Professional Documents

Culture Documents

Bank liable for encashing forged checks

Uploaded by

Jodel Cris BalitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank liable for encashing forged checks

Uploaded by

Jodel Cris BalitaCopyright:

Available Formats

Francisco V.

CA (1999)

G.R. No. 116320 November 29, 1999

FACTS:

June 23, 1977: Adalia Francisco (Francisco) president of A. Francisco Realty & Development Corporation (AFRDC) and Jaime C.

Ong (Ong) President and General Manager of Herby Commercial & Construction Corporation (HCCC), entered into a contract where

HCCC agreed to undertake the construction of 35 housing units and the development of 35 hectares of land.

HCCC was to be paid on turn-key basis (basis of the completed houses and developed lands delivered to and accepted by AFRDC and

the GSIS)

To facilitate payment, AFRDC executed a Deed of Assignment in favor of HCCC to enable the it to collect payments directly from the

GSIS.

Furthermore, the GSIS and AFRDC put up an Executive Committee Account with the Insular Bank of Asia & America (IBAA) of P4M

from which checks would be issued and co-signed by petitioner Francisco and the GSIS Vice-President Armando Diaz (Diaz).

February 10, 1978: HCCC filed a complaint w/ the RTC against Francisco, AFRDC and the GSIS for the collection of the unpaid balance

under the Land Development and Construction Contract in the amount of P515,493.89 for completed and delivered housing units

and land development.

Sometime in 1979: Ong discovered that Diaz and Francisco had executed and signed 7 checks drawn against the IBAA and payable to

HCCC but were never delivered to HCCC

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

GSIS gave Francisco custody of the checks since she promised that she would deliver the same to HCCC.

Francisco forged the signature of Ong, without his knowledge or consent, at the dorsal portion of the said checks to make it appear

that HCCC had indorsed the checks; Francisco then indorsed the checks for a second time by signing her name at the back of the

checks and deposited the checks in her IBAA savings account

June 7, 1979: Ong filed complaints charging Francisco with estafa thru falsification of commercial documents - dismissed by the

Assistant City Fiscal

According to Francisco, she agreed to grant HCCC the loans in the total amount of P585K and covered by 18 promissory notes in

order to obviate the risk of the non-completion of the project.

As a means of repayment, Ong allegedly issued a Certification authorizing Francisco to collect HCCCs receivables from the GSIS

RTC: favored Ong and against IBAA and Francisco

November 21, 1989: IBAA and HCCC entered into a Compromise Agreement which was approved by the trial court, wherein HCCC

acknowledged receipt of the amount of P370,475.00 in full satisfaction of its claims against IBAA, without prejudice to the right of

IBAA to pursue its claims against Francisco.

CA affirmed RTC

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Francisco claims that she was, in any event, authorized to sign Ong’s name on the checks by virtue of the Certification executed by

Ong in her favor giving her the authority to collect all the receivables of HCCC from the GSIS, including the questioned checks.

ISSUE: W/N Francisco can sign Ong’s name on the checks and it was not forgery

HELD: NO.

Francisco had custody of the checks, as proven by the check vouchers bearing her uncontested signature. Francisco forged the

signature of Ong on the checks to make it appear as if Ong had indorsed said checks

The Negotiable Instruments Law provides that where any person is under obligation to indorse in a representative capacity, he may

indorse in such terms as to negative personal liability

An agent, when so signing, should indicate that he is merely signing in behalf of the principal and must disclose the name of his

principal; otherwise, he shall be held personally liable

Instead of signing Ong’s name, Francisco should have signed her own name and expressly indicated that she was signing as an agent

of HCCC. Instead of signing Ong's name, Francisco should have signed her own name and expressly indicated that she was signing as

an agent of HCCC. Thus, the Certification cannot be used by Francisco to validate her act of forgery.

WHEREFORE, we AFFIRM the respondent court's decision promulgated on June 29, 1992, upholding the February 16, 1988 decision

of the trial court in favor of private respondents, with the modification that the interest upon the actual damages awarded shall be

at six percent (6%) per annum, which interest rate shall be computed from the time of the filing of the complaint on November 19,

1979. However, the interest rate shall be twelve percent (12%) per annum from the time the judgment in this case becomes final

and executory and until such amount is fully paid. The basis for computation of the six percent and twelve percent rates of interest

shall be the amount of P370,475.00. No pronouncement as to costs.

SO, ORDERED.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

San Carlos Milling Co. Ltd V. BPI (1933)

G.R. No. L-37467 December 11, 1933

FACTS:

San Carlos Milling Co. Ltd. (San Carlos) was in the hands of Alfred D. Cooper, its agent under general power of attorney with

authority of substitution

The principal employee in the Manila office was Joseph L. Wilson, to whom had been given a general power of attorney but without

power of substitution.

1926: Cooper, desiring to go on vacation, gave a general power of attorney to Newland Baldwin and at the same time revoked the

power of Wilson relative to the dealings with BPI

Wilson, conspiring together with Alfredo Dolores, a messenger-clerk in San Carlos' Manila office, sent a cable gram in code to the

company in Honolulu requesting a telegraphic transfer to the China Banking Corporation (China Bank) of Manila of $100,00.

The money was transferred by cable, and upon its receipt China Bank sent an exchange contract to San Carlos offering the sum of

P201K, which was then the current rate of exchange.

September 28, 1927: A manager's check on the China Banking Corporation for P201K payable to San Carlos Milling Company or

order was receipted for by Dolores deposited with the BPI having a fake endorsement (Baldwin forged as drawer)

For deposit only with Bank of the Philippine Islands, to credit of account of San Carlos Milling Co., Ltd.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

By (Sgd.) NEWLAND BALDWIN

For Agent

San Carlos had frequently withdrawn currency for shipment to its mill but never in so large an amount, and never under the sole

supervision of Dolores

Before delivering the money, the bank asked Dolores for P1 to cover the cost of packing the money, and he left the bank and shortly

afterwards returned with another check for P1, purporting to be signed by Newland Baldwin

Thereafter, the crime was discovered and San Carlos filed against the BPI and China Bank (after amendment complaint)

China Bank: as the prior endorsement had in law been guaranteed by the BPI, they are absolved even if the endorsement of

Newland Baldwin on the check was a forgery

BPI: guilty of no negligence, loss was due to the dishonesty of San Carlos employees and the negligence of San Carlos general agent

RTC: BPI in GF and San Carlos could not recover

ISSUE:

W/N BPI was bound to inspect the checks and shall therefore be liable in case of forgery

HELD:

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

YES. Judgment absolving the Bank of the Philippine Islands must therefore be reversed.

The duty was upon the BPI, and the China Banking Corporation was not bound to inspect and verify all endorsements of the check,

even if some of them were also those of depositors in that bank

A bank is bound to know the signatures of its customers; and if it pays a forged check, it must be considered as making the payment

out of its own funds, and cannot ordinarily charge the amount so paid to the account of the depositor whose name was forged.

There is no act of the plaintiff that led the bank astray. If it was in fact lulled into the false sense of security, it was by the effrontery

of Dolores, the messenger to whom it entrusted this large sum of money.

The proximate cause of the loss must therefore be due to the negligence of the bank in honoring and cashing the two forged checks.

Under section 23 of the Negotiable Instruments Law they are not a charge against San Carlos nor are the checks of any value to the

BPI.

The proximate cause of loss was due to the negligence of the Bank of the Philippine Islands in honoring and cashing the two forged

checks

The judgment absolving the Bank of the Philippine Islands must therefore be reversed, and a judgment entered in favor of plaintiff-

appellant and against the Bank of the Philippine Islands, defendant- appellee, for the sum of P200,001, with legal interest thereon

from December 23, 1928, until payment, together with costs in both instances. So, ordered.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

BANK OF THE PHILIPPINE ISLANDS v. CASA MONTESSORI INTERNATIONALE and LEONARDO T. YABUT

[G.R. No. 149454. May 28, 2004] (430 SCRA 261)

FACTS:

CASA Montessori International opened a current account with BPI with CASAs President Ms. Ma. Carina C. Lebron as one of its

authorized signatories. In 1991, after conducting an investigation, plaintiff discovered that nine (9) of its checks had been encashed

by a certain Sonny D. Santos since 1990 in the total amount of P782,000.00. It turned out that Sonny D. Santos with account at BPIs

Greenbelt Branch [was] a fictitious name used by third party defendant Leonardo T. Yabut who worked as external auditor of CASA.

Third party defendant voluntarily admitted that he forged the signature of Ms. Lebron and encashed the checks.

The PNP Crime Laboratory conducted an examination of the nine (9) checks and concluded that the handwritings thereon

compared to the standard signature of Ms. Lebron were not written by the latter.

On March 4, 1991, plaintiff filed the herein Complaint for Collection with Damages against defendant bank.

ISSUE 1:

Was there forgery under the Negotiable Instruments Law (NIL)?

HELD:

YES.

Forgery cannot be presumed. It must be established by clear, positive and convincing evidence. Under the best evidence rule

as applied to documentary evidence like the checks in question, no secondary or substitutionary evidence may inceptively be

introduced, as the original writing itself must be produced in court. But when, without bad faith on the part of the offeror, the

original checks have already been destroyed or cannot be produced in court, secondary evidence may be produced. Without bad

faith on its part, CASA proved the loss or destruction of the original checks through the Affidavit of the one person who knew of that

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

fact- Yabut. He clearly admitted to discarding the paid checks to cover up his misdeed. In such a situation, secondary evidence like

microfilm copies may be introduced in court.

Even with respect to documentary evidence, the best evidence rule applies only when the contents of a document -- such as the

drawer’s signature on a check -- is the subject of inquiry.

ISSUE 2:

Is BPI liable as the drawee bank for allowing payment on the checks to a wrongful and fictitious payee?

HELD:

YES. BPI -- the drawee bank -- becomes liable to its depositor-drawer for allowing payment on the checks to a wrongful and

fictitious payee. Since the encashing bank is one of its branches, BPI can easily go after it and hold it liable for reimbursement. It

may not debit the drawers account and is not entitled to indemnification from the drawer. In both law and equity, when one of two

innocent persons must suffer by the wrongful act of a third person, the loss must be borne by the one whose negligence was the

proximate cause of the loss or who put it into the power of the third person to perpetrate the wrong.

A bank is bound to know the signatures of its customers; and if it pays a forged check, it must be considered as making the

payment out of its own funds, and cannot ordinarily charge the amount so paid to the account of the depositor whose name was

forged.

WHEREFORE, the Petition in GR No. 149454 is hereby DENIED, and that in GR No. 149507 PARTLY GRANTED. The assailed Decision of

the Court of Appeals is AFFIRMED with modification: BPI is held liable for ₱547,115, the total value of the forged checks less the

amount already recovered by CASA from Leonardo T. Yabut, plus interest at the legal rate of six percent (6%) per annum --

compounded annually, from the filing of the complaint until paid in full; and attorney’s fees of ten percent (10%) thereof, subject to

reimbursement from Respondent Yabut for the entire amount, excepting attorney’s fees. Let a copy of this Decision be furnished the

Board of Accountancy of the Professional Regulation Commission for such action as it may deem appropriate against Respondent

Yabut. No costs.

SO, ORDERED.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

LAND BANK OF THE PHILIPPINES v. NARCISO L. KHO

G.R. No. 205839, July 7, 2016

BRION, J.

Facts:

Narciso L. Kho (Kho) purchased a manager’s check from Land Bank of the Philippines (LBP) worth Php 25,000,000.00 paid

using the money from his savings account in the same bank. The check was purchased in order to negotiate a deal with Red Orange.

LBP gave Kho the check and a photocopy of the check. The photocopy was given to Red Orange. The deal between Kho and Red

Orange did not push through. Rudy Medel (representing Red Orange) went to LBP to negotiate the check, LBP cleared the check and

notified Kho of the transaction. Kho was surprised as the original check was still with him. It turns out that the check negotiated by

Medel with LBP is spurious. Kho tried to recover the Php 25,000,000.00 from LBP, but the latter claims that the former was negligent

for giving Medel the photocopy of the check which was used to make the spurious check and thus they cannot be held liable for the

lost amount.

Issue:

Whether or not LBP should pay for the Php 25,000,000.00

Held:

The genuine check No. 07410 remained in Kho’s possession the entire time and Land Bank admits that the check it cleared

was a fake. When Land Bank’s CCD forwarded the deposited check to its Araneta branch for inspection, its officers had every

opportunity to recognize the forgery of their signatures or the falsity of the check. Whether by error or neglect, the bank failed to do

so, which led to the withdrawal and eventual loss of the Php 25,000,000.00. This is the proximate cause of the loss. Land Bank

breached its duty of diligence and assumed the risk of incurring a loss on account of a forged or counterfeit check. Hence, it should

suffer the resulting damage.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

We cannot agree with the Land Bank and the RTC’s positions that Kho is precluded from invoking the forgery. A drawer or a

depositor of the bank is precluded from asserting the forgery if the drawee bank can prove his failure to exercise ordinary care and if

this negligence substantially contributed to the forgery or the perpetration of the fraud.

The business of banking is imbued with public interest; it is an industry where the general public’s trust and confidence in the system

is of paramount importance. Consequently, banks are expected to exert the highest degree of, if not the utmost, diligence. They are

obligated to treat their depositors’ accounts with meticulous care, always keeping in mind the fiduciary nature of their relationship.

WHEREFORE, we PARTLY GRANT the petitions. The Court of Appeals' August 30, 2012 decision and February 14, 2013 resolution in

CA-G.R. CV No. 93881 are SET ASIDE. The Regional Trial Court's April 30, 2009 decision in Civil Case No. Q-06-57154 is REVERSED.

Petitioner Land Bank of the Philippines is ORDERED:

(1) to PAY Narciso Kho the sum of TWENTY-FIVE MILLION PESOS (P25,000,000.00), plus interest at the legal rate reckoned from the

filing of the complaint; and

(2) to ALLOW Narciso Kho to withdraw his remaining funds from Savings Account No. 0681-0681-80.

SO, ORDERED.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Samsung Construction v. Far East Bank and Trust Company (FEBTC) and CA

G.R. No. 129015

FACTS:

A certain Roberto Gonzaga presented for payment FEBTC Check No. 432100 to the bank’s branch in Bel-Air, Makati. The

check, payable to cash and drawn against Samsung Construction’s current account, was in the amount of P999,500.00. The bank

teller, Cleofe Justiani, checked the balance of the account. After ascertaining there were enough funds, and after comparing the

signature in the check and that of the specimen on record, Justiani was satisfied as to the authenticity of the signature on the check.

Gonzaga presented 3 identification cards to the bank officers.

Justiani forwarded the check to the branch Senior Assistant Cashier Gemma Velez for approval. Velez too concluded that the check

was indeed signed by the company’s Project Manager Jong Kyu Lee.

The check was also forwarded to Shirley Syfu, another bank officer for approval. Syfu then noticed that Jose Sempio III (Sempio), the

assistant accountant of Samsung Construction, was also in the bank. Syfu showed the check to Sempio, who vouched for the

genuineness of Jong’s signature.

Satisfied with the genuineness of the signature of Jong, Syfu authorized the banks encashment of the check to Gonzaga.

The following day, the company’s accountant, Kyu Yong Lee discovered that a check had been encashed. Aware that he had not

prepared such a check for Jong’s signature, Kyu found that the last blank check was missing.

Jong learned of the encashment of the check, and realized that his signature had been forged.

Samsung Construction filed a Complaint for violation of Section 23 of the NIL, and prayed for the payment of the amount debited as

a result of the questioned check plus interest, and attorney’s fees.

The RTC held that Jong’s signature on the check was forged and accordingly directed the bank to pay or credit back to Samsung

Constructions account the said amount.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

On appeal, the CA reversed the RTC Decision and absolved FEBTC from any liability.

ISSUE:

Whether or not FEBTC is liable to Samsung Construction in paying the forged check. Yes.

RULING:

Section 23 of the Negotiable Instruments Law states:

When a signature is forged or made without the authority of the person whose signature it purports to be, it is wholly inoperative,

and no right to retain the instrument, or to give a discharge therefore, or to enforce payment thereof against any party thereto, can

be acquired through or under such signature, unless the party against whom it is sought to enforce such right is precluded from

setting up the forgery or want of authority.

The general rule is to the effect that a forged signature is wholly inoperative, and payment made through or under such signature is

ineffectual or does not discharge the instrument. If payment is made, the drawee cannot charge it to the drawers’ account. The

traditional justification for the result is that the drawee is in a superior position to detect a forgery because he has the makers

signature and is expected to know and compare it. The rule has a healthy cautionary effect on banks by encouraging care in the

comparison of the signatures against those on the signature cards they have on file.

Quite palpably, the general rule remains that the drawee who has paid upon the forged signature bears the loss. The exception to

this rule arises only when negligence can be traced on the part of the drawer whose signature was forged, and the need arises to

weigh the comparative negligence between the drawer and the drawee to determine who should bear the burden of loss.

We recognize that Section 23 of the Negotiable Instruments Law bars a party from setting up the defense of forgery if it is guilty of

negligence. Yet, we are unable to conclude that Samsung Construction was guilty of negligence in this case.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Given the circumstances, extraordinary diligence dictates that FEBTC should have ascertained from Jong personally that the

signature in the questionable check was his.

Still, even if the bank performed with utmost diligence, the drawer whose signature was forged may still recover from the bank as

long as he or she is not precluded from setting up the defense of forgery. After all, Section 23 of the Negotiable Instruments Law

plainly states that no right to enforce the payment of a check can arise out of a forged signature. Since the drawer, Samsung

Construction, is not precluded by negligence from setting up the forgery, the general rule should apply. Consequently, if a bank pays

a forged check, it must be considered as paying out of its funds and cannot charge the amount so paid to the account of the

depositor. A bank is liable, irrespective of its good faith, in paying a forged check.

WHEREFORE, the Petition is GRANTED. The Decision of the Court of Appeals dated 28 November 1996 is REVERSED, and the Decision

of the Regional Trial Court of Manila, Branch 9, dated 25 April 1994 is REINSTATED. Costs against respondent.

SO, ORDERED.

PHILIPPINE NATIONAL BANK v. THE NATIONAL CITY BANK OF NEW YORK, and MOTOR SERVICE COMPANY, INC.

G.R. No. L-43596

October 31, 1936

FACTS:

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

In April 1933, unknown persons negotiated with Motor Services Company two checks, which were part of the stipulation in

payment of automobile tires purchased from the store of the defendant. It was allegedly issued by Pangasinan Transportation

Company against PNB in favor of the International Auto Repair Shop. The said checks were indorsed at the back however, by said

unknown persons. The Motor company therefore believed at that time that the signatures contained therein were genuine. The

checks were later deposited with the company’s account in National City Bank of NY. The said checks were consequently cleared and

PNB credited National City Bank of NY with the amounts thereof. Thereafter, PNB discovered that the signatures were forged and it

demanded the reimbursement of the amounts for which it credited the other bank. It demanded from the defendants the

reimbursement of the amounts for which it credited National City Bank of NY and for which the latter credited the Motor Service

Co., but they refused to make such reimbursements. Hence this case filed by PNB.

ISSUE:

1. Whether or not the payment of the checks in question made by the drawee bank constitutes an

"acceptance"? and

2. Whether PNB (Drawee Bank) can recover reimbursements from Motor Service. Co.?

HELD:

1. No.

Payment of the check does not automatically constitute an acceptance to preclude the drawee bank from setting up

forgery. Acceptance implies subsequent negotiation of the instrument, which is not true in case of payment of a check

because from the moment a check is paid it is withdrawn from circulation. When a drawee bank cashes or pays a check,

the cycle of negotiation is terminated, and is illogical to speak of subsequent holder who can invoke the warranty of

acceptor. Hence, the drawee bank is not precluded from setting up forgery.

2.

Yes.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

In cases like this, the party guilty of negligence bears the loss. In order to entitle a holder to payment of a forged check, the

holder must:

1) prove that the responsibility of determining the genuineness of the signature is upon the drawee; and

2) he was diligent in handling the check.

In this case, Motor Service Co was negligent. Thus, bearing the loss. The bank was only guilty of constructive negligence.

Motor Service Co on the other hand had several faults. In the two checks that were indorsed, the check that was later presented to

Motor Services bears a check number that is earlier than the one presented in an earlier transaction. Motor Services failed to check

it. They also took the check from an unknown person. International Auto Repair Shop is a company and, in such situation, it must

inquire as to the authority of the one indorsing.

Section 23 of the Negotiable Instruments Act provides that "when a signature is forged or made without the authority of the person

whose signature it purports to be, it is wholly inoperative, and no right to retain the instrument, or to give a discharge therefor, or to

enforce payment thereof against any party thereto, can be acquired through or under such signature, unless the party against whom

it is sought to enforce such right is precluded from setting up the forgery or want of authority.

PNB did not warrant to MCSI the genuineness of the checks in question, by its acceptance thereof, nor did it perform any act which

would have induced MSCI to believe in the genuineness. Therefore, PNB is not precluded from putting up the defense of forgery. It

did not warrant the genuineness of the signature when it paid the check and it did not induce the appellant to believe the

genuineness of the signature. They can recover reimbursements.

PNB V. CA (1968)

G.R. No. L-26001 October 29, 1968

FACTS:

January 15, 1962: Augusto Lim deposited in his current account with the PCIB branch at Padre Faura, Manila a GSIS Check of

P57,415.00 drawn against the PNB

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

PCIB stamped the following on the back of the check: "All prior indorsements and/or Lack of Endorsement Guaranteed, Philippine

Commercial and Industrial Bank," Padre Faura Branch, Manila

On the same date, following an established banking practice in the Philippines, the check was forwarded for clearing through the

Central Bank to the PNB and did not return said check the next day, or at any other time, but retained it and paid its amount to the

PCIB, as well as debited it against the account of the GSIS in the PNB. PNB received a formal notice from the GSIS that the check had

been lost, with the request that payment thereof be stopped.

January 31, 1962: Upon demand from the GSIS, the P57,415.00 was re-credited to them because the signatures of its officers on the

check were forged as well as the signatures of the General Manager and the Auditor of the GSIS on the check, as drawer, are forged

Then, payee Mariano D. Pulido indorsed it to Manuel Go and then indorsed by Manuel Go to Augusto Lim, which was paid and

debited to the account of GSIS.

February 2, 1962: PNB demanded from the PCIB the refund. PNB then filed against the PCIB. The CFI dismissed the case, which

prompted an appeal before the Court of Appeals, to which the CA affirmed the ruling of the lower court.

ISSUE:

1. W/N PCIB acquired the warranties of an indorser?

2. W/N PNB can obtain a refund from PCIB?

HELD:

1. NO. Affirmed

PCIB guaranteed not the authenticity of the signatures of the officers of the GSIS who signed because the GSIS is not

an indorser of the check, but as a drawer and therefore the warranty is irrelevant to the PNB's alleged right to recover

from the PCIB. In general, "acceptance" is not required for checks since they are payable on demand, accepted promise

to perform an act the acceptance of a bill is the signification by the drawee of his assent to the order of the drawer

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

payment actual performance compliance with obligation. Upon payment by PNB, the check then ceased to be a

negotiable instrument and became a voucher or proof of payment.

2. No.

PNB cannot obtain a refund. PNB had been guilty of a greater degree of negligence, because it had a previous and

formal notice from the GSIS that the check had been lost, with the request that payment thereof be stopped PNB's

negligence was the main or proximate cause for the corresponding loss PNB did not return the check when 1 of 2

innocent persons must suffer by the wrongful act of a third person, the loss must be borne by the one whose negligence

was the proximate cause of the loss or who put it into the power of the third person to perpetrate the wrong where the

collecting (PCIB) and the drawee (PNB) banks are equally at fault, the court will leave the parties where it finds them

applies in the case of a drawee who pays a bill without having previously accepted it. In this case, PNB was the proximate

cause of the loss, and hence may not recover from PCIB

WHEREFORE, the decision appealed from is hereby affirmed, with costs against the Philippine National Bank. It is so

ordered.

Philippine Commercial International Bank v. Court of Appeals

G.R. No. 121413, 29 January 2001, 350 SCRA 446

FACTS:

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

These consolidated petitions involve several fraudulently negotiated checks. The original actions a quo was instituted by Ford

Philippines to recover from the drawee bank, CITIBANK, N.A. (Citibank) and collecting bank, Philippine Commercial International

Bank (PCIBank) [formerly Insular Bank of Asia and America], the value of several checks payable to the Commissioner of Internal

Revenue, which were embezzled allegedly by an organized syndicate.

The plaintiff Ford drew and issued its Citibank check in favor of the Commissioner of Internal Revenue as payment of plaintiff’s

percentage or manufacturer’s sales taxes. The aforesaid check was deposited with the defendant IBAA (now PCIBank) and was

subsequently cleared at the Central Bank. Upon presentment with the defendant Citibank, the proceeds of the check were paid to

IBAA as collecting or depository bank. The proceeds of the same Citibank check of the plaintiff were never paid to or received by the

payee thereof, the Commissioner of Internal Revenue.

In a letter by the acting CIR, Ford was informed that its check was not paid to the government or its authorized agent but was

encashed by unauthorized persons. An investigation revealed that Ford’s general ledger accountant had recalled the check

purportedly because of an error in the computation of tax due. With his instruction, PCIBank replaced the check with two of its own

Manager’s Checks which were subsequently deposited with another bank.

ISSUE:

Whether PCIB is liable to reimburse Ford for the payment of the crossed check.

RULING:

Yes. Indeed, the crossing of the check with the phrase “Payee’s Account Only,” is a warning that the check should be

deposited only in the account of the CIR. Thus, it is the duty of the collecting bank PCIBank to ascertain that the check be deposited

in payee’s account only. Therefore, it is the collecting bank (PCIBank) which is bound to scruninize the check and to know its

depositors before it could make the clearing indorsement “all prior indorsements and/or lack of indorsement guaranteed”.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

The mere fact that the forgery was committed by a drawer-payors confidential employee or agent, who by virtue of his position had

unusual facilities for perpetrating the fraud and imposing the forged paper upon the bank, does NOT entitle the bank to shift the loss

to the drawer-payor, in the absence of some circumstance raising estoppel against the drawer. This rule likewise applies to the

checks fraudulently negotiated or diverted by the confidential employees who hold them in their possession.

In this case, there was no evidence presented confirming the conscious participation of PCIBank in the embezzlement. As a general

rule, however, a banking corporation is liable for the wrongful or tortuous acts and declarations of its officers or agents within the

course and scope of their employment. A bank will be held liable for the negligence of its officers or agents when acting within the

course and scope of their employment. It may be liable for the tortuous acts of its officers even as regards that species of tort of

which malice is an essential element. In this case, we find a situation where the PCIBank appears also to be the victim of the scheme

hatched by a syndicate in which its own management employees had participated.

A bank holding out its officers and agents as worthy of confidence will not be permitted to profit by the frauds these officers or

agents were enabled to perpetrate in the apparent course of their employment; nor will it be permitted to shirk its responsibility for

such frauds, even though no benefit may accrue to the bank therefrom. For the general rule is that a bank is liable for the fraudulent

acts or representations of an officer or agent acting within the course and apparent scope of his employment or authority. And if an

officer or employee of a bank, in his official capacity, receives money to satisfy an evidence of indebtedness lodged with his bank for

collection, the bank is liable for his misappropriation of such sum.

Lastly, banking business requires that the one who first cashes and negotiates the check must take some precautions to learn

whether or not it is genuine. And if the one cashing the check through indifference or other circumstance assists the forger in

committing the fraud, he should not be permitted to retain the proceeds of the check from the drawee whose sole fault was that it

did not discover the forgery or the defect in the title of the person negotiating the instrument before paying the check. For this

reason, a bank which cashes a check drawn upon another bank, without requiring proof as to the identity of persons presenting it, or

making inquiries with regard to them, cannot hold the proceeds against the drawee when the proceeds of the checks were

afterwards diverted to the hands of a third party. In such cases the drawee bank has a right to believe that the cashing bank (or the

collecting bank) had, by the usual proper investigation, satisfied itself of the authenticity of the negotiation of the checks. Thus, one

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

who encashed a check which had been forged or diverted and in turn received payment thereon from the drawee, is guilty of

negligence which proximately contributed to the success of the fraud practiced on the drawee bank. The latter may recover from the

holder the money paid on the check.

The Great Eastern Life Insurance Co. vs. Hongkong & Shanghai Banking Corp.

[GR 18657, 23 August 1922]

Facts:

The Great Eastern Life Insurance Co. (GELIC) is an insurance corporation, while Hongkong & Shanghai Banking Corp. (HSBC)

and Philippine National Bank (PNB) are banking corporations, and each is duly licensed to do its respective business in the Philippine

Islands.

On 3 May 1920, GELIC drew its check payable to the order of Lazaro Melicor for P2,000 on HSBC with whom it had an account.

E.M. Maasim fraudulently obtained possession of the check, forged Melicor's signature, as an endorser, and then personally

endorsed and presented it to PNB. The latter bank placed the said amount on Maasim’s account.

PNB endorsed the check to HSBC, which paid it, and charged the amount of the check to the account of GELIC.

In the ordinary course of business, HSBC rendered a bank statement to GELIC showing that the amount of the check was charged to

its account

About 4 months after the check was charged to the account of GELIC, it was discovered that Melicor, to whom the check was made

payable, had never received it, and that his signature, as an endorser, was forged by Maasim. With this knowledge, GELIC promptly

made a demand upon HSBC that it should be given credit for the amount of the forged check, which the bank refused to do, and

GELIC commenced the action to recover the P2,000 which was paid on the forged check.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Upon the issues being joined, a trial was had and judgment was rendered against the plaintiff and in favor of the defendants, from

which the plaintiff appeals, claiming that the court erred in dismissing the case, notwithstanding its finding of fact, and in not

rendering a judgment in its favor, as prayed for in its complaint.

On the petition of HSBC, PNB was made defendant. HSBC denies any liability, but prays that, if a judgment should be rendered

against it, in turn, it should have like judgment against PNB which denies all liability to either party. Upon the issued being joined, a

trial was had and judgment was rendered against GELIC and in favor HSBC and PNB from which GELIC appealed.

Issue:

Whether or not GELIC can recover inasmuch as Melicor’s indorsement was forged.

Ruling:

Plaintiff's check was drawn on Shanghai Bank payable to the order of Melicor. In other words, the plaintiff authorized and

directed the Shanghai Bank to pay Melicor, or his order, P2,000. It did not authorize or direct the bank to pay the check to any other

person than Melicor, or his order, and the testimony is undisputed that Melicor never did part with his title or endorse the check,

and never received any of its proceeds.

Section 23 of the Negotiable Instruments Law is square in point.

“When a signature is forged or made without the authority of the person whose signature it purports to be, it is wholly inoperative,

and no right to retain the instrument, or to give a discharge therefor, or to enforce payment thereof against any party thereto, can

be acquired through or under such signature, unless the party against whom it is sought to enforce such right is precluded from

setting up the forgery or want of authority.”

The money was on deposit in HSBC, and it had no legal right to pay it out to anyone except GELIC or its order. Here, GELIC ordered

HSBC to pay the P2,000 to Melicor, and the money was actually paid to Maasim and was never paid to Melicor, and he never

personally endorsed the check, or authorized any one to endorse it for him, and the alleged endorsement was a forgery.

Hence, HSBC has no defense to the present action.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

PNB cashed the check upon a forged signature, and placed the money to the credit of Maasim, who was the forger. That PNB then

endorsed the check and forwarded it to HSBC by whom it was paid. PNB had no license or authority to pay the money to Maasim or

anyone else upon a forged signature. It was its legal duty to know that Melicor's endorsement was genuine before cashing the

check. PNB’s remedy is against Maasim to whom it paid the money.

The Supreme Court reversed the lower court's judgment, and entered another in favor of GELIC and against HSBC for P2,000, with

interest thereon from 8 November 1920, at the rate of 6% per annum, and the costs of the action, and a corresponding judgment

will be entered in favor of HSBC against PNB for the same amount, together with the amount of its costs in the action.

NATIVIDAD GEMPESAW vs. CA and PHILIPPINE BANK OF COMMUNICATIONS

G.R. No. 92244 February 9, 1993

Facts:

Natividad Gempesaw issued checks, prepared by her bookkeeper, a total of 82 checks in favor of several supplies. Most of

the checks for amounts in excess of actual obligations as shown in their corresponding invoices. It was only after the lapse of more

than 2 years did, she discovered the fraudulent manipulations of her bookkeeper. It was also learned that the indorsements of the

payee were forged, and the checks were brought to the chief accountant of Philippine Bank of Commerce (the Drawee Bank,

Buendia Branch) who deposited them in the accounts of Alfredo Romero and Benito Lam. Gempesaw made demand upon the bank

to credit the amount charged due the checks. The bank refused. Hence, the present action.

Issue:

W/N Gempesaw has a right to recover the amount attributable to the forgeries?

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Held:

No.

As a rule, a drawee bank who has paid a check on which an indorsement has been forged cannot charge the drawer’s account for

the amount of said check. An exception to the rule is where the drawer is guilty of such negligence which causes the bank to honor

such checks. Gempesaw did not exercise prudence in taking steps that a careful and prudent businessman would take in

circumstances to discover discrepancies in her account. Her negligence was the proximate cause of her loss, and under Section 23 of

the Negotiable Instruments Law, is precluded from using forgery as a defense. On the other hand, the banking rule banning

acceptance of checks for deposit or cash payment with more than one indorsement unless cleared by some bank officials does not

invalidate the instrument; neither does it invalidate the negotiation or transfer of said checks. The only kind of indorsement which

stops the further negotiation of an instrument is a restrictive indorsement which prohibits the further negotiation thereof, pursuant

to Section 36 of the Negotiable Instruments Law. In light of any case not provided for in the Act that is to be governed by the

provisions of existing legislation, pursuant to Section 196 of the Negotiable Instruments Law, the bank may be held liable for

damages in accordance with Article 1170 of the Civil Code. The drawee bank, in its failure to discover the fraud committed by its

employee and in contravention banking rules in allowing a chief accountant to deposit the checks bearing second indorsements, was

adjudged liable to share the loss with Gempesaw on a 50:50 ratio.

PREMISES CONSIDERED, the case is hereby ordered REMANDED to the trial court for the reception of evidence to determine the

exact amount of loss suffered by the petitioner, considering that she partly benefited from the issuance of the questioned checks

since the obligation for which she issued them were apparently extinguished, such that only the excess amount over and above the

total of these actual obligations must be considered as loss of which one half must be paid by respondent drawee bank to herein

petitioner.

SO, ORDERED.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Jai-Alai Corp. of the Phil. vs. Bank of the Phil. Islands

G.R. No. L-29432 August 6, 1975 66 SCRA 29

FACTS:

Petitioner deposited 10 checks in its current account with BPI. The checks which were acquired by petitioner from Ramirez, a

sales agent of the Inter-Island Gas was all payable to Inter-Island Gas Service, Inc. or order. After the checks had been submitted to

Inter-bank clearing, Inter-Island Gas discovered that all the indorsements made on the checks purportedly by its cashiers were

forgeries. BPI thus debited the value of the checks against petitioner's current account and forwarded to the latter the checks

containing the forged indorsements which petitioner refused to accept.

ISSUE:

Whether BPI had the right to debit from petitioner's current account the value of the checks with the forged indorsements.

RULING:

YES.

Having indorsed the checks to BPI, Jai-Alai is deemed to have given the warranty prescribed in Section 66 of the NIL that

every single one of those checks "is genuine and in all respects what it purports to be."

The depositor of a check as indorser warrants that it is genuine and in all respects what it purports to be.

Jai Alai Corporation negligent in accepting the checks without question from Antonio Ramirez notwithstanding that the payee was

the Inter-Island Gas Services, Inc. and it did not appear that he was authorized to indorse it.

BPI acted within legal bounds when it debited the petitioner's account. Having indorsed the checks to respondent bank, petitioner is

deemed to have given the warranty prescribed in Section 66 of the NIL that every single one of those checks "is genuine and in all

respects what it purports to be." Respondent which relied upon the petitioner's warranty should not be held liable for the resulting

loss. ACCORDINGLY, the judgment of the Court of Appeals is affirmed, at petitioner's cost.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Assoc. Bank and Conrado Cruz V. CA (1992)

G.R. No. 89802 May 7, 1992

FACTS:

Merle Reyes is the owner of "Melissa's RTW" ready-to-wear garments

She deals with customers such as Robinson's Department Store, Payless Department Store, Rempson Department Store, and the

Corona Bazaar.

These companies issued in payment of their respective accounts crossed checks payable to Melissa's RTW in the amounts and on the

dates indicated below:

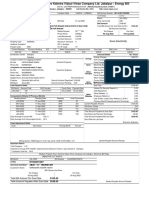

PAYOR BANK AMOUNT DATE

Payless Solid Bank P3,960.00 January 19, 1982

Robinson's FEBTC 4,140.00 December 18, 1981

Robinson's FEBTC 1,650.00 December 24, 1981

Robinson's FEBTC 1,980.00 January 12, 1982

Rempson TRB 1,575.00 January 9, 1982

Corona RCBC 2,500.00 December 22, 1981

Reyes was unaware of the issuance of the checks until she went to the companies for collection and was informed thereof.

She soon found out that it was deposited with Associated Bank and subsequently paid to one of the bank's trusted depositors,

Rafael Sayson, the check being indorsed by Eddie Reyes

Reyes sued in the RTC for the recovery of the checks plus damages.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

CA affirmed RTC: favored Reyes

ISSUE:

W/N Reyes has the right for recovery of the cross checks

HELD:

YES. petition DENIED.

There is no doubt that the checks were crossed checks and for payee’s account only. Reyes was able to show that she has never

authorized Sayson to deposit the checks nor to encash the same; that the bank had allowed all checks to be deposited, cleared and

paid to one Sayson in

violation of the instructions in the said crossed checks that the same were for payee’s account only; and that Reyes maintained a

savings account with the bank which never cleared the said checks.

Under accepted banking practice, crossing a check is done by writing two parallel lines diagonally on the top left portion of the

checks. The crossing is special where the name of a bank or a business institution is written between the two parallel lines, which

means that the drawee should pay

only with the intervention of the company. The crossing is general where the words written in between are “And Co.” and “for

payee’s account only”, as in the case at bar. This means that the drawee bank should not encash the check but merely accept it for

deposit.

The effects of crossing a check are as follows:

1. That the check may not be encashed but only deposited in the bank

2. That the check may be negotiated only once—to one who has an account with a bank

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

3. That the act of crossing the check serves as a warning to the holder that the check has been issued for a definite purpose so that

he must inquire if he has received the check pursuant to the purpose

The subject checks were accepted for deposit by the bank for the account of Say son although they were crossed checks and the

payee wasn't Sayson but Reyes. The bank stamped thereon its guarantee that all prior endorsements and/or lack of

endorsements guaranteed. By such deliberate and positive act, the bank had for all legal intents and purposes treated the said

checks as negotiable instruments and accordingly assumed the warranty of the endorser.

When the bank paid the checks so indorsed notwithstanding that title has not passed to the endorser, it did so at its peril and

became liable to the payee for the value of the checks.

WHEREFORE, the petition is DENIED, with costs against the petitioner. It is so ordered.

REPUBLIC BANK vs. MAURICIA T. EBRADA

G.R. No. L-40796 July 31, 1975

Facts:

Mauricio Ebrada encashed a back pay check for P1246.08 at Republic Bank (Escolta Branch). The Bureau of Treasury, which

issued the check advised the bank that the alleged indorsement of the check by one “Martin Lorenzo” was a forgery as the latter has

been dead since 14 July 1952; and requested that it be refunded he sum deducted from its account. The bank refunded the amount

to the Bureau and demanded upon Ebrada the sum in question, who refused. Hence, the present action.

Issue:

Whether or not the bank can recover from the last indorser.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

Held:

According to Section 23 of the Negotiable Instruments Law, where the signature on a negotiable instrument is forged, the

negotiation of the check is without force or effect. However, following the ruling in Beam vs. Farrell (US case), where a check has

several indorsements on it, only the negotiation based on the forged or unauthorized signature which is inoperative. The last

indorser, Ebrada, was duty-bound to ascertain whether the check was genuine before presenting it to the bank for payment. Her

failure to do so makes her liable for the loss and the Bank may recover from her the money she received for the check. Had she

performed her duty, the forgery would have been detected and fraud defeated. Even if she turned over the amount to Dominguez

immediately after receiving the cash proceeds of the check, she is liable as an accommodation party under Section 29 of the

Negotiable Instruments Law.

IN VIEW OF THE FOREGOING, the judgment appealed from is hereby affirmed in toto with costs against defendant-appellant.

SO, ORDERED.

NEGOTIABLE INSTRUMENTS DIGEST (FORGERY) JODEL CHRIS BALITA

You might also like

- Phillip Morris Companies and Kraft, IncDocument9 pagesPhillip Morris Companies and Kraft, IncNishant Chauhan100% (4)

- Financee ExerciseHandbook SolvedDocument59 pagesFinancee ExerciseHandbook SolvedRodrigo RamosNo ratings yet

- PWC Guide Financing Transactions Debt EquityDocument285 pagesPWC Guide Financing Transactions Debt Equitysl7789No ratings yet

- Nego Case Digest 2Document19 pagesNego Case Digest 2Rizza MoradaNo ratings yet

- LowieDocument4 pagesLowieJerry Marc CarbonellNo ratings yet

- SAN CARLOS V Bpi - DigestDocument1 pageSAN CARLOS V Bpi - DigestMirabel VidalNo ratings yet

- SC upholds conviction for forgery under NILDocument3 pagesSC upholds conviction for forgery under NILKobe Lawrence VeneracionNo ratings yet

- Case Digest Nego Part 2Document18 pagesCase Digest Nego Part 2KIM COLLEEN MIRABUENANo ratings yet

- Francisco VDocument2 pagesFrancisco VBingoheartNo ratings yet

- San Carlos Milling Vs BpiDocument2 pagesSan Carlos Milling Vs Bpim_ramas2001100% (1)

- BPI V IACDocument2 pagesBPI V IACDorothy PuguonNo ratings yet

- BPI Liable for Negligence in Cashing Forged CheckDocument8 pagesBPI Liable for Negligence in Cashing Forged CheckJohnRouenTorresMarzoNo ratings yet

- Nego CasesDocument16 pagesNego CasesAna Camille ReyesNo ratings yet

- Negotiable Instruments Case Digest: San Carlos Milling Co. LTD V. BPI (1993)Document2 pagesNegotiable Instruments Case Digest: San Carlos Milling Co. LTD V. BPI (1993)Michael BongalontaNo ratings yet

- Agency Case Digests - Art. 1899-1918 - Atty. Obieta - 2D 2012Document5 pagesAgency Case Digests - Art. 1899-1918 - Atty. Obieta - 2D 2012Albert BantanNo ratings yet

- G.R. No. 37467 Case DigestDocument3 pagesG.R. No. 37467 Case DigestsheilaNo ratings yet

- Francisco v. CADocument17 pagesFrancisco v. CAHeidiNo ratings yet

- 154792-1933-San Carlos Milling Co. Ltd. v. Bank of The20180418-1159-Ucjguw PDFDocument5 pages154792-1933-San Carlos Milling Co. Ltd. v. Bank of The20180418-1159-Ucjguw PDFKyle AgustinNo ratings yet

- SAN CARLOS MILLING CO., LTD VS. BPI and CHINABANKDocument5 pagesSAN CARLOS MILLING CO., LTD VS. BPI and CHINABANKArvy VelasquezNo ratings yet

- San Carlos Milling Co. LTD DigestDocument2 pagesSan Carlos Milling Co. LTD Digestjim jim100% (1)

- Digest 4Document22 pagesDigest 4KathleneGabrielAzasHaoNo ratings yet

- Nil CompendiumDocument251 pagesNil CompendiumEarl Justine OcuamanNo ratings yet

- San Carlos Milling v. BPI Digest For NegoDocument1 pageSan Carlos Milling v. BPI Digest For Negochaynagirl100% (1)

- Cash (Popularly Known As Greenbacks) For Safekeeping. The AgreementDocument5 pagesCash (Popularly Known As Greenbacks) For Safekeeping. The AgreementdorianNo ratings yet

- San Carlos Milling vs. BPI and ChinaBank (1933Document1 pageSan Carlos Milling vs. BPI and ChinaBank (1933Serena RogerNo ratings yet

- Bank Liable for Paying Forged ChecksDocument7 pagesBank Liable for Paying Forged ChecksLyresh NuddaNo ratings yet

- Bank of America VsDocument6 pagesBank of America VsDutchsMoin MohammadNo ratings yet

- Bank of The Philippine Islands vs. Iac FactsDocument2 pagesBank of The Philippine Islands vs. Iac FactsClaudine SumalinogNo ratings yet

- Nego Cases Digest CompleteDocument36 pagesNego Cases Digest CompleteJuvitNo ratings yet

- Gonzales Liable as Accommodation Party for PhP 1.8M LoanDocument38 pagesGonzales Liable as Accommodation Party for PhP 1.8M LoanMp CasNo ratings yet

- Forgery Case DigestsDocument14 pagesForgery Case DigestsMark Jason Crece AnteNo ratings yet

- BPI vs IAC and Zshornack: Ruling on Validity of Contract for Safekeeping of US DollarsDocument20 pagesBPI vs IAC and Zshornack: Ruling on Validity of Contract for Safekeeping of US DollarsJerry CaneNo ratings yet

- Cases 5Document4 pagesCases 5Thoughts and More ThoughtsNo ratings yet

- PCIB V CustodioDocument7 pagesPCIB V CustodioJVMNo ratings yet

- Bank Liable for Misappropriation of Trust Funds Deposited in Personal AccountDocument6 pagesBank Liable for Misappropriation of Trust Funds Deposited in Personal AccountKrisha FayeNo ratings yet

- Damages in Heirs of Bolado vs. Vda. de BulanDocument29 pagesDamages in Heirs of Bolado vs. Vda. de BulanMatthew WittNo ratings yet

- 15 Double Jeopardy - Arraignment & PleaDocument65 pages15 Double Jeopardy - Arraignment & PleaMarry SuanNo ratings yet

- Negotiable Instruments Law: San Carlos Mining Vs BPIDocument5 pagesNegotiable Instruments Law: San Carlos Mining Vs BPIkathNo ratings yet

- Moral Damages Ruling OverturnedDocument12 pagesMoral Damages Ruling Overturnedmb_estanislaoNo ratings yet

- Case Digests - NegoDocument7 pagesCase Digests - NegoAIZEL JOY POTOTNo ratings yet

- Garin DigestDocument6 pagesGarin DigestConcepcion Mallari GarinNo ratings yet

- Bpi VS IacDocument2 pagesBpi VS Iac001nooneNo ratings yet

- Deposits Case LawsDocument125 pagesDeposits Case LawsSZNo ratings yet

- BPI vs. IACDocument2 pagesBPI vs. IACkelbingeNo ratings yet

- Deposit CDDocument15 pagesDeposit CDsally deeNo ratings yet

- Francisco vs. CA - 319 SCRA 354, GR 116320Document9 pagesFrancisco vs. CA - 319 SCRA 354, GR 116320Krister VallenteNo ratings yet

- SAN CARLOS MILLING v. BPIDocument2 pagesSAN CARLOS MILLING v. BPIKaren Ryl Lozada BritoNo ratings yet

- Negotiable Instruments Digested Cases Compilation (Incomplete)Document40 pagesNegotiable Instruments Digested Cases Compilation (Incomplete)czabina fatima delicaNo ratings yet

- CASE DIGEST Commercial LawDocument7 pagesCASE DIGEST Commercial LawApril Dream Mendoza PugonNo ratings yet

- Section 20Document2 pagesSection 20einel dcNo ratings yet

- Negotiable Instruments - Case DigestDocument8 pagesNegotiable Instruments - Case DigestKeyba Dela CruzNo ratings yet

- Nego Case Digest FINALSDocument30 pagesNego Case Digest FINALSHazel Natanauan100% (1)

- On DepositsDocument48 pagesOn DepositsSusan Sabilala MangallenoNo ratings yet

- BPI vs. IACDocument9 pagesBPI vs. IACJoey Ann Tutor KholipzNo ratings yet

- Bpi Vs Iac 164 Scra 630 1988Document5 pagesBpi Vs Iac 164 Scra 630 1988ShielaMarie MalanoNo ratings yet

- Petitioner Vs Vs Respondents Domingo & Dizon Mauricio Law OfficeDocument11 pagesPetitioner Vs Vs Respondents Domingo & Dizon Mauricio Law OfficeLDCNo ratings yet

- 2.10 San CArlos Vs BPIDocument7 pages2.10 San CArlos Vs BPIMarion Yves MosonesNo ratings yet

- Case Digest Compiilation ATAPDocument62 pagesCase Digest Compiilation ATAPEzekiel EnriquezNo ratings yet

- Case Digests Atty CabochanDocument38 pagesCase Digests Atty CabochanAthena Lajom100% (1)

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- LOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSFrom EverandLOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSNo ratings yet

- Completion of legitime and collation of donationsDocument8 pagesCompletion of legitime and collation of donationsJodel Cris BalitaNo ratings yet

- Report On Intestate Succession (Art. 978-987)Document26 pagesReport On Intestate Succession (Art. 978-987)Jodel Cris BalitaNo ratings yet

- Succession Quiz No. 2 Answer - BalitaDocument5 pagesSuccession Quiz No. 2 Answer - BalitaJodel Cris BalitaNo ratings yet

- Art. 1080-1092 Succession ReviewerDocument7 pagesArt. 1080-1092 Succession ReviewerJodel Cris BalitaNo ratings yet

- Nego Assigned Cases 1Document7 pagesNego Assigned Cases 1Jodel Cris BalitaNo ratings yet

- Nego Assigned Cases 3 - CONSIDERATION-ACCOMODATION PARTYDocument12 pagesNego Assigned Cases 3 - CONSIDERATION-ACCOMODATION PARTYJodel Cris BalitaNo ratings yet

- Dsfs DFWSFSDF SDFDocument2 pagesDsfs DFWSFSDF SDFRaven UyNo ratings yet

- UPIN DAN IPIN Corp. 2014 financial reportDocument6 pagesUPIN DAN IPIN Corp. 2014 financial reportMuhammad Fajar Al AminNo ratings yet

- FABM2 - 12 - Q1 - Mod4 - Statement-of-Cash-Flow - V5 FSDocument20 pagesFABM2 - 12 - Q1 - Mod4 - Statement-of-Cash-Flow - V5 FSEllah OllicetnomNo ratings yet

- Long-Term Financial Planning: Fundamentals of Corporate FinanceDocument17 pagesLong-Term Financial Planning: Fundamentals of Corporate FinanceMuh BilalNo ratings yet

- Journal EntryDocument8 pagesJournal Entryapi-417927166No ratings yet

- Cash Flow Analysis of Sunset Boards, Inc. 2008-2009Document3 pagesCash Flow Analysis of Sunset Boards, Inc. 2008-2009phátNo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)James BondNo ratings yet

- Module: Activity 2: Michael Angelo G. Aleman February 22, 2022 AU-1BSA-A ACC 103Document3 pagesModule: Activity 2: Michael Angelo G. Aleman February 22, 2022 AU-1BSA-A ACC 103Michael Angelo Guillermo AlemanNo ratings yet

- Financial Inclusion Study of SBI & ICICI BanksDocument128 pagesFinancial Inclusion Study of SBI & ICICI BanksDinesh Nayak100% (1)

- Compound Interest 2Document7 pagesCompound Interest 2JORENCE PHILIPP ENCARNACIONNo ratings yet

- Balance Transfer AttachmentDocument8 pagesBalance Transfer AttachmentNg Han GuanNo ratings yet

- Save Electricity: N1823001387 JBA1 - 6 - 1823001387Document1 pageSave Electricity: N1823001387 JBA1 - 6 - 1823001387Shikha KanojiyaNo ratings yet

- ENG233 Ch2Document34 pagesENG233 Ch2Mikaela PadernaNo ratings yet

- Research Newsletter 2017 FinalDocument82 pagesResearch Newsletter 2017 FinalS mukherjeeNo ratings yet

- Thieves in The Temple - America Under The Federal Reserve System 04Document245 pagesThieves in The Temple - America Under The Federal Reserve System 04ma2003rk5159100% (1)

- Product ScheduleDocument26 pagesProduct ScheduleRavindra BasavarajuNo ratings yet

- Contrato BNBDocument2 pagesContrato BNBAnonimous BossNo ratings yet

- Partnership - OperationDocument53 pagesPartnership - OperationJulius B. OpriasaNo ratings yet

- Candlestick Cheat Sheet RGB FINAL PDFDocument16 pagesCandlestick Cheat Sheet RGB FINAL PDFNutzu ConstantinNo ratings yet

- Non Performing Assets of BanksDocument109 pagesNon Performing Assets of BanksJIGAR87% (23)

- Corporate Restructuring Strategies ExplainedDocument26 pagesCorporate Restructuring Strategies ExplainedAmar Singh SaudNo ratings yet

- A Study On Credit Risk ManagementDocument44 pagesA Study On Credit Risk ManagementShabreen Sultana100% (1)

- Accounting For SMEs QuestionnaireDocument4 pagesAccounting For SMEs QuestionnaireGirlie Sison100% (1)

- Ross 12e PPT Ch05 CalculatorDocument35 pagesRoss 12e PPT Ch05 CalculatorRae DanceNo ratings yet

- Hsslive Xii Acc 5 Dissolution of A Partnership Firm QNDocument6 pagesHsslive Xii Acc 5 Dissolution of A Partnership Firm QN6E13 ALMubeenNo ratings yet

- Covid-19, Textile Sector and Herding in Pakistani Stock MarketDocument5 pagesCovid-19, Textile Sector and Herding in Pakistani Stock MarketIAEME PublicationNo ratings yet

- Secrets To Retire RichDocument41 pagesSecrets To Retire RichBarun SinghNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet