Professional Documents

Culture Documents

GeneralLuna2017 Audit Report-Unlocked

GeneralLuna2017 Audit Report-Unlocked

Uploaded by

J Ja0 ratings0% found this document useful (0 votes)

10 views95 pagesOriginal Title

GeneralLuna2017_Audit_Report-unlocked

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views95 pagesGeneralLuna2017 Audit Report-Unlocked

GeneralLuna2017 Audit Report-Unlocked

Uploaded by

J JaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 95

Republic of the Philippines

COMMISSION ON AUDIT

Regional Office No. TV-A

Capitol Building, Lucena City

June 20,2018

Honorable Jose Stevenson M. Sangalang

Municipal Mayor

General Luna, Quezon

Dear Mayor Sangalang:

We are pleased to transmit the report on the results of the audit on the accounts and

operations of the Municipality of General Luna, Quezon for the Calendar Year (CY) ended

December 31, 2017, pursuant to Section 43 of Presidential Decree (PD) No. 1445,

otherwise known as the Government Auditing Code of the Philippines. and in line with the

Commission's effort towards informing Management on how fiscal responsibility has been

discharged.

‘Our audit was conducted in accordance with Philippine Public Sector Standards on

Auditing, and we believe that it provided reasonable bases, for the results of the audit.

The audit report, which was prepared by Ms. Vivian N. Cavida, Audit Team Leader, and

assisted by Ms. Marita M. Jalbuena and Mr. Aniceto P, Bautista, both Audit Team

Members under the supervision of the undersigned, consists of the Independent Auditor's

Report, the Audited Financial Statements, the Observations and Recommendations, the

Status of Implementation of Prior Year's Audit Recommendations and the Annexes.

We rendered a qualified opinion on the fairness of the presentation of the financial

statements of the Municipality of General Luna, Quezon, in view of the exceptions noted

in audit as stated in the Independents Auditor's Report in Part I of this report.

‘The significant observations and recommendations that need immediate action among,

others, are as follows:

1. Theexistence and valuation of the Property. Plant and Equipment (PPE) accounts with

a net book value totaling 230,556,626.13 could not be ascertained due to the failure

of the Inventory Committee to complete the physical inventory during the year as well

as to prepare and maintain property cards and subsidiary ledgers for each category of

PPE, contrary to Sections 124, 114 and 119 of the Manual on the New Government

‘Accounting System (MNGAS) for Local Government Unit (1.GU), Volume 1,

v

We reiterated our recommendation that the Municipal Mayor require the:

‘+ Inventory committee to complete the physical count of PPE of the Municipality and

submit the RPCPPE to the Audit Team for validation pursuant to Section 124 of

the MNGAS for LGU;

‘* Municipal Treasurer to prepare and maintain complete and updated Property, Plant

and Equipment Ledger Cards and Property Cards, and reconcile their records

regularly with the Accounting Office.

+ Municipal Treasurer and the Municipal Accountant to reconcile their records

regularly.

. Five parcels of land recorded in the books at P3,091,310.00 remain untitled in the

name of the Municipality, contrary to Section 148 of Commission on Audit (COA)

Circular No. 92-386. thus exposes the subject lots to third party claims.

We reiterated our recommendation that the Municipal Mayor instruct the Municipal

Assessor to facilitate the titling of the five parcels of land in compliance with Section

148 of COA Circular No. 92-386.

. Failure of the Municipal Treasurer's Office to exercise fully the statutory remedies as

provided under Sections 247, 256, 258 and 260 of Republic Act (R.A.) No. 7160 to

enforce collection of delinquent accounts resulted in the accumulation of real property

tax delinquencies to P19,573,940.92 as of December 31, 2017, thus the Municipality

stands to lose potential revenues which could have been utilized for its development

programs and projects.

We reiterated our recommendation that the Municipal Mayor require the Munieipal

‘Treasurer to exert extra effort and adopt the remedies to enforce collection of

delinquent real property taxes in accordance with RA No. 7160.

|. Cash advances granted to Municipal Officers and Employees totaling P94,439.98

recorded under the Advances to Officers and Employees account of P37.940.00 and

Advances to Payroll account of P56,499.98 remain unliquidated at year-end, contrary

to COA Circular No, 97-002 dated February 10, 1997, resulted to overstatement of the

respective assei accounts and understatement of related expenses equivalent to the

amount of unreported disbursements.

We recommended that the Municipal Mayor instruct the Municipal Accountant to:

‘© ensure the proper granting, utilization and liquidetion of all cash advances within

the prescribed period in accordance with the above-cited rules and regulation; and

* send written notice or demand to the Accountable Officers to immediately settle

their cash advances, otherwise, implement the withholding of their salary to be

applied to their accounts

5. The aon-reconding in the books of the Municipality of the donated ambulance from

‘the Pillippine Charity Sweepstakes Office (PCSO) is a violation of Section 63 of

Presidential Decree (P-D.) No. 1445, thus resulted to understatement of the Property,

Plant and Equipinent (PPE) account at year-end. Moreover, the donated ambulance

was not provided with depreciation, contrary to Pemgraphs 43,44, 66, 69 ond 71 of

the Philippine Puiblic Sector Accounting Standarés (PPSAS) 17, resulting in, the

‘understaicment of the related expense account and overstatement of the equity and

asset accounts.

We recommended that the Municipal Mayos instruct the Municipal Accountant to:

© take-up in the books ofthe Municipality the donated ambulance for fair presemation

of PPE account in the financial statements.

© compute, secord and present the sccumulated depreciation in the finencial

sietements Dursuani t Paragraphs 43, 66, 69 and 71 of PPSAS 17 for proper

valuation.

‘The other audit observations. ‘ogether with the recommended courses of action which were

discussed by the Audit Team with the concemed Municipal officials and suff during the

‘exit conférence conducted on June 19, 2017 are discussed in detail in Part Il of the report.

We respectfully sequest that the recommendations contained in Past I of the report be

implemented and that this Commission be informed of the actions tken thereon by

eccomplishing the Agency Action Pian and Status of Implementation (copy attached) and

retuming the samte within 60 days fom the date of receipt hereof.

We acknowledge the support end cooperation that you and your staff extended to the Audit

‘Team, thus facilitating the submission of thie report.

Very muly yours,

COMMISSION ON AUDIT

(Cony Furnished

‘Te Regional Director

Department of te Interior and Loes! Governmest, Region 1V-A

“The Regional Pieetor

‘Department of Budget and Management, Region IVA

“Te Regional Drestor

‘Burew of Local Goverment Finarce, Region IV-A

‘The Regional Director

CCammision on Aut Region V-A

‘The Seortary

Sangguniang Bayan, General Luna, Quezon

(q) paxejaq (9) 10

d) paruonuayduuy Aijered (p) (IN) pawauajduy on (9) (O) FmeFug (q) ({.) pawaurajduyy Ayng (0) 9q soy Kew voMUDWo|du Jo sMeIS :710N

ard 4A91 YQ Kousy Jo uoNIsog pur aE,

ayqoydde oy | wor 3 -

4 aiqysuodso uy

SMA fu | PREEUOKT | oommaman | wocrwosng | vomny | seoNRpUUUDDY | suORAREEO |

i : : : " a

wonoy Repaying | OSS pire, upay upny

Joy uoseaY, ub] uonoy Aousy

psy

LOZ ADA A TepUDTED aIp 304

suonupudULUCoD Y PUe SUOAEALDSGQ }IPnY

NOLLV.LNAWA TANI dO SALLV.LS PUC NV Td NOLLOV ADNAOV

(Kouady Jo auen)

EXECUTIVE SUMMARY

Introduction

The Municipality of General Luna, formerly a sitio of Macalelon, Quezon was

created into a municipality on November 1, 1929 under Executive Order No. 207. It is

located along the coast of Tayabas Bay in the southwestem portion of Quezon Province

and is one of the 12 municipalities covered by Bondoc Peninsula with a total land area of

10,215,5857 hectares subdivided into 27 barangays. It is currently classified as a 4" class

municipality with farming and fishing as the two major economic activities and is

considered one of the food bowls of the Province due to its abundant supply of farm and

fishery products. Its most featured celebration is the Centurion Festival held during the

Lenten Season which has been a tourist attraction.

I maintains General, Special Education and Trust Fund books.

‘The Organizational Structure of the Municipality is as follows:

Key Officials

‘Municipal Mayor = Jose Stevenson M. Sangalang

Municipal Vice Mayor ~ Jevito P. Red

Members of the

Sangguniang Bayan 1. Melaica M. Batariano

2, Kristine Chemobyl V. Florida

3. Rolando P, Atienza

4, Manvel G. Suarez

5. Jose Stenlee M. Sangalang

6. Remegio R. Agoncillo

7. Tomas P.Odiame

8, Miguel R. Salvo

9, William Pelotos

Municipal Accountant = Madonna A. Suarez

Municipal Treasurer ~ Monaliza L. Plata

r TL was complemented with a total workforce of 143 personnel in Calendar Year

(CY) 2017, with the following details:

Elected -u

Permanent = 70

Coterminous - 2

Job Order =

Total

Bis.

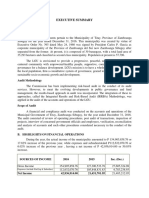

Financial Highlights

For CY 2017, the Municipality generated a total income of P84,937,843 from tex

revenue, service and business income, share from Internal Revenue Collections and other

income, The total funds utilized for the year amounted to 277,517,658 out of the total

appropriations of 99,193,083 leaving an unexpended balance of P21,675,42S. The

unutilized Capital Outlay appropriation amounting to P8,782,025 will be continued in CY

2018,

The Municipality's comparative financial position and results of operations for

CYs 2016 and 2017 are summarized below and shown in detail in the attached audited

financial statements.

Increase/

2017 2016 Decrease

Total Assets P 100,127,643 PR 96,045,038 P 4,082,605

Total Liabilities 46496875 48,244,142 (1,747,267)

Total Net Assets/Equity ‘53,630,768 47,800,896 5,829,872

Total Income 84,937,843 75,550,266 9,387,577

Total Expenses 79815637 60,795,588 19,020,039

Scope of Audit

Financial and compliance audit was conducted on the accounts and operations of

the Municipality for CY 2017 to ascertain the fairness of the presentation of the financial

statements and compliance of the Municipality with laws, rules and regulations as well as

the economical, efficient and effective utilization of resources.

Auditor’s Opinion on the Financial Statements

The Auditor rendered a qualified opinion on the faimess of the presentation of

the financial statements of the Municipality due to the following:

1, The existence and valuation of the Property, Plant and Equipment (PPE) accounts

With @ net book value totaling B30,556,626.13 could not be ascertained due to the

failure of the Inventory Committee to complete the physical inventory during the year

as well as to prepare and maintain property cards and subsidiary ledgers for each

category of PPE.

»

Cash advances granted to Municipal Officers and Employees totaling P94,439.98

recorded under the Advances to Officers and Employees account of 37,940.00 and

Advances to Payroll account of P56,499,98 remain unliquidated at year-end, resulted

to overstatement of the respective asset accounts and understatement of related

expenses equivalent to the amount of unreported disbursements,

3, The non-recording in the books of the Municipality of the donated ambulance from

the Philippine Charity Sweepstakes Office (PCSO) resulted to understatement of the

Property, Plant and Equipment (PPE) account at year-end. Moreover, the donated

ambulance was not provided with depreciation, resulting in the understatement of the

related expense account and overstatement of the equity and asset accounts

For the exceptions cited above, the Auditor recommended the Municipal

Mayor the following courses of action:

* create Inventory committee to complete the physical count of PPE of the Municipality

and submit the RPCPPE to the Audit Team for validation pursuant to Section 124 of

the MNGAS for LGU;

+ require the Municipal Treasurer to prepare and maintain complete and updated

Property, Plant and Equipment Ledger Cards (PPELC) and Property Cards, and

reconcile their records regularly with the Accounting Office; and

‘* instruct the Municipal Treasurer and the Municipal Accountant to reconcile their

records regularly.

‘* instruct the Municipal Accountant to ensure the proper granting. utilization and

liquidation of all cash advances within the prescribed period in accordance with the

above-cited rules and regulation; and

© instruct the Municipal Accountant to send written notice or demand to the

Accountable Officers to immediately settle their cash advances, otherwise, implement

the withholding of their salary to be applied to their accounts

* instruct the Municipal Accountant to take up in the books of the Municipality the

donated ambulance for fair presentation of PPE account in the financial statements;

and

* instruct the Municipal Accountant to compute, record and present the accumulated

depreciation in the financial statements pursuant to Paragraphs 43, 66, 69 and 71 of

PPSAS 17 for proper valuation.

Significant Observations and Recommendations

‘The following are the other significant audit observations and recommendations in

the audit of the Municipality for CY 2017;

1. Five parcels of land recorded in the books at P3,091,310.00 remain untitled in the

name of the Municipality, thus exposes the subject lots to third party claims.

v

We reiterate our recommendation that the Municipal Mayor instruct the Municipal

Assessor to facilitate the titling of the five parcels of land in compliance with Section

148 of Commission on Audit (COA) Circular No, 92-386.

Failure of the Municipal Treasurer's Office to exercise fully the statutory remedies 10

enforce collection of delinquent accounts resulted in the accumulation of real

property tax delinquencies to P19,573,940.92 taxes as of December 31, 2017, thus the

Municipality stands to lose potential revenues which could have been utilized for its

development programs and projects.

‘We reiterated our recommendation that the Municipal Mayor require the Municipal

Treasurer to exert extra effort and adopt the remedies to enforce collection of

delinquent real property taxes in accordance with R.A, No, 7160,

Fully depreciated and unserviceable properties totaling P183,734,50 were not

disposed of due to failure of the designated Property Custodian to prepare the

Inventory and inspection Report of Unserviceable Property (TIRUP) as required under

Section 79 of Presidential Decree (P.D.) 1445 and Section 125 of the MNGAS for

LGU, thereby depriving the Municipality of the possible additional income that cen

be derived therefrom.

We reiterated our recommendation that the Municipal Mayor instruct the Municipal

‘Treasurer to:

* conduct the physical inventory of the unserviceable properties of the

Municipality;

‘© prepare and submit the ITRUP as part of the disposal procedures; and

+ dispose the unserviceable properties in accordance with the steps and procedures

‘enumerated under Section 79 of P.D. No. 1445 to generate additional income out

of the proceeds from sale thereof

Guaranty/Security Deposits totalingP212,414,84which have been outstanding for two

‘years or more, were still not reverted to the Uneppropriated Surplus of the General

Fund, contrary to Section 98 of Presidential Decree (P.D,) No. 1445, thus existence

and correctness of the balance of the account cannot be relied upon,

We recommended that the Municipal Mayor instruct the Municipal Accountant to

confirm with the contractor and to request him to submit documents pertaining to his

claims, revert the account to the Unappropriated Surplus of the General Fund, subject

to an authority from the Sangguniang Bayan through a Resolution with the condition

that appropriation shall be made in the event that claim arises in the future pursuant to

the provisions of Section 98 of P.D, No. 1445.

. The Municipality failed to revert back to the unappropriated surplus of the General

Fund the unexpended balance of Local Disaster Risk Reduction Management

(LDRRM) Fund after 5 years amounting to P916,106.93, contrary to Section 21 of

Republic Act (R.A.) No. 10121, hence depriving the Municipality of funds which

could be used for other social services. Moreover, the Report on Sources and

Utilization of DRRMF for various months of CY 2017 were not prepared by the

Municipal Accountant and submitted by the LDRRM Officer to the COA Auditor,

contrary to Section 5.1.5 of Commission on Audit (COA) Circular No. 2012-002,

hhence monthly monitoring and evaluation on the utilization of DRRM fund for

various projects and activities could not be made,

We recommended that the Municipal Mayor require the:

© Municipal Accountant to revert back to the General Fund the unexpended balance

of LDRRM Fund for CYs 2011-2012 totalingP916,106.93 and to prepare the

Report on Sources and Utilization of DRRMF using the prescribed format as

provided in Section 5.1.5 of COA Circular No, 2012-002; and

* LDRRMO to submit the monthly Report on Sources and Utilization of DRRMF

to the COA Auditor for monitoring and evaluation.

|. Immediate and full settlement of the short-term loans (micro-financing benefits) and

the disallowed Representation Allawance and Transportation Allowance (RATA) in

2006-2007 with balances of P22,524.70 and P4,861.00, respectively, were not fully

settled at year-end, contrary to Section 2 of P.D. No. 1445 and Section 7.1 of the

2009 Rules and Regulations on the Settlement of Accounts (RRSA).

We recommended that the Municipal Mayor instruct the:

Municipal Accountant to take up in the books under the Other Receivables

account the balance of P22,524.70 which pertains to the unsettled balance of

short-term loans for fair presentation of PPE account in the financial statements;

* MT to pursue the immediate refund of the total amount of 222,524.70, otherwise

deduct it from the salary or from whatever money due the concemed Municipal

officials/employees; and

© MT to refund the overpayment made by borrowers/employees as presented in

‘Annex 8 and adopt measures to properly monitor balances of the account.

. ‘The Water Supply System of the Municipality of 211,230,972.11 was erroneously

recorded under Other Property, Plant and Equipment (PPE) sccount, contrary to COA

Circular No. 2015-009, resulting in the overstatement of the said account and

understatement of Water Supply System account by the same amount.

We recommended thet the Municipal Mayor require the Municipal Accountant to

take up the necessary accounting entries to adjust the account to ensure fair

presentation of the affected accounts in the financial statements.

The above observations and recommendations contained in the report were

communicated to the Municipal Mayor and other key officials under various Audit

Observation Memoranda and discussed in the exit conference conducted on June 19,

2017. Management’s views and comments were considered in the report, where

appropriate.

Status of Implementation of Prior Year’s Audit Recommendations

Of the 19 prior year's audit recommendations embodied in the 2016 Annual

Audit Report, eight were fully implemented, four were partially implemented and seven

‘were not implemented by the Municipality,

TABLE OF CONTENTS

PART SUBJECT PAGE

1 Audited Financial Statements

‘© Independent Auditor's Report 1

‘® Statement of Management's Responsibility for Financial Statements 4

© Comparative Statement of Financial Position 5

* Comparative Statement of Financial Performance 6

© Comparative Statement of Changes in Net Assets/Equity 7

Comparative Statement of Cash Flows 8

© Statement of Comparison of Budget and Actual Amounts 9

* Notes to Financial Statements 10

11 Detailed Observations and Recommendations

A. Financial and Compliance Audit 44

B. Unsettled Suspensions, Disallowances and Charges 59

C. Compliance with Tax Laws 539

D. Compliance with GSIS Rules and Regulations 39

E. Official Development Assistance 60

Til Status of Implementation of Prior Year's Audit Recommendations 61

IV Annexes

Statement of Financial Position (By Fund)

Statement of Financial Performance (By Fund)

Statement of Changes in Net Assets/Equity (By Fund)

Statement of Cash Flows (By Fund)

Schedule of RPT Delinquencies

Schedule of Fully Depreciated and Unserviceable Properties.

Schedule of Guaranty/Security Deposits

Schedule of Other Receivables

ena

Republic of the Philippines

COMMISSION ON AUDIT

Commonwealth Avenue, Quezon City

INDEPENDENT AUDITOR'S REPORT

Hon. Jose Stevenson M. Sangalang

Municipal Mayor

General Luna, Quezon

We have audited the accompanying combined financial statements of the Municipality of

General Luna, Province of Quezon which comprise the Statement of Financial Position as

of December 31, 2017 and the Statements of Financial Performance, Changes in Net

Assets/Equity, Comparison of Budget and Actual Amounts and Cash Flows for the

year then ended and a summary of significant accounting policies and other explanatory

information.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial

statements in accordance with the Philippine Public Sector Accounting Standards

(PPSAS) and for such internal control as management determines is necessary to enable

the preparation of financial statements that are free from material misstatement, whether

due to fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on these financial statements based on our

audit. We conducted our audit in accordance with Philippine Public Sector Standards on

Auditing Those standards require that we comply with ethical requirements and plan

and perform the audit to obtain reasonable assurance whether the financial statements are

free from materiel misstatement,

An audit involves performing procedures to obtain audit evidence about the amounts and

disclosures in the financial statements. The procedures selected depend on the auditor's

judgment, including the assessment of the risks of material misstatement of the financial

statements, whether due to fraud or error. In making those risk assessments, the auditor

considers internal control relevant to the entity's preparation and fair presentation of the

financial statements in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the entity's intemal control. An audit also includes evaluating the sppropriateness of

accounting policies used and the reasonableness of accounting estimates made by

‘management, as well as evaluating the overall presentation of the financial statements,

We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our qualified opinion,

Basis for Qualified Opinion

As discussed in Part Il, Observations and Recommendations portion of this report, the

following matters were noted:

1. The existence and valuation of the Property, Plant and Equipment (PPE) accounts

with a net book value totaling 230,556,626.13 could rot be ascertained due to the

failure of the Inventory Committee to complete the physical inventory during the year

‘as well as to prepare and maintain property cards and subsidiary ledgers for each

category of PPE.

2 Cash advances granted to Municipal Officers and Employees totaling P94,439.98

recorded under the Advances to Officers and Employees account of P37,940.00 and

Advances to Payroll account of P56,499.98 remain unliquidated at year-end. resulted

to overstatement of the respective asset accounts and understaiement of related

expenses equivalent to the amount of unreported disbursements.

The non-recording in the books of the Municipality of the donated ambulance from

the Philippine Charity Sweepstakes Office (PCSO), resulted to understatement of the

Property, Plant and Equipment (PPE) account at year-end. Moreover, the donated

ambulance was not provided with depreciation, resulting in the understatement of the

related expense account and overstatement of the equity and asset accounts

Qualified Opinion

In our opinion, except for the possible effects on the financial statements of the matters

described in the Basis for Qualified Opinion paragraph, the combined financial

statements present fairly, in all material respects, the financial position of the

Municipality of General Luna, Quezon as of December 31, 2017 and its financial

performance and its cash flows for the year then ended in accordance with the Philippine

Public Sector Accounting Standards,

Other Matters

1. Five parcels of land recorded in the books at P3,091,310.00 remain untitled in the

name of the Municipality, thus exposes the subject lots to third party claims.

2. Failure of the Municipal Treasurer's Office to exercise fully the statutory remedies to

enforce collection of delinquent accounts resulted in the accumulation of real property

tax delinquencies to P19,573,940.92 as of December 31. 2017. thus the Municipality

stands to lose potential revenues which could have been utilized for its development

programs and projee's.

COMMISSION ON AUDIT

By:

PG CAVIDA

(OIC) Audit Team Leader

June 19, 2018

Republic of the Philipines

PROVINCE OF QUEZON

Municipality of General Luna

—v00000—

‘STATEMENT OF MANAGEIIENT'S RESPONSIBILITY FOR FINANCIAL STATEMENTS

‘The management of the Municipal Government of General Luna Is responsible for all information and

representations contained in the accomparying Statement of Financial Position as of December 32, 2017

and the related Statement of Financial Performance, Statement of Cash Flows, Statement of comparison

of Budget and Actual Amounts, Statement of Changes In Net Assets/ Equity and the Notes to Financial

‘Statements forthe year then ended. The financial statements have been prepared in conformity with the

Philippine Public Sector Accounting Standards and generally accepted state accounting principles, and

‘reflect amounts that are based on the best estimates and Informed judgment of management with an

appropriate consideration to materiality,

In this regard, management maintains a system of accounting and reporting which provides for the

necessary internal controls to ensure that transactions are property austharized sry tes

sofeguarded against unauthorized use or disposition and liabilities are ed.

A, SUAREZ JOSESTEVENSONGt-SANGALANG

luricipal Accountant

Date Signed Date Signed

Municipality of General Luna, Quezon

STATEMENT OF FINANCIAL POSITION

Asat December 31, 2017

(With Comparative Figures for CY 2016)

Note 2017 2016

ASSETS

Current Assets

Cash and Cash Equivalents 4 RB $1555,774,78 P 44,087247.96

Receivables 5 17,130,371,76 24,468,612.2:

Inventories 6 - 1,491,353.29

Prepayments and Deferred Charges 7 138,244.27

Total Current Assets (68,824,390,81

Non- Current Assets

Property, Plant and Equipment 8 31,303,252.61 28.71

Total Non-Current Assets 31,303,252.61

Total Assets 100,127,643.42

LIABILITIES

Curent Ligbilities

Financial Liabilities 9 783,621.65, 1,781,099.44

Inter-Agency Payables 10 17,859,838.16 14,186,735.83

Intra-A gency Payables - 3,959,107.25

‘Trust Liabilities Nt 10,453,573.20 8,587,831.67

Deferred Credits/Uneamed Income 12 17,035,931.78 19,495,594.11

Total Current Lisbilities 46,132,968.79 48,010,368.30

‘Non-Curreat Liabilities

Other Payables B 363,910.31 233,774.18

Total Non-Curreat Liabilit 363,910.31

‘Total Liabilities 46,496,875.10

NET ASSETS/EQUITY

Government Equity 53,630,768.32 47,800,89639

‘Total Liabilities and Net Assets/Equity P _100,127.643.42 P _ 96,045,038.87

(See accompanying Notes to Financial Statements)

Municipality of General Luna, Quezon

STATEMENT OF FINANCIAL PERFORMANCE

For the Year Ended December 31, 2017

(With Comparative Figures for CY 2016)

Nowe 2017 2016

Revenue

Vax Revenue 14 P 24s7S8V.ID B14695,15632

Share fom Internal Revenue Collections 15 78.915,525.00 70,811,111.00

Service and Business Income 16 2,009,684.99 1,910,890,75,

‘Other Income 7 1,555, 1,133,108.40

Total Revenue 84,937.843.15, 75,550,266,47

‘Less: Current Uperating Expenses

Personncl Services 18 3620342193 31,442,243.21

Maintenance and Other Operating Expenses 19 32,160,191.03 21,935,849.45

Financial Expenses 20 496057 7822.50

Non-Cash Expenses 21 2

Current Operating Expenses 35.492,579.41

‘Surpius rom Current Uperation 1380237270 1¥,097,087.06

Add(Deduct):

Transfers, Assistance and Subsidy To 2 (8,680,366.50) __(4,903,008.77)

Surplus for the Period P 510220610 P 1475457829

(See accompanying Notes 10 Financial Statements)

‘Municipauity oF General Luna, Quezon

STATEMENT OF CHANGES IN NET ASSETS/EQUITY

For the Year Ended December 31, 2017

(With Comparative Figures for CY 2016)

‘Note 2017 2016

Balance at January 1,2017 PB 47,800,896.39 BP 33,452,910.84

Add (Dedued)

Prioe Period Errors a 107,665.83, (386,692.74)

Restated Balance 98,508,552.20 35,076218.10

Add Deduet) Changes in Net Assets/Equity During the Year

‘Surplus forthe Period 3.122,206.10 14,754,678.29

Total Recognized Revenue and Expenses forthe Period 14,754,678.29

Balance at December 31, 2017 P 47,800,896.39

(See accompanying Notes to Financial Statements)

‘Mantexpaiity of General Luna, (Quezon

STATEMENT OF CASH FLOWS

For the Year Ended December 31, 2017

(With Comparative Figures for CY 2016)

Note 2017 2016

Cash Flows from Operating Activites

Cash Inflows

Collection from Taxpayers P 2.497,58910 PB _2194,883.41

‘Share from Internal Revenue Collections 78,915.525.00 7011.11.00

Receipt from Business/Serviee Income 1,936,402.71 183143850

{terest Income 73,202.28 452.25

Other Receipts 32,704,386.42 20,159,583}

“Total Cash Inflows 116,087.185.51

Cash Outflows

Payments of Expenses 60,711,229.30 21.443.142.00

Peymentsto Suppliers and Creditors 180,835.84 18,336.988.66

Payments to Employees 36,203,421.93 20.453,112.24

Interest Expenies 4,960.57 7.4822:50

Other Expenses 3.776.444.00

{otal Cash Outlows 100.476,391.68 67.202.106.90

Net Cash Flows from Operating Activities 24 15.210.283.87 2787423657

Cash Flows front Investing Activitics

Cash Outflow

Purchase/Construction of Property, Plant and Equipment

[Net Cash Flows from Investing Activities

‘Cash blows trom Hinaneing Activites

(Cash Outflow

Paymentof Lom Amortization - 348,624.13

Net Cash Flow from Financing Activities (48,624.15)

‘Total Cash Provided by Operating, investing and Financing

Activities 7,508,526.82 25,002,407.44

‘Add: Cash atthe Bexinning ofthe Year 44,087.247.96 19.044.440.52

Cash Balance af the End ofthe Year P _S1S55.7478_ B __44047 287.96

(See accompanying Notes to Financial Statements)

‘Municipality of General Luna, Quezon

‘Stetemest of Comparison of Budget and Actual Amounts

For the Yeer Ended December 31,2017

iter Dire

Original Fal

Pancolae Badeted Amount sd Fiat ‘Act ‘ig ant

Ogial ial ‘Bader Anca ‘Acta

‘GENERALEUND

Rrowe

‘Allow Sours

1. Tax Reverie

‘2 Tax Rewer Property P — sa0000% ® — st04000 =P @azs9s2 a cm2s9s2

1. Otter ton Taxes 23000 0 2592874 _G142874)

“Toul Tax Reverie exo Tes soo 616836 1615825)

2 NoniexRevome

- 1 Service come 12830000 1.213,00000 = 1sm0570—_aaansv0)

bs Pani iceme sto.00000 “sto.0000 = YSeietss — os.taass)

Otter lane at Resets 142.5000 _1162.50000 = g2.s1401)

Teal NooTax Revenve Sass Tasss0000" ia

- (6. Exerml Somes

1 Shar fromthe Nato! tera

Revecue Taxes (RA) 7SUSSW _ 7491552500 7851352500,

Teal Reveve and Resins REISS ADAG “aos TS

2 apenas

(Carzat Appropriations

‘Gavel Fue Services

Teron! Sertcee 2spun2027 251220027 = asasnziz0—_agg8to7

Maiseoune wad Other Opwaing yews 23,157994)7 2307893307 CMOSHIO) —«1SSTOAKLT 730863139

Capi Oty ‘m.oon0 — «tn00.10 . pisacoso —313,53920

ath, Nation an Ppt Cont

Tenanel Services Ses13 3904515 = sgengas so

- Manieunce an Otier Opening epemex 110500000 1,106 00000 : ‘wostto: —-usaise7

Sov Secs ma Snel Ware

ersonel Serves, 25020130 25622130 = tro tea ess

Materce Oe Opeaing pene 1150000010000, ‘ 10671960, 938000

eonomie Series

Fersoael Series A2oq715)9—42okrisAe = kammasaio 126108

Maintence an Oe Opeaing pene VAI00000 181400000, + ‘iss7303 697

LERRME

Mantnnce wo Oe Opening pens SIDTIGIS SAMMI wey? 2.4383

Capit Out oio0e0 —.010,00000 : 4229000 '57,71000

20 Developme und

Capt Outy 15765,10500 —13,79,1080 = weeangas99—1asgaeiio

‘Abeaton fo Sie Cizensand PWD)

= “Mainersoce nl Other Opeaing xpeoms 65.0000 ——620,00000 . eis.44000 asco

tes

Naisterance af Oiter Opeating opens 42500000 4.48.00 + amuses anus

Contig Appropritioes

= ‘General Pale Services 1.60, 71940 __1o,601, 71940 weiss _anssisi

‘Tous Apprpriaies SRT “98681830 ETT) LT bass Lama riagr

> 7301450 in.11430)

1369893830301

Fesesy 3821561

z, suena __magon

3.15396

Notes to Financial Statements

(All amounts in Philippine Peso unless otherwise stated)

Note 1 - Profile

General Luna was formerly a sitio of Macalelon town, It was created into a

‘municipality on November 1, 1929 under Executive Order No. 207. Located

along the coast of Tayabas Bay in the southwestem portion of Quezon

Province, itis one of the 12 municipalities covered by Bondoc Peninsula with a

total lard area of 10,215,5857 hectares subdivided into 27 barangays. It is

currently classified as a 4" class municipality with farming and fishing as the

two major economic activities, and is considered one of the food bowls of the

province due to its abundant supply of farm and fishery products. The most

featured celebration here is the Centurion Festival held during the Lenten

Season which has been a tourism attraction.

For Calendar Year (CY) 2017. it is still headed by Hon, Jose Stevenson M.

Sangalang, Municipal Mayor and assisted by Vice Mayor Jovito P. Red.

Note 2 - The combined financial statements of the Municipal Government of General

Luna have been prepared in accordance with and comply with the Philippine

Public Sector Accounting Standards (PPSAS), These are presented in pesos,

which is the functional and reporting currency of the Municipality. The

accounting policies have been applied starting CY 2015.

Note 3 ~Summary of Significant Accounting Policies

3.1 Basis of Accounting

‘The Municipality uses accrual basis of accounting in accordance with PPSAS.

3.2 Consolidation

The controlled funds are all those over which the Municipality has the power to

govern the financial and operating policies. Inter-group transaction, balances

and unrealized gains and losses on transactions between funds are eliminated in

full.

3.3 Interest in Joint Venture

‘The Municipality has no interest in a joint venture which is a jointly controlled

entity, whereby the venturers have a binding arrangement that establishes joint

control over the economic activities of the entity. The Municipality will

recognize its interest in the joint venture using the proportionate consolidation

method, The Municipality will combine its proportionate share of each of the

assets, liabilities, income and expenses of the joint Venture with similar items,

line by line, in its consolidated financial statements, The financial statements of

the joint venture are prepared for the same reporting period as that of the

conirolled entity. Adjustments are to be made where necessary to bring the

accounting policies in line with those of the Municipality.

The joint venture is proportionately consolidated until the date on which the

Municipality ceases to have joint contro! over the joint venture, Upon loss of

Joint control, and provided that the former jointly controlled entity does not

become a subsidiary or an associate, the Municipality discontinues

proportionate consolidation and recognizes its remaining investment at the

carrying amount.

3.4 Revenue Recognition

Revenue from non-exchange transactions

Taxes, Fees and Hines

The Municipality recognizes revenue from taxes and fines when the event

‘occurs and the asset recognition criteria are met. To the extent that there is a

related condition attached that would give rise to a liability to repey the

amount, liability is recognized instead of revenue.

Transfers from Other Government Entities

Revenues from non-exchange transactions with other goverment entities are

measured at fair value and recognized on obtaining control of the asset (cash,

goods, services and property) if the transfer is free from conditions and it is

probable that the economic benefits or service potential related to the asset will

flow to the Municipality and can be measured reliably.

The Municipality availed of the S-year transitional provision for the

recognition of Tax Revenue-Real Property and Special Education Tax, For the

first year, there will be no change in policy for the recognition of the

aforementioned tax revenue.

Revenue from exchange transactions

Rendering of Services

‘The Municipality recognizes revenue trom rendering of services by reference

to the stage of completion when the outcome of the transaction can be

estimated reliably. The stage of completion is measured by reference to labor

hours incurred to date as « percentage of total estimated labor hours. Where the

contract outcome cannot be measured reliably, revenue is recognized only to

the extent that the expenses are incurred.

Sale of Goods

Revenue from the sale of goods is recognized when the significant risks and

rewards of ownership have been transferred to the buyer, usually on delivery of

the goods and when the amount of revenue can be measured reliably and it is

probable that the economic benefits or service potential associated with the

transaction will flow to the Municipality.

Interest Income

Interest income is accrued using the effective yield method. The ettective yield

discounts estimated future cash receipts through the expected life of the

financial asset to that assets net carrying amount. The method applies this

‘yield to the principal outstanding to determine interest income each period.

Dividends

Dividends or similar distributions must be recognized when the shareholder's

or the Municipality's right to receive payment is established,

Rental Income

Rental income arising from opersting leeses on investment properties is

accounted for on 2 straight-line basis over the lease terms and included in

revenue.

3.5 Investment Property

Investment properties are measured initially at cost, including transaction costs.

‘The carrying amount includes the replacement cost of components of an

existing investment property at the time that cost is incurred if the recognition

criteria are met and excludes the costs of day-to-day maintenance of an

investment property.

Investment property acquired through a non-exchange transaction is measured

at its fair value at the date of acquisition. Subsequent to initial recognition,

investment properties are measured using the cost model and are depreciated

cover a 30-year period.

Investment properties are derecognized either when they have been disposed of’

or When the investment property is permanently withdrawn from use and no

future economic benefit or service potential is expected from its disposal. The

difference between the net disposal proceeds and the carrying amount of the

asset is recognized in the surplus or deficit in the period of derecognition.

Transfers are made to or from investment property only when there is a change

in use.

3.6 Property, Plant and Equipment

All property, plant and equipment are stated at cost less accumulated

depreciation. Cost includes expenditure that is directly attributable to the

acquisition of the items. When significant parts of property, plant and

equipment are required to be replaced at intervals, the Municipality recognizes

such parts as individual assets with specific usefull lives and depreciates them

accordingly. Likewise, when a major inspection is performed, its cost is

recognized in the carrying amount of the plant and equipment as a replacement

if the recognition criteria are satisfied. All other repair and maintenance costs

are recognized in surplus or deficit as incurred. When an asset is acquired in a

non-exchange transaction for nil or nominal consideration the asset is initially

measured at its fair value.

Depreciation on assets is charged on a straight-line basis over the useful life of

the asset.

Depreciation is charged at rates calculated to allocate cost or valuation of the

asset less any estimated residual value over its remaining useful life.

Leased assets may consist of vehicles and machinery. The assets’ residual

values and useful lives are reviewed, and adjusted prospectively, it appropriate,

at the end of each reporting period. An asset's carrying amount is written down

immediately to its recoverable amount, or recoverable service amount, if the

asset's carrying amount is greater than its estimated recoverable amount or

recoverable service amount. The Municipality derecognizes items of property,

plant and equipment and/or any significant part of an asset upon disposal or

When no future economic benefits or service potential is expected from its

continuing use, Any gain or loss arising on derecognition of the asset

(calculated as the difference between the net disposal proceeds and the carrying,

amount of the asset) is included in the surplus or deficit when the asset is

derecognized

Public Infrastructures were recognized in the books in compliance with

‘Commission on Audit (COA) Circular No. 2015-008 dated November 25,

2015. Public Infrastructures are depreciated for 20 years as their useful life

sing straight line method of depreciation.

3.7 Leases

Municipality as a Lessee

Finance leases are leases thal transfer substantially all the risks and benetits

incidental to ownership of the leased item to the Municipality. Assets held

under finance lease are capitalized at the commencement of the lease at the

‘fair value of the leased property or, if lower, at the present value of the fisture

minimum lease payments, The Municipality also recognizes the associated

lease liability at the inception of the lease. The liability recognized is

measured as the present value of the future minimum lease payments at

initial recognition. Subsequent to initial recognition, lease payments are

apportioned between finance charges and reduction of the lease liability so as

to achieve a constant rate of interest on the remaining balance of the liability.

Finance charges are recognized as finance costs in surplus or deficit.

An asset held under a finance lease is depreciated over the useful life of the

asset. However, if there is no reasonable certainty that the LGU will obtain

ownership of the asset by the end of the lease term, the asset is depreciated

over the shorter of the estimated useful life of the asset and the lease term.

Operating leases are leases that do not transfer substantially all the risks and

benefits incidental to ownership of the leased item to the Municipality.

Operating lease payments are recognized as an operating expense in surplus

or deficit on a straight-line basis over the lease term.

Municipality as a Lessor

Leases in which the Municipality does not transfer substantially all the risks

and benefits of ownership of an asset are classified as operating leases. Initial

direct costs incurred in negotiating an operating lease are added to the

carrying amount of the leased asset and recognized over the lease term.

Rent received from an operating lease is recognized as income on a straight-

line basis over the lease term. Contingent rents are recognized as revenue in

the period in which they are eared.

3.8 Intangible Assets

Intangible assets acquired separately are initially recognized at cost, The cost

of intangible assets acquired in a non-exchange transaction is their fair value

at the date of the exchange. Following initial recognition, intangible assets

are carried at cost less any accumulated amortization and accumulated

impairment losses. Internally generated intangible assets, excluding

development cost, are not capitalized and expenditure is reflected in surplus

‘or deficit in the pericd in which the expenditure is incured.

The useful life of the intangible assets is assessed as cither finite or

indefinite. Intangible assets with a finite life are amortized on a straight line

method over its useful life. Software is amortized for 10-20 years.

Imangible asset with a finite useful life are assessed for impairment

whenever there is an indication that the asset may be impaired. The

‘amortization period and the amortization method for an intangible asset with

a finite useful life are reviewed at the end of each reporting period. Changes

in the expected useful life or the expected pattern of consumption of future

economic benefits embodied in the asset are considered to modify the

amortization period or method, as appropriate, and treated as changes in

accounting estimates, The amortization expense on an intangible asset with a

finite life is recognized in surplus or deficit as the expense category that is

consistent with the nature of the intangible asset.

Gains or losses arising from derecognition of an intangible asset are

measured as the difference between the net disposal proceeds and the

carrying amount of the asset and are recognized in the surplus or deficit when

the asset is derecognized.

Research and Development Cost

Research costs when incurred are treated as expenses by the Municipality.

Development costs on an individual project are recognized as intangible

assets when the Municipality can demonstrate:

a) The technical feasibility of completing the asset so that the asset will be

available for use or sale;

b) Its intention to complete and its ability to use or sell the asset;

©) How the asset will generate future economic benefits or service potential:

4) The availability of resources to complete the asset; end

) The ability to measure reliably the expenditure during development.

Following initial recognition of an asset, the asset is carried at cost less any

accumulated amortization and accumulated impairment losses. Amortization

of the asset begins when development is complete and the asset is available

for use. It is amortized over the period of expected future benefit. During the

period of development, the asset is tested for impairment annually with any

impairment losses recognized immediately in surplus or deficit.

3.9 Impairment of Non-Financial Assets

Impairment of Cash-Generating Assets

At each reporting date, the Municipality assesses whether there is an

indication that an asset may be impaired. If any indication exists, or when

annual impairment testing for an asset is required, the Municipality estimates

the asset's recoverable amount. An assets’ recoverable amount is the higher

of an asset’s or cash-generating unit's fair value less costs to sell and its

value in use and is determined for an individual asset, unless the asset does

not generate cash inflows that are largely independent of those from other

assets or groups of assets.

Where the carrying amount of an asset or the cash-generating unit (CGU)

exceeds its recoverable amount, the asset is considered impaired and is

written down to its recoverable amount. In assessing value in use, the

estimated future cash flows are discounted to their present value using a

discount rate that reflects current market assessments of the time value of

money and the risks specific to the asset. In determining fair value less costs

to sell, recent market transactions are taken into account, if available, If no

such transactions can be identified, an appropriate valuation model is used.

Impairment losses of continuing operations, including impairment on

inventories, are recognized in the statement of financial performance in those

expense categories consistent with the nature of the impaired asset,

For assets, an assessment is made at each reporting date as to whether there is

any indication that previously recognized impairment losses may no longer

exist or may have decreased. If such indication exists, the Municipality

estimates the asset’s or cash-generating unit's recoverable amount. A

previously recognized impairment loss is reversed only if there has been @

change in the assumptions used to determine the asset’s recoverable amount,

since the last impairment loss was recognized. The reversal is limited so that

the carrying amount of the asset does not exceed its recoverable amount, nor

exceed the camying amount that would have been determined, net of

depreciation, had no impairment loss been recognized for the asset in prior

years. Such reversal is recognized in surplus or deficit.

Impairment of Non-Cash-Generating Assets

‘The Municipality assesses at each reporting date whether there is an

indication that a non-cash-generating asset may be impaired. If any indication

exists, or when annual impairment testing for an asset is required, the

Municipality estimates the asset's recoverable service amount, An asset's

recoverable service amount is the higher of the non-cash generating asset's

fair value less costs to sell and its value in use.

Where the carrying amount of an asset exceeds its recoverable service

amount, the asset ts considered impaired and is written down to its

recoverable service amount.

In assessing value in use, the Municipality has adopted the depreciation

replacement cost approach. Under this approach, the present value of the

remaining service potential of an asset is determined as the depreciated

replacement cost of the asset. The depreciated replacement cost is measured

as the reproduction or replacement cost of the asset, Whichever is lower, less

accumulated depreciation calculated on the basis of such cost, to reflect the

already consumed or expired service potential of the asset. In determining

fair Value less costs to sell, the price of the asseis in a binding agreement in

an am's length transaction, adjusted for incremental costs that would be

directly attributed to the disposal of the asset is used. If there is no binding

agreement, but the asset is traded on an active market, fair value less cost t0

sell is the asset's market price less cost of disposal. If there is no binding sale

agreement or active market for an asset, the Municipality determines fair

‘value less cost to sell based on the best available information.

For each asset, an assessment is made at each reporting date as to whether

there is any indication that previously recognized impairment losses may no

longer exist or may have decreased. If such indication exists, management

estimates the asset's recoverable service amount. A previously recognized

impairment loss is reversed only if there has been a change in the

assumptions used to determine the asset's recoverable service amount since

the last impairment loss was recognized, The reversal is limited so that the

carrying amount of the asset does not exceed its recoverable service amount,

nor exceed the carrying amount that would have been determined, net of

depreciation, had no impairment loss been recognized for the asset in prior

years, Such reversal is recognized in surplus or deficit,

3.10 Financial Instruments

Financial Assets

Initial Recognition and Measurement

Financial assets are classified as financial assets at fair value through surplus

or deficit, loans and receivables, held-to-maturity investments or available-

for-sale financial assets, as appropriate, The Municipality determines the

classification of its financial assets at initial recognition.

Purchases or sales of financial assets that require delivery of assets within a

time frame established by regulation or convention in the marketplace

(regular way trades) are recognized on the trade date, the date that the

Municipality commits to purchase or sell the asset.

‘The Municipality's financial assets include: cash and short-term deposits;

trade and other receivables; loans and other receivables and quoted and

lunquoted financial instruments.

Subsequent Measurement

‘The subsequent measurement of financial assets depends on their

classification,

Financial Assets at Fair Value through Surplus or Deficit

Financial assets at fair value through surplus or deficit include financial

assets held for trading and financial assets designated upon initial recognition

at fair value through surplus and deficit. Financial assets are classified as

held for trading if they are acquired for the purpose of selling or repurchasing

in the near term, Financial assets at fair value through surplus or deficits are

carried in the statement of financial position at fair value with changes in fair

value recognized in surplus or deficit.

Loans and Receivables

Loans and receivables are non-derivative financial assets with fixed or

determinable payments that are not quoted in an active market. After initial

measurement, such financial assets are subsequently measured at amortized

cost using the effective interest method, less impairment. Amortized cost is

calculated by taking into account any discount or premium on acquisition and

fees or costs that are an integral part of the effective interest rate. Losses

arising from impairment are recognized in the surplus or deficit.

Heldcto-Maturity

Non-derivative financial assets with fixed or determinable payments and

fixed maturities are classified as held to maturity when the Municipality has

the positive intention and ability to hold it to maturity. After initial

measurement, held-to-maturity investments are measured at amortized cost

using the effective interest method, less impairment, Amortized cost is

calculated by taking into account any discount or premium on acquisition and

fees or costs that are an integral part of the effective interest rate, The losses

arising from impairment are recognized in surplus or deficit

Derecognition

‘The Municipality derccognizes a financial asset or, where applicable, a part

of financial asset or part or group of similar financial assets when:

48) The rights to receive cash flows from the asset have expired or is

waived;

b) The Municipality has transferred its rights to receive cash flows from

the asset or has assumed an obligation to pay the received cash flows

in full without material delay to a third party; and either: (a) the

Municipality has transferred substantially all the risks and rewards of

the asset; or (b) the Municipality has neither transferred nor retained

substantially all the risks and rewards of the asset, but has transferred.

control of the asset,

Impairment of Financiat Assets

The Municipality assesses at each reporting date whether there is objective

evidence that 2 financial asset or a group of financial assets is impaired. A

financial asset or a group of financial assets is deemed to be impaired if, there

is objective evidence of impairment as a result of one or more events that has

occurred atter the initial recognition of the asset (an incurred “loss event")

and that loss event has an impact on the estimated future cash flows of the

financial asset or the group of financial assets that can be reliably estimated,

‘Evidence of impairment may include the following indicators:

a) The debtors or a group of debtors are experiencing significant financial

difficulty:

’) Default or delinquency in interest or principal payments;

©) The probability that debtors will enter bankruptcy or other financial

reorganization; and

d) Observable data indicates a measurable decrease in estimated future

cash flows (e.g. changes in arrears or economic conditions that

correlate with defaults)

Financial Assels Carried at Amortized Cost

For financial assets carried at amortized cost, the Municipality first assesses

whether objective evidence of impairment exists individually for financial

‘assets that are individually significant, or collectively for financial assets that

are not individually significant. If the Municipality determines that no

objective evidence of impairment exists for an individually assessed financial

asset, whether significant or not, it includes the asset in a group of financial

assets with similar credit risk characteristics and collectively assesses them

for impairment, Assets that are individually assessed for impairment end for

Which an impairment loss is, or continued to be, recognized are not included

in a collective assessment of impairment.

If there is an objective evidence that an impairment loss has been incurred,

the amount of the loss is measured as the difference between the assets

carrying amount and the present value of estimated future cash flows

(excluding future expected credit losses that have not yet been incurred). The

present value of the estimated future cash flows is discounted at the financial

asset's original effective interest rete, [fa loan has a variable interest rate, the

discount rate for measuring any impairment loss is the current effective

interest rate,

‘The carrying amount of the asset is reduced through the use of an allowance

account and the amount of the loss is recognized in surplus or deficit. If, in a

subsequent year, the amount of the estimated impairment loss increases or

decreases because of an event occurring after the impairment was recognized,

the previously recognized impairment loss is increased or reduced by

adjusting the allowance account, If a future write-off is later recovered, the

recovery is credited to finance costs in surplus or deficit.

Financial Liabilities

Initial Recognition and Measurement

Financial liabilities within the scope of IPSAS 29 are classified as financial

liabilities at fair value through surplus or deficit or loans and borrowings. as

appropriate. The Municipality determines the classification of its financial

liabilities at initial recognition.

All financial liabilities are recognized initially at fair value and, in the case of

loans and borrowings, plus directly attributable transaction costs,

‘The Municipality's financial liabilities include trade and other payables.

Subsequent Measurement

‘The measurement of financial liabilities depends on their classification,

Financial Liabilities at Fair Value through Surplus or Deficit

Financial liabilities at fair value through surplus or deficit include financial

liabilities held for trading and financial liabilities designated upon initial

recognition as at fair value through surplus or deficit.

Loans and Borrowings

After initial recognition, interest bearing loans and borrowings are

subsequently measured at amortized cost using effective imerest method,

Gains and losses are recognized in surplus or deficit when the liabilities are

derecognized as well as through the effective interest method amortization

process.

Amortized cost is calculated by taking into account any discount or premium

‘on acquisition and fees or costs that are an integral part of the effective

interest rate.

Derecognition

A financial liability is derecognized when the obligation under the liability is

discharged or cancelled or expires.

‘When an existing financial liability is replaced by another from the same

lender on substantially diferent terms, or the terms of an existing liability are

substantially modified, such an exchange or modification is treated as a

derecognition of the original liability and the recognition of a new liability.

Offsetting of Financial Instruments

Financial assets and financial lisbilities are offset and the net amount

reported in the consolidated statement of financial position if, there is a

currently enforceable Jegal right to offset the recognized amount and there is

‘an intention to settle on a net basis, or to realize the assets and settle the

liabilities simultaneously.

Fair Value of Financial Instruments

‘The fair value of financial instruments that are traded in active markets at

each reporting date is determined by reference to quoted market prices or

dealer price quotations (bid price for long positions and ask price for short

positions), without any deduction for transaction costs,

3.11 Cash and Cash Equivalents

Cash and cash equivalents comprise cash on hand and cash in bank, deposits

on call and highly liquid investments with an original maturity of three

months or less, which are readily convertible to known amounts of cash and

are subject to insignificant risk of changes in value. For the purpose of the

consolidated statement of cash flows, cash and cash equivalents consist of

cash and short-term deposits as defined above, net of outstanding bank

overdrafts,

3.12 Inventories

Inventory is measured at cost upon initial recognition. To the extent that

inventory was received through non-exchange transactions (for no cost or for

a nominal cost), the cost is its fair value at the date of acquisition,

Costs incurred in bringing each product to its present location and conditions

are accounted for, as follows:

a) Raw materials: purchase cost using the weighted average cost method;

b) Finished goods and work in progress: cost of direct materials and labor

and a proportion of manufacturing overheads based on the normal

operating capacity, but excluding borrowing costs,

After initial recognition, inventory is measured at the lower of cost and net

realizable value. However, to the extent that a class of inventory is

distributed or deployed at no charge or for a nominal charge, that class of

inventory is measured at the lower of cost and current replacement cost.

Net realizable value is the estimated selling price in the ordinary course of

operations, less the estimated costs of completion and the estimated costs

necessary to make the sale, exchange, or distribution, Inventories are

recognized as an expense when deployed for utilization or consumption in

the ordinary course of operations of the Municipality.

3.13 Provisions

Provisions are recognized when the Municipality has a present obligation

(legal or constructive) as a result of a past event, it is probable that an

outflow of resources embodying economic henefits or service potential will

be required to settle the obligation and a reliable estimate can be made on the

amount of the obligation.

Where the Municipality expects some or all of a provision to be reimbursed,

for example, under an insurance contract, the reimbursement is recognized as

‘a separate asset only when the reimbursement is virtually certain.

The expense relating to any provision is presented in the statement of

financial performance net of any reimbursement.

Kehabilitation Liability

Rehabilitation costs are provided at the present value of expected casts 10

seitle the obligation using estimated cash flows and are recognized as part of

the cost of that particular asset. The cash flows are discounted at a current

rate that reflects the risks specific to the rehabilitation liability. The

unwinding of the discount is expensed as incurred and recognized in the

‘statement of financial performance as a finance cost. The estimated future

costs of decommissioning are reviewed annually and adjusted as appropriate.

Changes in the estimated future costs or in the discount rate applied are

added to or deducted from the cost of the asset.

Contingeni Liabilities

The Municipality does not recognize a contingent liability, but discloses

details of any contingencies in the notes to the tinancial statements, unless

the possibility of an outflow of resources embodying economic benefits or

service potential is remote.

Contingent Assets

‘The Municipality does not recognize a contingent asset, but discloses details

of a possible asset whose existence is contingent on the occurrence or non-

occurrence of one or more uncertain future events not wholly within the

control of the Municipality in the notes to the financial statements.

Contingent assets are assessed continually to ensure that developments are

appropriately reflected in the financial statements. If it has become virtually

certain that an inflow of economic benefits or service potential will arise and

the asset's value can be measured reliably, the asset and the related revenue

‘are recognized in the financial statements of the period in which the change

occurs.

3.14 Nature and Purpose of Reserves

The Municipality creates and maintains reserves in terms of specific

requirements.

3.15 Changes in Accounting Policies and Estimates

‘The Municipality recognizes the effects of changes in accounting policy

retrospectively. The effects of changes in accounting policy are applied

prospectively if retrospective application is impractical.

‘The Municipality recognizes the effects of changes in accounting estimates

prospectively by including in sumplus or deficit,

3.16 Foreign Currency Transactions

‘Transactions in foreign currencies are initially accounted for at the ruling rate

of exchange on the date of the transaction. Trade creditors or debtors

denominated in foreign currency are reported at the statement of financial

position reporting date by applying the exchange rate on that date. Exchange

differences arising from the settlement of creditors, or from the reporting of

creditors at rates different from those at which they were initially recorded

during the period, are recognized as income or expenses in the period in

which they arise,

3.17 Borrowing Costs

Borrowing costs are capitalized against qualitying assets as part of property,

plant and equipment. Such borrowing costs are capitalized over the period

during which the asset is being acquired or constructed and borrowings have

been incurred. Capitalization ceases when construction of the asset is

complete. Further, borrowing costs are charged to the statement of financial

performance.

3.18 Related Parties

‘The Municipality regards a releted party as a person or an entity with the

ability to exert control individually or jointly, or to exercise significant

influence over the Municipality, or vice versa, Members of key management

are regarded as related parties and comprise the Municipal Mayor, Vice-

Mayor, Sanggunian Members, Committee Officials and Members, Municipal

Accountant, Municipal Treasurer, Municipal Budget Officer, General

Services Officer and all Chiefs of Departments/Divisions.

3.19 Service Concession Arrangements

‘The Municipality analyses all aspects of service concession arrangements

that it enters into in determining the appropriate accounting treatment and

disclosure requirements. In particular, where a private party contributes an

asset to the arrangement, the Municipality recognizes that asset when, and

only when, it controls or regulates the services the operator must provide

iogether with the asset, to whom it must provide them, and at what price, In

the case of assets other than ‘whole-of-life’ assets, it controls, through

ownership, beneficial entitlement or otherwise — any significant residual

interest in the asset at the end of the arrangement. Any assets so recognized

fare measured at their fair value. To the extent that an asset has been

recognized, the Municipality also recognizes a corresponding liability,

adjusted by a cash consideration paid or received,

3.20 Budget Information

‘The annual budget is prepared on the modified cash basis, that is, all planned

costs and income are presented in a single statement to determine the needs

of the Municipality. As a result of the adoption of the Modified cash basis for

budgeting purposes, there are basis, timing or entity differences that would

require reconciliation between the actual comparable amounts and the

amounts presented as a separate additional financial statement in the

statement of comparison of budget and actual amounts, Explanatory

‘comments are provided in the notes to the annual financial statements; first,

the reasons for overall growth or decline in the budget are stated, followed by

details of overspending or under spending on line items.

3.21 Significant Judgments and Sources of Estimation Uncertainty

Judgments

In the process of applying the Municipality's accounting policies,

manayement has made judgments, which have the most significant effect on

the amounts recognized in the consolidated financial statements.

Operating Lease Commitments — Municipality as Lessor

‘The Municipality determines based on an evaluation of the terms and

conditions of the arrangements, (such as the lease term not constituting a

substantial portion of the economic life of the commercial property) that it

retains all the significant risks and rewards of ownership of the properties and

accounts for the contracts as operating leases.

Estimates and Assumptions

The key assumptions concerning the future and other key sources of

estimation uncertainty at the reporting date, that a significant risk of causing

a material adjustment to the carrying amounts of assets and liabilities within

the next financial year, are described below, The Municipality based its

assumptions and estimates on parameters available when the consolidated

financial statements were prepared, However, existing circumstances and

assumptions about future developments may change due to market changes

or circumstances arising beyond the contol of the Municipality. Such

changes are reflected in the assumptions when they occur,

Usefull Lives and Residual Values

The useful lives and residual values of assets are assessed using the following

indicators to inform potential future use and value from disposel:

a) The condition of the asset based on the assessment of experts employed

by the Municipality;

b) The nature of the asset, its susceptibility and adaptability to changes in

technology and processes;

) The nature of the processes in which the asset is deployed; and

4) Changes in the market in relation to the asset.

Impairment of Non-Financial Assets — Cosh-Generating Assets

‘The recoverable amounts of cash-generating units and individual assets have

been determined based on the higher of value-in-use calculations and fair

values less costs to sell. These calculations require the use of estimates and

assumptions. It is reasonably possible that the assumplions may change,

which may then impact management's estimations and require a material

adjustment to the carrying value of tangible assets,

‘The Municipality reviews and tests the carrying value of assets when events

or changes in circumstances suggest that the carrying amount may not be

recoverable. Cash-generating assets are grouped at the lowest level for which

identifiable cash flows are largely independent of cash flows of other assets

and liebilities. If there are indications that impairment may have occurred,

estimates of expected future cash flows are prepared for each group of assets.

Expected future cash flows used to determine the value in use of tangible

assets are inherently uncertain and could materially change over time,

Impairment of Non-Financial Assets — Non- Cash Generating Assets

‘The Municipality reviews and tests the carrying value of non-cash-generating

assets when events or changes in circumstances suggest that there may be a

reduction in the future service potential that can reasonably be expected to be

derived from the asset, Where indicators of possible impairment are present,

the Municipality undertakes impairment tests, which require the

determination of the fair value of the asset and its recoverable service

amount. The estimation of these inputs info the calculation relies on the use

ofestimates and assumptions.

Amy subsequent changes to the factors supporting these estimates and

assumptions may have an impact on the reported carrying amount of the

related asset.

Fair Value Estimation — Financial Instruments

Where the fair value of financial assets and financial liabilities recorded in

the statement of financial position cannot be derived trom active markets,

their fair value is determined using valuation techniques including the

discounted cash flow model. The inputs to these models are taken from

observable markets where possible, but where this is not feasible, judgments

are required in establishing fair values. Judgment includes the consideration

of inputs such as liquidity risk, credit risk and volatility. Changes in

assumptions about these factors could affect the reported fair value of

financial instruments,

Provisions

Provisions were raised and management determined an estimate based on the

information available. Provisions are measured at the management's best