Professional Documents

Culture Documents

Morning Brief - September 22, 2022

Uploaded by

ANKUR KIMTANIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning Brief - September 22, 2022

Uploaded by

ANKUR KIMTANICopyright:

Available Formats

Morning Brief – September 22, 2022

Global Domestic

• The Federal Reserve raised its target interest rate by • The Asian Development Bank (ADB) slashed India’s

75 bps to a range of 3.00%-3.25%. It signalled more economic growth projection for 2022-23 to 7% from

hikes with its policy rate rising to 4.40% by the end 7.2% earlier, citing higher than expected inflation

of this year, before topping out at 4.60% in 2023. and monetary tightening.

• US existing home sales dropped (by 0.4% m-o-m) • As per the first advance estimates of production of

for the seventh straight month in August as major Kharif crops for 2022-23, the foodgrains

affordability deteriorated further amid surging production is estimated to reach a new high of

mortgage rates and stubbornly high house prices. 149.92 million tonnes.

• Consumer inflation (NCPI) in Sri Lanka accelerated • Mineral production in the country fell 3.3% year-on-

to 70.2% y-o-y in August, after a 66.7% increase in year in July. The production of minerals such as iron

July. Food prices climbed 84.6%, while prices of non- ore, lead, petroleum crude, natural gas, etc. showed

food items rose 57.1%. negative growth.

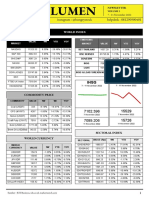

Global Indicators

20-09-2022 21-09-2022 % / bps change

Dow 30,706 30,184 -1.70

NASDAQ 11,425 11,220 -1.79

S & P 500 3,856 3,790 -1.71

Nikkei 225 27,688 27,313 -1.36

FTSE 100 7,193 7,238 0.63

US 10-yr (%) 3.56 3.53 -3 bps

UK 10-yr (%) 3.30 3.31 2 bps

Germany 10-yr (%) 1.93 1.89 -4 bps

Gold ($/t oz) 1,671 1,676 0.28

Crude Oil-WTI ($/bbl) 84.45 82.94 -1.79

Crude Oil-Brent ($/bbl) 90.62 89.83 -0.87

$/€* 1.00 0.98 -1.31

¥/$* 143.72 144.08 0.25

$/£* 1.14 1.13 -0.97

*(-)Appreciation/(+)Depreciation; Source: WSJ

Equity and Currency Markets - Domestic

20-09-2022 21-09-2022 % change

Sensex 59,720 59,457 -0.44

NIFTY 17,816 17,718 -0.55

Rs/$* 79.75 79.98 0.29

Rs/€* 79.82 79.57 -0.31

*(-)Appreciation/(+) Depreciation; Source: Mint

Money Market - Domestic

20-09-2022 21-09-2022

Avg. Call Rate (%) 5.47 5.54

Vol. Traded (Rs million) 1,30,568 1,34,753

Net banking system liquidity outstanding (Rs million)* 2,18,734 1,18,864

T-Bills 91 days (%) 5.78 5.88

182 days (%) 5.95 6.20

364 days (%) 6.40 NA

G-sec 3 years (%) 7.16 7.16

5 years (%) 7.22 7.22

10 years (%) 7.28 7.28

*(+)Deficit/(-)Surplus (Net banking system liquidity outstanding = total repo+MSF+SLF – total reverse repo); Source: CEIC, CCIL

FPI and MFs Investment Flows - Domestic

Equity Debt

Total (Net)^

Net Net

Net FPI Flows (USD million)

Aug-22 6,442 857 7,107

Sep-22* 1,402 811 2,319

20-Sep-22 92 (3) 91

21-Sep-22 226 (25) 201

MF Investments (Rs million)

Sept-22# 27,730 32,088 59,818

*Latest data as of previous trading day; #Data till Sept 08, 2022; ^Total (Net) of equity, debt & hybrid; Source: CEIC

Bond Spreads over G-Sec (PP)*- Domestic G-Sec Yields (%) - Domestic

PSU, FIs

10 Year NBFCs Corporates 10

& Banks

AAA 0.12 0.40 0.43

8

AA+ 0.47 0.93 0.83

AA 0.75 1.23 1.10

6

%

AA- 1.22 1.69 1.58

A+ 1.97 3.44 2.83 4

A 2.22 3.69 3.08

A- 2.47 3.94 3.58 2

BBB+ 2.97 4.44 4.08 1 2 5 10 15 20 30

BBB 3.22 4.69 4.33 Years

BBB- 3.72 5.19 4.83 31-Mar-22 30-Jun-22 21-Sep-22

*As of September 20, 2022; Source: FIMMDA Source: CCIL

Contact

Shambhavi Priya Associate Economist shambhavi.priya@careedge.in +91 - 22 - 6754 3493

CARE Ratings Limited

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022

Phone: +91-22-6754 3456 l CIN: L67190MH1993PLC071691

Disclaimer: This report has been prepared by CareEdge (CARE Ratings Limited). CareEdge has taken utmost care to ensure accuracy and objectivity based on information available in the public domain.

However, neither the accuracy nor completeness of the information contained in this report is guaranteed. CareEdge is not responsible for any errors or omissions in analysis/inferences/views or for

results obtained from the use of the information contained in this report and especially states that CareEdge has no financial liability whatsoever to the user of this report.

You might also like

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Morning Brief - October 07, 2022Document1 pageMorning Brief - October 07, 2022ANKUR KIMTANINo ratings yet

- Asian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificFrom EverandAsian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificNo ratings yet

- Morning Brief - September 23, 2022Document1 pageMorning Brief - September 23, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - October 07, 2022Document1 pageMorning Brief - October 07, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 26, 2022Document1 pageMorning Brief - September 26, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 07, 2022Document1 pageMorning Brief - September 07, 2022ANKUR KIMTANINo ratings yet

- Morning Cuppa 12-JanDocument2 pagesMorning Cuppa 12-JanSaroNo ratings yet

- Morning Cuppa 06-JanDocument2 pagesMorning Cuppa 06-JanSaroNo ratings yet

- Morning Cuppa 09-JanDocument2 pagesMorning Cuppa 09-JanWhaosidqNo ratings yet

- Daily Commodity, Currency & Money Market Update - 28th Dec 2023Document4 pagesDaily Commodity, Currency & Money Market Update - 28th Dec 2023S.M Abdulla ShuvoNo ratings yet

- Morning Cuppa 24-JanDocument2 pagesMorning Cuppa 24-JanSaroNo ratings yet

- LIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Cuppa 20-DecDocument3 pagesMorning Cuppa 20-DecSaroNo ratings yet

- Morning Cuppa 05-JanDocument2 pagesMorning Cuppa 05-Jankishan.p.borivaliNo ratings yet

- Morning Cuppa 30-OctDocument2 pagesMorning Cuppa 30-OctKeshavNo ratings yet

- Morning Cuppa 20-JanDocument2 pagesMorning Cuppa 20-JanSaroNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- LIVE-PGT-7th Oct, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-7th Oct, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Cuppa 14-DecDocument2 pagesMorning Cuppa 14-DecKeshav KhetanNo ratings yet

- Morning Cuppa 11-MayDocument2 pagesMorning Cuppa 11-MayShashank MisraNo ratings yet

- Morning Cuppa 17-AugDocument2 pagesMorning Cuppa 17-AugSourav PalNo ratings yet

- Morning Cuppa 30-MayDocument2 pagesMorning Cuppa 30-MayAkshay ChaudhryNo ratings yet

- LIVE-PGT-26th Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-26th Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Cuppa 27-OctDocument2 pagesMorning Cuppa 27-OctKeshavNo ratings yet

- Morning Cuppa 08-Oct-202110080838430715214Document2 pagesMorning Cuppa 08-Oct-202110080838430715214flying400No ratings yet

- Morning Cuppa 31-OctDocument2 pagesMorning Cuppa 31-OctKeshavNo ratings yet

- Sucor Sunrise: Jakarta Composite Index UpdateDocument6 pagesSucor Sunrise: Jakarta Composite Index UpdateyolandaNo ratings yet

- TD Economics: The Weekly Bottom LineDocument6 pagesTD Economics: The Weekly Bottom LinePaola VerdiNo ratings yet

- Morning Cuppa 12-DecDocument2 pagesMorning Cuppa 12-DecSaroNo ratings yet

- Morning Cuppa 23-JanDocument2 pagesMorning Cuppa 23-JanSaroNo ratings yet

- Morning Cuppa 14-JulyDocument2 pagesMorning Cuppa 14-JulyAjish CJ 2015No ratings yet

- TD Q3 PreviewDocument14 pagesTD Q3 PreviewForexliveNo ratings yet

- SPDR Gold Etfs Quarterly DashboardDocument6 pagesSPDR Gold Etfs Quarterly DashboardMicahNo ratings yet

- Myanmar Weekly: Selected Stock IndicesDocument13 pagesMyanmar Weekly: Selected Stock IndicesWai Mar ThantNo ratings yet

- Mysteel Iron Ore Index Daily 0224 PDFDocument2 pagesMysteel Iron Ore Index Daily 0224 PDFSatyam AvhadNo ratings yet

- Market Highlights: Week Ended January 29, 2010Document5 pagesMarket Highlights: Week Ended January 29, 2010adeoyedanielNo ratings yet

- Import Dropped Due To Covid-19 Disruption 16 Mar 2020Document3 pagesImport Dropped Due To Covid-19 Disruption 16 Mar 2020botoy26No ratings yet

- Morning Breifing 04-10-2019Document18 pagesMorning Breifing 04-10-2019afnaniqbalNo ratings yet

- Daily Notes: SM Investments Corporation (pse:SM)Document2 pagesDaily Notes: SM Investments Corporation (pse:SM)Anonymous xcFcOgMiNo ratings yet

- AP Newsletter Moderate September19Document15 pagesAP Newsletter Moderate September19sujeet panditNo ratings yet

- JUL 28 KBC Commodities ReportDocument2 pagesJUL 28 KBC Commodities ReportMiir ViirNo ratings yet

- Top Story:: WLCON: WLCON To Have 63 Stores by End-2020Document3 pagesTop Story:: WLCON: WLCON To Have 63 Stores by End-2020JNo ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- ICRA Analytics Daily Dossier 14 Nov 2022Document4 pagesICRA Analytics Daily Dossier 14 Nov 2022anilmeherNo ratings yet

- JUL 27 KBC Commodities ReportDocument2 pagesJUL 27 KBC Commodities ReportMiir ViirNo ratings yet

- Top Story:: PHEN: AC Energy Philippines Inc. Aims To Obtain 2,000 MW of Renewable Energy by 2025Document3 pagesTop Story:: PHEN: AC Energy Philippines Inc. Aims To Obtain 2,000 MW of Renewable Energy by 2025JNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapmarianoveNo ratings yet

- Fund Performance MetlifeDocument11 pagesFund Performance MetlifeDeepak DharmarajNo ratings yet

- ICRA Analytics Daily Dossier - 24 Jul 2023Document4 pagesICRA Analytics Daily Dossier - 24 Jul 2023Dhairya BuchNo ratings yet

- PHINTAS Weekly Report - 20231009Document5 pagesPHINTAS Weekly Report - 20231009Mas Anggoro Tri AtmojoNo ratings yet

- Markets Today!: 10 January 2022Document8 pagesMarkets Today!: 10 January 2022prajwalbhatNo ratings yet

- Ashika Morning Report - 29.02.2024Document10 pagesAshika Morning Report - 29.02.2024Tirthankar DasNo ratings yet

- Lumen Vol 2Document6 pagesLumen Vol 2Daniel AldianNo ratings yet

- Morning Cuppa 15-AprDocument2 pagesMorning Cuppa 15-AprAkshay ChaudhryNo ratings yet

- Top Story:: Banking Sector: S&P Flags Risks On Philippine BanksDocument4 pagesTop Story:: Banking Sector: S&P Flags Risks On Philippine BanksJNo ratings yet

- Date: 2023-05-04: Corporate G SecDocument3 pagesDate: 2023-05-04: Corporate G SecRonit SinghNo ratings yet

- Morning Cuppa 21-NovDocument2 pagesMorning Cuppa 21-NovSarvjeet KaushalNo ratings yet

- Gsec Parking ABC Limited Deal Con 06-10-22Document2 pagesGsec Parking ABC Limited Deal Con 06-10-22ANKUR KIMTANINo ratings yet

- Brokerage Structure Premeium October 2022Document1 pageBrokerage Structure Premeium October 2022ANKUR KIMTANINo ratings yet

- LIVE-PGT-7th Oct, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-7th Oct, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- 20220917002-Schroders Invite III-INVITEDocument1 page20220917002-Schroders Invite III-INVITEANKUR KIMTANINo ratings yet

- LIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- INTRODUCTORY - LETTER PGT FinalDocument1 pageINTRODUCTORY - LETTER PGT FinalANKUR KIMTANINo ratings yet

- LIVE-PGT-26th Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-26th Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- LIVE-PGT-26th Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-26th Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Faugere Gold Required Yield TheoryDocument34 pagesFaugere Gold Required Yield TheoryZerohedgeNo ratings yet

- Solution Manual For Solution Manual For Macroeconomics 10th Edition AbelDocument37 pagesSolution Manual For Solution Manual For Macroeconomics 10th Edition Abelfurculapesterer.kxun100% (13)

- Resume 4 PageDocument4 pagesResume 4 PageMohiuddin RownakNo ratings yet

- Economics Case Studies by Rohit Arora. 8299601690Document3 pagesEconomics Case Studies by Rohit Arora. 8299601690AkshitaNo ratings yet

- Econ 379Document4 pagesEcon 379Sijo VMNo ratings yet

- Exogenous Driver Analysis Driver Relative GDP GrowthDocument107 pagesExogenous Driver Analysis Driver Relative GDP GrowthBhagya FoodsNo ratings yet

- Gurunanakdevuniversity Amritsar: Faculty of Economics & BusinessDocument68 pagesGurunanakdevuniversity Amritsar: Faculty of Economics & Businessjubalmedia03No ratings yet

- Circular Flow Chart AP EconDocument16 pagesCircular Flow Chart AP EconPomfret AP Economics100% (4)

- Classical Political EconomyDocument2 pagesClassical Political EconomyScribdTranslationsNo ratings yet

- Gandhinagar Institute of Technology: Computer Engineering/Information Technology DepartmentDocument2 pagesGandhinagar Institute of Technology: Computer Engineering/Information Technology Departmentshah mananNo ratings yet

- Imed BBA CBCS 2014 SyllabusDocument146 pagesImed BBA CBCS 2014 SyllabusSaurabhNo ratings yet

- 4POL3 - TAN - Andrea Joses P (IMR History)Document3 pages4POL3 - TAN - Andrea Joses P (IMR History)ANDREA JOSES TANNo ratings yet

- ZebrawhiteDocument12 pagesZebrawhitechrisNo ratings yet

- SBP-BSC Assistant Director (OG-3) Sample PaperDocument11 pagesSBP-BSC Assistant Director (OG-3) Sample Paperasstt_dir_pndNo ratings yet

- Presentation 1 - Introduction To Money, Credit, and BankingDocument28 pagesPresentation 1 - Introduction To Money, Credit, and BankingNigel N. SilvestreNo ratings yet

- Role of Government in Economic SystemsDocument6 pagesRole of Government in Economic SystemsTirupal PuliNo ratings yet

- Tugas 3 Bahasa Inggris NiagaDocument2 pagesTugas 3 Bahasa Inggris NiagaWinda RozaliaNo ratings yet

- The Science and Art of DSGE ModellingDocument9 pagesThe Science and Art of DSGE ModellingkeyyongparkNo ratings yet

- Marginal ProductivityDocument2 pagesMarginal ProductivityJamesNo ratings yet

- International Economics II Ch-3Document62 pagesInternational Economics II Ch-3Terefe Bergene bussaNo ratings yet

- A.P. Econ. - APC, APS, MPC, MPS, and Ch. 27, Assignment 3 PDFDocument5 pagesA.P. Econ. - APC, APS, MPC, MPS, and Ch. 27, Assignment 3 PDFSophie NurNo ratings yet

- Pest Analysis of Gourmet Bakers and SweetsDocument11 pagesPest Analysis of Gourmet Bakers and SweetsNauman Bilal50% (2)

- IFM-Ravi Exchange Rate Determination (Happy Holi)Document33 pagesIFM-Ravi Exchange Rate Determination (Happy Holi)Ravi KhatriNo ratings yet

- Assessing Nominal GDP Targeting in The South African C 2017 Central Bank RevDocument10 pagesAssessing Nominal GDP Targeting in The South African C 2017 Central Bank RevarciblueNo ratings yet

- Notes To Introduction To Basic MicroeconomicsDocument8 pagesNotes To Introduction To Basic MicroeconomicsTricia Sta TeresaNo ratings yet

- Chapter No.53psDocument5 pagesChapter No.53psKamal SinghNo ratings yet

- Full Capital ConvertibilityDocument18 pagesFull Capital Convertibilityankur jaiswalNo ratings yet

- Marx's Theory of PopulationDocument7 pagesMarx's Theory of PopulationAbigail S. JacksonNo ratings yet

- Beyond MarginsDocument107 pagesBeyond MarginsClavita FernandesNo ratings yet

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank ManagementAshwin KGNo ratings yet