Professional Documents

Culture Documents

Evaluate Earth Mover Acquisition

Uploaded by

MohOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluate Earth Mover Acquisition

Uploaded by

MohCopyright:

Available Formats

Finance Assignment

You have been asked by the president of the Farr Construction Company to evaluate the proposed

acquisition of a new earth mover. The mover’s basic price is $50,000, and it would cost another $10,000

to modify it for special use. Assume that the mover falls into the MACRS 3-year class (see Appendix

11A), that it would be sold after 3 years for $20,000, and that it would require an increase in net

working capital (spare parts inventory) of $2,000 at the start of the project. This working capital will be

recovered at Year 3. The earth mover would have no effect on revenues, but it is expected to save the

firm $20,000 per year in before-tax operating costs, mainly labor. The firm’s marginal federal-plus-state

tax rate is 25%.

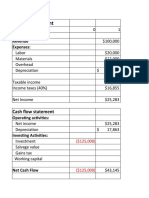

a. What are the Year-0 cash flows?

b. What are the operating cash flows in Years 1, 2, and 3?

c. What are the additional (nonoperating) cash flows in Year 3?

d. If the project’s cost of capital is 10%, should the earth mover be purchased?

Solution:

a.

Year 1 Year 2 Year 3 Year 4

0.3333 0.4445 0.1481 0.0741

$19,998 $26,670 $8,886 $4,446

CF0 CF1 CF2 CF3

CAPEX: $- $- $-

($50,000)

($10,000) $20,000 $20,000 $20,000

($19,998) ($26,670) ($8,886)

$2 ($6,670) $11,114

NWC:

($2,000) ($0.5) $1,667.5 ($2,778.5)

$1.5 ($5,002.5) $8,335.5

$19,998 $26,670 $8,886

$16,111.5

$2000

($62,000) $19,999.5 $21,667.5 $35,333

CF0 CF1 CF2 CF3

($62,000) $19,999.5 $21,667.5 $35,333

Book Value of Machine = $4,446

Market Value = $20,000

Price = 20,000-4,446 = $15,554

After TAX = 15,554*25% = $3,888.5

Profit = $20,000-3,888.5 = $16,111.5

Calculate NPV:

CF 1 CF 2 CF 3

NPV = CF0 + 1

+ 2

+ 3

(1+i) (1+i) (1+ i)

19,999.5 21,667.5 35,333

= 62000 + 1

+ 2

+ 3

(1.1) (1.1) (1.1)

NPV = 634.59 > 1 invest

You might also like

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- FM II Assignment 3 Solution W22Document3 pagesFM II Assignment 3 Solution W22Farah ImamiNo ratings yet

- Compare MIRR calculations using different methodsDocument11 pagesCompare MIRR calculations using different methodsMeghana ErapagaNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- Capital Budgeting Analysis of Overseas SubsidiaryDocument12 pagesCapital Budgeting Analysis of Overseas SubsidiaryThao Bui ThiNo ratings yet

- Pickins Mining Case Analysis - NPV, IRR, PaybackDocument5 pagesPickins Mining Case Analysis - NPV, IRR, PaybackWarda AhsanNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- Bacani HW FinalsDocument10 pagesBacani HW FinalsKyle BacaniNo ratings yet

- The NPV Is Positively Related To The The Value of Foreign CurrencyDocument10 pagesThe NPV Is Positively Related To The The Value of Foreign CurrencyYulia Tri CahyaniNo ratings yet

- Making Capital Investment DecisionsDocument70 pagesMaking Capital Investment DecisionsBussines LearnNo ratings yet

- Assignment 4 - Contemporary Engineering BookDocument9 pagesAssignment 4 - Contemporary Engineering BookDhiraj NayakNo ratings yet

- Lecture 5 - SolutionDocument7 pagesLecture 5 - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- Team 3 - NO-SOLUTIONS-INVESTMENT-DECISIONS-2-CONCH-PART1Document6 pagesTeam 3 - NO-SOLUTIONS-INVESTMENT-DECISIONS-2-CONCH-PART1Meriam HaouesNo ratings yet

- Solutions PracProblems Visit 4Document19 pagesSolutions PracProblems Visit 4Falak HanifNo ratings yet

- Assignment 7 ReplacementDocument4 pagesAssignment 7 ReplacementKhánh Đoan Lê ĐìnhNo ratings yet

- 19.6M initial investment cash flow analysisDocument13 pages19.6M initial investment cash flow analysisTerry Conrad KingNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Manufacturing Cash Flow ProjectionsDocument6 pagesManufacturing Cash Flow Projectionsmaran_navNo ratings yet

- The NPV Is Positively Related To The The Value of Foreign CurrencyDocument14 pagesThe NPV Is Positively Related To The The Value of Foreign CurrencyALI SHER HaidriNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Solutions On Capital Budgeting AssignmentsDocument3 pagesSolutions On Capital Budgeting AssignmentsjakezzionNo ratings yet

- MK Cap Budgeting CH 9 - 10 Ross PDFDocument17 pagesMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- Answer Chapter11 Cash Flow EstimationDocument3 pagesAnswer Chapter11 Cash Flow EstimationIsmah ParkNo ratings yet

- EE - Assignment Chapter 7 SolutionDocument7 pagesEE - Assignment Chapter 7 SolutionXuân ThànhNo ratings yet

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Start-up costs and break-even analysisDocument7 pagesStart-up costs and break-even analysisANo ratings yet

- FM II Assignment 2 Solution W22Document5 pagesFM II Assignment 2 Solution W22Farah ImamiNo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Excel Busi Finance FinDocument2 pagesExcel Busi Finance Finapi-258913756No ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Week 8 Capital Budgeting ApplicationsDocument6 pagesWeek 8 Capital Budgeting ApplicationsFayzan RafiqNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument9 pagesScenario Summary: Changing Cells: Result CellsatpugajoopNo ratings yet

- BAP Corporation Investment Proposal ReviewDocument4 pagesBAP Corporation Investment Proposal Reviewmohitgaba19No ratings yet

- Group Assigment CONCH PART1Document4 pagesGroup Assigment CONCH PART1BashirNo ratings yet

- Home Work 1 Corporate FinanceDocument8 pagesHome Work 1 Corporate FinanceAlia ShabbirNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet