Professional Documents

Culture Documents

12 Economics Sp03

Uploaded by

devilssksokoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Economics Sp03

Uploaded by

devilssksokoCopyright:

Available Formats

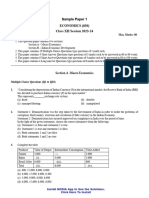

CBSE

Class 12 Economics

Sample Paper 03 (2019-20)

Maximum Marks: 80

Time Allowed: 3 hours

General Instructions:

i. All the questions in both the sections are compulsory. Marks for questions are indicated

against each question.

ii. Question number 1 - 10 and 18 - 27 are very short-answer questions carrying 1 mark

each. They are required to be answered in one word or one sentence each.

iii. Question number 11 - 12 and 28 - 29 are short-answer questions caring 3 marks each.

Answers to them should not normally exceed 60-80 words each.

iv. Question number 13 - 15 and 30 - 32 are also short-answer questions carrying 4 marks

each. Answers to them should not normally exceed 80-100 words each.

v. Question number 16 - 17 and 33 - 34 are long answer questions carrying 6 marks each.

Answers to them should not normally exceed 100-150 words each.

vi. Answer should be brief and to the point and the above word limit be adhered to as far as

possible.

Section A

1. Fill in the blanks:

In a ________ system, the rate of a tax falls as the tax base increases.

2. What do you mean by circular flow of income?

3. In S= -a+ (1-b) Y, -a represents

a. The amount of savings done when there is high level of income.

b. The amount of dissavings done when there is high level of income.

c. The amount of dissavings done when there is zero level of income.

Material downloaded from myCBSEguide.com. 1 / 19

d. The amount of savings done when there is zero level of income.

4. What is forward market?

OR

What is spot market?

5. Borrowings by govt.

a. Revenue Receipts

b. Capital Expenditure

c. Capital Receipts

d. Revenue Expenditure

6. Fill in the blanks:

If disposable income is ₹1000 and consumption expenditure is ₹750, the value of

average propensity to save will be ________.

7. Fill in the blanks:

________ is the gap showing deficient of current aggregate demand over ‘aggregate

supply at the level of full employment'.

8. State true or false:

Excess of foreign exchange payments on account of accommodating transactions

equals deficit in BOP.

9. Fill in the blanks:

_________ refers to the excess of revenue expenditure of the government over its

revenue receipts.

10. Match the following-:

(a) Plan expenditure (i) salaries

Material downloaded from myCBSEguide.com. 2 / 19

(b) Revenue expenditure (ii) emergency war expenses

(c) Capital expenditure (iii) construction of hospital by govt.

(d) Non plan expenditure (iv) purchase of shares by govt.

11. Explain any two objectives of government budget.

12. In an economy, income increases by 10,000 as a result of a rise in investment

expenditure by 1,000. Calculate:

a. Investment Multiplier

b. Marginal Propensity to Consume.

OR

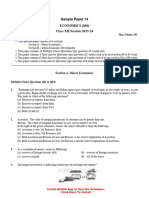

Complete the following table.

Income Marginal Propensity to Saving Average Propensity to

(Y) Consume (MPC) (S) Consume (APC)

0 -30

100 0.75 .......... ..........

200 0.75 .......... ..........

300 0.75 .......... ...........

13. Explain the banker to the Government9 function of the Central bank.

14. International trade patterns take time to respond to changes in exchange rates. A

considerable period of time may elapse before any improvement in net exports is

apparent. In the light of the above statement, explain the concept of "Exchange Rate

Changes"

OR

Are the following entered (i) on the credit side or the debit side and (ii) in the current

account or capital account in the Balance of Payments account?

Material downloaded from myCBSEguide.com. 3 / 19

You must give reasons for your answer.

i. Investments from abroad.

ii. Transfer of funds to relatives abroad.

15. From the following data about a government budget find (a) revenue deficit, (b) fiscal

deficit and (c) primary deficit.

(Rs. arab)

(i) Plan capital expenditure 120

(ii) Revenue expenditure 100

(iii) Non-plan capital expenditure 80

(iv) Revenue receipts 70

(v) Capital receipts net of borrowing 80

(vi) Interest payments 30

16. (i) Although India’s GDP is increasing but the welfare of the people is not increasing

with that pace. Do you think the concept of “Green GNP” should be followed?

(ii) Calculate a) GDPFC from the following data

Items Rs (in crores)

i) Rent 1400

ii) Royalty 200

iii) Interest 1500

iv) Wages and salaries 800

v) Profit 500

vi) Mixed-income 1000

vii) Depreciation 70

viii) Employer’s contribution to social security schemes 200

OR

Material downloaded from myCBSEguide.com. 4 / 19

From the following data calculate,

a. Gross Domestic Product at Market Price and

b. Factor Income to Abroad

Items (Rs.in Crore)

Compensation of employees 1000

Net exports (-) 50

Profits 400

Interest 250

Rent 150

Gross national product at factor cost 1850

Gross domestic capital formation 220

Net fixed capital formation 150

Change in stock 20

Factor income from abroad 30

Net indirect taxes 100

17. In an economy, C = 200+ 0.9 Y is the consumption function, (where, C - Consumption

expenditure and Y = National Income) and investment expenditure is Rs. 3,000.

Calculate

i. Equilibrium level of National Income

ii. Consumption Expenditure at equilibrium level of National Income

Section B

18. Name two services outsourced in India.

19. State true or false:

In human capital, investment in education and health is unproductive if it does not

enhance output of goods and services.

Material downloaded from myCBSEguide.com. 5 / 19

20. Match the following-:

(a) Industrial Development & Regulation Act (i) 1956

(b) Monopolistic & Restrictive Trade Practices Act (ii) 1973

(c) Industrial Policy (iii) 1969

(d) Foreign Exchange Regulation Act (iv) 1951

21. Micro credit programme

a. None

b. Credit provision made by large farmers

c. Credit provisions made by self-help group to its members

d. Credit provision made by small farmers

22. Fill in the blanks:

An arrangement in which a worker sells his labour and earns wages in return is

known as ________.

OR

Fill in the blanks:

Infrastructure is divided into two category which are economic and __________

infrastructure.

23. Fill in the blanks:

________ was a strategy launched in October 1965 for an increase in agricultural

output.

24. Which state has lowest percentage of population living below poverty line?

a. Kerala

Material downloaded from myCBSEguide.com. 6 / 19

b. Punjab

c. Haryana

d. Goa

25. Fill in the blanks:

________ refers to the rate of assimilation at which the environment can maintain

itself.

26. All production unit engaged in transforming one good into another is called

a. Primary sector

b. Secondary sector

c. None

d. Tertiary sector

27. Quality life index is prepared by UNDP for how many countries

a. 185

b. 186

c. 188

d. 187

28. Reversal of supply-demand relationship has had a major effect on the degradation of

the quality of environment. Elaborate.

OR

Expansion of one industry facilitates the expansion of the other. How economic

growth can become a dynamic process and a self-propelling activity of change?

29. ‘India is going to be a knowledge-based economy in the near future’. Discuss.

30. Why has the industrial sector performed poorly in the reform period?

31. What were the main shortcomings of IPR 1956?

Material downloaded from myCBSEguide.com. 7 / 19

OR

What were the objectives behind Trade and Investment Policy reforms?

32. Study the following data and answer the questions.

estimated annual growth of

density(per Sex

Country population(in population(2001- urbanisation

sq.km.) ratio

millions) 10)

India 1210 1.76 382 940 31.2

China 1339 0.47 143 950 51.3

Pakistan 176.2 1.8 225 952 37.2

Identify two demographic parameters in favour of China and also write reforms taken

by china to achieve the same.

33. Explain three defects of agriculture of marketing.

34. Do you agree with the statement that India has built up health infrastructure and has

made considerable progress in improving the health of its population? Explain the

advancements in this sector.

OR

What do you mean by organised sector? Discuss the reasons for fall in employment in

organised sector.

Material downloaded from myCBSEguide.com. 8 / 19

CBSE Class 12 Economics

Sample Paper 03 (2019-20)

Solution

Section A

1. Regressive Tax

2. It refers to the unending flow of the activities of production, income generation and

expenditure involving different sectors of the economy, producers and households in

particular.

3. (c) The amount of dissavings done when there is zero level of income.

Explanation: Here, -a implies dissavings when level of income is zero.

4. It deals with such sale and purchase of foreign exchange which is contracted

today but is implemented sometimes in the future. It defines forward rate of

exchange.

OR

It deals with current rate and purchase of foreign exchange. It defines spot rate of

exchange.

5. (c) Capital Receipts

Explanation: The borrowings by the govt creates liability. So borrowing by the govt

Material downloaded from myCBSEguide.com. 9 / 19

comes under capital receipts.

6. 0.25

7. Deflationary gap

8. False

9. Revenue deficit

10. (a) - (iii), (b) - (i), (c) - (iv), (d) - (ii)

11. i. Economic stability: Government budget is used to prevent business fluctuations

of inflation or deflation to achieve the objective of economic stability. The

government aims to control the different phases of business fluctuations through

its budgetary policy. Policies of the surplus budget during inflation and deficit

budget during deflation helps to maintain the stability of prices in the economy.

ii. Re-distribution of income: Reducing inequality is a major objective of

government's budget especially in developing country like India, where inequality

of income and wealth is very high. Government uses its financial tools of taxation

and subsidies to enhance equal distribution of income and wealth. In order to

ensure equity of income, the progressive tax structure is followed in India, which

imposes a higher burden of taxes on higher-income group and a lesser burden on

lower-income group. Also, those who earn below a substantial limit are exempted

from payment of taxes. The additional income generated from the higher income

group is re-distributed by the government in the form of subsidies to the poor

sections of the society, to ensure the objective of welfare. LPG subsidy is a good

example of such re-distribution of income.

12. Increase in income ( Y) = Rs.10,000

Increase in investment ( I) = RS, 1,000

Investment multiplier = ?

a. Investment multiplier = 10

b. K

10

Material downloaded from myCBSEguide.com. 10 / 19

MPC = 0.9

OR

Change Marginal Change in Average

Income in Propensity Consumption Consumption Saving Propensity

(Y) Income to Consume Expenditure ( (C) (S) to

( Y) (MPC) C) Consume

0 0 - - 30 -30 -

100 100 0.75 75 105 -5 1.05

200 100 0.75 75 180 20 0.9

300 100 0.75 75 45 45 0.85

Formulae used

S= Y-C, APC = C /Y, C = MPC X Y.

13. The Central bank acts as a banker to the central and state government. Central bank is

a banker, agent and financial adviser to the government.

1. As a banker: Central bank performs the same function for the government as

commercial banks perform for their customers. It maintains the accounts of the

central as well as the state governments. It receives deposits from the government

and makes short term advances to the government. It collects cheques and drafts

deposited in the government accounts.

2. As a Fiscal agent: The central bank collects taxes and other payments on behalf of

the government. It raises loans from the public and thus manages public debt.

3. As a Financial adviser: The central bank gives advice to the government on

economic, monetary, financial and fiscal matters such as deficit financing,

devaluation, trade policy and foreign exchange etc. According to De Kock, “The

central bank operates as govt’s banker because of the intimate connection

between public finance and monetary affairs”.

14. International trade patterns take time to respond to changes in exchange rates. A

considerable period of time may elapse before any improvement in net exports is

Material downloaded from myCBSEguide.com. 11 / 19

apparent. The following points explain the concept of Exchange rate changes:

The exchange rate is one of the most important determinants of a country. It

plays a vital role in the country’s level of trade.

Changes in nominal exchange rates would change the real exchange rate and

hence international relative prices.

A depreciation of the rupee will raise the cost of buying foreign goods and

make domestic goods less costly. This will raise net exports and therefore

increase aggregate demand.

Conversely, a currency appreciation would reduce net exports and, therefore,

decrease aggregate demand.

OR

i. Investments from abroad: In a capital account, such investments are entered

in the credit side because they increase the assets of the country by increasing the

flow of foreign exchange in the country.

ii. Transfer of funds to relatives abroad: In a current account, such funds are

entered on the debit side as they result in an outflow of domestic currency with no

returns.

15. (a) Revenue deficit = revenue expenditure - revenue receipts = 100 - 70 = 30 arabs.

(b) Fiscal deficit = total expenditure (revenue expenditure + capital expenditure) -

(revenue receipts + non debt capital receipts) = 100 + 120 + 80 - 70 - 80 = 150 arabs .

(c) primary deficit = fiscal deficit - interest payments = 150 - 30 = 120 arabs.

16. (i) Yes, the concept of Green GNP can be followed.

a. Green GNP measures national income or Output adjusted for the depletion of

natural resources and degradation of the environment.

b. It will help to attain sustainable use of the natural environment and equitable

distribution of benefits of development. A large number signifies greater

Sustainability.

(ii) NDPFC = Compensation of the employees + Mixed Income of the self employed +

Material downloaded from myCBSEguide.com. 12 / 19

Operating surplus

Compensation of Employees = Wages + Employer's Contribution = 800+200= 1000

Mixed Income of Self Employed = 1000

Operating Surplus = Rent + Royalty + Interest + Profit

=1400+200+1500+500=3600

NDPFC =1000+1000+3600

= Rs 5600 crore

GDPFC = NDPFC + Depreciation

= 5600 + 70

= Rs 5670 Crore

OR

Gross Domestic Product at Market Price (GDPMP):

= Compensation of employees + Operating surplus (Rent + Royalty + Interest + Profit) +

Mixed income + Depreciation + Net Indirect taxes

To calculate depreciation,

Gross Domestic Capital Formation = Net domestic capital formation + Depreciation

Put in equation (i)

1000 + (150 + 250 + 400) + 0 + 50 + 100

GDPMP = Rs.1950 crore

Factor Income to Abroad:

GNPFC = GDPMP - NIT + NFIA

1850 = 1950 - 100 + (Factor income to abroad - Factor income from abroad)

0 = Factor income to abroad - 30

Rs.30 crore = Factor income to abroad

17. i) Given, I = Rs. 3,000 and C = 200+ 0.9 Y

For equilibrium,Income (Y) = Consumption (C) + Investment (I)

Material downloaded from myCBSEguide.com. 13 / 19

Y = C + I

Y = (200 + 0.9 Y) + 3000

Y - 0.9 Y = 3200

or 0.1 Y = 3200

or

or National income (Y) = Rs. 32,000

ii) Given,I = Rs. 3,000 and C = 200+ 0.9 Y

Again, for equilibrium,Income (Y) = Consumption (C) + Investment (I)

Y = C + I

or 32,000 = C + 3,000 [Y = 32000, calculated in (i) ]

or C = 32,000-3,000

or Consumption expenditure (C) = Rs. 29,000

Section B

18. Voice-based business process and banking services are the two services outsourced in

India. Since India is a labour surplus country, MNCs benefit via outsourcing in India.

19. True

20. (a) - (iv), (b) - (iii), (c) - (i), (d) - (ii)

21. (c)

Credit provisions made by self help group to its members

Explanation:

SHGs promote saving habit among rural household.

22. Wage Employment

OR

Social

Material downloaded from myCBSEguide.com. 14 / 19

23. Green revolution

24. (d) Goa

Explanation: Goa has the lowest percentage of people living below the poverty line.

According to the Planning Commission’s recent report. It recorded 5.09 per cent or

about 75,000 poor in Goa which has a 14-lakh population. The monthly per capita

income of the state is Rs 1,090 in rural areas and Rs 1,134 in urban areas. There are

37,000 poor people (6.81%) in rural Goa, while 38,000 (4.09%) in urban Goa.

25. Carrying capacity

26. (b) Secondary sector

Explanation: Secondary sector takes raw materials and converts them into finished

products.

27. (d) 187

Explanation: The Physical Quality of Life Index (PQLI) is an attempt to measure the

quality of life or well-being of a country. The value is the average of three statistics:

basic literacy rate, infant mortality, and life expectancy at age one, all equally

weighted on a 0 to 100 scale.

28. The given statement is true. In the past, the demand for resources was less than their

supply and the rate at which the resources were extracted was less than the rate of

regeneration of these resources. On the other hand, in the present period, the demand

for resources is in excess of supply which means that the demand is beyond the rate

of regeneration of these resources. Their supply is limited due to overuse and misuse.

Thus we see that the issues related to the environment like pollution and waste

generation have become critical today.

OR

Availability of proper means of transport and communication, ample sources of

energy and a developed system of banking and finance generate an environment of

inter-industrial linkages.

In this situation, expansion of one industry facilitates the expansion of the other.

Accordingly, growth becomes a dynamic process and a self-propelling activity of

change. Indian economy has a very large skilled workforce which is still unemployed.

Material downloaded from myCBSEguide.com. 15 / 19

It is the established of industries only, which can generate employment opportunities

on a large scale.

29. India is soon emerging as a knowledge bank and has the potential to become a leading

knowledge-based economy with its youth population and growing information

technology The Indian software industry has been showing an impressive growth

over the past decade. The use of e-mail, e-governance and development of

information technology shows that India is slowly transforming itself into a

knowledge-based economy.

30. The Industrial Sector has performed poorly in the reform period because of

decreasing demand for industrial products due to various reasons such as cheaper

imports, inadequate investment, infrastructure, etc. Following reasons may be

enumerated in this context:

i. Cheaper imports have decreased the demand for domestic industrial goods.

ii. Globalisation created conditions for the free movement of goods and services from

foreign countries that adversely affected the local industries and employment

opportunities in developing countries.

iii. There was an inadequate investment in infrastructural facilities such as power

supply.

iv. A developing country like India still does not have access to developed countries

markets because of high non-tariff barriers.

v. The investment made in infrastructure facilities including power supply has

remained inadequate and hence domestic industries have not found conditions

favourable to compete with foreign goods. Globalisation has led to the free

movement of goods and services from foreign countries and thus, caused the local

industries to die out and employment opportunities to fall in developing countries

like India.

31. There were many shortcomings of IPR 1956.

1. Many industries which could easily be handed over to private sector were kept

under public sector control.

2. Too many industries were covered under license policy which created hurdle in

Material downloaded from myCBSEguide.com. 16 / 19

industrial development.

3. Too many regulations led to low level of industrial development.

4. This Resolution reduced the scope for the expansion of the private sector

significantly. Private sector apprehended that the expansion of public sector

meant swallowing of the private sector.

OR

Trade and investment policy reforms were initiated to:

a. Remove the restrictions on foreign goods and to increase international

competitiveness in Indian markets.

b. Attract foreign investment and to promote the adoption of modern technology into

the economy.

c. Dismantling of quantitative restrictions on imports and exports.

d. Reduction of tariff rates

e. Removal of licensing procedures for imports.

f. To increase the efficiency of domestic market.

32. The two demographic parameters in favour of China are:-

Moderate growth rate of population

Low density of population

Measures taken by china to achieve this are:-

One child policy was adapted by china since 1979 to reduce the growth rate of

the population to nearly half from 1.33% to 0.47% in the recent past.

To control its density of population they focused on the quality of life rather

than the sustenance of the people.

33. 1. Absence of Grading: As a general rule, there is hardly any grading of the

commodities to be marketed. Therefore, the purchaser has little, if any, confidence in

the quality of the product(s). But nothing really has happened. As per the Act, licenses

Material downloaded from myCBSEguide.com. 17 / 19

are issued on a selective basis to reliable merchants, under the supervision and

control of the Government staff. The graded commodities are subsequently passed on

to the market under the label of “AGMARK”.

2. Inadequate Storage and Warehousing Facilities: The average Indian fanner does

not have .adequate storage facilities. Moreover, there is no satisfactory warehousing

facilities in the market. For these two reasons the farmer has to sell his produce

immediately after the harvest. He cannot wait to obtain better prices in the future.

Moreover, due to lack of storage facilities, farmers are unable to obtain loans from co-

operative marketing societies or even commercial banks against the security of the

stored output.

3.Lack of Information: The market for agricultural products in India is not perfectly

competitive in the sense that the farmers do not usually get adequate information

about the price that prevail in big and organised markets. Due to lack of

communication facilities, the information about market prices rarely reaches the

farmers.

34. Yes, India has no doubt made extensive progress in health infrastructure and over the

years we have built up a vast health infrastructure and manpower at different levels.

The same has resulted in the eradication of deadly diseases and it has almost

eradicated polio and leprosy. India has developed a three-tier healthcare system that

takes care of the health needs at all levels.

Tier-1 includes PHC(Primary Health Centres), CHC(Community health centres) and

Sub centres. These are small hospitals set up mostly in small towns and rural areas

and managed by a single doctor and ANM. They educate people on healthcare

facilities, provide immunisation facilities.

Tier-2 includes Secondary Healthcare institutes. These are upgraded compared to

PHCs and have facilities for surgery, ECG and X-rays. They are located in big town and

district headquarters.

Tier-3 includes Tertiary Healthcare Centres. These are high end and fully equipped

medical centres offering specialised medical facilities. This sector also includes

educational and research centres such as AIIMS, NIMHNS etc.

Material downloaded from myCBSEguide.com. 18 / 19

OR

Organised sectors are the sectors where all the policies and regulations formulated by

the Government regarding the general condition of employment are followed.

Various Acts such as the Minimum Wages Act and payment of Gratuity Act are

followed. In the organised sector, people enjoy security of employment. They are

expected to work only for a fixed number of hours and any overtime work is paid.

Paid holidays, provident fund, gratuity and medical benefits are given to the people.

Many facilities such as clean drinking water, proper sanitation and safe working

conditions are ensured to the people.

The organized sector employment which grew 1.2 per cent per annum during 1983-94

recorded much less growth (0.05 per cent) during the post-reform period (1994-2008).

However, the growth rate of GDP accelerated from 5.4 per cent in 1983-1994 to 7.2 per

cent in 1994-2011. Thus, higher output growth failed to generate higher employment

in the nineties and in the first decade of the present century 1994-2011.

During 1994 to 2004-08 there was negative growth in employment in the organised

public sector (-0.65 per cent per annum), whereas in the organised private sector

employment increased at the rate of 1.75 per cent per annum. Thus, in the organised

private sector, the growth in employment was not sufficient to make up for the loss of

jobs in the public sector.

As a result, there was a decline in employment (-0.05 per cent per annum) in the

organised sector in 1999-2000 to 2004-08 despite a quite high growth of output in it.

The much lower growth of employment opportunities is due to the fact that the

employment elasticity of output growth in the organised private sector has sharply

declined in the recent years as a result of an increase in capital intensity. It means

fewer people have been able to participate in and benefit from the growth process in

the organised sector in the post-reform period. The Downsizing of the public sector

also contributed to job losses in organised sector.

Material downloaded from myCBSEguide.com. 19 / 19

You might also like

- 2021 Economics Solved Guess Paper Set 6Document20 pages2021 Economics Solved Guess Paper Set 6NitikaNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- 12 Economics Sp04Document21 pages12 Economics Sp04devilssksokoNo ratings yet

- CBSE Class 12 Economics Sample Paper 02 (2019-20)Document19 pagesCBSE Class 12 Economics Sample Paper 02 (2019-20)Anonymous 01HSfZENo ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- 12 Economcis t2 sp02Document9 pages12 Economcis t2 sp02ShivanshNo ratings yet

- 12 Economics Sp08Document18 pages12 Economics Sp08devilssksokoNo ratings yet

- 12 Economics23 24sp11Document14 pages12 Economics23 24sp11Dr. Anuradha ChugNo ratings yet

- Pre Board Class XII EconomicsDocument6 pagesPre Board Class XII EconomicsShubhamNo ratings yet

- National Income Review Questions PDFDocument30 pagesNational Income Review Questions PDFseverinmsangiNo ratings yet

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarNo ratings yet

- Omn XDu 8 Seiqk 1 OWSs XLNDocument20 pagesOmn XDu 8 Seiqk 1 OWSs XLNAnonymous 01HSfZENo ratings yet

- CBSE Class 12 Economics Sample Paper 01 (2019-20)Document21 pagesCBSE Class 12 Economics Sample Paper 01 (2019-20)Anonymous 01HSfZENo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- GR+XII +Chapter++Test +National+IncomeDocument7 pagesGR+XII +Chapter++Test +National+IncomeAkshatNo ratings yet

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- Delhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Document2 pagesDelhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Lekhana WesleyNo ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- Economics Set I QPDocument4 pagesEconomics Set I QPsaju pkNo ratings yet

- Sample Paper 3Document8 pagesSample Paper 3scorpiondeathdrop115No ratings yet

- 12 Economics23 24sp10Document14 pages12 Economics23 24sp10prakharg503No ratings yet

- SESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsDocument5 pagesSESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsAnupama RawatNo ratings yet

- Economics Term TestDocument4 pagesEconomics Term Testniranjankumar jeyaramanNo ratings yet

- Economics MsDocument8 pagesEconomics Msshobhana jayNo ratings yet

- Most Expected Questions Economics Section A MicroDocument3 pagesMost Expected Questions Economics Section A MicroRaju RanjanNo ratings yet

- Ecovisionnaire Must Do QuestionsDocument6 pagesEcovisionnaire Must Do QuestionsAastha VermaNo ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- EC Sample Paper 1 UnsolvedDocument8 pagesEC Sample Paper 1 Unsolvedhiruh5396No ratings yet

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimNo ratings yet

- EC Sample Paper 20 UnsolvedDocument8 pagesEC Sample Paper 20 Unsolvedmanjotsingh.000941No ratings yet

- Class 12 CBSE Economics Worksheet ABS Vidhya MandhirDocument8 pagesClass 12 CBSE Economics Worksheet ABS Vidhya Mandhiryazhinirekha4444No ratings yet

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941No ratings yet

- EC Sample Paper 3 UnsolvedDocument8 pagesEC Sample Paper 3 Unsolvedsubasree803No ratings yet

- SQP 20 Sets EconomicsDocument160 pagesSQP 20 Sets Economicsmanav18102006No ratings yet

- Economics Revision QuestionsDocument4 pagesEconomics Revision QuestionsDa Solve EriNo ratings yet

- Economics Ms PB 2 Set CDocument9 pagesEconomics Ms PB 2 Set CNirma SoniaNo ratings yet

- EconomicsDocument113 pagesEconomicsdevanshsoni4116No ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- ISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)Document15 pagesISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)hanaNo ratings yet

- Eco Set A XiiDocument6 pagesEco Set A XiicarefulamitNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- Economics-Part 02: Sub Section ADocument6 pagesEconomics-Part 02: Sub Section Ahiranya939509No ratings yet

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceHaseeb AhmadNo ratings yet

- KV MS PP 4-6Document21 pagesKV MS PP 4-6AADHYA KHANNANo ratings yet

- XII Economics Guess Paper - 2Document5 pagesXII Economics Guess Paper - 2kawaljeetsingh121666No ratings yet

- MS Economics Set-7Document7 pagesMS Economics Set-7Vaidehi BagraNo ratings yet

- 9000 Crores. What Is The Value of Exports?Document3 pages9000 Crores. What Is The Value of Exports?V S VIJITHNo ratings yet

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinancesaimNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- MLL For Late Bloomers - Class 12 ECON 2023-24Document59 pagesMLL For Late Bloomers - Class 12 ECON 2023-24nagpalmadhur5No ratings yet

- Chapter 2 QuestionsDocument16 pagesChapter 2 QuestionsAmalin IlyanaNo ratings yet

- Economics 12 2023-1Document31 pagesEconomics 12 2023-1aryantejpal2605No ratings yet

- Same Sex Marriages in IndiaDocument23 pagesSame Sex Marriages in IndiadevilssksokoNo ratings yet

- 12 Economics SP 2Document17 pages12 Economics SP 2devilssksokoNo ratings yet

- 12 Economics SP 1Document13 pages12 Economics SP 1devilssksokoNo ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- 12 Economics Sp08Document18 pages12 Economics Sp08devilssksokoNo ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- Integraty PactDocument1 pageIntegraty PactGhulam Ahmed ParvaizNo ratings yet

- DEFENCE Account CODE PDFDocument12 pagesDEFENCE Account CODE PDFkhaja1988No ratings yet

- PunchesDocument25 pagesPunchesJhoanne NagutomNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- Problem Set 4Document3 pagesProblem Set 4Luca VanzNo ratings yet

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocument13 pagesMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDrMichelleHutchinsonwdimp100% (18)

- 公 共 啟 事 Public Notices: AIA GROUP LIMITED (Company No.: 1366053)Document2 pages公 共 啟 事 Public Notices: AIA GROUP LIMITED (Company No.: 1366053)misc miscNo ratings yet

- Sales Quotation: Penawaran HargaDocument1 pageSales Quotation: Penawaran HargaAwan NugrohoNo ratings yet

- 1077 1992 Reff2021Document6 pages1077 1992 Reff2021Suman ChatterjeeNo ratings yet

- Cessna - 210 - P210 Parts Manual 1978 1986 - P697 12Document764 pagesCessna - 210 - P210 Parts Manual 1978 1986 - P697 12alex castroNo ratings yet

- Pestology CombinesDocument12 pagesPestology CombinessubhaNo ratings yet

- Business EconomicsDocument334 pagesBusiness Economicshp NETWORKNo ratings yet

- Ia 2 Finals AnswersDocument1 pageIa 2 Finals AnswersErica VillaruelNo ratings yet

- Annex B Learner Survey Form TemplateDocument1 pageAnnex B Learner Survey Form Templaten RNo ratings yet

- Uppwd T2Document71 pagesUppwd T2amit singh100% (1)

- Executive Summary: Business Model TemplateDocument6 pagesExecutive Summary: Business Model TemplateMike Kevin Castro100% (1)

- Microeconomics. Introduction To MicroeconomicsDocument2 pagesMicroeconomics. Introduction To MicroeconomicsEmily GNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document9 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)AR KhanNo ratings yet

- BillDocument1 pageBillSunil KumarNo ratings yet

- Consulting Math Drills - Chart Questions v5Document50 pagesConsulting Math Drills - Chart Questions v5FTU Ngo Thi Van Anh100% (2)

- Datasheet Zetamix AluminaDocument2 pagesDatasheet Zetamix Aluminaamandapoly0123No ratings yet

- Business MathematicsDocument18 pagesBusiness Mathematicskurlstine joanne aceronNo ratings yet

- Break Even MathDocument2 pagesBreak Even MathMuhammad Akmal HossainNo ratings yet

- De La Fuente and Vives - 1995Document41 pagesDe La Fuente and Vives - 1995StegabNo ratings yet

- Session 3Document12 pagesSession 3Julie ArnaudNo ratings yet

- Economic Bubbles British English StudentDocument6 pagesEconomic Bubbles British English StudentJorgeNo ratings yet

- SANY SY365 Hydraulic Diagram MPTS ™Document6 pagesSANY SY365 Hydraulic Diagram MPTS ™Martin MartinezNo ratings yet

- Lecture 4Document64 pagesLecture 4rishita agarwalNo ratings yet

- Felted Makeup Bag: Buy Yarn and Supplies HereDocument5 pagesFelted Makeup Bag: Buy Yarn and Supplies HereLangónéBaloghJuditNo ratings yet

- 33 Princ-ch33-Tổng Cung Và Tổng CầuDocument81 pages33 Princ-ch33-Tổng Cung Và Tổng CầuThành Đạt Lại (Steve)No ratings yet