Professional Documents

Culture Documents

Provides That If An Entity Has The Discretion To Refinance or Roll Over An Obligation

Uploaded by

Yuno Nanase0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

Provides That if an Entity Has the Discretion to Refinance or Roll Over an Obligation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesProvides That If An Entity Has The Discretion To Refinance or Roll Over An Obligation

Uploaded by

Yuno NanaseCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

provides that if an entity has the

discretion to refinance or roll over an

obligation

for at least twelve months after the

reporting period under an existing loan

facility, the obligation shall

be classified as noncurrent, even if it

would otherwise be due within a shorter

period.

The 12% note payable is classified as

current.

PAS 1, paragraph 72, provides that an

obligation that matures within one year

from the end of the

reporting period is classified as current

even if it is refinanced on a long-term

basis after the reporting

period and before issuance of the

financial statements.

The 12% note payable is refinanced on

March 1, 2017 and therefore classifies as

current.

Problem 2-17 A

Accounts payable 2,000,000

Short-term borrowings 1,500,000

Bonds payable 3,000,000

Premium on bonds payable 500,000

Mortgage payable - current portion

500,000

Bank loan 1,000,000

Total current liabilities 7,500,000

You might also like

- G.R. No. L-19118Document3 pagesG.R. No. L-19118Yuno NanaseNo ratings yet

- G.R. No. L-19118 - MARIANO A. ALBERT vs. UNIVERSITY PUBLISHING CO., INCDocument7 pagesG.R. No. L-19118 - MARIANO A. ALBERT vs. UNIVERSITY PUBLISHING CO., INCYuno NanaseNo ratings yet

- Constitution of The Philippines. - FAOLEXDocument3 pagesConstitution of The Philippines. - FAOLEXYuno NanaseNo ratings yet

- G.R. No. L-18062Document3 pagesG.R. No. L-18062Yuno NanaseNo ratings yet

- G.R. No. L-19550Document10 pagesG.R. No. L-19550Yuno NanaseNo ratings yet

- G.R. No. L-39050Document6 pagesG.R. No. L-39050Yuno NanaseNo ratings yet

- G.R. No. L-33172Document8 pagesG.R. No. L-33172Yuno NanaseNo ratings yet

- ABS-CBN vs. CA (1999) - LAW I.QDocument5 pagesABS-CBN vs. CA (1999) - LAW I.QYuno NanaseNo ratings yet

- G.R. No. L-15092Document4 pagesG.R. No. L-15092Yuno NanaseNo ratings yet

- AGENCY Ladymaridel's WeblogDocument58 pagesAGENCY Ladymaridel's WeblogYuno NanaseNo ratings yet

- Albert Vs University Publishing - Karenlustica17Document3 pagesAlbert Vs University Publishing - Karenlustica17Yuno NanaseNo ratings yet

- G.R. No. 191178Document9 pagesG.R. No. 191178Yuno NanaseNo ratings yet

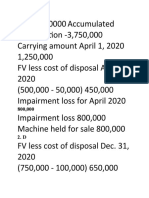

- Cost 5000000 Accumulated DepreciationDocument2 pagesCost 5000000 Accumulated DepreciationYuno NanaseNo ratings yet

- ACAUD - FA 5 Flashcards - QuizDocument10 pagesACAUD - FA 5 Flashcards - QuizYuno NanaseNo ratings yet

- Foreign Income Is Subject To Final Tax If The Taxpayer Is Taxable On Global IncomeDocument2 pagesForeign Income Is Subject To Final Tax If The Taxpayer Is Taxable On Global IncomeYuno NanaseNo ratings yet

- Jungsuk Jay Lee Is The CEO of NAVER Z USADocument5 pagesJungsuk Jay Lee Is The CEO of NAVER Z USAYuno NanaseNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- Under His Leadership ZEPETO Hit 20M Monthly Active UsersDocument8 pagesUnder His Leadership ZEPETO Hit 20M Monthly Active UsersYuno NanaseNo ratings yet

- War Postponed Any Future OlympicsDocument2 pagesWar Postponed Any Future OlympicsYuno NanaseNo ratings yet

- ZEPETO ZepewhoDocument3 pagesZEPETO ZepewhoYuno NanaseNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)