Professional Documents

Culture Documents

Hemant Kumar Agarwal Coi Ay 21-22

Uploaded by

Deepanshu AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hemant Kumar Agarwal Coi Ay 21-22

Uploaded by

Deepanshu AgarwalCopyright:

Available Formats

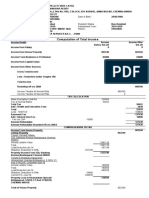

NAME OF ASSESSEE : HEMANT KUMAR AGARWAL

PAN : ADFPA4932M

FATHER'S NAME : LATE MOTI LAL AGARWAL

RESIDENTIAL ADDRESS : 12, GANGOTRI BHAWAN, STATION ROAD, KHATARI, RAMNAGAR,

UTTARAKHAND-244715

STATUS : INDIVIDUAL ASSESSMENT YEAR : 2021 - 2022

WARD NO : WARD 2(2)(5) RAM NAGAR FINANCIAL YEAR : 2020 - 2021

GENDER : MALE DATE OF BIRTH : 15/01/1960

EMAIL ADDRESS : deepanshu.agarwal.10@gmail.com

RESIDENTIAL STATUS : RESIDENT SENIOR CITIZEN

NAME OF BANK : ALLAHABAD BANK

MICR CODE : 244010004

IFSC CODE : ALLA0212381

ADDRESS : RAMNAGAR

ACCOUNT NO. : 50206663043

OPTED FOR TAXATION : NO

U/S 115BAC

RETURN : ORIGINAL (FILING DATE : 31/12/2021 & NO. : 758383760311221)

COMPUTATION OF TOTAL INCOME

INCOME FROM HOUSE PROPERTY 0

SELF OCCUPIED HOUSE

ADDRESS : 12, GANGOTRI BHAWAN, STATION ROAD,

KHATARI, RAMNAGAR, UTTARAKHAND-244715

ANNUAL VALUE NIL

LESS: INTEREST U/S 24(b) -109568

PROFITS AND GAINS FROM BUSINESS AND 736521

PROFESSION

PROFIT U/S 44AD - BUSINESS INCOME

PROFIT DEEMED U/S 44AD @ 8% OF RS. 2104346 168348

PROFIT DECLARED U/S 44AD @ 35% OF RS. 2104346 736521

PROFIT (HIGHER OF THE ABOVE) 736521

INCOME FROM OTHER SOURCES 15818

INTEREST ON BANK FDR 15818

TOTAL 15818

INTER-HEAD ADJUSTMENT OF LOSSES U/S 71

HOUSE PROPERTY LOSS SET OFF FROM BUSINESS -109568

INCOME

GROSS TOTAL INCOME 642771

LESS DEDUCTIONS UNDER CHAPTER-VIA

80C DEDUCTION 139450

80D MEDICAL INSURANCE PREMIA 25000

- HEALTH INSURANCE (SELF AND FAMILY) 25000

80TTB INTEREST ON DEPOSITS IN CASE OF SENIOR 10000

CITIZENS

TOTAL DEDUCTIONS 174450

TOTAL INCOME 468321

TOTAL INCOME ROUNDED OFF U/S 288A 468320

COMPUTATION OF TAX ON TOTAL INCOME

TAX ON RS. 300000 NIL

TAX ON RS. 168320 (468320-300000) @ 5% 8416

TAX ON RS. 468320 8416

8416

LESS : REBATE U/S 87A 8416

LESS TAX DEDUCTED AT SOURCE

SECTION 194C: CONTRACTORS AND 31701 31701

SUB-CONTRACTORS

-31701

REFUNDABLE (31701)

TAX ROUNDED OFF U/S 288B (31700)

DETAIL OF DEDUCTION U/S 80C

LIP 44000

Repayment of Housing Loan 95450

TOTAL 139450

Information regarding Turnover/Gross Receipt Reported for GST

GSTR No. 05ADFPA4932M2ZN

Amount of turnover/Gross receipt as per the GST return filed 2104346

Financial Particulars of Business

Partners/Members own capital 50000

Sundry creditors Nil

Total capital and liabilities 50000

Inventories Nil

Sundry debtors Nil

Cash-in-hand 50000

Other assets Nil

Total assets 50000

Balance Sheet (Regular books of account of business or profession are not maintained)

Sundry Debtors Rs. Nil Sundry Creditors Rs. Nil

Stock-in-trade Rs. Nil Cash Balance Rs. 50000.00

Details of Turnover as per GSTR-3B

Sr. No. GSTIN ARN Date of filing Return Period Taxable Turnover Total Turnover

1 05ADFPA4932M2ZN AA050420067999U 23/06/2020 APRIL,2020 0.00 0.00

2 05ADFPA4932M2ZN AA050520050812P 23/06/2020 MAY,2020 0.00 0.00

3 05ADFPA4932M2ZN AA050820115078J 24/09/2020 AUGUST,2020 432197.31 432197.31

4 05ADFPA4932M2ZN AA050620227105T 24/09/2020 JUNE,2020 45715.00 45715.00

5 05ADFPA4932M2ZN AA050720142221X 24/09/2020 JULY,2020 84515.73 84515.73

6 05ADFPA4932M2ZN AA050920094090H 24/10/2020 SEPTEMBER,2020 478331.00 478331.00

7 05ADFPA4932M2ZN AA051020131956M 23/11/2020 OCTOBER,2020 0.00 0.00

8 05ADFPA4932M2ZN AA050321199421I 20/04/2021 MARCH,2021 0.00 0.00

9 05ADFPA4932M2ZN AA0512202226310 24/01/2021 DECEMBER,2020 0.00 0.00

Total 1040759.04 1040759.04

You might also like

- ComputationDocument2 pagesComputationThe KingNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- UntitledDocument2 pagesUntitledJhalak AgarwalNo ratings yet

- Computation 2021-22Document2 pagesComputation 2021-22priyapatelfreeNo ratings yet

- PDF - 06-12-22 11-19-08Document4 pagesPDF - 06-12-22 11-19-08Jay SharmaNo ratings yet

- COMDocument2 pagesCOMkrishnajielectricNo ratings yet

- Coi PDFDocument2 pagesCoi PDFPixel computerNo ratings yet

- GgjdfhijfrbjcDocument3 pagesGgjdfhijfrbjcdmqktchxphNo ratings yet

- COM1Document2 pagesCOM1jikadarasamrat29No ratings yet

- Chandrakanth Yerram AY 2021-22 ComputationDocument2 pagesChandrakanth Yerram AY 2021-22 ComputationChandrakanth ChanduNo ratings yet

- Genius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21Document2 pagesGenius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21darshilNo ratings yet

- Prakash - Computation AY 2020-21Document1 pagePrakash - Computation AY 2020-21Koppisetti KrishnaNo ratings yet

- Amit Kumar Mudgal ComputationDocument4 pagesAmit Kumar Mudgal ComputationSHELESH GARGNo ratings yet

- Anoop Fy 18-19 ComputationDocument3 pagesAnoop Fy 18-19 ComputationGaurav RawatNo ratings yet

- Com (Rajubhai)Document2 pagesCom (Rajubhai)Gautam JainNo ratings yet

- UntitledDocument3 pagesUntitledVAIBHAV ARORANo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Arwpk6809n 2022Document2 pagesArwpk6809n 2022sehaj raizadaNo ratings yet

- Bojo Rad Receipt, 7-12, IT Return, PDFDocument15 pagesBojo Rad Receipt, 7-12, IT Return, PDFn2ulooteraNo ratings yet

- Details of T.D.S. On Non-SalaryDocument2 pagesDetails of T.D.S. On Non-SalaryFrench HubbNo ratings yet

- Comp 18-19 PDFDocument2 pagesComp 18-19 PDFFrench HubbNo ratings yet

- SUMITRA DEVI Comp 23-2 4Document2 pagesSUMITRA DEVI Comp 23-2 4tax sevenNo ratings yet

- Computation 12Document3 pagesComputation 12acme financialNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Compu PDFDocument4 pagesCompu PDFMihir ThakkarNo ratings yet

- M/S Siree Sainath Enterprises Nehru Gram, Nathanpur Dehradun UttarakhandDocument16 pagesM/S Siree Sainath Enterprises Nehru Gram, Nathanpur Dehradun UttarakhandRAJESH SHARMANo ratings yet

- PSP Management & Consultants Private Limited, Delhi: Amount in RupeesDocument6 pagesPSP Management & Consultants Private Limited, Delhi: Amount in Rupeesarun_cool20No ratings yet

- Mus Bhai Munda ComputitationDocument3 pagesMus Bhai Munda Computitationsatish devdaNo ratings yet

- Computation Anita SareeDocument3 pagesComputation Anita SareeSURYAKANT PATHAKNo ratings yet

- Pawan CMP 2021Document2 pagesPawan CMP 2021Daman SharmaNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Yusuf Bhai Munda Computation 2019-20Document3 pagesYusuf Bhai Munda Computation 2019-20satish devdaNo ratings yet

- COMPUTATIONDocument4 pagesCOMPUTATIONkambojnaresh693No ratings yet

- Arvind Bhawsar - (02374) - (2023-2024)Document6 pagesArvind Bhawsar - (02374) - (2023-2024)Sourabh YadavNo ratings yet

- Rajesh DwivediDocument25 pagesRajesh Dwivediblack kobraNo ratings yet

- Comp Anubhav Garg 23-24Document5 pagesComp Anubhav Garg 23-24prateek gangwaniNo ratings yet

- Nirima Sahu ComputationDocument2 pagesNirima Sahu Computationbrs consultancyNo ratings yet

- Attachment UnlockedDocument3 pagesAttachment Unlockedmbhalani1207No ratings yet

- R K S Infra Computation 2022Document4 pagesR K S Infra Computation 2022birpal singhNo ratings yet

- Computation Fy 21-22Document4 pagesComputation Fy 21-22rakeshkaydalwarNo ratings yet

- Please Send Me HackDocument3 pagesPlease Send Me Hackgaurav.verma17No ratings yet

- Coi 22-23Document2 pagesCoi 22-23Ruloans VaishaliNo ratings yet

- AmarDocument5 pagesAmarASHISH BHONDENo ratings yet

- Case Study 3 SolutionDocument2 pagesCase Study 3 Solutiongaurilakhmani2003No ratings yet

- PDF - 13-02-23 14-59-47Document2 pagesPDF - 13-02-23 14-59-47Miraculous IndiaNo ratings yet

- Dharmbir Computation 22-23 (1) - 1Document2 pagesDharmbir Computation 22-23 (1) - 1Ashish SehrawatNo ratings yet

- Nadaf Com 23-24Document2 pagesNadaf Com 23-24mubaraknadaf1988No ratings yet

- ComputationDocument2 pagesComputationprr technologiesNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- Computation of Total Income Income From House Property (Chapter IV C) 372534 1Document4 pagesComputation of Total Income Income From House Property (Chapter IV C) 372534 1ramanNo ratings yet

- Deepak ComputationDocument3 pagesDeepak ComputationRavi YadavNo ratings yet

- Computation FY 2021-22Document2 pagesComputation FY 2021-22mandhalanarshimlu48141No ratings yet

- Self-Occupied: Com Putati On of I Ncom E and Tax Pai DDocument5 pagesSelf-Occupied: Com Putati On of I Ncom E and Tax Pai DAnshika GoelNo ratings yet

- Anoop Itr AY 22-23 COMPUTATIONDocument2 pagesAnoop Itr AY 22-23 COMPUTATIONPavitar singhNo ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet

- Ashok Garg PDFDocument3 pagesAshok Garg PDFGourav sheelNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilDocument5 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilPadmalata ModekurtyNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- Hemant Kumar Agarwal Ay 21-22Document1 pageHemant Kumar Agarwal Ay 21-22Deepanshu AgarwalNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- DevaluationDocument4 pagesDevaluationYuvraj Vikram singhNo ratings yet

- Multiple Choice Question Bank (MCQ) Term - I: Class - XIIDocument59 pagesMultiple Choice Question Bank (MCQ) Term - I: Class - XIIDiya KhandelwalNo ratings yet

- An Introduction To Equity ValuationDocument37 pagesAn Introduction To Equity ValuationAamir Hamza MehediNo ratings yet

- Government InterventionDocument28 pagesGovernment Interventiontongai_mutengwa5194No ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisRudo AshedowyNo ratings yet

- PGBP - PaperDocument6 pagesPGBP - PapermuskaanNo ratings yet

- Absolute Deed of SaleDocument3 pagesAbsolute Deed of SaleNN DDL67% (3)

- Operations and Productivity SlidesDocument47 pagesOperations and Productivity SlidesgardeziiNo ratings yet

- COMPREHENSIVE CASE 1 QuestionDocument4 pagesCOMPREHENSIVE CASE 1 QuestionlurdeparduNo ratings yet

- Trading NR7 SetupDocument24 pagesTrading NR7 SetupQuyên NguyễnNo ratings yet

- holdcoPIK FridsonDocument30 pagesholdcoPIK Fridsongbana999No ratings yet

- Charles Case StudyDocument4 pagesCharles Case StudyTracy KiarieNo ratings yet

- Knowledge Is Power, So Be As Powerful As You Can!Document27 pagesKnowledge Is Power, So Be As Powerful As You Can!Ahemad ShamimNo ratings yet

- Report LI at BSNDocument8 pagesReport LI at BSNSitie Fatima ElaniNo ratings yet

- NCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Document22 pagesNCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Cedric ThompsonNo ratings yet

- Financial Management:: Professional Level Suggested Answers Nov-Dec 2020Document13 pagesFinancial Management:: Professional Level Suggested Answers Nov-Dec 2020Md Aliul AlimNo ratings yet

- IPP Report PDFDocument296 pagesIPP Report PDFMuhammad ZubairNo ratings yet

- Quant Checklist 217 PDF 2022 by Aashish AroraDocument94 pagesQuant Checklist 217 PDF 2022 by Aashish AroraSatyajit RoyNo ratings yet

- FDGDFDocument3 pagesFDGDF1No ratings yet

- First Metro Investment vs. Este. Del SolDocument3 pagesFirst Metro Investment vs. Este. Del SolAce MarjorieNo ratings yet

- Variance Analysis (Practice Problems)Document7 pagesVariance Analysis (Practice Problems)Godwin De GuzmanNo ratings yet

- Accounting Standard - 21Document14 pagesAccounting Standard - 21Devmalya MazumderNo ratings yet

- Business Intelligence & Analytics: HexawareDocument6 pagesBusiness Intelligence & Analytics: HexawaretanveerwajidNo ratings yet

- SCDL BusinessLaw Assignment Oct20Document9 pagesSCDL BusinessLaw Assignment Oct20priyajeejo100% (1)

- City Limits Magazine, November 1984 IssueDocument32 pagesCity Limits Magazine, November 1984 IssueCity Limits (New York)No ratings yet

- Techno - Entrepreneurship PPT 1Document9 pagesTechno - Entrepreneurship PPT 1Ti Amo Per SempreNo ratings yet

- Valuation of Equity ShareDocument11 pagesValuation of Equity ShareSarthak SharmaNo ratings yet

- Annual Report 2015 16 PDFDocument132 pagesAnnual Report 2015 16 PDFVickesh MalkaniNo ratings yet

- Axis Offer Latter For SalariedDocument4 pagesAxis Offer Latter For Salariedyoursmanish8312No ratings yet

- A Critique of The Anglo-American Model of Corporate GovernanceDocument3 pagesA Critique of The Anglo-American Model of Corporate GovernanceSabrina MilaNo ratings yet