberAman VermaNo ratings yet

- Tamil Nadu E-District: Application Training ManualDocument12 pagesTamil Nadu E-District: Application Training ManualDhiliban SwaminathanNo ratings yet

- Allied Bank: Internet Banking User Guide V2.0Document16 pagesAllied Bank: Internet Banking User Guide V2.0Muzna FaisalNo ratings yet

- Texnet Electronic Funds Transfer: Health and Human Services CommissionDocument6 pagesTexnet Electronic Funds Transfer: Health and Human Services CommissionJermaine BrownNo ratings yet

- Online TISSForm Instruction Revenue GatewayDocument7 pagesOnline TISSForm Instruction Revenue GatewayisayaNo ratings yet

- Online Land Revenue Payment (E-Pauti) : OME AGEDocument10 pagesOnline Land Revenue Payment (E-Pauti) : OME AGEpksjNo ratings yet

- Guidelines For Payment On URA PortalDocument3 pagesGuidelines For Payment On URA Portalzhong qing MaNo ratings yet

- TS ICET User Guide-2023Document25 pagesTS ICET User Guide-2023Nody Nody1No ratings yet

- Tamil Nadu E-District: Application Training ManualDocument21 pagesTamil Nadu E-District: Application Training ManualJijiPanNo ratings yet

- How To Pay Income Tax OnlineDocument9 pagesHow To Pay Income Tax OnlinemariaNo ratings yet

- E-Filing Process Brief - Ver1Document16 pagesE-Filing Process Brief - Ver1Duniya da RajaNo ratings yet

- Digital Signature Certificate User Manual: WWW - Taxgenius.co - inDocument12 pagesDigital Signature Certificate User Manual: WWW - Taxgenius.co - inTapan MazumderNo ratings yet

- Texnet Electronic Funds Transfer: Unclaimed PropertyDocument6 pagesTexnet Electronic Funds Transfer: Unclaimed PropertyEAZY CHARNo ratings yet

- CBIC-ICEGATE For CE and ST NEFT RTGS Payment AdvisoryDocument37 pagesCBIC-ICEGATE For CE and ST NEFT RTGS Payment AdvisoryS.P. GoelNo ratings yet

- TDS Statement Upload/View - User ManualDocument11 pagesTDS Statement Upload/View - User ManualVishal KesharwaniNo ratings yet

- Title: Its-I012 - Tax Deduction at Source Entry PurposeDocument8 pagesTitle: Its-I012 - Tax Deduction at Source Entry PurposeBhuwan SharmaNo ratings yet

- Tax. 23Document18 pagesTax. 23RahulNo ratings yet

- Functional Steps To Use Efiling &epaymentDocument66 pagesFunctional Steps To Use Efiling &epaymentAmanuelNo ratings yet

- User Manual Trust Money V1Document24 pagesUser Manual Trust Money V1Iftekhar Hasnat ShaonNo ratings yet

- Digital Signature Certificate User Manual: WWW - Taxgenius.co - inDocument11 pagesDigital Signature Certificate User Manual: WWW - Taxgenius.co - inR G InstituteNo ratings yet

- Instructions User Manual For Citizens To Pay Property Tax-BSKDocument6 pagesInstructions User Manual For Citizens To Pay Property Tax-BSKvinayakNo ratings yet

- Guide For Submitting TCC Application OnlineDocument6 pagesGuide For Submitting TCC Application OnlineSuresh PedapudiNo ratings yet

- For Example:: Code Ustar Reference NumberDocument3 pagesFor Example:: Code Ustar Reference Numberoz fmc3No ratings yet

- Citi Bank 2021 StatementsDocument2 pagesCiti Bank 2021 StatementsJohn call67% (3)

- Canara Bank Net Banking User GuideDocument8 pagesCanara Bank Net Banking User GuiderajandixitNo ratings yet

- E-Payment Guide LinesDocument2 pagesE-Payment Guide LinesaskNo ratings yet

- Esic Online ChallanDocument26 pagesEsic Online ChallanahtradaNo ratings yet

- E TDS ManualDocument30 pagesE TDS ManualJeetendra ShresthaNo ratings yet

- Eservices Hand BookDocument30 pagesEservices Hand Bookrchowdhury_10No ratings yet

- Online Billing User Guide v1 0Document35 pagesOnline Billing User Guide v1 0yudhaNo ratings yet

- CSCOperator REV-118 SolvencyCertificateDocument26 pagesCSCOperator REV-118 SolvencyCertificateSivasankarNo ratings yet

- Lampiran 1Document32 pagesLampiran 1Nazariah MaharuddinNo ratings yet

- EChallan ManualDocument4 pagesEChallan ManualUtkarsh GuptaNo ratings yet

- EpayDocument17 pagesEpayShrinivas PrabhuneNo ratings yet

- Online Invoicing User GuideDocument21 pagesOnline Invoicing User GuideBogdanNo ratings yet

- E-TdsDocument58 pagesE-TdsRohan JainNo ratings yet

- Guide For Contribution Payment Via Bill PaymentDocument8 pagesGuide For Contribution Payment Via Bill Paymentaro717No ratings yet

- 007QB - Chapter 3 - Setting Accounting DefaultsDocument24 pages007QB - Chapter 3 - Setting Accounting DefaultsJoseph SalidoNo ratings yet

- User Guide - TS Ecet-2019Document17 pagesUser Guide - TS Ecet-2019OLLURI ROHITNo ratings yet

- User Manual NBPDCL - Quick Bill PaymentDocument8 pagesUser Manual NBPDCL - Quick Bill PaymentALOK KUMARNo ratings yet

- Personal EStatementsHowToDocument1 pagePersonal EStatementsHowToMuhammad HanifNo ratings yet

- Centralized Cash Dividend Register (CCDR) : Guidelines To Register ForDocument1 pageCentralized Cash Dividend Register (CCDR) : Guidelines To Register Forراجہ اویس احمدNo ratings yet

- GST Payment - Step by Step ProcessDocument5 pagesGST Payment - Step by Step Processnilesh nayeeNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- CGST Rules 2017 Part B FormsDocument424 pagesCGST Rules 2017 Part B FormsPrasad IyengarNo ratings yet

- All Sections of Income Tax Act 1961Document37 pagesAll Sections of Income Tax Act 1961Prasad IyengarNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePrasad IyengarNo ratings yet

- Electricity Bill Payment ReceiptDocument1 pageElectricity Bill Payment ReceiptPrasad IyengarNo ratings yet

- 18bco23c U3Document17 pages18bco23c U3Prasad IyengarNo ratings yet

- 12 Accountancy Revision Notes Part B CH 1Document20 pages12 Accountancy Revision Notes Part B CH 1Prasad IyengarNo ratings yet

- E-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyDocument38 pagesE-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyPrasad IyengarNo ratings yet

- Procedure To Download 197 Certificate (Deductor Login)Document19 pagesProcedure To Download 197 Certificate (Deductor Login)Prasad IyengarNo ratings yet

- Online Challan Correction - Edit Deductee Row in Case of Unmatched ChallanDocument39 pagesOnline Challan Correction - Edit Deductee Row in Case of Unmatched ChallanPrasad IyengarNo ratings yet

- E-Tutorial - Request For ResolutionDocument12 pagesE-Tutorial - Request For ResolutionPrasad IyengarNo ratings yet

- E-Tutorial - Online Correction - Personal InformationDocument33 pagesE-Tutorial - Online Correction - Personal InformationPrasad IyengarNo ratings yet

- November 2019 ComricaDocument4 pagesNovember 2019 Comricaproemail632No ratings yet

- Inv 81386795 202308260801Document1 pageInv 81386795 202308260801kevinwrites28No ratings yet

- MJ Lhuiller vs. CIRDocument3 pagesMJ Lhuiller vs. CIRKRISIA MICHELLE ORENSENo ratings yet

- 410 For BhiwandiDocument9 pages410 For BhiwandirajasmudafaleNo ratings yet

- Technology Terhadap Aplikasi Electronic Wallet Milik BUMN)Document15 pagesTechnology Terhadap Aplikasi Electronic Wallet Milik BUMN)ROVITA NILASARINo ratings yet

- Bill TriDocument1 pageBill TrifajarNo ratings yet

- Sss Hemant 562Document1 pageSss Hemant 562msNo ratings yet

- Gratuity Trust - BenefitsDocument10 pagesGratuity Trust - BenefitsManoj Kumar KoyalkarNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sanchita KunwerNo ratings yet

- Tax Chronicles Issue 57 FinaDocument26 pagesTax Chronicles Issue 57 FinaMeagen Steven Brown SeidelNo ratings yet

- Vocher 100Document2 pagesVocher 100Arnoto SuryaNo ratings yet

- MashoodnasirDocument17 pagesMashoodnasirmashood nasirNo ratings yet

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNo ratings yet

- Om Clothing Bill-123Document2 pagesOm Clothing Bill-123Rsai KNo ratings yet

- St. Luke's Medical Center, Inc Vs CIRDocument1 pageSt. Luke's Medical Center, Inc Vs CIRVel June50% (2)

- Types: Fringe Benefit Vincent Ryan T. Esteves, Bsa-2Document1 pageTypes: Fringe Benefit Vincent Ryan T. Esteves, Bsa-2Lhorene Hope DueñasNo ratings yet

- Pre-Midterm Examination - TaxationDocument5 pagesPre-Midterm Examination - TaxationCarla Jane ApolinarioNo ratings yet

- 19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestDocument1 page19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestHarleneNo ratings yet

- Financial: 1, AN INDocument9 pagesFinancial: 1, AN INCity Legal OfficeNo ratings yet

- American Bureau of Shipping: Atoh Ntumngia ADocument1 pageAmerican Bureau of Shipping: Atoh Ntumngia AhansNo ratings yet

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDocument2 pagesRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountBISHAN DASSNo ratings yet

- SAMPLE MidtermDocument2 pagesSAMPLE MidtermPatricia Ann GuetaNo ratings yet

- Version 2309Document1 pageVersion 2309kevin cosnerNo ratings yet

- Fee Challan MS-PPT Fall 2020 & Spring 2021Document10 pagesFee Challan MS-PPT Fall 2020 & Spring 2021fahad arifNo ratings yet

- Axis Neft-Rtgs FormDocument3 pagesAxis Neft-Rtgs Formraghavjindal.spenzaNo ratings yet

- Receipt 87439751Document1 pageReceipt 87439751QasimNo ratings yet

- Tax Invoice: For Purple Panda Fashions Private LimtedDocument1 pageTax Invoice: For Purple Panda Fashions Private LimtedBiswajeetNo ratings yet

- Eliud Kitime, Laws of Taxation in TanzaniaDocument425 pagesEliud Kitime, Laws of Taxation in Tanzaniajonasharamba6No ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet