Professional Documents

Culture Documents

Difference Between Equity & Preference

Uploaded by

yd6tm9jwtpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference Between Equity & Preference

Uploaded by

yd6tm9jwtpCopyright:

Available Formats

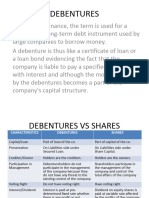

DiUlerence between SIhares amd Debentures

Shares

Basis of Difference

Shares are considered as a part| Debentures are

Debentures

I. Nature of Fund considered as a part

of owner fund of the company. of borrowed funds

the

2. Voting Rights Shareholders get full voting No voting rights. company.

rights in the company.

3. Issue of Discount Restrictions on issue of shares at No restriction on issue of

discount (i.e., maximum a rate at a discount.

at debentures

of discount is 10 per cent of the

nominal/face value.

4. Security No assets of the company are Company's assets

asse are mortgaged for

mortgaged as security against the raising funds from debentures.

issue of shares.

5. Status of Holders Owners. Creditors.

6. Risk to Holders Complete risk borne by holders. Debentures holders bear minimum

degree of risk.

7. Rate of Return Dividends are paid, when there Interest on debentures is paid at fixed

is adequate profit. The rate of|rate regulary.

dividend is not fixed. Dividends

are the regular source of income.

8. Priority of Refund Principal amount repayable after Payment is made to debenture holders

debenture holders. before shareholders.

9. Name of Return Shares get return in the form of Debentures get return in the form of

dividend. interest.

10. Effect on Borrowing Issue of equity shares increases Issue of debentures reduces the

Capacity the borrowing capacity of a borrowing capacity of a company.

company.

11. Convertibility Shares cannot be converted into Debentures can be converted nto

debentures. shares.

12. Repayment Shares are not redeemable A company can return its debentures

the

(paid back) during the life ofeven before the winding up of

the company (except in case of company.

redeemable preference shares)

You might also like

- Upwork PDFDocument20 pagesUpwork PDFJP0% (4)

- WD Gann Quotes CollectionDocument4 pagesWD Gann Quotes CollectionAsis SahooNo ratings yet

- Opportunity in Soft Drink IndustryDocument58 pagesOpportunity in Soft Drink Industrymaddy205075% (4)

- Importance of Social Cost Benefit AnalysisDocument9 pagesImportance of Social Cost Benefit AnalysisMohan RaoNo ratings yet

- Aviator 6Document117 pagesAviator 6Manuel Azabache GrandezNo ratings yet

- Final Project LUSH Group 2Document32 pagesFinal Project LUSH Group 2Pat Neenan60% (5)

- Rachita Bba LLB (H) ASSIGNMENT-Differences Between Shares and DebenturesDocument3 pagesRachita Bba LLB (H) ASSIGNMENT-Differences Between Shares and DebenturesRachita WaghadeNo ratings yet

- Note On Financial InstrumentsDocument5 pagesNote On Financial InstrumentsVismay GharatNo ratings yet

- 67188bos54090 Cp10u3Document31 pages67188bos54090 Cp10u3Pawan TalrejaNo ratings yet

- Issue of DebentureDocument17 pagesIssue of DebentureCma Vikas RajpalaniNo ratings yet

- Screenshot 2023-08-07 163856Document1 pageScreenshot 2023-08-07 163856devs2devilsNo ratings yet

- Shares and Debentures: A Comparison ChartDocument2 pagesShares and Debentures: A Comparison ChartJobin JohnNo ratings yet

- Company Law ProjectDocument6 pagesCompany Law ProjectKumar HarshNo ratings yet

- Issue of Debentures: UNIT - 3Document31 pagesIssue of Debentures: UNIT - 3Hansika ChawlaNo ratings yet

- AccountsDocument6 pagesAccountsAaditya KumarNo ratings yet

- SP Chapter 2 NotesDocument8 pagesSP Chapter 2 NotesShivani KambliNo ratings yet

- Omparative Table: Basis Shares Debentures StructureDocument2 pagesOmparative Table: Basis Shares Debentures StructureShalini Singh IPSANo ratings yet

- Corporate Accounts TheoryDocument6 pagesCorporate Accounts Theoryvik jainNo ratings yet

- SP DistinguishDocument7 pagesSP DistinguishTanya SinghNo ratings yet

- Company Acc Unit 3Document39 pagesCompany Acc Unit 3Megha DevanpalliNo ratings yet

- DebenturesDocument7 pagesDebenturesHina KausarNo ratings yet

- Accounts Final PresentationDocument30 pagesAccounts Final PresentationRITIKANo ratings yet

- EquityDocument10 pagesEquitygaurav4ektaNo ratings yet

- CBSE Class - XII Accountancy Revision Notes Accounting For Share CapitalDocument9 pagesCBSE Class - XII Accountancy Revision Notes Accounting For Share Capitalniks525No ratings yet

- Unit-7 BS-XI RK SinglaDocument34 pagesUnit-7 BS-XI RK SinglaJishnu DuhanNo ratings yet

- CL Topic 6Document11 pagesCL Topic 6magdawaks46No ratings yet

- Unit 3: Issue of Debentures: Learning OutcomesDocument30 pagesUnit 3: Issue of Debentures: Learning Outcomesashish malhotraNo ratings yet

- Company Acc - Issue of Debentures @CA - Study - NotesDocument9 pagesCompany Acc - Issue of Debentures @CA - Study - Notesbhawanar3950No ratings yet

- PLI Fundamentals of Capital Structures Pocket MBA Nov 2019Document85 pagesPLI Fundamentals of Capital Structures Pocket MBA Nov 2019Satya Prakash TrivediNo ratings yet

- Financial MarketDocument2 pagesFinancial MarketNatchie DigalNo ratings yet

- Acc DebenturesDocument12 pagesAcc DebenturesDRISYANo ratings yet

- Company Law: BY: Ramniwas SharmaDocument74 pagesCompany Law: BY: Ramniwas Sharmaramniwas sharmaNo ratings yet

- Chapter 8 Sources of Business FinanceDocument13 pagesChapter 8 Sources of Business FinanceSHUBHAM SHEKHAWATNo ratings yet

- Chapter 13 - Loan CapitalDocument15 pagesChapter 13 - Loan CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Long Term FinanceDocument18 pagesLong Term FinanceRameez SalimNo ratings yet

- Vii Class Xi Business StudiesDocument6 pagesVii Class Xi Business StudiesAwwCakeNo ratings yet

- BanKoncepts - Equity and DebtsDocument3 pagesBanKoncepts - Equity and DebtsVenkat IyerNo ratings yet

- Doc-20231220-Wa0002. 20231220 232817 0000Document15 pagesDoc-20231220-Wa0002. 20231220 232817 0000Khushdeep Kaur KaurNo ratings yet

- Company Formation 1. Write The Meaning of Private Limited Company. Mention Any Three Features of Private CompanyDocument23 pagesCompany Formation 1. Write The Meaning of Private Limited Company. Mention Any Three Features of Private CompanyBishu ThakurNo ratings yet

- Debentures: Specialised AccountingDocument18 pagesDebentures: Specialised AccountingFirezegi TeklehaymanotNo ratings yet

- Redemption of Debentures PDFDocument22 pagesRedemption of Debentures PDFVikas MandloiNo ratings yet

- Global Academy of Technology: Financial Management AssignmentDocument12 pagesGlobal Academy of Technology: Financial Management AssignmentChandan PNo ratings yet

- CSA Chapter2Document60 pagesCSA Chapter2arunvklplmNo ratings yet

- Equity Securities Market 1 PDFDocument30 pagesEquity Securities Market 1 PDFAlmira LozanoNo ratings yet

- Debt and EquityDocument5 pagesDebt and EquityABHYUDAYA BHARADWAJ MBA W 2021-24No ratings yet

- Chapter 2 Issue of Shares and RedemptionsDocument40 pagesChapter 2 Issue of Shares and RedemptionsEverjoice ChatoraNo ratings yet

- CharacteristicDocument2 pagesCharacteristicmurniyati mohamadNo ratings yet

- CBSE Class 12 Accountancy Company Accounts Share Capital WorksheetDocument13 pagesCBSE Class 12 Accountancy Company Accounts Share Capital WorksheetJenneil CarmichaelNo ratings yet

- Business LawDocument8 pagesBusiness Lawankita mishraNo ratings yet

- Chapter 3 - Sources of CapitalDocument7 pagesChapter 3 - Sources of CapitalAnthony BalandoNo ratings yet

- Reviewer SheDocument22 pagesReviewer SheAngela Christine CagaoanNo ratings yet

- Company Share Capital 2020Document26 pagesCompany Share Capital 2020Levin makokhaNo ratings yet

- Assignment - Sources of CapitalDocument14 pagesAssignment - Sources of Capitalabayomi abayomiNo ratings yet

- Debenture Vs Shares-2Document19 pagesDebenture Vs Shares-2nemewep527No ratings yet

- Equity Securities Market Final05272023Document39 pagesEquity Securities Market Final05272023Bea Bianca MadlaNo ratings yet

- 12th - Accontancy - EM Company Accounts - WWW - Tntextbooks.inDocument33 pages12th - Accontancy - EM Company Accounts - WWW - Tntextbooks.indeeksha6548gkNo ratings yet

- Share CapitalDocument4 pagesShare Capital20AH419 Talukdar DebanjanaNo ratings yet

- Loan Capital - RPS and DebenturesDocument23 pagesLoan Capital - RPS and Debenturesathirah jamaludinNo ratings yet

- 3-Bank and Stock ExchangeDocument2 pages3-Bank and Stock ExchangeRamzi Amar100% (1)

- CorporationDocument5 pagesCorporationaj7939408No ratings yet

- Differences Between Shares and DebenturesDocument2 pagesDifferences Between Shares and DebenturesKartik Chell100% (2)

- Financial Assets: Financial Instruments Ayon Sa Pas 32Document4 pagesFinancial Assets: Financial Instruments Ayon Sa Pas 32Chesca Marie Arenal Peñaranda100% (1)

- Corporate AccountingDocument70 pagesCorporate AccountingGayathriSrinivasanNo ratings yet

- Notes SHARESDocument3 pagesNotes SHARESPratik JainNo ratings yet

- Lecture14 Financing The CompanyDocument34 pagesLecture14 Financing The CompanyHarishvardhanNo ratings yet

- Financial Institutions Markets and Money 12Th Edition Kidwell Test Bank Full Chapter PDFDocument37 pagesFinancial Institutions Markets and Money 12Th Edition Kidwell Test Bank Full Chapter PDFclubhandbranwq8100% (10)

- Automotive Study RO-SBDocument69 pagesAutomotive Study RO-SBioanchiNo ratings yet

- Digital Transformation of U.S. Private BankingDocument9 pagesDigital Transformation of U.S. Private BankingCognizantNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Chapter 9 FM Case StudiesDocument5 pagesChapter 9 FM Case StudiesAlisha BhatiaNo ratings yet

- Novartis PharmaDocument11 pagesNovartis PharmaDeepak GuptaNo ratings yet

- IAS 17 - Leases: Example 1Document5 pagesIAS 17 - Leases: Example 1danabcNo ratings yet

- Business (Managerial) EconomicsDocument264 pagesBusiness (Managerial) EconomicsTanya VermaNo ratings yet

- Berkshire Hathaway Float MemoDocument4 pagesBerkshire Hathaway Float Memoclaphands22No ratings yet

- Rorde Wilkinson-Multilateralism and The World Trade Organisation - The Architecture and Extension of International Trade Regulation (Routledge Advances in International Political Economy) (2001)Document177 pagesRorde Wilkinson-Multilateralism and The World Trade Organisation - The Architecture and Extension of International Trade Regulation (Routledge Advances in International Political Economy) (2001)Chaimae EL MoussaouiNo ratings yet

- 4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesDocument11 pages4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesKent CondinoNo ratings yet

- TCS Recruitment Previous Year Pattern Questions Set-4Document2 pagesTCS Recruitment Previous Year Pattern Questions Set-4QUANT ADDANo ratings yet

- VP Marketing Building Materials in Seattle WA Resume Mark GallantDocument2 pagesVP Marketing Building Materials in Seattle WA Resume Mark GallantMarkGallantNo ratings yet

- Intro To Process SimulationDocument44 pagesIntro To Process SimulationAakriti BhandariNo ratings yet

- Security Analysis and Portfolio Management Unit-1 InvestmentDocument27 pagesSecurity Analysis and Portfolio Management Unit-1 InvestmentMadhu dollyNo ratings yet

- Analysis of Digital Domain HoldingsDocument71 pagesAnalysis of Digital Domain HoldingsCapriciousResearchNo ratings yet

- Maila Rosario College: College of Business Administration Major in Financial ManagementDocument9 pagesMaila Rosario College: College of Business Administration Major in Financial ManagementEleine AlvarezNo ratings yet

- PFRS 14 15 16Document3 pagesPFRS 14 15 16kara mNo ratings yet

- What Is 'Bitcoin': Digital Currency White PaperDocument11 pagesWhat Is 'Bitcoin': Digital Currency White PaperJJ RiveraNo ratings yet

- A Test of The Harrod-Domar/Financing Gap Growth Model (Ecuador)Document18 pagesA Test of The Harrod-Domar/Financing Gap Growth Model (Ecuador)Lotta WesterbergNo ratings yet

- Biljana GajicNew CNC Resume (Simple1)Document3 pagesBiljana GajicNew CNC Resume (Simple1)Joshua GillespieNo ratings yet

- Homework 4Document7 pagesHomework 4Liam100% (1)

- Ifs21 ScamDocument6 pagesIfs21 ScamRavi PrakashNo ratings yet

- MOTILAL OSWAL 2017-18 Annual Report AnalysisDocument3 pagesMOTILAL OSWAL 2017-18 Annual Report AnalysisSachin SurywanshiNo ratings yet