Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement: PAN Name

Uploaded by

Soumya SwainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement: PAN Name

Uploaded by

Soumya SwainCopyright:

Available Formats

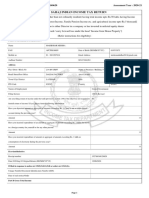

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

2020-21

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN AQBPJ3531E

Name DULI CHAND JAIN

THIKADAR PADA, , , TITILAGARH, TITILAGARH,BALANGIR, ORISSA, 767033

Address

Status Individual Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 542138840110920

Current Year business loss, if any 1 0

Taxable Income and Tax details

Total Income 359020

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 0

(+)Tax Payable /(-)Refundable (6-7) 8 0

Dividend Tax Payable 9 0

Distribution

Tax details

Interest Payable 10 0

Dividend

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income as per section 115TD 14 0

Accreted Income &

Additional Tax payable u/s 115TD 15 0

Interest payable u/s 115TE 16 0

Detail

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

Tax

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 11-09-2020 18:40:41 from IP address 103.108.51.17 and verified by

DULI CHAND JAIN

having PAN AQBPJ3531E on 11-09-2020 18:40:42 from IP address 103.108.51.17 using

Electronic Verification Code 6BAEN2KNXI generated through Aadhaar OTP mode.

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- ICICI Pru Mid Cap Fund - Lucky Draw For All FLs Except PD - Update As On 16.09.2022Document630 pagesICICI Pru Mid Cap Fund - Lucky Draw For All FLs Except PD - Update As On 16.09.2022Soumya SwainNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Shree Khatu - Comp - Ay - 2021-22Document4 pagesShree Khatu - Comp - Ay - 2021-22Soumya SwainNo ratings yet

- Perform & Win July'22 For Frontline Managers Final ResultDocument196 pagesPerform & Win July'22 For Frontline Managers Final ResultSoumya SwainNo ratings yet

- Resume Gopinath DeyDocument3 pagesResume Gopinath DeySoumya SwainNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Red Carpet - Goa Calling 2022 - All Frontline Managers Update As On August 16, 2022Document99 pagesRed Carpet - Goa Calling 2022 - All Frontline Managers Update As On August 16, 2022Soumya SwainNo ratings yet

- Celebrating India - 75, August 2022 Exclusively For Frontline Managers - Updated As On 17 August, 202Document126 pagesCelebrating India - 75, August 2022 Exclusively For Frontline Managers - Updated As On 17 August, 202Soumya SwainNo ratings yet

- Aadhaar Seeding Process ManualDocument2 pagesAadhaar Seeding Process ManualSoumya SwainNo ratings yet

- Registration ReportDocument1 pageRegistration ReportSoumya SwainNo ratings yet

- Resume SOUMYADocument3 pagesResume SOUMYASoumya SwainNo ratings yet

- Os19611729 EbiDocument4 pagesOs19611729 EbiSoumya SwainNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assess Pro 1Document140 pagesAssess Pro 1msnethrapal100% (2)

- Ack. AY 2022-23 RambirDocument1 pageAck. AY 2022-23 Rambirkdsss pNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruwar10ckjupiNo ratings yet

- Form of Return of Income Under Income-Tax Ordinance, 1984 (Ord. XXXVI of 1984)Document1 pageForm of Return of Income Under Income-Tax Ordinance, 1984 (Ord. XXXVI of 1984)Kulfi BarfiNo ratings yet

- GST Suvidha Kendra Service List 2019Document26 pagesGST Suvidha Kendra Service List 2019Jayant Kumar SwainNo ratings yet

- BookDocument98 pagesBookmuthulakshmiNo ratings yet

- Form 29 (See Rule 55 (1) ) Notice of Transfer of Ownership of A Motor VehicleDocument4 pagesForm 29 (See Rule 55 (1) ) Notice of Transfer of Ownership of A Motor Vehiclejagjit singhNo ratings yet

- DARSHAN P Project Report On TAX PAYERS PERSEPTION TOWARDS E - FILING SYSTEM OF INCOME TAX" (IN CASE STUDY OF BELLARI CITY)Document73 pagesDARSHAN P Project Report On TAX PAYERS PERSEPTION TOWARDS E - FILING SYSTEM OF INCOME TAX" (IN CASE STUDY OF BELLARI CITY)DARSHAN PNo ratings yet

- Itr SampleDocument1 pageItr SampleSURABHI PATRANo ratings yet

- Tax Laws Radhika Seth Very Good Notes For Llab StudentDocument66 pagesTax Laws Radhika Seth Very Good Notes For Llab StudentSurbhi Meera Sinha100% (1)

- (KMBN-308) : Summer Internship ReportDocument106 pages(KMBN-308) : Summer Internship ReportNeetika TripathiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Itr FormDocument10 pagesItr Formkunal kumarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 353838160140620 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 353838160140620 Assessment Year: 2020-21ADITYA KUMAR MISHRANo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Awareness On e Filing and Tax Returns PDFDocument51 pagesAwareness On e Filing and Tax Returns PDFVijaykumar ChalwadiNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingDocument1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number: Date of Filingcredit cardNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- Ack Cafpk4156a 2022-23 489614981130922Document1 pageAck Cafpk4156a 2022-23 489614981130922aditya_kavangalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush AgarwalNo ratings yet

- Shoaib StatementDocument88 pagesShoaib StatementshaikhNo ratings yet

- PDF 117257030310723Document1 pagePDF 117257030310723laduugamerNo ratings yet

- 46430bosinter p4 Seca Mod1initDocument24 pages46430bosinter p4 Seca Mod1initbahubali jainNo ratings yet

- Computation AY 2021 22Document83 pagesComputation AY 2021 22Vadivel Kumar TNo ratings yet

- Changes in ITR AY 20-21 by Dr. CA Abhishek MuraliDocument18 pagesChanges in ITR AY 20-21 by Dr. CA Abhishek MuraliRanga AmarNo ratings yet

- 1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFDocument64 pages1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFParas GuliaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearneerajNo ratings yet