Professional Documents

Culture Documents

Lec 2 Ratio Analysis

Uploaded by

Muhammad Hammad Rajput0 ratings0% found this document useful (0 votes)

6 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views16 pagesLec 2 Ratio Analysis

Uploaded by

Muhammad Hammad RajputCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

Security Analysis & Portfolio

Management (SAPM)

2/23/2022 Sir Asif (FUUAST) 1

Security Analysis & Portfolio Management

(SAPM)

Ratio Analysis

2/23/2022 Sir Asif (FUUAST) 2

Security Analysis & Portfolio Management

(SAPM)

• Ratio Analysis

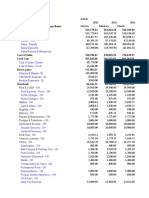

– Financial statements

• Income statement

• Balance sheet

• Cash Flow Statement

• Change in equity

2/23/2022 Sir Asif (FUUAST) 3

Security Analysis & Portfolio Management

(SAPM)

• Ratio analysis

– Ratio analysis consists of calculating financial

performance using five basic types of ratios:

• Liquidity

• Activity

• Debt

• Profitability

• Market

2/23/2022 Sir Asif (FUUAST) 4

Security Analysis & Portfolio Management

(SAPM)

• Liquidity

– Cash ratio. Compares the amount of cash and

investments to short-term liabilities. This ratio

excludes any assets that might not be immediately

convertible into cash, especially inventory.

– Quick ratio. Same as the cash ratio, but includes

accounts receivable as an asset. This ratio explicitly

avoids inventory, which may be difficult to convert

into cash.

– Current ratio. Compares all current assets to all

current liabilities. This ratio includes inventory, which

is not especially liquid, and which can therefore mis-

represent the liquidity of a business.

2/23/2022 Sir Asif (FUUAST) 5

Security Analysis & Portfolio Management

(SAPM)

• Activity

– An activity ratio is a type of financial metric that

indicates how efficiently a company is leveraging

the assets on its balance sheet, to generate

revenues and cash.

2/23/2022 Sir Asif (FUUAST) 6

Security Analysis & Portfolio Management

(SAPM)

• ACCOUNTS RECEIVABLE TURNOVER RATIO

– Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

• While a high ratio may indicate the company operates

on a cash basis or has quality customers that pay off

their debts quickly, a low ratio can suggest a bad credit

policy and poor collecting process. It helps in assessing

if its credit policies are helping or hurting the business.

2/23/2022 Sir Asif (FUUAST) 7

Security Analysis & Portfolio Management

(SAPM)

• WORKING CAPITAL RATIO

– Working Capital Ratio = Net Sales / Working Capital

– A high working capital ratio shows that the

business is efficiently using its short-term

liabilities and assets for supporting sales. A low

ratio could indicate bad debts or obsolete

inventory.

2/23/2022 Sir Asif (FUUAST) 8

Security Analysis & Portfolio Management

(SAPM)

• ASSET TURNOVER RATIO

– Asset Turnover Ratio = Sales / Average Total Assets

– This ratio is calculated at the end of a financial

year and can vary widely from one industry to

another. The higher the asset turnover ratio, the

better the company is performing.

2/23/2022 Sir Asif (FUUAST) 9

Security Analysis & Portfolio Management

(SAPM)

• FIXED ASSET TURNOVER RATIO

– Fixed Asset Turnover Ratio = Net Sales / (Fixed Assets – Accumulated Depreciation)

• A high turnover ratio indicates the assets are

being utilized efficiently for generating sales.

2/23/2022 Sir Asif (FUUAST) 10

Security Analysis & Portfolio Management

(SAPM)

• INVENTORY TURNOVER RATIO

– Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

– A low inventory turnover ratio may indicate

overstocking, poor marketing or a declining

demand for the product. A high ratio is an

indicator of good inventory management and a

higher demand for the product.

2/23/2022 Sir Asif (FUUAST) 11

Security Analysis & Portfolio Management

(SAPM)

• DAYS PAYABLE OUTSTANDING

– Days Payable Outstanding = Accounts Payable / (Cost of Sales/ Number of Days)

– The number of days is taken as 90 days for a

quarter or 365 days for a year. The ratio indicates

how well the cash flow is being managed.

– A low ratio indicates that the business is either not

utilizing its credit period efficiently or has short-

term arrangements with creditors.

2/23/2022 Sir Asif (FUUAST) 12

Security Analysis & Portfolio Management

(SAPM)

• Debt Ratio

– The debt ratio is a financial ratio that measures the extent

of a company’s leverage. The debt ratio is defined as the

ratio of total debt to total assets, expressed as a decimal

or percentage. It can be interpreted as the proportion of a

company’s assets that are financed by debt.

– A ratio greater than 1 shows that a considerable portion of

debt is funded by assets. In other words, the company has

more liabilities than assets. A high ratio also indicates that

a company may be putting itself at risk of default on its

loans if interest rates were to rise suddenly. A ratio below

1 translates to the fact that a greater portion of a

company's assets is funded by equity.

2/23/2022 Sir Asif (FUUAST) 13

Security Analysis & Portfolio Management

(SAPM)

• Profitability Ratio

– Profitability ratios assess a company's ability to earn profits from its sales

or operations, balance sheet assets, or shareholders' equity. Profitability

ratios indicate how efficiently a company generates profit and value for

shareholders.

– Net Profit Margin

• Net profit /Net Sales

– Gross Profit Margin

• Gross profit /Net Sales

– Return on Assets

• Net profit /Total Assets

– Return on Equity

• Net profit /Total shareholder Equity

2/23/2022 Sir Asif (FUUAST) 14

Security Analysis & Portfolio Management

(SAPM)

• Earnings Per Share

• EPS = net profit / no. of outstanding Share

• Book Value

• Book value = Total Equity / no. of outstanding Share

• Market/Book (M/B) Ratio

• Market/Book (M/B) Ratio = Market price / Book value

– A ratio of less than 1 can mean a stock might be undervalued, while a ratio greater

than 1 might mean it's overvalued.

• Price-Earnings (P/E) Ratio

• Price-Earnings (P/E) Ratio = Market price / EPS

• Price-Earnings (P/E) Growth Ratio

• PEG = PE/ EPS(Growth)

• Dividend Yield Ratio

• Per Share dividend / Current Market price

2/23/2022 Sir Asif (FUUAST) 15

Security Analysis & Portfolio Management

(SAPM)

Thank you

2/23/2022 Sir Asif (FUUAST) 16

You might also like

- Presentation 3 - Financial Statement Analysis (Draft)Document17 pagesPresentation 3 - Financial Statement Analysis (Draft)sanjuladasanNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- Financial Statement Analysis: by Uditha JayasingheDocument19 pagesFinancial Statement Analysis: by Uditha JayasinghesanjuladasanNo ratings yet

- Fsi Module 4 - Ratio AnalysisDocument9 pagesFsi Module 4 - Ratio AnalysisMahima Sudhir GaikwadNo ratings yet

- (Notes) Financial Management FundamentalsDocument65 pages(Notes) Financial Management FundamentalsJoanna Danielle AngNo ratings yet

- Manajemen Produksi & Operasi: Konsep Finance Dalam Galangan KapalDocument53 pagesManajemen Produksi & Operasi: Konsep Finance Dalam Galangan KapalRizal RachmanNo ratings yet

- Quant MF Scheme ReturnsDocument1 pageQuant MF Scheme Returnsfinal bossuNo ratings yet

- Financial Ratios and Analysis of Tata Motors: Research PaperDocument15 pagesFinancial Ratios and Analysis of Tata Motors: Research PaperMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- Quant MF Scheme ReturnsDocument1 pageQuant MF Scheme Returnsfinal bossuNo ratings yet

- Mutual FundsDocument20 pagesMutual FundsGaurav SharmaNo ratings yet

- Mutual FundsDocument20 pagesMutual FundsGaurav SharmaNo ratings yet

- Risk and Risk ManagementDocument32 pagesRisk and Risk ManagementAnandNo ratings yet

- Asset Liability Management of Icici Bank: Presented By: Paul Caroline Poornima Sonal AnvinDocument47 pagesAsset Liability Management of Icici Bank: Presented By: Paul Caroline Poornima Sonal AnvinsonalsankhlaNo ratings yet

- Chapter 4 Analysis of Financial StatementsDocument16 pagesChapter 4 Analysis of Financial StatementsKate Jazleen BaldevinoNo ratings yet

- Working Capital & Bank Stock AuditDocument23 pagesWorking Capital & Bank Stock AuditAartiNo ratings yet

- Gprmo 0003Document1 pageGprmo 0003ApNo ratings yet

- Processes of Financial ManagementDocument7 pagesProcesses of Financial ManagementHarryNo ratings yet

- Essay Regarding Our Webinar On AASI (Asset and Wealth Management)Document2 pagesEssay Regarding Our Webinar On AASI (Asset and Wealth Management)Roland Vincent JulianNo ratings yet

- Master Record Keeping SummaryDocument4 pagesMaster Record Keeping SummaryIolandaNo ratings yet

- FIN 516 Advanced Managerial Finance Week 4 Quiz A AnswerDocument5 pagesFIN 516 Advanced Managerial Finance Week 4 Quiz A AnswerPetraNo ratings yet

- Corpuz, Aily Bsbafm2 2 - ReviewquestionsDocument5 pagesCorpuz, Aily Bsbafm2 2 - ReviewquestionsAily CorpuzNo ratings yet

- Groww Nifty Total Market Index Fund KIMDocument37 pagesGroww Nifty Total Market Index Fund KIMG1 ROYALNo ratings yet

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSDocument27 pagesFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHNo ratings yet

- (FMDFINA) Bridging Blaze FMDFINA ReviewerDocument24 pages(FMDFINA) Bridging Blaze FMDFINA Reviewerseokyung2021No ratings yet

- Ratio and Financial Statement AnalysisDocument6 pagesRatio and Financial Statement AnalysisShoaib MadniNo ratings yet

- Financial Analysis and Reporting 1Document4 pagesFinancial Analysis and Reporting 1Anonymous ryxSr2No ratings yet

- L8 - Analysis and Interpretation of Financial Statements (Part 2)Document12 pagesL8 - Analysis and Interpretation of Financial Statements (Part 2)mishabmoomin1524No ratings yet

- FSA With CommentsDocument7 pagesFSA With CommentshananNo ratings yet

- FM Unit 2 Lecture Notes - Financial Statement AnalysisDocument4 pagesFM Unit 2 Lecture Notes - Financial Statement AnalysisDebbie DebzNo ratings yet

- 2018 03 10 Screening Jaclyn McclellanDocument52 pages2018 03 10 Screening Jaclyn McclellanYudhi GendutNo ratings yet

- CMA Part 2: Financial Decision MakingDocument149 pagesCMA Part 2: Financial Decision Makingbelkahla.rafik9015No ratings yet

- CAIIB BFM Module B PDF Paper 2 RISK MANAGEMENT by Ambitious BabaDocument91 pagesCAIIB BFM Module B PDF Paper 2 RISK MANAGEMENT by Ambitious Babaundru syamtejaNo ratings yet

- Ratio Analysis: 06/02/2020 1 Imlak Shaikh, PH.D, MDI GurgoanDocument43 pagesRatio Analysis: 06/02/2020 1 Imlak Shaikh, PH.D, MDI Gurgoanraghavendra_20835414No ratings yet

- Financial Analysis and PlanningDocument75 pagesFinancial Analysis and PlanningTewodros SetargieNo ratings yet

- Zeus Asset Management Case Week 5Document8 pagesZeus Asset Management Case Week 5Johanlee1992No ratings yet

- Session. 3. Bank ProfitabilityDocument14 pagesSession. 3. Bank ProfitabilityArbazuddin shaikNo ratings yet

- Presentation of FS & Its' AuditingDocument27 pagesPresentation of FS & Its' AuditingTeamAudit Runner GroupNo ratings yet

- Session 9 Ratio Analysis Theory 1634971215859Document30 pagesSession 9 Ratio Analysis Theory 1634971215859PunitNo ratings yet

- Financial AnalysisDocument8 pagesFinancial Analysisneron hasaniNo ratings yet

- Chapter 6Document24 pagesChapter 6Hakim JanNo ratings yet

- Chapter - 4 Activity/Turnover RatioDocument8 pagesChapter - 4 Activity/Turnover RatioLavanya RanganathanNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisM QasimNo ratings yet

- Financial Statements and Ratio Analysis NEWDocument108 pagesFinancial Statements and Ratio Analysis NEWDina Adel DawoodNo ratings yet

- BAFINMAX Handout Introduction To Working Capital ManagementDocument2 pagesBAFINMAX Handout Introduction To Working Capital ManagementDeo CoronaNo ratings yet

- Chapter 3 - Analysis of Financial StatementsDocument9 pagesChapter 3 - Analysis of Financial StatementsJean EliaNo ratings yet

- KIM - Principal Balanced Advantage FundDocument25 pagesKIM - Principal Balanced Advantage FundÃñkít KùmãrNo ratings yet

- Chapter 3 - Financial Ratio and AnalysisDocument28 pagesChapter 3 - Financial Ratio and AnalysisSarifah SaidsaripudinNo ratings yet

- All Ratio FormulasDocument44 pagesAll Ratio FormulasNikhilNo ratings yet

- ACCOUNTING PROCESS and CLASSIFICATIONDocument26 pagesACCOUNTING PROCESS and CLASSIFICATIONvdhanyamrajuNo ratings yet

- Transaction Banking NotesDocument87 pagesTransaction Banking NotesAnand SrinivasanNo ratings yet

- Tamim Fund Global High Conviction - Summary 2021Document3 pagesTamim Fund Global High Conviction - Summary 2021dkatzNo ratings yet

- Balance Sheet: Basic Financial StatementsDocument3 pagesBalance Sheet: Basic Financial StatementsAdrienne Erika MANAIGNo ratings yet

- Risk Management of A Cashflow Driven InvestmentDocument30 pagesRisk Management of A Cashflow Driven InvestmentRichard ChiangNo ratings yet

- Financial Analysiis TenchniquesDocument24 pagesFinancial Analysiis TenchniquesShreya GuptaNo ratings yet

- Chapter 5 Chapter Review QuestionsDocument3 pagesChapter 5 Chapter Review QuestionsTAE'S POTATONo ratings yet

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Document2 pagesPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187No ratings yet

- Kimmel, Weygandt, Kieso, Trenholm Financial Accounting: Tools For Business Decision-Making, Canadian EditionDocument6 pagesKimmel, Weygandt, Kieso, Trenholm Financial Accounting: Tools For Business Decision-Making, Canadian EditionPrameswari NaNo ratings yet

- Chapter 3 Solutions & NotesDocument17 pagesChapter 3 Solutions & NotesStudy PinkNo ratings yet

- Activity 3Document3 pagesActivity 3Muhammad Hammad RajputNo ratings yet

- Activity 2Document6 pagesActivity 2Muhammad Hammad RajputNo ratings yet

- Ramzan TimeDocument1 pageRamzan TimeMuhammad Hammad RajputNo ratings yet

- Abdul Wasay Roll No 53. Sec ADocument51 pagesAbdul Wasay Roll No 53. Sec AMuhammad Hammad RajputNo ratings yet

- JavaScript AssignmentDocument2 pagesJavaScript AssignmentMuhammad Hammad RajputNo ratings yet

- JavaScript Assignment 2Document1 pageJavaScript Assignment 2Muhammad Hammad RajputNo ratings yet

- 5 Lect. Risk - ReturnDocument19 pages5 Lect. Risk - ReturnMuhammad Hammad RajputNo ratings yet

- 1 Intro FMDocument8 pages1 Intro FMMuhammad Hammad RajputNo ratings yet

- 4 Lect. Time Value of Money - 2Document19 pages4 Lect. Time Value of Money - 2Muhammad Hammad RajputNo ratings yet

- CMRotationsDocument5 pagesCMRotationsMuhammad Hammad RajputNo ratings yet

- 3 Lect. Time Value of MoneyDocument21 pages3 Lect. Time Value of MoneyMuhammad Hammad RajputNo ratings yet

- Persuasive Essay: "Upcoming Advancment in Computer Technology"Document1 pagePersuasive Essay: "Upcoming Advancment in Computer Technology"Muhammad Hammad RajputNo ratings yet

- Technical & Business Writing TaskDocument4 pagesTechnical & Business Writing TaskMuhammad Hammad RajputNo ratings yet

- Types of ComputerDocument10 pagesTypes of ComputerMuhammad Hammad RajputNo ratings yet

- Revised Acct 3039 Course GuideDocument20 pagesRevised Acct 3039 Course GuideDaniel FergersonNo ratings yet

- SECC - Software Testing Service: Hossam Osman, PH.D R & D Unit ManagerDocument12 pagesSECC - Software Testing Service: Hossam Osman, PH.D R & D Unit ManagerAmany ShoushaNo ratings yet

- A Methodology For Performance Measurement and Peer Comparison in The Public Transportation Industry (2010)Document17 pagesA Methodology For Performance Measurement and Peer Comparison in The Public Transportation Industry (2010)Alfred LochanNo ratings yet

- Amul ProjectDocument66 pagesAmul ProjectRajesh Tyagi50% (2)

- MSQ-06 - Master BudgetDocument11 pagesMSQ-06 - Master Budgetralphalonzo50% (2)

- Retail Discount Store Business PlanDocument6 pagesRetail Discount Store Business PlanVaibhav NigamNo ratings yet

- Case Study Project Income Statement BudgetingDocument186 pagesCase Study Project Income Statement BudgetingKate ChuaNo ratings yet

- RocheDocument5 pagesRochePrattouNo ratings yet

- Global Brand - Mcdonalds' StrategiesDocument7 pagesGlobal Brand - Mcdonalds' StrategiesRajvi DesaiNo ratings yet

- Positioning Services in Competitive MarketsDocument23 pagesPositioning Services in Competitive MarketsathulkannanNo ratings yet

- Breaking Down The Work Breakdown Structure and Critical PathDocument7 pagesBreaking Down The Work Breakdown Structure and Critical PathGRUPOPOSITIVO POSITIVONo ratings yet

- HRD 2103 General EconomicsDocument3 pagesHRD 2103 General EconomicsJohn MbugiNo ratings yet

- MG603 Assignment No 1 Solution Fall 2023 by PIN2 and MUHAMMAD (MAS All Rounder)Document4 pagesMG603 Assignment No 1 Solution Fall 2023 by PIN2 and MUHAMMAD (MAS All Rounder)zakirhameed4304No ratings yet

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Inventory Management System Research PaperDocument8 pagesInventory Management System Research Paperkkxtkqund100% (1)

- ProjectreportonexploringexpresscargoDocument43 pagesProjectreportonexploringexpresscargosanzitNo ratings yet

- Buy Life Insurance Term Plan Online & Calculate Premium - Bharti Axa LifeDocument3 pagesBuy Life Insurance Term Plan Online & Calculate Premium - Bharti Axa LifeAmit KumarNo ratings yet

- The Sticking Point SolutionDocument9 pagesThe Sticking Point SolutionTim JoyceNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Case Bloomsbury Capital NCDocument39 pagesCase Bloomsbury Capital NCashmangano0% (1)

- Strategic Cost Management - Management AccountingDocument5 pagesStrategic Cost Management - Management AccountingVanna AsensiNo ratings yet

- Corporate Governance of WiproDocument34 pagesCorporate Governance of WiproMohammad Imran100% (2)

- Capabilty Statement Ankur DhirDocument2 pagesCapabilty Statement Ankur DhirAnkurNo ratings yet

- Felix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHDocument8 pagesFelix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHcyrel ocfemiaNo ratings yet

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocument23 pagesFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay Dhamijashweta sarafNo ratings yet

- Strat SheetDocument1 pageStrat Sheetcourier12No ratings yet

- CIM Original TemplateDocument5 pagesCIM Original Templatekashif4987No ratings yet

- Magnetic MarketingDocument144 pagesMagnetic Marketingritu100% (3)

- Dbe MesiDocument5 pagesDbe Mesiattl.cherry25No ratings yet

- Financial and Management Reporting SystemsDocument7 pagesFinancial and Management Reporting SystemsJanelAlajasLeeNo ratings yet