Professional Documents

Culture Documents

EMV Operation

Uploaded by

shanthi rajeshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EMV Operation

Uploaded by

shanthi rajeshCopyright:

Available Formats

4.

4 EMVCo Relationship with Other Standards Bodies The EMV Chip Specifications cannot be

considered in isolation, and to this end, EMVCo collaborates with other industry bodies and

standards organisations. Examples of this collaboration are given below. 1. International

Organisation for Standardisation (ISO) - The EMV Chip Specifications are based on underlying

International Organisation for Standardisation (ISO) standards as follows: ISO/IEC 7816:

Identification Cards – Integrated Circuit(s) Cards ISO/IEC 14443: Identification Cards – Contactless

Integrated Circuit(s) Cards – Proximity Cards 2. Payment Card Industry Security Standards Council

(PCI SSC) is primarily concerned with the protection of sensitive payment information such as

account information and personal identification numbers (PINs). The EMV Chip Specifications and

PCI standards are complementary in enhancing payment security and reducing fraud due to

counterfeit and lost and stolen cards. 3. The Near Field Communication (NFC) Forum – EMVCo has

been working to extend EMV technology to the contactless and mobile channels. This has required

alignment with the NFC Forum which is responsible for developing the specifications for

communication between NFC devices and services 4. GlobalPlatform - Part of EMVCo’s activities is to

review the functionality and security of platforms on which an EMV chip payment application will

reside. Alignment with standards bodies such as GlobalPlatform are important as EMV chip payment

applications are increasingly implemented on shared chip platforms that support multiple

applications, each from a different application owner. EMVCo, LLC A Guide to EMV Chip Technology

Version 2.0 November 2014 - 17 - Copyright © 2014 EMVCo, LLC. All rights reserved. 5 EMV Chip

Technology – How it Works 5.1 Stepping Through an EMV Chip Transaction There is a fundamental

difference between a magnetic stripe and an EMV chip transaction. For a magnetic stripe

transaction, the card is simply a data store that is read by the terminal and then the card is no longer

used. The terminal performs all the processing in conjunction with the issuer and / or payment

system and applies the rules for the transaction. During an EMV transaction, the chip is capable of

processing information and determines many of the rules that determine the outcome of the

transaction. The terminal helps enforce the rules set by the issuer on the chip. These rules can

include enforcing services such as offline data authentication, verifying the cardholder identity via

PIN or signature, online authorisation and so on. It is up to the issuing bank to define which of these

services is required for the current transaction, via the rules placed on the chip. If the terminal is

unable to provide the services requested by the chip, the issuer can set rules that will result in the

chip declining the transaction. Accordingly an EMV chip transaction requires interaction between the

chip and the terminal which is a protocol that is defined by the EMV Chip Specifications. The

protocol defines a series of steps, which are described in the following sections. EMVCo, LLC A Guide

to EMV Chip Technology Version 2.0 November 2014 - 18 - Copyright © 2014 EMVCo, LLC. All rights

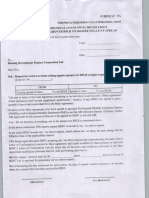

reserved. 5.1.1 Steps for an EMV Contact Transaction Figure 4: Processing Steps for an EMV Contact

Chip Transactio

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FinacleDocument28 pagesFinacleshanthi rajesh100% (1)

- Coceptual Model - DevSecOpsDocument28 pagesCoceptual Model - DevSecOpsshanthi rajeshNo ratings yet

- Offline Data Authentication The EMV ChipDocument1 pageOffline Data Authentication The EMV Chipshanthi rajeshNo ratings yet

- CISO Recruitment - CISO Recruiter - CISO Executive SearchDocument1 pageCISO Recruitment - CISO Recruiter - CISO Executive Searchshanthi rajeshNo ratings yet

- EMV2Document2 pagesEMV2shanthi rajeshNo ratings yet

- TandemDocument2 pagesTandemshanthi rajeshNo ratings yet

- Chip TechnologyDocument1 pageChip Technologyshanthi rajeshNo ratings yet

- Threat DetectionDocument9 pagesThreat Detectionshanthi rajeshNo ratings yet

- Security Expertise in Dev Sec OpsDocument5 pagesSecurity Expertise in Dev Sec Opsshanthi rajeshNo ratings yet

- BI TestingDocument4 pagesBI Testingshanthi rajeshNo ratings yet

- API Autoamtion TestingDocument27 pagesAPI Autoamtion Testingshanthi rajeshNo ratings yet

- AppiumDocument18 pagesAppiumshanthi rajeshNo ratings yet

- CAMSDocument2 pagesCAMSshanthi rajeshNo ratings yet

- UEBADocument2 pagesUEBAshanthi rajeshNo ratings yet

- What Is A Security Operations Center (SOC) ?Document3 pagesWhat Is A Security Operations Center (SOC) ?shanthi rajeshNo ratings yet

- SIEMDocument3 pagesSIEMshanthi rajeshNo ratings yet

- Network Traffic AnalysisDocument8 pagesNetwork Traffic Analysisshanthi rajeshNo ratings yet

- Mitre Att&ckDocument3 pagesMitre Att&ckshanthi rajeshNo ratings yet

- Cybersecurity CompetenceDocument3 pagesCybersecurity Competenceshanthi rajeshNo ratings yet

- Incident ResponseDocument5 pagesIncident Responseshanthi rajeshNo ratings yet

- Cloud Security ToolsDocument12 pagesCloud Security Toolsshanthi rajeshNo ratings yet

- 15 - Loan PricingDocument46 pages15 - Loan PricingAbhijeet Dash25% (4)

- Discuss Bretton Woods SystemDocument9 pagesDiscuss Bretton Woods SystemМұхтар ҚойшыбаевNo ratings yet

- QR Code Payment SystemDocument8 pagesQR Code Payment SystemIssaNo ratings yet

- Performance Analysis Using Camel Model-A Study of Select Private BanksDocument10 pagesPerformance Analysis Using Camel Model-A Study of Select Private BanksLIKHITHA RNo ratings yet

- Datos Bancarios FincasDocument42 pagesDatos Bancarios FincasEve MoralesNo ratings yet

- Format 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadDocument1 pageFormat 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadANANDARAJNo ratings yet

- Abdullahi Tijjani Lado: Customer StatementDocument19 pagesAbdullahi Tijjani Lado: Customer StatementAhmad Abdullahi TijjaniNo ratings yet

- Understanding Deposit InsuranceDocument2 pagesUnderstanding Deposit InsuranceDesiree MarianoNo ratings yet

- AU Small Finance Bank - Research InsightDocument6 pagesAU Small Finance Bank - Research InsightDickson KulluNo ratings yet

- Journal, T Accounts, WorksheetDocument10 pagesJournal, T Accounts, Worksheetkenneth coronelNo ratings yet

- Certificate of DepositDocument7 pagesCertificate of Depositbhimber007No ratings yet

- (03A) Cash Quiz ANSWER KEYDocument11 pages(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Simple and Compound Interest: Ryan Jeffrey P Curbano, PH.DDocument35 pagesSimple and Compound Interest: Ryan Jeffrey P Curbano, PH.DPrince RiveraNo ratings yet

- Credit Authorisation SchemeDocument6 pagesCredit Authorisation SchemeOngwang KonyakNo ratings yet

- MSB ATM GuidanceDocument3 pagesMSB ATM GuidanceJay CaplanNo ratings yet

- Law of Banking and Negotiable InstrumentsDocument35 pagesLaw of Banking and Negotiable InstrumentsM A MUBEEN 172919831047No ratings yet

- Know Your CustomerDocument9 pagesKnow Your CustomerSudip HatiNo ratings yet

- Digests WK 8Document2 pagesDigests WK 8Chic PabalanNo ratings yet

- Money ManagerDocument32 pagesMoney ManagerMuhammad ZainiansyahNo ratings yet

- Manish KumarDocument2 pagesManish KumarRatnesh JainNo ratings yet

- Card Cancellation DisclaimerDocument1 pageCard Cancellation Disclaimerambermikaela.siNo ratings yet

- Insured Name Relation Gender DOB AGE Marital Status Address1Document6 pagesInsured Name Relation Gender DOB AGE Marital Status Address1piyush singhNo ratings yet

- State Bank Mobicash User InstructionsDocument6 pagesState Bank Mobicash User InstructionsBijendra SinghNo ratings yet

- Mezan Intership ReportDocument151 pagesMezan Intership ReportMurtaza AkmalNo ratings yet

- Hetzner 2021-06-22 R0013604788Document2 pagesHetzner 2021-06-22 R0013604788Vitaliy PodobaNo ratings yet

- Invoice 4909 PDFDocument1 pageInvoice 4909 PDFGirish ShindeNo ratings yet

- Axis Bank and Canara Bank ProductsDocument12 pagesAxis Bank and Canara Bank ProductsManveeNo ratings yet

- 2014 10 05T18!50!34 R54 Instroduction To Asset Backed SecuritiesDocument37 pages2014 10 05T18!50!34 R54 Instroduction To Asset Backed SecuritiesmishikaNo ratings yet

- Motion To Dismiss With Prejudice - Bank of America, NA vs. Robles, Andy. 11-08-13Document10 pagesMotion To Dismiss With Prejudice - Bank of America, NA vs. Robles, Andy. 11-08-13JusticeForAmericans100% (1)

- Standby Letter of Credit ModelDocument1 pageStandby Letter of Credit ModelBernhardNo ratings yet