Professional Documents

Culture Documents

NotYet Earnings Suprise Monitor Yadeni 08aug2022

NotYet Earnings Suprise Monitor Yadeni 08aug2022

Uploaded by

scribbugCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NotYet Earnings Suprise Monitor Yadeni 08aug2022

NotYet Earnings Suprise Monitor Yadeni 08aug2022

Uploaded by

scribbugCopyright:

Available Formats

Quant Briefing:

Earnings Surprise Monitor

Yardeni Research, Inc.

August 8, 2022

Dr. Ed Yardeni

516-972-7683

eyardeni@yardeni.com

Joe Abbott

jabbott@yardeni.com

Please visit our sites at

www.yardeni.com

blog.yardeni.com

thinking outside the box

Table Of Contents

Table Of Contents

S&P 500 Earnings & Revenue Surprise Summary 1

S&P 500/400/600 Earnings Surprise for Current Quarter 2

S&P 500/400/600 Revenue Surprise for Current Quarter 3

S&P 500/400/600 Change in Shares Outstanding 4

S&P 500 Revenue & Earnings % Surprise 5

S&P 500 Revenue & Earnings % of Companies +/- 6

S&P 500 Revenue & Earnings Surprise ex-Energy 7

S&P 500 Revenue & Earnings Surprise ex-Financials 8

S&P 500 Revenue & Earnings Growth ex-Energy 9

S&P 500 Revenue & Earnings Growth ex-Financials 10

S&P 500 Sectors Quarterly Earnings Surprises 11-12

S&P 500 Sectors Quarterly Revenue Surprises 13-14

S&P 500 Sectors Quarterly Earnings Growth 15

S&P 500 Sectors Quarterly Revenue Growth 16

August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Earnings & Revenue Surprise Summary

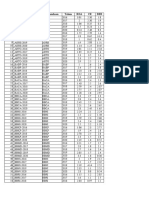

Table 1A: S&P 500 Earnings Surprise (as of August 8, 2022)

% Earnings % Y/Y Earnings % With Positive % With Negative % With Positive % With Negative # Companies

Surprise Growth Surprise Surprise Y/Y Growth Y/Y Growth Reported

Q2-2022 6.0 11.2 76.8 19.5 59.8 37.5 435

Q1-2022 7.3 12.9 77.4 20.3 66.7 31.9 500

Q4-2021 5.8 29.0 76.1 21.8 74.9 24.7 500

Q3-2021 10.8 44.4 81.3 14.8 81.7 17.3 500

Q2-2021 16.9 115.2 87.1 9.8 87.6 12.0 500

Q1-2021 23.4 51.7 86.9 11.4 77.3 21.3 500

Q4-2020 17.1 3.8 79.5 18.0 61.3 37.3 500

Q3-2020 19.7 -8.7 83.6 13.8 50.1 48.2 500

Q2-2020 23.4 -35.1 81.6 16.2 36.6 62.1 500

Q1-2020 3.9 -12.9 67.0 28.5 47.2 51.2 500

Q4-2019 5.4 4.0 70.9 21.2 66.5 31.8 500

Q3-2019 4.8 0.0 75.7 18.4 62.3 35.6 500

Q2-2019 6.1 1.7 74.0 18.8 64.9 33.7 500

Q1-2019 6.5 3.1 75.7 19.1 63.9 34.0 500

Q4-2018 3.5 14.3 70.1 24.5 71.2 26.8 500

Q3-2018 6.7 27.3 77.5 14.1 86.9 13.1 500

Q2-2018 5.2 26.5 80.6 16.4 86.0 13.0 500

Q1-2018 7.0 24.7 78.7 14.6 86.0 13.0 500

Q4-2017 5.0 16.7 76.1 16.8 77.5 20.0 500

Q3-2017 5.4 8.1 72.5 19.9 69.1 28.3 500

Q2-2017 5.6 11.7 72.7 19.3 70.1 27.3 500

Q1-2017 6.7 11.2 76.0 18.1 62.6 36.6 500

Q4-2016 3.7 10.0 68.2 22.5 68.4 28.2 500

Q3-2016 6.4 4.3 72.2 20.2 69.5 28.4 500

Q2-2016 4.6 -2.2 71.7 17.9 61.0 36.0 500

Q1-2016 4.9 -5.7 71.8 21.8 54.6 43.3 500

Q4-2015 3.8 -3.6 68.3 22.0 51.5 45.6 500

Q3-2015 5.6 -0.7 68.1 23.0 58.7 38.7 500

Q2-2015 5.3 1.5 69.7 21.7 61.6 36.5 500

Q1-2015 6.8 2.1 67.7 24.3 63.1 33.6 500

Q4-2014 4.4 6.8 68.9 20.7 70.0 27.3 500

Q3-2014 4.6 10.0 73.1 18.9 75.7 22.3 500

Q2-2014 2.8 7.9 66.6 23.4 75.7 22.4 500

Q1-2014 5.2 4.1 67.8 22.7 67.2 27.7 500

Q4-2013 3.3 9.4 64.8 23.9 68.7 28.2 500

Q3-2013 2.2 4.9 66.6 22.9 71.8 25.5 500

Q2-2013 3.0 4.1 66.0 24.5 68.5 30.1 500

Q1-2013 4.4 3.9 65.6 25.3 66.9 30.0 500

Q4-2012 5.2 6.2 68.1 22.4 64.4 33.1 500

Q3-2012 4.4 0.6 64.4 25.5 61.3 37.3 500

Q2-2012 4.2 7.0 66.7 24.5 63.6 35.0 500

Q1-2012 4.8 7.8 66.3 23.5 64.0 33.5 500

Q4-2011 4.8 9.0 62.7 27.2 67.3 30.5 500

Q3-2011 6.2 21.9 69.6 20.3 75.8 22.1 500

Q2-2011 6.0 11.8 70.5 19.4 77.3 20.9 500

Q1-2011 7.8 19.7 67.1 22.7 71.8 25.3 500

Q4-2010 6.6 211.1 69.6 21.1 76.4 21.5 500

Q3-2010 6.7 39.1 72.3 18.5 75.4 22.1 500

Q2-2010 9.9 27.9 74.5 16.1 76.7 20.8 500

Q1-2010 15.0 64.0 77.4 15.1 73.3 24.8 500

Q4-2009 6.9 -/+ 72.2 17.7 62.1 35.7 500

Q3-2009 17.1 -11.4 78.8 14.6 43.5 54.1 500

Q2-2009 17.1 -26.7 73.4 19.0 30.7 66.9 500

Q1-2009 5.5 -33.8 64.9 26.7 na na 500

Table 1B: S&P 500 Revenue Surprise

% Revenue % Y/Y Revenue % With Positive % With Negative % With Positive % With Negative # Companies

Surprise Growth Surprise Surprise Y/Y Growth Y/Y Growth Reported

Q2-2022 2.8 15.4 69.7 30.3 81.4 18.6 435

Q1-2022 2.5 13.6 73.8 26.2 84.8 15.2 500

Q4-2021 2.5 15.8 76.7 23.3 87.6 12.4 500

Q3-2021 2.8 16.4 76.5 23.5 90.1 9.9 500

Q2-2021 5.2 24.4 86.7 13.3 89.7 10.3 500

Q1-2021 3.8 10.2 77.7 22.3 76.6 23.4 500

Q4-2020 2.8 2.8 73.7 26.3 59.8 40.0 500

Q3-2020 3.7 -1.2 77.9 22.1 51.2 48.6 500

Q2-2020 2.9 -10.1 63.4 36.6 33.3 66.7 500

Q1-2020 -1.1 -2.3 60.1 39.9 55.2 44.8 500

Q4-2019 0.8 3.5 63.7 36.3 69.3 30.7 500

Q3-2019 0.8 3.6 58.2 41.8 67.7 32.1 500

Q2-2019 1.2 3.8 57.0 43.0 66.4 33.4 500

Q1-2019 0.2 4.9 57.1 42.9 67.5 32.3 500

Q4-2018 0.5 5.7 60.0 40.0 74.0 25.8 500

Q3-2018 1.3 8.6 60.9 39.1 83.1 16.9 500

Q2-2018 1.6 9.8 71.9 28.1 86.4 13.6 500

Q1-2018 1.1 8.2 75.7 24.3 87.6 12.4 500

Q4-2017 1.2 8.2 76.4 23.6 87.5 12.3 500

Q3-2017 1.3 5.8 67.6 32.4 78.8 21.2 500

Q2-2017 1.0 5.2 68.4 31.6 78.7 21.3 500

Q1-2017 0.7 8.0 63.1 36.9 39.4 14.2 500

Q4-2016 0.1 4.3 51.1 48.9 71.1 33.3 500

Q3-2016 0.2 2.6 54.2 45.8 66.7 33.3 500

Q2-2016 0.1 0.2 53.2 46.8 57.8 42.0 500

Q1-2016 -0.3 -1.4 52.4 47.4 55.2 44.8 500

Q4-2015 -0.5 -4.1 45.9 53.9 46.8 52.8 500

Q3-2015 -0.2 -3.9 43.1 56.7 51.4 48.6 500

Q2-2015 0.6 -3.7 48.4 51.6 52.2 47.8 500

Q1-2015 0.0 -3.9 43.2 56.8 55.2 44.8 500

Q4-2014 1.6 1.9 57.9 42.1 68.9 31.1 500

Q3-2014 0.3 4.2 59.7 40.3 72.2 27.8 500

Q2-2014 1.3 3.2 63.8 36.0 74.9 25.1 500

Q1-2014 0.0 2.7 52.2 47.8 71.0 28.7 500

Q4-2013 0.3 1.1 61.4 38.4 69.8 30.0 500

Q3-2013 1.0 3.4 54.0 46.0 71.6 28.2 500

Q2-2013 0.9 2.0 53.4 46.6 70.7 29.1 500

Q1-2013 -0.9 -0.2 45.8 54.0 64.3 35.5 500

Q4-2012 0.4 1.8 63.9 35.3 70.1 29.9 500

Q3-2012 -1.2 0.6 39.9 59.9 56.9 42.7 500

Q2-2012 -0.3 0.2 40.4 59.6 62.0 38.0 500

Q1-2012 1.1 5.4 64.9 35.1 73.2 26.8 500

Q4-2011 0.2 6.7 55.7 44.3 75.8 23.8 500

Q3-2011 1.5 10.9 60.4 39.6 81.2 18.8 500

Q2-2011 2.8 11.8 73.4 26.6 84.6 14.9 500

Q1-2011 1.1 9.5 66.3 33.7 77.8 22.2 500

Q4-2010 1.8 8.4 64.0 36.0 79.0 21.0 500

Q3-2010 0.7 8.5 60.6 39.4 80.7 19.1 500

Q2-2010 0.0 7.2 61.1 38.9 78.0 21.8 500

Q1-2010 1.2 11.4 67.9 32.1 78.2 21.8 500

Q4-2009 1.4 4.5 69.5 30.5 56.3 43.3 500

Q3-2009 0.2 -11.7 58.3 41.5 29.8 70.0 500

Q2-2009 0.1 -14.1 49.2 60.6 25.0 74.8 500

Q1-2009 -0.1 -10.6 36.5 63.5 na na 500

% surprise = difference between actual and consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research, Inc.

Page 1 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500/400/600 Earnings Surprise for Current Quarter

S&P 500/400/600 Earnings Surprise for Current Quarter

Table 3A: S&P Indexes Aggregate Revenue Surprise Q2-2022 (as of August 8, 2022)

% with % with % with % with

Expected Actual Y/Y % % with Flat

% Sales Positive Negative % with On Positive Y/Y Negative

Sector Y/Y Sales Sales Companies Y/Y Sales

Surprise Sales Sales Target Sales Sales Y/Y Sales

Growth (%) Growth (%) Reported Growth

Surprise Surprise Growth Growth

S&P 500 LargeCap 2.8 12.3 15.4 87.0 69.7 30.3 0.0 81.4 18.6 0.0

S&P 400 MidCap 3.9 14.9 19.3 79.8 72.4 27.6 0.0 82.1 17.9 0.0

S&P 600 SmallCap 7.5 13.5 22.2 75.3 70.6 29.2 0.2 77.9 22.1 0.0

LargeCap Sectors

Communication Services -0.1 3.1 3.0 82.6 57.9 42.1 0.0 52.6 47.4 0.0

Consumer Discretionary 2.6 13.3 16.2 72.4 59.5 40.5 0.0 81.0 19.0 0.0

Consumer Staples 3.4 4.2 7.7 75.8 76.0 24.0 0.0 76.0 24.0 0.0

Energy 7.5 65.5 77.9 95.2 80.0 20.0 0.0 95.0 5.0 0.0

Financials 1.9 1.2 3.1 93.9 54.8 45.2 0.0 74.2 25.8 0.0

Health Care 2.7 7.2 10.1 87.5 69.6 30.4 0.0 75.0 25.0 0.0

Industrials 0.4 12.3 12.8 93.0 66.7 33.3 0.0 83.3 16.7 0.0

Information Technology 0.1 7.2 7.2 78.9 75.0 25.0 0.0 85.0 15.0 0.0

Materials 1.4 15.5 17.1 92.9 76.9 23.1 0.0 84.6 15.4 0.0

Real Estate 1.6 14.9 16.7 96.8 76.7 23.3 0.0 96.7 3.3 0.0

Utilities 16.3 0.5 16.9 100.0 93.1 6.9 0.0 93.1 6.9 0.0

MidCap Sectors

Communication Services 0.7 16.2 17.0 62.5 60.0 40.0 0.0 100.0 0.0 0.0

Consumer Discretionary 2.3 12.2 14.8 62.9 61.5 38.5 0.0 79.5 20.5 0.0

Consumer Staples 4.8 4.9 9.9 38.9 57.1 42.9 0.0 71.4 28.6 0.0

Energy 21.6 71.0 107.9 100.0 78.6 21.4 0.0 85.7 14.3 0.0

Financials -0.8 -0.2 -1.0 95.0 75.4 24.6 0.0 71.9 28.1 0.0

Health Care -0.8 3.6 2.7 73.2 56.7 43.3 0.0 80.0 20.0 0.0

Industrials 3.4 10.2 14.0 84.1 75.9 24.1 0.0 89.7 10.3 0.0

Information Technology 1.0 25.5 26.9 80.4 75.6 24.4 0.0 82.9 17.1 0.0

Materials 4.2 19.0 24.0 84.6 77.3 22.7 0.0 90.9 9.1 0.0

Real Estate 6.2 -2.3 0.8 91.4 71.9 28.1 0.0 78.1 21.9 0.0

Utilities 16.6 26.0 51.2 87.5 100.0 0.0 0.0 92.9 7.1 0.0

SmallCap Sectors

Communication Services 0.4 11.9 12.3 88.2 66.7 33.3 0.0 73.3 26.7 0.0

Consumer Discretionary 2.0 8.8 11.0 58.4 63.5 36.5 0.0 69.2 30.8 0.0

Consumer Staples 8.9 5.4 14.8 62.1 77.8 22.2 0.0 77.8 22.2 0.0

Energy 31.4 51.7 101.0 88.9 91.7 8.3 0.0 100.0 0.0 0.0

Financials 1.3 1.9 3.2 88.0 61.1 37.9 1.1 74.7 25.3 0.0

Health Care -0.5 6.4 5.9 70.7 60.3 39.7 0.0 70.7 29.3 0.0

Industrials 4.3 10.2 15.0 77.3 76.5 23.5 0.0 85.3 14.7 0.0

Information Technology 3.6 7.5 11.4 64.3 80.0 20.0 0.0 77.8 22.2 0.0

Materials 5.5 17.0 23.5 73.5 92.0 8.0 0.0 96.0 4.0 0.0

Real Estate 1.1 9.5 10.8 91.7 72.7 27.3 0.0 75.0 25.0 0.0

Utilities 15.6 5.0 21.4 100.0 50.0 50.0 0.0 62.5 37.5 0.0

Table 3B: Slices & Dices

% with % with % with % with

Expected Actual Y/Y % % with Flat

% Sales Positive Negative % with On Positive Y/Y Negative

Sector/Industries Y/Y Sales Sales Companies Y/Y Sales

Surprise Sales Sales Target Sales Sales Y/Y Sales

Growth (%) Growth (%) Reported Growth

Surprise Surprise Growth Growth

LargeCap

S&P 500 ex-Energy 2.1 7.3 9.6 86.6 69.2 30.8 0.0 80.7 19.3 0.0

S&P 500 ex-Financials & Real Estat 2.9 13.8 17.0 85.9 72.1 27.9 0.0 82.6 17.4 0.0

S&P 500 ex-Tech 3.1 13.0 16.5 88.4 68.8 31.2 0.0 80.8 19.2 0.0

S&P 500 Retail Composite 1.8 5.8 7.7 46.2 75.0 25.0 0.0 75.0 25.0 0.0

S&P 500 Discretionary Retail 1.8 5.9 7.8 47.6 70.0 30.0 0.0 80.0 20.0 0.0

S&P 500 Staples Retail 1.7 5.6 7.4 40.0 100.0 0.0 0.0 50.0 50.0 0.0

S&P 500 Industrials Composite 2.6 13.4 16.3 83.3 69.3 30.7 0.0 79.3 20.7 0.0

S&P 500 Transportation 0.7 32.2 33.1 100.0 78.6 21.4 0.0 100.0 0.0 0.0

S&P 500 Industrials ex-Boeing 0.7 12.8 13.6 - - - - - - -

S&P 500 ex-Boeing 2.8 12.4 15.5 - - - - - - -

Information Technology ex-Apple 0.0 9.1 9.1 - - - - - - -

MidCap

S&P 400 ex-Energy 2.5 12.1 15.0 79.0 72.1 27.9 0.0 82.0 18.0 0.0

S&P 400 ex-Financials & Real Estat 4.4 17.7 23.0 75.4 71.7 28.3 0.0 85.2 14.8 0.0

S&P 400 ex-Tech 4.4 13.0 18.0 79.7 71.9 28.1 0.0 82.0 18.0 0.0

S&P 400 Retail Composite 2.7 15.4 18.5 19.0 50.0 50.0 0.0 75.0 25.0 0.0

S&P 400 Discretionary Retail 2.8 16.4 19.7 18.8 33.3 66.7 0.0 66.7 33.3 0.0

S&P 400 Staples Retail 1.0 3.8 4.8 20.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Industrials Composite 4.3 18.0 23.0 73.8 69.4 30.6 0.0 84.5 15.5 0.0

S&P 400 Transportation 2.3 11.4 14.0 100.0 80.0 20.0 0.0 90.0 10.0 0.0

SmallCap

S&P 600 ex-Energy 3.2 8.6 12.0 74.7 69.4 30.4 0.2 76.6 23.4 0.0

S&P 600 ex-Financials & Real Estat 8.0 14.6 24.0 72.6 73.1 26.9 0.0 78.7 21.3 0.0

S&P 600 ex-Tech 7.8 14.1 23.2 76.8 69.5 30.2 0.2 77.9 22.1 0.0

S&P 600 Retail Composite 2.9 9.5 12.7 48.8 55.0 45.0 0.0 70.0 30.0 0.0

S&P 600 Discretionary Retail -0.8 8.6 7.7 47.2 47.1 52.9 0.0 64.7 35.3 0.0

S&P 600 Staples Retail 17.8 13.3 33.5 60.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 600 Industrials Composite 8.4 14.3 24.1 69.4 73.2 26.8 0.0 79.0 21.0 0.0

S&P 600 Transportation 4.0 31.3 36.6 90.9 90.0 10.0 0.0 100.0 0.0 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 2 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500/400/600 Revenue Surprise for Current Quarter

S&P 500/400/600 Revenue Surprise for Current Quarter

Table 2A: S&P Indexes Aggregate Earnings Surprise Q2-2022 (as of August 8, 2022)

% with % with % with

Expected Actual Y/Y % % with % with Flat

% EPS Positive Negative % with On Negative

Sector Y/Y EPS EPS Growth Companies Positive Y/Y Y/Y EPS

Surprise EPS EPS Target EPS Y/Y EPS

Growth (%) (%) Reported EPS Growth Growth

Surprise Surprise Growth

S&P 500 LargeCap 6.0 4.8 11.2 87.0 76.8 19.5 3.7 59.8 37.5 2.8

S&P 400 MidCap 10.9 13.8 26.2 79.8 69.9 25.4 4.7 61.8 36.4 1.9

S&P 600 SmallCap 8.0 10.3 19.2 75.8 65.1 29.9 5.1 51.6 47.5 0.9

LargeCap Sectors

Communication Services 4.0 -16.9 -13.6 82.6 63.2 36.8 0.0 26.3 73.7 0.0

Consumer Discretionary 9.1 -9.1 -0.9 72.4 71.4 28.6 0.0 54.8 42.9 2.4

Consumer Staples 5.1 -2.9 2.1 75.8 72.0 16.0 12.0 56.0 40.0 4.0

Energy 11.3 261.8 302.9 95.2 85.0 10.0 5.0 100.0 0.0 0.0

Financials 4.6 -24.9 -21.4 93.9 69.4 30.6 0.0 33.9 64.5 1.6

Health Care 7.8 1.7 9.6 87.5 76.8 17.9 5.4 51.8 44.6 3.6

Industrials 4.4 26.2 31.7 93.0 83.3 10.6 6.1 86.4 9.1 4.5

Information Technology 1.3 0.5 1.8 78.9 86.7 11.7 1.7 71.7 25.0 3.3

Materials 3.4 15.2 19.1 92.9 76.9 23.1 0.0 61.5 38.5 0.0

Real Estate 30.8 -17.6 7.7 96.8 76.7 23.3 0.0 53.3 46.7 0.0

Utilities 7.8 -11.0 -4.1 100.0 72.4 13.8 13.8 55.2 37.9 6.9

MidCap Sectors

Communication Services 2.5 4.5 7.1 62.5 60.0 40.0 0.0 60.0 40.0 0.0

Consumer Discretionary 12.7 1.4 14.2 62.9 76.9 17.9 5.1 56.4 43.6 0.0

Consumer Staples 9.5 -6.9 1.9 38.9 71.4 28.6 0.0 57.1 42.9 0.0

Energy 11.8 225.6 263.9 100.0 57.1 35.7 7.1 85.7 14.3 0.0

Financials 11.8 -13.2 -3.0 96.7 70.7 27.6 1.7 44.8 50.0 5.2

Health Care -7.1 -4.4 -11.1 73.2 60.0 36.7 3.3 40.0 56.7 3.3

Industrials 16.5 19.0 38.7 84.1 79.3 19.0 1.7 77.6 20.7 1.7

Information Technology 5.6 8.9 15.0 80.4 78.0 17.1 4.9 68.3 29.3 2.4

Materials 6.3 26.8 34.7 84.6 77.3 13.6 9.1 81.8 18.2 0.0

Real Estate 30.1 16.3 51.3 88.6 54.8 35.5 9.7 67.7 32.3 0.0

Utilities -0.7 -3.0 -3.6 87.5 42.9 42.9 14.3 42.9 57.1 0.0

SmallCap Sectors

Communication Services -50.2 118.5 8.9 88.2 53.3 40.0 6.7 46.7 53.3 0.0

Consumer Discretionary 11.2 -4.4 6.4 58.4 65.4 34.6 0.0 46.2 53.8 0.0

Consumer Staples 11.5 -10.7 -0.4 62.1 55.6 38.9 5.6 33.3 66.7 0.0

Energy 28.8 762.3 953.3 92.6 68.0 32.0 0.0 84.0 16.0 0.0

Financials -20.3 -27.2 -41.9 90.7 67.3 23.5 9.2 36.7 60.2 3.1

Health Care -58.6 -58.4 -82.8 70.7 46.6 43.1 10.3 31.0 69.0 0.0

Industrials 19.9 6.9 28.2 77.3 73.5 25.0 1.5 66.2 33.8 0.0

Information Technology 20.0 -0.7 19.1 64.3 77.8 15.6 6.7 71.1 26.7 2.2

Materials 16.4 870.9 1030.1 76.5 73.1 23.1 3.8 73.1 26.9 0.0

Real Estate 283.1 -60.4 51.5 87.5 61.9 35.7 2.4 54.8 45.2 0.0

Utilities -5.3 -11.6 -16.3 100.0 50.0 50.0 0.0 50.0 50.0 0.0

Table 2B: Slices & Dices

% with % with % with

Expected Actual Y/Y % % with % with Flat

% EPS Positive Negative % with On Negative

Sector/Industries Y/Y EPS EPS Growth Companies Positive Y/Y Y/Y EPS

Surprise EPS EPS Target EPS Y/Y EPS

Growth (%) (%) Reported EPS Growth Growth

Surprise Surprise Growth

LargeCap

S&P 500 ex-Energy 5.2 -5.7 -0.9 86.6 76.4 20.0 3.6 57.8 39.3 2.9

S&P 500 ex-Financials & Real Estat 6.3 12.2 19.2 85.9 78.0 17.7 4.3 64.1 33.0 2.9

S&P 500 ex-Tech 7.1 5.9 13.5 88.4 75.2 20.8 4.0 57.9 39.5 2.7

S&P 500 Retail Composite 9.4 -48.3 -43.4 46.2 91.7 8.3 0.0 50.0 41.7 8.3

S&P 500 Discretionary Retail 11.7 -56.7 -51.7 47.6 90.0 10.0 0.0 50.0 40.0 10.0

S&P 500 Staples Retail 4.3 -9.1 -5.2 40.0 100.0 0.0 0.0 50.0 50.0 0.0

S&P 500 Industrials Composite 5.9 11.5 18.1 83.3 79.0 17.3 3.7 64.3 32.7 3.0

S&P 500 Transportation 1.4 175.4 179.2 100.0 71.4 21.4 7.1 100.0 0.0 0.0

S&P 500 Industrials ex-Boeing 4.8 27.7 33.7 - - - - - - -

S&P 500 ex-Boeing 6.0 4.9 11.3 - - - - - - -

Information Technology ex-Apple 0.7 4.6 5.3 - - - - - - -

MidCap

S&P 400 ex-Energy 10.8 5.5 16.8 79.0 70.5 24.9 4.6 60.7 37.4 2.0

S&P 400 ex-Financials & Real Estat 9.4 24.4 36.1 75.4 71.7 23.5 4.8 65.2 33.5 1.3

S&P 400 ex-Tech 11.4 14.3 27.2 79.7 68.7 26.6 4.7 60.8 37.4 1.8

S&P 400 Retail Composite 11.6 11.7 24.6 19.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Discretionary Retail 11.6 12.9 26.0 18.8 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Staples Retail 11.7 -1.9 9.6 20.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Industrials Composite 9.5 22.7 34.4 73.8 73.8 21.8 4.4 65.5 33.0 1.5

S&P 400 Transportation 11.4 82.2 103.0 100.0 70.0 30.0 0.0 90.0 10.0 0.0

SmallCap

S&P 600 ex-Energy 4.4 -8.3 -4.2 75.0 64.9 29.8 5.3 49.8 49.3 0.9

S&P 600 ex-Financials & Real Estat 13.7 34.6 53.0 70.9 64.8 31.1 4.1 55.9 43.8 0.3

S&P 600 ex-Tech 6.9 11.5 19.2 77.4 63.7 31.5 4.9 49.5 49.8 0.7

S&P 600 Retail Composite 6.3 -17.8 -12.7 48.8 60.0 40.0 0.0 40.0 60.0 0.0

S&P 600 Discretionary Retail -0.3 -19.4 -19.6 47.2 58.8 41.2 0.0 35.3 64.7 0.0

S&P 600 Staples Retail 72.0 1.7 75.0 60.0 66.7 33.3 0.0 66.7 33.3 0.0

S&P 600 Industrials Composite 13.2 33.4 51.0 69.9 64.6 31.0 4.4 55.6 44.1 0.3

S&P 600 Transportation 22.1 66.6 103.5 90.9 80.0 20.0 0.0 70.0 30.0 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 3 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500/400/600 Change in Shares Outstanding

S&P 500/400/600 Change in Shares Outstanding

Table 4: S&P Indexes Changes in Basic Shares Outstanding (as of August 8, 2022)

% cos with % cos with % cos with % cos with

# companies Y/Y % Q/Q %

falling share o/s falling share o/s

Sector with share data change in change in

shares o/s down >4% shares o/s down >4%

for Q2-2022 shares shares

y/y y/y q/q q/q

S&P 500 LargeCap 435 -0.1 58.4 17.2 0.4 57.9 2.3

S&P 400 MidCap 323 2.9 50.2 20.1 0.5 51.4 3.1

S&P 600 SmallCap 457 0.6 39.4 12.5 0.3 37.4 3.1

LargeCap Sectors

Communication Services 19 3.1 47.4 21.1 3.9 47.4 0.0

Consumer Discretionary 42 -0.6 64.3 31.0 -0.3 76.2 4.8

Consumer Staples 25 -0.3 64.0 0.0 -0.5 60.0 4.0

Energy 20 1.8 40.0 20.0 0.0 55.0 5.0

Financials 62 -2.9 72.6 37.1 -0.2 58.1 4.8

Health Care 56 -0.9 57.1 16.1 -0.2 55.4 0.0

Industrials 66 -1.8 72.7 13.6 -0.6 75.8 1.5

Information Technology 60 -1.0 66.7 11.7 0.0 70.0 1.7

Materials 26 -2.7 84.6 19.2 -0.8 65.4 0.0

Real Estate 30 9.6 13.3 0.0 2.4 16.7 0.0

Utilities 29 0.8 10.3 3.4 -0.2 13.8 3.4

MidCap Sectors

Communication Services 5 0.0 60.0 0.0 0.0 60.0 0.0

Consumer Discretionary 39 -2.0 71.8 25.6 -1.3 79.5 7.7

Consumer Staples 10 4.6 40.0 30.0 4.7 40.0 0.0

Energy 14 15.2 28.6 7.1 1.0 28.6 0.0

Financials 58 3.2 58.6 24.1 2.2 50.0 3.4

Health Care 30 2.1 26.7 6.7 1.0 30.0 3.3

Industrials 58 -1.1 62.1 24.1 -0.7 63.8 3.4

Information Technology 41 -1.0 51.2 24.4 -0.6 61.0 2.4

Materials 22 -2.3 77.3 31.8 -0.9 77.3 0.0

Real Estate 32 7.9 15.6 12.5 0.1 18.8 3.1

Utilities 14 1.3 14.3 0.0 0.3 7.1 0.0

SmallCap Sectors

Communication Services 16 6.0 18.8 6.3 2.3 25.0 0.0

Consumer Discretionary 52 -3.8 69.2 30.8 -1.3 65.4 7.7

Consumer Staples 18 1.5 33.3 5.6 0.1 38.9 0.0

Energy 25 6.4 24.0 0.0 0.2 16.0 0.0

Financials 97 2.5 57.7 19.6 0.8 53.6 6.2

Health Care 58 -0.1 15.5 12.1 0.1 15.5 1.7

Industrials 68 -1.2 45.6 11.8 -0.3 44.1 1.5

Information Technology 45 -8.7 51.1 11.1 -0.1 46.7 4.4

Materials 26 1.0 30.8 0.0 0.3 26.9 0.0

Real Estate 44 3.0 4.5 0.0 0.7 6.8 0.0

Utilities 8 5.6 0.0 0.0 1.2 0.0 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 4 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings % Surprise

Figure 1.

6.0 6.0

5.5 S&P 500 NET REVENUE SURPRISE* 5.5

(percent)

5.0 5.0

4.5 4.5

4.0 4.0

3.5 3.5

3.0 3.0

Q2

2.5 2.5

2.0 2.0

1.5 1.5

1.0 1.0

.5 .5

.0 .0

-.5 -.5

-1.0 -1.0

yardeni.com

-1.5 -1.5

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

* Percentage that S&P 500 companies reported revenues above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 2.

25 25

S&P 500 NET EARNINGS SURPRISE*

20 (percent) 20

15 15

10 10

Q2

5 5

0 0

-5 -5

-10 -10

-15 -15

-20 -20

yardeni.com

-25 -25

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

* Percentage that S&P 500 companies reported earnings above or below the consensus estimate at the time of the earnings report.

Earnings surprise capped at -20% during Q4-2008.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 5 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings % of Companies +/-

Figure 3.

100 100

S&P 500 POSITIVE & NEGATIVE REVENUE SURPRISES*

80 (percent of companies) 80

Q2

60 60

40 40

20 20

0 0

-20 -20

Q2

-40 -40

-60 -60

yardeni.com

-80 -80

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

* Percentage of S&P 500 companies that reported revenues above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 4.

100 100

S&P 500 POSITIVE & NEGATIVE EARNINGS SURPRISES*

(percent of companies)

80 80

Q2

60 60

40 40

20 20

0 0

-20 Q2 -20

-40 -40

yardeni.com

-60 -60

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

* Percentage of S&P 500 companies that reported earnings above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 6 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Surprise ex-Energy

Figure 5.

12 12

10 QUARTERLY REVENUE SURPRISE* 10

8 (percent) 8

6 6

4 4

2 Q1 2

0 0

-2 -2

-4 -4

-6 -6

-8 -8

-10

S&P 500 (2.5) -10

-12 S&P 500 Energy (7.9) -12

-14 S&P 500 ex-Energy (2.0) -14

-16 -16

1.25 1.25

1.00 1.00

.75 Percent Surprise Attributable to Energy (0.5) .75

.50 Q1 .50

.25 .25

.00 .00

-.25 -.25

-.50 -.50

-.75 -.75

-1.00 -1.00

-1.25 -1.25

yardeni.com

-1.50 -1.50

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that revenues were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 6.

125 125

QUARTERLY EARNINGS SURPRISE*

100 (percent) S&P 500 (7.3) 100

S&P 500 Energy (4.8)

75 S&P 500 ex-Energy (7.6) 75

50 50

25 25

Q1

0 0

-25 -25

2.0 2.0

1.5

Percent Surprise Attributable to Energy (-0.3) 1.5

1.0 1.0

.5 .5

.0 .0

Q1

-.5 -.5

-1.0 -1.0

yardeni.com

-1.5 -1.5

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that earnings were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 7 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Surprise ex-Financials

Figure 7.

15 15

QUARTERLY REVENUE SURPRISE*

10 (percent) 10

5 5

Q1

0 0

-5 S&P 500 (2.5) -5

S&P 500 Financials (2.0)

-10 -10

S&P 500 ex-Financials (2.6)

-15 -15

-20 -20

2.5 2.5

2.0 2.0

1.5 1.5

1.0 1.0

.5 .5

.0 Q1 .0

-.5 -.5

-1.0 -1.0

-1.5 -1.5

-2.0 -2.0

Percent Surprise Attributable to Financials (-0.1)

-2.5 -2.5

-3.0 yardeni.com -3.0

-3.5 -3.5

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that revenues were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 8.

30 30

QUARTERLY EARNINGS SURPRISE*

20 (percent) 20

10 10

Q1

0 0

-10 S&P 500 (7.3) -10

S&P 500 Financials (9.7)

-20 -20

S&P 500 ex-Financials (6.9)

Surprise capped at 20% and -20% due to extreme values.

-30 -30

15 15

10 Percent Surprise Attributable to Financials (0.4) 10

5 5

0 Q1 0

-5 -5

-10 -10

-15 -15

yardeni.com

-20 -20

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that earnings were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 8 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Growth ex-Energy

Figure 9.

60 60

QUARTERLY REVENUE GROWTH*

45 (percent) 45

30 30

15 Q1 15

0 0

-15 -15

-30 S&P 500 (13.6) -30

-45

S&P 500 Energy (50.0) -45

S&P 500 ex-Energy (10.4) Growth capped at 50% due to extreme values.

-60 -60

6 6

4

Percentange Points Attributable to Energy (3.2) 4

Q1

2 2

0 0

-2 -2

-4 -4

-6 -6

yardeni.com

-8 -8

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 10.

80 80

QUARTERLY EARNINGS GROWTH*

60 (percent) 60

40 40

20 20

Q1

0 0

-20 -20

S&P 500 (12.9)

-40 S&P 500 Energy (50.0) -40

-60 S&P 500 ex-Energy (6.4) -60

Growth capped at 50% and -50% due to extreme values.

-80 -80

10 10

8 Percentange Points Attributable to Energy (6.5) 8

6 Q1 6

4 4

2 2

0 0

-2 -2

-4 -4

-6 -6

-8 -8

yardeni.com

-10 -10

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 9 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Growth ex-Financials

Figure 11.

40 40

QUARTERLY REVENUE GROWTH*

30 (percent) 30

20 20

Q1

10 10

0 0

-10 S&P 500 (13.6) -10

S&P 500 Financials (2.2)

-20 -20

S&P 500 ex-Financials (15.3)

-30 -30

3 3

2 Percentage Points Attributable to Financials (-1.7) 2

1 1

0 0

-1 -1

Q1

-2 -2

-3 -3

-4 -4

yardeni.com

-5 -5

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 12.

80 80

QUARTERLY EARNINGS GROWTH*

60 (percent) 60

40 40

20 20

Q1

0 0

-20 S&P 500 (12.9) -20

-40 S&P 500 Financials (-17.7) -40

S&P 500 ex-Financials (21.3)

-60 -60

Growth capped at 60% and -60% due to extreme values.

-80 -80

75 75

Percent Points Attributable to Financials (-8.4)

50 50

25 25

Growth contribution capped at 60% and -60% due to extreme values.

0 0

Q1

-25 -25

-50 -50

yardeni.com

-75 -75

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 10 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Surprises

Figure 13.

40 25

30

S&P 500 HEALTH CARE

earnings surprise (%) 20

20 (7.3)

(9.7) 15

10 Q1 Q1 10

0

5

-10

-20 0

Q4-2008 capped at -20%

-30 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

40 80

30

COMMUNICATION SERVICES INDUSTRIALS 70

60

20

(2.1) 50

10 40

Q1 30

0

20

-10

(4.0) 10

-20 Q1 0

-30 -10

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 25

75 CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY

20

50

25 (5.8) 15

0 Q1 10

-25 Q1 5

-50 (5.1)

-75 0

-100 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

15 80

CONSUMER STAPLES MATERIALS

12 60

9 (6.8) (9.4) 40

Q1

6

20

3 Q1

0 0

-3 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

140 100

120 ENERGY REAL ESTATE

80

100

80 (4.8) (26.7) 60

60

40

40

Q1

20 20

0 Q1

0

-20

-40 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

75 20

FINANCIALS UTILITIES

50 Q1 15

25 (15.6)

(9.7) 10

Q1

0

5

-25

-50 0

yardeni.com

-75 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 11 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Surprises

Figure 14.

150 125

125 S&P 500 HEALTH CARE 100

100 % of companies with positive and negative earnings Q1

surprise (percent) 75

75 Q1

50

50

25

25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

150 125

COMMUNICATION SERVICES INDUSTRIALS 100

100 Q1

Q1 75

50 50

0 25

0

-50

-25

-100 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

125 125

100

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 100

Q1

75 75

50 Q1 50

25 25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

125 125

100

CONSUMER STAPLES MATERIALS 100

Q1 Q1

75 75

50 50

25 25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 100

ENERGY Q1 REAL ESTATE 75

75 Q1

50

50

25

25

0

0

-25

-25 -50

-50 -75

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 100

FINANCIALS Q1 UTILITIES

75 Q1

50 50

25

0

0

-25 -50

-50

yardeni.com

-75 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 12 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Surprises

Figure 15.

6 4

5 S&P 500 HEALTH CARE

Q1 3

4 revenue surprise (%) (2.5)

3 2

Q1

2 1

1 0

0 (3.1)

-1 -1

-2 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

6 6

COMMUNICATION SERVICES INDUSTRIALS

4 4

2 (-1.4) (0.8) 2

Q1

0 0

Q1

-2 -2

-4 -4

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

6 8

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY

6

4

(1.1) (2.2) 4

2

Q1 Q1 2

0

0

-2 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

6 9

CONSUMER STAPLES MATERIALS 6

4

Q1 Q1 3

2 (2.9) 0

0 -3

-6

-2 (3.5)

-9

-4 -12

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

15 8

10

ENERGY REAL ESTATE

Q1 6

5

0

(1.2) 4

-5 2

-10 Q1

(7.9) 0

-15

-20 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

15 15

10

FINANCIALS UTILITIES 10

Q1

5 (9.1) 5

Q1

0 0

-5 -5

-10 -10

(2.0)

-15 -15

yardeni.com

-20 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 13 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Surprises

Figure 16.

200 100

S&P 500 HEALTH CARE Q1 75

150 % of companies with positive and negative revenue

surprise (percent) 50

100

Q1 25

50

0

0

-25

-50 -50

-100 -75

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 100

75

COMMUNICATION SERVICES INDUSTRIALS Q1 75

50 50

Q1 25

25

0

0

-25

-25 -50

-50 -75

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

125 125

100 CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 100

Q1

75 75

Q1

50 50

25 25

0 0

-25 -25

-50 -50

-75 -75

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 150

75

CONSUMER STAPLES Q1 MATERIALS

100

50 Q1

25 50

0 0

-25

-50

-50

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 100

75

ENERGY Q1 REAL ESTATE Q1 75

50 50

25

25

0

0

-25

-25 -50

-50 -75

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

100 100

FINANCIALS UTILITIES Q1

75

50 Q1 50

25

0

0

-25 -50

-50

yardeni.com

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 14 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Growth

Figure 17.

175 30

150 S&P 500 HEALTH CARE 25

125 y/y earnings growth (%)

100 20

Q1

75 (12.9) (18.4) 15

50

25 10

Q1

0 5

-25

-50 0

capped at 120%

-75 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

90 75

75 COMMUNICATION SERVICES INDUSTRIALS 50

60 Q1

25

45

30 0

15 -25

0 Q1 -50

-15 (-3.9) (38.7)

-30 -75

capped at 60%

-45 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

150 100

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 80

100

60

50 (-7.7) (13.5) 40

0 Q1 20

Q1

0

-50

-20

capped at 100% and -75%

-100 -40

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

40 200

CONSUMER STAPLES MATERIALS

30 150

(7.2) (46.1) 100

20

Q1 50

10

Q1 0

0 -50

capped at 150%

-10 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

140 100

ENERGY Q1

REAL ESTATE

75

70

(100.0) (39.2) 50

Q1

0 25

0

-70

-25

Capped at 100% and -100% due to extreme values. capped at 90%

-140 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

150 50

FINANCIALS UTILITIES 40

100

30

50 (-17.7) (24.9) Q1

20

0 10

Q1 0

-50

-10

capped at -80% and 90% yardeni.com

-100 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 15 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Growth

Figure 18.

30 25

25 S&P 500 HEALTH CARE

y/y revenue growth (%) 20

20 (14.7)

15 (13.6) Q1 Q1 15

10

10

5

0 5

-5

0

-10

-15 -5

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

30 40

COMMUNICATION SERVICES INDUSTRIALS 30

20 (7.7) 20

Q1 10

10

Q1 0

0 -10

(12.2)

-20

-10 -30

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

60 30

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY

45 20

30 (11.9) Q1 10

15

Q1

0

0

-15 (10.7) -10

-30 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

15 60

CONSUMER STAPLES MATERIALS

40

10

(8.2) Q1 (24.1) Q1 20

5

0

0

-20

-5 -40

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

80 Q1 20

60

ENERGY REAL ESTATE

Q1 15

40 (58.8)

(19.1) 10

20

5

0

0

-20

-40 -5

capped at 60%

-60 -10

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

40 30

30

FINANCIALS UTILITIES 25

20

20 (2.1) 15

10 10

Q1 5

0 Q1 0

-10 -5

(2.2) -10

-20 -15

yardeni.com

-30 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 16 / August 8, 2022 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

Copyright (c) Yardeni Research, Inc. 2022. All rights reserved. The information

contained herein has been obtained from sources believed to be reliable, but is not

necessarily complete and its accuracy cannot be guaranteed. No representation or

warranty, express or implied, is made as to the fairness, accuracy, completeness, or

correctness of the information and opinions contained herein. The views and the other

information provided are subject to change without notice. All reports and podcasts posted on

http://blog.yardeni.com

www.yardeni.com, blog.yardeni.com, and YRI’s Apps are issued

without regard to the specific investment objectives, financial situation, or particular needs

of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell

any securities or related financial instruments. Past performance is not necessarily a guide

to future results. Company fundamentals and earnings may be mentioned occasionally, but

should not be construed as a recommendation to buy, sell, or hold the company’s stock.

Predictions, forecasts, and estimates for any and all markets should not be construed as

recommendations to buy, sell, or hold any security--including mutual funds, futures

contracts, and exchange traded funds, or any similar instruments.

The text, images, and other materials contained or displayed on any Yardeni Research, Inc.

product, service, report, email or website are proprietary to Yardeni Research, Inc. and

constitute valuable intellectual property. No material from any part of www.yardeni.com,

http://blog.yardeni.com

blog.yardeni.com, and YRI’s Apps may be downloaded, transmitted,

broadcast, transferred, assigned, reproduced or in any other way used or otherwise

disseminated in any form to any person or entity, without the explicit written consent of

Yardeni Research, Inc. All unauthorized reproduction or other use of material from Yardeni

Research, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary

and intellectual property rights, including but not limited to, rights of privacy. Yardeni

Research, Inc. expressly reserves all rights in connection with its intellectual property,

including without limitation the right to block the transfer of its products and services and/or

to track usage thereof, through electronic tracking technology, and all other lawful means,

now known or hereafter devised. Yardeni Research, Inc. reserves the right, without further

notice, to pursue to the fullest extent allowed by the law any and all criminal and civil

remedies for the violation of its rights.

The recipient should check any email and any attachments for the presence of viruses.

Yardeni Research, Inc. accepts no liability for any damage caused by any virus transmitted

by this company’s emails, website, blog and Apps. Additional information available on

request.

requests@yardeni.com

You might also like

- Labor Market Statistics q12020 en 1Document4 pagesLabor Market Statistics q12020 en 1Toofy AlNo ratings yet

- Shubham Moon Marketing 4.0 Final Assignment MBA 1Document26 pagesShubham Moon Marketing 4.0 Final Assignment MBA 1shubham moonNo ratings yet

- Gross Domestic ProductDocument8 pagesGross Domestic ProductEmmylou Molito PesidasNo ratings yet

- Sweet Biscuits in India DatagraphicsDocument3 pagesSweet Biscuits in India DatagraphicsSiddhant KoradiaNo ratings yet

- Prashant Sharma BudgetDocument24 pagesPrashant Sharma BudgetPrashant SharmaNo ratings yet

- Business CommunicationDocument16 pagesBusiness CommunicationHarsh ManralNo ratings yet

- BOIPPTNew 06112020Document36 pagesBOIPPTNew 06112020Rohit AggarwalNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

- Drinking Milk Products in Vietnam - Datagraphics: Country Report - Aug 2019Document3 pagesDrinking Milk Products in Vietnam - Datagraphics: Country Report - Aug 2019Tiger HồNo ratings yet

- Gabriel IndiaDocument137 pagesGabriel IndiaIshaan MakkerNo ratings yet

- Analysis of Bop Position of India in Last 10 Years: Ritika Kamboj Mba Finance Sec A A001110719068Document7 pagesAnalysis of Bop Position of India in Last 10 Years: Ritika Kamboj Mba Finance Sec A A001110719068Simran chauhanNo ratings yet

- RCB - México 2017Document5 pagesRCB - México 2017Freddy Ilave HuamaniNo ratings yet

- Pakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Document1 pagePakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Aleem RasoolNo ratings yet

- Alibaba Group Holding Limited: Strong BuyDocument9 pagesAlibaba Group Holding Limited: Strong BuyAnonymous P73cUg73L100% (1)

- YriearningsforecastDocument7 pagesYriearningsforecastjhllninmNo ratings yet

- Contoh Tabulasi Data EviewsDocument4 pagesContoh Tabulasi Data EviewsBela KhairunnisyakNo ratings yet

- Madhuvanthi Raja-Accounts Minor 2Document11 pagesMadhuvanthi Raja-Accounts Minor 2madhuvanthi.rajaaNo ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Why North Macedonia - 2020 - Real Estate Market - Fortonmka Cushman & WakefieldDocument54 pagesWhy North Macedonia - 2020 - Real Estate Market - Fortonmka Cushman & Wakefieldana.filiposka124No ratings yet

- Savoury Biscuits in India DatagraphicsDocument2 pagesSavoury Biscuits in India DatagraphicsSiddhant KoradiaNo ratings yet

- Beta CalculatorDocument19 pagesBeta CalculatorcakartikayNo ratings yet

- Draft Financial Performance of Nairobi Stock ExchangeDocument9 pagesDraft Financial Performance of Nairobi Stock ExchangekinduNo ratings yet

- Wilcon Depot Inc.Document9 pagesWilcon Depot Inc.Aleli BaluyoNo ratings yet

- Haider Bhai Account StatementDocument1 pageHaider Bhai Account StatementSalman SajidNo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- Result Presentation (Result)Document14 pagesResult Presentation (Result)Shyam SunderNo ratings yet

- MS CIT Year Wise Admission Count - 2021 01Document1 pageMS CIT Year Wise Admission Count - 2021 01rajshrichormare21No ratings yet

- fm2 Project Phase 1Document7 pagesfm2 Project Phase 1SACHIN THOMAS GEORGE MBA19-21No ratings yet

- Prepaid Expenses 31.03.2019Document5 pagesPrepaid Expenses 31.03.2019pradeep vermaNo ratings yet

- GNP and GDPDocument4 pagesGNP and GDPov_ramoneNo ratings yet

- Subject: Islamic Finance: Assignment: 3Document9 pagesSubject: Islamic Finance: Assignment: 3AimeeNo ratings yet

- CAPMDocument3 pagesCAPMalwyn sequeiraNo ratings yet

- Ii. Fiscal Situation: Combined Government Finances: 2008-09Document7 pagesIi. Fiscal Situation: Combined Government Finances: 2008-09gkmishra2001 at gmail.comNo ratings yet

- 1 1 4欧洲站简介Document32 pages1 1 4欧洲站简介calvinianzNo ratings yet

- Education and Health Sector in PakistanDocument17 pagesEducation and Health Sector in PakistanMuhammad UmairNo ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- 2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioDocument10 pages2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioNurul JannahNo ratings yet

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- BMG704 (16432)Document20 pagesBMG704 (16432)EhinomenNo ratings yet

- Финансовая модель СтартапаDocument107 pagesФинансовая модель СтартапаЧудо НяниNo ratings yet

- Quarterly Estimated GDPDocument11 pagesQuarterly Estimated GDPb2023ankitkumar.singhNo ratings yet

- 2022.07 Pavise Monthly Letter FlagshipDocument4 pages2022.07 Pavise Monthly Letter FlagshipKan ZhouNo ratings yet

- 321b0800 4111smartDocument11 pages321b0800 4111smartpankajNo ratings yet

- Comparison SBIN ICICIDocument135 pagesComparison SBIN ICICIGauravNo ratings yet

- Member Statement 2720289 PDFDocument3 pagesMember Statement 2720289 PDFnelsonNo ratings yet

- Marred by Regulatory Scrutiny: Qiwi PLCDocument4 pagesMarred by Regulatory Scrutiny: Qiwi PLCRalph SuarezNo ratings yet

- Trend Analysis: September 2020Document6 pagesTrend Analysis: September 2020Sharmarke Mohamed AhmedNo ratings yet

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- Demand Forecast CASEDocument5 pagesDemand Forecast CASENirajanNo ratings yet

- Cia DAMDocument24 pagesCia DAMvishalNo ratings yet

- FM Graphs and Ratios TableDocument10 pagesFM Graphs and Ratios TableNehal SharmaNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/31Document4 pagesCambridge International AS & A Level: BUSINESS 9609/31underhiswings0110No ratings yet

- Sensiblu - Campaign Results - Aug18Document11 pagesSensiblu - Campaign Results - Aug18Mihaela VladNo ratings yet

- Eco Assignment123456789Document19 pagesEco Assignment123456789Diksha LathNo ratings yet

- Davelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Document6 pagesDavelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Josué LeónNo ratings yet

- Corporate Finance Ii Project: Tvs MotorsDocument11 pagesCorporate Finance Ii Project: Tvs MotorsMr JainNo ratings yet

- Total Expenditure 2018-2019 5540120 471810 2155699 165218 335078 558084 719067 407958 61550 122954 365561Document4 pagesTotal Expenditure 2018-2019 5540120 471810 2155699 165218 335078 558084 719067 407958 61550 122954 365561Hassan RanaNo ratings yet

- The Relationship Between Unemployment and GDP: Unempolyment Rate (%)Document4 pagesThe Relationship Between Unemployment and GDP: Unempolyment Rate (%)senith lasenNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- مقارنة بين أشهر برامج التحليل النوعيDocument3 pagesمقارنة بين أشهر برامج التحليل النوعيkhalidgnNo ratings yet

- 12 Important SEO KPIs You Should TrackDocument19 pages12 Important SEO KPIs You Should TrackkhalidgnNo ratings yet

- Uncovering Progress of Health Information Management PracticesDocument32 pagesUncovering Progress of Health Information Management PracticeskhalidgnNo ratings yet

- Optigrill: DE NL FR EN DA SV FI NODocument17 pagesOptigrill: DE NL FR EN DA SV FI NOkhalidgnNo ratings yet

- KFH Research Turkey Focus 2012 A Strained YearDocument2 pagesKFH Research Turkey Focus 2012 A Strained YearkhalidgnNo ratings yet

- Iso 17000Document57 pagesIso 17000Osama MohammedNo ratings yet

- Tax Invoice and Other Such Instruments: Central Board of Excise & CustomsDocument4 pagesTax Invoice and Other Such Instruments: Central Board of Excise & CustomsAvinash DangwalNo ratings yet

- Sales Process: Automating The Sales Process: SAP Business One Version 9.3Document31 pagesSales Process: Automating The Sales Process: SAP Business One Version 9.3Abrans GarciaNo ratings yet

- Od329347325735250100 1Document4 pagesOd329347325735250100 1AneesEverNo ratings yet

- Organizational Analysis ModelsDocument7 pagesOrganizational Analysis ModelsMohamed M AlasrigyNo ratings yet

- Advanced Cost and Management AccountingDocument5 pagesAdvanced Cost and Management AccountingAivin JosephNo ratings yet

- Phase1 Group 2 Mm2 AssignmentDocument13 pagesPhase1 Group 2 Mm2 AssignmentAbhinav SinghNo ratings yet

- E Commerce in AlbaniaDocument10 pagesE Commerce in AlbaniaAnxhelaNo ratings yet

- Lecture 3 - Project ChronologyDocument16 pagesLecture 3 - Project ChronologyHaider ShahNo ratings yet

- Instagram and Facebook MarketingDocument6 pagesInstagram and Facebook Marketingaadarsh mahajanNo ratings yet

- Grade 11 - Fundamentals of Accountancy, Business and Management 1Document126 pagesGrade 11 - Fundamentals of Accountancy, Business and Management 1Marionne Jose TitanNo ratings yet

- Kashato-Shirts MerchandisingDocument3 pagesKashato-Shirts MerchandisingFred Wilson100% (1)

- Project Guidelines and Rubric: CompetenciesDocument1 pageProject Guidelines and Rubric: CompetenciesClintonM.OrengeNo ratings yet

- Manufacturing of Javadhu PowderDocument2 pagesManufacturing of Javadhu PowderkhsreeharshaNo ratings yet

- Ifrs 3 Acqusition of A Group of Assets Nov 17Document2 pagesIfrs 3 Acqusition of A Group of Assets Nov 17JPNo ratings yet

- Digital Revolution PDFDocument26 pagesDigital Revolution PDFSakti AlhadidNo ratings yet

- CCIC验收合格 PDFDocument26 pagesCCIC验收合格 PDFHaider KingNo ratings yet

- Mel Arthor QueditDocument2 pagesMel Arthor QueditMel Arthor QueditNo ratings yet

- Fluence Solar + Storage White PaperDocument8 pagesFluence Solar + Storage White PaperPovaSNo ratings yet

- Tax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaDocument13 pagesTax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- BEJ - Vol8 - 2 - Big Data Analytics Tackling Business Challenges in Banking IndustryDocument7 pagesBEJ - Vol8 - 2 - Big Data Analytics Tackling Business Challenges in Banking IndustryDerrick Kojo SenyoNo ratings yet

- Analyzing The Impact of Covid19 On Sustainable Fashion Consumption With A Model Based On Consumer Value Perceptions 2023 Emerald PublishingDocument25 pagesAnalyzing The Impact of Covid19 On Sustainable Fashion Consumption With A Model Based On Consumer Value Perceptions 2023 Emerald PublishingASMITA MAHAPATRANo ratings yet

- Specialization Vs GeneralizationDocument4 pagesSpecialization Vs GeneralizationAshishNo ratings yet

- PT. Bumimulia Indah Lestari PT. Monde Mahkota BiskuitDocument14 pagesPT. Bumimulia Indah Lestari PT. Monde Mahkota BiskuitRobertus HaekaseNo ratings yet

- Statista - 2022 - Satisfaction With Leading Foodservice Brands in MoroccoDocument8 pagesStatista - 2022 - Satisfaction With Leading Foodservice Brands in MoroccoFatima Zahra ZeroualiNo ratings yet

- Process, Location, Layout Strategies and Human Resources, Job Design and Work Measurement FIXDocument23 pagesProcess, Location, Layout Strategies and Human Resources, Job Design and Work Measurement FIXNormayanaNo ratings yet

- Chapter 7 PDFDocument40 pagesChapter 7 PDFNur FitriainiNo ratings yet

- Implied Condition or Warranty As To Quality or Fitness For Any Particular Purpose of Goods Supplied."Document6 pagesImplied Condition or Warranty As To Quality or Fitness For Any Particular Purpose of Goods Supplied."Reetika VaidNo ratings yet

- Chapter 1 MaintenanceDocument16 pagesChapter 1 MaintenanceAbel TayeNo ratings yet

- Sticker MonitorDocument21 pagesSticker MonitorRestia SchleiferNo ratings yet