Professional Documents

Culture Documents

DrVijayMalik Company Analyses Vol 9

DrVijayMalik Company Analyses Vol 9

Uploaded by

dhavalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DrVijayMalik Company Analyses Vol 9

DrVijayMalik Company Analyses Vol 9

Uploaded by

dhavalCopyright:

Available Formats

www.drvijaymalik.

com

1|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Company Analyses (Vol. 9)

Live Examples of Company Analysis using “Peaceful Investing” Approach

By

Dr Vijay Malik

2|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Copyright © Dr Vijay Malik.

All rights reserved.

This e-book is a part of services of www.drvijaymalik.com

No part of this e-book may be reproduced, distributed, or transmitted in any form or by any means, including

photocopying, recording, or other electronic or mechanical methods, without the prior written permission

of Dr Vijay Malik.

Printed in the Republic of India

www.drvijaymalik.com

3|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Important: About the book

This book contains the analysis of different companies done by us on our website (www.drvijaymalik.com)

in response to the queries asked by multiple readers/investors.

These analysis articles contain our viewpoint about different companies arrived at by studying them using

our stock investing approach “Peaceful Investing”.

The opinions expressed in the articles are formed using the data available at the date of the analysis from

public sources. As the data of the company changes in future, our opinion also keeps on changing to factor

in the new developments.

Therefore, the opinions expressed in the articles remain valid only on their respective publishing dates and

would undergo changes in future as the companies keep evolving while moving ahead in their business life.

These analysis articles are written as one-off opinion snapshots at the date of the article. We do not plan to

have continuous coverage of these companies by updating the articles or the book after future quarterly or

annual results. Therefore, we would not update the articles or the book based on the future results declared

by the companies.

Therefore, we recommend that the book and the articles should be taken as an illustration of the practical

application of our stock analysis approach “Peaceful Investing” and NOT as a research report on the

companies mentioned here.

The articles and the book should be used by the readers to improve their understanding of our stock analysis

approach “Peaceful Investing” and NOT as an investment recommendation to buy or sell stocks of these

companies.

All the best for your investing journey!

Regards,

Dr Vijay Malik

Regd. with SEBI as a Research Analyst

4|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Table of Contents

Important: About The Book .......................................................................................................................... 4

1) Deepak Nitrite Ltd .................................................................................................................................... 6

2) Jamna Auto Industries Ltd ...................................................................................................................... 61

3) Pnc Infratech Ltd .................................................................................................................................... 99

4) Valiant Organics Ltd ............................................................................................................................ 145

5) Ngl Fine Chem Ltd ............................................................................................................................... 179

6) Monte Carlo Fashions Ltd .................................................................................................................... 224

7) Lincoln Pharmaceuticals Ltd ................................................................................................................ 271

8) Som Distilleries & Breweries Ltd......................................................................................................... 314

9) Asian Energy Services Ltd ................................................................................................................... 364

10) Beekay Steel Industries Ltd ................................................................................................................ 420

How To Use Screener.In "Export To Excel" Tool .................................................................................... 462

Premium Services ..................................................................................................................................... 487

Disclaimer & Disclosures ......................................................................................................................... 503

5|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

1) Deepak Nitrite Ltd

Deepak Nitrite Ltd is India’s leading manufacturer of Phenol, Acetone, optical brightening agents (OBA),

fuel additives and other chemical intermediates like sodium nitrite/nitrates etc.

Company website: Click Here

Financial data on Screener: Click Here

6|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

While analysing the history of Deepak Nitrite Ltd for the last 10-years (FY2012-FY2021), an investor

would notice that originally, the company did not have any subsidiary; therefore, it used to report only

standalone financial data.

In FY2014, the company formed a wholly-owned subsidiary (WOS), Deepak Nitrite LLC in the USA.

However, the company still reported standalone financials because; the subsidiary did not have any

operations.

FY2014 annual report, page 94:

During the year, company has incorporated a subsidiary ‘Deepak Nitrite LLC’, a Limited Liability

Company in the United States of America. The said Subsidiary has no transactions up to March

31, 2014. Therefore, consolidated financial results have not been prepared and published

In the next year, FY2015, Deepak Nitrite Ltd changed the name of its subsidiary in the USA to Deepak

Nitrite Corporations Inc., took 49% shareholding in Deepak Gulf LLC in Oman and acquired 100%

shareholding of Deepak Phenolics Ltd (earlier known as Deepak Clean Tech Ltd).

FY2015 annual report, page 33:

Last year, your Company also incorporated Deepak Nitrite Corporation, Inc. in North Carolina,

USA to take care of marketing & operations part of customers in Northern and Southern American

region. Your Company is also having an Associate Company Deepak Gulf LLC in Oman with 49%

of holding in total Share Capital.

FY2015 annual report, page 44:

Acquiring the entire Share Capital of Deepak Phenolics Limited (earlier known as Deepak Clean

Tech Limited) and then investing in the said wholly owned subsidiary company.

As in FY2015, the subsidiaries and associate companies of Deepak Nitrite Ltd had started to conduct

financial transactions; therefore, the company started to report consolidated financial performance from

FY2015 onwards.

We believe that while analysing any company, an investor should always look at the company as a whole

and focus on financials, which represent the business picture of the entire company including its

subsidiaries, joint ventures etc. Consolidated financials of a company present such a picture. Therefore, if

a company reports both standalone as well as consolidated financials, then in such a case, it is advised that

the investor should prefer the analysis of consolidated financials of the company, whenever they are present.

Therefore, in the case of Deepak Nitrite Ltd, we have analysed standalone financials until FY2014 and

consolidated financials from FY2015 onwards.

With this background, let us analyse the financial performance of the company.

7|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

8|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Financial and Business Analysis of Deepak Nitrite Ltd:

While analyzing the financials of Deepak Nitrite Ltd, an investor notices that the sales of the company have

grown at a pace of 21% year on year from ₹790 cr in FY2012 to ₹4,360 cr in FY2021. Further, the sales of

the company have increased to ₹5,905 cr in the 12-months ended September 30, 2021, i.e. during Oct. 2020-

Sept. 2021.

While analysing the sales growth of the company over the last 10-years, an investor notices that the sales

of the company increased every year except in FY2017 when the sales of Deepak Nitrite Ltd declined

marginally from ₹1,373 cr in FY2016 to ₹1,371 in FY2017.

While analysing the profitability of Deepak Nitrite Ltd, an investor notices that the operating profit margin

(OPM) of the company has also increased every year in the last 10-years (FY2012-FY2021) except FY2017

when the OPM of the company declined from 12% in FY2016 to 10% in FY2017.

To understand the reasons for the financial performance of Deepak Nitrite Ltd, an investor needs to read

the publicly available documents of the company like annual reports, conference calls, credit rating reports,

fund-raising prospectuses as well as its corporate announcements. Then she would understand the factors

leading to the increase in its revenue and profit margins as well as the reasons for the decline in performance

in certain periods.

After going through the above-mentioned documents, an investor notices the following key factors, which

influence the business of Deepak Nitrite Ltd. An investor needs to keep these factors in her mind while she

makes any predictions about the performance of the company.

1) Dependence of raw material of Deepak Nitrite Ltd on crude oil prices:

One of the key features that an investor learns while analysing Deepak Nitrite Ltd is that its business has

significant linkages to crude oil prices. This is because; most of the raw materials used by Deepak Nitrite

Ltd are derived from crude oil.

The largest contribution to the revenues of Deepak Nitrite Ltd (about 58% in FY2021) is from the phenolic

business (phenol, acetone and isopropyl alcohol). In the case of phenolic business, the key raw materials

are benzene and propylene, which are derived from crude oil. As a result, their prices are strongly linked to

crude oil prices.

Conference call, February 2021, page 11:

Somsekhar Nanda: The top line in Deepak Phenolics depends on the crude price and hence the prices of

propylene, benzene and hence phenol and acetone.

9|Page

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

An investor would appreciate that the phenolic business, which is currently, the largest contributor to

Deepak Nitrite Ltd.’s business was started in FY2019. However, in the case of other products as well, the

raw material prices are strongly linked to crude oil prices.

FY2016 annual report, page 37:

crude oil and related petrochemical intermediates, which form an important source of raw materials for

your Company

Even for the products, which the company is producing for more than a decade, the prices of the raw

materials are linked to crude oil prices.

FY2010 annual report, page 23:

An ongoing threat to your Company’s business is crude oil prices. An increase in price could significantly

increase raw material prices.

Conference call, May 2011, page 2:

there has been a fair amount of volatility in price of crude and resulting volatility in our key raw material

Therefore, an investor would appreciate that the prices for the raw material of almost all the products

manufactured by Deepak Nitrite Ltd are dependent on crude oil prices.

Moreover, an investor would appreciate that crude oil is one of the most volatile commodities in the world.

In the past, the prices of crude oil have witnessed very sharp fluctuations. The following chart from

Macrotrends, showing historical prices of crude oil indicates that from 2008 until now, crude oil prices have

witnessed levels from $20 to $140 per barrel.

10 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

An investor would notice that crude oil prices touched a high of about $140 per barrel in 2008 and then

declined to about $40 in 2009. Then, the prices recovered to about $115 in 2011 only to decline sharply

over 2014-2016 to about $30 in 2016. Thereafter, the crude oil prices increased again to about $70 per

barrel in 2018 and then declined to about $20 in 2020. Currently, the prices have increased to about $80 in

2022.

Therefore, an investor would appreciate that the crude oil prices have been very volatile over the last decade

and have moved up and down in a cyclical manner. As a result, the raw material prices for Deepak Nitrite

Ltd would also be highly volatile during this period.

The investor would also acknowledge that when any company faces such significant volatility in its raw

material prices, then it becomes a challenge for it to maintain stability in its business on the parameters like

profitability.

Moreover, it is not only the raw material prices of Deepak Nitrite Ltd that depend on crude oil prices; for

many products, the demand from the customers is also dependent on crude oil prices. This is because; many

customers reduce the purchase of products from Deepak Nitrite Ltd when crude oil prices are in the

declining phase. After all, they attempt to minimize inventory losses.

In the FY2015 annual report, Deepak Nitrite Ltd highlighted to its investors that some of the customers

reduced their purchases during the year when crude oil prices were declining.

FY2015 annual report, page 32:

11 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Towards the beginning of the second half of FY 2014-15, due to the sharp decline in international crude

oil prices, there was disruption in volume off-take from some of your Company’s customers who decided

to minimize inventory to insulate them from heightened volatility. As a result of this, some products

witnessed temporary decline in demand.

Let us see how Deepak Nitrite Ltd has managed such challenges when its business model is significantly

dependent on volatile crude oil prices.

2) Formula based pricing of end products as well as the raw material of Deepak

Nitrite Ltd:

While analysing the business of Deepak Nitrite Ltd, an investor comes across multiple instances where the

company intimated to its shareholders that its pricing arrangements with both, its customers as well as its

suppliers are formula-based, which allow regular revision of prices.

The company has been following the formula-based pricing for both its customers as well as its suppliers

for a very long time. During its conference call with investors in February 2011, Deepak Nitrite Ltd

highlighted the formula based selling prices to the customers as well as formula based purchase prices from

its suppliers, which are linked to crude oil prices.

Conference call, February 2011, page 5:

Sanjay Upadhyay: Yes Abhijeet, just to add on this, where we feel that prices are fluctuating violently we

go by formula base pricing where customer also understands the price mechanism, so that is how we try to

manage those things, where it is a long-term contract there we try to see that it is a formula based pricing

linked to the major raw material which are crude based.

Umesh Asaikar: Similarly we try to enter with some of our suppliers on formula base. It will be fair to

everybody, and then one lands up with proper, fair and reasonable manufacturing margins, and one is not

exposed to violent trends and volatility in material prices.

Even after the passage of more than 10-years, in October 2021, Deepak Nitrite Ltd again emphasized to the

investors that formula-based pricing is the best proposition in its business.

Conference call, October 2021, page 3:

Maulik Mehta: As mentioned earlier, our approach instead of timing the market both from RM and FG

side, was focused on back-to-back formula-based arrangements with suppliers and customers both where

the contracts are signed with a predetermined benchmark index on an annualized basis, which allows us

to procure at the best rate possible. Parallelly, with our customers also, in many cases we have formula-

based pricing, whereby we are able to pass on raw material price increases after a period of time. We

believe under the current situation of high volatility; this is the most optimal approach one can have.

12 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Therefore, an investor would appreciate that Deepak Nitrite Ltd has built a business model where most of

its business is via products where the sale prices is calculated by using a formula based on an index (linked

to crude oil price). The company follows the same formula based pricing with its suppliers as well.

As a result, when the crude oil prices increase, then the cost of raw materials for Deepak Nitrite Ltd

increases. Similarly, as the cost of raw material for Deepak Nitrite Ltd increases, it is able to increase the

selling price of its products to its customers and therefore, it is able to protect is profit margins.

In the conference call done by the company with investors in May 2011, it highlighted that it has been able

to maintain its margins because it could pass on the increase in its costs to its customers.

Conference call, May 2011, page 2:

Umesh Asaikar: …we are in a position to pass on the increase in price line and thus we were able to

maintain the margins.

In the above chart showing crude oil prices, an investor would note that in 2020-2021, crude oil prices

increased sharply from about $20 per barrel to about $80 per barrel. As a result, the raw materials of Deepak

Nitrite Ltd increased significantly. However, despite such an increase, the company reported its highest-

ever operating profit margin because it could pass on the increase in the cost of its raw material to its

customers.

Conference call, May 2021, page 4:

Maulik Mehta: …This was achieved despite a significant increase in raw materials almost across the board

as the company was able to pass on a lot of the cost.

From the above discussion, an investor would notice some important observations. She would note that the

key raw material used by Deepak Nitrite Ltd are derivatives of crude oil. Therefore, its raw material prices

are very volatile. However, the company is able to pass on the increase in its costs to its customers by way

of formula-based pricing.

An investor would note that due to formula-based pricing linked to crude oil prices, the sales prices of

Deepak Nitrite Ltd are highly volatile. As a result, many times, during the periods when crude oil prices

decline, then the company is not able to increase its sales despite a significant increase in the volumes.

For example, in FY2010, the sales of the company declined in value by 7% from ₹572 cr in FY2009 to

₹532 cr in FY2010; despite an increase in the volume of sales by more than 20%.

FY2010 annual report, page 27:

Financial Year 2009-10 has been an eventful year for your Company. The turnover for the year was Rs.

532 crores compared to Rs. 572 crores in the previous year…Your Company has been able to increase the

quantitative volumes by more than 20% compared to the previous year.

13 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Again, in FY2016, when the crude oil prices declined sharply from about $130 per barrel in 2014 to about

$30 per barrel in 2016, its raw material prices declined and in turn, the company had to reduce its sales

price, which affected its revenue.

FY2016 annual report, page 37:

The prices of crude oil and related petrochemical intermediates, which form an important source of raw

materials for your Company declined significantly over the past one year thereby impacting top-line

growth.

Nevertheless, due to formula-based pricing, the company is able to avoid any hit on its profit margins.

Therefore, an investor would appreciate that over the last 10-years, the company has been able to report

continuously improving operating profit margin.

However, after making a detailed reading of the public documents, an investor notices that the pass-through

of increased costs is not a simple and straight event. Deepak Nitrite Ltd faces multiple challenges before it

can get a higher price from its customers.

3) Challenges in increasing prices to customers despite formula-linked

arrangements:

In the prospectus for its qualified institutional placement (QIP) in January 2018 (source: BSE), Deepak

Nitrite Ltd acknowledged that there have been occasions when it could not pass on the increase in its costs

to its customers.

QIP prospectus, January 2018, page 38:

there have also been occasions when we have been unable to pass on increases in raw materials prices to

our customers.

At times, Deepak Nitrite Ltd could not pass on the increase in the raw material prices to its customers

because of the fear of losing market share.

In October 2021, in the press release declaring the Q2-FY2022 result, Deepak Nitrite Ltd intimated to its

shareholders that it did not increase the prices of its leading products to maintain market share. Under this

dynamic strategy, the company increased the prices of products other than its leadership products.

Q2-FY2022 press release, October 2021, page 2:

Assessing the market situation, the Company deployed a dynamic strategy this quarter, which involved

focusing on preserving market share for leadership products while driving pricing for some other products.

14 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Moreover, an investor notices that the contracts entered by Deepak Nitrite Ltd with its customers allow for

revision in the prices only at fixed intervals like every quarter. Therefore, it can increase prices only after a

gap of 3-months from the previous price change.

However, an investor would notice that the crude oil prices and hence its raw material prices are very

volatile and can fluctuate a lot during the period of a quarter (3-months). Therefore, at times, Deepak Nitrite

Ltd was stuck in situations where after a recent price revision, the raw material prices increased

significantly. However, it could not increase its prices and had to take a hit on its margins during the period

until the subsequent price revision.

For example, in May 2021 conference call, Deepak Nitrite Ltd highlighted to its investors that it could not

increase the prices to some of its customers where the review of pricing is after each quarter. In such a case,

Deepak Nitrite Ltd had to absorb the increase in its costs.

Conference call, May 2021, page 4:

Maulik Mehta: …In some products where there is more of a long-term relationship where the contractual

clause is to look at price reviews every quarter. We had to absorb the cost increase within the quarter and

look at how best we can ensure that we are able to pass it on the next opportunity that we have to review.

On many previous occasions, Deepak Nitrite Ltd had highlighted this challenge of absorbing an increase in

raw material costs during the period between the dates of the pricing review. For example, in the FY2015

annual report, the company highlighted this as a major weakness of its business model, to its investors.

FY2015 annual report, page 34:

WEAKNESSES: One of the major hurdles for the chemical industry is its susceptibility to volatile raw

material costs particularly BCC. Absorbing cost of this volatile market becomes challenging, as there are

time lags before any costs benefit or price hike can be passed on to customers.

In FY2012, the company suffered a hit on its profitability when it could not pass on the increase in raw

material prices to its customers.

Conference call, May 2012, page 3:

Sanjay Upadhyay: PAT was impacted by lag in passing the high increase in the price of key raw material.

Therefore, an investor would appreciate that when the raw material of any company are highly volatile

(linked to crude oil prices), then having a formula-based product pricing may also not be sufficient. This is

because; such arrangements allow for revision in the prices after a fixed interval like a quarter. However,

the crude oil prices and hence, the raw material costs can change significantly during this period.

15 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

In addition, at times, companies like Deepak Nitrite Ltd are not able to increase prices because they face

intense competition from global chemical manufacturers. The company had intimated to its shareholders

that it faces strong price-based competition from foreign companies.

QIP prospectus, January 2018, page 44:

We face price pressures from foreign companies that are able to produce chemicals at competitive costs

and consequently, supply their products at cheaper prices.

Deepak Nitrite Ltd had highlighted to its investors that the products made and the processes followed by it

are the same, which are followed by other global manufacturers e.g. in China. Therefore, it faces strong

competition from China.

Conference call, February 2021, page 19:

Maulik Mehta: Of course, we face significant competition from China, of course, our processes that we

employ across multiple products, in many of these cases, Chinese companies also do the same. This has

always been a feature for the chemical intermediate segment, and is not expected to change.

Therefore, despite formula-based pricing arrangements, before increasing prices to its customers Deepak

Nitrite Ltd has to continuously think of the threat of foreign competitors taking away its market share.

An investor would notice that in the recent period, there have been significant challenges in sea trade due

to shortage of containers as well as unavailability of ships for sending cargo via sea.

Conference call, February 2021, page 3:

…challenges on international shipping, due to container and ship unavailability.

Conference call, August 2021, page 9:

Maulik Mehta: And there were a lot of export disruptions where ship berthing was not available, where

you had the Suez Canal issue…

Conference call, October 2021, page 6:

There were supply restriction bottlenecks due to container shortage…

An investor would appreciate that due to challenges in trade-by-sea, the freight costs would increase and it

becomes difficult to import goods at a cheap price. Deepak Nitrite Ltd also highlighted to its investors in

May 2015 conference call that due to the above-mentioned challenges, sea freight has gone up and now, it

is difficult for people to import and sell in India.

Conference call, May 2021, page 10:

16 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Sanjay Upadhyay: …sea freight are also going up. It is extremely difficult for people to import and sell in

India.

Therefore, an investor would notice that during FY2021 and later, Deepak Nitrite Ltd has taken significant

advantage of the difficulties faced by the importers in procuring goods from abroad. Because of the high

demand due to lower imports, the company is able to run its factories at very high utilization levels. For

example, in FY2021, the company was running its phenol plant at a capacity utilization level of 130%.

Conference call, May 2021, page 13:

Sanjay Upadhyay: In fact, today we are running at 130% capacity utilization

An investor would appreciate that such high capacity utilization levels lead to a lot of operating leverage

benefits i.e. lower per-unit cost of products. In addition, lack of competition from cheaper imports has

Deepak Nitrite Ltd to charge a high price of its goods to its customers.

As a result, it does not come as a surprise to the investor when she notices that during FY2021, Deepak

Nitrite Ltd has reported its highest-ever operating profit margin (OPM) of 29% and an OPM of 28% in the

12-months ended September 30, 2021, i.e. during Oct. 2020-Sept. 2021.

4) Lack of long-term contracts with customers and suppliers:

While analysing the business history of Deepak Nitrite Ltd an investor notices that in the past, the company

did not have any long-term supply arrangements with either its customers or its suppliers. The company

highlighted this as a risk in the prospectus before the QIP in January 2018.

QIP, January 2018, page 39:

We do not have long term agreements with majority of our suppliers. We do not have long term agreements

with any of our customers.

An investor would note that if a company does not have long-term supply arrangements/contracts with its

customers, then it continuously faces the risk of customers shifting to the competitors without much

difficulty. This is because; in the absence of long-term contracts, the barriers to entry to the competitors go

down.

QIP, January 2018, page 39:

Absence of such long term agreements exposes us to the risk that our customers may cease to source

products from us.

17 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Similarly, an absence of long-term supply arrangements with the suppliers puts Deepak Nitrite Ltd at the

risk of failure to get raw material when it requires it urgently.

QIP, January 2018, page 39:

Short term supplier contracts subject us to risks such as price volatility, unavailability of certain raw

materials in the short term and failure to source critical raw materials in time, which would result in a

delay in manufacturing of the final product.

An investor would notice that the lack of long-term supply agreements with customers and suppliers

exposes Deepak Nitrite Ltd to many risks. Then, she wonders, why the company is not going for long-term

contracts.

Upon reading the past annual reports, an investor comes across the fact that it has not been the case always.

Previously, the company used to enter into long-term contracts and used to highlight it to the investors as

one of the major achievements.

For example, in the FY2010 annual report, Deepak Nitrite Ltd pointed out to the investors that it has entered

into long-term contracts with customers and suppliers, which has increased the durability of its business

model.

FY2010 annual report, page 4:

…has been able to enter into long-term contracts with both suppliers and customers, thereby enhancing the

durability of its business model.

Therefore, it looks like originally, the company preferred to have long-term contracts with its suppliers and

customers. However, subsequently, Deepak Nitrite Ltd had to pay a penalty to one of its key suppliers for

natural gas, GAIL (India) Ltd, when it could not use its contracted quantity of natural gas.

As per the FY2016 annual report, when Deepak Nitrite Ltd did not use the committed amount of natural

gas, then GAIL (India) Ltd asked it to pay a penalty of ₹7.18 cr. After arbitration, it seems that the penalty

amount was reduced to ₹1.41 cr.

FY2016 annual report, page 171:

The Company has entered into a long term contractual arrangement with GAIL India Limited (“GAIL”)

for supply of Gas with a Take or Pay obligations. A communication was received from GAIL regarding

non-consumption of committed quantity for the year 2014. Accordingly, the Company is required to deposit

a sum of ₹ 718.00 Lacs which may subsequently be adjusted in future against the consumption of Gas. The

matter has been referred to an arbitrator for settlement, which is pending. However, GAIL has offered the

Company to settle the matter amicably by paying one-time charges of ₹ 141.00 Lacs. Based on the above

understanding, the Company has prudently provided for the said charges during the year.

18 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

It seems that due to such experience, the company avoided long-term contracts and by January 2018 (date

of QIP prospectus); Deepak Nitrite Ltd started preferring short-term contracts with its suppliers as well as

customers.

However, in the absence of long-term contracts, the risks of short-term contracts highlighted by Deepak

Nitrite Ltd in its QIP prospectus came true and the company realized the benefits of entering into long-term

contracts.

Therefore, in the current year (FY2022), Deepak Nitrite Ltd has again started stressing about entering into

long-term contracts with its customers. The company acknowledged that in the past, it did not prioritize

long-term contracts with customers because they were already giving it a business for the last 10-15 years.

Therefore, the company thought that why ‘bother’ about getting into long-term contracts.

However, it seems that now, the company has realized that long-term contracts make a strong relationship

between the customer and supplier. Therefore, now, Deepak Nitrite Ltd has again started focusing on long-

term contracts with customers.

Conference call, October 2021, pages 11-12:

Abhijit Akella: …the investor communication also talks about various long-term formula linked

arrangement that you are kind of working on, so could you share some more insights…

Maulik Mehta: …Earlier, Deepak itself stayed away from this because we said look we have 10 years, 15

years relationship with these customers, they have been depending on us, they have been giving us a lion’s

share of their requirements, why bother to get into that, but as we have gone ahead in the last couple of

years, we have realized that their focus then can shift towards business development, market development

rather than worrying about annual discussions with Deepak and that has successfully transpired itself into

a more solidified relationship…

Therefore, an investor would notice that over FY2010-FY2022, Deepak Nitrite Ltd has seen its focus shift

from long-term contracts in FY2010 to preferring short-term contracts by FY2018. It seems that the penalty

imposed by GAIL (India) Ltd for the non-usage of a committed amount of natural gas may have played a

role in this transition. However, now, Deepak Nitrite Ltd has once again realized that having long-term

contracts is good for a strong relationship between the suppliers and customers. Therefore, in FY2022, the

company is again showing a preference for long-term contracts.

Going ahead, an investor should closely monitor whether the company continues to stick to long-term

arrangements with its customers and suppliers or it switches back to short-term contracts.

5) Focus on high-value products and energy efficiency by Deepak Nitrite Ltd:

19 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

While reading about the business of Deepak Nitrite Ltd over the years, an investor notices that from FY2012

to FY2021, the company increased its operating profit margin (OPM) from 7% to 29%. This improvement

of about 22% in the OPM is significant. As a result, an investor needs to analyse the reasons for the same.

When an investor observes the different expenses incurred by Deepak Nitrite Ltd and compares them year

on year by benchmarking them as a percentage of sales, then she notices that two parameters, raw material

costs and power & fuel have shown the most remarkable improvement over the last 10-years (FY2012-

FY2021).

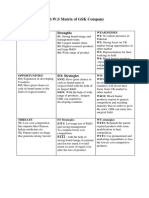

The below table compares different expenses as a percentage of sales for Deepak Nitrite Ltd in FY2012

and FY2021.

An investor would notice that from FY2012 to FY2021, Deepak Nitrite Ltd could reduce its raw material

costs as a percentage of sales from 67% in FY2012 to 51% in FY2021; thereby, adding 16% (= 67 – 51) to

its operating profit margin (OPM).

A reduction in the raw material cost as a percentage of sales indicates that Deepak Nitrite Ltd has focused

on high margin products over the years, which has resulted in an improvement in profitability.

While analysing the annual reports of Deepak Nitrite Ltd over the years, an investor comes across multiple

instances where the company highlighted an improvement in the product mix i.e. selling more high-margin

products, as a reason for the improvement in its profit margins.

In the FY2016 annual report, Deepak Nitrite Ltd highlighted that an improvement in the product mix

resulted in higher profitability.

FY2016 annual report, page 37:

20 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

A combination of factors including favourable product mix, efficiency gains and better realisations across

key products also contributed to better EBITDA performance.

In FY2018 also, the company mentioned improvement in the product mix (selling more high margin

products) as the reason for increasing profits.

FY2018 annual report, page 50:

Full resumption of normal operations and favourable shift in product mix led to better PAT performance

The company continued to improve its product mix in the subsequent years i.e. FY2019, FY2020 and

FY2021 as well.

FY2019 annual report, page 66:

Margin expansion was a result of product-mix adjustments, better realisation, and cost leadership

initiatives

FY2020 annual report, page 55:

The expansion of margins was an outcome of enhancements in the product mix, improved realizations and

cost reduction efforts undertaken at Company level.

FY2021 annual report, page 71:

The Company undertook several enhancements in the product mix, improved realisations and cost-

reduction efforts that helped deliver better margins.

Looking at the above disclosures, an investor would appreciate that changing the product mix of the

company over the years, has contributed significantly to the improvements in the profit margins of the

company. From the changing product mix, an investor would note that Deepak Nitrite Ltd is able to

manufacture different products in its plants as per the changing market scenario i.e. its plants are

multipurpose.

In a multipurpose plant, Deepak Nitrite Ltd can easily switch production from one product to another

whenever it realises that any particular product is commanding a higher profit margin in the market.

In multiple instances in the past, Deepak Nitrite Ltd has highlighted that its plants are multipurpose and

provide it with the flexibility to change the products that are manufactured at a short notice.

Conference call, May 2010, page 7:

Deepak Mehta: Right…the benefit is these multipurpose plants help us to see that if there are any spurt in

demands for any other segments we can quickly switch over and make those intermediate.

21 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

In the FY2017 annual report, the company explained to its investors that it could report a higher margin

in its basic chemicals segment when it shifted production away from fuel additives to other intermediates.

The company decided to produce other intermediates because the demand for fuel additives was low and

the multipurpose plants allowed it to produce other products.

FY2017 annual report, page 31:

Basic Chemicals: While business of Fuel Additives was subdued during the year, the same production lines

could have been utilised for producing other contributory products during the year, which gave boost to

the margin in this business segment.

The credit rating agency, ICRA, highlighted in its report for the company in January 2018 that multipurpose

plants allowed Deepak Nitrite Ltd to use the production lines of fuel additives to produce Sodium Nitrite

and Sodium Nitrate.

Credit rating report, ICRA, January 2018, page 2:

…the facilities are designed to provide flexibility to change the product mix to cater to market requirements.

For instance, the company used a few of its production lines, originally meant for fuel additives, to

manufacture sodium nitrite/ sodium nitrate given the decline in demand for fuel additives.

In the conference call in August 2021, the company highlighted to the investors that it focuses on chemical

processes instead of specific chemical products while designing its manufacturing plants. The company

mentioned that in the past when it focused on making plants for a specific product, then it had to suffer.

Therefore, it changed its strategy to focus on multipurpose plants.

Conference call, August 2021, page 19:

Maulik Mehta: So, it is not like the Deepak Nitrite of old where one plant only focused on making one

product, we have learnt at a very high cost the need to be fungible and have the flexibility of product.

As per the company, it focuses on developing integrated product chains where many products can be

produced instead of focusing on specific products.

Conference call, October 2021, page 3:

Maulik Mehta: The Company’s business strategy is to prioritize the development of integrated product

chains over standalone products…

Therefore, an investor would appreciate that Deepak Nitrite Ltd has preferred to create multipurpose

manufacturing plants where it can switch production from one chemical to another as per changing market

scenario. Due to this flexibility, the company has been able to improve its product mix over the years to

focus more on high-margin products. This is one of the most important factors leading to a significant

improvement in the profit margins of the company.

22 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

From the above table on the analysis of operating expenses of Deepak Nitrite Ltd as a percentage of its

sales, an investor would remember that the other parameter leading to significant savings for the company

was power & fuel costs. Over FY2012-FY2021, Deepak Nitrite Ltd decreased its power & fuel costs from

about 10% of sales in FY2012 to about 6% of sales in FY2021, which contributed an improvement of about

4% in the operating profit margin (OPM) of the company.

While reading the annual reports of Deepak Nitrite Ltd, an investor notices that the company has

continuously focused on improving its energy efficiency and has taken multiple steps about the same over

the years.

In FY2010, the company highlighted that it is shifting away from the usage of furnace oil to using natural

gas and coal in its manufacturing plants.

Conference call, May 2020, page 7:

Deepak Mehta: I would say some significant portion is also going for bringing in more energy efficiency

in all these four sites, wherever possible we have been moving into investments in using gas which is now

more readily available, thanks to Reliance, wherever possible we are now moving from furnace oil based

boilers to coal based boilers…

In addition, to reduce the power costs, Deepak Nitrite Ltd is constructing a captive power plant in Dahej,

which as per the company, is about to get completed soon.

FY2021 annual report, page 25:

Expand Capabilities: Completion of captive power plant is nearing

Conference call, October 2021, page 5:

Maulik Mehta: …we are expecting to commission IPA to manufacture 30,000 tonnes of additional capacity

and 29-megawatt cogent plant during this current quarter.

The new captive power plant would be in addition to another captive power plant that it has in Nandesari,

near Vadodara, which it commissioned in 2004 (as per FY2011 annual report, page 17).

Therefore, an investor would note that Deepak Nitrite Ltd has taken steps to improve its cost efficiencies,

which has contributed to an increase in its profit margins.

The credit rating agency, CRISIL, highlighted the role of cost efficiencies in the improvement of its profit

margins in its report for Deepak Nitrite Ltd in August 2020.

The group’s operating profitability improved to 25.1% in fiscal 2020 from 16.1% in fiscal 2019 supported

by extraordinary performance of PP segment as well as increase in the margins for the BC segment owing

to cost efficiency measures…

23 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Going ahead, an investor should keep a close watch on the raw material costs as well as other cost efficiency

measures of Deepak Nitrite Ltd. This is because; a tight control on the same is needed to keep its operating

profit margins at current improved levels.

An investor would also remember that in the recent period, due to difficulties in the sea trade i.e. ship

shortage, container shortage etc., the importers are not able to source cheap goods from overseas

manufacturers. As a result, Deepak Nitrite Ltd is able to charge a high price to its customers and run its

plants at very high utilization levels exceeding 100%. This has resulted in the best ever profit margins for

the company.

Going ahead, an investor should keep a close watch on the profit margins because; the supply chain

bottlenecks like challenges of sea trade would not continue forever. Once the supply chain problems are

resolved, then the competition from foreign manufacturers would increase, which may bring down the profit

margins.

The company itself realizes this; as a result, it has acknowledged that the current profit margins on some of

its products like Phenol are not sustainable.

Conference call, August 2021, page 18:

Sanjay Upadhyay: …Phenol, of course, you can’t expect this kind of EBITDA margins every quarter, so I

cannot commit on that.

Therefore, an investor should be cautious while projecting the currently improved profit margins in her

future projections.

While analysing the tax payout ratio of Deepak Nitrite Ltd., an investor notices that for most of the years,

the tax payout ratio of the company has been in line with the standard corporate tax rate prevalent in India.

It was only in FY2015 when the company reported a tax payout ratio of 21%. The primary reason for the

lower tax payout ratio in FY2015 was an adjustment of minimum alternate tax (MAT) credits of about ₹11

cr.

In recent years, the tax payout ratio has declined to 25% from the previous years’ level of about 30%, which

seems to be in line with the recent changes in the corporate tax rates implemented by India.

Operating Efficiency Analysis of Deepak Nitrite Ltd:

a) Net fixed asset turnover (NFAT) of Deepak Nitrite Ltd:

When an investor analyses the net fixed asset turnover (NFAT) of Deepak Nitrite Ltd in the past years

(FY2013-21), then she notices that the NFAT of the company has declined from 4.0 in FY2013 to 2.4 in

FY2021.

24 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

While analysing the business decisions taken by Deepak Nitrite Ltd during the last 10-years (FY2012-

FY2021), an investor notices that the company has consistently invested money in creating additional

manufacturing capacity during this period.

Some of the major capital expenditure projects undertaken by Deepak Nitrite Ltd during the last 10-years

are:

FY2011-FY2013: Optical brightening agent (OBA) project in Dahej, Gujarat: Phase 1 was

completed in March 2013 (FY2014 annual report, page 45) and the remaining project was

completed in FY2015 (FY2015 annual report, page 7).

FY2011-FY2014: Brownfield expansion of salt section in Nandesari, Vadodara: commissioned in

June 2013 (FY2014 annual report, page 45).

FY2017-FY2019: A very large greenfield project in Dahej for Phenol and Acetone was

commissioned in November 2018 (FY2019 annual report, page 18).

FY2020-FY2021: Isopropyl Alcohol (IPA) plant, 30,000 MTPA in Dahej (FY2020 annual report,

page 37).

FY2021-FY2022: Doubling of the capacity of IPA plant from 30,000 MTPA to 60,000 MTPA and

a captive power plant of 29 MW (Conference call, October 2021, page 4).

While analysing the various investor communications done by Deepak Nitrite Ltd, an investor gets to know

that the asset turnover of the investments done by the company in the last 10-years, is in the range of 1.50

to 2.25 times.

In May 2010, the company intimated to its shareholders that the asset turnover for the investments planned

for OBA and salts segments was expected to be 1.50-1.75 times.

Conference call, May 2010, page 9:

Paurav Lakhani: So roughly the additional sales from this Dahej plant would be in the region of what…?

Deepak Mehta: Again this depends upon the product mix, but I can say that our turnover to investment has

been in the ratio of about 1.5 to 1.75 to 1.

While planning the large Phenol project in May 2016, the company intimated to its shareholders that it is

expecting a turnover ratio of about 2.25 times on its investment in the project.

Conference call, May 2016, page 6:

Arun Malhotra: The same asset turnover, means on Rs. 1200 crore of CAPEX…?

Somsekhar Nanda: The asset turn ratio on a normal crude price, crude price is subdued now, on a normal

situation it will be about 2.25x:1.

25 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Further, in May 2021, while elaborating the strategy for upcoming capacity expansion projects, the

company intimated to its shareholders that it expects an asset turnover ratio of about 1.75 to 2.00 times on

its investments.

Conference call, May 2021, page 16:

Onkar Ghugardare: I was looking into what can be the asset turnover.

Sanjay Upadhyay: Normally we look at 1.75 to 2x

Therefore, an investor would appreciate that almost all the projects undertaken by the company during the

last 10-years have an asset turnover ranging from 1.50 – 2.00 times.

The largest project undertaken by Deepak Nitrite Ltd, the Phenol project, commissioned for a cost of ₹1,400

cr reported a turnover of about ₹2,561 cr in FY2021 (FY2021 annual report, page 271) while running at a

capacity utilization of 115% (FY2021 annual report, page 14). It amounts to an asset turnover of about 1.83

(=2,561 / 1,400).

As the new investments done by Deepak Nitrite Ltd in the last 10-years are producing a lower fixed asset

turnover than the historical fixed assets (in FY2013, the NFAT was 4.0), therefore, the NFAT of the

company has come down over the last 10-years to 2.4 in FY2021.

Going ahead, an investor should keep a close watch on the progress of the newly announced project and

the capacity utilization levels of Deepak Nitrite Ltd so that she can assess whether the company is utilizing

its assets efficiently or not.

b) Inventory turnover ratio of Deepak Nitrite Ltd:

While analysing the efficiency of inventory utilization by Deepak Nitrite Ltd, an investor notices that over

the last 10 years (FY2013-FY2021), the inventory turnover ratio (ITR) of the company has remained

constant at the levels of about 10.5-11.0. The ITR was 10.6 in FY2013 and 11.0 in FY2021.

However, during these years, the ITR has witnessed significant fluctuation when it declined to its lowest to

6.7 in FY2018. Thereafter, the ITR started increasing and it improved significantly to 11.0 in FY2021.

Therefore, when an investor analyses the efficiency of inventory management of Deepak Nitrite Ltd, then

she may see it in terms of two different periods; first, until FY2018 and then the second period from FY2019

until date.

An investor would recollect from the above discussion on net fixed asset turnover that during the first phase,

FY2013-FY2018, Deepak Nitrite Ltd had done a major capital expenditure in Dahej, Gujarat, where it

created a plant to manufacture optical brightening agents (OBA), which is a part of the colours segment.

26 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

OBA was a forward integration step for Deepak Nitrite Ltd because it was already making the raw material

for OBA, which is Diamino stilbene disulfonic acid (DASDA) and Para Nitro Toluene (PNT), which is

used to make DASDA.

FY2012 annual report, page 8:

Our greenfield expansion in Dahej is a forward integration to manufacture OBA. With the completion of

this greenfield project at Dahej, we will complete the vertical integration from Toluene to Optical

Brightening Agent – OBA (Toluene ->PNT -> DASDA -> OBA). This feat places us amongst the very few

fully integrated player in the world with such a capability.

The company highlighted that it is one of the very few fully integrated manufacturers of OBA. Deepak

Nitrite Ltd had created a large capacity of OBA because; soon it captured 75% of the domestic market for

OBA.

FY2018 annual report, page 45:

Your Company is the only fully integrated manufacturer of Optical Brighteners (OBAs) which is backward

integrated up to the feedstock of toluene. In this segment, your Company caters to 75% of the domestic

requirement of brighteners

To analyse the business dynamics of OBA production, when an investor analyses the locations where

Deepak Nitrite Ltd manufactures each of these products in the OBA chain, then she gets to know that:

Toluene is converted into PNT (Para Nitro Toluene) in the Nandesari plant near Vadodara, Gujarat

PNT is converted into DASDA in its Hyderabad plant in Telangana

Thereafter, DASDA is converted into OBA in its newly created plant in Dahej, Gujarat.

An investor would appreciate that to make OBA; first, the company has to buy Toluene in Gujarat and

process it into PNT in Nandesari. Then, it has to send it about 1,050 km away to Hyderabad in Telangana

to convert it into DASDA. Thereafter, it has to send DASDA back to Gujarat in the Dahej plant, which is

about 1,020 km away from Hyderabad.

Therefore, an investor would appreciate the long distances the products have to travel to be converted from

Toluene to OBA. Moreover, an investor would note that some of these products are hazardous and require

special transport arrangements like special containers, speed limits, temperature etc., which further

increases the cost of transportation and hence, the cost of inventory management and production.

Such a production process where dangerous chemicals are moved crisscross across the country to make the

final product puts pressure on the efficiency of inventory management. As a result, the more OBA the

company produced, the more its inventory turnover suffered. It seems to be one of the key reasons for the

decline in the inventory turnover ratio (ITR) of Deepak Nitrite Ltd declined from 10.6 to 6.7 during

FY2013-FY2018.

27 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Deepak Nitrite Ltd started the production of its Phenol plant at Dahej, Gujarat in November 2018 (FY2019)

in its wholly-owned subsidiary, Deepak Phenolics Ltd (DPL). This plant is a very large plant when

compared to the existing size of business operations of Deepak Nitrite Ltd. Therefore, any improvement or

deterioration in the operating efficiency of the Phenol plant was going to significantly affect the entire

company.

In the case of Phenol production as well, the company had to undertake significant transportation of its raw

material because its key raw material to produce Phenol, Benzene, is sold by refineries. In the case of many

international manufacturers of Phenol, they have their plants within the refinery premises in order to reduce

the cost of production. However, Deepak Nitrite Ltd did not enjoy such an advantageous location.

The company highlighted it as one of the major disadvantages to its shareholders in its conference call in

February 2021 (pages 14-15).

Maulik Mehta: Our competitive disadvantage primarily, if I am comparing to global marquee players in

the same segment, is that they manufacture phenol and acetone right next to their raw material sources. So

normally they do it attached to a refinery… and we have no easy access to putting the plant up in the same

premises as refiners.

Therefore, the company had to tie up with large refineries present at a distance. It even had to consider

sourcing the raw material, benzene, from faraway places like Bhatinda in Punjab about 1,250 km away.

Conference call, May 2021, page 9:

Maulik Mehta: …Now there is a new benzene plan that is coming up in Bhatinda, so we continue to see

small, medium and big opportunities to optimize our supply chain…

Deepak Nitrite Ltd has acknowledged that the cross-country shipment of hazardous chemicals in its

production process poses a risk and as a result. As a result, it has done special arrangements to contain the

damages in any toward incident like placing first respondents at every 120 km on the route.

FY2019 annual report, page 69:

Considering the cross-country movement of over 6 Lakhs MT of explosive/hazardous materials, DPL is

committed towards improving the safety standards for road transportation. DPL has interfaced with Loss

Control Services (LCS) for ‘First Respondents’ services with an aim to minimise the environmental and

social impact of in-transit incidents. LCS has a strong network of First Respondents stationed every 120

kms between the facility and DPL’s sources/destinations. LCS’s teams possess adequate know-how and

experience in handling materials and are equipped with a 24-hour central control room.

Looking at the dangerous nature of the chemicals being transported, Deepak Nitrite Ltd has implemented a

logistic safety management system, which does real-time, GPS-based monitoring of its transport vehicles.

FY2020 annual report, page 81:

28 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Logistic Safety Management System: Your Company has, along with its peers, founded Nicer Globe, an

independent platform, which provides real-time monitoring of the movement of dangerous goods across the

length and breadth of India…with GPS for real-time monitoring for the safety of its customers, carriers,

suppliers, distributors and contractors.

An investor would appreciate that all these special arrangements to transport dangerous products increase

the cost of production. Therefore, in order to control the costs and be competitive with the larger

multinational manufacturers, the company had to improve the efficiency of its logistical activities.

The company highlighted to the investors that it has put in a lot of effort and technology to save on logistics

costs in order to be competitive.

Conference call, May 2021, page 8:

Maulik Mehta: I think here again it is the pennies that take care of the pounds, we do software modeling,

we do a lot of analysis about how we can manage material movement without risking too much.

The management of the company stated that the logistics planning in the production process involves so

much time & effort that it looks like they are a logistics company that happens to produce phenol and

acetone.

Conference call, May 2021, page 8:

Maulik Mehta: …I still remember Mr. Mehta’s one point to a group of investors, he said that sometime the

phenolic business seems like we were actually running a logistics company that happens to make phenol

and acetone.

Therefore, an investor would appreciate that due to the strong focus on logistics planning in the phenol

business, which is now about 58% of the overall revenue of Deepak Nitrite Ltd in FY2021, the company

has done significant improvements in the efficiency of inventory management.

Therefore, it seems to be the major reason for the improvement in the inventory turnover ratio (ITR) of

Deepak Nitrite Ltd since FY2019 when the Phenol plant became functional. The ITR of Deepak Nitrite Ltd

has increased from 6.7 in FY2018 to 11.0 in FY2021.

Going ahead, an investor should monitor the inventory turnover ratio of Deepak Nitrite Ltd so that she can

assess whether the company is utilizing its inventory efficiently or not.

c) Analysis of receivables days of Deepak Nitrite Ltd:

While analysing the receivables days of Deepak Nitrite Ltd, an investor would notice that the receivables

days of the company used to be in the range of 72 days to 85 days from FY2013 to FY2018. Thereafter, the

29 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

receivables days improved to 57 days in FY2021. The significant change in the business of Deepak Nitrite

Ltd during recent years (since FY2019) has been the operationalization of the phenol plant.

Deepak Nitrite Ltd is currently, the largest domestic producer of phenol with a market share of about 65%.

FY2020 annual report, page 27:

Through DPL, we achieved a key milestone by substituting majority of the local market imports of Phenol

and Acetone, and reportedly attaining a market share of about 65% in the country.

It seems that due to a strong position in the phenol market, Deepak Nitrite Ltd is able to get its money for

phenol from the customers in a comparatively shorter period than in the case of other products. As a result,

its receivables days have witnessed an improvement ever since the phenol plant has become operational.

Going ahead, an investor should keep a close watch on the receivables position of the company to monitor

whether its receivables days go back to the previous levels of 72-85 days.

From the above discussion, an investor would appreciate that in the last 10-years; Deepak Nitrite Ltd has

kept its efficiency of inventory management under control and has improved its efficiency of receivables

collection. As a result, the company has been able to grow in the last 10-years without deterioration of its

working capital position.

When an investor compares the cumulative net profit after tax (cPAT) and cumulative cash flow from

operations (cCFO) of Deepak Nitrite Ltd for FY2012-21, then she notices that over the last 10-years

(FY2012-FY2021), the company has converted its profit into cash flow from operations.

Over FY2012-21, Deepak Nitrite Ltd reported a total net profit after tax (cPAT) of ₹1,951 cr. During the

same period, it reported cumulative cash flow from operations (cCFO) of ₹2,384 cr.

It is advised that investors should read the article on CFO calculation, which would help them understand

the situations in which companies tend to have the CFO lower than their PAT. In addition, the investors

would also understand the situations when the companies would have their CFO higher than the PAT.

Learning from the article on CFO will indicate to an investor that the cCFO of Deepak Nitrite Ltd is higher

than the cPAT due to the following factors:

Depreciation expense of ₹613 cr (a non-cash expense) over FY2012-FY2021, which is deducted

while calculating PAT but is added back while calculating CFO.

Interest expense of ₹494 cr (a non-operating expense) over FY2012-FY2021, which is deducted

while calculating PAT but is added back while calculating CFO.

30 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

The Margin of Safety in the Business of Deepak Nitrite Ltd:

a) Self-Sustainable Growth Rate (SSGR):

Upon reading the SSGR article, an investor would appreciate that if a company is growing at a rate equal

to or less than the SSGR and it can convert its profits into cash flow from operations, then it would be able

to fund its growth from its internal resources without the need of external sources of funds.

Conversely, if any company attempts to grow its sales at a rate higher than its SSGR, then its internal

resources would not be sufficient to fund its growth aspirations. As a result, the company would have to

rely on additional sources of funds like debt or equity dilution to meet the cash requirements to generate its

target growth.

An investor may calculate the SSGR using the following formula:

SSGR = NFAT * NPM * (1-DPR) – Dep

Where,

SSGR = Self Sustainable Growth Rate in %

Dep = Depreciation rate as a % of net fixed assets

NFAT = Net fixed asset turnover (Sales/average net fixed assets over the year)

NPM = Net profit margin as % of sales

DPR = Dividend paid as % of net profit after tax

While analysing the SSGR of Deepak Nitrite Ltd, an investor would notice that over the years, the company

had an SSGR in the single digits. It is only recently that a significant improvement in the product prices

due to supply chain disruptions in China as well as in the sea trade has allowed Deepak Nitrite Ltd to enjoy

very high-profit margins.

FY2020 annual report, page 55:

This performance has been partially caused by supernormal realisation in DASDA owing to China’s

temporary disruption and hence may be seen in light of this.

The company even acknowledged that such margins are not sustainable.

Conference call, August 2021, page 18:

Sanjay Upadhyay: …Phenol, of course, you can’t expect this kind of EBITDA margins every quarter, so I

cannot commit on that.

An investor would appreciate that the recent high prices of the products have led to an improvement in the

profit margins of Deepak Nitrite Ltd, which may not sustain at these levels going ahead. These high margins

31 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

have increased its SSGR in recent years to 20%. Any correction in the margins in the future may lead to a

decline in the SSGR of Deepak Nitrite Ltd.

Therefore, an investor is looking at a situation, where over most of the last 10-years, the SSGR of Deepak

Nitrite Ltd has been in the single digits whereas, over the same period, the company has grown its sales at

a CAGR of about 21%.

As the company has grown its sales more than its SSGR; therefore, in order to grow its sales from ₹790 cr

in FY2012 to ₹4,360 cr in FY2021, the company has to raise additional capital in the form of incremental

debt and equity dilution multiple times.

Over the last 10-years (FY2012-FY2021), the company has raised an additional debt of ₹329 cr as its total

debt has increased from ₹261 cr in FY2012 to ₹590 cr in FY2021 (329 = 590 – 261).

Over and above the debt, in the last 10-years, Deepak Nitrite Ltd has diluted its equity three times for

meeting the funds’ requirements of the phenol plant. It raised a total of ₹383 cr from FY2016 to FY2018.

FY2016: QIP1: ₹83.3 cr (FY2016 annual report, page 43)

FY2017: QIP2: ₹150 cr (FY2017 annual report, page 5)

FY2018: QIP2: ₹150 cr (FY2018 annual report, page 21)

Therefore, an investor would notice that during the last 10-years (FY2012-FY2021), the company has

grown its business beyond what its internal resources could sustain in the terms of SSGR. As a result, it

had to raise a total of ₹712 cr (additional debt: ₹329 cr + additional equity: ₹383 cr) to meet its funds’

requirement.

Deepak Nitrite Ltd has always followed the route of taking on additional capital for its growth because even

in the previous decade, it had raised additional equity. Deepak Nitrite Ltd raised about ₹45 cr in May 2006

by way of a rights issue and about ₹15 cr by way of conversion of warrants in February 2010 (QIP

prospectus, January 2018, page 62).

Deepak Nitrite Ltd realizes that its growth aspirations are beyond what its internal resources can sustain in

terms of SSGR. The recent increase of SSGR in FY2021 to 20% seems to be based on unsustainable product

prices and profit margins.

The company realizes it. Therefore, the company has made it very clear that in order to maintain the growth

momentum; it would have to continue raising additional capital by way of incremental debt and equity

dilution.

In 2021, Deepak Nitrite Ltd intimated to its shareholders that it is not looking forward to becoming a debt-

free company indicating that it will keep raising debt for expanding its business.

Conference call, February 2021, page 9:

32 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Somsekhar Nanda: …never ever we have said that we would like to be zero debt Company or a low levered

Company. We would like to grow, and which means you will have to infuse capital in form of debt or equity.

And for that matter, if we have to increase our debt levels, that is fine…

Conference call, August 2021, page 13:

Maulik Mehta: But, in fact, Mr. Sanjay Upadhyay has told us many times that, look, he is very tired of

people asking him about zero debt, he is not interested in being a zero-debt Company.

The company also realizes that its funds’ requirements are beyond what its internal resources can provide.

Therefore, to fund its recently announced capital expenditure of about ₹1,200 cr for new products like

solvents, fluorination platform, brownfield expansion of existing products and more capex to be announced

later, Deepak Nitrite Ltd has already initiated the process to raise additional equity.

In December 2021, Deepak Nitrite Ltd has initiated a postal ballot process to obtain approvals from its

shareholders for a qualified institutional placement (QIP) of about ₹2,000 cr. In the postal ballot notice to

the shareholders for approving the QIP, the company has acknowledged that the internal resources of the

company would only be able to meet a partial funds’ requirement. Therefore, it would have to raise

additional money by way of equity dilution.

The corporate announcement, December 29, 2021, page 9:

While it is expected that the internal generation of funds would partially meet the funding requirement of

its growth objectives, it is thought prudent for the Company to have enabling approvals to raise capital at

an appropriate time for the purpose of funding some of these growth opportunities…

From the above discussion, an investor would appreciate that Deepak Nitrite Ltd is continuously relying on

outside capital for meeting its growth aspirations. Frequently raising equity money by way of qualified

institutional placements (QIP) and debt is a clear indication in this regard.

Moreover, when an investor analyses the history of Deepak Nitrite Ltd right from its beginning in 1970,

then she notices that the company has launched its initial public offer (IPO) on the Bombay Stock Exchange

(BSE) in 1971 even before it had started manufacturing any product. Effectively, Deepak Nitrite Ltd

constructed its first manufacturing plant by raising equity money from public shareholders via an IPO.

Source: Company website: Legacy

It was this very trust that gave Deepak Nitrite’s very first IPO great success. Conducted even before the

company had started manufacturing, it was oversubscribed by 20 times.

Therefore, an investor would notice that Deepak Nitrite Ltd started the foundation of its entire business by

raising equity from outside shareholders even before it could start manufacturing a product. Therefore, it

seems that consistently relying on additional money is a consistent practice at Deepak Nitrite Ltd. and it

33 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

has shown the same by relying on debt and QIP in the past and also by going for approval for another QIP

for its upcoming capital expansion plans.

Nevertheless, an investor should appreciate that the growth aspirations of the company are beyond what its

internal resources can sustain and the recent increase in SSGR is due to abnormally high product prices and

elevated profit margins, which may not sustain in the future.

The company has acknowledged it and the investor may keep a close watch on the equity dilution levels

and incremental debt that Deepak Nitrite Ltd raises so that she may timely assess whether these are in the

best interests of the shareholders or the company is going overboard.

An investor arrives at a similar conclusion when she analyses the free cash flow (FCF) position of Deepak

Nitrite Ltd.

b) Free Cash Flow (FCF) Analysis of Deepak Nitrite Ltd:

While looking at the cash flow performance of Deepak Nitrite Ltd, an investor notices that during FY2012-

2021, it generated cash flow from operations of ₹2,384 cr. During the same period, it did a capital

expenditure of about ₹2,396 cr.

Therefore, during this period (FY2012-2021), Deepak Nitrite Ltd had a negative free cash flow (FCF) of

(₹12) cr (=2,384 – 2,396).

In addition, during this period, the company had a non-operating income of ₹156 cr and an interest expense

of ₹494 cr. As a result, the company had a total negative free cash flow of (₹350) cr (= -12 + 156 – 494).

Please note that the capitalized interest is already factored in as a part of the capex deducted earlier.

In addition, during the last 10-years (FY2012-FY2021), Deepak Nitrite Ltd paid out a total dividend of

₹247 cr (excluding dividend distribution tax, DDT) to its shareholders. Over and above this amount, Deepak

Nitrite Ltd would have paid a DDT of about ₹50 cr being 20% of the dividend paid. Therefore, Deepak

Nitrite Ltd paid out about ₹300 cr to its shareholders in dividends and the dividend distribution tax.

Therefore, Deepak Nitrite Ltd faced a total cash flow deficit of about ₹650 cr (= 350 + 300).

Deepak Nitrite Ltd resorted to meet this cash flow gap by way of raising incremental debt of ₹329 cr as its

total debt has increased from ₹261 cr in FY2012 to ₹590 cr in FY2021 (329 = 590 – 261). Over and above

the debt, in the last 10-years, Deepak Nitrite Ltd has diluted its equity three times for meeting the funds’

requirements of the phenol plant. It raised a total of ₹383 cr from FY2016 to FY2018.

Going ahead, an investor should keep a close watch on the free cash flow generation by Deepak Nitrite Ltd

to understand whether the company continues to generate surplus cash from its operations.

34 | P a g e

Copyright © Dr Vijay Malik. All Rights Reserved.

www.drvijaymalik.com

Self-Sustainable Growth Rate (SSGR) and free cash flow (FCF) are the main pillars of assessing the margin

of safety in the business model of any company.

Additional aspects of Deepak Nitrite Ltd:

On analysing Deepak Nitrite Ltd and after reading annual reports, DRHP, its credit rating reports and other

public documents, an investor comes across certain other aspects of the company, which are important for

any investor to know while making an investment decision.

1) Management Succession of Deepak Nitrite Ltd:

Deepak Nitrite Ltd is a part of the Deepak group, which was founded by Mr C. K. Mehta. Currently, Mr C.

K. Mehta is the chairman-emeritus of the company since August 5, 2016 (FY2017 annual report, page 46).

At present, four members of the Mehta family are a part of the board of directors and executive management

of the company.

Mr Deepak C. Mehta (age 66 years) son of Mr C. K. Mehta is the chairman and managing director

of the company.

Mr Ajay C. Mehta (age 63 years) son of Mr C. K. Mehta and brother of Mr Deepak Mehta is a non-

executive director of the company. He resigned from the position of managing director of Deepak