Professional Documents

Culture Documents

Income Tax Calculator Calculate Income Tax For FY 2022-23

Uploaded by

Vivek LakkakulaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculator Calculate Income Tax For FY 2022-23

Uploaded by

Vivek LakkakulaCopyright:

Available Formats

' ( )

Home Loan APPLY ONLINE

Home > Home Loan > Income Tax Calculator

Overview Features and Benefits Eligibility

Income Tax Calculator APPLY ONLINE

Income Tax Calculator

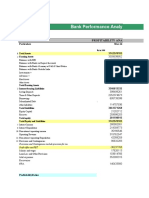

Financial Year:2022-23

Male Female

Annual income (Rs.) " 0

Interest paid on Home Loan 0

Principal repaid on Home Loan 0

What is an income tax calculator?

An Income Tax Calculator is an online tool you can use to

assess your tax liability as per the relevant tax laws. The

Income Tax Calculator considers factors like your income,

age, interest paid towards your home loan, expenses, and

investments to indicate the total tax payable on your

income under the new or old tax regime.

Depending on the tax regime, the tax slabs and factors

considered will vary. The online tax calculator is free,

easy-to-use, and generates error-free results instantly.

How to use an income tax calculator for FY

2022-23? (AY 2023-24)?

To know your tax liability with an income tax calculator,

simply enter relevant details in the fields:

Select your age bracket

Enter your annual income

Disclose investments and eligible deductions under

Sections like:

80C (ELSS funds, PPF, house loan principal

repayment, etc.)

80CCD(1B) (National Pension System)

24B (Home loan interest repayment)

80E (Education loan interest repayment)

80G (donations to charitable institutions)

Enter HRA, LTA exemptions

You can enter ‘0’ for fields that are not applicable. Once

you go through the steps, you will see your tax payable

under the old and new regimes for AY 2023-24 (FY 2022-

23).

How is income tax calculated?

Income tax is calculated on your taxable income based on

the tax slab applicable. Your taxable income is derived by

adding income from all sources (salary, rent, capital gains,

etc.) to get your gross total income and subtracting from

this the deductions and exemptions you are eligible for.

Taxes already paid in the form of TDS or advance tax will

be considered when calculating income tax.

Calculate income tax for the old regime:

In the old tax regime, you benefit from standard

deduction and can claim special allowances and tax

exemptions on HRA and LTA to arrive at your income from

salary. To this, add income from other sources, such as

house property, capital gains, and business/ profession to

get your gross total income. Next, you can claim

deductions under Sections 80C, 80D, 80TTA, etc., to get

your taxable Income.

Your taxable income is taxed at the relevant tax slab rate

and cess is added to give you your total tax payment.

Calculate income tax for the new regime:

In the new tax regime, you forgo most exemptions and

deductions, for instance, LTC, HRA, standard deduction,

deductions under Sections 80C, 80D, 80E, 80G, and so

on. Add income from other sources to your income from

salary to get your Gross Total Income.

This is taxed at the concessional tax slab rates and cess is

added to give you your total income tax payment.

Income tax slabs for new and old regime

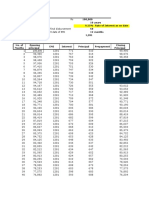

New income tax slab for FY 2020-21 & AY 2023-24

Taxable income Tax rates

Up to Rs. 2,50,000 NIL

Rs. 2,50,001 – Rs. 5% of income above Rs.

5,00,000 2.5 lakh + 4% cess on

income tax

Rs. 5,00,001 – Rs. Rs. 12,500 + 10% of total

7,50,000 income above Rs. 5 lakh

+ 4% cess

Rs. 7,50,001 – Rs. Rs. 37,500 + 15% of total

10,00,000 income above Rs. 7.5

lakh + 4% cess

Rs. 10,00,001 – Rs. Rs. 75,000 + 20% of

12,50,000 total income above Rs.

10 lakh + 4% cess

Rs. 12,50,001 – Rs. Rs. 1,25,000 + 25% of

15,00,000 total income above Rs.

12.5 lakh + 4% cess

Above Rs. 15,00,000 Rs. 1,87,500 + 30% of

total income above Rs.

15 lakh + 4% cess

The old regime tax slabs for AY 2023-24 are as follows.

1. For individuals below age 60

Taxable income Tax rates

Up to Rs. 2.5 lakhs NIL

Rs. 2,50,001 – Rs. 5 lakhs 5% of income above Rs.

2.5 lakh + 4% cess on

income tax

Rs. 5,00,001 – Rs. 10 Rs. 12,500 + 20% of

lakhs income above Rs. 5 lakh

+ 4% cess

Above Rs. 10 lakhs Rs. 1,12,500 + 30% of

income above Rs. 10 lakh

+ 4% cess

2. For individuals between 60 and 80 years (senior

citizens)

Taxable income Tax rates

Up to Rs. 3 lakhs NIL

Rs. 3,00,001 – Rs. 5 lakhs 5% of income above Rs.

3 lakh + 4% cess on

income tax

Rs. 5,00,001 – Rs. 10 Rs. 10,500 + 20% of

lakhs income above Rs. 5 lakh

+ 4% cess

Above Rs. 10 lakhs Rs. 1,10,000 + 30% of

income above Rs. 10 lakh

+ 4% cess

3. For individuals aged 80 and above (super-senior

citizens)

Taxable income Tax rates

Up to Rs. 5 lakhs NIL

Rs. 5,00,001 – Rs. 10 20% of income above Rs.

lakhs 5 lakh + 4% cess on

income tax

Above Rs. 10 lakhs Rs. 1,00,000 + 30% of

income above Rs. 10 lakh

+ 4% cessnt

What are the benefits of filing income tax

online?

Filing income tax returns online:

Is quick and convenient

Allows for faster and electronic tax refunds

Facilitates a prompt confirmation receipt and real-

time status updates

Is confidential and secure

Is error-free and saves professional costs

Helps with VISA processing, getting insurance, and

loan applications

Serves as an income and address proof

Makes it easy to avoid the late penalty

Helps you carry forward losses

Does everyone have to file income tax?

You must file income tax returns if your gross total

income for the financial year exceeds the basic exemption

limit. For the old regime, the basic exemption limit is:

Rs. 2.5 lakh for residents below age 60

Rs. 3 lakh for senior citizens (between 60 and 80

years)

Rs. 5 lakh for super-senior citizens (80 years and

above)

In the new tax regime, the basic exemption is Rs. 2.5 lakh

across all age categories.

Additionally, you must file ITR if you have:

Deposited more than Rs. 1 crore in current

account(s)

Spent more than Rs. 2 lakh on foreign travel

Incurred more than Rs. 1 lakh on electricity

Income in/ assets from/ signing authority in an

account in a foreign country

Gross total income more than the exemption limit

before claiming relevant capital gains exemptions

As per Union Budget 2021, senior citizens above age 75

are exempt from filing ITR for FY 2021-22 if they have only

pension and interest income and the two are deposited/

earned in the same bank.

What are the eligibility criteria to file

income tax?

Any resident citizen with gross total income above the

basic exemption limit must file income tax returns.

However, if your total income is less than the taxable limit,

you can file a NIL return.

Other entities that file ITR in India are:

Hindu Undivided Family (HUF)

Associations of Persons (AoPs)

Local authorities

Corporate firms

Charitable/ religious trusts

Companies

Artificial juridical persons

Body of Individuals (BOI)

Depending on the taxpayer, the correct ITR form must be

used.

What are the details required for e-filing an

income tax return?

For e-filing of income tax return keep the following details

and documents ready:

PAN, Aadhaar, permanent address

Bank account details relevant to the financial year

(indicate which account any income tax refund

should go to)

Form 16 and proofs of interest income, for instance,

from FDs

Deduction details, pertaining to Section 80C, 80D,

and others under Chapter VI-A

Proof of tax paid (advance tax, TDS, etc.)

What are the tax exemptions available for

salaried individuals?

Standard deduction (Rs. 50,000)

House Rent Allowance (partial or total)

Leave Travel Allowance (for domestic travel)

Work-related expenses (telephone bills, meal

coupons, etc.)

Deductions under Section

80C, 80CCC, 80CCD(1) (NPS, PPF, ELSS,

tuition fees, tax-saver FD)

80D (health insurance premiums)

80C, 24B, and 80EE/ 80EEA (home loan

repayment)

80E (education loan interest)

80G (contributions to approved charitable

organisations)

80TTA (savings account interest)

Other deductions

These exemptions/ deductions apply to the old regime.

Under the new regime only very few allowances and

deductions are available.

Frequently asked questions about the

income tax calculator

How much income tax should I pay on my

salary?

How much income tax you pay on your salary depends

on your taxable income and the income tax slab you fall

under. Your taxable income is what you get when you

subtract the exemptions and deductions from your

Gross Total Income, which includes your salary (less

HRA, standard deduction, etc., for the old regime) and

income from other sources.

The tax slab depends on your taxable income and age

and is different for the old and new regime.

What is the limit of 80C deduction?

How much tax rebate can I avail on a home

loan?

Read More

Related articles

Know the tax benefits on a Joint

Home Loan

! 4688 | 2 min read

A detailed guide on income tax

rebate

! 22856 | 2 min read

CIBIL score for Home Loan: Know

the impact of credit score on Home

Loans

! 29809 | 2 min read

A complete guide to applying for a

Home Loan

! 5915 | 1 min read

Related videos

0

000::4

488 Home Loan - Fees and charges

! 1415

0

000::5599 Factors to consider before taking

a Home Loan

! 947

0

000::4

488 Tips to Improve Home Loan

Eligibility

! 655

0

011::0

000 Home Loan - How to apply?

! 2562

# Go To Top

Application Forms

Personal Loan Business Loan

Home Loan Gold Loan

Bajaj Finserv RBL Bank Bajaj Finserv DBS Bank

SuperCard credit card

EMI Network Card Wallet Care

Health Insurance Loan for Doctors

Fixed Deposit Loan Against Property

Loan for Chartered Online Trading

Accountants

Two-wheeler Loan

Loans $

Insurance $

Finance for Professionals $

Investments $

Pocket Insurance $

Bajaj Mall $

Wallets & Cards $

Value Added Services $

Pre-approved Offers

Offers & Promotions

Bills & Recharges

Insights

Calculators $

Legal $

Reach Us $

Corporate Office Our Companies

6th Floor Bajaj Finserv

Bajaj Finserv Ltd.

Corporate Office, Off

Pune-Ahmednagar Bajaj Finance Ltd.

Road, Viman Nagar, Pune Bajaj Allianz General

- 411014 Insurance

Bajaj Finance Bajaj Allianz Life

Insurance

Limited Regd.

Office Bajaj Finserv Markets

Akurdi, Pune - 411035 Bajaj Housing

Ph No.: 020 7157-6403 Finance Ltd.

Email ID:

Bajaj Financial

investor.service@bajajfin

Securities Ltd.

serv.in

Bajaj Finserv Health

Ltd.

Corporate Identity

Number (CIN)

L65910MH1987PLC0429

61

% &

IRDAI Corporate Download App

Agency

Registration

Number

CA0101

(Valid till 31-Mar-2025)

URN -

WEB/ BFL/22-

23/1/V1

Bajaj Finserv

Limited Regd.

Office

Bajaj Auto Limited

Complex Mumbai - Pune

Road,

Pune - 411035 MH (IN)

Ph No.: 020 7157-6064

Email

ID: investors@bajajfinser

v.in

Corporate Identity

Number (CIN)

L65923PN2007PLC1300

75

@2022 Bajaj Finserv Limited

,

Products

- . * +

H

Hoom

mee Download App Offers My Account

You might also like

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- Income Tax Rates For FY 2023-24 (AY 2024-25)Document13 pagesIncome Tax Rates For FY 2023-24 (AY 2024-25)ghs niduvani niduvaniNo ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Recruiting CoordinatorDocument2 pagesRecruiting CoordinatorResponsiveEdNo ratings yet

- Flexible Benefit Plan (FBP) Policy Document: DisclaimerDocument47 pagesFlexible Benefit Plan (FBP) Policy Document: DisclaimerRafunsel Presentation100% (1)

- Dear Ashish Mishra,: Engineer (Trainee) With The CompanyDocument18 pagesDear Ashish Mishra,: Engineer (Trainee) With The Companybobbinpreet kaurNo ratings yet

- Employee Self Verification FormDocument6 pagesEmployee Self Verification Formdharsan321No ratings yet

- National Pension Scheme (NPS) Guidelines FY 2019-20Document21 pagesNational Pension Scheme (NPS) Guidelines FY 2019-20harrishNo ratings yet

- Labour and Industrial Law - October 15-16,2022Document208 pagesLabour and Industrial Law - October 15-16,2022NAZIRNo ratings yet

- Omega External Career Portal CareersDocument5 pagesOmega External Career Portal CareersAdityaNo ratings yet

- Income Tax and PF, ESIC Due DatesDocument40 pagesIncome Tax and PF, ESIC Due DatesEXELIENT TAX SERVICESNo ratings yet

- Regd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Document9 pagesRegd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Pragathi MittalNo ratings yet

- Project On Pan Card and Its BenefitsDocument22 pagesProject On Pan Card and Its BenefitsShambhavi SharmaNo ratings yet

- Offer Letter - 24-Mar-2022 - 02 - 35 - 52Document15 pagesOffer Letter - 24-Mar-2022 - 02 - 35 - 52TestNo ratings yet

- CTS Marriage Loan PolicyDocument5 pagesCTS Marriage Loan PolicyshaannivasNo ratings yet

- Artifact 5 - Employee Pension Scheme Form 10 CDocument4 pagesArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryNo ratings yet

- IDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsDocument6 pagesIDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsSidharth patraNo ratings yet

- Esic Online ChallanDocument26 pagesEsic Online ChallanahtradaNo ratings yet

- EPF Withdrawal Transfer ProcessDocument12 pagesEPF Withdrawal Transfer ProcessPKNo ratings yet

- Annexure II Details of AllowancesDocument4 pagesAnnexure II Details of AllowancesPravin Balasaheb GunjalNo ratings yet

- Code of Conduct EthicsDocument6 pagesCode of Conduct EthicsGURMUKH SINGHNo ratings yet

- Coca ColaDocument15 pagesCoca ColapardeepbthNo ratings yet

- Credit Statement (Form 26AS) OnlineDocument8 pagesCredit Statement (Form 26AS) Onlinemevrick_guyNo ratings yet

- Tharun J - AmDocument7 pagesTharun J - AmTharun RickyNo ratings yet

- 2020 HQ Holidays CircularDocument1 page2020 HQ Holidays CircularSumanth Gundeti0% (1)

- Collabera Confidentiality AgreementDocument6 pagesCollabera Confidentiality AgreementMaheshKandguleNo ratings yet

- Benefit Summary IndiaDocument5 pagesBenefit Summary IndiaMohd Asim AftabNo ratings yet

- Few Points To Be Kept in Mind While Doing Investment DeclarationDocument8 pagesFew Points To Be Kept in Mind While Doing Investment Declarationcool rock MohindraNo ratings yet

- FlexiDeclaration 4050Document1 pageFlexiDeclaration 4050rahulkumar1878No ratings yet

- Presented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreDocument30 pagesPresented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreshraddhavanjariNo ratings yet

- Police Verification LetterDocument1 pagePolice Verification LetterysrhsnNo ratings yet

- Joining Forms Guide for BCCL New EmployeesDocument13 pagesJoining Forms Guide for BCCL New EmployeesgopamaheshwariNo ratings yet

- Asian Paints Annual Report 2016-17Document312 pagesAsian Paints Annual Report 2016-17Rachanesh Ghatge100% (1)

- Senior SAP SD Consultant Offer LetterDocument10 pagesSenior SAP SD Consultant Offer LetterRahul JagdaleNo ratings yet

- How Tax Planning Saved Over Rs. 113KDocument10 pagesHow Tax Planning Saved Over Rs. 113KGangothri Asok100% (1)

- Lic Pension Policy - Retire & Enjoy PresentationDocument57 pagesLic Pension Policy - Retire & Enjoy PresentationK.N. BabujeeNo ratings yet

- Wage Revision 8.5.Document9 pagesWage Revision 8.5.aanand007No ratings yet

- Employee Accommodation Policy: Ramana Gounder Medical TrustDocument22 pagesEmployee Accommodation Policy: Ramana Gounder Medical TrustAaju KausikNo ratings yet

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraNo ratings yet

- Ebook Compensation PayrollDocument9 pagesEbook Compensation PayrollKhyati BhardwajNo ratings yet

- Employee Benefits IndiaDocument2 pagesEmployee Benefits Indiabaskarbaju1No ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- FAQs On Sodexo Meal PassDocument7 pagesFAQs On Sodexo Meal PassPooja TripathiNo ratings yet

- 2020 Employer Toolkit V12 1Document22 pages2020 Employer Toolkit V12 1sachinitsmeNo ratings yet

- Css Corp FinalDocument20 pagesCss Corp FinalPraveen KumarNo ratings yet

- Offerletter 369844Document24 pagesOfferletter 369844Gokul GandhiNo ratings yet

- Vaibhav Balkheria MGB LETTERDocument3 pagesVaibhav Balkheria MGB LETTERV VaNo ratings yet

- Candidate Declaration FormDocument8 pagesCandidate Declaration FormDon RajuNo ratings yet

- Address ProofDocument1 pageAddress Proofsrikar dasaradhiNo ratings yet

- Employee Car Lease Policy GuideDocument3 pagesEmployee Car Lease Policy GuideSimanto RoyNo ratings yet

- Employees' State Insurance Corporation E-Pehchan CardDocument3 pagesEmployees' State Insurance Corporation E-Pehchan CardAadil HashmiNo ratings yet

- Darshan Shetty - AnnexureDocument1 pageDarshan Shetty - Annexuredarshan shettyNo ratings yet

- E-Nomination Facility by Epfo On Unified Member PortalDocument10 pagesE-Nomination Facility by Epfo On Unified Member PortalUpasana Talapady100% (2)

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300No ratings yet

- Offer Letter - Komal SharmaDocument6 pagesOffer Letter - Komal SharmaHIMANI RANANo ratings yet

- My First Offer From Accenture Letter of JoiningDocument2 pagesMy First Offer From Accenture Letter of JoiningsdrfNo ratings yet

- Job Offer-EXECUTIVE - ARDocument5 pagesJob Offer-EXECUTIVE - ARJagadeesh Sura100% (1)

- Your Guide to Tax Efficient LivingDocument28 pagesYour Guide to Tax Efficient LivingPadmapriya SrinivasanNo ratings yet

- Income Affidavit Vinit (Corrected) 28.05.2019Document19 pagesIncome Affidavit Vinit (Corrected) 28.05.2019rahul100% (1)

- Sharda University ICICI Bank EL OfferDocument3 pagesSharda University ICICI Bank EL Offerdrvatsa90No ratings yet

- An Economic Analysis of Financial StructureDocument27 pagesAn Economic Analysis of Financial StructureAlejandroArnoldoFritzRuenesNo ratings yet

- Cash Flow and Financial Management On Drystock Farms: A B C DDocument4 pagesCash Flow and Financial Management On Drystock Farms: A B C DMarcial Jr. MilitanteNo ratings yet

- Construction Economics and Finance - Cash Flow ManagementDocument50 pagesConstruction Economics and Finance - Cash Flow ManagementMilashuNo ratings yet

- CA Final Financial Reporting Additional Material on Ind AS 32, 107 & 109 ClassificationDocument16 pagesCA Final Financial Reporting Additional Material on Ind AS 32, 107 & 109 Classificationvignesh_viki100% (1)

- Role and Functions of Commercial Banks in Ethiopia - Gebremariam K Segu - Academia - EduDocument7 pagesRole and Functions of Commercial Banks in Ethiopia - Gebremariam K Segu - Academia - Eduየዓለምዘውድ መኮንንNo ratings yet

- Equity Issue 2005 PDFDocument400 pagesEquity Issue 2005 PDFanon_299093230No ratings yet

- United Planters vs. CADocument10 pagesUnited Planters vs. CAJosine ProtasioNo ratings yet

- Section 2 - Amendment of Schedule-1 of Act No. 2 of 1899Document34 pagesSection 2 - Amendment of Schedule-1 of Act No. 2 of 1899ASHUTOSH MISHRANo ratings yet

- SIADS 523 PresentationDocument14 pagesSIADS 523 PresentationgeorgethioNo ratings yet

- Form No. 135Document2 pagesForm No. 135mayurgada42% (12)

- PNB Housing Loan ProjectDocument38 pagesPNB Housing Loan ProjectgunpriyaNo ratings yet

- DPD Affordable Housing Progress Report Q1 2017Document73 pagesDPD Affordable Housing Progress Report Q1 2017The Daily LineNo ratings yet

- Summary For Account ReceivablesDocument6 pagesSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- X SST Question Paper - Common ExaminationDocument9 pagesX SST Question Paper - Common Examinationcartoonexplorers7No ratings yet

- About Addleshaw Goddard in The GCCDocument12 pagesAbout Addleshaw Goddard in The GCCThanikesan MudaliarNo ratings yet

- Math - P301 - Simple InterestDocument2 pagesMath - P301 - Simple InterestCarlos OliveroNo ratings yet

- Relationship Between Banker and CustomerDocument10 pagesRelationship Between Banker and Customerswagat098No ratings yet

- Commercial BankDocument7 pagesCommercial Bankchandrashekhar.verma4025No ratings yet

- Mid Term: Maple Leaf Cement Factory Limited Annual Report 2021Document4 pagesMid Term: Maple Leaf Cement Factory Limited Annual Report 2021usman haiderNo ratings yet

- Chap 6Document65 pagesChap 6ahmad altoufailyNo ratings yet

- Rubina ShaikhDocument100 pagesRubina ShaikhNehaNo ratings yet

- Who Pays? How Industry Insiders Rig The Student Loan System-And How To Stop ItDocument19 pagesWho Pays? How Industry Insiders Rig The Student Loan System-And How To Stop ItRoosevelt InstituteNo ratings yet

- Shreya Jain - PGFC1935 - Performance AnalysisDocument13 pagesShreya Jain - PGFC1935 - Performance AnalysisSurbhî GuptaNo ratings yet

- Loan EMI ScheduleDocument5 pagesLoan EMI ScheduleHema Kumar Hema KumarNo ratings yet

- Balance Sheet CompanyDocument16 pagesBalance Sheet CompanyNidhi ShahNo ratings yet

- What Is Imputed Interest?Document3 pagesWhat Is Imputed Interest?1abhishek1No ratings yet

- The Famous New Bubbles of The 21st Century: Cases of Irrational ExuberanceDocument73 pagesThe Famous New Bubbles of The 21st Century: Cases of Irrational ExuberanceJohn TaskinsoyNo ratings yet

- Green Banking in IndiaDocument50 pagesGreen Banking in IndiaTorakshi Gupta100% (6)