Professional Documents

Culture Documents

Govt Incenties

Uploaded by

kumar sunnyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Govt Incenties

Uploaded by

kumar sunnyCopyright:

Available Formats

INCENTIVES BY THE GOVERNMENT

The Government of India has announced series of incentives for promoting this project for installing

such plants to the entire printers engaged in developing alternative energy source.

The Major Incentives are

100% Depreciation: The total Value of plant and machinery is allowed to be depreciated in the 1 st year.

Excise Exemption: The solid fuel briquettes are completely exempted from Excise duty. The

government is also considering exemption in the case of plant and machinery.

Sales Tax Exemption: The various states like M.P. Maharashtra, Rajasthan, Delhi, Pondicherry have

exempted solid fuels briquettes from sales tax. Other states are also considering the same and many

states and offering sales tax exemption in backward area.

No Licenses: The whole industry of non conventional energy sources has been exempted for obtaining

any license.

Income tax Exemption for 1st Five Year

The Central and State Government give Subsidies.

Low rate of interest from Government Financial Institutions.

Deduction under Section 80JJA

Section 800JJA DEDUCTION IN RESPECT OF PROFITES & GAINS FROM BUSINESS OF

COLLECTING AND PROCESSING OF BIO-DEGRADABLE WASTE

Persons Covered All Assesses.

Eligible Amount Profits and Gains from business of collecting and processing or

treating of Bio-degradable waste.

The business should be of collecting and processing or treating of Bio-

degradable waste for.

Relevant (1). Generating Power, or

Conditions/Points (2). Producing Bio-Fertilizers, Bio-Pesticides or other biological

agents, or

(3). Producing Bio Gas, or

(4). Making Pellet or Briquettes for Fuel, or

(5). Organic Manure.

100% of the Profit and Gains from such business shall be allowed as a

Extent of Deduction deduction for a period of five consecutive assessment years

beginning with the assessment year relevant to previous year in

which such business commences.

Links For Section 1. http://caopinion.co.in/Post/Deduction-under-Section-80JJA

Subsidy Subsidy: 25% subsidy under a male name or 30% subsidy under a

Female name, available from

KVIC (Khadi and Village Industries Commission)

DIC (District Industrial Corporation).

Kindly find the below given link for the same

www.kvic.org.in/PDF/PMEGPscheme.pdf

You might also like

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- Null 2Document12 pagesNull 2Kaif UddinNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Slides 1 (PS& ITA) .Document37 pagesSlides 1 (PS& ITA) .Sakinah AminNo ratings yet

- Scheme For Promotion of Ethanol and Bio-Fuel ProductionDocument6 pagesScheme For Promotion of Ethanol and Bio-Fuel Productionvivekmatani7No ratings yet

- Incentives For InvestmentsDocument3 pagesIncentives For Investmentssamanthao_10No ratings yet

- Benefits and Incentives of ZEDDocument13 pagesBenefits and Incentives of ZEDharshitkarnaniNo ratings yet

- Profits and Gains of Business or ProfessionDocument17 pagesProfits and Gains of Business or Professionapi-3832224No ratings yet

- Assmt of CompaniesDocument23 pagesAssmt of Companieskarishmapatel93No ratings yet

- Profits and Gains of Business or ProfessionDocument17 pagesProfits and Gains of Business or ProfessionAman hingoraniNo ratings yet

- 7.co-Operative Society and Producer Companies-3Document14 pages7.co-Operative Society and Producer Companies-3Muthu nayagamNo ratings yet

- Incentives For New InvestmentsDocument21 pagesIncentives For New InvestmentsJosephNo ratings yet

- 2020 Membership Info - Global (8!5!2019)Document16 pages2020 Membership Info - Global (8!5!2019)Jenefer AntoNo ratings yet

- Union Budget - FY 2011-12: RPG Life Science Limited (RPGLS)Document6 pagesUnion Budget - FY 2011-12: RPG Life Science Limited (RPGLS)arpita_jaiswal_2No ratings yet

- BMO Capital Markets 10th Annual Farm To Market Conference: Brett Begemann May 20, 2015Document17 pagesBMO Capital Markets 10th Annual Farm To Market Conference: Brett Begemann May 20, 2015Toni HercegNo ratings yet

- EDC Scheme External54Document8 pagesEDC Scheme External54Global Industrial SolutionsNo ratings yet

- 2024 Membership Info - GlobalDocument16 pages2024 Membership Info - GlobalhuihudsonNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument4 pagesSection 80P - Deduction For Co-Operative SocietiesPaym entNo ratings yet

- Msme Policy 2022 v-1Document13 pagesMsme Policy 2022 v-1Gupta MittalNo ratings yet

- BIHAR Induatrail Policy 2011Document16 pagesBIHAR Induatrail Policy 2011Vikram SaharanNo ratings yet

- 2019 Membership Info - GlobalDocument14 pages2019 Membership Info - GlobalhuihudsonNo ratings yet

- 2025 Membership Info Global - ENGLISH (11!01!2023)Document16 pages2025 Membership Info Global - ENGLISH (11!01!2023)ravi.rnrfreedomNo ratings yet

- Taxation Benefits To Ssi, Various IncentivesDocument31 pagesTaxation Benefits To Ssi, Various IncentivesThasni MK33% (3)

- Income Earned From Members Exempt As Per Concept of MutualityDocument2 pagesIncome Earned From Members Exempt As Per Concept of MutualityajitNo ratings yet

- NullDocument7 pagesNullvinoth kumarNo ratings yet

- 001 - STM - Create ActDocument22 pages001 - STM - Create ActAlbert SantiagoNo ratings yet

- 2024 Membership Info Non-Core - ENGLISH (11-3-2022)Document16 pages2024 Membership Info Non-Core - ENGLISH (11-3-2022)neotheuniverseNo ratings yet

- Exemptions & Tax Incentives (Act 896) - Power Point PresentationDocument50 pagesExemptions & Tax Incentives (Act 896) - Power Point PresentationGabrielNo ratings yet

- Cooperate Accounting CiaDocument20 pagesCooperate Accounting Ciaarpit bagariaNo ratings yet

- TRABAHO Bill, House's Version of TRAIN 2Document6 pagesTRABAHO Bill, House's Version of TRAIN 2Andrew James Tan LeeNo ratings yet

- Benefit of MsmeDocument6 pagesBenefit of MsmePIYUSH GOSAINNo ratings yet

- PGBP (Contd.)Document45 pagesPGBP (Contd.)Aarti SainiNo ratings yet

- IT RR Draft v040321 v2Document22 pagesIT RR Draft v040321 v2Jeanette LampitocNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Aatmanirbhar: GujaratDocument16 pagesAatmanirbhar: Gujaratnidhi216No ratings yet

- Income From Other SourcesDocument31 pagesIncome From Other SourcesNeeraj AgarwalNo ratings yet

- Union Budget 2008-09: SKP Securities Ltd. SKP Securities Ltd. SKP Securities Ltd. SKP Securities LTDDocument23 pagesUnion Budget 2008-09: SKP Securities Ltd. SKP Securities Ltd. SKP Securities Ltd. SKP Securities LTDjoblessiceNo ratings yet

- Biofuel IndiaDocument3 pagesBiofuel IndiaPoonam ThoolNo ratings yet

- RR 5-2021Document22 pagesRR 5-2021zelayneNo ratings yet

- Chemical and Petrochemical IndustryDocument6 pagesChemical and Petrochemical IndustryjeevaNo ratings yet

- Tax IncentivesDocument43 pagesTax Incentivesmay leeNo ratings yet

- Investment IncentiveDocument47 pagesInvestment IncentiveAzizki WanieNo ratings yet

- Section Wise - Income Tax DeductionsDocument25 pagesSection Wise - Income Tax DeductionsCaCs Piyush SarupriaNo ratings yet

- GO - Ms - No - 14Document192 pagesGO - Ms - No - 14Adhavan M AnnathuraiNo ratings yet

- Kashyap Kansara Pranav Patel Amit Chandani Dhaval Patel Deep PatelDocument13 pagesKashyap Kansara Pranav Patel Amit Chandani Dhaval Patel Deep PatelPranav PatelNo ratings yet

- Co-Operative Society Smart Notes - Yash KhandelwalDocument3 pagesCo-Operative Society Smart Notes - Yash Khandelwalhtassociates12No ratings yet

- National Budget Report 2021-2022: BANGLADESHDocument11 pagesNational Budget Report 2021-2022: BANGLADESHI'm AlamNo ratings yet

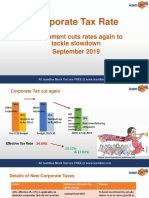

- Corporate Tax Rate Cut by GovernmentDocument5 pagesCorporate Tax Rate Cut by GovernmentKumar MohitNo ratings yet

- S&A KS - MSME Stimulus - UpdateV7Document5 pagesS&A KS - MSME Stimulus - UpdateV7Shatir LaundaNo ratings yet

- Incentives CategoriesDocument4 pagesIncentives CategoriesmilletfusionsNo ratings yet

- Tax Planning For Individuals Under Income Tax ActDocument9 pagesTax Planning For Individuals Under Income Tax ActSIDDHESHNo ratings yet

- Andhra Pradesh Fiscal Incentives, Exemptions & Subsidies: Units For Providing Cash SubsidyDocument2 pagesAndhra Pradesh Fiscal Incentives, Exemptions & Subsidies: Units For Providing Cash SubsidySree NivasNo ratings yet

- Small Scal Industry PolicyDocument6 pagesSmall Scal Industry PolicysweetuhemuNo ratings yet

- Soumya Agrawal BVDocument18 pagesSoumya Agrawal BVSoumya AgrawalNo ratings yet

- Requirement Membership ApplicationDocument7 pagesRequirement Membership ApplicationkezNo ratings yet

- Hul PPT (CTP)Document31 pagesHul PPT (CTP)vedantNo ratings yet

- DSIR Blog - All About RND Tax Benefits and Incentives in India PDFDocument17 pagesDSIR Blog - All About RND Tax Benefits and Incentives in India PDFsgdsjNo ratings yet

- Madhya Pradesh - Industry Promotion Policy 2004 and Action Plan AnnouncedDocument6 pagesMadhya Pradesh - Industry Promotion Policy 2004 and Action Plan Announcedapi-3711789No ratings yet

- IndusDocument7 pagesIndusstuteestuteeNo ratings yet

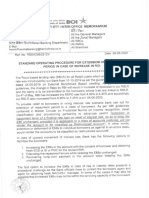

- Sop RoiDocument12 pagesSop Roikumar sunnyNo ratings yet

- DECLARATIONDocument1 pageDECLARATIONkumar sunnyNo ratings yet

- Data Work Services Company DemoDocument11 pagesData Work Services Company Demokumar sunnyNo ratings yet

- Interzone Transfer Application 1 1Document3 pagesInterzone Transfer Application 1 1kumar sunnyNo ratings yet

- Q 4 Results Intimation 240522Document29 pagesQ 4 Results Intimation 240522kumar sunnyNo ratings yet

- Fitment Chart Wef Nov 2017Document4 pagesFitment Chart Wef Nov 2017kumar sunnyNo ratings yet

- WhitepaperDocument9 pagesWhitepaperkumar sunnyNo ratings yet

- Staff Housing Loan Advance Circular-1Document34 pagesStaff Housing Loan Advance Circular-1kumar sunnyNo ratings yet

- Strategic Management ModelsDocument4 pagesStrategic Management ModelsBarno NicholusNo ratings yet

- Global Review Solar Tower Technology PDFDocument43 pagesGlobal Review Solar Tower Technology PDFmohit tailorNo ratings yet

- Pet Care in VietnamFull Market ReportDocument51 pagesPet Care in VietnamFull Market ReportTrâm Bảo100% (1)

- 254 AssignmentDocument3 pages254 AssignmentSavera Mizan ShuptiNo ratings yet

- Analysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)Document11 pagesAnalysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)AJHSSR JournalNo ratings yet

- NYLJtuesday BDocument28 pagesNYLJtuesday BPhilip Scofield50% (2)

- Minas-A6 Manu e PDFDocument560 pagesMinas-A6 Manu e PDFJecson OliveiraNo ratings yet

- Key Features of A Company 1. Artificial PersonDocument19 pagesKey Features of A Company 1. Artificial PersonVijayaragavan MNo ratings yet

- Divider Block Accessory LTR HowdenDocument4 pagesDivider Block Accessory LTR HowdenjasonNo ratings yet

- BS en 118-2013-11Document22 pagesBS en 118-2013-11Abey VettoorNo ratings yet

- Opel GT Wiring DiagramDocument30 pagesOpel GT Wiring DiagramMassimiliano MarchiNo ratings yet

- Sikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPDocument15 pagesSikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPHemant MeenaNo ratings yet

- Summary - A Short Course On Swing TradingDocument2 pagesSummary - A Short Course On Swing TradingsumonNo ratings yet

- It14 Belotti PDFDocument37 pagesIt14 Belotti PDFHolis AdeNo ratings yet

- Idmt Curve CalulationDocument5 pagesIdmt Curve CalulationHimesh NairNo ratings yet

- Surge Arrester: Technical DataDocument5 pagesSurge Arrester: Technical Datamaruf048No ratings yet

- Mutual Fund Insight Nov 2022Document214 pagesMutual Fund Insight Nov 2022Sonic LabelsNo ratings yet

- SVPWM PDFDocument5 pagesSVPWM PDFmauricetappaNo ratings yet

- ARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiDocument5 pagesARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiGAURAV DANGARNo ratings yet

- European Steel and Alloy Grades: 16Mncr5 (1.7131)Document3 pagesEuropean Steel and Alloy Grades: 16Mncr5 (1.7131)farshid KarpasandNo ratings yet

- Strength and Microscale Properties of Bamboo FiberDocument14 pagesStrength and Microscale Properties of Bamboo FiberDm EerzaNo ratings yet

- ACC403 Week 10 Assignment Rebecca MillerDocument7 pagesACC403 Week 10 Assignment Rebecca MillerRebecca Miller HorneNo ratings yet

- 6mm Superlite 70 40t Clear +16as+6mm ClearDocument1 page6mm Superlite 70 40t Clear +16as+6mm ClearNav JavNo ratings yet

- Hoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFDocument2 pagesHoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFMarco Antonio Gutierrez PulchaNo ratings yet

- Criminal Law I Green Notes PDFDocument105 pagesCriminal Law I Green Notes PDFNewCovenantChurchNo ratings yet

- Atom Medical Usa Model 103 Infa Warmer I - 2 PDFDocument7 pagesAtom Medical Usa Model 103 Infa Warmer I - 2 PDFLuqman BhanuNo ratings yet

- Sappi Mccoy 75 Selections From The AIGA ArchivesDocument105 pagesSappi Mccoy 75 Selections From The AIGA ArchivesSappiETCNo ratings yet

- Usha Unit 1 GuideDocument2 pagesUsha Unit 1 Guideapi-348847924No ratings yet

- Mcqs in Wills and SuccessionDocument14 pagesMcqs in Wills and Successionjudy andrade100% (1)

- Risk and Uncertainty in Estimating and TenderingDocument16 pagesRisk and Uncertainty in Estimating and TenderingHaneefa ChNo ratings yet