Professional Documents

Culture Documents

ACC 103D Financial Markets Conceptual Activity No. 2

Uploaded by

Natchie Digal0 ratings0% found this document useful (0 votes)

11 views2 pagesBonds provide limited ownership rights to bondholders who have loaned money to a company. They receive regular interest payments but have the lowest claim on company assets if it goes bankrupt. Preferred stockholders have ownership rights that are higher than common stock but lower than bonds. They receive dividend payments before common stockholders but after bondholders if the company is liquidated. Common stockholders have ownership rights through voting and residual claims but the lowest priority for payments if the company fails.

Original Description:

Original Title

Financial Market

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonds provide limited ownership rights to bondholders who have loaned money to a company. They receive regular interest payments but have the lowest claim on company assets if it goes bankrupt. Preferred stockholders have ownership rights that are higher than common stock but lower than bonds. They receive dividend payments before common stockholders but after bondholders if the company is liquidated. Common stockholders have ownership rights through voting and residual claims but the lowest priority for payments if the company fails.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesACC 103D Financial Markets Conceptual Activity No. 2

Uploaded by

Natchie DigalBonds provide limited ownership rights to bondholders who have loaned money to a company. They receive regular interest payments but have the lowest claim on company assets if it goes bankrupt. Preferred stockholders have ownership rights that are higher than common stock but lower than bonds. They receive dividend payments before common stockholders but after bondholders if the company is liquidated. Common stockholders have ownership rights through voting and residual claims but the lowest priority for payments if the company fails.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Natchie Digal BSA – 1

ACC 103D Financial Markets

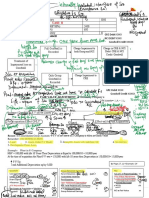

Conceptual Activity No. 2: Capital Markets

Bonds Ordinary Shares Preferred Shares

A.) Ownership and Limited rights under Belongs to common Limited rights when

Control of the firm default in interest stockholders through dividends are missed

payment. voting rights and

residual claim to

Bonds do not alter the income. Preferred stockholders

ownership structure. usually have no or

An investor who buys a An ordinary share limited, voting rights in

corporate bond is represents a fraction of corporate governance.

loaning money to the ownership in the

company and they do corporation that issues

not become a part it. As an owner, the

owner of the company. shareholder gets a vote

in the company's major

decisions, decided at

its shareholder

meetings. For each

share of common stock

owned, the stockholder

gets one vote, so the

stockholder's opinion

becomes weightier

when they own more

shares.

B.) Obligation to Contractual obligation None Must receive payment

provide return to pay interest to its before common

bondholders on a Shareholders do expect stockholders

regular basis. returns on their

investments, either Preferred shareholders

through stock growth have a priority in

or dividend payments. dividend payments

But the company over the holders of the

always has the option common stock. If a

to repurchase some or preferred share has

all of its outstanding cumulative dividends,

shares if and when it then it contains the

no longer has need of provision that should a

equity capital, thereby company fail to pay out

consolidating dividends at any time

ownership and at the stated rate, then

increasing the value of the issuer will have to

shares still available by make up for it as time

reducing the supply. goes on.

C.) Claims to the asset Highest claim Lowest claim of any Bondholders and

in the event of security holder creditors must be

bankruptcy In bankruptcy, the satisfied first

bondholders have a In the event of

liquidation preference bankruptcy, common If the company enters

over investors with stock investors receive bankruptcy, preferred

ownership or the any remaining funds stockholders are

shareholders. after bondholders, entitled to be paid

creditors (including from company assets

employees), and before common

preferred stock holders stockholders.

are paid.

D.) Tax Obligation of Tax deductible Not deductible Not deductible

the corporation Cost = Interest

payment x (1-Tax rate)

E.) Tax Obligation of Municipal bond 70 % of dividend to Same as common stock

the recipient of interest is tax-exempt another corporation is

income tax-attempt

You might also like

- Articles of Incorporation Template 06Document6 pagesArticles of Incorporation Template 06張 雲No ratings yet

- 4organizationalmanagementg11 q1 Mod4 Forms of Business Organization v2 R.olegarioDocument24 pages4organizationalmanagementg11 q1 Mod4 Forms of Business Organization v2 R.olegarioHarvey FernandezNo ratings yet

- LONG-TERM FINANCE MULTIPLE CHOICE QUIZDocument3 pagesLONG-TERM FINANCE MULTIPLE CHOICE QUIZsushmaNo ratings yet

- Methods of Raising CapitalDocument6 pagesMethods of Raising CapitalKumar HarshNo ratings yet

- Reviewer (Unit 7)Document5 pagesReviewer (Unit 7)shaina.planco4No ratings yet

- SECURITIESDocument6 pagesSECURITIESAlyssa SungaNo ratings yet

- Equity Markets: Bulatao, Clemente, Dalope, Mercado, Nelmida, Ramilo, SantosDocument206 pagesEquity Markets: Bulatao, Clemente, Dalope, Mercado, Nelmida, Ramilo, SantosJayveerose BorjaNo ratings yet

- Shares and Debentures: A Comparison ChartDocument2 pagesShares and Debentures: A Comparison ChartJobin JohnNo ratings yet

- Chapter 20: The Features of Stock: EquityDocument3 pagesChapter 20: The Features of Stock: EquityDara Louise PantalunanNo ratings yet

- Lecture14 Financing The CompanyDocument34 pagesLecture14 Financing The CompanyHarishvardhanNo ratings yet

- Difference between Equity & PreferenceDocument1 pageDifference between Equity & Preferenceyd6tm9jwtpNo ratings yet

- REVIEWER IN SHAREHOLDERS EQUITYDocument22 pagesREVIEWER IN SHAREHOLDERS EQUITYAngela Christine CagaoanNo ratings yet

- Chapter 7b Long Term Finance - EquityDocument23 pagesChapter 7b Long Term Finance - Equitychanky-wp22No ratings yet

- 3 Ordinary and Preference SharesDocument4 pages3 Ordinary and Preference SharesVP RaoNo ratings yet

- PLI Fundamentals of Capital Structures Pocket MBA Nov 2019Document85 pagesPLI Fundamentals of Capital Structures Pocket MBA Nov 2019Satya Prakash TrivediNo ratings yet

- Corporations Cheat Sheet: by ViaDocument6 pagesCorporations Cheat Sheet: by ViaMartin LaiNo ratings yet

- Equity Securities MarketDocument6 pagesEquity Securities MarketAngelica DechosaNo ratings yet

- Omparative Table: Basis Shares Debentures StructureDocument2 pagesOmparative Table: Basis Shares Debentures StructureShalini Singh IPSANo ratings yet

- Company Law 1Document7 pagesCompany Law 1Pushpendra BadgotiNo ratings yet

- Rachita Bba LLB (H) ASSIGNMENT-Differences Between Shares and DebenturesDocument3 pagesRachita Bba LLB (H) ASSIGNMENT-Differences Between Shares and DebenturesRachita WaghadeNo ratings yet

- Sources of Capital and Forms ExplainedDocument7 pagesSources of Capital and Forms ExplainedAnthony BalandoNo ratings yet

- Business Law 3E3MzKXXH34eDocument8 pagesBusiness Law 3E3MzKXXH34ebhawnaNo ratings yet

- IV.-Equity-Market-Securities LessonDocument4 pagesIV.-Equity-Market-Securities LessonSandia EspejoNo ratings yet

- Chapter 7 - CorporationDocument5 pagesChapter 7 - CorporationNyah MallariNo ratings yet

- The Shareholders Are General Agents of The Business. Pre-Emptive RightDocument20 pagesThe Shareholders Are General Agents of The Business. Pre-Emptive RightSaeym SegoviaNo ratings yet

- Short and Long Term Finance Incl Islamic Finance Lecture 3Document60 pagesShort and Long Term Finance Incl Islamic Finance Lecture 3Ambreen RabbaniNo ratings yet

- Presented by Ankur Srivastava IBMR-IBS, BangaloreDocument25 pagesPresented by Ankur Srivastava IBMR-IBS, BangaloreAnkur SrivastavaNo ratings yet

- Corporate Accounts TheoryDocument6 pagesCorporate Accounts Theoryvik jainNo ratings yet

- Screenshot 2023-08-07 163856Document1 pageScreenshot 2023-08-07 163856devs2devilsNo ratings yet

- Week 3-Lesson 5 - 6 - 7Document4 pagesWeek 3-Lesson 5 - 6 - 7Hong TrnhNo ratings yet

- CBSE Class 12 Accountancy Chapter 7 NotesDocument9 pagesCBSE Class 12 Accountancy Chapter 7 Notesniks525No ratings yet

- Corporation: Sources of FinancingDocument7 pagesCorporation: Sources of Financingibrahim mohamedNo ratings yet

- Notes SHARESDocument3 pagesNotes SHARESPratik JainNo ratings yet

- CharacteristicDocument2 pagesCharacteristicmurniyati mohamadNo ratings yet

- BanKoncepts - Equity and DebtsDocument3 pagesBanKoncepts - Equity and DebtsVenkat IyerNo ratings yet

- Financial Accounting AssignmentDocument10 pagesFinancial Accounting AssignmentMudada Trevor IINo ratings yet

- Note On Financial InstrumentsDocument5 pagesNote On Financial InstrumentsVismay GharatNo ratings yet

- Presentation Company - Accounting by Anshika & Diya-2Document15 pagesPresentation Company - Accounting by Anshika & Diya-2Diya bhangaleNo ratings yet

- Corporate Actions PresentationDocument12 pagesCorporate Actions PresentationSheetal LaddhaNo ratings yet

- SP Chapter 2 NotesDocument8 pagesSP Chapter 2 NotesShivani KambliNo ratings yet

- Presented by Ankur Srivastava IBMR-IBS, BangaloreDocument25 pagesPresented by Ankur Srivastava IBMR-IBS, BangaloreInfofree987No ratings yet

- Stocks - Financial Corporate - Team 6Document16 pagesStocks - Financial Corporate - Team 6Châu Nguyễn Thị MinhNo ratings yet

- Issue of Shares - Equity and Preference SharesDocument7 pagesIssue of Shares - Equity and Preference SharesgitaNo ratings yet

- Chapter 13 - Loan CapitalDocument15 pagesChapter 13 - Loan CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Divided by The Number of Shares OutstandingDocument5 pagesDivided by The Number of Shares OutstandingRia GabsNo ratings yet

- Reviewer FINANCE LESSON 4Document12 pagesReviewer FINANCE LESSON 4Lili esNo ratings yet

- Corporation Law: Separate Juridical PersonalityDocument41 pagesCorporation Law: Separate Juridical PersonalityNico CaldozoNo ratings yet

- Capital Structure and ReservesDocument40 pagesCapital Structure and ReservesEverjoice ChatoraNo ratings yet

- CorporationDocument5 pagesCorporationaj7939408No ratings yet

- Ey Buy Back of SharesDocument4 pagesEy Buy Back of SharesManan ChhabraNo ratings yet

- Global Academy of Technology: Financial Management AssignmentDocument12 pagesGlobal Academy of Technology: Financial Management AssignmentChandan PNo ratings yet

- Capital StructureDocument5 pagesCapital StructureKristine SacatropezNo ratings yet

- Capital and FinancingDocument11 pagesCapital and FinancingaliyahnicoleeeeNo ratings yet

- Angel Guidebook - Term Sheet 2Document12 pagesAngel Guidebook - Term Sheet 2Mike DorseyNo ratings yet

- Business LawDocument11 pagesBusiness LawsimrnNo ratings yet

- Business LawDocument8 pagesBusiness Lawankita mishraNo ratings yet

- AccountsDocument6 pagesAccountsAaditya KumarNo ratings yet

- Topic 10 - Primary InvestmentDocument76 pagesTopic 10 - Primary InvestmentArun GhatanNo ratings yet

- Legal Memo on Preferred SharesDocument5 pagesLegal Memo on Preferred SharesChristine PacienciaNo ratings yet

- You Do Note Iz The Liar Iz The PeykDocument23 pagesYou Do Note Iz The Liar Iz The Peyksalamat lang akinNo ratings yet

- Chapter 8 Sources of Business FinanceDocument13 pagesChapter 8 Sources of Business FinanceSHUBHAM SHEKHAWATNo ratings yet

- AnswerDocument8 pagesAnswerMary Jescho Vidal AmpilNo ratings yet

- The Filipino Way and Qualities of the Filipino Moral IdentityDocument5 pagesThe Filipino Way and Qualities of the Filipino Moral IdentityNatchie DigalNo ratings yet

- INTRODocument3 pagesINTRONatchie DigalNo ratings yet

- The Filipino Way and Qualities of the Filipino Moral IdentityDocument5 pagesThe Filipino Way and Qualities of the Filipino Moral IdentityNatchie DigalNo ratings yet

- Lesson 1Document1 pageLesson 1Natchie DigalNo ratings yet

- Lesson 1Document4 pagesLesson 1Natchie DigalNo ratings yet

- Lesson 2Document2 pagesLesson 2Natchie DigalNo ratings yet

- Lesson 3Document2 pagesLesson 3Natchie DigalNo ratings yet

- GAM Chapter 1Document14 pagesGAM Chapter 1Natchie DigalNo ratings yet

- GAM Chapter 2-3Document18 pagesGAM Chapter 2-3Natchie DigalNo ratings yet

- Notice of 15th AGM On 16 09 2021Document13 pagesNotice of 15th AGM On 16 09 2021Edward DevisNo ratings yet

- Walmart-Flipkart Acquisition: A Case Study of the Biggest E-Commerce Deal in IndiaDocument11 pagesWalmart-Flipkart Acquisition: A Case Study of the Biggest E-Commerce Deal in Indiachandu johnNo ratings yet

- Enhanced Model Term Sheet - V2.0 - 05262021Document34 pagesEnhanced Model Term Sheet - V2.0 - 05262021yousefNo ratings yet

- LIST OF CASES FOR DIGEST CORPO Updated 2020 STUDENTS COPY. MIDTERMS 2Document4 pagesLIST OF CASES FOR DIGEST CORPO Updated 2020 STUDENTS COPY. MIDTERMS 2Kaemy MalloNo ratings yet

- Class Database - AnalysisDocument11 pagesClass Database - AnalysisMadhur DeshmukhNo ratings yet

- DividendDocument34 pagesDividendquoteNo ratings yet

- Registered Agent Number 26944Document3 pagesRegistered Agent Number 26944georgiinaNo ratings yet

- Suntec REIT Achieves Record High DPU of 9.932 Cents in FY 2011Document127 pagesSuntec REIT Achieves Record High DPU of 9.932 Cents in FY 2011Nooreza PeerooNo ratings yet

- Case: Ii: Lecturer: Mr. Shakeel BaigDocument2 pagesCase: Ii: Lecturer: Mr. Shakeel BaigKathleen De JesusNo ratings yet

- Accounting Principles: Corporations: Dividends, Retained Earnings, and Income ReportingDocument55 pagesAccounting Principles: Corporations: Dividends, Retained Earnings, and Income ReportingWadood AhmedNo ratings yet

- ACTBFAR Lecture - Accounting For Corporation - V25Document147 pagesACTBFAR Lecture - Accounting For Corporation - V25Kristian Angelo MamarilNo ratings yet

- SV150 Top 10 042212Document1 pageSV150 Top 10 042212Chris FentonNo ratings yet

- Dow's Bid For Rohm and HaasDocument2 pagesDow's Bid For Rohm and HaasPavitraNo ratings yet

- Adrs and GDRS: Similarities and Benefits - Financial ManagementDocument5 pagesAdrs and GDRS: Similarities and Benefits - Financial ManagementvikasNo ratings yet

- Div Policy UploadDocument14 pagesDiv Policy UploadGauri TyagiNo ratings yet

- Manulife PhilippinesDocument4 pagesManulife PhilippinesvhinereyesNo ratings yet

- Listing of SecuritiesDocument10 pagesListing of Securitiesoureducation.inNo ratings yet

- How The 'PayPal Mafia' Redefined Success in Silicon Valley - Feature - TechRepublicDocument14 pagesHow The 'PayPal Mafia' Redefined Success in Silicon Valley - Feature - TechRepublicabbasalipmpNo ratings yet

- CARTRADE 25012022123949 LetterDocument30 pagesCARTRADE 25012022123949 Lettermadhav kumarNo ratings yet

- Mergers and Acquisitions REVDocument18 pagesMergers and Acquisitions REVhizelaryaNo ratings yet

- Corporate Governance and Leadership-A Case of Infosys and TATADocument6 pagesCorporate Governance and Leadership-A Case of Infosys and TATASaketNo ratings yet

- Meaning of A Company MeetingDocument12 pagesMeaning of A Company MeetingRahul Kathuria70% (10)

- Top HR Leaders in IndiaDocument1 pageTop HR Leaders in IndiaRaja SarkarNo ratings yet

- Introduction To Financial ManagementDocument38 pagesIntroduction To Financial ManagementAnna TeusdeaNo ratings yet

- Journal Entries For Stockholders' EquityDocument2 pagesJournal Entries For Stockholders' EquityMary100% (11)

- Company LawDocument2 pagesCompany LawMustaq AhmedNo ratings yet

- Motilal Oswal Amc DetailsDocument75 pagesMotilal Oswal Amc Detailssudishsingh8No ratings yet