Professional Documents

Culture Documents

5-Article Text-70-1-10-20210528

Uploaded by

Husnain NazirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5-Article Text-70-1-10-20210528

Uploaded by

Husnain NazirCopyright:

Available Formats

Kawanua International Journal of Multicultural Studies

Vol. 1, No. 2, December 2020. 66

Zakat and Taxes in Islamic Overview: in terms of Benefit

Darvina 1, Safrudin Halimy Kamaluddin2, Muhammad Ridho3

1,2,3 UIN Imam Bonjol Padang, Indonesia

Article Info ABSTRACT

Article history: This article will discuss Zakat and taxes from an advantageous

Received Jun 5, 2020 perspective. Zakat and taxes are two obligations that must be

Revised Oct 5, 2020 carried out by Muslims in Indonesia. This tax is charged to every

Accepted Dec 19, 2020 citizen who should pay taxes, which are at first glance looks very

contradicted to Islamic teachings. In Islamic teachings, groups of

people are obliged to spend a small portion of their assets as Zakat,

Keywords: namely those who have been categorized as capable persons

Benefit already having had Nishab to give Zakat. By conducting literature

Islam studies and a descriptive analysis approach, it is found that Zakat

Tax contains the hope of obtaining blessings, cleansing the soul,

Zakat cultivating it with various virtues, and fostering cleanliness and

benefits on the assets owned. Tax and Zakat possess the same

purpose namely a source of funds to create a just and prosperous

society by sustaining equitability between material and spiritual

needs. Taxes are used to finance activities in the fields and sectors

of development. The distribution of Zakat to Mustahik, especially

the poor and needy people, is expected to support their economic

life to help national economic growth.

This is an open-access article under the CC BY license.

Corresponding Author:

Darvina,

Universitas Islam Negeri Imam Bonjol, Padang, Indonesia.

Anduring, Kec. Kuranji, Kota Padang, Sumatera Barat 25171

Email: vina15091999@gmail.com

Journal homepage: http://ejournal.iain-manado.ac.id/index.php/KIJMS

67

1. INTRODUCTION

Tax is an essential thing for every country because it is the State's primary income, which

dramatically influences the State treasury and other fields' payment. Apart from affecting State revenues,

of course, taxes also play a role in realizing development. In-state life for a Muslim, obedience adheres to

the government's obligation to pay taxes and commit to issue Zakat. It's ordered by religion; at the time of

the Prophet and the Rashidin caliphs, Zakat was imposed on Muslim residents, while taxes were imposed

on non-residents. Muslim. No resident is subject to Zakat and tax (Qaradawi et al., 2007, p. 22).

In determining the Law on something related to society, such as taxes, one is based on Islamic Law's

public benefit. One of the ushul fiqh rules states that available services are prioritized over specific benefits.

This basis can be used as a reference for tax collection, as noted by figures from the Maliki school of thought.

Al-Maslahah Mursalah is the superior argument in the form of sharia texts that do not show whether

or not validity is recognized. Instead, general ideas show that the Shari'a maintains various benefits at

realizing profit in every Law as it aims to eliminate fading and damage, both material and meaningful things

in present or future (Ahmad & Mahmood, 2009, p. 22).

Therefore, knowledge regarding the understanding of Zakat vs. tax in Islamic Law is essential. It can

be clarified for the reader in the discussion section. This paper will discuss the meaning of Zakat, tax, and

the object of Zakat and tax itself. After that, the writer will describe and analyze the similarities and

differences. The reference books used in this discussion are the Zakat fiqh book compiled by Yusuf Al-

Qardhawi, which discusses Zakat extensively and deeply and explores the virtues of Zakat in the

dimensions of worship and the economy of the people. The author also refers to a book entitled al-Dharaib

fi Nizam al-Mali al-Islami. This book was written by Ibrahim Kharis, which discusses the position of taxation

in Islam, whether it is legal or illegal, whether Zakat is in line with benefit within a specific time under

Maqasid Shari'ah or not. Also, the author refers to scientific journals related to these two discussions. This

paper's novelty is that the benefit in the shari'ah is used as an analysis tool for taxes that are considered

illegal under the arguments of sharia ', which are often used as a means of oppression. But the authors view

from another dimenssion.

2. RESEARCH METHOD

In this article, the authors conducted a literature study by examining some of the literature related

to Zakat and taxes. In the method of comparative descriptive analysis by comparing between Zakat and tax

in terms of benefit. This discussion examines the difference between theory and reality. The solution in the

form of the benefits that are expected to be realized will be found.

3. RESULTS AND DISCUSSION

Understanding Zakat According to Islamic Law

Zakat is a masdar (the origin of the word) of Zakat, which means blessing, growing clean, and

sound. Another opinion says that the basic word zakat means increasing and growing. According to

terminology, Zakat means a certain amount of property that Allah obliged to be submitted to the person

who is entitled, besides means spending a certain amount.

The Maliki school defines Zakat by issuing a particular part of the unique assets that have reached

the nishab (the quantity limit that requires Zakat) to those entitled to receive it (mustahiqq). With a record,

ownership is full and comes haul (a year of payment of Zakat), not mining and agricultural goods. The

Hanafi school of thought defines Zakat by making some particular assets into unique properties,

determined by the Shari'ah because of Allah SWT. The Shafii school defines Zakat as an expression for the

discharge of property or body uniquely. Meanwhile, the Hanbali school represents Zakat with the

obligatory rights (excluded) of particular special groups' assets.

According to Nawawi, the amount spent from wealth is called Zakat because what is spent "adds a

lot, makes it more meaningful and protects wealth from destruction." Meanwhile, according to Ibn

Taymiyah, the soul of a person who gives Zakat will be clean, and his wealth will be neat, clean, and have

an increased meaning. This means that the definition of growth and development is not only meant for

wealth but goes beyond that. According to Law no. 38 of 1999, what is meant by Zakat is assets that must

be set aside by a Muslim or an entity owned by Muslim following religious provisions to be given to those

entitled to receive it. Zakat is an individual right required by Allah for the Muslims' assets, which are

designated for the poor and other Mustahik, as a sign of gratitude for Allah's blessings and to get closer to

Allah al-Mighty and to cleanse themselves of their assets (Kailani & Slama, 2020).

Contemporary Islamic economic thinkers define Zakat as assets that have been determined by the

government or authorized officials, to the general public or individuals that are binding, final, without

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

68

receiving certain rewards by the government in accordance with the ability of the property owners, which

are allocated to meet the needs of the eight groups determined by the Koran, as well as to meet the political

demands for Islamic finance (Kharis, 2014, p. 26).

3.1 Among Sources of State Income

the sources of state income that had occurred during the Prophet Sallallahu Alayhi wa salam were:

a. Zakat, which is the obligation of every Muslim who has assets to reach his nishab. Besides, the

owner of the property has the right to pay his own Zakat and give it to those in need, and the

ruler also has the right to withdraw Zakat from Muslims who have property, especially if they

refuse it, then the Zakat is collected by the zakat officials (amil) assigned by the leader. , and

distributed following the provisions stipulated by Allah in the Al-Quran Surah At-Taubah: 60.

The presence can be this of amil zakat assigned by both Muslims' leaders, which occurred

during the time of the Prophet PBUH. or the next generation (Sali et al., 2020).

b. An inheritance that cannot be divided. In the science of inheritance (faraid) there is a

discussion of undivided assets. Two opinions are famous among faraid experts. The first

opinion must be returned to each of the heirs-their closeness to the deceased and being

considered, except for one of the wives or husbands. The second opinion said that all assets

that are not divided/excess are then returned to the Baitul Mall/state treasury. However, one

day the excess property cannot be returned to the respective heirs; for example, if someone

dies and the heir is a widow, the widow gets 1/6 of the right, and the rest - the tiger doesn't

want to - must be returned to Baitul Mal.

c. Jizyah is property/tribute taken from unbelievers who are allowed to live in an Islamic country

to guarantee their security.

d. Ganimah and fai '. Ghanimah is the property of the infidels (al-harbi) controlled by the Muslims

in the presence of war. Meanwhile, fai 'is the property of the kafir al-harbi, who was left behind

and regulated by the Muslims without any war. Allah has determined Ghanimah for its

distribution in Al-Qur'an surah Al-Anfal: 41, which is 4/5 for the troops of war while 1/5 is left

for Allah, His Messenger, the Prophet's relatives, the orphans, the poor, and Ibnu Sabil. And the

channeling is through Baitul Mall. Meanwhile, fai 'is divided as in Al-Qur'an surah Al-Hashr: 7,

that is, everything is for Allah, His Messenger, the Prophet's relatives, the orphans, the poor,

and ibn sabil. And distribution (also) through the mall (Meirison, 2019).

e. Kharaj, we have explained this in the point: Is there a land tax in Islam?", Above. 6. Sadaqah

tatawwu, namely the people voluntarily donating to the State, is used for the common interest.

f. Mining products and the like. Or from other income that can support the government's budget

needs, other than payment by tyranny, such as state-owned enterprises.

3.2 Understanding Taxes According to Islamic Law

Etymologically, tax in Arabic is known as Adh-daribah, which comes from the root word daraba,

yadribu, darban, which means: to oblige, determine, determine, beat, explain, or impose, and others.

Dharaba is the form of the verb (fi "il), while the noun form (Ism) is daribah, which can be interpreted as a

burden. It is called a disadvantage because it is an additional obligation on assets other than Zakat so that

in its implementation, it will be felt like a burden (Gusfahmi, 2011, p. 28).

Meanwhile, according to Islamic legal experts in defining taxes are:

a. Johansen defined taxes as levies drawn from tax collectors' people (JOHANSEN, 2018, p. 45).

b. Qardhawi defines tax as an obligation determined on the Taxpayer, which must be deposited

to the State following the provisions, without getting performance back from the State. The

results are to finance general expenses on the one hand and to realize some economic, social,

political goals, and other destinations the State wishes to achieve (Qaradawi et al., 2007, p.

999).

Zallum and Gusfahmi argue that taxes are assets that Allah al-Mighty obliged to Muslims to finance

the various needs and expenditure items required of them in Baitul Mal's condition; there is no money or

assets. From these multiple definitions, it appears that the explanations put forward by Qardhawi are still

secular because there are no elements of Sharia in them. Whereas the purpose of tax according to Zallum is

closer and more precise to the values of Sharia, because in the definition he put forward, there are five

crucial elements of tax according to Sharia, namely:

a. Required by Allah Almighty.

b. The object is property. The subjects are wealthy Muslims.

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

69

c. The goal is to finance the needs of the State.

d. Implemented because of an emergency (extraordinary), which must be addressed by Ulil Amri

(government). These four essential elements, in line with the principles of State revenue.

according to the Islamic Economic System, must fulfill four parts, namely:

1) There must be nash (Quran and Hadith) who ordered every source of income and

collection.

2) There is a separation of sources of acceptance from Muslims and non-Muslims.

3) The system of collecting Zakat and taxes must ensure that the rich and affluent who have

the advantages alone bear the main burden.

4) There are demands for the general benefit of tax characteristics, according to Sharia.

There are several provisions on tax (dharibah)according to Islamic Sharia, which at the same time

distinguish it from taxes in the capitalist system (non-Islamic) characteristics of tax according to Sharia,

namely:

a. Tax (shariah) is temporary, not continuous, can only be collected when in Baitul mal there is

no property or less. When Baitul mal is replenished, the tax liability can be abolished. Unlike

Zakat, which is still collected, there are no more parties in need(mustahik). While non-Islamic

tax(tax)is eternal.

b. Taxes (shariah) should only be collected for financing, which is an obligation for the Muslims,

and to the extent that the amount required for the funding compulsory should not be more.

According to non-Islamic (tax), the tax is intended for all citizens without distinguishing

religion.

c. Taxes (daribah) are only taken from Muslims, not non-Muslims because daribah is collected

to finance the needs that become an obligation for Muslims.

d. Taxes (daribah) are only collected from wealthy Muslims, not collected from other than.

e. Tax (daribah) is only collected following the required amount of financing, no more.

f. Tax (Dharibah)can be removed when it is no longer needed.

Requirements for Tax Collection according to Sharia:

According to Qardhawi Pajak, which is recognized in the history of Islamic fiqh and the justified

system must meet several conditions: The assets (taxes) collected are needed. There are no other sources

that can be expected. The surcharge can be levied if the State needs funds, while other sources are not

obtained.

Some scholars require they collect taxes if Baitul Mal is empty. If the tax is needed and there is no

other adequate source, then the tax collection may be mandatory with the terms. But it should be noted, and

the burden must be fair and not burdensome. Do not cause complaints from the public (Gusfahmi, 2011, p.

77).

Fairness in tax collection is based on economic, social considerations and the people's needs and

development. The distribution of tax proceeds must also be fair and not polluted by corruption, collusion,

and nepotism elements. Taxes should be used to finance the interests of the people, not for immorality or

lust. Tax proceeds should be used in the public interest, not for the group's benefit (party), not for the rulers'

desires, personal interests, the luxuries of the families of officials and those close to them. Therefore, the

Quran pays attention to the target zakat in detail and should not be a game of passion, greed, or Money

Politic benefit. There is the approval of experts or scholars of character (Junus, 1966). The head of State,

deputy, governor, or local government shall not act alone to require taxes and determine the amount unless

it is consulted and obtained by experts and scholars in the community. Because basically, a person's

property is unlawfully disturbed, and the property is free from various burdens and dependents. Still, if

there is a need for public benefit, it must be discussed with experts, including scholars (Sali, 2019).

3.3 Subjects and Objects of Zakat and Taxes

a. The subject of Zakat and taxes

The subject of Zakat is the Muslims who have enough wealth Nisab, which is called the term A-

Muzakkiy in Islamic Law. While the matter of tax has been stipulated in the Law of The Republic of

Indonesia number 7 of 1983, Chapter II Article 2, paragraphs 1 and 2 reads: The subject of tax is a person

or individual inheritance that has not been divided as a unity in place of the rightful, a body consisting of a

limited liability company, a communion company, a state and local-owned enterprise with the name and in

any form, an individual alliance or other association, a firm, a cooperative association, a foundation or

institution and a permanent establishment (Zuḥailī, 2002, p. 76).

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

70

The tax subject consists of domestic and foreign taxes, namely tax subjects not residing, not

established, or not domiciled in Indonesia, who can receive or earn income from Indonesia. However, the

issue of taxes has been determined since the beginning of Islam's development, which only includes

Muslims (Ummulkhayr et al., 2017). Ahlu Dzimmi and Ahlu Harbi, still tax provisions that have been

enacted by the Indonesian government, are not contrary to Islamic Law because the taxes that have been

collected from the Taxpayer are used to improve the welfare of the population, which is one of the targets

of Islamic teachings.

b. Zakat and Tax Objects

The object of Zakat is the wealth of Muslims both agreed and disputed by the Fuqaha' among

others: Gold and Silver (currency), Business goods, Crops (agriculture and plantations), mining products

from Rikaz, and professional income (salaries, wages, and honorariums), but the object of the tax is income

that is any additional economic capability received or obtained by taxpayers both from Indonesia and from

outside Indonesia. it can be used for consumption or increase the wealth of taxpayers concerned by name

and in any form, including in it (Fakhruddin & Indonesia, 2008, p. 67). What is meant by income as tax

above is still spelled out in other parts of the Law? Nevertheless, in this description, it is deliberately not

loaded because it is only intended as a comparison material with the implementation of taxes in the early

days of Islamic development. The object of taxation was limited to business property, agriculture, and

plantation farms. However, it is not contrary to the tax object set out in the Act, except that it is only a

development of what has existed by the current economic expansion(Dr. Anwar, 2017, p. 45).

3.4 Equations and Difference between Zakat and Pinvite in Islam

Can be quoted with several points of similarity between Zakat and taxes:

a. There is an element of compulsion to issue

b. Both are deposited for government institutions (in Zakat knew Amil zakat)

c. The government does not give a particular reward to the giver.

d. Have societal, economic, and political goals in addition to financial objectives.

As for the different aspects:

a. In terms of name and etiquette, that gives different motivations. Zakat: holy, growing. Tax

(dharaba):tribute.

b. The fact and purpose of Zakat are also associated with the problem of worship to approach

yourself to God.

c. Regarding to nisab limits and their provisions. Nisab Zakat has been determined by the Creator

of Sharia, which can not be reduced or added by anyone. While on taxes, this can change

following government policy.

d. Regarding its sustainability and continuity, Zakat is fixed and continuous, while taxes can be

inconsistent.

e. Regarding its expenditure, the target of Zakat has been clear and straightforward. Taxes on

state general expenditures.

f. Its relationship with the ruler, the Taxpayer relationship, is very close and depends on the

ruler. Obligatory Zakat related to his God. If the ruler does not play a role, the individual can

take it out individually.

g. Purpose and purpose, Zakat has a higher spiritual and moral sense than taxes.

Another apparent difference between taxes and Zakat is among them:

a. Alms are only for the poor and the needy, and those err. And Allah is All-Clear, All-Knower.

b. Zakat applies to the Muslims only because the Zakat serves to purify the culprits, and we can't

say to the infidels because the infidels will not become holy but must believe first. While the

tax applies to the infidels who live in the land of the Muslims

c. What is removed by the Messenger of Allah ' PBUH about the withdrawal of one-tenth of

human property is a tax commonly withdrawn by the Gentiles. Zakat is not a tax because Zakat

is part of the stuff that must be removed by the imam/leader and returned/given to the people

who are entitled.

d. Zakat is one form of Islamic Sharia exemplified by the Messenger of Allaah PBUH, while the tax

is the sunnah of the Gentiles whose origins are usually levied by the kings of Arabia or non-

Arabs, and among their habits is to withdraw a tenth of the tax of human merchandise

through/pass through the area of power

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

71

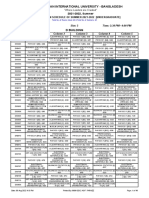

Table 1. Equality between Zakat and tax

Description Zakat Tax

Elements of At-Taubah: 103 and fought warnings and foreclosures

coercion

At the time of Abu Bakr's

caliphate

Managing items Amil Zakat Agency (BAZ) Dirjen Pajak, KPPN

Goal Community welfare "Welfare development."

Rewards no reward no reward

Table 2. Difference between Zakat and tax

Zakat Tax

Name

Legal basis Al-Qur'an and al-Hadith & PP Laws.

Nature State Obligations Religious

Obligations

Subject Muslims only All citizens

Conditions From the maker of shari'a Policies and

(Allah) powers of the

ruler

Sustainability and Fixed and continuous Exists while

sustainability necessary

and

disappears

when not

needed

Relationship with the Ruler His relationship with God His

relationship

with the

government

Based on the above points, it can be said that "zakat is worship and tax all at once." As a

tax, Zakat is an obligation in the form of property whose management is carried out by the State.

The State asks for it by force, and if one does not want to pay it voluntarily, then the proceeds are

used to finance projects for the benefit of the community.

3.5 Purpose of Tax and Zakat

The purpose of tax and the meaning of Zakat have something in common, namely as a source of

funds to realize a just and prosperous society that is equitable and sustainable between material and

spiritual needs. Taxes are used to finance activities in the field, and the development sector, as well as the

utilization of zakat funds, can be channeled to develop activities that are adjusted to the allocation of zakat

recipients, such as economic development, transportation, and tourism, increasing religious practice,

educational sector, young generation and culture, health development, social welfare guarantee, women's

role sector, growth in the field of politics, government apparatus and foreign Law.

4 CONCLUSION

As mentioned, Zakat is one of Islam's pillars, a maaliyah worship that has a crucial position in

building society. Taxes are part of a person's property or entity issued to the State by the Taxpayer each

year. Etymologically, the tax in Arabic is known as Ad-daribah, which comes from the essential words

daraba, yadribu, dharban, which means: oblige, establish, determine, hit, explain, or impose, and others.

Daraba is a form of the verb (fi "il), while the noun form(Ism)is Daribah, which can be interpreted as load.

It is called a burden because it is an additional obligation on property other than Zakat to feel like a burden

in its implementation.

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

72

Meanwhile, according to Islamic Law, experts in defining taxes are: Fawaz describes taxes as levies

drawn from the people by tax pullers. Taxes as obligations set against taxpayers, which must be deposited

to the State following the provisions, without obtaining achievements back from the State, and the result

to finance public expenditures on the one hand and to realize some of the economic, social, political, and

other objectives that the State wants to achieve. It can be concluded that between the Law of tax payment

and the payment of Zakat, there are several similarities and differences. After some opinions from fuqaha'

experts related to Zakat or taxes' amount, taxes and Zakat are only compared to thinly.

Public interest. Likewise, tax funds in the center and the region (provinces, districts/cities) that

have been collected through the State Budget and or APBD can be allocated for the construction of worship

facilities such as mosques, churches, temples, and others. This is justified according to government rules

and God's rules. Technically, both opinions above seem to be. When viewed in terms of operational

techniques, the second opinion is more effective because it has forced power but is not guaranteed

independence. While the first opinion is technically less useful because it has no force, institutional

autonomy is more assured of authority. Despite its advantages and shortcomings, it is clear that Zakat must

be managed professionally and empowered. And the distribution must also be on target following its

designation.

Likewise, taxes collected, organized, and used for purposes have been determined by the

government without the need for requirements as desired by Islam. However, there are similarities; if the

person affected by taxes or the obligatory Zakat has handed over his obligations to the State, then that

obligation has been fulfilled. Of the many similarities between the two can be drawn a meeting point for

the possibilities of being united Zakat to taxes or vice versa, then taken into account as having fulfilled

obligations at once. If it can be taken at least by tax officers or 'amilin to Zakat Payer, these possibilities can

calculate the tax burden that must be deposited to the state treasury based on the receipt of existing

taxpayer payments. So the officer received the handover of Zakat from the muzakki (Zakat Payer) and

booked in the name of Zakat. Then he received a tax amount of the total tax liability minus the amount paid

in the name of Zakat. Hikmah and The Purpose of Distribution of Zakat funds and Taxes for the Construction

of Mosques stated above that after the zakat funds are collected, alternative management can be utilized

through industrial projects, home industries, and others that are profitable, then from the results of its

utilization is finally distributed to the Zakat Recipients and following the provisions of al-Taubah: 60, which

is interpreted contextually, which is technically determined on a priority scale by selecting one of the eight

ashnaf that exist.

Similarly, tax funds coordinated by the government (Tax Service) are basically used for

development, including the construction of worship facilities (mosques). Thus, the wisdom and purpose of

Zakat (including taxes) for the benefit and benefit of human life, both mentally, spiritually, and material

(worldly). The wisdom and meaning of Zakat (including taxes) in the eyes of scholars, in general, there are

at least two implications, especially for muzakki, namely: First, for personal life, such as sanctification of

the soul from stingy nature, fond of charity, reducing hubbu al-dunya (crazy about the world), and love for

fellow human beings (dhu'afa). Second, for social life in a broad sense, such as minimizing the glaring gap

between the rich and the rich, social security can be realized, and other social problems. The construction

of mosques carried out by the community aims to provide comfort and enjoyment of worship to God.

Mosque existence as a public means of worship of Muslims and the means of social activities needed by

Muslims in general. Sofyan Syafri Harahap asserted that "nowadays we see the mosque not only as a place

of prayer but also a place to provide religious and general education, organizational meetings, shops, and

even martial arts, sports, arts, weddings and the inauguration of walimatul 'urus." Thus, the purpose of

building a mosque through zakat funds and or taxes is anything that can benefit and benefit the whole

community can be justified by the rules of the products of God and His Messenger (in this case Uli al-Amri,

the government).

ACKNOWLEDGEMENTS

Praise be to thank God, the creator of all nature and all human actions. This article can also be

completed thanks to the help of our Dean at the Faculty of Ushuluddin, the support of friends who

participated in the preparation of this article, namely Yogi Prasetia and Mr. Dr. Safrudin Halimy Kamaluddin

MA as the chairman of BAZNAZ Padang City.

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

73

REFERENCES

Ahmad, M. U., & Mahmood, A. (2009). Zakat fund – concept and perspective. International Journal of Monetary

Economics and Finance, 2(3/4), 197. https://doi.org/10.1504/IJMEF.2009.029058

Dr. Anwar. (2017). The Law Of Productive Zakat In Islam And Its Impact Towards Economy.

https://doi.org/10.5281/ZENODO.293800

Fakhruddin & Indonesia. (2008). Fiqh & manajemen zakat di Indonesia. UIN Malang Press.

Gusfahmi, G. (2011). Pajak menurut syariah. Rajawali Press.

JOHANSEN, B. (2018). ISLAMIC LAW ON LAND TAX AND RENT: The peasants' loss of property rights as interpreted in the

... Hanafite legal literature of the mamluk and ottoman. ROUTLEDGE.

Junus, U. (1966). The payment of Zakat al-Fitrah in a Minangkabau community. Bijdragen Tot de Taal-, Land- En

Volkenkunde / Journal of the Humanities and Social Sciences of Southeast Asia, 122(4), 447–454.

https://doi.org/10.1163/22134379-90002922

Kailani, N., & Slama, M. (2020). Accelerating Islamic charities in Indonesia: Zakat , sedekah and the immediacy of social

media. southeast Asia Research, 28(1), 70–86. https://doi.org/10.1080/0967828X.2019.1691939

Kharis, I. K. (2014). ) (دراسة مقارنة:الضرائب في النظام المالي اإلسالمي. https://library.dctabudhabi.ae/sirsi/detail/393750

Meirison, M. (2019). Mashlahah dan Penerapannya dalam Siyasah as Syar’iyah. Ijtihad, 32(1), Article 1.

https://doi.org/10.15548/ijt.v32i1.32

Qaradawi, Y., Harun, S., Hafidhuddin, D., & Hasanuddin. (2007). Hukum zakat: Studi komparatif mengenai status dan

filsafat zakat berdasarkan Quran dan Hadis. Litera Antar Nusa.

Sali, M. A. (2019). Distinction of Justice and Fairness during Umar bin Abdul Aziz�s Reign. AJIS: Academic Journal of

Islamic Studies, 4(2), 127. https://doi.org/10.29240/ajis.v4i2.954

Sali, M. A., Saharuddin, D., & Rosdialena, R. (2020). Takhrij Fikih dan Permasalahan Kontemporer. Al-Istinbath : Jurnal

Hukum Islam, 5(1), 51. https://doi.org/10.29240/jhi.v5i1.1235

Ummulkhayr, A., Yusuf Owoyemi, M., & Binti Mohammed Cusairi, R. (2017). Determinants of Zakat Compliance Behavior

among Muslims Living Under Non-Islamic Governments. International Journal of Zakat, 2(1), 95–108.

https://doi.org/10.37706/ijaz.v2i1.18

Zuḥailī, W. az-. (2002). al-Fiqh al-islāmī wa-adillatuhū: Aš-šāmil li-ʾl-adilla aš-šarʿīya wa-ʾl-ārā al-maḏhabīya wa-ahamm

an-naẓarīyāt al-fiqhīya wa-taḥqīq al-aḥādīṯ an-nabawīya wa-taḫrīǧihā mulḥaqan bihī fahrasa alfābāʾīya šāmila

li-ʾl-mauḍūʿāt wa-ʾl-masāʾil al-fiqhīya. Ǧuzʾ 11: al-Fahāris al-ʿāmma: fahrasa alfabāʾȳia šāmila li-ʾl-āyāt wa-ʾl-

aḥādīṯ wa-ʾl-mauḍūʿāt al-fiqhīya (Nachdr. der vierten verb. Ausg). Dār al-fikr.

Kawanua International Journal of Multicultural Studies, Vol. 1, No. 2, December 2020.

You might also like

- Saad 2020 E RDocument12 pagesSaad 2020 E RMcD DeliveryNo ratings yet

- 617-Article Text-1224-1-10-20230910Document9 pages617-Article Text-1224-1-10-20230910Afif Asy-SyirbuniNo ratings yet

- Discourses of Institutionalization of Zakat Management System in Contemporary Indonesia: Effect of The Revitalization of Islamic EconomicsDocument13 pagesDiscourses of Institutionalization of Zakat Management System in Contemporary Indonesia: Effect of The Revitalization of Islamic Economicsdicky irawan prabowoNo ratings yet

- Management of Zakah Centralised VS Decentralised A PDFDocument25 pagesManagement of Zakah Centralised VS Decentralised A PDFTilesNo ratings yet

- ZakatDocument23 pagesZakatFayz Al FarisiNo ratings yet

- Zakat and TaxationDocument13 pagesZakat and TaxationTotok HarmoyoNo ratings yet

- Zakat in Islam: A Powerful Poverty Alleviating Instrument For Islamic CountriesDocument12 pagesZakat in Islam: A Powerful Poverty Alleviating Instrument For Islamic CountriesSalah ZyadaNo ratings yet

- Zakat in Islam A Powerful Poverty Alleviating Instrument For Islamic CountriesDocument11 pagesZakat in Islam A Powerful Poverty Alleviating Instrument For Islamic CountriesPurnama Putra0% (1)

- 1555 5062 1 SMDocument22 pages1555 5062 1 SMHaikal Wanda RifasalNo ratings yet

- Literacy On The Fundamental Information PDFDocument14 pagesLiteracy On The Fundamental Information PDFJean Diane JoveloNo ratings yet

- Riphah International University IslamabadDocument5 pagesRiphah International University IslamabadAnees Ur RehmanNo ratings yet

- 549-Article Text-1073-1-10-20200718Document15 pages549-Article Text-1073-1-10-20200718Mad SharkdomNo ratings yet

- Kajian Hukum Islam Terhadap Dinamika Pelaksanaan Zakat Padi: (Studi Di Kampung Sukajadi Kecamatan Bumiratu Nuban)Document18 pagesKajian Hukum Islam Terhadap Dinamika Pelaksanaan Zakat Padi: (Studi Di Kampung Sukajadi Kecamatan Bumiratu Nuban)amin rizkyNo ratings yet

- Individual Assignment IDocument4 pagesIndividual Assignment IKayeilviliThamilchelvanNo ratings yet

- Zakat and UshrDocument5 pagesZakat and UshrAnees Ur RehmanNo ratings yet

- Zakat: and Will Be Given To The Poor Among Them." This Hadith of Prophet (PBUH) Explains The Nature and Purpose of ZakatDocument9 pagesZakat: and Will Be Given To The Poor Among Them." This Hadith of Prophet (PBUH) Explains The Nature and Purpose of ZakatMuhammad ibrahimNo ratings yet

- Pengentasan Kemiskinan Melalui Pemberdayaan Zakat: Oleh: Nur Ahmad, M.S.IDocument20 pagesPengentasan Kemiskinan Melalui Pemberdayaan Zakat: Oleh: Nur Ahmad, M.S.IfaizalaminNo ratings yet

- Zakat, Barang Tambang, Dan Keadilan Sosial Di Indonesia: Uswatun HasanahDocument19 pagesZakat, Barang Tambang, Dan Keadilan Sosial Di Indonesia: Uswatun HasanahAmy Sabrina SNo ratings yet

- Review of The Contemporary Zakat CollectDocument5 pagesReview of The Contemporary Zakat Collectkestar09No ratings yet

- Bayt Al-Māl and The Distribution of Zakāt: Mahmood NamaziDocument10 pagesBayt Al-Māl and The Distribution of Zakāt: Mahmood NamaziAlexsandro Wagner de AraújoNo ratings yet

- Zakat in Islamic LawDocument12 pagesZakat in Islamic LawMuris SupicNo ratings yet

- Zakah and Public FinanceDocument19 pagesZakah and Public FinanceNajeeba AliNo ratings yet

- Chapter 4 ZakatDocument5 pagesChapter 4 ZakatAlif HakimNo ratings yet

- Zakat - Third Pillar of IslamDocument4 pagesZakat - Third Pillar of Islamsyedaliuddinahmed2009No ratings yet

- Welfare InstituteDocument24 pagesWelfare InstituteSANIYAAH INAMNo ratings yet

- Transformasi Tradisi Filantropi Islam: Studi Model Pendayagunaan Zakat, Infaq, Sadaqah Wakaf Di IndonesiaDocument14 pagesTransformasi Tradisi Filantropi Islam: Studi Model Pendayagunaan Zakat, Infaq, Sadaqah Wakaf Di IndonesiasalsabilaNo ratings yet

- Jurnal Ekonomi Islam Al-Infaq Vol. 2 No. 1 Maret 2011 PDFDocument81 pagesJurnal Ekonomi Islam Al-Infaq Vol. 2 No. 1 Maret 2011 PDFWawan Gunawan100% (1)

- TOWARDS ZAKAhDocument11 pagesTOWARDS ZAKAhJenny IslamNo ratings yet

- Towards Achieving The Quality of Life in The Management of Zakat Distribution To The Rightful Recipients (The Poor and Needy)Document9 pagesTowards Achieving The Quality of Life in The Management of Zakat Distribution To The Rightful Recipients (The Poor and Needy)civiliiiNo ratings yet

- Kontekstualisasi Makna Zakat: Studi Kritis Kosep Sabilillah Menurut Masdar Farid Mas'UdiDocument7 pagesKontekstualisasi Makna Zakat: Studi Kritis Kosep Sabilillah Menurut Masdar Farid Mas'UdiMaya Surya MirantiNo ratings yet

- Basic EkonomiDocument11 pagesBasic Ekonomif2vccqdndgNo ratings yet

- Zakat Vs Taxation The Issue of Social Justice and Redistribution of WealthDocument11 pagesZakat Vs Taxation The Issue of Social Justice and Redistribution of WealthNaufal LazuardiNo ratings yet

- 2009 - Pengagihan Zakat Oleh Institusi Zakat Di Malaysia - Mengapa Masyarakat Islam Tidak Berpuas Hati PDFDocument24 pages2009 - Pengagihan Zakat Oleh Institusi Zakat Di Malaysia - Mengapa Masyarakat Islam Tidak Berpuas Hati PDFAzila WahidNo ratings yet

- Pemahaman Masyarakat Terhadap Kewajiban Zakat Di Kecamatan Ilir Barat Ii Kota PalembangDocument15 pagesPemahaman Masyarakat Terhadap Kewajiban Zakat Di Kecamatan Ilir Barat Ii Kota Palembanghabibah qurrotaNo ratings yet

- Wa0000.Document3 pagesWa0000.Mai ChutyaNo ratings yet

- Integrasi Hukum Pajak Dan Zakat Di Indonesia Telaah Terhadap Pemikiran Masdar Farid Mas'udiDocument18 pagesIntegrasi Hukum Pajak Dan Zakat Di Indonesia Telaah Terhadap Pemikiran Masdar Farid Mas'udiRien DessNo ratings yet

- Research StudyDocument7 pagesResearch StudyJrhn AliGuiamaludinNo ratings yet

- Jurnal DwitaDocument16 pagesJurnal DwitaDwita TaNo ratings yet

- Issues in Zakat Institution AssignmentDocument14 pagesIssues in Zakat Institution AssignmentmohamedNo ratings yet

- Welfare Services of Islamic BanksDocument9 pagesWelfare Services of Islamic BanksMayra NiharNo ratings yet

- Rules of Zakat PDFDocument10 pagesRules of Zakat PDFWan AbqariNo ratings yet

- Rules of Zakat PDFDocument10 pagesRules of Zakat PDFWan AbqariNo ratings yet

- Islamic Economic System 1Document49 pagesIslamic Economic System 1Yeng SureiyāzuNo ratings yet

- Economic System of IslamDocument6 pagesEconomic System of IslamHamza KayaniNo ratings yet

- In The Name of God The MercifulDocument8 pagesIn The Name of God The Mercifulإإبرهيم ياولىNo ratings yet

- 2009 - Pengagihan Zakat Oleh Institusi Zakat Di Malaysia - Mengapa Masyarakat Islam Tidak Berpuas HatiDocument23 pages2009 - Pengagihan Zakat Oleh Institusi Zakat Di Malaysia - Mengapa Masyarakat Islam Tidak Berpuas HatiAzila WahidNo ratings yet

- Following Is The Difference Between Tax and ZakatDocument6 pagesFollowing Is The Difference Between Tax and ZakatShanizam Mohamad Poat100% (4)

- 74 ArticleText 121 1 10 20190714Document9 pages74 ArticleText 121 1 10 20190714sidraNo ratings yet

- The Role of Zakat in Establishing Social PDFDocument5 pagesThe Role of Zakat in Establishing Social PDFSafia AyazNo ratings yet

- Peran Strategis Organisasi Zakat Dalam Menguatkan Zakat Di DuniaDocument7 pagesPeran Strategis Organisasi Zakat Dalam Menguatkan Zakat Di DuniaAhmad Arib AlfarisyNo ratings yet

- Peluang, Tantangan, Dan Strategi Zakat Dalam Pemberdayaan Ekonomi UmatDocument8 pagesPeluang, Tantangan, Dan Strategi Zakat Dalam Pemberdayaan Ekonomi UmatShahibul AbrarNo ratings yet

- The Politics of Zakat Management in Indonesia The Tension Between BAZ and LAZDocument17 pagesThe Politics of Zakat Management in Indonesia The Tension Between BAZ and LAZM Anton AthoillahNo ratings yet

- Itrest & Types 7Document31 pagesItrest & Types 7bilal1434No ratings yet

- Zakat Management Paradigm Comparison ofDocument16 pagesZakat Management Paradigm Comparison ofBagas N ArdhaniNo ratings yet

- Zakat Made Easy FavxsmDocument90 pagesZakat Made Easy Favxsmerlima pengasinanNo ratings yet

- A Review On Literature of Islamic Charities Between 2008-2018Document18 pagesA Review On Literature of Islamic Charities Between 2008-2018aliNo ratings yet

- International Chamber of Commerce: Foreign Exchange and Risk ManagementDocument25 pagesInternational Chamber of Commerce: Foreign Exchange and Risk ManagementHusnain NazirNo ratings yet

- ZakatDocument16 pagesZakatHusnain NazirNo ratings yet

- HR AssigmentDocument2 pagesHR AssigmentHusnain NazirNo ratings yet

- Zakat Vs TaxesDocument40 pagesZakat Vs TaxesHusnain NazirNo ratings yet

- Topic Income Tax AuthoritiesDocument5 pagesTopic Income Tax AuthoritiesHusnain NazirNo ratings yet

- Business and Corporate FinanceDocument1 pageBusiness and Corporate FinanceHusnain NazirNo ratings yet

- IntroductionDocument1 pageIntroductionHusnain NazirNo ratings yet

- Topic Income Tax AuthoritiesDocument5 pagesTopic Income Tax AuthoritiesHusnain NazirNo ratings yet

- IntroductionDocument1 pageIntroductionHusnain NazirNo ratings yet

- IntroductionDocument1 pageIntroductionHusnain NazirNo ratings yet

- Zikr Habib Mirza Maghfoor 2010Document7 pagesZikr Habib Mirza Maghfoor 2010Jayden KabiniNo ratings yet

- Muhammad M Al-Azami On Schachts Origins of Muhammadan JurisprudenceDocument10 pagesMuhammad M Al-Azami On Schachts Origins of Muhammadan JurisprudenceNacer BenrajebNo ratings yet

- Malaysian Halal Management System (MHMS) 2020 PDFDocument53 pagesMalaysian Halal Management System (MHMS) 2020 PDFleyanchele100% (1)

- Intellectual JihadDocument12 pagesIntellectual JihadayangarmyNo ratings yet

- Tolerance and IslamDocument10 pagesTolerance and IslamMaleeha AyubNo ratings yet

- Biography of Saad Ibn Abi Waqqas RADocument4 pagesBiography of Saad Ibn Abi Waqqas RAArwa FatimaNo ratings yet

- CJJ-TN or - 0 PDFDocument5 pagesCJJ-TN or - 0 PDFAsmahane AsmahaneNo ratings yet

- Islamiat References For O Levels (CIE) Islamiat 2058 PDF Muhammad HadithDocument1 pageIslamiat References For O Levels (CIE) Islamiat 2058 PDF Muhammad Hadithkhadija talhaNo ratings yet

- Jinn WikiaDocument4 pagesJinn WikiaAbe Abe100% (1)

- Aziah Locus StandiDocument21 pagesAziah Locus StandiMukhlisah NawawiNo ratings yet

- (Salafimedia) To Vote or Not To VoteDocument3 pages(Salafimedia) To Vote or Not To VoteMohammed Aboobaker HNo ratings yet

- Islam and The Islamization in The PhilippinesDocument12 pagesIslam and The Islamization in The PhilippinesHanifah AngkayNo ratings yet

- Data Entry Operator Police 07 G 2020Document27 pagesData Entry Operator Police 07 G 2020Aahad AmeenNo ratings yet

- Islamiat 2000-2016 PDFDocument30 pagesIslamiat 2000-2016 PDFZahra YumnaNo ratings yet

- Islam On The Move - Tablighi JamaatDocument257 pagesIslam On The Move - Tablighi JamaatAhmed ZaheedNo ratings yet

- Al Mu'Minun 54 118 - DeaskmqCLvDocument33 pagesAl Mu'Minun 54 118 - DeaskmqCLvUruj e AnjumNo ratings yet

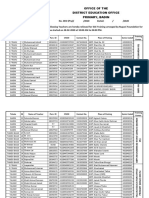

- Office of The District Education Office Primary, BadinDocument3 pagesOffice of The District Education Office Primary, BadinGhulam HyderNo ratings yet

- FPSC Solved Past Paper For The Post of Custom Inspector (BPS-16)Document17 pagesFPSC Solved Past Paper For The Post of Custom Inspector (BPS-16)Power EngineersNo ratings yet

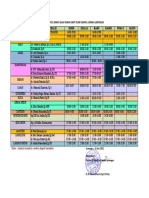

- Daftar Kumpulan Nilai (DKN) Pengetahuan Peserta Didik Pkpps Tingkat Wustha Al Ishlah Semester Ganjil TP 2021-2022Document2 pagesDaftar Kumpulan Nilai (DKN) Pengetahuan Peserta Didik Pkpps Tingkat Wustha Al Ishlah Semester Ganjil TP 2021-2022sholehhuddin alfaruqNo ratings yet

- Final - Day 2 Slot 3Document48 pagesFinal - Day 2 Slot 3MH SyamNo ratings yet

- Proof of The Preservation of The QuranDocument7 pagesProof of The Preservation of The QuranZaky MuzaffarNo ratings yet

- Flyer Aceh Summer School v3Document6 pagesFlyer Aceh Summer School v3Silvi OktariNo ratings yet

- Andrew RippinDocument33 pagesAndrew RippinEgi Prayoga0% (1)

- Merangkai Konsep Harga Jual Berbasis Nilai Keadilan Dalam IslamDocument25 pagesMerangkai Konsep Harga Jual Berbasis Nilai Keadilan Dalam Islamrizkyutami55No ratings yet

- FQH 101Document13 pagesFQH 101Hani Haj SassiNo ratings yet

- Silsilah Nabi PDFDocument7 pagesSilsilah Nabi PDFtias.yana50% (2)

- CSS Islamiat Topic 1Document31 pagesCSS Islamiat Topic 1Ashfaque AhmedNo ratings yet

- Data Tmen Heri Kamis ZoomDocument16 pagesData Tmen Heri Kamis ZoomRo FiNo ratings yet

- JADWAL POLY RAWAT JALAN 13 Juni 2022Document1 pageJADWAL POLY RAWAT JALAN 13 Juni 2022Farid Nur HabibiNo ratings yet

- Islamiat Short Questions EnglishDocument43 pagesIslamiat Short Questions EnglishMuhammad SafdarNo ratings yet