Professional Documents

Culture Documents

Chapter 1 Investments Background and Issues

Uploaded by

Houssein MedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 Investments Background and Issues

Uploaded by

Houssein MedCopyright:

Available Formats

FINA 4320: Investment Management

Chapter 1

Investments: Background and Issues

Rajkamal Vasu

University of Houston

C. T. Bauer College of Business

Fall 2019

Chapter 1 Investments: Background and Issues 1 / 11

Real versus Financial Assets

Nature of Investment: Reduce current consumption for greater future

consumption

Real Assets

Used to produce goods and services: Property, plants and equipment,

human capital, etc.

Determine the productive capacity and net income of the economy

Financial Assets

Claims on real assets or real asset income

Chapter 1 Investments: Background and Issues 2 / 11

Real versus Financial Assets

All financial assets (owner of the claim) are offset by a financial

liability (issuer of the claim)

When we aggregate over all balance sheets, only real assets remain

Hence the net wealth of an economy is the sum of its real assets

Chapter 1 Investments: Background and Issues 3 / 11

Types of Financial Assets

1 Debt (Fixed Income Securities)

Payments are fixed or determined by a formula

Can be short term or long term, safe or risky

2 Equity

Common stock is an ownership share in the corporation.

Payments to stockholders are not fixed, but depend on the success of

the firm

3 Derivatives

Value derives from prices of other assets such as bond or stock prices

Used to hedge risks or transfer them to other parties

Chapter 1 Investments: Background and Issues 4 / 11

Financial Markets and the Economy

Informational Role

Do market prices equal the fair value estimate of a security’s expected

future risky cash flows?

Can we rely on markets to allocate capital to the best uses?

Consumption Timing

When current basic needs are met, shift consumption through time by

investing surplus

Allocation of Risk

Catering to investors based on their risk-return appetite

Chapter 1 Investments: Background and Issues 5 / 11

Investment Process

Asset Allocation

Choosing the percentage of funds in asset classes

Security Selection

Choosing which particular securities to hold within each asset class

The asset allocation decision is the primary determinant of a

portfolio’s return

Chapter 1 Investments: Background and Issues 6 / 11

Markets Are Competitive

Risk-Return Trade-Off

Assets with higher expected returns have higher risk

How do we measure risk?

How does diversification affect risk?

Market Efficiency and Implications

Securities should be neither underpriced nor overpriced on average

Security prices should reflect all information available to investors

Whether we believe markets are efficient affects our choice of

appropriate investment-management style

Chapter 1 Investments: Background and Issues 7 / 11

Active vs. Passive Management

Chapter 1 Investments: Background and Issues 8 / 11

The Players

Business Firms (net borrowers)

Households (net savers)

Governments (can be both borrowers and savers)

Financial Intermediaries (connectors of borrowers and lenders)

Commercial banks

Investment companies

Pension funds

Hedge funds

Chapter 1 Investments: Background and Issues 9 / 11

Investment Bankers, Venture Capital and Private Equity

Investment Bankers: Firms that specialise in primary market

transactions

Primary Market: A market where newly issued securities are offered to

the public

Secondary market: A market where previously issued securities are

traded among investors

Venture Capital: Money invested to finance a new firm

Private Equity: Investments in a company that are not traded on a

stock exchange

Chapter 1 Investments: Background and Issues 10 / 11

The Rise of Systemic Risk During the Financial Crisis

Systemic Risk is the risk of breakdown in the financial system,

particularly due to spillover effects from one market into others

By 2007, many banks were highly leveraged and had little capital as a

buffer against losses

They borrowed at low interest for short term, and invested in

long-term, illiquid, high-yielding securities

They needed to constantly refinance their positions to pay back the

loan, or else quickly sell off their less liquid asset portfolios

Even a small portfolio loss could cause the bank’s net worth to

become negative, making it difficult to refinance the loans

In such a situation, banks may stop lending to prevent further losses,

thus exacerbating funding problems for their customary borrowers

Chapter 1 Investments: Background and Issues 11 / 11

You might also like

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketFrom EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketNo ratings yet

- MF0010 SLM Unit 01 PDFDocument21 pagesMF0010 SLM Unit 01 PDFAkshay DaveNo ratings yet

- Real Estate Riches: Building Wealth through Property InvestmentFrom EverandReal Estate Riches: Building Wealth through Property InvestmentNo ratings yet

- Tutorial 1 SolutionsDocument4 pagesTutorial 1 SolutionsnatashaNo ratings yet

- Assets AllocationDocument16 pagesAssets AllocationkavyaNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- APM NotesDocument24 pagesAPM NotesDaniyal BilalNo ratings yet

- Quote of The Day: "If You Can't Explain It Simply, You Don't Understand It Well Enough." - Albert EinsteinDocument40 pagesQuote of The Day: "If You Can't Explain It Simply, You Don't Understand It Well Enough." - Albert EinsteinAfnanNo ratings yet

- FIN - 605 - Lecture NotesDocument195 pagesFIN - 605 - Lecture NotesDebendra Nath PanigrahiNo ratings yet

- Equity Mutual FundsDocument49 pagesEquity Mutual FundskeneoNo ratings yet

- Financial Institutions, Markets, & Money, 10 Edition: Power Point Slides ForDocument56 pagesFinancial Institutions, Markets, & Money, 10 Edition: Power Point Slides Forsamuel debebeNo ratings yet

- Investments Complete Part 1 1Document65 pagesInvestments Complete Part 1 1THOTslayer 420No ratings yet

- Chapter - IntroductionDocument6 pagesChapter - IntroductionNahidul Islam IUNo ratings yet

- Investment QuizDocument13 pagesInvestment QuizAruzhan BekbaevaNo ratings yet

- Security Analysis AND Portfolio ManagmentDocument26 pagesSecurity Analysis AND Portfolio ManagmentRahul PatwariNo ratings yet

- 2 Fin. EnvirnmentDocument18 pages2 Fin. EnvirnmentOmar Faruk 2235292660No ratings yet

- Risk Return Analysis of Equity Mutual FundsDocument34 pagesRisk Return Analysis of Equity Mutual FundskeneoNo ratings yet

- FMI Practice Questions (Final Exam)Document53 pagesFMI Practice Questions (Final Exam)MirzaMuhammadNo ratings yet

- Investment Analysis and Portfolio ManagementDocument36 pagesInvestment Analysis and Portfolio ManagementShiji ShuklaNo ratings yet

- CHAPTER 2:the Financial: Environment: Markets, Institutions, and Interest RatesDocument19 pagesCHAPTER 2:the Financial: Environment: Markets, Institutions, and Interest RatesSahin SorkerNo ratings yet

- Bank Management Financial Services by Peter S. Rose Sylvia C. Hudgins 2 3 C10!11!12!13!14 1Document164 pagesBank Management Financial Services by Peter S. Rose Sylvia C. Hudgins 2 3 C10!11!12!13!14 1trung luuchiNo ratings yet

- 8th Batch QuestionDocument6 pages8th Batch Questionmdkhairulalam19920No ratings yet

- FICM ObsaaDocument105 pagesFICM Obsaasamuel kebede100% (1)

- Series-V-A: Mutual Fund Distributors Certification ExaminationDocument218 pagesSeries-V-A: Mutual Fund Distributors Certification ExaminationAjithreddy BasireddyNo ratings yet

- Securities Analysis and Portfolio ManagementDocument50 pagesSecurities Analysis and Portfolio ManagementrimonasharmaNo ratings yet

- Financial Market and InstituionsDocument99 pagesFinancial Market and Instituionsዝምታ ተሻለNo ratings yet

- Combine Slide JFP463EDocument333 pagesCombine Slide JFP463EZuhairy ZakariaNo ratings yet

- Mutual FundsDocument15 pagesMutual FundsMirchi RiyazNo ratings yet

- Contemporary Issues: Submitted By: Submitted To: Payal Goyal Amit Kumar Semester:-Ii MBA SESSION-2011-2013Document54 pagesContemporary Issues: Submitted By: Submitted To: Payal Goyal Amit Kumar Semester:-Ii MBA SESSION-2011-2013Vikas Singh RajputNo ratings yet

- Security Analysis 1Document59 pagesSecurity Analysis 1manafNo ratings yet

- Unit 1Document19 pagesUnit 1Kunal MakodeNo ratings yet

- FinanceDocument13 pagesFinanceفہد ملکNo ratings yet

- Insurance PDF (Guidely)Document203 pagesInsurance PDF (Guidely)brownboxcreations1803No ratings yet

- Lecture Notes IDocument26 pagesLecture Notes IdfbeNo ratings yet

- 1-Introduction To InvestmentDocument32 pages1-Introduction To InvestmentAqil RidzwanNo ratings yet

- Liquidity Risk: Alberto PlazziDocument7 pagesLiquidity Risk: Alberto PlazziPablo DiegoNo ratings yet

- Module 3 - Lesson 1 Risk and Rates of ReturnDocument12 pagesModule 3 - Lesson 1 Risk and Rates of ReturnAnna Danica JugadoraNo ratings yet

- NISM Kotak PDFDocument167 pagesNISM Kotak PDFgopikanayiNo ratings yet

- NISM MF Distributors Certification Duration - 2 DaysDocument167 pagesNISM MF Distributors Certification Duration - 2 DaysGaurav ButailNo ratings yet

- Overview of Financial Markets and Institutions AssignmentDocument4 pagesOverview of Financial Markets and Institutions AssignmentArgieshi GCNo ratings yet

- CIMA F2 SummaryDocument21 pagesCIMA F2 SummaryFederico BelloNo ratings yet

- CH 01 GitDocument23 pagesCH 01 GitFify AhmadNo ratings yet

- Lecture 1 2021 (2) 1Document18 pagesLecture 1 2021 (2) 1Joel CarreiraNo ratings yet

- Pasig Catholic College: Financial Markets Chap. 2. Overview of The Financial SystemDocument51 pagesPasig Catholic College: Financial Markets Chap. 2. Overview of The Financial SystemVictorioLazaroNo ratings yet

- Investement Analysis and Portfolio Management Chapter 1Document8 pagesInvestement Analysis and Portfolio Management Chapter 1Oumer Shaffi100% (3)

- Viney7e SM Ch01Document9 pagesViney7e SM Ch01Tofuu PowerNo ratings yet

- SAPMDocument93 pagesSAPMSOUMIKNo ratings yet

- Performance of Mutual Funds: Abstract - The Financial Crisis of 2008Document5 pagesPerformance of Mutual Funds: Abstract - The Financial Crisis of 2008m_a_secretNo ratings yet

- Financial Markets and InstitutionsDocument31 pagesFinancial Markets and Institutionsqueen estevesNo ratings yet

- FIN 464 Chapter-10Document27 pagesFIN 464 Chapter-10ShaNto RaHmanNo ratings yet

- Understanding Investments: Review QuestionsDocument6 pagesUnderstanding Investments: Review QuestionsMuhammad HarisNo ratings yet

- Role of Financial Markets and InstitutionsDocument25 pagesRole of Financial Markets and InstitutionsvlaciarNo ratings yet

- Lecture Notes On Investments: A Holistic Approach For The Indian MarketDocument27 pagesLecture Notes On Investments: A Holistic Approach For The Indian MarketAkriti GuptaNo ratings yet

- FM19 Chap 1Document24 pagesFM19 Chap 1Loui CanamaNo ratings yet

- CIMA F2 Summary - v1Document28 pagesCIMA F2 Summary - v1Federico BelloNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- AMFI Mutual Fund (Advisor) Module: Preparatory Training ProgramDocument231 pagesAMFI Mutual Fund (Advisor) Module: Preparatory Training Programallmutualfund100% (5)

- Mutual FundsDocument16 pagesMutual Fundsvirenshah_9846No ratings yet

- Chapter 1Document13 pagesChapter 1mark sanadNo ratings yet

- Dwda 90194743 09102013Document1 pageDwda 90194743 09102013Gauhar Abbas100% (1)

- Performance Guarantees: A. Guarantees Subject To Liquidated DamagesDocument3 pagesPerformance Guarantees: A. Guarantees Subject To Liquidated Damagesdeepdaman18891No ratings yet

- Reflection Paper 2 (MM)Document1 pageReflection Paper 2 (MM)Paul Irineo MontanoNo ratings yet

- Actividad 19 Evidencia 7 Taller "Talking About Logistics, Workshop"Document5 pagesActividad 19 Evidencia 7 Taller "Talking About Logistics, Workshop"claudia gomezNo ratings yet

- Essentials of College and University AccountingDocument121 pagesEssentials of College and University AccountingLith CloNo ratings yet

- 2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - LibroDocument82 pages2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - Librovallejo13No ratings yet

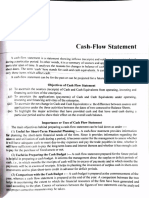

- Cash Flow Statements TheoryDocument16 pagesCash Flow Statements Theorysk9693092588No ratings yet

- A Study On The Usage of E-Payment System and Its in Uence To Digital Financial Inclusion in Coimbatore District, Tamil NaduDocument11 pagesA Study On The Usage of E-Payment System and Its in Uence To Digital Financial Inclusion in Coimbatore District, Tamil NaduResearch SolutionsNo ratings yet

- Consumer Buying Behaviour of Cars in India - A Survey: January 2018Document7 pagesConsumer Buying Behaviour of Cars in India - A Survey: January 2018Prashant MishraNo ratings yet

- Management 8th Edition Kinicki Solutions Manual 1Document66 pagesManagement 8th Edition Kinicki Solutions Manual 1rodney100% (52)

- Eco 211 HandoutDocument62 pagesEco 211 HandoutHannah CokerNo ratings yet

- 01-CalapanCity2019 Transmittal LetterDocument6 pages01-CalapanCity2019 Transmittal LetterkQy267BdTKNo ratings yet

- Network Marketing Business Plan ExampleDocument50 pagesNetwork Marketing Business Plan ExampleJoseph QuillNo ratings yet

- MCom - Accounts ch-13 Topic3Document19 pagesMCom - Accounts ch-13 Topic3Sameer GoyalNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Fyp Logbook (Week 1-5) - Marked NurhadzlinDocument23 pagesFyp Logbook (Week 1-5) - Marked Nurhadzlinjohnjabaraj100% (1)

- Accenture Cover LetterDocument8 pagesAccenture Cover Letterafjwrcqmzuxzxg100% (2)

- DIVYA VISHWAKARMA Construction IndustryDocument87 pagesDIVYA VISHWAKARMA Construction IndustryNITISH CHANDRA PANDEYNo ratings yet

- Sage Pastel Partner Courses...Document9 pagesSage Pastel Partner Courses...Tanaka MpofuNo ratings yet

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. byDocument56 pagesSecuritisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. bykannangksNo ratings yet

- 8 General Foods v. NACOCODocument3 pages8 General Foods v. NACOCOShaula FlorestaNo ratings yet

- HDFC Bank Notice For SettlementDocument1 pageHDFC Bank Notice For Settlementtomarankit44No ratings yet

- Wiley CFA Test Bank 180527 (20 Preguntas)Document12 pagesWiley CFA Test Bank 180527 (20 Preguntas)rafav10No ratings yet

- Artikel MMT Lisa Nilhuda 17002060Document7 pagesArtikel MMT Lisa Nilhuda 17002060Erlianaeka SaputriNo ratings yet

- Habtamu SerteDocument17 pagesHabtamu SerteAklilu GirmaNo ratings yet

- CV Template 0018Document1 pageCV Template 0018Rahma idahNo ratings yet

- Set8 Maths Classviii PDFDocument6 pagesSet8 Maths Classviii PDFLubna KaziNo ratings yet

- Certificado EGT 20000 MAX G2Document4 pagesCertificado EGT 20000 MAX G2Diego PionaNo ratings yet

- Tenant Verification Form PDFDocument2 pagesTenant Verification Form PDFmohit kumarNo ratings yet

- MARINGO Category 1 (HOUSE 1310) Occupier For January 2023Document1 pageMARINGO Category 1 (HOUSE 1310) Occupier For January 2023sophia sambaNo ratings yet