Professional Documents

Culture Documents

Annexure-A 2022 141 Taxmann Com 20 Calcutta 21 06 2022

Uploaded by

Shaik Mastanvali0 ratings0% found this document useful (0 votes)

17 views4 pagesThe High Court of Calcutta heard an appeal regarding an income tax assessment order passed against the assessee. The Assessing Officer had sent a show cause notice and draft assessment order to the assessee online, but the assessee did not respond within the deadline due to illness. As a result, the National Faceless Assessment Centre passed an ex parte assessment order. The High Court determined that the assessee should be permitted to file objections to the assessment order, which will be treated as a draft order, and the Assessing Officer will then proceed to complete the assessment after considering the assessee's objections. The Court remanded the matter back to the Assessing Officer to provide the assessee an opportunity to

Original Description:

Original Title

Annexure-A_2022_141_taxmann_com_20_Calcutta_21_06_2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe High Court of Calcutta heard an appeal regarding an income tax assessment order passed against the assessee. The Assessing Officer had sent a show cause notice and draft assessment order to the assessee online, but the assessee did not respond within the deadline due to illness. As a result, the National Faceless Assessment Centre passed an ex parte assessment order. The High Court determined that the assessee should be permitted to file objections to the assessment order, which will be treated as a draft order, and the Assessing Officer will then proceed to complete the assessment after considering the assessee's objections. The Court remanded the matter back to the Assessing Officer to provide the assessee an opportunity to

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesAnnexure-A 2022 141 Taxmann Com 20 Calcutta 21 06 2022

Uploaded by

Shaik MastanvaliThe High Court of Calcutta heard an appeal regarding an income tax assessment order passed against the assessee. The Assessing Officer had sent a show cause notice and draft assessment order to the assessee online, but the assessee did not respond within the deadline due to illness. As a result, the National Faceless Assessment Centre passed an ex parte assessment order. The High Court determined that the assessee should be permitted to file objections to the assessment order, which will be treated as a draft order, and the Assessing Officer will then proceed to complete the assessment after considering the assessee's objections. The Court remanded the matter back to the Assessing Officer to provide the assessee an opportunity to

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

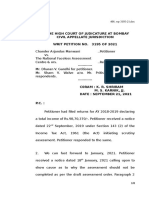

[2022]

141 taxmann.com 20 (Calcutta)[21-06-2022]

INCOME TAX : Where Assessing Officer sent show

cause notice along with draft assessment order to

assessee through online mode and assessee could

not respond to show cause notice within date fixed

for compliance and later on National Faceless

Assessment Centre passed ex parte assessment

order under section 144B, assessee was to be

permitted to put in his objections against aforesaid

assessment order which was to be treated as draft

assessment order and after filing of objections

Assessing Officer shall proceed to complete

assessment

■■■

[2022] 141 taxmann.com 20 (Calcutta)

HIGH COURT OF CALCUTTA

Biki Overseas (P.) Ltd.

v.

Union of India*

T. S. SIVAGNANAM AND HIRANMAY BHATTACHARYYA, JJ.

M.A.T. NO. 704 OF 2022

I.A. NO. CAN 1 OF 2022

JUNE 21, 2022

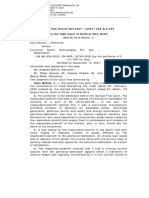

Section 144B of the Income-tax Act, 1961 - Faceless

assessment (Ex parte order) - Assessing Officer sent show

cause notice along with draft assessment order to assessee

through online mode - Assessee did not open his inbox on

account of ill health and as a result of which he could not

respond to show cause notice within date fixed for

compliance - Later on National Faceless Assessment Centre

passed ex parte assessment order dated 23-3-2022 under

section 144B on assessee - Assessee filed writ petition

challenging assessment order on ground of violation of

principles of natural justice - Whether assessee was to be

permitted to put in his objections against impugned

assessment order which shall be treated as draft

assessment order and after filing of objections Assessing

Officer shall proceed to complete assessment - Held, yes

[Para 9] [Matter remanded]

CASES REFERRED TO

Tin Box Co. v. CIT [2001] 116 Taxman 491/249 ITR 216 (SC) (para

8).

Vikash Singh, Ms. Sneha Singh and R.N. Bandyopadhyay for

the Appellant. S. Roy Chowdhury for the Respondent.

JUDGMENT

T.S. Sivagnanam, J. - By consent of the parties, we take up the

appeal itself for hearing and disposal.

2. This intra-Court appeal is directed against the order dated

26th April, 2022 in W.P.A. No. 6938 of 2022. The appellants filed

the writ petition challenging an assessment order dated 23rd

March, 2022 under section 147 read with section 144B of the

Income-tax Act, 1961 (hereafter 'the Act'). In the writ petition,

the appellants had challenged the assessment order mainly on

the ground of violation of principles of natural justice.

3. It is not in dispute that the show cause notice dated 8th

March, 2022 along with the draft assessment order was sent to

the assessee through online mode. However, the assessee's case

is that he did not open his inbox on account of ill health and as a

result of which, he could not respond to the show cause notice

within the date fixed for compliance, i.e. 14th March, 2022.

Therefore, the writ petition was filed seeking for an opportunity

to place the material before the Assessing Officer.

4. The learned Single Bench opined that the appellants have not

challenged the constitutional validity of any statutory provision

and that there is no violation of principle of natural justice and

the assessment order being an appealable order, did not

entertain the writ petition and the same was dismissed.

Aggrieved by the same, the appellants had filed the present

appeal.

5. The learned Advocate appearing for the appellants pleads for

an opportunity before the Assessing Officer so that the

assessment order can be made on merits after considering the

material, which is available with the appellants/assessee.

6. The learned Standing Counsel for the respondents, on written

instruction from the Income-tax Officer, Ward -11(1), Kolkata,

submitted that the order being an appealable order, the writ

petition was rightly not entertained. Further, it is submitted that

ample opportunity was provided to the assessee before passing

the ex parte assessment order, which was passed on 23rd March,

2022 by the National Faceless Assessment Centre (N.F.A.C.) and

that the appellants/assessee in spite of filing the appeal before

the CIT(A) had filed the writ petition before this Court. Though

such averment has been made, no particulars have been given as

to on what date the appeal was filed before the CIT (A) nor the

stage of the present appeal.

7. The learned Advocate appearing for the appellants, on specific

instruction from his client, would submit that the appellants had

never filed an appeal and moved the writ Court seeking for an

opportunity to go before the Assessing Officer.

8. It is no doubt true that the impugned order is an appealable

order and the appellate authority can re-examine the factual

position. However, the opportunity which the assessee is entitled

to before the original authority can never be replaced to that of

the opportunity before the appellate authority. The Hon'ble

Supreme Court in the case of Tin Box Co. v. CIT [2001] 116

Taxman 491/249 ITR 216 held that the assessment order made by

the ITO without giving a proper opportunity of hearing to the

assessee was bad in law. Further, it was held that the possibility

of placing of evidence by the assessee before the appellate

authorities would be of no use to hold the said order valid.

9. Considering the facts and circumstances of the case, we are of

the view that ends of justice would be met if an opportunity is

granted to the assessee to go before the Assessing Officer.

However, for such reason, we are not inclined to quash the

assessment order dated 23rd March, 2022, which shall be treated

as draft assessment order and the appellants shall be permitted

to put in their objections within a period that will be indicated by

the Assessing Officer within a week from the date of receipt of

the server copy of this order. After filing of the objections, the

Assessing Officer shall proceed to complete the assessment in

terms of the procedure laid down by the National Faceless

Assessment Centre.

10. Assuming an appeal had been preferred before the CIT (A), it

would not be of any consequence as we have directed the

Assessing Officer to take a fresh decision in the matter.

11. With the aforesaid direction, the appeal and the connected

application are disposed of.

12. No costs.

13. Urgent photostat certified copy of this order, if applied for, be

furnished to the parties expeditiously upon compliance of all legal

formalities.

S.K. Jain

*Matter remanded.

You might also like

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Annexure-D 2022 139 Taxman 543 Madras 288 Taxman 110 Madras 06 05 22Document4 pagesAnnexure-D 2022 139 Taxman 543 Madras 288 Taxman 110 Madras 06 05 22Shaik MastanvaliNo ratings yet

- 2022 134 Taxmann Com 214 Madras 2022 285 Taxman 141 Madras 22 10 2021Document8 pages2022 134 Taxmann Com 214 Madras 2022 285 Taxman 141 Madras 22 10 2021diksha chouhanNo ratings yet

- Cta 2D CV 10240 M 2021mar01 AssDocument8 pagesCta 2D CV 10240 M 2021mar01 AssFirenze PHNo ratings yet

- Stephanus V Roads Authority (HC-MD-LAB-MOT-REV-2023-00028) (2023) NALCMD 49 (6 October 2023)Document7 pagesStephanus V Roads Authority (HC-MD-LAB-MOT-REV-2023-00028) (2023) NALCMD 49 (6 October 2023)bgfkh6wqrzNo ratings yet

- Virdichand Bawandas Huf Karta of Huf Pawankumar Virdhichand Agrawal Versus The National E-Assessment Centre - 2022 (8) Tmi 91 - Gujarat High CourtDocument9 pagesVirdichand Bawandas Huf Karta of Huf Pawankumar Virdhichand Agrawal Versus The National E-Assessment Centre - 2022 (8) Tmi 91 - Gujarat High CourtSrichNo ratings yet

- 148d 50 LAC Cost ImposedDocument36 pages148d 50 LAC Cost ImposedNeena BatlaNo ratings yet

- 2021 127 Taxmann Com 875 NCL AT 2021 168 SCL 110 NCL AT 16 04 2021 Ms AKJ FincapDocument7 pages2021 127 Taxmann Com 875 NCL AT 2021 168 SCL 110 NCL AT 16 04 2021 Ms AKJ FincapPrakhar MaheshwariNo ratings yet

- Acrow Construction Vs PNB & OrsDocument6 pagesAcrow Construction Vs PNB & OrsnotimebishNo ratings yet

- Uti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)Document8 pagesUti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)bharath289No ratings yet

- Dev Bahuudeshiva SansthaDocument13 pagesDev Bahuudeshiva SansthaRam hedaNo ratings yet

- Annexure-C 2021 297 Delhi 2021 281 Taxman 279 Delhi 02 06 21Document5 pagesAnnexure-C 2021 297 Delhi 2021 281 Taxman 279 Delhi 02 06 21Shaik MastanvaliNo ratings yet

- Riya 2101817 VAC - 301Document9 pagesRiya 2101817 VAC - 301Ankit VermaNo ratings yet

- Case Law 2023 10 Centax 190 Bom 22 08 2023Document6 pagesCase Law 2023 10 Centax 190 Bom 22 08 2023Ashwini ChandrasekaranNo ratings yet

- Case Law - (2022) 1 Centax 220 (A.P.) (26-09-2022)Document2 pagesCase Law - (2022) 1 Centax 220 (A.P.) (26-09-2022)Rajeev SharmaNo ratings yet

- Philippine Supreme Court Jurisprudence Year 2013 February 2013 DecisionsDocument8 pagesPhilippine Supreme Court Jurisprudence Year 2013 February 2013 DecisionsNikNo ratings yet

- STAY - SC OrderDocument3 pagesSTAY - SC OrdermvsarmaNo ratings yet

- Insular Savings Bank vs. FEBTCDocument6 pagesInsular Savings Bank vs. FEBTCJune Erik YlananNo ratings yet

- CIR Vs First Express - Case DigestDocument2 pagesCIR Vs First Express - Case DigestKaren Mae ServanNo ratings yet

- Riya 2101817 VAC - 301Document9 pagesRiya 2101817 VAC - 301Ankit VermaNo ratings yet

- Company Appeal (AT) (Ins.) No. 1070 of 2022Document15 pagesCompany Appeal (AT) (Ins.) No. 1070 of 2022Surya Veer SinghNo ratings yet

- 2022 ZWSC 11Document12 pages2022 ZWSC 11Seka LihleNo ratings yet

- Paschimanchal Vidyut Vitran Nigam Ltd. Vs HSA TradersDocument10 pagesPaschimanchal Vidyut Vitran Nigam Ltd. Vs HSA TradersSparsh JainNo ratings yet

- Versus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeDocument7 pagesVersus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeshailjaNo ratings yet

- Consultation in RetrenhcmentDocument11 pagesConsultation in RetrenhcmentAmbakisye AsukileNo ratings yet

- 170533-2015-Fortune Life Insurance CompDocument6 pages170533-2015-Fortune Life Insurance CompChristian VillarNo ratings yet

- Additional Claim at Assessement StageDocument4 pagesAdditional Claim at Assessement StageRajeshkumar RabidasNo ratings yet

- For The Appellant. For The RespondentDocument3 pagesFor The Appellant. For The Respondent911 SupportNo ratings yet

- Pinga V. Heirs of Santiago GR No. 170354 Facts:: Ex ParteDocument11 pagesPinga V. Heirs of Santiago GR No. 170354 Facts:: Ex ParteMikaela PamatmatNo ratings yet

- Allied Banking Vs BpiDocument9 pagesAllied Banking Vs BpiEricson Sarmiento Dela CruzNo ratings yet

- Petitioner Respondent: First DivisionDocument10 pagesPetitioner Respondent: First DivisionRobert Jayson UyNo ratings yet

- Judicial UpdateDocument13 pagesJudicial UpdateAkshay BahetiNo ratings yet

- Rahul Builders Vs Arihant Fertilizers and ChemicalS071214COM58590Document5 pagesRahul Builders Vs Arihant Fertilizers and ChemicalS071214COM58590tamilNo ratings yet

- ALLIED BANK CORP. V BPI G.R. No. 188363Document8 pagesALLIED BANK CORP. V BPI G.R. No. 188363Mark John RamosNo ratings yet

- Test 8Document5 pagesTest 8KONINIKA BHATTACHARJEE 1950350No ratings yet

- Vijaya Municipal Corporation Vs Vensar ConstructionDocument7 pagesVijaya Municipal Corporation Vs Vensar ConstructiontanyaNo ratings yet

- Kumpulan Liziz SDN BHD (In Liquidation) V Pembinaan Azam Jaya SDN BHDDocument39 pagesKumpulan Liziz SDN BHD (In Liquidation) V Pembinaan Azam Jaya SDN BHDMohd ZulfadhliNo ratings yet

- Drafts BrondyDocument8 pagesDrafts BrondyRoi DizonNo ratings yet

- CIR V MINDANAO SANITARIUM AND HOSPITAL INCDocument4 pagesCIR V MINDANAO SANITARIUM AND HOSPITAL INCAlexis Anne P. ArejolaNo ratings yet

- CIR Vs FBDCDocument2 pagesCIR Vs FBDCCarmz SumileNo ratings yet

- Moot Issues For MemorialDocument8 pagesMoot Issues For MemorialPratyush MailapurNo ratings yet

- 3680 - 2022 - 41 - 1501 - 34222 - Judgement - 21-Mar-2022 - Supreme Court JudgementDocument22 pages3680 - 2022 - 41 - 1501 - 34222 - Judgement - 21-Mar-2022 - Supreme Court Judgementmuskan khatriNo ratings yet

- SC-32-13 GDC Hauliers VS ZakeyoDocument10 pagesSC-32-13 GDC Hauliers VS Zakeyotsitsi.faziboNo ratings yet

- (Barcena) Sunshine Transportation Vs NLRCDocument2 pages(Barcena) Sunshine Transportation Vs NLRCBryan Jayson Barcena100% (1)

- RCBC V CirDocument4 pagesRCBC V CirleighsiazonNo ratings yet

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats91% (11)

- SC Cases Batch 1Document49 pagesSC Cases Batch 1William SantosNo ratings yet

- Cta 2D CV 10517 R 2023may18 AssDocument14 pagesCta 2D CV 10517 R 2023may18 AssgregmanilaNo ratings yet

- Can GST Scrutiny Be There After Audit 1705059483Document5 pagesCan GST Scrutiny Be There After Audit 1705059483RajatNo ratings yet

- GBL (85 89)Document14 pagesGBL (85 89)doraemonNo ratings yet

- G.R. No. 222837, July 23, 2018 LIM GAW JR. Vs CIRDocument12 pagesG.R. No. 222837, July 23, 2018 LIM GAW JR. Vs CIRJavieNo ratings yet

- 13 Fortune Life Insurance Company Inc. V.20210505-12-Ebq4miDocument7 pages13 Fortune Life Insurance Company Inc. V.20210505-12-Ebq4miEd Therese BeliscoNo ratings yet

- J Plus Development Asia vs. Utility Assurance G.R. No. 199650, June 26, 2013 FactsDocument4 pagesJ Plus Development Asia vs. Utility Assurance G.R. No. 199650, June 26, 2013 FactsArmstrong BosantogNo ratings yet

- Chander Arjandas Manwani Vs The National Faceless Assessment Centre Ors. Bombay High CourtDocument8 pagesChander Arjandas Manwani Vs The National Faceless Assessment Centre Ors. Bombay High Courtdiksha chouhanNo ratings yet

- Issue 1 PetitionerDocument6 pagesIssue 1 PetitionerRiya NitharwalNo ratings yet

- Efore Shok Umar Orah Ember UdicialDocument8 pagesEfore Shok Umar Orah Ember UdicialSaloni KumarNo ratings yet

- Order Non Est PetitionerDocument4 pagesOrder Non Est PetitionerRiya NitharwalNo ratings yet

- K. JPLUS ASIA Vs UTILITY ASSURANCE CORPDocument2 pagesK. JPLUS ASIA Vs UTILITY ASSURANCE CORPArlene DurbanNo ratings yet

- J 2021 SCC OnLine Del 4387 2021 228 AIC 335Document7 pagesJ 2021 SCC OnLine Del 4387 2021 228 AIC 335mohitguptaNo ratings yet

- Procter and Gamble Vs CIRDocument1 pageProcter and Gamble Vs CIRLeogen TomultoNo ratings yet

- Rapido Auto - Railway STN To OfcDocument3 pagesRapido Auto - Railway STN To OfcShaik MastanvaliNo ratings yet

- Zomato - 230722Document1 pageZomato - 230722Shaik MastanvaliNo ratings yet

- Queries 25 07 2022Document16 pagesQueries 25 07 2022Shaik MastanvaliNo ratings yet

- VouchingDocument16 pagesVouchingShaik MastanvaliNo ratings yet

- Legal Audit ApplicabilityDocument1 pageLegal Audit ApplicabilityShaik MastanvaliNo ratings yet

- Section 194J - TDS On Fees For Professional or Technical ServicesDocument24 pagesSection 194J - TDS On Fees For Professional or Technical ServicesShaik MastanvaliNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- Cost Records and Cost Audit Applicability - Companies Act - IndiaFilingsDocument6 pagesCost Records and Cost Audit Applicability - Companies Act - IndiaFilingsShaik MastanvaliNo ratings yet

- Types of GST Returns - Forms, Due Dates & PenaltiesDocument24 pagesTypes of GST Returns - Forms, Due Dates & PenaltiesShaik MastanvaliNo ratings yet

- Provident Fund - Applicability and TypesDocument3 pagesProvident Fund - Applicability and TypesShaik MastanvaliNo ratings yet

- GST Invoice Details I Essential InformationDocument7 pagesGST Invoice Details I Essential InformationShaik MastanvaliNo ratings yet

- How To Refresh Cell Data After Applying Number Formatting in ExcelDocument14 pagesHow To Refresh Cell Data After Applying Number Formatting in ExcelShaik MastanvaliNo ratings yet

- Annexure-C 2021 297 Delhi 2021 281 Taxman 279 Delhi 02 06 21Document5 pagesAnnexure-C 2021 297 Delhi 2021 281 Taxman 279 Delhi 02 06 21Shaik MastanvaliNo ratings yet

- (GKN) 2002 - 125 - Taxman - 963 - SC - 2003 - 259 - ITR - 19 - SC - 2003 - 179 - CTR - 11 - SC - 25 - 11 - 2002Document3 pages(GKN) 2002 - 125 - Taxman - 963 - SC - 2003 - 259 - ITR - 19 - SC - 2003 - 179 - CTR - 11 - SC - 25 - 11 - 2002Shaik MastanvaliNo ratings yet

- Economic Laws Compiler (Updated) @mission - CA - FinalDocument628 pagesEconomic Laws Compiler (Updated) @mission - CA - FinalShaik MastanvaliNo ratings yet

- Notfctn 79 Central Tax English 2020Document19 pagesNotfctn 79 Central Tax English 2020Shaik MastanvaliNo ratings yet

- Will FormatDocument1 pageWill FormatShaik MastanvaliNo ratings yet

- SC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inDocument10 pagesSC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inShaik MastanvaliNo ratings yet

- S 271B of The Act When No Books of Accounts Were Maintained - Taxguru - inDocument3 pagesS 271B of The Act When No Books of Accounts Were Maintained - Taxguru - inShaik MastanvaliNo ratings yet

- Reassessment - Horrendous Journey For Assessee! - Taxguru - inDocument16 pagesReassessment - Horrendous Journey For Assessee! - Taxguru - inShaik MastanvaliNo ratings yet

- Annexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Document16 pagesAnnexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Shaik MastanvaliNo ratings yet

- 2021 128 Taxmann Com 18 ArticleDocument11 pages2021 128 Taxmann Com 18 ArticleShaik MastanvaliNo ratings yet

- Jurisprudence On Warning ShotDocument4 pagesJurisprudence On Warning ShotMagdalena Opn PulisNo ratings yet

- Book2 (CLJ4)Document65 pagesBook2 (CLJ4)Christopher PerazNo ratings yet

- Court-Ordered TX Congressional Map (2/18)Document1 pageCourt-Ordered TX Congressional Map (2/18)rollcallNo ratings yet

- 23 Dulay V Lelina, Jr.Document9 pages23 Dulay V Lelina, Jr.hsjhsNo ratings yet

- Synopsis of Clinical Diagnostic Interview QuestionsDocument2 pagesSynopsis of Clinical Diagnostic Interview QuestionsRoxanne ForbesNo ratings yet

- Requesting Letter Sample For Inward Outward Non Trade1Document2 pagesRequesting Letter Sample For Inward Outward Non Trade1TEODULO PININGNo ratings yet

- Serafin vs. Lindayag (A.M. No. 297-MJ, September 30, 1975)Document5 pagesSerafin vs. Lindayag (A.M. No. 297-MJ, September 30, 1975)Marienyl Joan Lopez VergaraNo ratings yet

- Subtracting 2-Digit Numbers (A) : Name: Date: Calculate Each DifferenceDocument8 pagesSubtracting 2-Digit Numbers (A) : Name: Date: Calculate Each DifferenceAnonymous wjC0lzTN0tNo ratings yet

- Lease ContractDocument3 pagesLease ContractSometimes goodNo ratings yet

- Jamnalal Bajaj Institute of Management: Telgi ScamDocument14 pagesJamnalal Bajaj Institute of Management: Telgi ScamAnkita DesaiNo ratings yet

- Certiorari-People vs. GoDocument4 pagesCertiorari-People vs. GoRea Nina OcfemiaNo ratings yet

- Racism and Rhetoric, From Ferguson To PalestineDocument5 pagesRacism and Rhetoric, From Ferguson To PalestineThavam RatnaNo ratings yet

- SVG ChattogramDocument24 pagesSVG ChattogramMosharrofur Rahman ShahedNo ratings yet

- Historical Movie Review - Jojo RabbitDocument2 pagesHistorical Movie Review - Jojo RabbitDean SmithNo ratings yet

- Casanovas V HordDocument11 pagesCasanovas V HordfullpizzaNo ratings yet

- The Two Princes of CalabarDocument3 pagesThe Two Princes of CalabarEric Savir33% (3)

- Real - Fraud and ErrorDocument5 pagesReal - Fraud and ErrorRhea May BaluteNo ratings yet

- Https SSC - Digialm.com-Watermark - pdf-14Document67 pagesHttps SSC - Digialm.com-Watermark - pdf-14SHIVAM SINGHNo ratings yet

- Obat Yang Tersedia Di PuskesmasDocument4 pagesObat Yang Tersedia Di PuskesmasHas minaNo ratings yet

- Crim Cases (Civil Status & Robbery)Document223 pagesCrim Cases (Civil Status & Robbery)noirchienneNo ratings yet

- Securing Children's Rights: Childreach International Strategy 2013-16Document13 pagesSecuring Children's Rights: Childreach International Strategy 2013-16Childreach InternationalNo ratings yet

- Case Study 2.internal Control-CashDocument3 pagesCase Study 2.internal Control-CashAlvian CBNo ratings yet

- De Jesus v. UyloanDocument11 pagesDe Jesus v. UyloanDiego De Los ReyesNo ratings yet

- Write The Past Tense of The Irregular Verbs Below.: AwokeDocument1 pageWrite The Past Tense of The Irregular Verbs Below.: AwokeJoséNo ratings yet

- Jess 406Document8 pagesJess 406zippersandNo ratings yet

- Sample Counter AffidavitDocument2 pagesSample Counter AffidavitIllia Manaligod100% (1)

- Compiled Case Digests For Articles 1015-1023, 1041-1057, New Civil Code of The PhilippinesDocument134 pagesCompiled Case Digests For Articles 1015-1023, 1041-1057, New Civil Code of The PhilippinesMichy De Guzman100% (1)

- One Flesh Elizabeth JenningsDocument14 pagesOne Flesh Elizabeth Jenningsfaryal khan100% (1)

- Queen Elizabeth IIDocument14 pagesQueen Elizabeth IIbrunostivalNo ratings yet

- Bit Resolution MPDCDocument2 pagesBit Resolution MPDCLeizl DanoNo ratings yet