Professional Documents

Culture Documents

Shilpa

Uploaded by

kiccha kicchaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shilpa

Uploaded by

kiccha kicchaCopyright:

Available Formats

PRADHAN MANTRI JAN-DHAN YOJANA

CHAPTER-

AN OVERVIEW OF REPORT

INTRODUCTION

The pradhan mantra jan dhan yojana is a inational mission for financial inclusion launchad in

august 2014 deemed to ensure access to financial services namely banking saving and deposit

account remittance credit insurance and pension in an affordable manner.

The aspect of financial inclusion is aimed towards delivering financial services at an

affordable cost to low-income segments of the society with an aim to promote banking activity

among the financially excluded people and reduce povety the scheme is an innovative concept in

that direction.

BASIS OF BENEFICIARIES:

1. Interest is offered on the deposits that are made towards the savings account

opened under the scheme.

2. Individuals need not maintain a minimum balance under the scheme however in

case they wish to avail cheque facilities a minimum balance must be maintained.

3. Individuals receive accidental insurance cover of $1.1lakh under the rupay scheme.

4. Under the scheme insurance products and pension access are provided.

5. Account holder can check their balance using the mobile banking facility.

6. An overdraft facility of $5000 is provided to one account in the household the

facility is usually provided to the lady in the house.

7. In case individuals are beneficiaries of government scheme direct benefit transfer

option is provided.

8. In case the account was opned between 2014 and 31 january 2015 life cover of

$30000 is provided in case the beneficiary passes away.

CONCEPTUAL FRAME WORK:

OBJECTIVES OF THE REPORT:

The major objective of newly announced pradhan mantrai jan –dhan yojana

1. To provide a bank account to every poor in life country.

2. To provide interst free loan to small farmers.

3. To provide free financial assistance to tribal communities.

4. To provide free medical facility to minority people.

REVIEW OF LITERATURE:

1. SHARMA AND KUKREJA:

An analytical study relevance of financial inclusion for developing nation.

Secondary data parameter used current status of FI access of rural people to bank. There was a big

gap between inclusion and the rural people need.

2. BARHATE AND JAGTAP:

Pradhan mantrai jan dhan yojana the study reveabled that the scheme helpful

to boost the previous scheme secondary data.

3. HUSSIAM:

Pradhan mantrai jan dhan yojana the must intensive financial inclusion scheme

in india secondary data parameter this scheme was not only beneficial to eradicate poverty curb

corruption but also helpful to generate employment opportunity.

SCOPE:

Area of only cover in channagiri.

METHOLOGY:

The research design is descriptive in natur the data used for the study is secondary data is

collected form CRISIL inclusion various report of RBI and website.Financial inclusion report published

by RBI and government of india committees international institations like international monetaey

fund and work bank.

PRIMARY DATA:

Primary data refers to the first hand data gathered by the researcher himself on the other

hand secondary data is information which has been collected in the past by someone else.

SECONDARY DATA :

Secondary data refers to data that is collected by someone others of secondary data for

social science include censuses information collected by government departments organizational

records and data that was originally collected for other research purpose.

LIMITATIONS:

1. Availability to people in age group 18-70 yearswith bank account

2. Rs1 per annum with effect from june 1 2022 the premium is Rs 20 per annum

STAMEMENT OF PROBLEM:

1. Behaviour of employee not good.

2. Delay in processing.

3. Lack of agent support.

4. Inadequate information.

5. Lack of awareness among employees.

6. Banker reluctant to open your account .

7. Lengthy process.

You might also like

- Project ReportDocument79 pagesProject ReportNigin K Abraham100% (1)

- Social Impact Assessment of Pradhanmantri Jan Dhan YojanaDocument8 pagesSocial Impact Assessment of Pradhanmantri Jan Dhan YojanaNikhil GargNo ratings yet

- Financial Inclusion Using Pradhan Mantri Jan-Dhan Yojana - A Conceptual StudyDocument12 pagesFinancial Inclusion Using Pradhan Mantri Jan-Dhan Yojana - A Conceptual StudyabhaybittuNo ratings yet

- Rough Draft: Labour Law-Ii Topic-Central Government Jan-Dhan Yojna - An AnalysisDocument3 pagesRough Draft: Labour Law-Ii Topic-Central Government Jan-Dhan Yojna - An AnalysisGunjan SinghNo ratings yet

- Pradhan Mantri Jan Dhan Yojana: A National Mission On Financial Inclusion in IndiaDocument5 pagesPradhan Mantri Jan Dhan Yojana: A National Mission On Financial Inclusion in Indiaprateeksri10No ratings yet

- Public Policy ProjectDocument28 pagesPublic Policy ProjectRahul KanoujiaNo ratings yet

- Top 6 Govt Schemes From Ministry of FinanceDocument9 pagesTop 6 Govt Schemes From Ministry of FinanceM shivNo ratings yet

- Pradhan Mantri Jan Dhan Yojana: National Mission On Financial InclusionDocument3 pagesPradhan Mantri Jan Dhan Yojana: National Mission On Financial InclusionBikash Kumar NayakNo ratings yet

- Minukumari Amity ProposalDocument6 pagesMinukumari Amity ProposalMinu kumariNo ratings yet

- Assessing The Impact of Pradhan Mantri Jan Dhan Yojana On Financial Inclusion in IndiaDocument27 pagesAssessing The Impact of Pradhan Mantri Jan Dhan Yojana On Financial Inclusion in Indiaakkiakshit99No ratings yet

- Full Paper (Modified) - PMJDYDocument16 pagesFull Paper (Modified) - PMJDYMuhammed Shafi MkNo ratings yet

- 1781CMD111Document40 pages1781CMD111Yogi DarshuNo ratings yet

- Journal - Nikita 2jul14mrrDocument7 pagesJournal - Nikita 2jul14mrrRohit KumarNo ratings yet

- Synopsis Complete 17 11 2023Document12 pagesSynopsis Complete 17 11 2023D-Park Software Solutions And ConsultancyNo ratings yet

- Pradhan Mantri Jan Dhan YojnaDocument19 pagesPradhan Mantri Jan Dhan Yojnaavinash gauravNo ratings yet

- A Study of Rural Banking in India-SynopsisDocument4 pagesA Study of Rural Banking in India-SynopsisNageshwar singh100% (4)

- Pmjdy Project JgjthesisDocument87 pagesPmjdy Project JgjthesisBikash Kumar Nayak100% (1)

- Pradhan Mantri Jan Dhan Yojana Research Paper PDFDocument5 pagesPradhan Mantri Jan Dhan Yojana Research Paper PDFpoypdibkf100% (1)

- Pradhan Mantri Jan Dhan Yojana: November 2020Document8 pagesPradhan Mantri Jan Dhan Yojana: November 2020tglorious14No ratings yet

- Vignesh Total UnitsDocument60 pagesVignesh Total UnitsBnaren NarenNo ratings yet

- Unit 4: by Ankita UpadhyayDocument65 pagesUnit 4: by Ankita UpadhyayAarushi CharurvediNo ratings yet

- Micro Finance Unit 3 FullDocument7 pagesMicro Finance Unit 3 Fulljaharlal MarathiNo ratings yet

- Black Book CHP 1Document19 pagesBlack Book CHP 1Raj GandhiNo ratings yet

- Awareness of MicrofinanceDocument34 pagesAwareness of MicrofinanceDisha Tiwari100% (1)

- 19.format Hum A Study of Pradhan Mantri Jan Dhan YojanaDocument6 pages19.format Hum A Study of Pradhan Mantri Jan Dhan YojanaImpact JournalsNo ratings yet

- Dumy Research PaperDocument7 pagesDumy Research Papertripti naiduNo ratings yet

- Financial Inclusion Growth in India: A Study With Reference To Pradhan Mantri Jan-Dhan Yojana (PMJDY)Document16 pagesFinancial Inclusion Growth in India: A Study With Reference To Pradhan Mantri Jan-Dhan Yojana (PMJDY)Muhammed Shafi. M.KNo ratings yet

- Agriculture Current Affairs October PDFDocument48 pagesAgriculture Current Affairs October PDFHarisana ChandranNo ratings yet

- Impact of Payment Banks in Indian Financial Inclusion: Dr.R.CHANDRASEKARAN, Assistant ProfessorDocument8 pagesImpact of Payment Banks in Indian Financial Inclusion: Dr.R.CHANDRASEKARAN, Assistant ProfessorSamil MusthafaNo ratings yet

- Pardhmantri Rojgar Yojayana Arshdeep Project (Pmjdy)Document78 pagesPardhmantri Rojgar Yojayana Arshdeep Project (Pmjdy)Raj KumarNo ratings yet

- Financial InclusiionDocument37 pagesFinancial InclusiionPehoo ThakurNo ratings yet

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanNo ratings yet

- PMJDYDocument7 pagesPMJDY123009190No ratings yet

- CapstoneDocument29 pagesCapstonelajjo1230% (1)

- What Is Financial Inclusion?: Providing Formal Credit AvenuesDocument5 pagesWhat Is Financial Inclusion?: Providing Formal Credit AvenuesRahul WaniNo ratings yet

- AMFPL Credit Appraisal PolicyDocument16 pagesAMFPL Credit Appraisal PolicyPranav GuptaNo ratings yet

- 13 - Conclusion and SuggestionsDocument4 pages13 - Conclusion and SuggestionsjothiNo ratings yet

- Pradhan Mantri Gramodaya YojanaDocument20 pagesPradhan Mantri Gramodaya YojanaDILEESHNo ratings yet

- A Study On Customer On Perception On MicrofinanceDocument53 pagesA Study On Customer On Perception On MicrofinanceJay VardhanNo ratings yet

- JAN DHAN YOJNA ANALYSIS OF THE ONE-YEAR JOURNEY-Tejas-Oct15Document22 pagesJAN DHAN YOJNA ANALYSIS OF THE ONE-YEAR JOURNEY-Tejas-Oct15gggNo ratings yet

- Introduction and Research Methodology: Chapter - 1Document33 pagesIntroduction and Research Methodology: Chapter - 1Piyush SethiNo ratings yet

- Financial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Document36 pagesFinancial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Hubspot GroupNo ratings yet

- Financial Inclusion in India - A Review of Initiatives and AchievementsDocument10 pagesFinancial Inclusion in India - A Review of Initiatives and AchievementsRidhiNo ratings yet

- The Evolution of The Microfinance in India - An OverviewDocument2 pagesThe Evolution of The Microfinance in India - An OverviewAdri MitraNo ratings yet

- Synopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Document4 pagesSynopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Rohit UbaleNo ratings yet

- Micro Finance in Rural IndiaDocument20 pagesMicro Finance in Rural IndiaMinhaj KhurshidNo ratings yet

- Vikas ProjectDocument49 pagesVikas ProjectVinay KhannaNo ratings yet

- A Critical Analysis of Micro Finance in IndiaDocument54 pagesA Critical Analysis of Micro Finance in IndiaArchana MehraNo ratings yet

- IJCRT2104422Document8 pagesIJCRT210442222mb0034No ratings yet

- LDPP Research PaperDocument8 pagesLDPP Research PaperPrajwal GugnaniNo ratings yet

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- Pmjdy 13 08 19Document1 pagePmjdy 13 08 19Deepak RajputNo ratings yet

- Paper8 - PendingDocument9 pagesPaper8 - PendingApooNo ratings yet

- Anshu Bansal GuptaDocument32 pagesAnshu Bansal Guptasahu_krishna1995No ratings yet

- Assignment 1 Research Report On Impact of MicrofinanceDocument17 pagesAssignment 1 Research Report On Impact of MicrofinanceBikash Kumar ShahNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Economic Solidarity Program the Best Financial Solutions Necessary to Provide Liquidity Material and How to Avoid the Financial Problem Facing Individual, Family, and CommunityFrom EverandEconomic Solidarity Program the Best Financial Solutions Necessary to Provide Liquidity Material and How to Avoid the Financial Problem Facing Individual, Family, and CommunityNo ratings yet

- Navigating Government Assistance Programs: A Comprehensive GuideFrom EverandNavigating Government Assistance Programs: A Comprehensive GuideNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- FleetBoston FinancialDocument5 pagesFleetBoston FinancialChris.No ratings yet

- © All Rights Reserved, Indian Institute of Management BangaloreDocument2 pages© All Rights Reserved, Indian Institute of Management Bangaloresanchay3090No ratings yet

- Time Value of Money QuestionsDocument4 pagesTime Value of Money QuestionsGadafi FuadNo ratings yet

- Hotel Details Check in Check Out Rooms: Guest Name: DateDocument1 pageHotel Details Check in Check Out Rooms: Guest Name: DateSunil ChejaraNo ratings yet

- Sbi ProjectDocument25 pagesSbi ProjectPritesh patelNo ratings yet

- MTN Mobile Money ServiceDocument2 pagesMTN Mobile Money Serviceegbedavid0No ratings yet

- Franz Holz Art. 0894 - Continuous Piano Hinge - Staineless SteelDocument3 pagesFranz Holz Art. 0894 - Continuous Piano Hinge - Staineless SteelErikas AbepaNo ratings yet

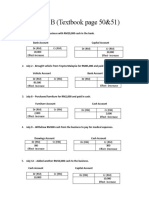

- Multiple Deposit Creation by Euro BanksDocument20 pagesMultiple Deposit Creation by Euro BankshrishikeshkrojhaNo ratings yet

- Spiel 4 Kinds of ProductDocument6 pagesSpiel 4 Kinds of ProductEman OlympiaNo ratings yet

- Project Report of Bank of KathmanduDocument30 pagesProject Report of Bank of KathmanduShree Shrestha100% (1)

- Chap 17Document10 pagesChap 17Sakshi GuptaNo ratings yet

- Value at Risk (VAR) : Banking and Financial Markets: A Risk Management Perspective Prof. PC Narayan Summary For Week SixDocument12 pagesValue at Risk (VAR) : Banking and Financial Markets: A Risk Management Perspective Prof. PC Narayan Summary For Week SixJonahJuniorNo ratings yet

- Account StatementDocument2 pagesAccount StatementBilal AhmadNo ratings yet

- Boe 13Document62 pagesBoe 13Dhananjay SinghNo ratings yet

- Group 3 Synthesis Case 3 Lehman BrothersDocument8 pagesGroup 3 Synthesis Case 3 Lehman BrothersMarnelli CatalanNo ratings yet

- Fundamentals of IFBDocument50 pagesFundamentals of IFBAbyotBeyechaNo ratings yet

- ISO 20022 Debit Notification: Camt.054 Version 2Document17 pagesISO 20022 Debit Notification: Camt.054 Version 2chandan_infotechNo ratings yet

- Finance ProjectDocument78 pagesFinance ProjectRuchi SharmaNo ratings yet

- LiquidityDocument26 pagesLiquidityPallavi RanjanNo ratings yet

- Commercial BankDocument8 pagesCommercial BankNitesh Kotian100% (2)

- Indian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Document66 pagesIndian Banking System by Swapnil Chavan in Banking and Insurance Category On ManagementParadise - 13Sonu SharmaNo ratings yet

- Vision and MissionDocument10 pagesVision and MissionMun YeeNo ratings yet

- Section BDocument2 pagesSection BEmmy LizaNo ratings yet

- Jamuna Bank Presentation 1Document49 pagesJamuna Bank Presentation 1Md ShahnewazNo ratings yet

- Fi Account Statement A2Document9 pagesFi Account Statement A2Mostakin NnNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFDocument2 pagesPrudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFPraveer MoreyNo ratings yet

- Indo-Nepal Remittance: Branch Level User ManualDocument21 pagesIndo-Nepal Remittance: Branch Level User ManualShuvajoyyyNo ratings yet

- Bank of Baroda - Presentation OverviewDocument24 pagesBank of Baroda - Presentation OverviewDinesh Babu PugalenthiNo ratings yet

- International Payment InstrumentsDocument48 pagesInternational Payment InstrumentsSimona StancioiuNo ratings yet

- Print ChallanDocument1 pagePrint ChallanSameer AsifNo ratings yet