Professional Documents

Culture Documents

Untitled

Uploaded by

Jhalak AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Jhalak AgarwalCopyright:

Available Formats

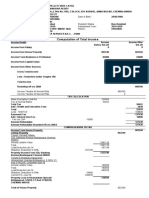

NAME OF ASSESSEE : ANKIT GOEL

PAN : BJYPG8779E

RESIDENTIAL ADDRESS : E-6 3RD FLOOR, RANJEET SINGH ROAD, ADARSH NAGAR, DELHI,

DELHI-110033

STATUS : INDIVIDUAL ASSESSMENT YEAR : 2021 - 2022

WARD NO : WARD 34(6) DELHI FINANCIAL YEAR : 2020 - 2021

GENDER : MALE DATE OF BIRTH : 07/12/1989

AADHAAR NO. : 309516413344 PASSPORT NO. : U8395875

MOBILE NO. : 9811440339

EMAIL ADDRESS : aggarwaljhalak@yahoo.in

RESIDENTIAL STATUS : RESIDENT

NAME OF BANK : PUNJAB NATIONAL BANK

MICR CODE : 110024099

IFSC CODE : PUNB0171000

ADDRESS : DELHI PITAMPURA, DISTT. NEW DE

ACCOUNT NO. : 1710001500005237

OPTED FOR TAXATION : NO

U/S 115BAC

RETURN : ORIGINAL

COMPUTATION OF TOTAL INCOME

PROFITS AND GAINS FROM BUSINESS AND 405306

PROFESSION

PROFIT U/S 44AD - THE FINE COMPANY

PROFIT DEEMED U/S 44AD @ 8% OF RS. 3661896 292952

PROFIT DECLARED U/S 44AD 405306

PROFIT (HIGHER OF THE ABOVE) 405306

INCOME FROM OTHER SOURCES 145532

INTEREST ON SAVING BANK A/C 4750

PROFESSIONAL CHARGES 40269

INTEREST ON FDR 7594

INTEREST ON INCOME TAX REFUND 698

OTHER INCOME 92221

TOTAL 145532

GROSS TOTAL INCOME 550838

LESS DEDUCTIONS UNDER CHAPTER-VIA

80C DEDUCTION 31551

80D MEDICAL INSURANCE PREMIA 15031

- HEALTH INSURANCE (SELF AND FAMILY) 10031

- PREVENTIVE HEALTH CHECKUP (SELF AND FAMILY) 5000

80TTA INTEREST ON DEPOSITS IN SAVINGS ACCOUNT 4750

TOTAL DEDUCTIONS 51332

TOTAL INCOME 499506

TOTAL INCOME ROUNDED OFF U/S 288A 499510

COMPUTATION OF TAX ON TOTAL INCOME

TAX ON RS. 250000 NIL

TAX ON RS. 249510 (499510-250000) @ 5% 12476

TAX ON RS. 499510 12476

12476

LESS : REBATE U/S 87A 12476

LESS TAX DEDUCTED AT SOURCE

SECTION 194JB: SECTION 194JB 3020 3020

-3020

REFUNDABLE (3020)

EXEMPTED INCOME

Interest On Ppf U/S 10(11) 710

710

DETAIL OF DEDUCTION U/S 80C

LIC 21551

PPF 10000

TOTAL 31551

ANKIT GOEL

(Self)

Financial Particulars of Business

Partners/Members own capital 62221

Sundry creditors Nil

Total capital and liabilities 62221

Inventories Nil

Sundry debtors Nil

Balance with banks 26054

Cash-in-hand 36167

Total assets 62221

Details of Tax Deducted at Source on Income other than Salary

Sl. Tax Deduction Name and address of the Deductor Amount Total tax Amount B/F

No. Account Number paid /credited deducted claimed for C/F

(TAN) of the this year

Deductor

194JB : SECTION 194JB

1. DELI08119G INDIAN INSTITUTE OF GEMS & JEWELLERY DELHI 40269 3020 3020

Grand Total 40269 3020 3020

Details of Turnover as per GSTR-3B

Sr. No. GSTIN ARN Date of filing Return Period Taxable Turnover Total Turnover

1 07BJYPG8779E1ZD AA070420609090U 09/07/2020 APRIL,2020 3450373.00 3450373.00

2 07BJYPG8779E1ZD AA070520669388V 05/08/2020 MAY,2020 95582.88 95582.88

3 07BJYPG8779E1ZD AA0706207319818 05/08/2020 JUNE,2020 19740.00 19740.00

4 07BJYPG8779E1ZD AA070820249012M 13/09/2020 AUGUST,2020 0.00 0.00

5 07BJYPG8779E1ZD AA070720651056E 13/09/2020 JULY,2020 63400.00 63400.00

6 07BJYPG8779E1ZD AA0709209126182 24/10/2020 SEPTEMBER,2020 32800.00 32800.00

7 07BJYPG8779E1ZD AA071020391692E 18/11/2020 OCTOBER,2020 0.00 0.00

8 07BJYPG8779E1ZD AA071120665969U 22/12/2020 NOVEMBER,2020 0.00 0.00

9 07BJYPG8779E1ZD AA070321275700J 09/04/2021 MARCH,2021 0.00 0.00

10 07BJYPG8779E1ZD AA071220659230P 17/01/2021 DECEMBER,2020 0.00 0.00

Total 3661895.88 3661895.88

You might also like

- Midland Energy Resources (Final)Document4 pagesMidland Energy Resources (Final)satherbd21100% (3)

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocument6 pagesItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNo ratings yet

- Cash Flow Statement - Amith PanickerDocument5 pagesCash Flow Statement - Amith PanickerAmith PanickerNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- RAVINDRA KUMAR RANA Income Tax Return 2022-23Document4 pagesRAVINDRA KUMAR RANA Income Tax Return 2022-23birpal singhNo ratings yet

- Quiz No. 1 - Proof of CashDocument1 pageQuiz No. 1 - Proof of CashGaile YabutNo ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505No ratings yet

- Ajay Kapoor & CoDocument4 pagesAjay Kapoor & CoPratibha0% (1)

- Computation of Total Income Income From House Property (Chapter IV C) - 50267Document19 pagesComputation of Total Income Income From House Property (Chapter IV C) - 50267ASHISH BHONDENo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 470243Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 470243Aman AggarwalNo ratings yet

- Q1 2022 Fintech Report 1130Document30 pagesQ1 2022 Fintech Report 1130fakeid fakeidNo ratings yet

- Ocean Carriers FinalDocument4 pagesOcean Carriers FinalBilal AsifNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Hemant Kumar Agarwal Coi Ay 21-22Document2 pagesHemant Kumar Agarwal Coi Ay 21-22Deepanshu AgarwalNo ratings yet

- Anoop Fy 18-19 ComputationDocument3 pagesAnoop Fy 18-19 ComputationGaurav RawatNo ratings yet

- COMDocument2 pagesCOMkrishnajielectricNo ratings yet

- PDF - 06-12-22 11-19-08Document4 pagesPDF - 06-12-22 11-19-08Jay SharmaNo ratings yet

- Delhi taxpayer income tax return detailsDocument2 pagesDelhi taxpayer income tax return detailsPixel computerNo ratings yet

- Computation Anita SareeDocument3 pagesComputation Anita SareeSURYAKANT PATHAKNo ratings yet

- COMP ANUBHAV GARG 23-24Document5 pagesCOMP ANUBHAV GARG 23-24prateek gangwaniNo ratings yet

- Genius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21Document2 pagesGenius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21darshilNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- ComputationDocument2 pagesComputationThe KingNo ratings yet

- Attachment UnlockedDocument3 pagesAttachment Unlockedmbhalani1207No ratings yet

- Please Send Me HackDocument3 pagesPlease Send Me Hackgaurav.verma17No ratings yet

- Amit Kumar Mudgal ComputationDocument4 pagesAmit Kumar Mudgal ComputationSHELESH GARGNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- GgjdfhijfrbjcDocument3 pagesGgjdfhijfrbjcdmqktchxphNo ratings yet

- Deepak ComputationDocument3 pagesDeepak ComputationRavi YadavNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAmitraja DasNo ratings yet

- Bojo Rad Receipt, 7-12, IT Return, PDFDocument15 pagesBojo Rad Receipt, 7-12, IT Return, PDFn2ulooteraNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Computation 2021-22Document2 pagesComputation 2021-22priyapatelfreeNo ratings yet

- PAN AFWPY6433L Total Income Rs. 484420 for AY 2021-22Document2 pagesPAN AFWPY6433L Total Income Rs. 484420 for AY 2021-22Chandrakanth ChanduNo ratings yet

- COMPUTATIONDocument4 pagesCOMPUTATIONkambojnaresh693No ratings yet

- UntitledDocument3 pagesUntitledVAIBHAV ARORANo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- Individual tax returnDocument2 pagesIndividual tax returnbrs consultancyNo ratings yet

- Senior Citizen Income Tax ReturnDocument2 pagesSenior Citizen Income Tax ReturnSwaran AhujaNo ratings yet

- AmarDocument5 pagesAmarASHISH BHONDENo ratings yet

- Computation Fy 21-22Document4 pagesComputation Fy 21-22rakeshkaydalwarNo ratings yet

- Computation of Total Income Income From House Property (Chapter IV C) 372534 1Document4 pagesComputation of Total Income Income From House Property (Chapter IV C) 372534 1ramanNo ratings yet

- M/S Siree Sainath Enterprises Nehru Gram, Nathanpur Dehradun UttarakhandDocument16 pagesM/S Siree Sainath Enterprises Nehru Gram, Nathanpur Dehradun UttarakhandRAJESH SHARMANo ratings yet

- BS 31.03.09Document11 pagesBS 31.03.09Leslie FlemingNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilDocument5 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilPadmalata ModekurtyNo ratings yet

- Income tax returnDocument2 pagesIncome tax returnshrikant mishraNo ratings yet

- Comp Ranveer Ay21-22Document3 pagesComp Ranveer Ay21-22Ashok ShuklaNo ratings yet

- Com 22 23Document2 pagesCom 22 23SiddharthNo ratings yet

- Statement of Income and Tax Calculation for AY 2020-2021Document2 pagesStatement of Income and Tax Calculation for AY 2020-2021Mohammad AzharuddinNo ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- ComputationDocument2 pagesComputationsrikar velamuriNo ratings yet

- COM1Document2 pagesCOM1jikadarasamrat29No ratings yet

- Nilesh Gulab Yadav 2020-21Document6 pagesNilesh Gulab Yadav 2020-21Faizan JallumiraNo ratings yet

- Computation of Total Income (As Per Section 115BAC (New Tax Regime) ) Income From Business or Profession (Chapter IV D) 916408Document3 pagesComputation of Total Income (As Per Section 115BAC (New Tax Regime) ) Income From Business or Profession (Chapter IV D) 916408S K GUPTA & ASSOCIATESNo ratings yet

- AKSHAY KUMAR GUPTA Income Tax Return 2021-2022Document3 pagesAKSHAY KUMAR GUPTA Income Tax Return 2021-2022avishkar guptaNo ratings yet

- Akshay Comp. 21-22Document3 pagesAkshay Comp. 21-22avishkar guptaNo ratings yet

- Comp 21Document6 pagesComp 21aprna SharmaNo ratings yet

- Computation of Income: Nazneen Mohammed Javed ShaikhDocument3 pagesComputation of Income: Nazneen Mohammed Javed ShaikhRahul RampalNo ratings yet

- 1703918279_documents_0Document3 pages1703918279_documents_0rajindermechNo ratings yet

- Shri Amit Santwani Ji Computitaon 2023-24Document2 pagesShri Amit Santwani Ji Computitaon 2023-24bhupeshkaushik61No ratings yet

- PARTICULARS OF EXISTING BUSINESS FINANCIALSDocument18 pagesPARTICULARS OF EXISTING BUSINESS FINANCIALSbiswajeetNo ratings yet

- com (rajubhai) (1)Document2 pagescom (rajubhai) (1)Gautam JainNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

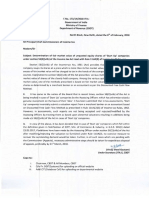

- Letter To VendorDocument3 pagesLetter To VendorJhalak AgarwalNo ratings yet

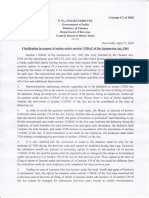

- Determination Fiar Market Value Unquoted Equity Shares Start Up 6 2 2018Document1 pageDetermination Fiar Market Value Unquoted Equity Shares Start Up 6 2 2018Jhalak AgarwalNo ratings yet

- Calling of Option For New Personal Taxation Regime of Reduced Tax Rates Reg Annex II 21-04-20 PDFDocument2 pagesCalling of Option For New Personal Taxation Regime of Reduced Tax Rates Reg Annex II 21-04-20 PDFnsreddy3613No ratings yet

- Circular No 12 2022Document7 pagesCircular No 12 2022shantXNo ratings yet

- AU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryDocument4 pagesAU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryNick KNo ratings yet

- Muthoot Annual Report For Fy 2018-19Document332 pagesMuthoot Annual Report For Fy 2018-19Salman SalmanNo ratings yet

- BUSINESS FINANCE - BDO BankDocument11 pagesBUSINESS FINANCE - BDO BankCarmela Isabelle DisilioNo ratings yet

- Marketing Management - Individual Assigment 2Document5 pagesMarketing Management - Individual Assigment 2francis MallyaNo ratings yet

- Vouched For Top Adviser 2020Document20 pagesVouched For Top Adviser 2020DhawalChandanNo ratings yet

- Case (Renminbi) - Discussion QuestionsDocument2 pagesCase (Renminbi) - Discussion QuestionsAnimesh ChoubeyNo ratings yet

- PdfjoinerDocument115 pagesPdfjoinerAnisha SapraNo ratings yet

- Extinguishing ObligationsDocument60 pagesExtinguishing ObligationsLarry Calata AlicumanNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- Jaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesDocument72 pagesJaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesLOKESH CHAUDHARYNo ratings yet

- Partial Withdrawal Cum Surrender Application Form Ver00 001Document2 pagesPartial Withdrawal Cum Surrender Application Form Ver00 001Laila RatnalaNo ratings yet

- Internship Report For CollegeDocument23 pagesInternship Report For CollegeAaron0% (1)

- How credit boom episodes can lead to banking crisesDocument6 pagesHow credit boom episodes can lead to banking crisesumairmbaNo ratings yet

- Hsslive-XII-english NotesDocument3 pagesHsslive-XII-english NotesAreej HassanNo ratings yet

- Sir Win Accounting Lectures - Financial Transaction WorksheetDocument2 pagesSir Win Accounting Lectures - Financial Transaction WorksheetJennette Rose M. ArcillaNo ratings yet

- CO VallejoDocument9 pagesCO VallejoTeyangNo ratings yet

- IshaqDocument1 pageIshaqishaqrashid36No ratings yet

- Chap 013 Financial Accounting (Statement of Cash Flow)Document39 pagesChap 013 Financial Accounting (Statement of Cash Flow)salman saeed100% (2)

- Depreciation Accounting 101: Calculating and Journalizing MethodsDocument12 pagesDepreciation Accounting 101: Calculating and Journalizing MethodsHikmatkhan NooraniNo ratings yet

- Chapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Document62 pagesChapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Mohammad Salim Hossain0% (1)

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Case Study On Strategic Management 2Document8 pagesCase Study On Strategic Management 2Mamta SharmaNo ratings yet

- Introductory Econometrics For Finance' © Chris Brooks 2002 1Document11 pagesIntroductory Econometrics For Finance' © Chris Brooks 2002 1tagashiiNo ratings yet

- Quiz Questions: Student Centre Chapter 1: The Goals and Functions of Financial ManagementDocument4 pagesQuiz Questions: Student Centre Chapter 1: The Goals and Functions of Financial ManagementSandyNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet