Professional Documents

Culture Documents

Various Jurisdictions For Incorporation of Companies

Uploaded by

Vamsi Krishna0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

Various Jurisdictions for Incorporation of Companies

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesVarious Jurisdictions For Incorporation of Companies

Uploaded by

Vamsi KrishnaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

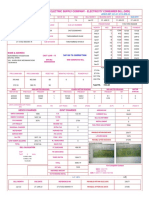

Jurisdiction Isle of Man Gibraltar

The Designated Business

Legislation Companies Act, 2014

(Registration and Oversight) Act

Minimum Directors 1 (need not be local Director) 1 (need not be local Director)

Minimum Share

1 1

Holders

Company Secretary

Local Register No Yes (Local)

Required with appropriate

Agent / Contact Required

Local Registered licenses.

Person Yes Yes (however,

Office No minimum,

Minimum Share

Nil generally the standard share

Capital

Minimum (Authorized)

Share

Nil capital isGBP

GBP1 £2000)

Capital (Paid up) Cost of registration: £100

Government Fees Annual returns fee if filed on GBP 200 (approx.)

laundering and

time:countering

£380 the

Crypto License Standard registration: Application Feeof Company - 10

financing of terrorism 48 hours Incorporation

Timeline 2-hour registration possible at Based

days on Complexity of

No

£250inheritance tax, withholding company is 0%

DLT License - 3 to 4 months

Taxes p.a.

Corporate Service tax, capital gains tax and stamp (tax rate for other

Memorandum andcompanies

Articles of is

Opening an IOM Bank Account:

Provider Fees transmitting, transferring, Association, Register of Directors,

More details £1,000 onwards

providing safe custody or storage

Cayman Islands Estonia Code, 1995 Authority Act (MDIA

Estonian Commercial Malta Act)

Money Laundering and Terrorist

1 (Estonian Citizen as Director Innovative Technology

Anti-Money Laundering and

1 (need not be local Director) Financing Prevention

required who will actAct

as the AML Arrangement

1 (need notand Services

be local Act

Director)

1 officer)

1 2

Not compulsory No Yes

Required Required Required

Yes Required with Board in Estonia Yes

requirements, it must be fully

No Minimum 12,000 EUR

subscribed upon incorporation,

$30-$160No Minimum

(based on no. of days) 12,000 EUR € 250 fee)

€375 (standard

contact person in Estonia = €200-

Annual Fees- $800 €245-€2250 (Based on authorised

Cayman Island Monetry

Certification Authority State400

Fees- $800

per year, fee

application on average.

for license is without anshare

exchange for own

capital)

(CIMA), obtain a waiver or hold a the documents received)

3,300 EUR or By 10 days (subject

accounts) - 5,000toeuros,

compliance)

plus

3-4 days (subject to compliance

the e-Residency card (up

only distributed profits are to 5 Standard Registration of

Corporate Tax: 35% (refunds the can

royalty Income review)

tax, or capital working days from the moment company with opening

usually subject to 20% corporate be obtained by shareholders) Bank

gains tax. copy of: Certificate of attorney and application from the Registered Office for 1 Year,

Electronic income tax of 20/80 of the of

shareholder(s)/member(s) netthe VAT: 18% (standard)

Incorporation,

Specifically excluded from this management board (in case with Registered

Memorandum and Agent for 1 Year,

https://www.welcome-center-

are digital representations of fiat malta.com/blockchain-services-

India

Companies Act, 2013

2

2

Yes

Required

Yes

Rs. 1,00,000

No minimum

Rs. 6,000 - Rs. 30,000

Nil

15 Days

25% - 30%

Rs. 10,000 - Rs. 50,000

You might also like

- Investment Management ProblemsDocument8 pagesInvestment Management ProblemsVamsi KrishnaNo ratings yet

- A HRC 38 21-EnDocument17 pagesA HRC 38 21-EnVamsi KrishnaNo ratings yet

- J 121 JILS 2021 85 Vamsi00117 Gmailcom 20230215 152206 1 18Document18 pagesJ 121 JILS 2021 85 Vamsi00117 Gmailcom 20230215 152206 1 18Vamsi KrishnaNo ratings yet

- J 2017 SCC OnLine Del 7862 2017 239 DLT 699 2017 72 Mahindraprabu Tnnluacin 20230227 081513 1 5Document5 pagesJ 2017 SCC OnLine Del 7862 2017 239 DLT 699 2017 72 Mahindraprabu Tnnluacin 20230227 081513 1 5Vamsi KrishnaNo ratings yet

- A HRC 37 CRP.4Document60 pagesA HRC 37 CRP.4Vamsi KrishnaNo ratings yet

- Lheit, Sooksripaisarnkit & Kan So (2021) 35 ANZ Mar LJDocument10 pagesLheit, Sooksripaisarnkit & Kan So (2021) 35 ANZ Mar LJVamsi KrishnaNo ratings yet

- 7010401Document39 pages7010401Vamsi KrishnaNo ratings yet

- International Law and The Environment Third Edition Patricia BirnieDocument888 pagesInternational Law and The Environment Third Edition Patricia Birnielucia wongNo ratings yet

- TP 2018 18 SCC 346 354 Mahindraprabu Tnnluacin 20230202 235442 1 9Document9 pagesTP 2018 18 SCC 346 354 Mahindraprabu Tnnluacin 20230202 235442 1 9Vamsi KrishnaNo ratings yet

- Viva Schedule (20.05.2022)Document2 pagesViva Schedule (20.05.2022)Vamsi KrishnaNo ratings yet

- Notes On CRADocument4 pagesNotes On CRAVamsi KrishnaNo ratings yet

- International Human Rights Instruments: United NationsDocument7 pagesInternational Human Rights Instruments: United NationsVamsi KrishnaNo ratings yet

- Tattoo Artist and Tattoo Bearers Rights Under The LawDocument8 pagesTattoo Artist and Tattoo Bearers Rights Under The LawVamsi KrishnaNo ratings yet

- The Crime of Barratry Criminal ResponsibDocument8 pagesThe Crime of Barratry Criminal ResponsibVamsi KrishnaNo ratings yet

- Kort 1952Document8 pagesKort 1952Vamsi KrishnaNo ratings yet

- Scheinin PowerpointDocument45 pagesScheinin PowerpointVamsi KrishnaNo ratings yet

- FSM QuestionsDocument23 pagesFSM QuestionsVamsi KrishnaNo ratings yet

- Law of Torts - LLB - Notes PDFDocument53 pagesLaw of Torts - LLB - Notes PDFSimran94% (18)

- Note On Anti-DefectionDocument4 pagesNote On Anti-DefectionAdv Rohit DeswalNo ratings yet

- Sec. 177 (9) and (10) R/W The Companies: (Meetings of Board and Its Powers) Rules 2014-Legislative CommentDocument1 pageSec. 177 (9) and (10) R/W The Companies: (Meetings of Board and Its Powers) Rules 2014-Legislative CommentVamsi KrishnaNo ratings yet

- Sbaa 7002Document93 pagesSbaa 7002Vamsi KrishnaNo ratings yet

- Is Article 35a Constitutionally ValidDocument4 pagesIs Article 35a Constitutionally ValidVamsi KrishnaNo ratings yet

- Freedom of Religion ActDocument1 pageFreedom of Religion ActVamsi KrishnaNo ratings yet

- Historical Sociology Papers - A SummaryDocument7 pagesHistorical Sociology Papers - A SummaryVamsi KrishnaNo ratings yet

- Note On Anti-DefectionDocument4 pagesNote On Anti-DefectionAdv Rohit DeswalNo ratings yet

- Note On Anti-DefectionDocument11 pagesNote On Anti-DefectionVamsi KrishnaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Company Isin Description in NSDLDocument183 pagesCompany Isin Description in NSDLvishalNo ratings yet

- 3.7.2.1 C - Details of Linkages 1Document207 pages3.7.2.1 C - Details of Linkages 1Rai Media TechnologiesNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- PMM Doc 3Document15 pagesPMM Doc 3satexNo ratings yet

- Scoopwhoop Media PVT - LTDDocument10 pagesScoopwhoop Media PVT - LTDANISHNo ratings yet

- Required:: Answer: The Optimal Transaction Size Is P70,711Document2 pagesRequired:: Answer: The Optimal Transaction Size Is P70,711Unknowingly AnonymousNo ratings yet

- Student Entrepreneurship in The Social Knowledge EconomyDocument156 pagesStudent Entrepreneurship in The Social Knowledge EconomyKharisma Sofiana SiregarNo ratings yet

- Handout 4 - Financial Statements AnalysisDocument46 pagesHandout 4 - Financial Statements Analysisyoussef abdellatifNo ratings yet

- MAPI - Annual Report 2019 PDFDocument373 pagesMAPI - Annual Report 2019 PDFAshfina HardianaNo ratings yet

- Singapore IncDocument2 pagesSingapore IncBastiaan van de Loo100% (1)

- Bussiness Case Nabati MTDocument12 pagesBussiness Case Nabati MTFi Fiyunda50% (2)

- Good OutlineDocument76 pagesGood OutlineLizzy McEntire100% (1)

- Financial Ratios at A GlanceDocument8 pagesFinancial Ratios at A Glance365 Financial AnalystNo ratings yet

- What Is NS 5Tx5T?: Investment Universe, Process & StrategyDocument2 pagesWhat Is NS 5Tx5T?: Investment Universe, Process & StrategyBina ShahNo ratings yet

- Bandhan Statement SandipDocument4 pagesBandhan Statement SandipIndranilGhosh0% (1)

- Concepts of CostsDocument14 pagesConcepts of CostsMughees Ahmed100% (1)

- Fruit and Horticulture ProcessingDocument16 pagesFruit and Horticulture ProcessingDavid BernardNo ratings yet

- Introduction Session2Document12 pagesIntroduction Session2Swati PathakNo ratings yet

- Mambulao Lumber V PNB (22 SCRA 359)Document4 pagesMambulao Lumber V PNB (22 SCRA 359)Jose RolandNo ratings yet

- Eko Hotel BarcelonaDocument19 pagesEko Hotel BarcelonajlacandaloNo ratings yet

- KIA India Dealer Application FormDocument8 pagesKIA India Dealer Application FormB SubashNo ratings yet

- Hyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesHyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)aurang zaibNo ratings yet

- Reflective Reading 1 - Turning Crisis Into OpportunityDocument10 pagesReflective Reading 1 - Turning Crisis Into OpportunityyashitaNo ratings yet

- FD SsssssDocument704 pagesFD Ssssssakashjain19950312No ratings yet

- Do You Think Globalization Leads To Cultural ImperialismDocument2 pagesDo You Think Globalization Leads To Cultural Imperialismjezreel alog83% (6)

- Chapter 12Document8 pagesChapter 12Renu GandhiNo ratings yet

- 02 Chapter AnswersDocument3 pages02 Chapter AnswersRABICCA FAISALNo ratings yet

- Shiro Business 4Document35 pagesShiro Business 4jasim jaisNo ratings yet

- Cs-Supertrends 22 Eng RGBDocument47 pagesCs-Supertrends 22 Eng RGBWildan AriefNo ratings yet

- Statement of Financial Position: Problem 1: True or FalseDocument13 pagesStatement of Financial Position: Problem 1: True or FalsePaula Bautista0% (1)