Professional Documents

Culture Documents

TaxComputation Regular

Uploaded by

anurag ranaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TaxComputation Regular

Uploaded by

anurag ranaCopyright:

Available Formats

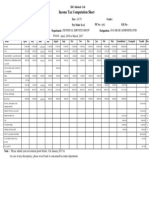

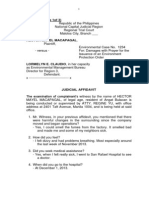

Tax Computation For the Month of 31-Dec-2021

Employee Code 108915741 Employee Name Anurag Rana

Location BANGALORE DOJ 30/11/2020

Tax Regime Applied

Amounts are in INR

PARTICULARS TOTAL

I EARNINGS

BASIC 211530

HRA 105765

CONVEYANCE 17600

ADDL. EXGRATIA 8432

LTA 44066

MEDICAL 13750

TRANSPORT ALLOWANCE 44000

STATUTORY BONUS 11328

NIGHT SHIFT ALLOWANCE 21375

ANNUAL ASA 2250

ANNUAL MEAL 10549

GROSS INCOME 490645

II LESS : EXEMPT U/S 10

SALARY AFTER SEC.10

III LESS : DEDUCTIONS U/S 16

TAX ON EMPLOYMENT 2200

STANDARD DEDUCTION 50000

SALARY AFTER SEC16 438445

IV OTHER INCOME REPORTED BY EMPLOYEE

TAXABLE SALARY 438445

V DEDUCTIONS UNDER CHAPTER VIA

(A) SECTION 80C

PF 19800

TOTAL INVESTMENTS 19800

REBATE 19800

(B) OTHER DEDUCTIONS UNDER CHAPTER VIA:

TAXABLE INCOME 418650

HRA EXEMPTION COMPUTATION

RENTLESS10BASIC -21153

HRA PAID 105765

** This is a computer generated tax computation sheet and does not require signature and stamp.

You might also like

- Tax ComputationDocument1 pageTax Computationanurag ranaNo ratings yet

- Tax ComputationDocument1 pageTax ComputationAyaan ZaiNo ratings yet

- COMDocument2 pagesCOMkrishnajielectricNo ratings yet

- February 2022Document2 pagesFebruary 2022RajasekarNo ratings yet

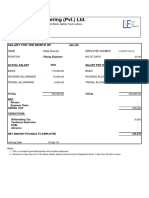

- Payslip Nov - Sailu1 fINALDocument2 pagesPayslip Nov - Sailu1 fINALChristine HallNo ratings yet

- Payslip Nov - Sailu1Document2 pagesPayslip Nov - Sailu1Christine Hall0% (1)

- PDF - 13-02-23 14-59-47Document2 pagesPDF - 13-02-23 14-59-47Miraculous IndiaNo ratings yet

- Income Tax Computation Sheet: Assessment Year: 2017-2018 April, 2016 To March, 2017 PeriodDocument1 pageIncome Tax Computation Sheet: Assessment Year: 2017-2018 April, 2016 To March, 2017 PeriodAshok kumarNo ratings yet

- Comp Anubhav Garg 23-24Document5 pagesComp Anubhav Garg 23-24prateek gangwaniNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- Employee Name: Badipati Phani KrishnaDocument2 pagesEmployee Name: Badipati Phani KrishnaphanikrishnabNo ratings yet

- Payslip-34 (Lankalapalli Durga Prasad) Jul 2022Document2 pagesPayslip-34 (Lankalapalli Durga Prasad) Jul 2022Durga PrasadNo ratings yet

- 2020 Ashbourne Industies Inc. TB - TEMPLATEDocument8 pages2020 Ashbourne Industies Inc. TB - TEMPLATEbhefickNo ratings yet

- Salary SlipDocument1 pageSalary Sliprichard parkerNo ratings yet

- Doc-20230725-Wa0011. (2)Document1 pageDoc-20230725-Wa0011. (2)s0026637No ratings yet

- PDF - 06-12-22 11-19-08Document4 pagesPDF - 06-12-22 11-19-08Jay SharmaNo ratings yet

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505No ratings yet

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- Computation 1Document1 pageComputation 1Aditya JoshiNo ratings yet

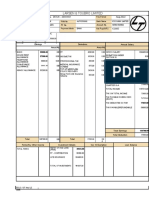

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Salary SlipDocument1 pageSalary Slipsaadbshaheen97No ratings yet

- Wings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Document1 pageWings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Venkatanarayana BolluNo ratings yet

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Project For ITT - 10Document1 pageProject For ITT - 10PRASHANT SHELKENo ratings yet

- 42 Saadsalaryslip 01 11 22Document1 page42 Saadsalaryslip 01 11 22saadbshaheen97No ratings yet

- Yearly Payslip PDFDocument1 pageYearly Payslip PDFRupam JhaNo ratings yet

- Business CommunicationDocument1 pageBusiness CommunicationRupam JhaNo ratings yet

- Pembahasan Chapter 14Document8 pagesPembahasan Chapter 14Ai TanahashiNo ratings yet

- Payslip-Vishal Kawade-January, 2023-1 PDFDocument1 pagePayslip-Vishal Kawade-January, 2023-1 PDFAditya PLNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- ComputationDocument1 pageComputationbirpal singhNo ratings yet

- Peepper StoryDocument1 pagePeepper StoryAnonymous ce49esgnveNo ratings yet

- UntitledDocument2 pagesUntitledJhalak AgarwalNo ratings yet

- Yusuf Bhai Munda Computation 2019-20Document3 pagesYusuf Bhai Munda Computation 2019-20satish devdaNo ratings yet

- Tauhid Ahmed - Payslip May'2021Document1 pageTauhid Ahmed - Payslip May'2021pooja sandhuNo ratings yet

- StocksDocument3 pagesStocksnagaraja h iNo ratings yet

- Cont Payslip Jan-2024Document1 pageCont Payslip Jan-2024Aftab Hussain ChaudhryNo ratings yet

- PrmRptPayslipgeneral0001 PDFDocument1 pagePrmRptPayslipgeneral0001 PDFNiloy BiswasNo ratings yet

- Computation of Income Tax Sagar Panjwani FY 2016-17Document3 pagesComputation of Income Tax Sagar Panjwani FY 2016-17Amol vasanta dhakateNo ratings yet

- Nirdosh Comp 21-22Document1 pageNirdosh Comp 21-22Asfa rehmanNo ratings yet

- September 2022Document1 pageSeptember 2022amitdesai92No ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- NIKEDocument2 pagesNIKEDave MendozaNo ratings yet

- PR MR PT Payslip GeneralDocument1 pagePR MR PT Payslip GeneralArun PVNo ratings yet

- Stryker India PVT LTD: Payslip For The Month of April 2019Document4 pagesStryker India PVT LTD: Payslip For The Month of April 2019Anonymous scxyMokpNo ratings yet

- Case Study 3 SolutionDocument2 pagesCase Study 3 Solutiongaurilakhmani2003No ratings yet

- 3.4 GR 11 Income Statement QuizDocument2 pages3.4 GR 11 Income Statement QuizAva TravoNo ratings yet

- Mas Mas Q&aDocument2 pagesMas Mas Q&aCraig MadziyireNo ratings yet

- Income Sttatement & Balance Sheet Further Consideration: DetailsDocument8 pagesIncome Sttatement & Balance Sheet Further Consideration: DetailsXX OniiSan XXNo ratings yet

- Shown For Tax Purpose Only # Includes CLA & COLA. (Upto Officer Level Below A.M)Document1 pageShown For Tax Purpose Only # Includes CLA & COLA. (Upto Officer Level Below A.M)rahimshahNo ratings yet

- Cashflow TemplateDocument2 pagesCashflow TemplateeyasNo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- Business Income Template (Ain)Document9 pagesBusiness Income Template (Ain)Imran FarhanNo ratings yet

- Aswati Payslip - Nov18 PDFDocument1 pageAswati Payslip - Nov18 PDFAshwati NairNo ratings yet

- BAISAKHADocument2 pagesBAISAKHARashpreet PandiNo ratings yet

- CashDocument1 pageCashshainternalauditorsNo ratings yet

- Share SHAdab KHANDocument4 pagesShare SHAdab KHANanurag ranaNo ratings yet

- AshishCV MarketingDocument3 pagesAshishCV Marketinganurag ranaNo ratings yet

- Resume - Nikhil NikamDocument1 pageResume - Nikhil Nikamanurag ranaNo ratings yet

- Shrikant ResumeDocument3 pagesShrikant Resumeanurag ranaNo ratings yet

- Hitler's Responsibility For The Second World WarDocument2 pagesHitler's Responsibility For The Second World WarsharmallamaNo ratings yet

- Posco Act 2012Document37 pagesPosco Act 2012artidwivedi100% (2)

- AACM Aviation Security AC-SEC-002-R01Document2 pagesAACM Aviation Security AC-SEC-002-R01cplowhangNo ratings yet

- LAW Assignment 5.1Document2 pagesLAW Assignment 5.1Christine CariñoNo ratings yet

- Introducing Alternative Dispute Resolution in Criminal Litigation: An OverviewDocument15 pagesIntroducing Alternative Dispute Resolution in Criminal Litigation: An OverviewVeena Kulkarni DalaviNo ratings yet

- In Re PNB V Us District CourtDocument3 pagesIn Re PNB V Us District CourtXtina MolinaNo ratings yet

- APPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Basalong & Handayan.2021Document2 pagesAPPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Basalong & Handayan.2021deth shotNo ratings yet

- PreliminaryReport 10 Audrey LNDocument18 pagesPreliminaryReport 10 Audrey LNtraderash1020No ratings yet

- 2010 Act On Public Procurement, SlovakiaDocument126 pages2010 Act On Public Procurement, Slovakiazweiblumen100% (3)

- Erick Hansen Pleads GuiltyDocument4 pagesErick Hansen Pleads GuiltyDanielWaltersNo ratings yet

- Contributor Licensing AgreementDocument6 pagesContributor Licensing AgreementInitial DSNo ratings yet

- Vol.10 Issue 22 September 30-October 6, 2017Document32 pagesVol.10 Issue 22 September 30-October 6, 2017Thesouthasian TimesNo ratings yet

- Police Stop and Search Policy Surrey and Sussex 1161Document7 pagesPolice Stop and Search Policy Surrey and Sussex 1161walnut853No ratings yet

- IPOPHL Memorandum Circular No. 2022-013 - Amendments To The Rules and Regulations On Inter Partes ProceedingsDocument10 pagesIPOPHL Memorandum Circular No. 2022-013 - Amendments To The Rules and Regulations On Inter Partes ProceedingsJay FranciscoNo ratings yet

- Forecast Civil Legal Edge Atty. Rabuya PDFDocument100 pagesForecast Civil Legal Edge Atty. Rabuya PDFSjaney67% (3)

- Family Suit No. 125 2020Document4 pagesFamily Suit No. 125 2020MuhammadTariqNo ratings yet

- Sit Lie Ordinance MaterialsDocument36 pagesSit Lie Ordinance MaterialsWTSP 10No ratings yet

- Chilling Judicial IndependenceDocument37 pagesChilling Judicial IndependenceDinh Thanh Phuong 001891No ratings yet

- Marcaida VS AglubatDocument2 pagesMarcaida VS Aglubatermeline tampusNo ratings yet

- Sogie Bill Position PaperDocument1 pageSogie Bill Position PaperAlyanna Magro100% (3)

- 337 Matling Vs CorosDocument2 pages337 Matling Vs Corosjovani emaNo ratings yet

- Tender Document CONCORDocument109 pagesTender Document CONCORgiri_placid100% (1)

- ANNEX F (Page 1of 3)Document12 pagesANNEX F (Page 1of 3)elmersgluethebombNo ratings yet

- Tagactac Vs JimenezDocument2 pagesTagactac Vs JimenezjessapuerinNo ratings yet

- "Section 25. Assessment of Property Subject To Back Taxes. - Real Property Declared For The First Time Shall Have Back TaxesDocument2 pages"Section 25. Assessment of Property Subject To Back Taxes. - Real Property Declared For The First Time Shall Have Back TaxesMargaux Ramirez100% (1)

- Immaculata Vs NavarroDocument1 pageImmaculata Vs Navarromcris101No ratings yet

- Hadley V Baxendale (1854) - ExplainedDocument20 pagesHadley V Baxendale (1854) - ExplainedEshantha Samarajiwa100% (2)

- Standard Oil Company V JaramilloDocument13 pagesStandard Oil Company V JaramilloAlcazar Renz JustineNo ratings yet

- BCRPC 12 2 13 003 1Document21 pagesBCRPC 12 2 13 003 1api-230185042No ratings yet

- Meaning of Memorandum of Association (Moa) and Various Clauses of MoaDocument13 pagesMeaning of Memorandum of Association (Moa) and Various Clauses of MoabhargaviNo ratings yet