0% found this document useful (0 votes)

629 views45 pagesBugget

The document discusses accounting topics related to master budgets and strategic business analysis. It provides information on:

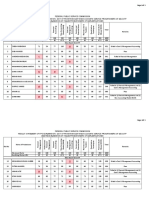

1) What a master budget consists of and its importance for financial planning and identifying areas for adjustment.

2) The components of an operating budget, including sales, production, materials, labor, and expenses budgets, and of a financial budget.

3) How to create budgets for sales, cash collections, inventory purchases, production, direct materials, and cash disbursements.

Uploaded by

Trexie De Vera JaymeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

629 views45 pagesBugget

The document discusses accounting topics related to master budgets and strategic business analysis. It provides information on:

1) What a master budget consists of and its importance for financial planning and identifying areas for adjustment.

2) The components of an operating budget, including sales, production, materials, labor, and expenses budgets, and of a financial budget.

3) How to create budgets for sales, cash collections, inventory purchases, production, direct materials, and cash disbursements.

Uploaded by

Trexie De Vera JaymeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd