Professional Documents

Culture Documents

A.T.A. Is A System - Brochure

Uploaded by

John Wick0 ratings0% found this document useful (0 votes)

7 views3 pagesThe ATA system allows for the free movement of goods across international borders for temporary use or display without payment of import duties or taxes. Goods are covered by a single document, the ATA carnet, which is secured by an international guarantee system. The system was developed in 1961 and updated in 1990 with the Istanbul Convention to simplify customs procedures and promote international trade by replacing separate agreements with a single framework. It benefits businesses by expediting the transport of goods across borders and allowing their temporary importation into multiple countries with a single document.

Original Description:

Original Title

A.T.A. is a system - Brochure

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe ATA system allows for the free movement of goods across international borders for temporary use or display without payment of import duties or taxes. Goods are covered by a single document, the ATA carnet, which is secured by an international guarantee system. The system was developed in 1961 and updated in 1990 with the Istanbul Convention to simplify customs procedures and promote international trade by replacing separate agreements with a single framework. It benefits businesses by expediting the transport of goods across borders and allowing their temporary importation into multiple countries with a single document.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesA.T.A. Is A System - Brochure

Uploaded by

John WickThe ATA system allows for the free movement of goods across international borders for temporary use or display without payment of import duties or taxes. Goods are covered by a single document, the ATA carnet, which is secured by an international guarantee system. The system was developed in 1961 and updated in 1990 with the Istanbul Convention to simplify customs procedures and promote international trade by replacing separate agreements with a single framework. It benefits businesses by expediting the transport of goods across borders and allowing their temporary importation into multiple countries with a single document.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

THE ATA SYSTEM

AN INSTRUMENT FOR PROMOTING

INTERNATIONAL TRADE

The ATA system

The ATA carnet is now the

The ATA is a system allowing the document most widely used by the

free movement of goods across frontiers business community for international

and their temporary admission into a operations involving temporary

Customs territory with relief from duties admission of goods.

and taxes. The goods are covered by a

single document known as the ATA carnet Establishment of the ATA system

that is secured by an international

guarantee system. The ATA carnet system was

developed in response to the needs

The term “ATA” is a combination of of various types of business to move

the initial letters of the French words their products to trade fairs or

“Admission temporaire” and the English international exhibitions, as samples

words “Temporary Admission”. to potential buyers, or simply as

their own professional equipment .

Thanks to this system, the These goods must be able to be

international business community enjoys easily and rapidly transported

considerable simplification of Customs across frontiers.

formalities. No import duties or taxes are

collected for the temporary importation of As a result the Customs

goods covered by the system since Co-operation Council (now the

internationally valid security has been World Customs Organization)

established by the national associations adopted the Customs Convention on

issuing the ATA carnets. These national the ATA carnet for the temporary

associations are approved by Customs admission of goods (ATA

and are affiliated to an international Convention) in 1961. In addition a

guaranteeing chain administered by the number of other international

International Bureau of Chambers of Conventions for the specific types of

Commerce (IBCC). goods were established.

Modernization of the ATA system · Goods imported duty-free

(Istanbul Convention) cannot remain indefinitely in the

country of temporary importation.

Between 1950 and 1970, there was The period fixed for re-exportation is

a proliferation in the number of laid down in each Annex.

international Conventions,

Recommendations, Agreements and other · The goods must be re-

instruments on temporary admission, exported in the same state. They

creating confusion for the international must not undergo any change

business community and complicating the during their stay in the country of

work of Customs. In the early 1990’s the temporary importation, except

WCO decided to take draft a world-wide normal depreciation due to the use

Convention on temporary admission to made of them.

combine, into a single international

instrument, 13 existing temporary · Economic prohibitions or

admission agreements. restrictions at importation are not

applied since they generally relate to

The Convention on Temporary goods cleared for home use, thus

Admission was adopted in Istanbul in serving as a national protection

1990 and became known as the "Istanbul measure.

Convention". Its objectives and principles

are : Practical benefits of the ATA

system for the business

· To devise a single instrument for the community

simplification and harmonization of

temporary admission formalities, replacing The ATA carnet system (ATA

all the existing Conventions or Convention and Istanbul

Recommendations dealing solely or Convention) is beneficial to all

principally with temporary admission. The parties, traders and travellers as

subjects covered by the former well as Customs.

Conventions are now covered by the

Annexes to the Istanbul Convention. ü The ATA carnet replaces

national Customs formalities for

· Each Annex authorizes the temporary admission or transit, thus

temporary admission of goods imported saving costs in clearing goods at

for a specific purpose, e.g. Annex B.1. each frontier.

covers goods for display or use at fairs or

exhibitions.

ü Any duties and taxes that may come

due are guaranteed merely by the

presentation of the carnet and its

acceptance by Customs offices. There is

therefore no need to furnish a cash

deposit or other forms of security.

ü The ATA carnet covers the transport

of goods in Customs transit while en route

to or returning from a country of temporary

importation and, where applicable, within

that country.

ü For the period of validity of the ATA

carnet (normally one year), the goods can

be temporarily imported under the same

carnet in the Customs territories of as

many Contracting Parties, and as often,

as the carnet holder wishes.

ü The seals affixed or the identification

of the goods by a Customs office can be

recognized by the Customs offices of

other Contracting Parties where the goods

subsequently pass. This facilitates

Customs controls and saves the carnet

holder time when the goods cross

frontiers.

The practical advantages of this

system are reflected in the increasing

number of Contracting Parties. The ATA

Convention is currently applied by 63

Contracting Parties and the Istanbul

Convention by 39 Contracting Parties.

You might also like

- Customs Modernization and Tariff Act (CMTA)Document47 pagesCustoms Modernization and Tariff Act (CMTA)Sanchez RomanNo ratings yet

- Incoterms 2020 ChangesDocument4 pagesIncoterms 2020 Changesptomarxd100% (1)

- AfCFTA A Tralac Guide 7th Edition August 2020Document28 pagesAfCFTA A Tralac Guide 7th Edition August 2020Alexander MakaringNo ratings yet

- List of OfficialsDocument6 pagesList of OfficialsevilsageNo ratings yet

- Cmta RA10863Document89 pagesCmta RA10863Dennis MarcelinoNo ratings yet

- CMTA Republic Act No 10863Document98 pagesCMTA Republic Act No 10863Althea Acas0% (1)

- GCC Unified Guide For Customs ProceduresDocument75 pagesGCC Unified Guide For Customs Proceduresyahya Her,manson100% (1)

- India-UK Free Trade AgreementDocument21 pagesIndia-UK Free Trade AgreementMohit SharmaNo ratings yet

- Introduction To Customs - Sec. 103Document8 pagesIntroduction To Customs - Sec. 103pat alvarezNo ratings yet

- Custom Clearance ProcessDocument16 pagesCustom Clearance ProcessZariq ShahNo ratings yet

- Changes Under The Customs Modernization and Tariff ActDocument6 pagesChanges Under The Customs Modernization and Tariff ActcandiceNo ratings yet

- Exim ManualDocument110 pagesExim ManualShubham ShuklaNo ratings yet

- PLB - EnglishDocument16 pagesPLB - Englishsetyabudi bowolaksonoNo ratings yet

- Sustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010From EverandSustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010No ratings yet

- Glossary of International Customs Terms PDFDocument38 pagesGlossary of International Customs Terms PDFDaris Purnomo JatiNo ratings yet

- Ata Carnet NacenDocument10 pagesAta Carnet NacensreeramaNo ratings yet

- Certificate of Origin - WikiDocument5 pagesCertificate of Origin - WikiAndreiBurteaNo ratings yet

- Glossary of International Customs TermsDocument41 pagesGlossary of International Customs TermsclarizjoyprettyhokNo ratings yet

- Customs Regulatory FrameDocument115 pagesCustoms Regulatory FrameCarlos Adolfo Salah FernandezNo ratings yet

- Aligned Invoice Layout Key For International Trade: Recommendation 6Document7 pagesAligned Invoice Layout Key For International Trade: Recommendation 6rajen sahaNo ratings yet

- 9 May 1989Document19 pages9 May 1989Hendry ArdiNo ratings yet

- About ATA CarnetDocument4 pagesAbout ATA CarnetRohan NakasheNo ratings yet

- Concept An FuctionsDocument3 pagesConcept An Fuctionsalvaro valverdeNo ratings yet

- Customs 1. GeneralDocument13 pagesCustoms 1. GeneralFilip FunieruNo ratings yet

- Understanding The WtoDocument6 pagesUnderstanding The WtoNabinSundar NayakNo ratings yet

- Income Indirect Taxes Customs Duties An Introduction ICPAK April 2021Document25 pagesIncome Indirect Taxes Customs Duties An Introduction ICPAK April 2021REJAY89No ratings yet

- General and Common Provisions 1Document7 pagesGeneral and Common Provisions 1ALAJID, KIM EMMANUELNo ratings yet

- Customs Modernization and Tariff Act SeriesDocument13 pagesCustoms Modernization and Tariff Act SeriesRodel Cadorniga Jr.No ratings yet

- Goods Declaration Revised HitlDocument4 pagesGoods Declaration Revised HitlNdipapeh mamaNo ratings yet

- TermsDocument11 pagesTermsJerleen FelismeniaNo ratings yet

- Customs Modernization and Tariff ActDocument78 pagesCustoms Modernization and Tariff ActKylene Nichole EvaNo ratings yet

- Export (Departure)Document6 pagesExport (Departure)Arbie DecimioNo ratings yet

- Trade RegulationsDocument26 pagesTrade RegulationsJohn WaweruNo ratings yet

- The World Customs OrganizationDocument3 pagesThe World Customs Organizationammoos100% (1)

- A New Basis For International ShippingDocument21 pagesA New Basis For International ShippingMedhat Saad EldinNo ratings yet

- R.A. 10863 Cmta PDFDocument105 pagesR.A. 10863 Cmta PDFRonah CabalozaNo ratings yet

- Tariff HandbookFINAL 7 JUNE 2013 Version1Document2,034 pagesTariff HandbookFINAL 7 JUNE 2013 Version1tonet1No ratings yet

- Republic Act No. 10863Document109 pagesRepublic Act No. 10863Hib Atty TalaNo ratings yet

- 1999 TS0060Document88 pages1999 TS0060hrstgaNo ratings yet

- RA Republic Act No. 10863 PDFDocument165 pagesRA Republic Act No. 10863 PDFLex Tamen CoercitorNo ratings yet

- Second ExamDocument44 pagesSecond ExammarialeNo ratings yet

- Lecture 4 - Regulators ImpactDocument52 pagesLecture 4 - Regulators ImpactAdi ShaikhNo ratings yet

- Assignment On Antidumping: An Indian PerspectiveDocument11 pagesAssignment On Antidumping: An Indian Perspectivehaidersyed06No ratings yet

- Gatt and Rounds of NegotiationsDocument27 pagesGatt and Rounds of NegotiationsAshwina NamtaNo ratings yet

- Understanding Regulators Impact On Project SCM: Ali ZakiDocument52 pagesUnderstanding Regulators Impact On Project SCM: Ali ZakiHaadNo ratings yet

- Customs Law: Carraige of Goods by Sea and Multi-Modal TransportDocument27 pagesCustoms Law: Carraige of Goods by Sea and Multi-Modal TransportaviingoleNo ratings yet

- Introduction To Customs Duty: Brief Background of Customs LawDocument8 pagesIntroduction To Customs Duty: Brief Background of Customs LawABC 123No ratings yet

- (REPUBLIC ACT NO. 10863, May 30, 2016) : An Act Modernizing The Customs and Tariff AdministrationDocument135 pages(REPUBLIC ACT NO. 10863, May 30, 2016) : An Act Modernizing The Customs and Tariff AdministrationelCrisNo ratings yet

- Congress of The Philippines: Metro ManilaDocument155 pagesCongress of The Philippines: Metro ManilaJV Reobaldez MirandaNo ratings yet

- ACTIVITIES Ingles Caridad Romero CuencaDocument4 pagesACTIVITIES Ingles Caridad Romero CuencaCari RomeroNo ratings yet

- Also Known As : Free Trade Zones and Trade in ODSDocument4 pagesAlso Known As : Free Trade Zones and Trade in ODSaryanNo ratings yet

- Konvensi IstanbulDocument74 pagesKonvensi IstanbulTri Alvian MachwanaNo ratings yet

- CmtaDocument100 pagesCmtaChell MinsNo ratings yet

- Changes Under The Customs Modernization and Tariff ActDocument2 pagesChanges Under The Customs Modernization and Tariff ActJay-r PlazaNo ratings yet

- Ra 10863 Cmta MasterDocument171 pagesRa 10863 Cmta MasterRenz Patrick M. Santos0% (1)

- TM1 ReviewerDocument112 pagesTM1 ReviewerDonnabel FonteNo ratings yet

- Customs Manual 2012Document8 pagesCustoms Manual 2012SameerLalakiyaNo ratings yet

- TAX CustomsDocument105 pagesTAX CustomsPeasant MarieNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument25 pagesFaculty of Law: Jamia Millia IslamiaShimran ZamanNo ratings yet

- Draft Preventive Manual Vol IDocument654 pagesDraft Preventive Manual Vol Ipooram001No ratings yet

- List of Topics For Trade Issues PaperDocument2 pagesList of Topics For Trade Issues PaperAnkit KumarNo ratings yet

- Colombianos en Lista ClintonDocument22 pagesColombianos en Lista Clintonmizusu1986No ratings yet

- دور المستودع الجمركي في دعم تنافسية المؤسسات و التصدر (دراسة حالة شركة أفريكافي)Document10 pagesدور المستودع الجمركي في دعم تنافسية المؤسسات و التصدر (دراسة حالة شركة أفريكافي)Mouna MounaNo ratings yet

- RTAsDocument35 pagesRTAsLucya ShopeeNo ratings yet

- BOC Memo-2018-02-025 - Establishment of The Preferential Rate Unit Pursuant To CMO 16-2011Document1 pageBOC Memo-2018-02-025 - Establishment of The Preferential Rate Unit Pursuant To CMO 16-2011PortCallsNo ratings yet

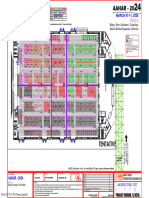

- Aahar 2024 H6-30.01.24Document1 pageAahar 2024 H6-30.01.24salesa1creativedesignNo ratings yet

- Tariff and Non TariffDocument243 pagesTariff and Non TariffQuynh LeNo ratings yet

- Philippine Trade Policy and StrategiesDocument15 pagesPhilippine Trade Policy and StrategiesRamirez Mark IreneaNo ratings yet

- REGIONAL INTEGRATION AFRICA ARIA English - Full PDFDocument281 pagesREGIONAL INTEGRATION AFRICA ARIA English - Full PDFNela MaiquitaNo ratings yet

- Notice: Customhouse Broker License Cancellation, Suspension, Etc.Document6 pagesNotice: Customhouse Broker License Cancellation, Suspension, Etc.Justia.comNo ratings yet

- Essay - ProtectionismDocument4 pagesEssay - ProtectionismAkshat LalNo ratings yet

- Rules of OriginDocument5 pagesRules of OriginMARKNo ratings yet

- CW Unit 1-3Document21 pagesCW Unit 1-3Ken WalkerNo ratings yet

- International Trade Theory and Policy Global Edition 12Th Paul R Krugman Full ChapterDocument51 pagesInternational Trade Theory and Policy Global Edition 12Th Paul R Krugman Full Chapterannetta.switzer206100% (5)

- Examples of Free Trade Areas IncludeDocument9 pagesExamples of Free Trade Areas IncludeKartic JainNo ratings yet

- A New Era For Transatlantic Trade LeadershipDocument48 pagesA New Era For Transatlantic Trade LeadershipEKAI CenterNo ratings yet

- Business Environment: Unit-IDocument8 pagesBusiness Environment: Unit-IGᴏᴡᴛʜᴀᴍ ᴛᴇᴊNo ratings yet

- View FileDocument1 pageView Filemhammadbaig456No ratings yet

- Kelompok 7. Customs UnionDocument23 pagesKelompok 7. Customs Unionsri yuliaNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Lesson Plan of International BusinessDocument3 pagesLesson Plan of International BusinessAkshay Anand100% (1)

- MCOM Banking and Finance SyllabusDocument49 pagesMCOM Banking and Finance SyllabusPriyanka ManwatkarNo ratings yet

- Different Types of TariffDocument3 pagesDifferent Types of TariffMeraNo ratings yet

- Kinh Te Quoc Te - Vu Thanh Huong - Chapter 09 - Session 1 Nontariff Trade Barriers and The New ProtectionismDocument10 pagesKinh Te Quoc Te - Vu Thanh Huong - Chapter 09 - Session 1 Nontariff Trade Barriers and The New ProtectionismTho NguyenNo ratings yet

- Usppi ResponsabilitiesDocument2 pagesUsppi ResponsabilitiesDiana SotoNo ratings yet

- CASE STUDY Down With DumpingDocument2 pagesCASE STUDY Down With DumpingJona FranciscoNo ratings yet

- 72 00 04 Fault3Document12 pages72 00 04 Fault3fernando heNo ratings yet