Professional Documents

Culture Documents

Basic Accounting - Ballada - Chapter 2

Uploaded by

Joana Elizabeth A. Castro0 ratings0% found this document useful (0 votes)

32 views27 pagesREVIEWER

Original Title

Basic Accounting - Ballada- Chapter 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentREVIEWER

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views27 pagesBasic Accounting - Ballada - Chapter 2

Uploaded by

Joana Elizabeth A. CastroREVIEWER

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

Basic Financial Accounting & Reporting

The Accounting Equation and the Double-Entry System

Learning Objectives: :

After studying this chapter, you should be able to:

Describe the parts of an information system.

Explain how an accounting information system helps the decision makers.

Define the elements of financial statements.

Describe the account (the simple T-Account) and its uses.

5. Understand what is meant by the accounting equation and prove the

validity of the "mirror image" concept.

6, Understand what is meant by the double-entry system.

7. Explain how the ou led -entry system follows the rules of the accounting

equation.

8. Define debits and credits.

9. Summarize the rules of debit and credit as applied to alarica? sheet and

income statement accounts.

10. Describe the nature of the typical account titles used in recording

transactions.

11. Analyze and state the effects of business transactions on an entity's assets,

liabilities and owner's equity and record these effects in accounting

equation form using the financial transaction worksheet and the T-

Accounts.

12. Distinguish between revenue and receipts.

AwNE

Companies like Microsoft, the software giant and Deloitte & Touche, the big US accounting firm,

use Vervex’s EnGage 2.0 to manage large projects that involve employees, subcontractors and

Consultants worldwide. The software allows team members to report on their progress via the

corporate intranet, as well as generate invoices and timesheets that can be easily accessed by

corporate headquarters. Intranet is a version of the Intemet internal to a specific company and

is privately controlled.

Vervex Technologies established in 1994 is owned by Price Givens. This Irvine, California-based

company develops database and corporate intranet applications that help project managers

keep track of offsite workers’ projects. Givens and his team of software developers started by

producing project management applications for accountants. But with Givens in Irvine and the

64 | Basic Finencio y Prof. WIN Ballada

pony’s software developers in Bellevue, Washington, geographic distance interfered with

ollaboration. Givens knew an intranet could be the ultimate solution. Vervex’s newese

nmekeeping sotware program, FSBTime, was designed specifically for accountants, architects

and others who bill clients for their time. However, 27-year old Givens was surprised to find out

that most visitors to Vervex’s Web site were actually other software companies. “One of our

biggest customers has all their software developers in India and all their managers in California»

Givens said. Givens was able to create a niche by addressing specific needs such that sales in

1996 was USS1.2 million. 1999 projections is USS2.5 million. Adopted from: Business Start-Ups, Apri

1993

Givens is helping business entities generate timely accounting information regarding

activities or events which are important to the continued existence of the business. His

software products ensure that his clients have the accurate and relevant data needed by

the system to be able to accumulate the information necessary for timely accounting

reports.

PARTS OF AN INFORMATION SYSTEM

An information system is a collection of people, procedures, software, hardware and

data which works together to provide information essential to running an organization.

espe, : ;

People are competent end users working to increase their productivity. End users use

hardware and software to solve information-related or decision-making problems.

Procedures '

Procedures are manuals and guideli instruct end users on how'to use the

software and hardware.

are

oftware Is another name for progra ructions that tell the computer how to

process data. There are basically two kind

System Software

System software is ba

resources. An example is

‘operating systems.

e that helps a cor “manage nternal

g system. Windows and Linux are popular

Application Software

Application software performs useful work on general-purpose problems. The two

types of applications software are basic applications and advanced applications.

asic applications include:

+ Erowsers—navigate, explore, find Information on the Internet.

. Word processor —prepare written documents,

The Accounting Equation and the Double Entry System | 65

OT

‘+ Spreadsheet—analyze and summarize numerical data.

Database management system—-organize and manage data and information.

«Presentation graphics—communicate a message or persuade other people.

‘Advanced applications include:

Multimedia “integrate video, music, voice, and graphics to create interactive presentati

Web publishers—create interactive multi-media Web pages.

Graphics programs—create professional publications, draw, edit, and modify images.

Virtual reality—create realistic three-dimensional virtual or simulated environments.

‘Antficial intelligence—simulated human thought processes and actions.

Project managers—plan projects, schedule, people, and control resources.

Hardware

Hardware consists of input devices, the system unit, secondary storage, output devices,

and communication devices.

Input Devices 5! i

Input devices translate data and programs that humans can understand into a form the

computer can process. The more common are the keyboard, mouse, scanner, digital

camera and microphone.

“The System Unit

The system unit consists of electronic circuitry with two parts:

'* Central processing unit (CPU)—controls and manipulates data to produce information.

+ Memory (primary storage)—temporarily holds data, program instructions, and processed data.

Secondary Storage

Secondary storage stores data and programs. Three most common storage media are:

flash drive, hard disk and optical disk.

Output Devices

Output devices output processed information from the CPU. Two important output

devices are: monitor and printer.

Communications Devices .

These send and receive data and programs from one computer to another. A device

that connects a microcomputer to a telephone is a modem.

Data

Data is the raw material for data processing. Data consists of numbers, letters and

symbols and relates to facts, events and transactions. Data describes something and is

typically stored electronically in a file. A file is a collection of characters organized as a

single unit. Common types of files are: document, worksheet and database.

66 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Balada

SS

ACCOUNTING INFORMATION SYSTEM.

Every business organization must have an accounting information system which will

generate reliable financial information needed by the decision-makers in a timely

manner. The design and operation of a system must consider the anticipated users of

the information and the types of decisions they are expected to make. The design of

the system to meet the entity's information requirement depends on the firm’s size,

nature of operations, volume of transaction data, organizational structure, form of

business and extent of government regulation. These will influence the way in which

information is accumulated and reported in the financial statements.

An accounting information system is the combination of personnel, records and

procedures that a business uses to meet its:need for financial information. Most firms

have an accounting manual that specifies the policies and procedures to be followed in

accumulating information within the accounting information system. , This manual

details what events are to be recorded in the accounts, and when anid how the

information is to be classified and accumulated.

The

‘Accounting

Process

Economic

‘Accounting

Activities

Information

Actions

(decisions) Decision

Makers

‘An effective accounting information system should achieve the following objectives:

‘+ To process the information efficiently at the least cost (cost-benefit principle).

* To protect entity’s assets, to ensure that data are reliable, and to minimize wastes and

the possibility of theft or fraud (control principle).

To be in harmony with the entity's organizational and human factors (compatibility

principle). .

* To be able to accommodate growth in the volume of transactions arid for organizational,

changes (flexibility principle).

+ The Accounting Equation and the Double Entry System | 67

‘The preceding diagram illustrates how economic activities flow into the accounting

process, which produces accounting information. This information is then used by

decision makers in making economic decisions and taking specific actions; thus,

resulting in economic activities. The cycle goes on.

TYPES OF ACCOUNTING INFORMATION SYSTEMS

In general terms, companies use three types of accounting information systems to

record the results of transactions: manual systems, computer-based transaction

systems and database systems. All of these systems are designed to capture

information regarding accounting events to prepare financial statements. In a nutshell,

manual systems utilize paper-based journals (general and special) and ledgers (general

and subsidiary). Computer-based transaction systems replace paper records with

computer records. Database systems embed accounting data within the business event

data on which they are based. .

Computer-Based Transaction Systems

Manual systems rely on human processing so they are labor intensive and may be

Jnefficient in today’s complex business environment. Because manual systems rely on

human processing, they may be prone to error. To overcome these deficiencies, many

companies have computerized their accounting processes.

A computer-based transaction system mairitains accounting data separately from other

operating data. That is, the accounting records are kept separately from the records

required for the expenditure, revenue and conversion processes. Suffice it to say, at this

point, that there is a greater degree of compartmentalization of work to preserve the

integrity of the accounting information system but not as ideal as the database system.

This system treats information in the same manner as a manual system. The user is

simply filling in a computer screen that looks and oftentimes acts like a source

document. Some of the advaritages of this system are as follows:

* Transactions can be quickly posted to the appropriate accounts, bypassing the

journalizing process.

‘* Detailed listings of transactions can be printed for review at any time,

© Internal controls and edit checks can be used to prevent and detect errors.

© Awide variety of reports can be prepared,

Accounting packages consists of several modules. A module is ‘a program which deals.

with one particular part of a business accounting system. A simple accounting package

might consist of only one module, in which case it is called a stand-alone module. But

more often it will consist of several modules, in which case, it will then be called a suite.

Examples include QuickBooks and Peachtree.

68 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

Se

Database Systems

Relational database systems such as enterprise resource planning (ERP) depart from the

“accounting equation” method of organizing data. These ERP systems such as SAP,

Oracle and PeopleSoft capture data, both financial and non-financial, and store that

information in a data warehouse. Database systems reduce inefficiencies and

redundancies that often exist in transaction-based systems.

For example, in transaction-based systems, customer information (like name, address,

phone, credit limit) is often maintained separately from customer account information.

Thus, a salesperson who does not know a customer's balance might inadvertently

encourage a customer to purchase items that exceed that credit limit. Also, separate

departments have special information needs such that when a database system is not

used then the same customer information may be recorded several times. ‘Advantages

of database systems include:

‘© The system recognizes business rather than just accounting events.

* The system supports reduction in operating inefficiencies.

© The system eliminates redundant data.

STAGES OF DATA PROCESSING

Processing of raw data into useful accounting information then finally into summarized

reports follows the usual input-processing-output progression. Each transaction

entered into the accounting system should be supported by source documents like

customer invoices, vendor invoices, deposit slips, checks, timecards and memos. These

documents serve as evidence that a particular transaction occurred. They also provide

the necessary details and supports. The computer, with the use of the accounting

software, then processes the inputs. As will be discussed later, the manual system of

journalizing, posting, preparing the trial balance and updating the accounts are done

almost instantaneously. When required, the financial statements and other accounting

reports can be viewed on the screen or printed as output documents.

In many situations, manual systems are inferior to computerized systems in terms of

productivity, speed, accessibility, quality of output, incidence of errors and bulk.

ELEMENTS OF FINANCIAL STATEMENTS

The elements of financial statements defined in the March 2018 Conceptual Framework

for Financial Reporting (2018 Conceptual Framework) are:

. ilities and equity - relate to a reporting entity's financial position; and

. incomeand eters relate to a reporting entity's financial performance.

The Accounting Equation and the Double Entry System | 69

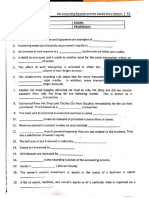

In summary, the elements of financial statements are defined as follows:

* [L Blement Definition or Description

‘Asset | Avpresent economic resource controlled by the entity as 9 result of past

events, An economic resource is a right that has the potential to produce

economic benefits.

Liability | Apresent obligation of the entity to transfer an economic resource as a result of

ast events, '

Equity | The residual interest in the assets of the entity after deducting allits liabilities,

Income | Increases in assets, or decreases in abilities, that result in increases in equity,

ther than those relating to contributions from holders of equity claims.

Expenses | Decreasesin assets, or increases in iabilties, that result in decreases in equity,

other than those relating to distributions to holders of equity claims.

Financial Position

alia

Per March 2018 Conceptual Framework for Financial Reporti

Framework), Fe eS encecmnor resource controllec

_past events. An economic resource is a right that has the potential to produce economit

benefits. There are three aspects to these definitions: “right”; “potential to produce

economic benefits”; and “control”.

ptual

Rights that have the potential to produce economic benefits take many forms,

including:

(a) rights that correspond to an obligation of another party, for example:

(i) rights to receive cash.

(ii) rights to receive goods or services.

(iii) rights to exchange economic resources with another party on favorable terms.

Such rights include, for example, a forward contract to buy an econor

resource on terms that are currently favorable or an option to buy an economic

resource, ,

(iv) rights to benefit from an obligation of another party to transfer an economic

resource if a specified uncertain future event occurs,

(b) rights that do not correspond to an obligation of another party, for example:

(i) rights over physical objects, such as property, plant and equipment or

inventories. Examples of such rights. are a right to use a physical object or 2

right to benefit from the residual value of a leased object

(ii) rights to use intellectual property,

An economic resource could produce economic benefits for an entity by entitling or

enabling it to do, for example, one or more of the followin

(a) receive contractual cash flows or.another economic resource;

(b) exchange economic resources with another party on favorable terms;

70 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

——————_———————— TY

(c) produce cash inflows or avoid cash outflows by, for example:

(i) using the economic resource either individually or in combination with other

economic resources to produce goods or provide services;

(ii) using the economic resource to enhance the Value of other economic resources;

or

(iii) leasing the economic resource to anothet party;

(d) receive cash or other economic resources by selling the economic

resource; or

(e) extinguish liabilities by transferring the economic resource.

An entity controls an economic resource if it has the present ability to direct the use

of the economic resource and obtain the economic benefits that may flow from it.

Control includes the present ability to prevent other parties from directing the use of

the economic resource and from obtaining the economic benefits that may flow

from it. It follows that, if one party controls an economic resource, no other party

controls that resource,

Liability

A liability is a present obligation of the entity to transfer an economic resource as a

result of past events. For aliability to exist, three criteria must all be satisfied:

(a) the entity has an obligation;

(b) the obligation is to transfer an economic resource; and

(c) the obligation is a present obligation that exists as a result of past events

An obligation is a duty or responsibility that an entity has no practical ability to

avoid. An obligation is always owed to another party (or parties). The other party (or

parties) could be a person or another entity, a group of people or other entities, or

society at large. It is not necessary to know the identity of the party (or parties) to

whom the obligation is owed. If one party has an obligation to transfer an economic: »

resource, it follows that another party (or parties) has a right to receive that

economic resource.

Obligations to transfer an economic resource include, for example:

(a) obligations to pay cash. '

(b) obligations to deliver goods or provide services.

(c) obligations to exchange economic resources with another party on

unfavorable terms. Such obligations include, for example, a forward contract

to sell an economic resource on terms that are currently unfavorable or an

option that entitles another party to buy an economic resource from the

entity.

(d) obligations to transfer an economic resource if a specified uncertain future

event occurs, "

The Accounting Equation and the Double Entry System | 71

(e) obligations to issue a financial instrument if that financial instrument will

oblige the entity to transfer an economic resource.

A present obligation exists as a result of past events only if:

(a) the entity has already obtained economic benefits or taken an action; and

(b)'as a consequence, the entity will or may have to transfer an economic

resource that it would not otherwise have had to transfer.

Equity

Equity is the residual interest in the assets of the enterprise after deducting all its

liabilities, In other words, they are claims against the entity that do not meet the

definition of a'liability.

Equity may pertain to any of the following depending on the form of business

organization: :

+ Ina sole proprietorship, there is only one owner's equity account because

there is only one owner.

+ Inapartnership, an owner's equity account exists for each partner.

+ In a corporation, owners’ equity or stockholders’ equity consists of share

capital, retained earnings and reserves representing appropriations of

retained earnings among others.

Financial Performance

Income is increases in assets, or decreases iri liabilities, that result in increases in equity,

other than those relating to contributions from holders of equity claims.

Expenses are decreases in assets, or increases in liabilities, that result in decreases in

equity, other than those relating to distributions to holders of equity claims.

It follows from these definitions of income and expenses that contributions from

holders of equity claims are not income, and distributions to holders of equity claims are

not expenses. Income and expenses are the elements of financial statements that relate

to an entity's financial performance. Users of financial statements need information

about both an entity's financial position and its financial performance. Hence, although

income and expenses are defined in terms of changes in assets and liabilities,

information about income and expenses is just as important as information about assets

and liabilities,

THE ACCOUNT A

The basic summary device of accounting is the account. A separate account is

maintained for each element that appears in the balance sheet (assets, liabilities and

| 2021 Edition by Prof. WIN Ballada

ee

»me and expenses). Thus, an account may be

ases, decreases and balance of each element

2ments. The simplest form of the account is

3 similarity to the letter "T". The account has

sount Title

or Right side or

fe Credit side

iness is performing. They are the final products of

we arrive at the items and amounts that make UP

rasic tool of accounting is the accounting equation.

reces controlled by the enterprise, the present

residual.interest in the assets. It states that assets

ler’s equity. The basic accounting model is:

Liabilities + Owner’s Equity

ft side of the equation opposite the liabilities and

ncreases and decreases in assets are recorded in the

as liabilities and owner’s equity are recorded. The

2s and owner’s equity follow the same rules of debit

: is related to the.accounting equation. Transactions

es (left and right sides), subtractions from both sides

n and subtraction on the same side (left or right side),

.e maintained as shown below:

Owner's

Liabilities ' Eauity

The Accounting Equation and the Double Entry System | 73

——

DEBITS AND CREDITS—THE DOUBLE-ENTRY SYSTEM

Accounting is based on a double-entry system which means that the dual effects of a

business transaction is recorded. A debit side entry must have a corresponding credit

side entry. For every transaction, there must be one or more accounts debited and one

or more accounts credited. Each transaction affects at least two accounts. The total

debits for a transaction must always equal the total credits.

An account is debited when an amount is entered on the left side of the account and

credited when an amount is entered on the right side. The abbreviations for debit and

credit are Dr. (from the Latin debere) and Cr. (from the Latin credere), respectively.

The account type determines how increases or decreases in it are recorded. Increases in

assets are recorded as debits (on the left side of the account) while decreases in assets

are recorded as credits (on the right side). Conversely, increases in liabilities and

owner's equity are recorded by credits and decreases are entered as debits.

The rules of debit and credit for income and expense accounts are based on the

relationship of these accounts to owner’s equity. Income increases owner's equity and

expense decreases owner’s equity. Hence, increases in income are recorded as credits

and decreases as debits. Increases in expenses are recorded. as debits and decreases as

credits. These are the rules of debit and credit. The following summarizes the rules:

Balance Sheet Accounts

Assets Liabilities and Owner's Equity

Debit . pce ve Credit

Increases ect reese Increases,

Normal Balance Normal Balance

Income Statement Accounts ‘

Debit for

decreases in owner's equity

Credit for

increases in owner's equity

Expenses Income

Debit rT a Credit

t ta dad hf au t

Increases actlees nares Increases

Normal Balonce Normal Balance

74 | Basie Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

Accounts

Debit Credit

Increases in Increases in

t Assets Liabilities t

Expenses Owner's Capital

Income

Decreases in

Owner's Capital Assets

Liabilities | J Decreases in

Income Expenses

NORMAL BALANCE OF AN ACCOUNT

The normal balance of any account refers to the side of the account—debit or credit—

where increases are recorded, Asset, owner's withdrawal and expense accounts

normally have debit balances; liability, owner's equity and income accounts normally

have credit balances. This result occurs because increases in an account are usually

greater than or equal to decreases.

Increases Recorded by Normal Balance

‘Account Category - Debit Credit Debit Credit

Assets v v

Liabilities v v

‘Owner's Equit

‘Owner's Capital v v

Withdrawals v v

Income v v

Expenses v v

ACCOUNTING EVENTS AND TRANSACTIONS

An accounting event is an economic occurrence that causes changes in’an enterprise’s

assets, liabilities, and/or equity. Events may be internal actions, such ‘as the use of

equipment for the production of goods or services. It can also be an external event,

such as the purchase of raw materials from a supplier. A transaction is a particular kind

of event that involves the transfer of something of value between two entities.

Examples of transactions include acquiring assets from owner(s), borrowing funds from

creditors, and purchasing or selling goods and services.

TYPES AND EFFECTS OF TRANSACTIONS

It will be beneficial in the long-term to be able to understand a classification approach

t emphasizes the effects of accounting events rather than the recording procedures

t

involved. This approach is quite pioneering. Although business entities

merous transactions, all transactions can be classified into one of four,

The Accounting Equation and the Double Entry System | 75

—————$——

1. Source of Assets (SA). An asset account increases and a corresponding claims

(liabilities or owner's equity) account increases. Examples: (1) Purchase of supplies

‘on account; (2) Sold goods an cash on delivery basi

2. Exchange of Assets (EA). One asset account increases and another asset account

decreases. Example: Acquired equipment for cash.

Use of Assets (UA). An asset account decreases and a corresponding claims

(liabilities or equity) account decreases. Example: (1) Settled accounts payable; (2)

Paid salaries of employees.

4, Exchange of Claims (EC). One claims (liabilities or owner’s equity) account increases

and another claims (liabilities or owner's equity) account decreases. Example:

Received utilities bill but did not pay.

Every accountable event has a dual but self-balancing effect on the accounting equation.

Recognizing these events will not in any manner affect the equality of the basic

accounting model. The four types of transactions above may be further expanded into

nine types of effects as follows: a

1. Increase in Assets = Increase in Liabilities (SA)

2. Increase in Assets = Increase in Owner’s Equity (SA)

3, _ Increase in one Asset = Decrease in another Asset (EA)

A. Decrease in Assets = Decrease in Liabilities (UA)

5, " Decrease in Assets = Decrease in Owner’s Equity (UA)

6. _ Increase in Liabilities = Decrease in Owner's Equity (EC)

7. Increase in Owner's Equity = Decrease in Liabilities (EC)

8. _ Increase in one Liability = Decrease in another Liability (EC)

9. Increase in one Owner's Equity = Decrease in another Owner's Equity (EC)

TYPICAL ACCOUNT TITLES USED

. STATEMENT OF FINANCIAL POSITION

Assets

Assets are should be classified only into two: current assets and non-current assets. Per

revised Philippine Accounting Standards (PAS) No. 1, an entity shall classify assets as

current when:

2. It expects to realize the asset, or intends to sell or consume .it, in its normal

operating cycle; :

b. it holds the asset primarily for the purpose of trading;

c. it expects to realize the asset within twelve months after the reporting period; or

d. the asset is cash or a cash equivalent (as defined in PAS No. 7) unless the asset is

restricted from being exchanged or used to settle a liability for at least twelve

months after the reporting period.

All other assets should be classified as non-current assets. Operating cycle is the time

between the acquisition of assets for processing and their realization in cash or cash

equivalents. When the entity's normal operating cycle is not clearly identifiable, it is

assumed to be twelve months.

i :

ncial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

Current Assets

Cash. Cash is any medium of exchange that a bank will accept for deposit at face value,

It includes coins, currency, checks, money orders, bank deposits and drafts.

Cash Equivalents. Per PAS No. 7, these are short-term, highly liquid investments that

are readily convertible to known amounts of cash and’ which are subject to an

insignificant risk of changes in value. ;

Notes Receivable. A note receivable is a written pledge that the customer will pay the

business a fixed amount of money on a certain date.

Accounts Receivable. These are claims against customers arising from sale of services

or goods on credit. This type of receivable offers less security than a promissory note.

Inventories. Per PAS No. 2, these are assets which are (a) held for sale in the ordinary |

course of business; (b) in the process of production for such sale; or (c) in the form of

materials or supplies to be consumed in the production process or in the rendering of |

services.

Prepaid Expenses. These are expenses paid for by the business in advance. It is an

asset because the business avoids having to pay cash in the future for a specific

expense. These include insurance and rent. These prepaid items represent’ future

economic benefits—assets—until the time these start to contribute to the earning

process; these, then, become éxpenses.

Non-current Assets

Property, Plant and Equipment. Per PAS No. 16, these are tangible assets that-are held |

by an enterprise for use in the production or supply of goods or’services, or for rental to |

others, or for administrative purposes and which are expected to be used during more

than one period. Included are such items as land, building, machinery and equipment,

furniture and fixtures, motor vehicles and equipment.

Accumulated Depreciation. It is a contra account that contains the sum of the periodic |

depreciation charges. The balance in this account is deducted from the cost of the

related asset—equipment or buildings—to obtain book value.

Intangible Assets. Per PAS No. 38, these are identifiable, nonmonetary assets without

physical substance held for use in the production or supply of goods or services, for |

rental to others, or for administrative purposes.. These include goodwill, patents,

copyrights, licenses, franchises, trademarks, brand names, secret processes: |

subscription lists and non-competition agreements.

Liabil

Per revised Philippine Accounting Standards (PAS) No. 1, an entity shall classify a liability

as current when:

it expects to settle the liability in its normal operating cycle;

it holds the liability primarily for the purpose of trading;

the liability is due'to be settled within twelve months after the reporting period; or

the entity does not have an unconditional right to defer settlement of the liability

for at least twelve rrionthé after the reporting period.

pose

Allother liabilities should be classified as non-current liabilities.

Current Liabilities

Accounts Payable. This account represents the reverse relationship of the accounts

receivable. By accepting the goods or services, the buyer agrees to pay for them in the

near future. *

Notes Payable. A note payable is like a note receivable but in a reverse sense. In the

case of a note payable, the business entity is the maker of the note; that is, the business

entity is the party who promises to pay the other party a specified amount of money, on

a specified future date.

Accrued Liabilities. Amounts owed to others for unpaid expenses. This account

includes salaries payable, utilities payable, interest payable and taxes payable.

Unearned Revenues. When the business entity receives payment before providing its

customers with goods or services, the amounts received are recorded in the unearned

revenue account (liability method).- When the goods or services are provided to the

customer, the unearned revenue is reduced and income is recognized.

Current Portion of Long-Term Debt. These are portions of mortgage notes, bonds and

other long-term indebtedness which are to be paid within one year from the balance

Sheet date.

Non-current Liabilities

Mortgage Payable. This account records long-term debt’ of the business entity for

which the business entity has pledged certain assets as security to the creditor. In the

event that the debt payments are not made, the creditor can foreclose or cause the

mortgaged asset to be sold to enable the entity to settle the claim.

Bonds Payable. Business organizations often obtain substantial sums of money from

lenders to finance the acquisition of equipment and cther needed assets. They obtain

these funds by issuing bonds. The bond is a contract between the issuer and the lender

specify ing the terms of repayment and the interest to be charged. -

Owner's Equity

Capital (from the Latin capitalis, meaning “property”). This account is used to record

the original and additional investments of the owner of the business entity. It is

increased by the amount of profit earned during the year or is decreased by a loss. Cash

or other assets that the owner may withdraw from the business ultimately reduce it, .

This account title bears the name of the owner.

Withdrawals. When the owner of a business entity withdraws cash or other assets, _

such are recorded in the drawing or withdrawal account rather than directly reducing

the owner's equity account.

Income Summary. It isa temporary account used at the end of the accounting period to

close income and expenses. This account shows the profit or loss for the period before

closing to the capital account. :

INCOME STATEMENT

Income

Service Income, Revenues earned by performing services for a customer or client; for

example, accounting services by a CPA firm, laundry services by a laundry shop.

Sales, Revenues earned as a result of sale of merchandise; for example, sale of building

materials by a construction supplies firm.

Expenses

Cost of Sales. The cost incurred to purchase or to produce the products sold to

customers during the period; also called cost of goods sold.

Salaries or Wages Expense. Includes all payments as a result of an employer-employee

relationship such as salaries or wages, 13° month pay, cost of living allowances and

other related benefits,

Telecommunications, Electricity, Fuel and Water Expenses. Expenses related to use of

telecommunications facilities, consumption of electricity, fuel and water.

Rent Expense. Expense for space, equipment or other asset rentals,

Supplies Expense. Expense of using supplies (e.g. office supplies) in the conduct of daily

business.

Insurance Expense. Portion of premiums paid on insurance coverage {e.g. on motor

vehicle, health, life, fire, typhoon or flood) which has expired.

The Accounting Equation and the Double Entry System | 79

5

ACCOUNTING FOR BUSINESS TRANSACTIONS

Accountants observe many events that they identify and measure in financial terms. A

business transaction is the occurrence of an event or a coi:dition that affects financial

position and can be reliably recorded.

Financial Transaction Worksheet

‘Every financial transaction can be analyzed or expressed in terms of its effects on the

accounting equation. The financial transactions will be analyzed by means of a financial

transaction worksheet which is a form used to analyze increases and decreases in the

assets, liabilities or owner's equity of a business entity.

Illustration. Emerita Modesto decided to establish a sole proprietorship business and

named it as Modesto Graphics Design. Modesto is a graphic designer who has

extensive experience in drawing, layout, typography, lettering, diagramming and

photography. She possesses the talent to visually communicate to a ‘tenet audience

with the right combination of words, images and ideas.

Modesto Graphics Design can do the layout and production design of newspapers,

magazines, corporate reports, journals and other publications. ‘The entity:can create

promotional displays; marketing brochures for services and products; packaging design

for products; and distinctive logos for businesses. She also enters into agreements with

clients for the progressive development and maintenance of their web sites. Her initial

- revenue stream comes from web designing.

The owner, Emerita Modesto, makes the business decisions. The assets of the company

belong to Modesto and all obligations of the business are her responsibility. Any

income that the entity earns belongs solely to Modesto.

When, a specific asset, liability or owner's equity item is created by a financial

transaction, it is listed in the financial transaction worksheet using the appropriate

accounts. The worksheet that follows shows the first transaction of the Modesto

Graphics Design., The dates are enclosed in parentheses.

During March 2020, the first month of operations, various financial transactions took

place. These transactions are described and analyzed as follows:

Mar.1 Modesto started her new business by depositing P350,000 in a bank account

in the name of Modesto Graphics Design at BPI Poblacion Branch.

iti llada

80 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Balla

Modesto Graphics Design

Financial Transaction Worksheet

Month of March 2020

Assets 2 Liabilities + Owner's Equity

Cash = Modesto, Capital

(1) __P350,000 = 350,000

The financial transaction is analyzed as follows:

+ Anentity separate and distinct from Modesto’s personal financial affairs is created,

+ An economic resource—cash of P350,000 is invested in the business entity. The

source of this asset is the contribution made by the owner, which represents

owner's equity. The owner's equity account is Modesto, Capital.

+ The dual nature of the transaction is that cash is invested and owner's equity

created. The effects on the accounting equation are as follows: increase in asset—

cash from zero to P350,000 and increase in owner's equity from zero to P350,000.

«At this point, the entity has no liabilities, and assets equal owner's equity.

Mar.5 Computer equipment costing P145,000.is acquired on cash basis. The effect

of the transaction on the basic equation is:

Assets = Liabilities + Owner's Equity

Cash + Computer = Modesto, Capital

Equipment

Bal. 350,000 = 350,000

(5) _ (145,000) P145,000

Bal. + 145,000 350,000

350,000 =

350,000

This transaction did not change the total assets but it did ch:

assets—it decreased one asset—cash and increased another asset—computer

equipment by P145,000. Note that the sums of the balances on both sides of the

equation are equal. This equality must always exist,

ange the composition of the

Mar.9 Computer supplies in the amount of P25,000 are purchased on account.

Assets = Liabil

les + Owner's Equity

"

Cash + Computer + Computer Accounts + ~— Modesto, Capital

Supplies Equipment Payable

Bal. 205,000 P145,000 = 350,000

(9) : 25,000 = P 25,000

Bal, __P205,000 + _P25,000 + __P145,000~ = P 25,000 + 350,000

375,000 = 375,000

aoe

—_

The Accounting Equation and the Double Entry System | 81

Assets don’t have to be purchased in cash. It can also be purchased on credit. Acquiring

the computer supplies with a promise to pay the amount due later is called buying on

account. This transaction increases both the assets and the liabilities of the business.

The asset affected is computer supplies and the liability created is an accounts payable

Mar.11 Modesto Graphics Design collected P88,000 in cash for designing interactive

web sites for two exporters based inside the ASEAN Ecozone.

Assets = Liabilities + Owner's

Equity

Cash + Computer + Computer = Accounts +" - Modesto,

Supplies Equipment Payable Capital

Bal. 205,000 25,000 145,000 = 25,000 350,000

(11) __ 88,000 = : 88,000

Bal, _ 293,000 + _P25,000 + __P145,000_ = P25,000_ + 438,000)

453,000. =

463,000

The entity earned service income by designing web sites for clients. Modesto rendered

her professional services and collected revenues in cash. The effect on the accounting

equation is an increase in the asset—cash and an increase in owner’s equity. Income

increases owner's equity. This transaction caused the business to grow, as shown by the

increase in total assets from P375,000 to P463,000.

Mar. 16 Modesto paid P'18,000 to MVP Bills Express, a one-stop bills payment service

company, for the semi-monthly utilities.

Assets

Liabilities + ~ Owner's Equity

Cash + Computer ¥ Computer

Accounts + ~—‘ Modesto, Capital

Supplies Equipment Payable

Bal. 293,000 25,000 145,000 = 25,000 438,000

(a6) ___ (18,000) = (18,000)

Bal, __P275,000_ + _P25,000_ + 145000 = P25;000_ + 420,000

445,000 445,000

Expenses are recorded when they are incurred. Expenses can be paid in cash when they

occur, or they can be paid later, The payment for utilities is an expense for the month of

March. It represented an outflow of resources ahd a reduction of owner's equity.

Expenses have the opposite effect of income; they cause the business to shrink as

shown by the smaller amount of total assets of P445,000.

Mar. 17 The entity has service agreements with several Netpreneurs to maintain and

update théir web sites weekly. Modesto billed these clients P35,000 for

services already rendered during the month.

82 | Bosic Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

——_——_——— oF

A

Lo + On

Cash # © Accounts + Computer + Computer

‘Accounts + Modesto,

Receivatle Supplies Equipment Payable Capital’

Bal. 275,000 25,000 145,000 = 25,000 420,000,

a7) “P35,000 = 35,000

a

Bal. _P275,000_ + __P35,000_ + 25,000 + P145,000 P25,000_ + __PA55,000

480,000 = _P480,000

The entity has performed services to clients so income should already be recognized, |

Modesto is entitled to receive payment for these but the clients did not pay

immediately. Performing the services creates an economic resource, the clients’ |

promise to pay the amount which is called accounts receivable, This transaction

resulted to an increase in an asset—accounts receivable and an increase in owner's |

equity of P35,000. |

|

Mar. 19 Modesto made a partial payment of P17,000 for the Mar. 9 purchase on

account. |

A = L + OE |

Cash ~Accounts. + Computer + Computer = Accounts + Modesto,

Receivable Supplies Equipment Payable Capital

Bal. P275,000 35,000 25,000 145,000 25,000 455,000

(19) __ (27,000) (17,000)_

Bal. = P258,000_ + P35,000_ + 25,000 + 145,000 = __P8,000 + P455,000_ |

463,000 463,000,

This transaction is a payment on account. The effect on the accounting equation is @ |

decrease in the asset—cash and a decrease in the liability—accounts payable. The

payment of cash on account has no effect on the asset—computer supplies because the

payment does not increase or decrease the supplies available to the business.

Mar. 20 Checks totaling P25,000 were received from clients for billings dated Mar. 17.

A al rai + OE

Cash + += Aecounts_ «+ ©Computer + Computer = Accounts + Modesto,

Receivable Supplies * Equipment Payable Capital

Bal. 258,000 35,000 25,000 145,000 = ~ P8,000 455,000

(20) 25,000 (25,000) .

Bal. 283,000 + P10,000_ + P25,000_ + P145,000_ = P8,000. +

ee 463,000 = ° P463,000

Accounting Equation and the Double Entry System | 83

tty ans ene billed clients for services already rendered, On Mar. 20, the

Collect P25,000 from Bae

The business should them. The asset—cash is increased by P25,000.

Not record service income on Mar. 20 sinc

income last Mi 2 it has already recorded

the Income last Mar. 17. Total assets are unchanged. The business merely reduced one

asset—accounts receivable and increased anather—cash,

Mar. 21 Modesto withdrew 20,000 from the business for her personal use.

A di

+ OE

Cash + Accounts. + Computer + Computer

Receivable ‘Supplies

Accounts + Modesto,

Equipment Payable Capital

Bal. 283,000 10,000, “p25,000 145,000 = —P8,000 455,000

(24) __{20,000) = (20,000)

Bal. _P765,000_ + 10,000. + _P25,000_ + __P145000 = _ 8,000 + __P435,000_

443,000. = 443,000

Withdrawal of cash or other assets for personal use is the way by which the owner of

the entity receives advance distribution of the profits. On Mar. 1, Modesto invested

350,000; both cash and owner's equity increased. The transaction was an investment

by the owner and not an income-generating activity. Modesto simply transferred funds

from her personal account to the business. A cash withdrawal is exactly the opposite.

The P20,000 cash withdrawal transaction resulted toa reduction in both cash and

owner's equity.

Mar. 27 Alessandra Publishing submitted .a bill to Modesto for P8,000 worth of

Newspaper advertisements. for this month. Modesto will pay this bill next

month,

A = ak + OE

Cash + Accounts + Computer + Computer = Accounts + Modesto,

Receivable Supplies Equipment Payable Capital

Bal. 263,000 P10,000 25,000 145,000 P 8,000 435,000

(27) 8,000 (3,000)

Bal, _ 263,000, 30,000. +___P25,000 145,000 P16,000_ + __P427,000

443,000 = __P443,000

Alessandra rendered’ services on account. Modesto Graphics Design has incurred an

expense in the amount of .P8,000 by availing of Alessandra's services. There was no

Payment during the month. This advertising expense resulted to a decrease in owner's

‘equity and an increase in'the liability—accounts payable.

and Reporting

121 Edition by Prof. WIN Ballada

Mar. 31 Modesto paid her assistant designer salaries of P15,000 for the month.

A Z = L + OE

cash + Accounts + Computer + Computer

Accounts + Modesto,

Receivable Supplies Equipment Payable Capital

Bal 10,000 25,000, P145o00 = —P16,000 427,009,

(28) __(15,000) a = (35,000)

Sol. P288,000_ + —P10,000_ + P2500 +” _P145,000_ = _ _Pi6,000 + P412,000

a + FS 000 = 6,000 + EN, 000

428,000 = _P428,000

This transaction resulted to a reduction in owner's equity as well as a reduction in cash,

By providing her services to Modesto for the month, the assistant designer has created |

for the business an expense—salaries expense.

Use of T-Accounts

Analyzing and recording transactions using the accounting equation is useful in

conveying a basic understanding of how transactions affect the business. However, it is

not an efficient approach once the number of accounts involved increases. Double-

entry system provides a formal system of classification and recording business

transactions. i

Illustration. The rules of debit and credit will.be applied to the Modesto Graphics |

Design illustration for comparison. Three transactions will be added to the example. |

Before being recorded, a transaction must be analyzed to determine which accounts

must be increased or decreased. After this has been determined, the rules of debit and.

credit are applied to effect the appropriate increases and decreases to the accounts.,

Mar.1 Modesto started her new business by depositing P350,000 in a bank account

in the name of Modesto Graphics Design at BPI Poblacion Branch.

Assets (Increase) = Owner's Equity (Increase)

Cash Modesto, Capital

Debit Credit > Debit Credit

(+) 0 0 (+)

3-1 350,000 3 350,000

This transaction increased both the asset—cash and owner's equity. According to. the

rules of debit and credit, an increase in asset is recorded as debit while a

owner's equity is recorded as credit; thus, the entry is to debit

‘Modesto, Capital. The transaction dates are placed on the left side

reference.

The Accounting Equation and the Double Entry System | 85

Mar.2 Computer equipment is acquired by issuing a PS0,000 note payable to Paco

Roman Office Systems. The note is due in six months.

Assets (Increase) = Liabilities (Increase)

Computer Equipment Notes Payable

Debit Credit Debit Credit

(+) 0 oO (+

3-2 50,000 2 50,000

The transaction increased by P50,000 the asset—computer equipment and the

liability—notes payable. Computer equipment must be debited and notes payable must

be credited.

Mar.3 Modesto paid P15,000 to Del Rosario Suites for rent on the office studio for

the months of March, April and May.

Assets (Decrease) . Assets (Increase)

Cash Prepaid Rent

Debit Credit Debit Credit

) a i) Q

a4 350,000 | 3-3 15,000 33 15,000

The entity paid advance rent for three months. A resource having future economic

benefit—prepaid rent, is acquired for 4 cash payment of P15,000. ‘Increases in assets

are recorded by debits and decreases in assets are recorded by credits. The transaction

resulted to a debit to prepaid rent and a credit to cash for P15,000. The prepaid rent is

consumed based on the passage of time so that after one month, P5,000 of the prepaid

rent will be transferred to the rent expense account.

Mar.4 — Received advance payment of P18,000 from Marco Polo ASEAN Hotel for web

site updating for the next three months.

Assets (Increase) = Liabilities (Increase)

Cash + Unearned Revenues

Debit Credit Debit _ Credit

(+) 0 +) (+)

34 350,000 | 3-3 “15,000 a4 18,000

3-4 18,000

The entity has an obligation to Marco Polo ASEAN Hotel for the next three months. This

Jiability is called unearned revenues. The asset—cash is increased by a debit of P18,000

ind the liability—unearned revenues is increased by a credit of P18,000. As it renders

ervice, the entity discharges its obligation at a rate of P6,000 per month for the next

86 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

cn ne

Mar.5 Computer equipment costing P145,000 is acquired on cash basis.

Assets (Decrease) = Assets (Increase)

Cash Computer Equipment

Debit Credit Debit Credit

) a «) 0

BL 350,000 | 3-3 15,000 32 50,000

34 18,000 | 3-5 145,000 35 145,000

This transaction increased the asset—computer equipment.and decreased the asset—

cash. Assets are increased by debits and decreased by credits; thus, computer

‘equipment is debited and cash is credited for P145,000.

Mar.9 Computer supplies in the amount of P25,000 are purchased on account.

Assets (Increase) = Liabilities (increase)

Computer Supplies Accounts Payable

Debit Credit Debit Credit

(+ 0 0 ()

39 25,000 39 25,000

The asset—computer supplies is increased by a debit of P25,000 while the liability

account—accounts payable is increased by a credit for the same amount.

Mar. 11 Modesto Graphics Design collected P88,000 in cash for designing web sites.

Assets (Increase) = Owner's Equity (Increase)

Cash Design Revenues

Debit Credit Debit Credit

(*) @ i] (4)

21 350,000 | 3-3 15,000 341 88,000

24 18,000 | 3-5 145,000 4

241 88,000

The transaction increased the asset—cash and increased the income account—desigt

revenues. Assets are increased by debits, income are increased by credits; henc® a

debit of P88,000 to cash and a credit of P88,000 to design revenues is rnade. Increase

in income increase owner's equity.

The Accounting Equation and the Double Entry System | 87

Mar.16 Modesto paid P18,000 to MVP Bills Express for the semi-monthly utilities.

Assets (Decrease) Owner's Equity (Decrease)

Cash Utilities Expense

Debit Credit Debit Credit

y Q (+) 0

3-4 350,000 | 33 15,000 18,000

34 18,000 | 3-5 145,000

3-11 88,000 | 3-16 18,000

Expenses are increased by debits and assets are decreased by credits; therefore, utilities

expense is debited and cash credited for P18,000, Increases in expenses decrease

owner's equity.

Mar.17 Modesto billed clients P35,000 for services already rendered during the

month.

Assets (Increase) = Owner's Equity (Increase)

Accounts Receivable Design Revenues

Debit Credit Debit Credit

i) Q a @)

317 35,000 Bat 88,000

3-17 35,000

Assets are increased by debits, income are increased by credits. Increases in income

increase owner's equity. A debit of P35,000' to accounts receivable and a credit of

35,000 to the income account—design revenues is needed.

Mar. 19 Modesto partially paid P17,000 for the Mar. 9 purchase of computer supplies.

Assets (Decrease) Liabilities (Decrease)

Cash Accounts Payable

Debit Credit Debit Credit ~

() 0 oO a)

34 350,000 | 3-3 15,000 17,000 | 3-9 25,000

3-4 18,000 | 3-5 145,000

3-41 88,000 | 3-16 18,000

3.19 17,000

Assets are decreased by credits while liabilities are decreased by debits. The transaction

is recorded by debiting accounts payable and crediting cash for P'17,000 each

88 | Basic Financial Accounting and Reporting 2021 Edition by Prof. WIN Ballada

Mar. 20 Received checks totaling P25,000 from clients for billings dated Mar. 17,

Assets (Increase) = Assets (Decrease)

Cash Accounts Receivable

Debit Credit Debit * Credit

@) 0 ) 0

31 350,000 | 3.3 15,000 347 35,000] 3-20 25,000

34 18,000 | 3-5 145,000 *

341 88,000] 3.16 18,000

320 25,000 3-19 17,000

Collections on account reduced the asset—accounts receivable but increased the

asset—cash. Assets are increased by debits and decreased by credits; thus, a debit to

cash for P25,000 and a credit to accounts receivable for P25,000 is made.

Mar. 21 Modesto withdrew P20,000 from the business for her personal use.

Assets (Decrease) = Owner's Equity (Decrease)

Cash Modesto, Withdrawals

Debit Credit Debit Credit

(+) 0 ( 0

3-1 350,000 | 3-3 15,000 3-21 20,000

3-8 18,000 | 3-5 * 145,000

Bed 88,000 | 3-16 18,000

3-20 . 25,000| 3-19 17,000

3-21 20,000 :

Withdrawals are reductions. of owner's equity but are not expenses of the business

entity. A withdrawal is a personal transaction of the owner that is exactly the opposite

of an investment.

This transaction increased the withdrawals account but reduced cash. Debits record

increases in the withdrawals account and credits record decreases in asset accounts;

thus, a debit to withdrawals and a credit to cash for P20,000 each is necessary.

Mar. 27 Alessandra billed Modesto for P8,000 ads. Modesto witl pay next month.

Liabilities (Increase) = Owner's Equity (Decrease)

Accounts Payable Advertising Expense

Debit Credit Debit Credit

0 (+) (+) 4 0

3-19 17,000 | 3-9 25,000 3-27 8,000

3-27 8,000

The Accounting Equation and the Double Entry System | 89

Ei ee leila it ae alin

This transaction increased the expense—advertising expense and increased the

liability—accounts payable by P8,000. Expenses are increased by debits while liabilities

are increased by credits; hence, an entry to debit advertising expense and to credit

accounts payable for P8,000isneeded. _ ,

Mar, 31 Modesto paid her assistant designer salaries of P15,000 for the month.

Assets (Decrease) = Owner's Equity (Decrease)

Cash Salaries Expense

Debit Credit Debit Credit

(+) D) (+) tP)

3-1 350,000 | 3-3 15,000 3-31 15,000

3-4 18,000 | 3-5 145,000

3-11 88,000 | 3-16. 18,000

3-20 25,000 | 3-19 17,000 |

3-21 20,000 .

331 15,000 =

Expenses are increased by debits and assets are decreased by credits. Hence, salaries

expense is debited for P15,000 and cash credited for the same amount. «Increases in

salaries expense decrease owner's equity.

DISTINCTION BETWEEN REVENUES AND RECEIPTS

At this point, it will be useful to learn the distinction between revenues and receipts as

illustrated in the following table. The table shows various types of sales transactions

and classifies the effect of each on cash receipts and sales revenues for “this year”:

ThisYear

Transaction Amount Cash Sales

: J Receipts Revenue

1. Cash sales made this year. 200,000 200,000 200,000

2. Credit sales made last year; 300,000 300,000 0

cash received this year.

3. Credit sales made this year; 400,000. 400,000: 400,000

cash received this year.

4. Credit sales made this year; 100,000 0 * 100,000

cash to be received next year. es

Total 900,000 ___P700,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Purcom ReviewerDocument6 pagesPurcom ReviewerJoana Elizabeth A. CastroNo ratings yet

- CNS AnaDocument75 pagesCNS AnaJoana Elizabeth A. CastroNo ratings yet

- Sas #3Document6 pagesSas #3Joana Elizabeth A. CastroNo ratings yet

- Hes006 CNS Lab 15 18Document50 pagesHes006 CNS Lab 15 18Joana Elizabeth A. CastroNo ratings yet

- Basic Accounting - Ballada - Chapter 1 ProblemsDocument12 pagesBasic Accounting - Ballada - Chapter 1 ProblemsJoana Elizabeth A. CastroNo ratings yet

- Basic Accounting - Ballada - Chapter 2 ProblemsDocument26 pagesBasic Accounting - Ballada - Chapter 2 ProblemsJoana Elizabeth A. CastroNo ratings yet

- Basic Accounting - Ballada - Chapter 1Document49 pagesBasic Accounting - Ballada - Chapter 1Joana Elizabeth A. CastroNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)