Professional Documents

Culture Documents

Shazma-N - Economics Cheat Sheet 2022

Uploaded by

gabes shivoloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shazma-N - Economics Cheat Sheet 2022

Uploaded by

gabes shivoloCopyright:

Available Formats

Economics Cheat Sheet

by shazma.n via cheatography.com/149997/cs/32537/

Topic 1- National Income Accounting & BOP Topic 1- National Income Accounting & Topic 4- Price Levels & Exchange Rate in

BOP (cont) LR

National gross Y=C+I+G+CA

Income domestic Credit Entry any transaction exports Purchasing explains movements in the

Identity product is resulting in of goods, Power exchange rate between two

given by receiving services, Parity countries’ currencies by

consumption payments from assets changes in the countries’

expenditures, foreigners price levels

plus Debit Entry any transaction imports Absolute identical E= P/P*

investment resulting in of goods PPP basket of

expenditures, making services, goods

plus payments assets should be

government sold for

Components Current CA+KAn‐

expenditures, same

of BOP Account, on+Cap‐

plus exports, amount of

Accounts Financial italAcc= -

minus imports money in

Account, ORT

National the amount of S= Y-C(Y-T)- Capital Account diff

Savings output that is G or S= countries

Current shows the CA= EX-

not devoted to Sp+Sg or when

Account difference b/w IM+ Net

private S=I+CA expressed

exports and Unilateral

consumption in same

imports of Transfer

and currency

goods and

government Relative % Δ in Ee-E/E= π-π*

services plus

spending PPP exchange

net unilateral

Balance records a *every intern‐ transfer rate

of country's ational between 2

Financial difference b/w KA=

Payments international transaction currencies

Account sales & KAnonr‐

transactions enters the over many

purchases of es+ORT

with the rest BOP period

assets to

of the world in accounts equals to

foreigners

a given time twice, once the inflation

Non-reserve the purchases & sales of

period- as a credit rate differ‐

Portion assets by the private sector

records its and once as entials

payments and debit Reserve the purchases foreign- between 2

recepits from Portion & sales of currency countries

foreigners and foreign assets denomi‐

Monetary shows PPP holds, LR

shows by the country's nated

Approach factors that Model, shocks

demand and monetary assets

to affect MS are permanent

supply of a authority held by

Exchange and MD will

country's central

Rate play a role

currency in banks

in determ‐

FEM ining

exchange

rate

Equilibrium E= (MS/MS )

exchange (L(Y,R)/(L(R,Y)

rate

By shazma.n Published 16th June, 2022. Sponsored by CrosswordCheats.com

cheatography.com/shazma-n/ Last updated 16th June, 2022. Learn to solve cryptic crosswords!

Page 1 of 3. http://crosswordcheats.com

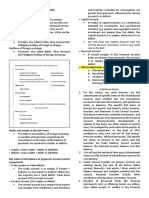

Economics Cheat Sheet

by shazma.n via cheatography.com/149997/cs/32537/

Topic 4- Price Levels & Exchange Rate in Topic 2- Asset Approach to Exchange Rate Topic 2- Asset Approach to Exchange Rate

LR (cont) (cont) (cont)

Domestic MS Exchange DC Covered agents can lock in the R= Ee-E/E annualized percentage change

Increases rate deprec‐ interest future exchange rate by R*+ in the DC/FC exchange rate

increases iates Rate getting a forward F- R*+E - e

expecting DC return on FC

Foreign MS Exchange DC Parity contract & eliminating E/E E/E deposits

Increases rate apprec‐ uncertainty

Increase R curve shifts Capital

decreases iates Real the rate at which its value in right, invest in inflows & DC

Domestic Exchange DC Rate of expressed in terms of a repres‐ Domestic DC Deposit appreciates

Interest Rate rate deprec‐ Return entative output basket is Interest

increases increases iates expected to rise

Increase R* curve shifts Capital

Foreign Interest Exchange DC Expected the rate at which the value of in right, invest in outflows &

Rate increases rate apprec‐ ate of an investment in the asset is Foreign FC deposit DC deprec‐

decreases iates return expected to rise over time Interest iates

Domestic Output Exchange DC Arbitrage the process of buying a Expected R* curve shifts Capital

increases rate apprec‐ currency cheap and selling it Deprec‐ right, invest in outflows &

decreases iates dear iation of FC deposit DC deprec‐

Foreign Output Exchange DC Asset IPR holds & deals with financial DC iates

Increases rate deprec‐ Approach capitals Forward parties agree to exchange

increases iates Focused on money mkt shocks Trading currencies on some future date

and impacts on exchange rate at a pre-negotiated exchange

Topic 2- Asset Approach to Exchange Rate (SR & LR) rate

Exchange the price of EDC/FC=1/EDC/FC R, return on DC deposits Spot trades are settled immediately

Rate one domestic Trading

currency in interest

terms of rate Generalized Approach (real exchange rate,

another(D‐ q)

C/FC) Real measures shows how

e

Forward the R= R*+E -E/E exchange the many baskets

exchange exchange rate, q purchasing of domestic

rates rate that is power of a goods are

contracted country's needed to

today for currency exchange one

the relative to basket of

exchange another foreign goods

of country's q= E(P/P*)

currencies currency

at a If q real depreciation of DC

specified increases

date in the

If q real appreciation of DC

future

decreases

Interest the condition that the expected

Parity returns on deposits of any two

Condition currencies are equal when

measured in the same

currency

By shazma.n Published 16th June, 2022. Sponsored by CrosswordCheats.com

cheatography.com/shazma-n/ Last updated 16th June, 2022. Learn to solve cryptic crosswords!

Page 2 of 3. http://crosswordcheats.com

Economics Cheat Sheet

by shazma.n via cheatography.com/149997/cs/32537/

Generalized Approach (real exchange rate, Topic 3- Money, Interest Rate & Exchange Topic 3- Money, Interest Rate & Exchange

q) (cont) Rate (cont) Rate (cont)

q=1 Absolute PPP q= E(P/P*) Y real when income Exchange the immediate depreciation of

q=0 Relative PPP qe-q/q=0 income= increases, Rate a currency to a shock is

real GDP consumption Unders‐ greater than its long run

If AD domestic goods PPP of DC

increases, hooting response

increa‐ are more increases

volume of transa‐

ses-do‐ valuable and real

ction increases

mestic apprec‐

iation of Interest R= r+Π

DC rate-

fisher

If AD* domestic goods PPP of DC

increa‐ are less valuable decreases Money MS/P= R adjusts to

ses-fo‐ and real market L(R,Y) ensure the

reign deprec‐ equili‐ money market is

iation of brium in equilibrium in

DC SR

Genera‐ considers how in the LR If MS Pressure for R to fall to initial

lized changes in both changes in increases level

Approach monetary and q, changes If real Consum‐ L(R,Y) increases

real sides of the in P and P* income Y ption and R increases

economy affect lead to a increases increases

LR exchange change in and we

rate E hold more

money

Topic 3- Money, Interest Rate & Exchange In the P= P= MS/L(R ,Y*)

Rate long run MS/L(R,Y)

Money the total amount of Currency Quantity %Δ MS+%ΔV=

Supply currency and in circul‐ Theory of %ΔP+%ΔY

checking deposits ation+‐ Money

held by Demand

Level no change in MS

households and Deposit

change in means no

firms

MS change in Π

Aggregate the toal demand Md= doesn't

Money for money by all L(R,Y) impact

Demand households and %Δ in MS

firms in the

Exchange immediate response to a

economy

Rate disturbance is greater than its

L(R,Y) liquidity function Oversh‐ long-run response

R nominal interest opport‐ ooting

rate unity

cost of

holding

money

By shazma.n Published 16th June, 2022. Sponsored by CrosswordCheats.com

cheatography.com/shazma-n/ Last updated 16th June, 2022. Learn to solve cryptic crosswords!

Page 3 of 3. http://crosswordcheats.com

You might also like

- Balance of Payment: and Its ComponentsDocument13 pagesBalance of Payment: and Its ComponentsАндрей ГудзьNo ratings yet

- Balance of Payments (BoP)Document41 pagesBalance of Payments (BoP)anindya_kundu100% (1)

- Import Costing Calculation Sheet: Spare Parts SupplierDocument1 pageImport Costing Calculation Sheet: Spare Parts SupplierajayNo ratings yet

- Hoofstuk 4 - EngelsDocument20 pagesHoofstuk 4 - EngelsKevin MulderNo ratings yet

- Balance of Payment ECO 415Document6 pagesBalance of Payment ECO 415DaudNo ratings yet

- Mid Term Cheat SheetDocument2 pagesMid Term Cheat SheetnupurNo ratings yet

- Quiz #4Document4 pagesQuiz #4Erine ContranoNo ratings yet

- Governmental Handout IIDocument10 pagesGovernmental Handout IIHoang HaNo ratings yet

- Balance of PaymentDocument1 pageBalance of PaymentCHAN KWOK KING G9G-01No ratings yet

- Circular Flow Diagram: Week 2 National Income Accounting (NIA)Document9 pagesCircular Flow Diagram: Week 2 National Income Accounting (NIA)MarisolNo ratings yet

- Macro 9 Balance of PaymentDocument7 pagesMacro 9 Balance of PaymentRashinaNo ratings yet

- Chapter 3. International Flow of FundsDocument16 pagesChapter 3. International Flow of FundsTuấn LêNo ratings yet

- Circular Flow Chart AP EconDocument16 pagesCircular Flow Chart AP EconPomfret AP Economics100% (4)

- MINE4503 - 02 - Mine Economics - 020 - PRESENTATION - 01-FTMDocument16 pagesMINE4503 - 02 - Mine Economics - 020 - PRESENTATION - 01-FTMJoshNo ratings yet

- Macro Eco NotesDocument55 pagesMacro Eco NotesSiya saniyaNo ratings yet

- Company Name: Financial Follow Up Report (FFR - I)Document4 pagesCompany Name: Financial Follow Up Report (FFR - I)Ravikanth MehtaNo ratings yet

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- Midterm - MGT003Document6 pagesMidterm - MGT003GIGI BODONo ratings yet

- Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument7 pagesFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- MDSX M09 EP Slides v2Document34 pagesMDSX M09 EP Slides v2Little LoachNo ratings yet

- Glimpse of Eco Summary MatDocument14 pagesGlimpse of Eco Summary MatSourabhNo ratings yet

- Ratio AnalysisDocument1 pageRatio Analysistanveeraddozai1126No ratings yet

- Economic Envt - National IncomeDocument30 pagesEconomic Envt - National IncomeRajat NigamNo ratings yet

- National Income and Related Aggregates: Dr. Roopali Srivastava Department of Management ITS, GhaziabadDocument30 pagesNational Income and Related Aggregates: Dr. Roopali Srivastava Department of Management ITS, GhaziabadniteshNo ratings yet

- IBF ch5Document35 pagesIBF ch5meka mehdeNo ratings yet

- The Data of Macroeconomics: Chapter Two 1Document22 pagesThe Data of Macroeconomics: Chapter Two 1laibaNo ratings yet

- Corporate Model Template Long-DataDocument274 pagesCorporate Model Template Long-DataIndrama PurbaNo ratings yet

- Economics Mrunalsir Notes3 AnnotatedDocument68 pagesEconomics Mrunalsir Notes3 AnnotatedakankshaNo ratings yet

- Adobe Scan 20-Apr-2023Document6 pagesAdobe Scan 20-Apr-2023Notes GlobeNo ratings yet

- Flow Chart - Ind AS 21 - Effect of Exchange DifferencesDocument1 pageFlow Chart - Ind AS 21 - Effect of Exchange DifferencesHiren PasadNo ratings yet

- Balance of Payments)Document4 pagesBalance of Payments)BasavarajNo ratings yet

- IAS 21 - Foreign Currency TransactionsDocument1 pageIAS 21 - Foreign Currency TransactionsDawar Hussain (WT)No ratings yet

- International Economics Achievement Indicators: Lesson 1.1 Balance of Payment (Bop)Document5 pagesInternational Economics Achievement Indicators: Lesson 1.1 Balance of Payment (Bop)Shameer KhanNo ratings yet

- Poa FormatDocument4 pagesPoa FormatSumithaNo ratings yet

- Balance of PaymentsDocument6 pagesBalance of Paymentssakshikarn0207No ratings yet

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- Chapter 4 - The Balance of Payments - BlackboardDocument28 pagesChapter 4 - The Balance of Payments - BlackboardCarlosNo ratings yet

- BE Balance of PaymentDocument16 pagesBE Balance of Paymentkevinnp149No ratings yet

- PCM - Ni & Bop Pts RevisionDocument86 pagesPCM - Ni & Bop Pts RevisionDeshiha SNo ratings yet

- EC102 Week3 MacroecnomicsDocument3 pagesEC102 Week3 Macroecnomicsfrances leana capellan100% (2)

- Ias 21Document1 pageIas 21Dawar Hussain (WT)No ratings yet

- Import Tariffs and Quotas Under Perfect CompetitionDocument66 pagesImport Tariffs and Quotas Under Perfect CompetitionVyNo ratings yet

- Classification of AccountsDocument6 pagesClassification of AccountsdddNo ratings yet

- Mod 2 EFMDocument7 pagesMod 2 EFMJack mazeNo ratings yet

- L03 - Real Sector Accounts, Analysis and ForecastingDocument29 pagesL03 - Real Sector Accounts, Analysis and ForecastingDekon MakroNo ratings yet

- Balance of Payments (BOP) : For Sebi Grade A & Rbi Grade B ExamsDocument9 pagesBalance of Payments (BOP) : For Sebi Grade A & Rbi Grade B ExamsSujataNo ratings yet

- Accounts FormatsDocument14 pagesAccounts Formats727822TPMB005 ARAVINTHAN.SNo ratings yet

- International EconomicsDocument259 pagesInternational EconomicsSusi DianNo ratings yet

- Updated 11 9 20 Act301 - Powerpoint 01.20Document47 pagesUpdated 11 9 20 Act301 - Powerpoint 01.20Praveen KNNo ratings yet

- Lecture 6Document26 pagesLecture 6K59 Le Nhat ThanhNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- 2022 Budget Proposal (BP) Forms M204Document128 pages2022 Budget Proposal (BP) Forms M204Gerry Zaraspe TiamsimNo ratings yet

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetrio_harcanNo ratings yet

- Topic 2: Balance of Payments (Bop) Balance of Payments (BOP)Document2 pagesTopic 2: Balance of Payments (Bop) Balance of Payments (BOP)KayeNo ratings yet

- Prof. Ruchi M Alliance Business SchoolDocument41 pagesProf. Ruchi M Alliance Business SchoolNikita MadhogariNo ratings yet

- BOPDocument36 pagesBOPAhmed MagdyNo ratings yet

- Managerial Economics Topic 7Document103 pagesManagerial Economics Topic 7Renuka Badhoria (HRM 21-23)No ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- The Real Exchange Rate Fiscal Deficits and Capital FlowsDocument12 pagesThe Real Exchange Rate Fiscal Deficits and Capital FlowsSatish BindumadhavanNo ratings yet

- RTM Summarized (By Zeus) .Ps - enDocument66 pagesRTM Summarized (By Zeus) .Ps - engabes shivolo100% (1)

- Quinle - Oscm Supply 2022Document1 pageQuinle - Oscm Supply 2022gabes shivoloNo ratings yet

- Nataliemoore Reduce-InflammationDocument2 pagesNataliemoore Reduce-Inflammationgabes shivoloNo ratings yet

- Sushiii - Dimensions of GlobalizationDocument3 pagesSushiii - Dimensions of Globalizationgabes shivoloNo ratings yet