Professional Documents

Culture Documents

GeneralLuna Quezon ES2017

GeneralLuna Quezon ES2017

Uploaded by

J Ja0 ratings0% found this document useful (0 votes)

9 views6 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views6 pagesGeneralLuna Quezon ES2017

GeneralLuna Quezon ES2017

Uploaded by

J JaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

EXECUTIVE SUMMARY

Introduction

The Municipality of General Luna, formerly a sitio of Macalelon, Quezon was

created into a municipality on November 1, 1929 under Executive Order No. 207. It is

located along the coast of Tayabas Bay in the southwestem portion of Quezon Province

and is one of the 12 municipalities covered by Bondoc Peninsula with a total land area of

10,215,5857 hectares subdivided into 27 barangays. It is currently classified as a 4" class

municipality with farming and fishing as the two major economic activities and is

considered one of the food bowls of the Province due to its abundant supply of farm and

fishery products. Its most featured celebration is the Centurion Festival held during the

Lenten Season which has been a tourist attraction.

I maintains General, Special Education and Trust Fund books.

‘The Organizational Structure of the Municipality is as follows:

Key Officials

‘Municipal Mayor = Jose Stevenson M. Sangalang

Municipal Vice Mayor ~ Jevito P. Red

Members of the

Sangguniang Bayan 1. Melaica M. Batariano

2, Kristine Chemobyl V. Florida

3. Rolando P, Atienza

4, Manvel G. Suarez

5. Jose Stenlee M. Sangalang

6. Remegio R. Agoncillo

7. Tomas P.Odiame

8, Miguel R. Salvo

9, William Pelotos

Municipal Accountant = Madonna A. Suarez

Municipal Treasurer ~ Monaliza L. Plata

r TL was complemented with a total workforce of 143 personnel in Calendar Year

(CY) 2017, with the following details:

Elected -u

Permanent = 70

Coterminous - 2

Job Order =

Total

Bis.

Financial Highlights

For CY 2017, the Municipality generated a total income of P84,937,843 from tex

revenue, service and business income, share from Internal Revenue Collections and other

income, The total funds utilized for the year amounted to 277,517,658 out of the total

appropriations of 99,193,083 leaving an unexpended balance of P21,675,42S. The

unutilized Capital Outlay appropriation amounting to P8,782,025 will be continued in CY

2018,

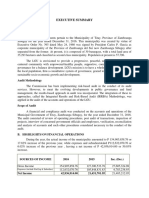

The Municipality's comparative financial position and results of operations for

CYs 2016 and 2017 are summarized below and shown in detail in the attached audited

financial statements.

Increase/

2017 2016 Decrease

Total Assets P 100,127,643 PR 96,045,038 P 4,082,605

Total Liabilities 46496875 48,244,142 (1,747,267)

Total Net Assets/Equity ‘53,630,768 47,800,896 5,829,872

Total Income 84,937,843 75,550,266 9,387,577

Total Expenses 79815637 60,795,588 19,020,039

Scope of Audit

Financial and compliance audit was conducted on the accounts and operations of

the Municipality for CY 2017 to ascertain the fairness of the presentation of the financial

statements and compliance of the Municipality with laws, rules and regulations as well as

the economical, efficient and effective utilization of resources.

Auditor’s Opinion on the Financial Statements

The Auditor rendered a qualified opinion on the faimess of the presentation of

the financial statements of the Municipality due to the following:

1, The existence and valuation of the Property, Plant and Equipment (PPE) accounts

With @ net book value totaling B30,556,626.13 could not be ascertained due to the

failure of the Inventory Committee to complete the physical inventory during the year

as well as to prepare and maintain property cards and subsidiary ledgers for each

category of PPE.

»

Cash advances granted to Municipal Officers and Employees totaling P94,439.98

recorded under the Advances to Officers and Employees account of 37,940.00 and

Advances to Payroll account of P56,499,98 remain unliquidated at year-end, resulted

to overstatement of the respective asset accounts and understatement of related

expenses equivalent to the amount of unreported disbursements,

3, The non-recording in the books of the Municipality of the donated ambulance from

the Philippine Charity Sweepstakes Office (PCSO) resulted to understatement of the

Property, Plant and Equipment (PPE) account at year-end. Moreover, the donated

ambulance was not provided with depreciation, resulting in the understatement of the

related expense account and overstatement of the equity and asset accounts

For the exceptions cited above, the Auditor recommended the Municipal

Mayor the following courses of action:

* create Inventory committee to complete the physical count of PPE of the Municipality

and submit the RPCPPE to the Audit Team for validation pursuant to Section 124 of

the MNGAS for LGU;

+ require the Municipal Treasurer to prepare and maintain complete and updated

Property, Plant and Equipment Ledger Cards (PPELC) and Property Cards, and

reconcile their records regularly with the Accounting Office; and

‘* instruct the Municipal Treasurer and the Municipal Accountant to reconcile their

records regularly.

‘* instruct the Municipal Accountant to ensure the proper granting. utilization and

liquidation of all cash advances within the prescribed period in accordance with the

above-cited rules and regulation; and

© instruct the Municipal Accountant to send written notice or demand to the

Accountable Officers to immediately settle their cash advances, otherwise, implement

the withholding of their salary to be applied to their accounts

* instruct the Municipal Accountant to take up in the books of the Municipality the

donated ambulance for fair presentation of PPE account in the financial statements;

and

* instruct the Municipal Accountant to compute, record and present the accumulated

depreciation in the financial statements pursuant to Paragraphs 43, 66, 69 and 71 of

PPSAS 17 for proper valuation.

Significant Observations and Recommendations

‘The following are the other significant audit observations and recommendations in

the audit of the Municipality for CY 2017;

1. Five parcels of land recorded in the books at P3,091,310.00 remain untitled in the

name of the Municipality, thus exposes the subject lots to third party claims.

v

We reiterate our recommendation that the Municipal Mayor instruct the Municipal

Assessor to facilitate the titling of the five parcels of land in compliance with Section

148 of Commission on Audit (COA) Circular No, 92-386.

Failure of the Municipal Treasurer's Office to exercise fully the statutory remedies 10

enforce collection of delinquent accounts resulted in the accumulation of real

property tax delinquencies to P19,573,940.92 taxes as of December 31, 2017, thus the

Municipality stands to lose potential revenues which could have been utilized for its

development programs and projects.

‘We reiterated our recommendation that the Municipal Mayor require the Municipal

Treasurer to exert extra effort and adopt the remedies to enforce collection of

delinquent real property taxes in accordance with R.A, No, 7160,

Fully depreciated and unserviceable properties totaling P183,734,50 were not

disposed of due to failure of the designated Property Custodian to prepare the

Inventory and inspection Report of Unserviceable Property (TIRUP) as required under

Section 79 of Presidential Decree (P.D.) 1445 and Section 125 of the MNGAS for

LGU, thereby depriving the Municipality of the possible additional income that cen

be derived therefrom.

We reiterated our recommendation that the Municipal Mayor instruct the Municipal

‘Treasurer to:

* conduct the physical inventory of the unserviceable properties of the

Municipality;

‘© prepare and submit the ITRUP as part of the disposal procedures; and

+ dispose the unserviceable properties in accordance with the steps and procedures

‘enumerated under Section 79 of P.D. No. 1445 to generate additional income out

of the proceeds from sale thereof

Guaranty/Security Deposits totalingP212,414,84which have been outstanding for two

‘years or more, were still not reverted to the Uneppropriated Surplus of the General

Fund, contrary to Section 98 of Presidential Decree (P.D,) No. 1445, thus existence

and correctness of the balance of the account cannot be relied upon,

We recommended that the Municipal Mayor instruct the Municipal Accountant to

confirm with the contractor and to request him to submit documents pertaining to his

claims, revert the account to the Unappropriated Surplus of the General Fund, subject

to an authority from the Sangguniang Bayan through a Resolution with the condition

that appropriation shall be made in the event that claim arises in the future pursuant to

the provisions of Section 98 of P.D, No. 1445.

. The Municipality failed to revert back to the unappropriated surplus of the General

Fund the unexpended balance of Local Disaster Risk Reduction Management

(LDRRM) Fund after 5 years amounting to P916,106.93, contrary to Section 21 of

Republic Act (R.A.) No. 10121, hence depriving the Municipality of funds which

could be used for other social services. Moreover, the Report on Sources and

Utilization of DRRMF for various months of CY 2017 were not prepared by the

Municipal Accountant and submitted by the LDRRM Officer to the COA Auditor,

contrary to Section 5.1.5 of Commission on Audit (COA) Circular No. 2012-002,

hhence monthly monitoring and evaluation on the utilization of DRRM fund for

various projects and activities could not be made,

We recommended that the Municipal Mayor require the:

© Municipal Accountant to revert back to the General Fund the unexpended balance

of LDRRM Fund for CYs 2011-2012 totalingP916,106.93 and to prepare the

Report on Sources and Utilization of DRRMF using the prescribed format as

provided in Section 5.1.5 of COA Circular No, 2012-002; and

* LDRRMO to submit the monthly Report on Sources and Utilization of DRRMF

to the COA Auditor for monitoring and evaluation.

|. Immediate and full settlement of the short-term loans (micro-financing benefits) and

the disallowed Representation Allawance and Transportation Allowance (RATA) in

2006-2007 with balances of P22,524.70 and P4,861.00, respectively, were not fully

settled at year-end, contrary to Section 2 of P.D. No. 1445 and Section 7.1 of the

2009 Rules and Regulations on the Settlement of Accounts (RRSA).

We recommended that the Municipal Mayor instruct the:

Municipal Accountant to take up in the books under the Other Receivables

account the balance of P22,524.70 which pertains to the unsettled balance of

short-term loans for fair presentation of PPE account in the financial statements;

* MT to pursue the immediate refund of the total amount of 222,524.70, otherwise

deduct it from the salary or from whatever money due the concemed Municipal

officials/employees; and

© MT to refund the overpayment made by borrowers/employees as presented in

‘Annex 8 and adopt measures to properly monitor balances of the account.

. ‘The Water Supply System of the Municipality of 211,230,972.11 was erroneously

recorded under Other Property, Plant and Equipment (PPE) sccount, contrary to COA

Circular No. 2015-009, resulting in the overstatement of the said account and

understatement of Water Supply System account by the same amount.

We recommended thet the Municipal Mayor require the Municipal Accountant to

take up the necessary accounting entries to adjust the account to ensure fair

presentation of the affected accounts in the financial statements.

The above observations and recommendations contained in the report were

communicated to the Municipal Mayor and other key officials under various Audit

Observation Memoranda and discussed in the exit conference conducted on June 19,

2017. Management’s views and comments were considered in the report, where

appropriate.

Status of Implementation of Prior Year’s Audit Recommendations

Of the 19 prior year's audit recommendations embodied in the 2016 Annual

Audit Report, eight were fully implemented, four were partially implemented and seven

‘were not implemented by the Municipality,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aurora Executive Summary 2021Document8 pagesAurora Executive Summary 2021J JaNo ratings yet

- 09-GuimarasProv2021 Part2-Observations and RecommDocument44 pages09-GuimarasProv2021 Part2-Observations and RecommJ JaNo ratings yet

- President Roxas Executive Summary 2012Document6 pagesPresident Roxas Executive Summary 2012J JaNo ratings yet

- 01-CapizProv2021 Audit ReportDocument130 pages01-CapizProv2021 Audit ReportJ JaNo ratings yet

- 09-LigaoCity2015 Observations and RecommDocument4 pages09-LigaoCity2015 Observations and RecommJ JaNo ratings yet

- BinalonanWD-R1 ES2018Document4 pagesBinalonanWD-R1 ES2018J JaNo ratings yet

- 09-AntiqueProv2021 Part2-Observations and RecommDocument58 pages09-AntiqueProv2021 Part2-Observations and RecommJ JaNo ratings yet

- 2016 COA Report For NaujanDocument190 pages2016 COA Report For NaujanJ JaNo ratings yet

- 01-BoholProvince2021 Audit ReportDocument221 pages01-BoholProvince2021 Audit ReportJ JaNo ratings yet

- DILG Joint - Circulars 2011414 C7a40511f3 - 2Document5 pagesDILG Joint - Circulars 2011414 C7a40511f3 - 2J JaNo ratings yet

- Linapacan2014 Audit Report-UnlockedDocument168 pagesLinapacan2014 Audit Report-UnlockedJ JaNo ratings yet

- Coa C2019-001Document14 pagesCoa C2019-001J JaNo ratings yet

- Langiden Abra ES2016 2-UnlockedDocument9 pagesLangiden Abra ES2016 2-UnlockedJ JaNo ratings yet

- GeneralLuna2017 Audit Report-UnlockedDocument105 pagesGeneralLuna2017 Audit Report-UnlockedJ JaNo ratings yet

- Coa M2014-011Document13 pagesCoa M2014-011J JaNo ratings yet

- Mananita Songs Without ChordsDocument1 pageMananita Songs Without ChordsJ JaNo ratings yet

- Doc210318 21032018164945Document2 pagesDoc210318 21032018164945J JaNo ratings yet

- Prosperidad ADS ES2016Document66 pagesProsperidad ADS ES2016J JaNo ratings yet

- Real Quezon ES2016Document9 pagesReal Quezon ES2016J JaNo ratings yet

- Titay ZS ES2016Document5 pagesTitay ZS ES2016J JaNo ratings yet

- KalingaProv ES2015Document4 pagesKalingaProv ES2015J JaNo ratings yet

- GeneralLuna2017 Audit Report-UnlockedDocument95 pagesGeneralLuna2017 Audit Report-UnlockedJ JaNo ratings yet

- Malinao Aklan ES2016Document8 pagesMalinao Aklan ES2016J JaNo ratings yet