Professional Documents

Culture Documents

Exercises Lesson 3

Uploaded by

Nino LACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises Lesson 3

Uploaded by

Nino LACopyright:

Available Formats

Job Costing, Normal and Actual Costing

Anderson Construction assembles residential houses. It uses a job-costing system with

two direct-cost categories (direct materials and direct labor) and one indirect-cost pool

(assembly support). Direct labor-hours is the allocation base for assembly support costs.

In December 2020, Anderson budgets 2021 assembly-support costs to be $8.000.000

and 2021 direct labor-hours to be 160.000.

At the end of 2021, Anderson is comparing the costs of several jobs that were started

and completed in 2021.

Laguna Model Mission Model

Construction Period Feb-June 2021 May-Oct 2021

Direct Materials $106.450 $127.604

Direct Labor $36.276 $41.410

Direct Labor-hours 900 1.010

Direct materials and direct labor are paid for on a contract basis. The costs of each are

known when direct materials are used or when direct labor-hours are worked. The 2021

actual assembly-support costs were $6.888.000, and the actual direct labor-hours were

164.000.

1. Compute the (a) budgeted indirect-cost rate and (b) actual indirect-cost rate. Why do

they differ?

2. What are the job costs of the Laguna Model and the Mission Model using (a) normal

costing and (b) actual costing?

3. Why might Anderson Construction prefer normal costing over actual costing?

4. What is the total amount of over/under absortion?

Job Costing, accounting for manufacturing overhead, budgeted rates

The Solomon Company uses a job-costing system at its Dover, Delaware plant. The

plant has a machining department and a finishing department. Solomon uses normal

costing with two direct-cost categories (direct materials and direct manufacturing labor)

and two manufacturing overhead cost pools (the machining department, with machine

hours as the allocation base, and the finishing department with the direct manufacturing

labor costs as the allocation base). The 2021 budget for the plant is as follows:

Machining Department Finishing Department

Manufacturing Overhead $10.660.000 $7.372.000

Direct Manufacturing $940.000 $3.800.000

Labor costs

Direct Manufacturing labor 36.000 145.000

hours

Machine hours 205.000 32.000

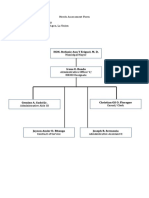

1. Prepare an overview diagram of Solomon´s job-costing system

2. What is the budgeted overhead rate in the Machining Department? In the finishing

department?

3. During the month of January, the job-cost record for Job 431 shows the following:

Machining Department Finishing Department

Direct Materials used $15.500 $5.000

Direct Manufacturing $400 $1.100

Labor costs

Direct Manufacturing labor 50 50

hours

Machine hours 130 20

Compute the total manufacturing overhead allocated to Job 431.

4. Assuming that Job 431 consisted of 400 units of product, what is the cost per unit?

5. Amounts at the end of 2021 are as follows:

Machining Department Finishing Department

Manufacturing Overhead $11.070.000 $8.236.000

incurred

Direct Manufacturing $1.000.000 $4.400.000

Labor costs

Machine hours 210.000 31.000

Compute the under –or overallocated manufacturing overhead for each department and

for the Dover plant as a whole.

6 Why might Salomon use two different manufacturing overhead cost pools in its job-

costing system?

You might also like

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- Tutorial + Homework Job Costing CADocument2 pagesTutorial + Homework Job Costing CAmiranti dNo ratings yet

- Asistensi + Homework Job Costing PDFDocument2 pagesAsistensi + Homework Job Costing PDFYogie YaditraNo ratings yet

- Exercises Job Costing Normal Costing - March 29 2023Document2 pagesExercises Job Costing Normal Costing - March 29 2023alica.durcekovaNo ratings yet

- Chapter 4 Part II ContinueDocument5 pagesChapter 4 Part II ContinueYAHIA ADELNo ratings yet

- Cost Accounting Tutorial 2 Session Problem 1Document2 pagesCost Accounting Tutorial 2 Session Problem 1BagoesadhiNo ratings yet

- Chapter 3 Exercises - ABC SystemDocument2 pagesChapter 3 Exercises - ABC SystemMandy KhouryNo ratings yet

- Solution:: Step: 1 of 7: Job Costing, Accounting For Manufacturing Overhead, Budgeted Rates. The PisanoDocument5 pagesSolution:: Step: 1 of 7: Job Costing, Accounting For Manufacturing Overhead, Budgeted Rates. The PisanoHerry SugiantoNo ratings yet

- Job Order Costing QuestionsDocument2 pagesJob Order Costing QuestionsPASCHAL IBELENo ratings yet

- Job CostingDocument24 pagesJob CostingRam KnowlesNo ratings yet

- 3 Process and Job Order Costing System 2019Document8 pages3 Process and Job Order Costing System 2019Abdallah SadikiNo ratings yet

- PBEIIDocument6 pagesPBEIIDirajen PMNo ratings yet

- ABC ProblemsDocument2 pagesABC Problemsxenon cloudNo ratings yet

- BBA211 Vol8 JobCostingDocument10 pagesBBA211 Vol8 JobCostingAnisha SarahNo ratings yet

- Chapter 2 HomeworkDocument2 pagesChapter 2 HomeworkAliya KainazarovaNo ratings yet

- Job CostingDocument24 pagesJob CostingElaine YapNo ratings yet

- Handout 601 - TRADITIONAL COSTING SYSTEMDocument7 pagesHandout 601 - TRADITIONAL COSTING SYSTEMDeedra DavidsonNo ratings yet

- Job Costing TutorialDocument1 pageJob Costing TutorialSULEIMANNo ratings yet

- Ma As2Document6 pagesMa As2Omar AbidNo ratings yet

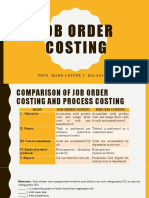

- Job Order Costing: Prof. Mark Lester T. Balasa, CpaDocument24 pagesJob Order Costing: Prof. Mark Lester T. Balasa, CpaNah HamzaNo ratings yet

- AFAR - 11.1-Cost Accounting (Job Order and Process Costing)Document3 pagesAFAR - 11.1-Cost Accounting (Job Order and Process Costing)Daniela AubreyNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- (W5) Tutorial Answer Chapter 3 JOCDocument4 pages(W5) Tutorial Answer Chapter 3 JOCMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- BUSN 2110 Assignment 2Document3 pagesBUSN 2110 Assignment 2Fresh & Fit Fitness And RecreationNo ratings yet

- Tugas Individual 345Document7 pagesTugas Individual 345Mochamad PutraNo ratings yet

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- Answers Homework # 15 Cost MGMT 4Document7 pagesAnswers Homework # 15 Cost MGMT 4Raman ANo ratings yet

- WK5 - JOC Exercise 1Document5 pagesWK5 - JOC Exercise 1LIM YIN SHUAN KM-PelajarNo ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Exercises Chapter 3Document13 pagesExercises Chapter 3mohsen bukNo ratings yet

- Name: Shahihul Islam NPM: 22001082171 Class: A1Document2 pagesName: Shahihul Islam NPM: 22001082171 Class: A1shahihul IslamNo ratings yet

- Assignment Question AccDocument5 pagesAssignment Question AccruqayyahqaisaraNo ratings yet

- Garrison 8 Ex 5-20, PR 5-25Document17 pagesGarrison 8 Ex 5-20, PR 5-25Shalini VeluNo ratings yet

- Seasone 9Document1 pageSeasone 9wahyuniNo ratings yet

- Exercises Lecture4Document3 pagesExercises Lecture4LizzyNo ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- ABC CostingDocument15 pagesABC Costingjpg17No ratings yet

- Factory OverheadDocument2 pagesFactory Overheadenchantadia0% (1)

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Lessons - Week 3Document3 pagesLessons - Week 3Miss SlayerNo ratings yet

- Quiz 2 - Job Costing - Printable, V (5.0)Document7 pagesQuiz 2 - Job Costing - Printable, V (5.0)Edward Prima KurniawanNo ratings yet

- TTTTTDocument5 pagesTTTTTDannah Mae CalañasNo ratings yet

- Quiz ABCDocument2 pagesQuiz ABCZoey Alvin EstarejaNo ratings yet

- Topic 4 Extra QuestionsDocument2 pagesTopic 4 Extra QuestionsThirusha balamuraliNo ratings yet

- Job Costing - ExcercisesDocument31 pagesJob Costing - Excercisesგიორგი კაციაშვილიNo ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Activity Based CostingproblemsDocument6 pagesActivity Based CostingproblemsDebarpan HaldarNo ratings yet

- Asian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017Document6 pagesAsian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017didi chenNo ratings yet

- ABC Sample Problems 1Document13 pagesABC Sample Problems 1Mary Grace PagalanNo ratings yet

- Managerial-Accounting 8e Hansen-Ebook 1Document4 pagesManagerial-Accounting 8e Hansen-Ebook 1212300163No ratings yet

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- Exercises: Set B: Standard CustomDocument4 pagesExercises: Set B: Standard CustomMalik HamidNo ratings yet

- Ch02 Job Order Costing1Document8 pagesCh02 Job Order Costing1Laika Mico MotasNo ratings yet

- Soal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DDocument4 pagesSoal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DSarah Dzuriyati SamiyahNo ratings yet

- JAVIER CA Wk13 Les JO Cost AccountingDocument5 pagesJAVIER CA Wk13 Les JO Cost AccountingCharlize Adriele C. Comprado3210183No ratings yet

- Practical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsFrom EverandPractical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsNo ratings yet

- Remote Projects Follow-up with Scrum-Excel Burn Down Chart: Scrum and Jira, #1From EverandRemote Projects Follow-up with Scrum-Excel Burn Down Chart: Scrum and Jira, #1No ratings yet

- General Milling Corp Vs CA (DIGEST)Document2 pagesGeneral Milling Corp Vs CA (DIGEST)Raima Marjian Sucor100% (1)

- Electronic Service Tool 2020C v1.0 Product Status ReportDocument6 pagesElectronic Service Tool 2020C v1.0 Product Status ReportHakim GOURAIANo ratings yet

- 27 HestiaDocument24 pages27 HestiaAlberto AdameNo ratings yet

- Finaldis2011 1Document4 pagesFinaldis2011 1syaiful.idzwanNo ratings yet

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionDocument2 pagesNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaNo ratings yet

- 147380-1 Motoman XRC Controller Fieldbus (XFB01) Instruction ManualDocument102 pages147380-1 Motoman XRC Controller Fieldbus (XFB01) Instruction Manualrubi monNo ratings yet

- Dissertation Sample CommerceDocument4 pagesDissertation Sample CommerceBuyPapersOnlineForCollegeCanada100% (1)

- GCE Composite 1306 v4 PDFDocument28 pagesGCE Composite 1306 v4 PDFParapar ShammonNo ratings yet

- Nacc NCCRDocument6 pagesNacc NCCRChaitra Gn100% (1)

- Internship PresentationDocument22 pagesInternship PresentationCalvin WongNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument4 pagesCambridge International Advanced Subsidiary and Advanced Leveljunk filesNo ratings yet

- HRDM 21 Midnotes - TwoDocument51 pagesHRDM 21 Midnotes - TwoTimNo ratings yet

- N G Ày 2 0 T H Á NG B A N Ă M 2 0 2 0: Brand ManagementDocument10 pagesN G Ày 2 0 T H Á NG B A N Ă M 2 0 2 0: Brand ManagementThịnh NguyễnNo ratings yet

- VMware SD WAN Google Cloud Platform Virtual Edge Deployment GuideDocument24 pagesVMware SD WAN Google Cloud Platform Virtual Edge Deployment GuideJuan RojasNo ratings yet

- DITS 2213 Final Exam OSDocument6 pagesDITS 2213 Final Exam OSAmirul FaizNo ratings yet

- Latex Hints and TricksDocument24 pagesLatex Hints and TricksbilzinetNo ratings yet

- Extractive Metallurgy Pachuca Tank DesignDocument8 pagesExtractive Metallurgy Pachuca Tank DesignXtet AungNo ratings yet

- ERP Final PPT 22-4Document10 pagesERP Final PPT 22-4ramesh pokhriyaalNo ratings yet

- 1LA7070-4AB10-Z A11 Datasheet en PDFDocument1 page1LA7070-4AB10-Z A11 Datasheet en PDFKraponis TylnessNo ratings yet

- Theories of International TradeDocument33 pagesTheories of International Tradefrediz79No ratings yet

- 40th Caterpillar Performance HandbookDocument372 pages40th Caterpillar Performance Handbookcarlos_córdova_8100% (11)

- Google Translate - Google SearchDocument1 pageGoogle Translate - Google SearchNicole Alex Bustamante CamposNo ratings yet

- Why CPVC Pipes FailDocument12 pagesWhy CPVC Pipes FailNikita Kadam100% (1)

- Valentine Carol Ann Duffy EssayDocument8 pagesValentine Carol Ann Duffy Essayafibybflnwowtr100% (1)

- Collection of Sum of MoneyDocument4 pagesCollection of Sum of MoneyRaf TanNo ratings yet

- Estrada, Roubenj S. Quiz 1Document13 pagesEstrada, Roubenj S. Quiz 1Roubenj EstradaNo ratings yet

- 2 - Water Requirements of CropsDocument43 pages2 - Water Requirements of CropsHussein Alkafaji100% (4)

- ITEC 11 Lesson 1.1Document35 pagesITEC 11 Lesson 1.1ivyquintelaNo ratings yet

- DocumentDocument2 pagesDocumentAddieNo ratings yet

- 1a. Create Your Yosemite Zone USB DriveDocument9 pages1a. Create Your Yosemite Zone USB DriveSimon MeierNo ratings yet