Professional Documents

Culture Documents

Foreign Income Is Subject To Final Tax If The Taxpayer Is Taxable On Global Income

Uploaded by

Yuno Nanase0 ratings0% found this document useful (0 votes)

10 views2 pagesOriginal Title

Foreign income is subject to final tax if the taxpayer is taxable on global income

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesForeign Income Is Subject To Final Tax If The Taxpayer Is Taxable On Global Income

Uploaded by

Yuno NanaseCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Foreign income is subject to final tax if the taxpayer

is taxable on global income. F/T

F

T/F. Items of passive income rom abroad are subject

to final tax.

F

T/F. Interest income on government securities are

subject to final tax.

T

T/F. All items of passive income are generally

subject to final tax.

F

T/F. Final tax is collected at source; hence, there is

no need to file an income tax return.

T

T/F. Corporations are tax-exempt on inter-corporate

dividends from any corporation.

F

T/F. Individuals and corporations are tax-exempt on

interest income on long-term deposits.

F

T/F. Dividends from resident corporations are

subject to regular tax.

T

T/F. Dividends from real estate investment trusts are

exempt from final tax.

F

T/F. Stock dividends are always exempt from final

tax.

F

T/F. Corporations are subject to final tax on prices.

F

T/F. The share in the net income of a business

partnership is subject to a creditable withholding tax,

not final tax.

F

T/F. General professional partnerships are subject to

final tax but not to regular tax.

F

T/F. All non-residents are exempt from final tax on

foreign currency deposits.

T

T/F. Royalties, active or passive, are subject to

regular income tax.

F

T/F. The tax sparing rule is applicable to resident

and non-resident foreign corporations.

F

You might also like

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- The Final Tax On Winnings Applies To CorporationsDocument6 pagesThe Final Tax On Winnings Applies To CorporationsYuno NanaseNo ratings yet

- TAXATION LAW HIGHLIGHTSDocument4 pagesTAXATION LAW HIGHLIGHTSJM BermudoNo ratings yet

- AYANN KOPYA WELL WAG MAGREKLAMO PAG WALA DITO SAGOT MAY GOOGLEDocument59 pagesAYANN KOPYA WELL WAG MAGREKLAMO PAG WALA DITO SAGOT MAY GOOGLEJOSHUA M. ESCOTONo ratings yet

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- Chapter 5 Final TaxDocument2 pagesChapter 5 Final Taxcherry blossomNo ratings yet

- Chapter 5 - Final Income TaxationDocument13 pagesChapter 5 - Final Income TaxationBisag AsaNo ratings yet

- Notes in Taxation Law by Atty Vic MamalateoDocument99 pagesNotes in Taxation Law by Atty Vic MamalateoAr Vee100% (8)

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- IT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Document6 pagesIT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Mary Jescho Vidal Ampil100% (1)

- Taxation ReviewerDocument25 pagesTaxation ReviewerLes EvangeListaNo ratings yet

- Notes in Taxation Law by Atty Vic MamalateoDocument99 pagesNotes in Taxation Law by Atty Vic Mamalateorossfrancisco_l8835100% (2)

- TAX by MamalateoDocument38 pagesTAX by MamalateoTheresa Montales0% (1)

- BUCOTAX Post MidtermDocument8 pagesBUCOTAX Post MidtermCecille CastellNo ratings yet

- Philippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMDocument22 pagesPhilippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMGracely Calliope De JuanNo ratings yet

- CHAPTER5Document16 pagesCHAPTER5Bisag Asa86% (7)

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Understand VAT Principles in 40 CharactersDocument2 pagesUnderstand VAT Principles in 40 CharactersCali Shandy H.No ratings yet

- Corporate Income TaxationDocument39 pagesCorporate Income TaxationVinz G. VizNo ratings yet

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- Tax On CorporationsDocument6 pagesTax On CorporationsJumen Gamaru TamayoNo ratings yet

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDocument6 pagesAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNo ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsDocument6 pagesPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieNo ratings yet

- The Philippines Income TaxDocument8 pagesThe Philippines Income TaxmendozaivanrichmondNo ratings yet

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeDocument9 pagesGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeFrancis Kyle Cagalingan SubidoNo ratings yet

- Banggawan ExercisesDocument100 pagesBanggawan ExercisesPeter Piper100% (1)

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Other Local TaxesDocument25 pagesOther Local Taxesjoankristel19lNo ratings yet

- Chapter 5 Final Income TaxationDocument2 pagesChapter 5 Final Income TaxationBisag AsaNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Business and Tax Laws: INC Guntur Puttu Guru PrasadDocument28 pagesBusiness and Tax Laws: INC Guntur Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Tax obligations of resident Filipino citizensDocument2 pagesTax obligations of resident Filipino citizensAJ Quim100% (1)

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- Income Tax Table - NIRCDocument6 pagesIncome Tax Table - NIRCgoateneo1bigfightNo ratings yet

- Deductions From Gross Income - 020807Document9 pagesDeductions From Gross Income - 020807Hilarie JeanNo ratings yet

- Income TaxationDocument27 pagesIncome TaxationAries Gonzales CaraganNo ratings yet

- Philippine Tax System: I. Introduction To Tax System in The PhilippinesDocument3 pagesPhilippine Tax System: I. Introduction To Tax System in The Philippinescluadine dinerosNo ratings yet

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- Germany Tax SystemDocument21 pagesGermany Tax Systemmonicaongko0% (1)

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- Taxation Basics & PrinciplesDocument8 pagesTaxation Basics & PrinciplescesalyncorillaNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- G.R. No. L-18062Document3 pagesG.R. No. L-18062Yuno NanaseNo ratings yet

- SC rules judgment can be executed against company president due to non-registrationDocument3 pagesSC rules judgment can be executed against company president due to non-registrationYuno NanaseNo ratings yet

- Succession Cases5 DigestDocument5 pagesSuccession Cases5 Digestnia coline mendozaNo ratings yet

- Constitution of The Philippines. - FAOLEXDocument3 pagesConstitution of The Philippines. - FAOLEXYuno NanaseNo ratings yet

- G.R. No. L-19118 - MARIANO A. ALBERT vs. UNIVERSITY PUBLISHING CO., INCDocument7 pagesG.R. No. L-19118 - MARIANO A. ALBERT vs. UNIVERSITY PUBLISHING CO., INCYuno NanaseNo ratings yet

- G.R. No. L-15092Document4 pagesG.R. No. L-15092Yuno NanaseNo ratings yet

- Supreme Court Rules on Estate Partition CaseDocument8 pagesSupreme Court Rules on Estate Partition CaseYuno NanaseNo ratings yet

- G.R. No. L-39050Document6 pagesG.R. No. L-39050Yuno NanaseNo ratings yet

- G.R. No. L-19550Document10 pagesG.R. No. L-19550Yuno NanaseNo ratings yet

- Measurement of Equipment DecDocument3 pagesMeasurement of Equipment DecYuno NanaseNo ratings yet

- G.R. No. 149351 - SPEED DISTRIBUTING CORP., ET AL. v. COURT OF APPEALS, ET ALDocument14 pagesG.R. No. 149351 - SPEED DISTRIBUTING CORP., ET AL. v. COURT OF APPEALS, ET ALYuno NanaseNo ratings yet

- G.R. No. 191178Document9 pagesG.R. No. 191178Yuno NanaseNo ratings yet

- Albert vs University Publishing Case DigestDocument3 pagesAlbert vs University Publishing Case DigestYuno NanaseNo ratings yet

- AGENCY Ladymaridel's WeblogDocument58 pagesAGENCY Ladymaridel's WeblogYuno NanaseNo ratings yet

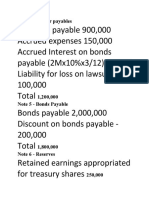

- Trade and Other PayablesDocument2 pagesTrade and Other PayablesYuno NanaseNo ratings yet

- ABS-CBN vs. CA (1999) - LAW I.QDocument5 pagesABS-CBN vs. CA (1999) - LAW I.QYuno NanaseNo ratings yet

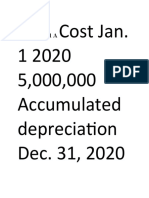

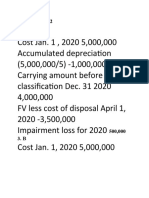

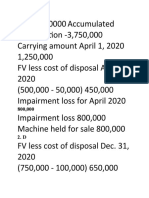

- Problem 67 1 A Cost JanDocument10 pagesProblem 67 1 A Cost JanYuno NanaseNo ratings yet

- When You Join Us On March 17Document3 pagesWhen You Join Us On March 17Yuno NanaseNo ratings yet

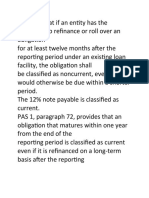

- Provides That If An Entity Has The Discretion To Refinance or Roll Over An ObligationDocument2 pagesProvides That If An Entity Has The Discretion To Refinance or Roll Over An ObligationYuno NanaseNo ratings yet

- Problem 6 9 1 2Document2 pagesProblem 6 9 1 2Yuno NanaseNo ratings yet

- Total Noncurrent Liabilities 2Document3 pagesTotal Noncurrent Liabilities 2Yuno NanaseNo ratings yet

- Intermediate AccountingDocument6 pagesIntermediate AccountingYuno NanaseNo ratings yet

- Audit Procedures for CashDocument10 pagesAudit Procedures for CashYuno NanaseNo ratings yet

- Cost 5000000 Accumulated DepreciationDocument2 pagesCost 5000000 Accumulated DepreciationYuno NanaseNo ratings yet

- Under His Leadership ZEPETO Hit 20M Monthly Active UsersDocument8 pagesUnder His Leadership ZEPETO Hit 20M Monthly Active UsersYuno NanaseNo ratings yet

- Founded in 2018 Naver Z Is The Team Behind ZEPETODocument2 pagesFounded in 2018 Naver Z Is The Team Behind ZEPETOYuno NanaseNo ratings yet

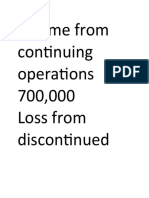

- Income From Continuing Operations 700Document7 pagesIncome From Continuing Operations 700Yuno NanaseNo ratings yet

- The Metaverse Is ComingDocument2 pagesThe Metaverse Is ComingYuno NanaseNo ratings yet

- Jungsuk Jay Lee Is The CEO of NAVER Z USADocument5 pagesJungsuk Jay Lee Is The CEO of NAVER Z USAYuno NanaseNo ratings yet

- On The Heels ofDocument5 pagesOn The Heels ofYuno NanaseNo ratings yet