Professional Documents

Culture Documents

Business Economics - Pre-Coursework Assigment

Uploaded by

Suncica ŠkolicCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Economics - Pre-Coursework Assigment

Uploaded by

Suncica ŠkolicCopyright:

Available Formats

Serbia is an upper middle-income country with a GDP per capita of US$ 5,080 in 2016.

Main exports are from

automotive, agricultural, food processing, metal and chemical sectors. Foreign Direct Investments (FDI) are

increasing, building on FDI in the agri-food (11.6%), telecommunications, retail, real estate, pharmaceutical,

automotive (15.9%) and banking sectors

Serbia has been advancing towards a free market economy for over a decade even though the global

financial crisis and frequent elections have slowed down the reforms in the country. Some areas that require attention

are rounding off the transition to a market economy by reducing the state presence in the economy and tackling

structural rigidities and obstacles to growth.

Government is offering range of different packages to foreign investors which are planning to open new job

positions, from tax reduction to non-return funds to the investors.

Geographic position:

Serbia has favorable geographic position and geo politically important territory - As a logistics base, Serbia

is the perfect location for a company to efficiently serve its EU, SEE or Middle Eastern customers.

Foreign Trade Agreements:

Serbia became an EU candidate member state in 2012 and began accession talks in January 2014 and ready

for accession by 2020. This allows nearly all exports to enter the EU without customs duties or limits on quantities.

Also FTA with Russia, Belarus and Kazakhstan, provides Serbia access to a market of 170 million people.

Goods produced in Serbia that have a least 51% value added in Serbia, are considered of Serbian origin and exported

to these markets customs-free.

The EFTA (European Free Trade Association) states include Iceland, Liechtenstein, Norway and

Switzerland and a free trade agreement with Serbia came into force in 2009. Industrial products originating in Serbia

can be exported to Turkey without paying custom duties.

It is therefore especially interesting for investors in the manufacturing sector Through several FTA’s and

other bilateral and multilateral trade agreements Serbia has broad market access and is able to export duty free to

almost 1.1 billion people in total.

Competitive Operation Cost:

The Serbian labour force is generally very skilled, highly qualified, well trained and management usually

speaks English well, it is considered to be strong business performance driver. The Labour Law, amended in 2014,

regulates rights, obligations and liabilities of employers with additional flexibility in regards to hiring and other

benefits to employer. The national minimum net salary is 130 RSD net per working hour.

In terms of cost of utilities, Serbian office rental spaces are competitive. The prices of electricity (0.0112-

0.0336 EUR/KWh), gas (0.3057 EUR/m3) and other fuels, postal services, landline telephony, fax service and

maintenance of motor vehicles are low.

Cost of land is very low compared to other European countries and varies from 4.000-6.000EUR/ha, renting

the land the land is more common in price range of 50-100EUR/ha/year.

Taxes:

Extremely competitive environment provides second lowest corporate income tax in Europe, together with

other favorable taxes and costs. The corporate profit tax rate is set at 15%, standard VAT rate is 20%, salary Tax

amount is roughly 65% of the net salary but the tax burden for employers can be reduced through a variety of

financial and tax incentives.

Tax system does not always function in a transparent and consistent manner. There is a lack of certainty and

uniformity in working with administrative government institutions. Therefore it is highly recommended to hire a tax

consultant with experience in Serbia prior to entering the market.

Recommendation:

There are numerous advantages to doing business in Serbia. Serbia’s focus on EU accession, access to

significant markets through free trade agreements, competitive operating costs, and financing resources are all key to

consider.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Informal LetterDocument1 pageInformal LetterSuncica ŠkolicNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 9Document1 page9Suncica ŠkolicNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 8Document1 page8Suncica ŠkolicNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Active - Passive Exercises 1Document2 pagesActive - Passive Exercises 1Michelle Constantia0% (3)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Be or HaveDocument2 pagesBe or HaveEdurne De Vicente PereiraNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 17Document1 page17Suncica ŠkolicNo ratings yet

- 19Document1 page19Suncica ŠkolicNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Clothes 2Document1 pageClothes 2Suncica ŠkolicNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- VII3 5min TestDocument1 pageVII3 5min TestSuncica ŠkolicNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- VII Unit 4 TestDocument2 pagesVII Unit 4 TestSuncica ŠkolicNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Inicijalni VDocument2 pagesInicijalni VSuncica ŠkolicNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Classroom SketchDocument2 pagesThe Classroom SketchSuncica ŠkolicNo ratings yet

- Animals Test IirDocument1 pageAnimals Test IirSuncica ŠkolicNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- FC Star PB 1 2Document5 pagesFC Star PB 1 2Suncica ŠkolicNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- V Razred NameDocument1 pageV Razred NameSuncica ŠkolicNo ratings yet

- Present Simple Vs Present Continuous ExercisesDocument6 pagesPresent Simple Vs Present Continuous Exercisesmiss_diya046627100% (3)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- VI Razred IOPDocument1 pageVI Razred IOPSuncica ŠkolicNo ratings yet

- IV Write The Correct First, Second or Third Conditional Eg.: I'm Much Better. If I SchoolDocument3 pagesIV Write The Correct First, Second or Third Conditional Eg.: I'm Much Better. If I SchoolSuncica ŠkolicNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- FC Star PB 1 2Document5 pagesFC Star PB 1 2Suncica ŠkolicNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unit 4 Test VDocument2 pagesUnit 4 Test VSuncica ŠkolicNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- V Razred NameDocument1 pageV Razred NameSuncica ŠkolicNo ratings yet

- Hey Kids, How Much Do You Know About Using The Internet?Document1 pageHey Kids, How Much Do You Know About Using The Internet?Suncica ŠkolicNo ratings yet

- VII Razred EngleskiDocument1 pageVII Razred EngleskiSuncica ŠkolicNo ratings yet

- Present Perfect VDocument1 pagePresent Perfect VSuncica ŠkolicNo ratings yet

- Present Perfect IVDocument1 pagePresent Perfect IVSuncica ŠkolicNo ratings yet

- Present Perfect IIIDocument1 pagePresent Perfect IIISuncica ŠkolicNo ratings yet

- Present Simple Peti RazredDocument2 pagesPresent Simple Peti RazredSuncica ŠkolicNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- TestDocument2 pagesTestSuncica ŠkolicNo ratings yet

- Present Simple Vs Present Continuous ExercisesDocument6 pagesPresent Simple Vs Present Continuous Exercisesmiss_diya046627100% (3)

- Communication SkillsDocument14 pagesCommunication SkillsZakia AkramNo ratings yet

- Winter ExamDocument4 pagesWinter ExamJuhee SeoNo ratings yet

- Penilaian Tengah Semester (PTS) Ganjil: Madrasah Ibtidaiyah Al-Islamiyyah Campurejo Sambit PonorogoDocument9 pagesPenilaian Tengah Semester (PTS) Ganjil: Madrasah Ibtidaiyah Al-Islamiyyah Campurejo Sambit PonorogoJadon SancoNo ratings yet

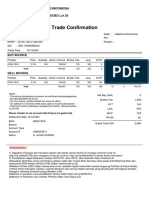

- Trade ConfirmationDocument1 pageTrade ConfirmationHavid KurniaNo ratings yet

- LSBF - Acca - f9 Study Notes June 2015Document216 pagesLSBF - Acca - f9 Study Notes June 2015Nausheen Ahmed Noba100% (1)

- Dynatech 4ST Pumps Series Catalog 50 HZDocument16 pagesDynatech 4ST Pumps Series Catalog 50 HZDYNATECH PUMPS PTE LTDNo ratings yet

- Name 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Document3 pagesName 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Katherine Borja100% (2)

- Consumer Behavior and Rational Choice: Managerial EconomicsDocument62 pagesConsumer Behavior and Rational Choice: Managerial EconomicsalauoniNo ratings yet

- Introduction Law and EconomicsDocument12 pagesIntroduction Law and EconomicsShubham YadavNo ratings yet

- PL 130307Document6 pagesPL 130307secui marianNo ratings yet

- Balance Sheet Problem SolvingDocument14 pagesBalance Sheet Problem SolvingJust Some Guy without a MustacheNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Document2 pagesBcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Hariom ShingalaNo ratings yet

- Speaking SamplesDocument13 pagesSpeaking SamplesCheekyMonkeyFaceNo ratings yet

- OLA BillDocument3 pagesOLA BillPradeepNo ratings yet

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATCharlieEleerNo ratings yet

- 2 Does HSBC's Most Recent Campaign Resonate With Its Target Audience? Why or Why Not?Document10 pages2 Does HSBC's Most Recent Campaign Resonate With Its Target Audience? Why or Why Not?Trang HaNo ratings yet

- Contract Period of PKS POLAND 2022 LP Calang PortDocument22 pagesContract Period of PKS POLAND 2022 LP Calang PortDisdikbun acehjaya22No ratings yet

- Anthropology and EntrepreneurshipDocument100 pagesAnthropology and EntrepreneurshipBernadett VásárhelyiNo ratings yet

- HE6 W3aDocument4 pagesHE6 W3aMa Theresa BambaoNo ratings yet

- Pertanyaan Dasar Price Sensitivity MeterDocument1 pagePertanyaan Dasar Price Sensitivity MeterAgung LaksanaNo ratings yet

- NAMA: Wimbi Achmad Sauqi Zainal Abidin Kelas: Pai4/VI NIM: 0301182192 1Document10 pagesNAMA: Wimbi Achmad Sauqi Zainal Abidin Kelas: Pai4/VI NIM: 0301182192 1FikryNo ratings yet

- Roger Fisher and William Ury - 5 Principles of NegotiationDocument1 pageRoger Fisher and William Ury - 5 Principles of Negotiationapi-26763370100% (1)

- Solution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W JohnsonDocument6 pagesSolution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W JohnsonVanessaMerrittdqes100% (35)

- Tax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocument3 pagesTax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due Datenithin itikalaNo ratings yet

- Birkenstock Orthopaedie GMBH and Co. KG (Formerly Birkenstock Orthopaedie GMBH) Philippine Shoe Expo Marketing CorporationDocument2 pagesBirkenstock Orthopaedie GMBH and Co. KG (Formerly Birkenstock Orthopaedie GMBH) Philippine Shoe Expo Marketing CorporationbrigetteNo ratings yet

- Economics Analysis AssignmentDocument9 pagesEconomics Analysis AssignmentAyaad SiddiquiNo ratings yet

- 2023 04 29 Annual ReportDocument1 page2023 04 29 Annual ReportbiancamantohNo ratings yet

- Employees' Provident Fund Scheme, 1952: Form-19Document9 pagesEmployees' Provident Fund Scheme, 1952: Form-19Rahul ModhNo ratings yet

- Confirmed: Vru5Hy 247.20 MYR Booking DetailsDocument2 pagesConfirmed: Vru5Hy 247.20 MYR Booking DetailsSkyXuNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet