Professional Documents

Culture Documents

Anandam

Uploaded by

Vedant PradhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anandam

Uploaded by

Vedant PradhanCopyright:

Available Formats

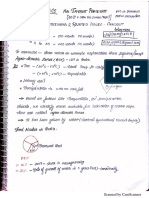

Income Statement 2012-13 2013-14 2014-15

Sales

Cash 200 480 800

Credit 1800 4320 7200

Total Sales 2000 4800 8000

Cost of Goods Sold 1240 2832 4800

Gross Profit 760 1968 3200

Operating Expenses

General, Administation,and selling expenses 80 450 1000

Depreciation 100 400 660

Interest Expenses (on borrowings) 60 158 340

Total Expenses 240 1008 2000

Profit before tax (PBT) 520 960 1200

Tax @30% 156 288 360

Profit after tax (PAT) 364 672 840

Profit before interest and tax (PBIT) 580 1118 1540

Ratio Analysis for Company 2012-13 2013-14 2014-15

Current Ratio 2.54 1.79 1.60

Quick Ratio 1.31 0.93 0.79

Receivables Turnover 5.33 4.44

Inventory Turnover 5.27 4.27

Receivables Days 68.44 82.13

Inventory Days 69.20 85.55

Debt-to-Equity Ratio 0.61 0.77 1.25

Net Profit Ratio 18.20 14.00 10.50

Return on Equity 48.00 46.67

Return on Total Assets 16.47 11.39

Interest Coverage Ratio 9.67 7.08 4.53

Balance Sheet 2012-13 2013-14 2014-15

Assets

Fixed assets (net of depreciation) 1900 2500 4700

Current assets

Cash and cash equivalents 40 100 106

Accounts receivable 300 1500 2100

Inventories 320 1500 2250

Total Current Assets 660 3100 4456

Total Assets 2560 5600 9156

Equity & Liabilities

Equity share capital (shares of Rs 10 each) 1200 1600 2000

Reserve & Surpulus 364 1036 1876

Long-term borrowings 736 1236 2500

Current liabilities 260 1728 2780

Total Liabilities 2560 5600 9156

Ratio Analysis for Industry Ratio Analysis for Anandam 2015

Current Ratio 2.3 Current Ratio 1.6

Quick Ratio 1.2 Quick Ratio 0.79

Receivables Turnover 7 times Receivables Turnover 4.44 times

Inventory Turnover 4.85 times Inventory Turnover 4.27 times

Receivables Days 52 days Receivables Days 82.13

Inventory Days 75 days Inventory Days 85.55

Debt-to-Equity Ratio 35% Debt-to-Equity Ratio 125%

Net Profit Ratio 18% Net Profit Ratio 10.50%

Return on Equity 22% Return on Equity 46.67%

Return on Total Assets 10% Return on Total Assets 11.39%

Interest Coverage Ratio 10 Interest Coverage Ratio 4.53

You might also like

- Summary Sheet - Helpful For Retention For Corporate GovernanceDocument16 pagesSummary Sheet - Helpful For Retention For Corporate GovernanceVedant PradhanNo ratings yet

- Keywords: Edible Coatings and Films, Herbal Films, Shelf Life, Food Preservation, NovelDocument30 pagesKeywords: Edible Coatings and Films, Herbal Films, Shelf Life, Food Preservation, NovelVedant PradhanNo ratings yet

- Herbal Edible FilmsDocument8 pagesHerbal Edible FilmsVedant PradhanNo ratings yet

- Scanned by CamscannerDocument4 pagesScanned by CamscannerVedant PradhanNo ratings yet

- Scanned by CamscannerDocument6 pagesScanned by CamscannerVedant PradhanNo ratings yet

- Ethics PathakDocument67 pagesEthics PathakVedant PradhanNo ratings yet

- Eco. Jayant PDFDocument79 pagesEco. Jayant PDFVedant PradhanNo ratings yet

- BiomesDocument10 pagesBiomesVedant PradhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Standard Costing and Its Role in Today's Manufacturing EnvironmentDocument10 pagesStandard Costing and Its Role in Today's Manufacturing Environmentsuraj5726100% (2)

- Chap 008Document69 pagesChap 008dbjnNo ratings yet

- Case Study Zara: Presented To: Department of Management Studies Mnit JaipurDocument20 pagesCase Study Zara: Presented To: Department of Management Studies Mnit Jaipurashishjoshi85No ratings yet

- Important EWM TablesDocument6 pagesImportant EWM TablespraveenNo ratings yet

- Retail Whitepaper SKU Rationalization Technique Inventory Optimization Retail Sector 0312 1Document17 pagesRetail Whitepaper SKU Rationalization Technique Inventory Optimization Retail Sector 0312 1Charles BinuNo ratings yet

- Assigment1 - Il - LatestDocument35 pagesAssigment1 - Il - LatestNurul HidayahNo ratings yet

- Inventory Management PDF 1 8Document8 pagesInventory Management PDF 1 8sheikhNo ratings yet

- STRATEGIC COSTMan QUIZ 3Document5 pagesSTRATEGIC COSTMan QUIZ 3StephannieArreolaNo ratings yet

- Inventory Estimation and LCNRV Sample ProblemsDocument3 pagesInventory Estimation and LCNRV Sample Problemsaldric taclanNo ratings yet

- Billerudkorsnas Supplier Self Assessment QuestionnaireDocument7 pagesBillerudkorsnas Supplier Self Assessment QuestionnaireDdivya KumarNo ratings yet

- Ipls PDFDocument119 pagesIpls PDFTekle TibebuNo ratings yet

- Case 3.1Document2 pagesCase 3.1Sandeep Agrawal100% (6)

- Study of Inventory Management in Sonalika International TractorsDocument75 pagesStudy of Inventory Management in Sonalika International TractorsDeepak Singh100% (2)

- Hasnol (B.i)Document5 pagesHasnol (B.i)Mohd Nazri AwangNo ratings yet

- Migo Mb1B MB51 Mb1A Mb1C Mb5B MB52 MB01 MB31 Omjj MB21 MBST MB90 Mb5L Mb5TDocument3 pagesMigo Mb1B MB51 Mb1A Mb1C Mb5B MB52 MB01 MB31 Omjj MB21 MBST MB90 Mb5L Mb5TKetan KarmaseNo ratings yet

- SYSPRO ERP SolutionDocument17 pagesSYSPRO ERP SolutionericonasisNo ratings yet

- 03 0450 12 MS Prov Rma 08022023110937Document24 pages03 0450 12 MS Prov Rma 08022023110937abin alexanderNo ratings yet

- Sales & Operations Planning: An Introduction Sales & Operations Planning: An IntroductionDocument36 pagesSales & Operations Planning: An Introduction Sales & Operations Planning: An IntroductionMeshayu RenaNo ratings yet

- GHI Company Comparative Balance Sheet For The Year 2015 & 2016Document3 pagesGHI Company Comparative Balance Sheet For The Year 2015 & 2016Kl HumiwatNo ratings yet

- Rancangan Perniagaan BI PDFDocument45 pagesRancangan Perniagaan BI PDFAlFakir Fikri AlTakiriNo ratings yet

- NIBCO - Copper FittingsDocument56 pagesNIBCO - Copper Fittingsjpdavila205No ratings yet

- Spares Provisioning For MaintenanceDocument14 pagesSpares Provisioning For MaintenanceTolasa Namomsa100% (2)

- Chapter 4 HRMDocument28 pagesChapter 4 HRMJatin MandhyanNo ratings yet

- P8 Book v2.0Document588 pagesP8 Book v2.0baalshastri pandit100% (1)

- Working Capital ManagementDocument71 pagesWorking Capital ManagementNaveen Kumar Rudrangi100% (1)

- Resume Psak 14: Inventories: Conversion CostDocument9 pagesResume Psak 14: Inventories: Conversion Costcindy azarine dimitriNo ratings yet

- Stock Management of BIGBAZARDocument16 pagesStock Management of BIGBAZARNikhilMahindrakarNo ratings yet

- Ratio AnalysisDocument12 pagesRatio AnalysisShivam VeerNo ratings yet

- BuggetDocument45 pagesBuggetTrexie De Vera JaymeNo ratings yet