Professional Documents

Culture Documents

2022 Budget - Changes in Duty Eff 01 May 2022

Uploaded by

jessyshah0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

2022 Budget - Changes In Duty Eff 01 May 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pages2022 Budget - Changes in Duty Eff 01 May 2022

Uploaded by

jessyshahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

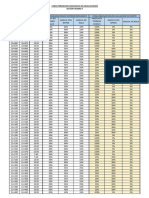

1ST MAY DUTY CHANGES

HSN CODE ITEM NAME CURRENT DUTY INCREASED DUTY

1012100 pure-bred breeding horses 0% 30%

0511 99 11 Artemia 5% 30%

0511 10 00 Bovine Semen 5% 30%

0801 31 00 Cashew nuts in shell 2.50% 30%

0802 51 00, 0802 52 00 All goods (pistachios in shell, shelled) 10% 30%

0804 10 20, 0804 10 30 All goods(Dates) 20% 30%

0805 10 00, 0805 50 00, 0806 10 00, 0808 30 00 or 0808 40 00 All goods (citrus fruit, fresh) 30% 40%

0904 11 10 Long pepper (Piper longum) 30% 70%

*0907 All goods (cloves) 35% 70%

1001 19 00 or 1001 99 10 Wheat 40% 100%

1005 10 00, 1007 or 1008 21, 1008 29 All goods (maize (corn) 50% 70%

100590 All goods (pop corn) 50% 60%

1104 22 00 De-hulled oat grain 15% 30%

1107 10 00, 1108 12 00 All goods (malt) 30% 40%

1207 91 00 All goods (other oil seed and oleginous fruits) 20% 30%

1209 91 or 1209 99 All goods (seeds, fruits and spores) 5% 30%

1401 10 00 Bamboo 25% 30%

1702 11 or 1702 19 All goods (other sugars etc) 25% 30%

1905 31 00 or 1905 32 All goods (waffles and wafers,sweet biscuits etc) 30% 45%

2207 20 00 All goods (ethly alcohol) 5% 30%

2309 10 00 All goods (animal feeding preparations) 20% 30%

Chapter 23 (except 23091000) All goods (de-oiled cake, rice bran etc) 15% 30%

25 (except 2515, 2516, 2523, 2524) All goods (salt, natural sand, kaolin, clays, chalk,pebbles, ,mica etc) 5% 10%

2503 00 10 Crude or unrefined sulphur 2.50% 10%

2510 Rock phosphate 2.50% 5%

2520 10 10, 2520 10 20, 2520 10 90 Gypsum 2.50% 10%

2523 29 All goods (portland cements) 0% 10%

2528 All goods (natural borated) 2.50% 10%

2601 to 2617 All goods (iron ores, maganese ores) 2.50% 5%

2604 00 00 Nickel Ore and Concentrate 0% 5%

2612 10 00 Uranium Ore and Concentrates, for generation of Nuclear Power 0% 5%

2620 11 00, 2620 19 All goods (hard zinc spelter) 5% 10%

2620 30 All goods (brass dross) 5% 10%

2701, 2702, 2703 All goods (coal, briquettes, lignite,peat) 5% 10%

2704, 2705, 2706 All goods (coke, tar etc) 5% 10%

2707 All goods (benzol, toluol etc oil) 2.50% 10%

2708 All goods (pitches coke) 5% 10%

2710 12 50 Avgas 0% 10%

2710, 2711, 2712, 2713, 2714 or 2715 All goods (excluding naphtha), other than the goods 5% 10%

2710 12 21, 2710 12 22, 2710 12 29 Naphtha 2.50% 10%

2711 19 10, 2711 19 20 Liquefied petroleum gases (LPG) 5% 10%

2711 12 00 Propane 2.50% 10%

2711 13 00 Butanes 2.50% 10%

2713 12 10, 2713 12 90 Calcined Petroleum Coke 7.50% 10%

28 (except 2801, 2802, 2803, 2804, 2805, 2 809 20 10, 2810 00 20, 2814, 2823 00 10, 2837 11 00 and 2843) All goods 7.50% 10%

2801 20 00 Iodine 2.50% 5%

2818 20 10 All goods (alumina calcined) 5% 10%

2825 40 00 Nickel oxide and hydroxide 0% 10%

2844 20 00 All goods, for generation of Nuclear Power 0% 10%

29(except 29054300, 29054400 and 29337100) All goods 7.50% 10%

2901, 2902 (except 2902 43 00, 2902 50 00) All goods 2.50% 10%

2902 41 00 o-xylene 0% 10%

2903 (except 2903 11 10, 2903 12 00, 2903 13 00, 2903 22 00) or 2904 All goods 5% 10%

2902 43 00 p-xylene 0% 10%

2902 50 00 Styrene 2% 10%

2903 15 00 Ethylene Dichloride (EDC) 0% 10%

2903 21 00 Vinyl chloride monomer (VCM) 2% 10%

2905 31 00 Mono ethylene glycol (MEG) 5% 10%

2910 20 00 Methyl oxirane (propylene oxide) 5% 10%

2917 36 00 Purified Terephthalic Acid (PTA), Medium Quality Terephthalic Acid (MTA) and Qualified Terephthalic 5%Acid (QTA) 10%

2917 37 00 Dimethyl terephthalate (DMT) 5% 10%

2926 10 0 Acrylonitrile 2.50% 10%

293371 00 Caprolactam 5% 10%

2905 43 00, 2905 44 00, 3301, 3501, 3502, 3503, 3504, 3505, 3809 10 00 All goods 20% 30%

31 (except 31022100, 31023000, 31025000, 31043000, 31052000, 31053000, 31054000, 31055100, 31055900, 31056000,All goods31059010,

(fertilisers)

31059090) 7.50% 10%

3201, 3202, 3203, 3204, 3205 00 00, 3206 (except 3206 11, 3201 20 00 and 3206 19 00) or 3207 All Goods (tanning extract,coloring matter, etc) 7.50% 10%

3201 20 00 Wattle extract 2.50% 10%

3403 All Goods(lubricating preparations) 7.50% 10%

3801, 3802, 3803 00 00, 3804, 3805, 3806, 3807, 3809 (except 3809 10 00), 3810, 3812, 3815, 3816 00 00, 3817, 3821

All goods

00 00,CHEMICALS)

3824 (exceptother

3824 than

60 andthose

3824at99

S.00)

No.or

250A

3827 7.50% 10%

3823 11 00, 3823 12 00, 3823 13 00, 3823 19 00 or 3823 70 All goods 7.50% 30%

3901 to 3915 (except 3904 and 3908) All goods LDPE, HDPE, POLYMERS,POLYACETALS, PVA,ACRYLIC POLYMERS 7.50% 10%

3906 90 70 Sodium polyacrylate 5% 10%

4001 21, 4001 22, 4001 29 All goods (SMOKED SHEETS NATURAL RUBBER) 25% or Rs. 30/- per kg, whichever

25% is lower

5101 All goods (WOOL) 2.50% 25%

5102 All goods 5% 25%

5103 10 10, 5103 20 10, 5103 20 20, 5103 20 90 Wool Waste 5% 25%

5103 10 90, 5103 30 00 All goods other than Wool waste 10% 25%

5105 29 10 Wool Tops 2.50% 20%

5201 All goods (COTTON) 5% 25%

5301 All goods (FLAX, RAW) 0% 30%

5303 10 00 Raw jute 5% 25%

5401, 5402, 5403, 5404, 5405 00 00 or 5406 All goods (sewing thread,synthetic yarn,filament yarn,monofilament yarn) 5% 20%

5501 to 5510 All goods (filament tow,staple fibers, waste, yarn,sewing thread) 5% 20%

5511 All goods 5% 25%

6815 91 00, 6901, 6902, or 6903 All goods 7.50% 10%

7001 00 10 All goods (ENAMEL GLASS RODS) 5% 10%

7015 10 10 Rough ophthalmic blanks, 5% 10%

7101 10 10 and 7101 21 00 Raw pearls 5% 10%

7110 31 00, 7110 39 00 Rhodium 2.50% 10%

7201, 7202, 7203, 7205 (excluding 7226 11 00) All goods (PIG IRON,FERRO ALLOY,FERROUS ) 5% 15%

7202 60 00 Ferro-nickel 2.50% 15%

7204 All goods [Effective rate of ‘Nil’ will operate through S. No. 368 of 50/2017- Customs till 01.04.2023] 2.50%

SCRAP 15%

7404 COPPER WASTE SCRAP 2.50% 5%

7411 or 7412 All goods (COPPER TUBE & PIPE, FITTING) 7.50% 10%

75 All goods (NICKEL) 0% 5%

7602 Aluminium scrap 2.50% 5%

8105 20 10 Cobalt mattes and other intermediate products of cobalt metallurgy 2.50% 5%

8110 10 00, 8110 20 00 All Goods (MANGANESE) 2.50% 5%

8407 21 00 Outboard motors 5% 15%

8419 19 20 Water heaters 7.50% 10%

8421 39 20, 8421 39 90 All goods (FILTERS) 7.50% 10%

8502 (except 8502 11 00, 8502 20 10, 8502 40 00) All goods (ELECTRIC GENERATING SET) 7.50% 10%

8503 00 10, 8503 00 21 or 8503 00 29 All goods (PARTS OF MOTOR) 7.50% 10%

8504 10 10, 8504 10 20 or 8504 10 90 All goods ELECTRIC TRANSFORMER 7.50% 10%

8546 All goods ELECTRIC INSULATOR 7.50% 10%

8547 All goods FITTING 7.50% 10%

9030 31 00, 9030 90 10 All goods 7.50% 10%

8802 11 00 and 8802 12 00 Helicopters 2.50% 10%

8902 00 10 Trawlers and other fishing vessels 0% 10%

8905 10 00 All goods ,part of repair of dregers 0% 10%

8907 10 00 All goods, floating structures, raft, etc 0% 10%

8908 00 00 All goods vessels 2.50% 10%

9018 32 30, 9018 50 20, 9018 90 21, 9018 90 24, 9018 90 43, 9018 90 95, 9018 90 96, 9018 90 97, 9018 90 98 Goods required for medical, surgical, dental or veterinary use 5% 10%

9018 (other than items in entry at Sr. No. 563 and 9018 90 99), 9019 (other than 9019 10 20), 9020, 9021 All goods 7.50% 10%

9108, 9110 or 9114 30 10 Watch dials and watch movements 5% 10%

9506 91 All goods 10% 20%

You might also like

- Government of Pakistan Ministry of Finance (Revenue Division)Document17 pagesGovernment of Pakistan Ministry of Finance (Revenue Division)Muhammad RaheelNo ratings yet

- 2023 Letter-Control-Bodies-Authorities-Import-Organic-Products-From-Certain-Countries - enDocument8 pages2023 Letter-Control-Bodies-Authorities-Import-Organic-Products-From-Certain-Countries - enAdinaNo ratings yet

- Factory/ Explicit Cost 300,000.00 Implicit/ Opportunity Cost 15,000.00 Revenue 450,000.00Document7 pagesFactory/ Explicit Cost 300,000.00 Implicit/ Opportunity Cost 15,000.00 Revenue 450,000.00Jhon JseNo ratings yet

- İmalat Mühendisliği: Bin Frekans Kümülatif % Bin Frekans Kümülatif %Document11 pagesİmalat Mühendisliği: Bin Frekans Kümülatif % Bin Frekans Kümülatif %Gökhan BilginNo ratings yet

- Factor Low Level (-1) High Level (+1)Document3 pagesFactor Low Level (-1) High Level (+1)Mirac B KayaNo ratings yet

- Profit - Volume Graph Unit FC VC Total Cost Revenue ProftDocument3 pagesProfit - Volume Graph Unit FC VC Total Cost Revenue ProftArnold BernasNo ratings yet

- Notification No. 68 /2012-CustomsDocument40 pagesNotification No. 68 /2012-Customsrithbaan basuNo ratings yet

- Van Westerndorp Pricing (4826)Document3 pagesVan Westerndorp Pricing (4826)Mrinal DuttNo ratings yet

- Disability List Exemptions List 32 From 2012Document160 pagesDisability List Exemptions List 32 From 2012Vaishnavi JayakumarNo ratings yet

- Balance General: (Millones de Pesos) Años 1 2 3 ActivosDocument1 pageBalance General: (Millones de Pesos) Años 1 2 3 ActivosDavid MejíaNo ratings yet

- BCG Matrix of AppleDocument3 pagesBCG Matrix of Applevishal bansiwalNo ratings yet

- All GFP TablesDocument2 pagesAll GFP TablesAaina GoyalNo ratings yet

- Particle Separator Guidelines 1996 PDFDocument5 pagesParticle Separator Guidelines 1996 PDFRicardo MachadoNo ratings yet

- Grafik Pengendalian ProsesDocument2 pagesGrafik Pengendalian ProsesArya Adji PrastyaNo ratings yet

- Grafik Pengendalian ProsesDocument2 pagesGrafik Pengendalian ProsesArya Adji PrastyaNo ratings yet

- Pengendalian Proporsional Reverse (Proporsional 20)Document2 pagesPengendalian Proporsional Reverse (Proporsional 20)Arya Adji PrastyaNo ratings yet

- New DutyDocument6 pagesNew DutyPropane TechNo ratings yet

- Dashboard 2Document3 pagesDashboard 2Veallu JagadaseenNo ratings yet

- G.E. 183 PDFDocument118 pagesG.E. 183 PDFchandramohanNo ratings yet

- Histogram: Bin Frequencycumulative % Bin Frequencycumulative %Document3 pagesHistogram: Bin Frequencycumulative % Bin Frequencycumulative %Sylva LeeNo ratings yet

- Progres FO: Item Progres Unt Qty Unt PercentaseDocument4 pagesProgres FO: Item Progres Unt Qty Unt Percentasesanggih Nur HidayatNo ratings yet

- Main Dashboard 1Document1 pageMain Dashboard 1Maekal GintingNo ratings yet

- Macroeconomics: Assignment Calculation and GraphDocument2 pagesMacroeconomics: Assignment Calculation and GraphjaribhaiNo ratings yet

- TPEF ( (12 365 24) 11.257,29 / 869: Intercade Consultancy & TrainingDocument38 pagesTPEF ( (12 365 24) 11.257,29 / 869: Intercade Consultancy & TrainingGabrielPacovilcaArhuataNo ratings yet

- Gestão A VistaDocument16 pagesGestão A VistaRoda6038cNo ratings yet

- Ternary Diagram REV1Document6 pagesTernary Diagram REV1agus izzaNo ratings yet

- VlookupDocument4 pagesVlookupAlishba Muhammad SharifNo ratings yet

- Inventory Balance DailyDocument1 pageInventory Balance DailyAngela ChanNo ratings yet

- December Promoters TargetDocument3 pagesDecember Promoters Targetnaomilk33No ratings yet

- Failure Mode by Stoppage HRDocument7 pagesFailure Mode by Stoppage HReshetNo ratings yet

- Shading Amazon Panel Homedepot Panel Shading Amazon Panel: Voltage Under 30 Ω LoadDocument8 pagesShading Amazon Panel Homedepot Panel Shading Amazon Panel: Voltage Under 30 Ω LoadpanmanNo ratings yet

- Prueba de Evaluaci NDocument5 pagesPrueba de Evaluaci Nerwin.villuendasNo ratings yet

- Plantilla MantenimientoDocument26 pagesPlantilla MantenimientoAaron AltamiranoNo ratings yet

- Aranceles Del Perú: Part A.1 Tariffs and Imports: Summary and Duty RangesDocument2 pagesAranceles Del Perú: Part A.1 Tariffs and Imports: Summary and Duty RangesJhordam Maxwell Gómez TorresNo ratings yet

- Xi Fi FR % FiDocument3 pagesXi Fi FR % FiRonald HuaychoNo ratings yet

- Histo ParetoDocument6 pagesHisto ParetoCristian RobertoNo ratings yet

- Profil Tarifaire OmcDocument1 pageProfil Tarifaire OmcMEKORY ROMEONo ratings yet

- Histogramme: 5 Fréquence % CumuléDocument6 pagesHistogramme: 5 Fréquence % CumuléARKASNo ratings yet

- Tiered Commission Rates Using SUMPRODUCTDocument9 pagesTiered Commission Rates Using SUMPRODUCTsourabh6chakrabort-1No ratings yet

- 2 Unit CR - SCurveDocument3 pages2 Unit CR - SCurveBlack MambaNo ratings yet

- Trivial Many: Data For Pareto ChartDocument3 pagesTrivial Many: Data For Pareto ChartAakriti KhadkaNo ratings yet

- Introduction To Affinity Diagrams and Pareto ChartsDocument20 pagesIntroduction To Affinity Diagrams and Pareto ChartsAmit SenNo ratings yet

- Is Delta Variant Awareness Effective?: Frequency Percentage Yes 98 98% No 2 2% Total 100 100%Document13 pagesIs Delta Variant Awareness Effective?: Frequency Percentage Yes 98 98% No 2 2% Total 100 100%Danica Leonor SanchezNo ratings yet

- Introduction To Affinity Diagrams and Pareto ChartsDocument13 pagesIntroduction To Affinity Diagrams and Pareto ChartsSin TungNo ratings yet

- Ethanol Mixing CalculatorDocument3 pagesEthanol Mixing CalculatorGHDEngNo ratings yet

- PCBelgaum Sambra FruitDocument2 pagesPCBelgaum Sambra FruitAnam enterprisesNo ratings yet

- Isulation Punch ProgressDocument1 pageIsulation Punch ProgressmahmoudNo ratings yet

- Analisa SaringanDocument3 pagesAnalisa SaringanDicky KurniawanNo ratings yet

- February 3 2017 - Sheet1Document1 pageFebruary 3 2017 - Sheet1api-347896282No ratings yet

- FR CP Self Assessment ConsolidationDocument10 pagesFR CP Self Assessment ConsolidationAkhtar QuddusNo ratings yet

- 3.sieve Analysis in Fine AggregateDocument1 page3.sieve Analysis in Fine AggregateLakshithaGonapinuwalaWithanageNo ratings yet

- 27 Total Product Average Product and Marginal ProductDocument103 pages27 Total Product Average Product and Marginal ProductVaibhav SuranaaNo ratings yet

- IG Range CompressionDocument1 pageIG Range CompressionCreditTraderNo ratings yet

- Gates-Gaudin-Schumann Plot: Cumulative Percent PassingDocument1 pageGates-Gaudin-Schumann Plot: Cumulative Percent PassingAgen KolarNo ratings yet

- Speedometer Tachometer Chart ExcelDocument6 pagesSpeedometer Tachometer Chart ExcelHummadNo ratings yet

- Kurva RPM THDDocument3 pagesKurva RPM THDWulan MaharaniNo ratings yet

- Height Weight 60 110 Height 1 65 150 Weight 0.937895 1 74 200 70 185 70 170 66 160 68 180 72 195 64 135 71 215Document3 pagesHeight Weight 60 110 Height 1 65 150 Weight 0.937895 1 74 200 70 185 70 170 66 160 68 180 72 195 64 135 71 215JdeeNo ratings yet

- Metrado Tramo 5Document4 pagesMetrado Tramo 5luismchambi27No ratings yet

- CX Rules 2002Document12 pagesCX Rules 2002jessyshahNo ratings yet

- Cex 0906Document1 pageCex 0906jessyshahNo ratings yet

- Cus 0222Document24 pagesCus 0222jessyshahNo ratings yet

- Cex 1106Document1 pageCex 1106jessyshahNo ratings yet

- Notfn No. 157 DTD 28031990Document2 pagesNotfn No. 157 DTD 28031990jessyshahNo ratings yet

- Index - of - CITES - Species - 2022-01-22 12 - 59Document1,508 pagesIndex - of - CITES - Species - 2022-01-22 12 - 59jessyshahNo ratings yet

- cs50 2018 NewDocument54 pagescs50 2018 NewjessyshahNo ratings yet

- Customs - Public - Notice - No. 164 2016 - DTD - 30112016 - Mandatory - Advance - Filing - For - FCL - ImportsDocument1 pageCustoms - Public - Notice - No. 164 2016 - DTD - 30112016 - Mandatory - Advance - Filing - For - FCL - ImportsjessyshahNo ratings yet

- Baked Steel Cut Oats and Vegetables PDFDocument1 pageBaked Steel Cut Oats and Vegetables PDFjessyshahNo ratings yet

- Afghani Basmati Rice With Raisins and CarrotsDocument1 pageAfghani Basmati Rice With Raisins and CarrotsjessyshahNo ratings yet

- Cleaning Automotive Glass at HomeDocument1 pageCleaning Automotive Glass at HomejessyshahNo ratings yet

- Black Bean ChiliDocument1 pageBlack Bean ChilijessyshahNo ratings yet

- Linea Ingl IntDocument10 pagesLinea Ingl IntjessyshahNo ratings yet

- Aduki Bean Ginger DipDocument1 pageAduki Bean Ginger DipjessyshahNo ratings yet

- Customs Exchange Rate May'2012Document1 pageCustoms Exchange Rate May'2012jessyshahNo ratings yet

- Samsung Galaxy GT-S5360 - ManualDocument133 pagesSamsung Galaxy GT-S5360 - ManualMihaiisvoranuNo ratings yet

- HPCI India2013 Floor PlanDocument1 pageHPCI India2013 Floor PlanjessyshahNo ratings yet

- Ce117adv Xtl-03833a enDocument64 pagesCe117adv Xtl-03833a enjessyshahNo ratings yet

- What Is UCP 600? EngelstaligDocument5 pagesWhat Is UCP 600? EngelstaligShiju Dev MeledathNo ratings yet

- What Is UCP 600? EngelstaligDocument5 pagesWhat Is UCP 600? EngelstaligShiju Dev MeledathNo ratings yet

- Samsung Convection CQ138 User ManualDocument56 pagesSamsung Convection CQ138 User Manualjessyshah100% (2)

- What Is UCP 600? EngelstaligDocument5 pagesWhat Is UCP 600? EngelstaligShiju Dev MeledathNo ratings yet

- What Is UCP 600? EngelstaligDocument5 pagesWhat Is UCP 600? EngelstaligShiju Dev MeledathNo ratings yet

- HPCI India Floor 2010Document1 pageHPCI India Floor 2010jessyshahNo ratings yet

- Manufacture and Use of Dairy Protein FractionsDocument7 pagesManufacture and Use of Dairy Protein FractionsRed riotNo ratings yet

- Sulfite and Soda PulpingDocument17 pagesSulfite and Soda PulpingSACHIN CHAVAN0% (1)

- SONAC PhosterolDocument2 pagesSONAC PhosterolDiel MichNo ratings yet

- SOP - Quenching Pyrophoric MaterialsDocument5 pagesSOP - Quenching Pyrophoric Materialsdhavalesh1No ratings yet

- Ciulu, 2018 ReviewDocument20 pagesCiulu, 2018 ReviewLia PuspitasariNo ratings yet

- Planilha Sem TítuloDocument56 pagesPlanilha Sem TítuloAnonymous T.I.No ratings yet

- ابريتنغ منولDocument86 pagesابريتنغ منولGhassan Al HaririNo ratings yet

- Iso 660 2020Document9 pagesIso 660 2020verry100% (1)

- Randox RANSOD PDFDocument3 pagesRandox RANSOD PDFGuntur Suseno KristoforusNo ratings yet

- Topic 10 Organic Chemistry 1Document7 pagesTopic 10 Organic Chemistry 1locodeno07No ratings yet

- Cell Organelles WorksheetDocument7 pagesCell Organelles Worksheetapi-278440419No ratings yet

- Excelsize 22 (Visco VS Solid%)Document2 pagesExcelsize 22 (Visco VS Solid%)Ardita Rizki FauziNo ratings yet

- Solvent Properties ChartDocument1 pageSolvent Properties ChartlobocernaNo ratings yet

- Biochemistry Book 2Document119 pagesBiochemistry Book 2Jugnu JugnuNo ratings yet

- Molecules 27 03372Document17 pagesMolecules 27 03372amir zubairNo ratings yet

- MSDS Zetag 8125 PDFDocument8 pagesMSDS Zetag 8125 PDFBhuvnesh SinghNo ratings yet

- Tinosorb MDocument6 pagesTinosorb McebuenafeNo ratings yet

- 235 - GHS Disinfectant Hospital Grade - 0916 PDFDocument6 pages235 - GHS Disinfectant Hospital Grade - 0916 PDFskype2121No ratings yet

- Hyperconjugation - Chemistry LibreTextsDocument2 pagesHyperconjugation - Chemistry LibreTextsAatmaanandaNo ratings yet

- Initiation: This Is A Two-Step Process Involving: (1) The Decomposition of The Initiator Into Primary RadicalsbDocument4 pagesInitiation: This Is A Two-Step Process Involving: (1) The Decomposition of The Initiator Into Primary RadicalsbYounis MuhsinNo ratings yet

- Isomerism in BiomoleculesDocument14 pagesIsomerism in BiomoleculesNaji Mohamed Alfatih100% (6)

- Chemical Pump Data EbaraDocument8 pagesChemical Pump Data EbaraGea Mandiri ciptaNo ratings yet

- Acumulatori As Cu Membrana EPEDocument12 pagesAcumulatori As Cu Membrana EPEopetruNo ratings yet

- Plant Design 1 Project ReportDocument100 pagesPlant Design 1 Project Reportfarwa rizviNo ratings yet

- CB - n990 Epdm ProfilesDocument3 pagesCB - n990 Epdm ProfilesMartha GuzmanNo ratings yet

- Coordination Chemistry Reviews: Juan Chen, Wesley R. BrowneDocument21 pagesCoordination Chemistry Reviews: Juan Chen, Wesley R. BrowneSiti ZhaafiraNo ratings yet

- Transesetrification ProcessDocument33 pagesTransesetrification Processdark knightNo ratings yet

- (Food Safety) Table OlivesDocument32 pages(Food Safety) Table OlivesChiêu Nghi VõNo ratings yet

- 5 BiocatDocument4 pages5 BiocatPanjabrao ChavanNo ratings yet

- MSDS Biflex TC TermiticideDocument15 pagesMSDS Biflex TC TermiticideAhmad IssaNo ratings yet