Professional Documents

Culture Documents

Partnership Division of Profits

Uploaded by

Ryou ShinodaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Division of Profits

Uploaded by

Ryou ShinodaCopyright:

Available Formats

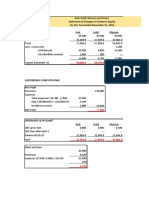

E -1

Jack Jill

Net Income 48,000

Salary allowances 24,000 30,000 -54,000

Balance 2:1 -6,000

-6,000 x 2/3 -4,000

-6000 x 1/3 -2,000 Incomme summary 48,000

Share in Profits 20,000 28,000 Jack, cap 20,000

Jill, cap 28,000

E-2

X Y

Net Income 90,000

Interest on original investments:

X 50,000 x 10% 5,000

Y 100,000 10% 10,000 -15,000

Salary allowances 27,000 18,000 -45,000

Balance equally 15,000 15,000 30,000

Total share in Profits 47,000 43,000

E-3

X Y

Net Ioss -10,000

Interest on original investments:

X 50,000 x 10% 5,000

Y 100,000 10% 10,000 -15,000

Salary allowances 27,000 18,000 -45,000

Balance equally -35,000 -35,000 -70,000

Total share in Profits -3,000 -7,000 X, cap 3,000

Y, cap 7,000

Inc. summ 10,000

E-4

Fred Ethel Increase:

Capital beginning 42,000 58,000 Additional investment

Add share in NI (40,000 /2) 20,000 20,000 Net income

Total 62,000 78,000 Decreases: Withdrawals

Less withdrawals -12,000 -17,000

Capital at the end 50,000 61,000

E-5

A B

Net Income 90,000

Salary allowances 60,000 -60,000

Balance equally 15,000 15,000 30,000

Total share 15000 75000

Share in NI 15,000 75,000

Additional investment 10,000

less withdrawals -48,000

Increase in capital 15,000 37,000

E-6

U V W

1/1 Capital 480,000 720,000 1,080,000

7/1 Investment 120,000

10/1 Withdrawal -180,000

Ave. Capital - U

1/1 480,000 x 12/12 = 480,000

7/1 120,000 x 6/12 = 60,000

Ave. Capital - U 540,000

W

1/1 1,080,000 x 12/12= 1,080,000

10/1 -180,000 x 3/12= -45,000

Ave. 1,035,000

U V W

Net Income 420,000

Salary allowances 72,000 60,000 48,000 -180,000

8% Interest on average capital

U - 540,000 x 8% 43,200

V - 720,000 x 8% 57,600

W - 1,035,000 x 8% 82,800 -183,600

Balance equally 18,800 18,800 18,800 56,400

Share in Profits 134,000 136,400 149,600

Capital, beg. 480,000 720,000 1,080,000

Add: Share in NI 134,000 136,400 149,600

Investment 120,000

Total 734,000 856,400 1,229,600

Less: withdrawals -180,000

Drawings against she in NI -60,000 -60,000 -60,000

Capital 12/31 674,000 796,400 989,600

E-7

A B

Net loss -6,000

Salary alllowances 80,000 40,000 -120,000

10% interest on beg. capital:

A - 80,000 x 10% 8,000

B - 40,000 x 10% 4,000 -12,000

Balance -138,000

A - 138,000 x 8/12 -92,000

B - 138,000 x 4/12 -46,000

Share in losses -4,000 -2,000

Capital, beginning 80,000 40,000

Less: share in lossses -4,000 -2,000

withdrawals -4,000 -4,000

Capital, end of yr. 1 72,000 34,000

Yr.2 A B

Net Income 22,000

Salary alllowances 80,000 40,000 -120,000

10% interest on beg. capital: NIBB 22,000 /110%

A - 72,000 x 10% 7,200 NIAB 20,000 100%

B - 34,000 x 10% 3,400 -10,600 BONUS 2,000 10%

Bonus to A 2,000 -2,000

Bal. equally -55,300 -55,300 -110,600

Share in Profit 33,900 -11,900

Capital beg. Yr. 2 72,000 34,000

Add share in profit 33,900 -11,900

Less withdrawals -4,000 -4,000

Capital - Dec. 31, yr2 101,900 18,100

u

You might also like

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationDocument4 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationKyla Artuz Dela CruzNo ratings yet

- Partnership DissolutionDocument9 pagesPartnership DissolutionArieza MontañoNo ratings yet

- Joint VentureDocument24 pagesJoint VentureRoma Dela CruzNo ratings yet

- Jordan Pippen Total: Multiple Choice Answers and SolutionsDocument25 pagesJordan Pippen Total: Multiple Choice Answers and SolutionsNelia Mae S. VillenaNo ratings yet

- Chapter 18 Answer KeyDocument9 pagesChapter 18 Answer KeyNCT100% (1)

- Seatwork Problem 1Document11 pagesSeatwork Problem 1Zihr EllerycNo ratings yet

- Solutions - Formation-LumpSum LiquidationDocument14 pagesSolutions - Formation-LumpSum LiquidationLuna SanNo ratings yet

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- Example - Tax ComputationDocument10 pagesExample - Tax ComputationAminul Islam RubelNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- Chapter 2 Partnership Operationsdoc PDF FreeDocument25 pagesChapter 2 Partnership Operationsdoc PDF Freemaria evangelistaNo ratings yet

- Multiple Choice Answers and Solutions: Total P110,000 P 70,000 P180,000Document25 pagesMultiple Choice Answers and Solutions: Total P110,000 P 70,000 P180,000Lyca TudtudNo ratings yet

- Emnace, Activity 2Document6 pagesEmnace, Activity 2Cheveem Grace EmnaceNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)John Carlos DoringoNo ratings yet

- P S T Total: PT PapanDocument20 pagesP S T Total: PT Papansean franciscusNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- AFAR Q1 Pre-Week SolMan - MAY 2019Document13 pagesAFAR Q1 Pre-Week SolMan - MAY 2019Aj PacaldoNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter 2Document27 pagesChapter 2Mary MarieNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- Jordan Pippen Total: Multiple Choice Answers and SolutionsDocument26 pagesJordan Pippen Total: Multiple Choice Answers and SolutionsJOEMAR LEGRESONo ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Solution Chapter 18Document3 pagesSolution Chapter 18starfireNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Acccob1 Online Quiz 3 - Solution Guide (Part Iii)Document3 pagesAcccob1 Online Quiz 3 - Solution Guide (Part Iii)Abe Miguel BullecerNo ratings yet

- Chapter 2 Partnership OperationsDocument24 pagesChapter 2 Partnership OperationsChelsy SantosNo ratings yet

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- Admission Transfer of Capital (100,000 0.2) 20,000Document16 pagesAdmission Transfer of Capital (100,000 0.2) 20,000NURHAM SUMLAYNo ratings yet

- Example 2 - Tax ComputationDocument19 pagesExample 2 - Tax ComputationAminul Islam RubelNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Reo Afst TryDocument4 pagesReo Afst TryAEDRIAN LEE DERECHONo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Red, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Document7 pagesRed, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Vivienne Rozenn LaytoNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- B, Capital After Admission 480,000: Problem 1 #1Document6 pagesB, Capital After Admission 480,000: Problem 1 #1Alizah BucotNo ratings yet

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- SET B Starts at No. 33Document7 pagesSET B Starts at No. 33Nico BalleberNo ratings yet

- MC Problems Chap 2Document4 pagesMC Problems Chap 2AlexandriteNo ratings yet

- Aa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Document14 pagesAa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Mary Joy BalangcadNo ratings yet

- CHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Document11 pagesCHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Lorifel Antonette Laoreno TejeroNo ratings yet

- Complex Group ConsolidatedDocument13 pagesComplex Group Consolidatedtαtmαn dє grєαtNo ratings yet

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- Partnership Operations Solution GuideDocument26 pagesPartnership Operations Solution GuideRachel GreenNo ratings yet

- APC Ch3sol 2Document16 pagesAPC Ch3sol 2Hans ManaliliNo ratings yet

- 100,000 550,000 200,000 50,000 Net Loss: 100,000/.20% 500,000Document3 pages100,000 550,000 200,000 50,000 Net Loss: 100,000/.20% 500,000Alizah BucotNo ratings yet

- Chapter 2 Partnership OperationsDocument26 pagesChapter 2 Partnership OperationsKianJohnCentenoTuricoNo ratings yet

- AFAR AnswerDocument4 pagesAFAR AnswerKenneth PalubonNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Balance Sheet TemplateDocument16 pagesBalance Sheet TemplateRyou ShinodaNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesRyou ShinodaNo ratings yet

- Operating Segment TemplateDocument8 pagesOperating Segment TemplateRyou ShinodaNo ratings yet

- PPE TemplateDocument31 pagesPPE TemplateRyou ShinodaNo ratings yet

- Partnershipdivision of ProfitsDocument2 pagesPartnershipdivision of ProfitsRyou ShinodaNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationRyou ShinodaNo ratings yet

- Receivables IntermediateDocument25 pagesReceivables IntermediateRyou ShinodaNo ratings yet

- Journal To Trial BalanceDocument8 pagesJournal To Trial BalanceRyou ShinodaNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationRyou ShinodaNo ratings yet

- Comprehensive Income TemplateDocument20 pagesComprehensive Income TemplateRyou ShinodaNo ratings yet

- Cash Flow TemplateDocument19 pagesCash Flow TemplateRyou ShinodaNo ratings yet

- CFAS ReviewDocument15 pagesCFAS ReviewRyou ShinodaNo ratings yet

- Cash ReceivablesDocument31 pagesCash ReceivablesRyou ShinodaNo ratings yet

- Completion of Acctg. CycleDocument8 pagesCompletion of Acctg. CycleRyou ShinodaNo ratings yet

- Interim FS TemplateDocument4 pagesInterim FS TemplateRyou ShinodaNo ratings yet

- Composition of Cash Petty CashDocument7 pagesComposition of Cash Petty CashRyou ShinodaNo ratings yet

- 18.arrears Interest CalculationDocument3 pages18.arrears Interest CalculationKingpinNo ratings yet

- Chapter 17 - Financial ManagementDocument7 pagesChapter 17 - Financial ManagementArsalNo ratings yet

- Michael March StatmentDocument11 pagesMichael March StatmentMucho Facerape100% (1)

- Financial 1004Document6 pagesFinancial 1004May Anne BarlisNo ratings yet

- Pwerm and Hybrid Methods For Allocation of ValuationDocument4 pagesPwerm and Hybrid Methods For Allocation of ValuationShelly Pratiwi NingsihNo ratings yet

- CA Final Vsi Jaipur IDT ABC Analysis For Nov 2023Document4 pagesCA Final Vsi Jaipur IDT ABC Analysis For Nov 2023Dharani SsNo ratings yet

- U.S. Hegemony Today - Peter GowanDocument12 pagesU.S. Hegemony Today - Peter GowanpeterVoterNo ratings yet

- Intro To Financial Accounting Chapter 1Document41 pagesIntro To Financial Accounting Chapter 1hermitpassiNo ratings yet

- Explanation of The RCCP For BUSLAW IIDocument3 pagesExplanation of The RCCP For BUSLAW IINarvaez, Angel BethNo ratings yet

- Financial Crises: Lessons From The Past, Preparation For The FutureDocument298 pagesFinancial Crises: Lessons From The Past, Preparation For The FutureJayeshNo ratings yet

- Group Project 2, S011Document1 pageGroup Project 2, S011Himanshu MalikNo ratings yet

- Dsop Fund-Post Budget Analysis - 21 Feb 2021Document4 pagesDsop Fund-Post Budget Analysis - 21 Feb 2021Sandeep SinghNo ratings yet

- RaymondDocument3 pagesRaymondAkankshaNo ratings yet

- Sabar & Partners CPADocument9 pagesSabar & Partners CPAAnonymous gT1reJHgLNo ratings yet

- Mba Eco v6 e F ADocument108 pagesMba Eco v6 e F AantonamalarajNo ratings yet

- MBFS Unit 1Document48 pagesMBFS Unit 1pearlksrNo ratings yet

- LP Elements of Statement of Financial PositionDocument3 pagesLP Elements of Statement of Financial PositionAld Rich NuñezNo ratings yet

- IBM Smarter Cities Challenge - Jacksonville Final ReportDocument50 pagesIBM Smarter Cities Challenge - Jacksonville Final ReportTimothy GibbonsNo ratings yet

- Topic: A Study On Awareness and Accessing Behavior Of: DEMAT Account in Rajpipla CityDocument19 pagesTopic: A Study On Awareness and Accessing Behavior Of: DEMAT Account in Rajpipla CityBhavesh VasavaNo ratings yet

- Revenue Regulations No. 12-99: September 6, 1999Document16 pagesRevenue Regulations No. 12-99: September 6, 1999I.G. Mingo MulaNo ratings yet

- Axix Bank ProjectDocument67 pagesAxix Bank ProjectSâñjây BîñdNo ratings yet

- Governmental Entities: and General Fund Accounting: Mcgraw-Hill/IrwinDocument45 pagesGovernmental Entities: and General Fund Accounting: Mcgraw-Hill/IrwinnicahNo ratings yet

- TranslationDocument10 pagesTranslationOh Oh OhNo ratings yet

- Pay&Save Account 112022Document1 pagePay&Save Account 112022maxNo ratings yet

- Local Taxation Part IDocument35 pagesLocal Taxation Part IEmille LlorenteNo ratings yet

- Fidelity Case DigestDocument2 pagesFidelity Case DigestCandypopNo ratings yet

- Fin 321 Case PresentationDocument19 pagesFin 321 Case PresentationJose ValdiviaNo ratings yet

- LTD Offer 2019 EurDocument2 pagesLTD Offer 2019 EurkatariamanojNo ratings yet

- FRM-I Valuation Models NotesDocument146 pagesFRM-I Valuation Models Notesprincelyprince100% (2)

- FIN546Document8 pagesFIN546Florarytha RebaNo ratings yet