Professional Documents

Culture Documents

Real Innerspring R 16102017

Uploaded by

Accounts SMPLCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Innerspring R 16102017

Uploaded by

Accounts SMPLCopyright:

Available Formats

October 16, 2017

Real Innerspring Technologies Private Limited

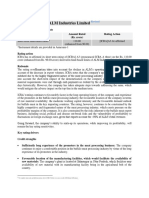

Summary of rated instruments

Instrument* Rated Amount Rating Action

(in Rs. crore)

Fund-based Limits 3.60 [ICRA]B+; withdrawn

Non-fund Based Limits 0.50 [ICRA]A4; withdrawn

Unallocated 1.90 [ICRA]B+; withdrawn

Total 6.00

*Instrument details are provided in Annexure-1

Rating action

ICRA has withdrawn the long-term rating of [ICRA]B+ (pronounced ICRA B plus) for the Rs. 3.60-crore

fund-based and Rs. 1.90-crore unallocated limits and the short-term rating of [ICRA]A4 (pronounced

ICRA A four) for the Rs. 0.50-crore non-fund based limits of Real Innerspring Technologies Private

Limited (RIPL) at the request of the company

Rationale

The ratings assigned to Real Innerspring Technologies Private Limited have been withdrawn at the

request of the company as all the rated bank facilities has been closed.

Key rating drivers

Credit strengths: Not applicable

Credit weaknesses: Not applicable

Analytical approach: For arriving at the ratings, ICRA has applied its rating methodologies as indicated

below.

Links to applicable criteria

Corporate Credit Ratings: A Note on Methodology

ICRA Policy on Withdrawal and Suspension of Credit Rating

About the Company

Incorporated in 2004 by the Gupta family, RIPL manufactures foam and spring mattresses. The company

commenced operations at its manufacturing unit in Noida, Uttar Pradesh in 2004. This was followed by

the addition of manufacturing units in Rudarpur (Uttarakhand) and Bhiwandi (Maharashtra). The spring

mattresses manufactured by RIPL are sold under the brand name Sleep Zone. In 2013, the company

acquired the manufacturing and marketing license from an international mattress manufacturing company,

which markets its products under the brand name King Koil. The directors of RIPL are Mr. Archit Gupta,

Mr. Nitin Gupta and Mr. Shobit Gupta, who along with other professionals manage the affairs of the

company. The promoters have been involved in the mattress trading business over the last four decades

and are also involved in various other businesses such as manufacturing non-woven fabric and composite

containers.

Key financial indicators (Audited)

FY2014 FY2015

Operating Income (Rs. crore) 18.13 24.22

PAT (Rs. crore) 0.30 -0.55

OPBDIT/ OI (%) 6.0% 4.9%

RoCE (%) 7.6% 4.4%

Total Debt/ TNW (times) 7.60 22.13

Total Debt/ OPBDIT (times) 7.31 9.34

Interest coverage (times) 3.26 1.36

NWC/ OI (%) 15.0% 11.8%

Note: FY2016 and FY2017 audited financial statements not available

OI: Operating Income; PAT: Profit after Tax; OPBDIT: Operating Profit before Depreciation, Interest,

Taxes and Amortisation; ROCE: PBIT/Avg (Total Debt + Tangible Net-Worth + Deferred Tax Liability -

Capital Work - in Progress);

NWC: Net Working Capital

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for last three years

Table:

S.No Name of Current Rating Chronology of Rating History for

Instrument the past 2 years

Type Rated Month-year & Month- year Month- year &

amount Rating & Rating Rating

(Rs. crore)

October 2017 May 2016 September 2015

1 Cash Credit Long 3.25 [ICRA]B+ [ICRA]B+ [ICRA]B+

Term Withdrawn

2. Term Loan Long 0.35 [ICRA]B+ [ICRA]B+ [ICRA]B+

Term Withdrawn

3. Unallocated Long 1.90 [ICRA]B+ [ICRA]B+ [ICRA]B+

Term Withdrawn

2. Non-fund Short 0.50 [ICRA]A4 [ICRA]A4 [ICRA]A4

Based Limits Term Withdrawn

Complexity level of the rated instrument

ICRA has classified various instruments based on their complexity as "Simple", "Complex" and "Highly

Complex". The classification of instruments according to their complexity levels is available on the

website www.icra.in

Annexure-1

Details of Instrument

Name of the Date of Coupon Maturity Size of the issue Current Rating

instrument issuance rate Date (Rs. crore) and Outlook

Cash Credit December - - 3.25 [ICRA]B+

2004 withdrawn

Term Loan December - - 0.35 [ICRA]B+

2004 withdrawn

Unallocated - - 1.90 [ICRA]B+

withdrawn

Non-fund Based - - 0.50 [ICRA]A4

withdrawn

Source: RIPL.

Name and Contact Details of the Rating Analyst(s):

Sabyasachi Majumdar Gaurav Singla

+124-4545 304 +124-4545 366

sabyasachi@icraindia.com gaurav.singla@icraindia.com

Manish Ballabh Uday Kumar

+124-4545 812 +124- 4545 867

manish.ballabh@icraindia.com uday.kumar@icraindia.com

Name and Contact Details of Relationship Contacts:

Jayanta Chatterjee

+91 80 4332 6401

jayantac@icraindia.com

About ICRA Limited:

ICRA Limited was set up in 1991 by leading financial/investment institutions, commercial banks and

financial services companies as an independent and professional investment Information and Credit

Rating Agency.

Today, ICRA and its subsidiaries together form the ICRA Group of Companies (Group ICRA). ICRA is a

Public Limited Company, with its shares listed on the Bombay Stock Exchange and the National Stock

Exchange. The international Credit Rating Agency Moody’s Investors Service is ICRA’s largest

shareholder.

For more information, visit www.icra.in

© Copyright, 2017, ICRA Limited. All Rights Reserved

Contents may be used freely with due acknowledgement to ICRA

ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. ICRA ratings are subject to

a process of surveillance, which may lead to revision in ratings. An ICRA rating is a symbolic indicator of ICRA’s current

opinion on the relative capability of the issuer concerned to timely service debts and obligations, with reference to the instrument

rated. Please visit our website www.icra.in or contact any ICRA office for the latest information on ICRA ratings outstanding.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable, including

the rated issuer. ICRA however has not conducted any audit of the rated issuer or of the information provided by it. While

reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’ without any

warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied, as to the accuracy,

timeliness or completeness of any such information. Also, ICRA or any of its group companies may have provided services other

than rating to the issuer rated. All information contained herein must be construed solely as statements of opinion, and ICRA

shall not be liable for any losses incurred by users from any use of this publication or its contents.

Registered Office

ICRA Limited

1105, Kailash Building, 11th Floor, 26, Kasturba Gandhi Marg, New Delhi 110001

Tel: +91-11-23357940-50, Fax: +91-11-23357014

Corporate Office

Mr. Vivek Mathur

Mobile: +91 9871221122

Email: vivek@icraindia.com

Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122002

Ph: +91-124-4545310 (D), 4545300 / 4545800 (B) Fax; +91- 124-4050424

Mumbai Kolkata

Mr. L. Shivakumar Mr. Jayanta Roy

Mobile: +91 9821086490 Mobile: +91 9903394664

Email: shivakumar@icraindia.com Email: jayanta@icraindia.com

3rd Floor, Electric Mansion A-10 & 11, 3rd Floor, FMC Fortuna

Appasaheb Marathe Marg, Prabhadevi 234/3A, A.J.C. Bose Road

Mumbai—400025, Kolkata—700020

Board : +91-22-61796300; Fax: +91-22-24331390 Tel +91-33-22876617/8839 22800008/22831411,

Fax +91-33-22870728

Chennai Bangalore

Mr. Jayanta Chatterjee Mr. Jayanta Chatterjee

Mobile: +91 9845022459 Mobile: +91 9845022459

Email: jayantac@icraindia.com Email: jayantac@icraindia.com

5th Floor, Karumuttu Centre 'The Millenia'

634 Anna Salai, Nandanam Tower B, Unit No. 1004,10th Floor, Level 2 12-14, 1 & 2,

Chennai—600035 Murphy Road, Bangalore 560 008

Tel: +91-44-45964300; Fax: +91-44 24343663 Tel: +91-80-43326400; Fax: +91-80-43326409

Ahmedabad Pune

Mr. L. Shivakumar Mr. L. Shivakumar

Mobile: +91 9821086490 Mobile: +91 9821086490

Email: shivakumar@icraindia.com Email: shivakumar@icraindia.com

907 & 908 Sakar -II, Ellisbridge, 5A, 5th Floor, Symphony, S.No. 210, CTS 3202, Range

Ahmedabad- 380006 Hills Road, Shivajinagar,Pune-411 020

Tel: +91-79-26585049, 26585494, 26584924; Fax: Tel: + 91-20-25561194-25560196; Fax: +91-20-

+91-79-25569231 25561231

Hyderabad

Mr. Jayanta Chatterjee

Mobile: +91 9845022459

Email: jayantac@icraindia.com

4th Floor, Shobhan, 6-3-927/A&B. Somajiguda, Raj

Bhavan Road, Hyderabad—500083

Tel:- +91-40-40676500

You might also like

- Autocratic Leadership Style of Henry Ford 1.1. DefinitionDocument3 pagesAutocratic Leadership Style of Henry Ford 1.1. DefinitionThảo Ngọc100% (2)

- Chapter 5-Elasticity Multiple ChoiceDocument33 pagesChapter 5-Elasticity Multiple ChoiceBriceHong100% (4)

- Essential Statistics Regression and Econometrics 2nd Edition Smith Solutions ManualDocument13 pagesEssential Statistics Regression and Econometrics 2nd Edition Smith Solutions Manualjustinparkerywkjmfiotz100% (17)

- Mira Exim - R-30082017Document5 pagesMira Exim - R-30082017vinay durgapalNo ratings yet

- Avantor Performance Materials - R - 25052018Document5 pagesAvantor Performance Materials - R - 25052018Ankit JainNo ratings yet

- YFC Projects - R-28062017Document5 pagesYFC Projects - R-28062017vinay durgapalNo ratings yet

- Religare Comtrade Limited: Summary of Rated InstrumentsDocument5 pagesReligare Comtrade Limited: Summary of Rated Instrumentsvinay durgapalNo ratings yet

- Nicomet Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesNicomet Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionAsdf AsdfNo ratings yet

- Saya Homes ProjectDocument5 pagesSaya Homes ProjectSatish RAjNo ratings yet

- Aghara Knitwear Pvt. LTD.: Summary of Rated InstrumentsDocument6 pagesAghara Knitwear Pvt. LTD.: Summary of Rated Instrumentssatvik ahujaNo ratings yet

- Shree Radhekrushna Ginning - R-11092017Document6 pagesShree Radhekrushna Ginning - R-11092017SuMit PaTilNo ratings yet

- Investigation On The Flow Behaviour of ADocument6 pagesInvestigation On The Flow Behaviour of ANikhil GuptaNo ratings yet

- Vikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesVikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating Actionvinay durgapalNo ratings yet

- Mechemco - R-30102017 PDFDocument7 pagesMechemco - R-30102017 PDFflytorahulNo ratings yet

- Jainam Cables (India) Private Limited: Summary of Rated InstrumentsDocument6 pagesJainam Cables (India) Private Limited: Summary of Rated InstrumentspunamNo ratings yet

- Maha Durga Charitable Trust: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesMaha Durga Charitable Trust: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionNeeraj_Kumar_AgrawalNo ratings yet

- Ashish Builders and Developers-R-17022020Document5 pagesAshish Builders and Developers-R-17022020Shubhankar NayakNo ratings yet

- Solairedirect Energy India Private LimitedDocument6 pagesSolairedirect Energy India Private LimitedAfzal AneesNo ratings yet

- Zinka Logistics Solutions - R - 07062018 PDFDocument6 pagesZinka Logistics Solutions - R - 07062018 PDFSANIL BADHANINo ratings yet

- BFG International Private Limited: Summary of Rated InstrumentsDocument6 pagesBFG International Private Limited: Summary of Rated InstrumentsB Vignesh BabuNo ratings yet

- Avon Rims Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Crore) Rating ActionDocument5 pagesAvon Rims Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Crore) Rating ActionDevansh ThaparNo ratings yet

- AOV Exports Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDocument7 pagesAOV Exports Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDevansh ThaparNo ratings yet

- Singer India Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesSinger India Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionSaravanan BalakrishnanNo ratings yet

- Laser Fibers Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDocument6 pagesLaser Fibers Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionBhavin SagarNo ratings yet

- Dwarka Das Agarwal: Summary of Rated InstrumentDocument3 pagesDwarka Das Agarwal: Summary of Rated InstrumentVinaykumar MunjiNo ratings yet

- Havells India Limited-30032018Document3 pagesHavells India Limited-30032018vinay durgapalNo ratings yet

- RL Steel Jan 2017 ICRADocument6 pagesRL Steel Jan 2017 ICRAPuneet367No ratings yet

- Ayushman Merchants Private Limited: Summary of Rated InstrumentsDocument6 pagesAyushman Merchants Private Limited: Summary of Rated InstrumentsJeffNo ratings yet

- ABT Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesABT Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionWilliam Veloz DiazNo ratings yet

- United India Insurance_r_12042018Document4 pagesUnited India Insurance_r_12042018Jishan Enterprises Ltd.No ratings yet

- Captain Sports: Instrument Amount Rating Action Rs. Crore August 2015Document3 pagesCaptain Sports: Instrument Amount Rating Action Rs. Crore August 2015Jeetu JainNo ratings yet

- Ashapura International - R-29032019Document4 pagesAshapura International - R-29032019DarshanNo ratings yet

- Hiten Fasteners - R-30092016Document3 pagesHiten Fasteners - R-30092016Chandra ShekarNo ratings yet

- Tata Metaliks Limited - R - 24112020 PDFDocument3 pagesTata Metaliks Limited - R - 24112020 PDFHitesh ModiNo ratings yet

- Arvind Pipes & Fittings Industries Private Limited: Summary of Rated InstrumentDocument4 pagesArvind Pipes & Fittings Industries Private Limited: Summary of Rated InstrumentDinesh RupaniNo ratings yet

- Darshita Aashiyana R 12012018Document3 pagesDarshita Aashiyana R 12012018Deepak KumarNo ratings yet

- R.S. Brothers Retail - R-06122017Document7 pagesR.S. Brothers Retail - R-06122017srv 99No ratings yet

- Dhanuka Extractions Private Limited: Summary of Rated InstrumentDocument3 pagesDhanuka Extractions Private Limited: Summary of Rated InstrumentShambhu MehtaNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- Brajesh Packaging Private - R - 25082020Document4 pagesBrajesh Packaging Private - R - 25082020DarshanNo ratings yet

- Sri Someshwara - R-27022017 PDFDocument6 pagesSri Someshwara - R-27022017 PDFAjith KumarNo ratings yet

- India Grid Trust - R - 06022020 PDFDocument3 pagesIndia Grid Trust - R - 06022020 PDFrchawdhry123No ratings yet

- Ramnord Research Laboratories Pvt. LtdDocument6 pagesRamnord Research Laboratories Pvt. LtdraghavNo ratings yet

- Daund Sugar Private LimitedDocument5 pagesDaund Sugar Private Limitedkrushna.maneNo ratings yet

- Elite India Constructions Private Limited: Instrument Amount (Rs. Crore) Rating Action September 2016Document3 pagesElite India Constructions Private Limited: Instrument Amount (Rs. Crore) Rating Action September 2016vinay durgapalNo ratings yet

- Triveni TurbineDocument6 pagesTriveni TurbinevikasNo ratings yet

- Multichem Specialities Private Limited: Instrument Amount (Rs. Crore) Rating ActionDocument3 pagesMultichem Specialities Private Limited: Instrument Amount (Rs. Crore) Rating ActionDharmendra B MistryNo ratings yet

- Magnolia Martinique - R - 03082017Document7 pagesMagnolia Martinique - R - 03082017Bhavin SagarNo ratings yet

- ALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating ActionDocument6 pagesALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating Actionsgr_kansagraNo ratings yet

- M K Roy & Bros Projects Private Limited: Instrument Amount Rating ActionDocument3 pagesM K Roy & Bros Projects Private Limited: Instrument Amount Rating ActionBhavin SagarNo ratings yet

- Sapra: World'S Largest Rice Millers & Basmati Rice ExportersDocument17 pagesSapra: World'S Largest Rice Millers & Basmati Rice ExportersDhyan MothukuriNo ratings yet

- Mapping of ICRA's Long-Term and Short-Term RatingsDocument3 pagesMapping of ICRA's Long-Term and Short-Term RatingsmaheshNo ratings yet

- Riyan Paper Mill: Summary of Rated InstrumentsDocument6 pagesRiyan Paper Mill: Summary of Rated InstrumentsKNOW INDIANo ratings yet

- Anand Jewels (Indore) - R-30072019Document6 pagesAnand Jewels (Indore) - R-30072019Rishabh KhandelwalNo ratings yet

- Azure Power Thirty Six - R-15102018Document6 pagesAzure Power Thirty Six - R-15102018vinay durgapalNo ratings yet

- Titan Company Limited: Migration of The Rating Outstanding On The Medium-Term Rating Scale To The Long-Term Rating ScaleDocument5 pagesTitan Company Limited: Migration of The Rating Outstanding On The Medium-Term Rating Scale To The Long-Term Rating ScaleMalavShahNo ratings yet

- Gora Mal Hari Ram - R - 27012014Document3 pagesGora Mal Hari Ram - R - 27012014Nishanth LokanathNo ratings yet

- Yashodhara Super Speciality Hospital Private LimitedDocument6 pagesYashodhara Super Speciality Hospital Private LimitedAvinash ShelkeNo ratings yet

- Simero Vitrified Private Limited: Instrument Amount (Rs. Crore) Rating ActionDocument3 pagesSimero Vitrified Private Limited: Instrument Amount (Rs. Crore) Rating ActionSonuNo ratings yet

- Della Adventure R 17112017Document7 pagesDella Adventure R 17112017Anil KanojiaNo ratings yet

- Rajratan Global Wire LimitedDocument6 pagesRajratan Global Wire Limitedpraveen kumarNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Organizational Change ManagementDocument235 pagesOrganizational Change ManagementtavanNo ratings yet

- 2015 SLCC Volunteer Staff AppDocument3 pages2015 SLCC Volunteer Staff AppjoeyjamisonNo ratings yet

- Slomins Home Heating Oil ServiceDocument2 pagesSlomins Home Heating Oil ServiceRohin Cookie SharmaNo ratings yet

- The Impact of COVID-19 in The Construction Sector and Its Remedial MeasuresDocument12 pagesThe Impact of COVID-19 in The Construction Sector and Its Remedial MeasuresdamithNo ratings yet

- Fa-Q by Lolits Dos - 2 PDFDocument35 pagesFa-Q by Lolits Dos - 2 PDFMark Jovin RomNo ratings yet

- Sample Questions MBADocument8 pagesSample Questions MBAMike McclainNo ratings yet

- Get Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024Document26 pagesGet Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024ajay.patelNo ratings yet

- Review JurnalDocument12 pagesReview JurnalMahatma RamantaraNo ratings yet

- Inverter List A19Document2 pagesInverter List A19Raimundo OliveiraNo ratings yet

- Pricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDocument11 pagesPricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- MY Price List With CSV SBDocument6 pagesMY Price List With CSV SBNini Syaheera Binti JasniNo ratings yet

- Scan To Scribd With CcscanDocument13 pagesScan To Scribd With CcscanclarkcclNo ratings yet

- 2023 Telkomsigma Company ProfileDocument17 pages2023 Telkomsigma Company Profiletry.slashing101No ratings yet

- Integral X-500 Wall Basin Product SpecsDocument1 pageIntegral X-500 Wall Basin Product SpecsRudolfGerNo ratings yet

- Strategic Thinking Lessons for Ghana's Technical UniversitiesDocument15 pagesStrategic Thinking Lessons for Ghana's Technical Universitieswawi5825No ratings yet

- Software Testing Strategies: Software Engineering: A Practitioner's Approach, 7/eDocument33 pagesSoftware Testing Strategies: Software Engineering: A Practitioner's Approach, 7/egarimadhawan2No ratings yet

- 2ND Wave Case 11 Cir VS GJMDocument2 pages2ND Wave Case 11 Cir VS GJMChristian Delos ReyesNo ratings yet

- Flange Weld Build UpDocument2 pagesFlange Weld Build UpMohd Shafuaaz KassimNo ratings yet

- Gantt Chart Schedule - FreeDocument16 pagesGantt Chart Schedule - FreeJohn Carl SalasNo ratings yet

- Inventory Levels On Throughput: The Effect of Work-In-Process and Lead TimesDocument6 pagesInventory Levels On Throughput: The Effect of Work-In-Process and Lead TimesTino VelazquezNo ratings yet

- Jai MiniDocument63 pagesJai MiniJaimini PrajapatiNo ratings yet

- Financial Performance Assessment of Banking Sector in India: A Case Study of Old Private Sector BanksDocument1 pageFinancial Performance Assessment of Banking Sector in India: A Case Study of Old Private Sector BanksRAHUL KUMARNo ratings yet

- EconDocument12 pagesEconfranz justin kyle syNo ratings yet

- Letter of Enquiry and Response EditedDocument5 pagesLetter of Enquiry and Response EditedMugdhaNo ratings yet

- 煤炭英文 LOIDocument3 pages煤炭英文 LOIH.INo ratings yet

- Etax - End - User - Manual - TaxpayerDocument33 pagesEtax - End - User - Manual - TaxpayerAdedeji OluwatobilobaNo ratings yet

- Case Study 1 (Payroll Management)Document8 pagesCase Study 1 (Payroll Management)ABINYA A 2237921No ratings yet