Professional Documents

Culture Documents

Big Picture C Uloa

Uploaded by

Anvi Rose CuyosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Big Picture C Uloa

Uploaded by

Anvi Rose CuyosCopyright:

Available Formats

BIG PICTURE C

Week 6-7: Unit Learning Outcomes (ULO): At the end of the unit, you are expected to:

a. Learn and understand the various theories of international trade and explain the

various strategies on firm’s internationalization process;

b. Know and distinguish political into legal aspects of international business and

identify respectively the different risks associated on it; and

c. Understand and explain exchange rate and its system and identify the participant

in the monetary and financial systems.

Big Picture in Focus: ULOa. Learn and understand the various theories of

international trade and explain the various strategies on firm’s

internationalization process.

essential terms of the curriculum

Metalanguage

The following are terms to be remembered as we go through in studying this unit.

Please refer to these definitions as supplement in case you will encounter difficulty in

understanding the concepts of trading theories and internationalization.

1. Beggar-thy-neighbor policies are trading policies which promotes benefits of

one country at the expense of others.

2. Free Trade refers to the relative absence of restrictions to the flow of goods

and services between nations.

3. Economies of Scale is the cost reduction mechanism of a firm. It is where firm

incurs a lower average cost while creating an increasing number of outputs.

4. Monopolistic Advantage refers to resources or capabilities a company holds

that few other firms have.

Essential Knowledge

In this unit you are going to learn the theories of international trade and the

internationalization of the firm. This unit will highlight theories that explain on why do

nations trade and how internationalizing firm gain, enhance, and sustain competitive

advantage. Please note that you are not limited to exclusively refer to these resources.

Thus, you are expected to utilize other books, research articles and other resources that

are available in the university’s library e.g. ebrary, search.proquest.com etc., and even

online tutorial websites.

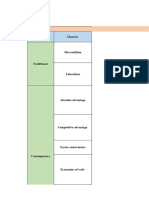

1. Theories on International Trade

Countries do trade for the purpose of using their resources efficiently thus

becoming them productive. The outcomes of the said activity help keep the cost of many

everyday products low, which translates into higher living standards. Other reasons why

do nation trade can be explained by the following theories:

Mercantilism - the belief that national prosperity is the result of a

positive balance of trade, achieved by maximizing exports and

minimizing imports. Mercantilism explains why nations attempt to run a

trade surplus - that is, to export more goods than they import. However,

mercantilism tends to harm firms that import and its consumers, may

lead to an increase in prices (inflation), and invite beggar-thy-neighbor

policies.

Absolute Advantage Principle - states that a country benefits by

producing primarily those products in which it has an absolute

advantage - those that it can produce using fewer resources than any

other country. It negates the view of the mercantilists which deprives

individuals of the ability to trade freely and to benefit from voluntary

exchange. This principle follows the notion of Adam Smith that nations

have much to benefit from free trade. Each country can increase its

wealth by specializing in the production of goods in which it has unique

advantages, exporting those goods, and then importing other goods in

which it has no particular advantage. If every nation follows this practice,

each can consume more than it otherwise could, generally at lower cost.

Comparative Advantage Principle – asserted by David Ricardo, this

principle contends that what matters is not the absolute cost of

production, but rather the relative efficiency with which the two countries

can produce the products. The comparative advantage principle states

that it will be beneficial for two countries to trade with each other as long

as one is relatively more efficient at producing goods or services needed

by the other. This principle is the foundational logic for free trade among

nations today. The comparative advantage view is optimistic because it

implies that a nation need not be the first-, second-, or even third-best

producer of a particular product to benefit from international trade. A

country needs to be only relatively capable in producing various types

of goods. In this way, the comparative advantage view implies that it is

generally advantageous for all countries to participate in international

trade.

Factor Proportions Theory or Factor Endowment Theory –

proposed by Eli Heckscher and his student, Bertil Ohlin, this theory

suggests that each country should export products that intensively use

relatively abundant factors of production and import goods that

intensively use relatively scarce factors of production. The theory states

that, in addition to differences in the efficiency of production, differences

in the quantity of production factors countries hold also determine

international trade patterns. In this way, a country that possesses an

abundance of a given production factor (e.g., labor, land) obtains a per-

unit-cost advantage in the production of goods that use that factor

intensively.

International Product Life Cycle Theory – proposed by Raymond

Vernon whom observed that each product and its manufacturing

technologies go through three stages of evolution: introduction,

maturity, and standardization. During the introduction stage, the new

product is produced in the inventing country, which enjoys a temporary

monopoly. As the product enters the maturity phase, the product’s

inventors mass-produce it and seek to export it to other advanced

economies. In the standardization phase, knowledge about how to

produce the product is widespread and manufacturing has become

straightforward. Once standardized, however, mass production

becomes the dominant activity and can be accomplished using cheaper

inputs and lower-cost labor.

New Trade Theory – this theory argues that increasing returns to scale,

especially economies of scale, are important for superior international

performance in industries that succeed best as their production volume

increases. This theory arises when trade was growing fastest among

industrialized countries with similar factors of production while there

appeared to be no clear comparative advantage. Many national markets

are small, and the domestic producer may not achieve economies of

scale because it cannot sell products in large volume. New trade theory

implies that firms can solve this problem by exporting and gaining

access to the much larger global marketplace. The effect of increasing

returns to scale allows the nation to specialize in a smaller number of

industries in which it may not necessarily hold factor or comparative

advantages. According to new trade theory, trade is thus beneficial even

for countries that produce only a limited variety of products.

2. Enhancing Nation’s Competitive Advantage

The globalization of markets has fostered a new type of competition - a race

among nations to reposition themselves as attractive for business and investment. The

more competitive economies today possess a combination of comparative advantages

and firm-specific advantages which then lead to national competitive advantages. There

are three contemporary perspectives help explain the development of national

competitive advantage: the competitive advantage of nations, the determinants of

national competitiveness, and national industrial policy.

Competitive Advantage of Nations

Michael Porter provides insights with regards to the firm’s competitive

advantage. According to him, the competitive advantage of a nation depends

on the collective competitive advantages of the nation’s firms. Over time, this

relationship is reciprocal; the competitive advantages the nation holds tend to

drive the development of new firms and industries with these same competitive

advantages. At both the firm and national levels, competitive advantage and

technological advances grow out of innovation. Innovation results primarily

from R&D. It also promotes productivity, which is measured as output per unit

of labor or capital. The more productive a firm is, the more efficiently it uses its

resources. At the national level, productivity is a key determinant of the nation’s

long-run standard of living and a basic source of national per-capita income

growth.

Determinants of National Competitiveness

Michael Porter described several factors that give rise to competitive

advantage at both the company and national levels. Named the Porter

Diamond Model, it comprises four major elements:

• Demand Conditions - refer to the nature of home-market demand for

specific products and services. The presence of demanding customers

pressures firms to innovate faster and produce better products.

• Firm strategy, structure, and rivalry - refer to the nature of domestic

rivalry and conditions in a nation that determines how firms are created,

organized, and managed. Vigorous competitive rivalry puts these firms

under continual pressure to innovate and improve. They compete not

only for market share but also for human talent, technical leadership,

and superior product quality. The presence of strong competitors in a

nation helps to create and maintain national competitive advantage.

• Factor conditions - describe the nation’s resources such as labor,

natural resources and advanced factors such as capital, technology,

entrepreneurship, advanced work force skills, and know-how. Each

nation has a relative abundance of certain factor endowments. This

helps determine the nature of its national competitive advantage.

• Related and supporting industries - refer to the presence of clusters

of suppliers, competitors, and skilled workforce. An industrial cluster

refers to a concentration of businesses, suppliers, and supporting firms

in the same industry located at a particular geographic location.

National Industrial Policy

Porter’s Diamond Model integrates country based theories (with their focus

on nation-level comparative advantages) with firm-based theories (with their

focus on firm-level competitive advantages) to determine national

competitiveness. Many countries develop national industrial policies. A

national industrial policy is a proactive economic development plan a

government launches to build or strengthen a particular industry, often

implemented in collaboration with the private sector. Usually, governments

design such policies to support high value-adding industries, those that yield

higher corporate profits, better wages, and tax revenues.

3. Internationalizing Firm

Internationalization process model describe how companies expand abroad.

According to this model, internationalization takes place in incremental stages over a long

period. Initially and without much analysis or planning, firms begin exporting, the simplest

foreign market entry strategy. As they become more knowledgeable, firms gradually

progress to foreign direct investment (FDI), the most complex entry strategy. The

relatively slow nature of internationalization often results from managers’ uncertainty and

uneasiness about how to proceed. They lack information about foreign markets and

experience with cross-border transactions. The progression from exporting to FDI

coincides with increasing levels of both risk and control. The gradual, incremental model

of internationalization is illustrated by the following patterns:

“Preoccupied with business in its home market, the firm starts out

with a domestic focus. Management may be unable or unwilling to

start doing international business because of concerns over its

readiness or perceived obstacles in foreign markets. Eventually, the

firm advances to the pre-export stage, often because it receives

unsolicited product orders from abroad. In this stage, management

investigates the feasibility of undertaking international business.

Later, the firm advances to the experimental involvement stage by

initiating limited international activity, typically through basic

exporting. As managers begin to view foreign expansion more

favorably, they undertake active involvement in international

business. This occurs through the systematic exploration of

international options and the commitment of resources and

managerial time to achieve international success. Management may

finally advance to the committed involvement stage. This stage is

characterized by genuine interest and commitment of resources to

making international business a key part of the firm’s profit-making

and value-chain activities. In this stage, the firm targets numerous

foreign markets through various entry modes, especially FDI.”

4. How can internationalizing firm gain and sustain competitive advantage?

Various multinational corporations (MNC’s) have gone expansion on a large scale.

This have helped shape international patterns of trade, investment, and technology flows

which then become the thrust of globalization and integration among economies. To

retain the influence of the MNC’s, different strategies internationalizing firms use in order

to gain and sustain their competitive advantage. The following are explanations why do

MNC’s continue internationalizing.

FDI Based Explanation

Most explanations of international business have emphasized FDI, the

preferred entry strategy of MNEs. These large, resource-rich companies

conduct business through networks of production facilities, marketing

subsidiaries, regional headquarters, and other operations around the world.

The following are three alternative theories developed by scholars explaining

how firms can use FDI to gain and sustain competitive advantage.

• Monopolistic Advantage Theory - this theory suggests that firms that

use FDI as an internationalization strategy must own or control certain

resources and capabilities not easily available to competitors. This gives

them a degree of monopoly power over local firms in foreign markets.

This monopolistic advantage should be specific to the MNE itself, such

as a proprietary technology or a brand name, rather than to the locations

where it does business. Monopolistic advantage theory argues that at

least two conditions should be present for a firm to target a foreign

market over its home market. First, returns accessible in the foreign

market should be superior to those available in the home market. This

would provide the firm with incentives to expand abroad to take

advantage of its monopoly power. Second, returns achievable in the

foreign market should be superior to those earned by existing domestic

competitors in the foreign market. This would give the firm an

opportunity to earn monopoly profits that domestic firms in the foreign

market cannot imitate.

• Internalization Theory – this theory explains the process by which

firms acquire and retain one or more value-chain activities inside the

firm. Internalizing value chain activities (instead of outsourcing them to

external suppliers) reduces the disadvantages of dealing with outside

partners for performing arms-length activities such as exporting and

licensing. Internalization also gives the firm greater control over its

foreign operations.

• Dunning’s Eclectic Paradigm – proposed by Professor John Dunning,

eclectic paradigm as a framework explain the extent and pattern of the

value chain operations that companies should own abroad. is often

viewed as the most comprehensive of FDI theories. The eclectic

paradigm specifies three conditions that determine whether a company

will internationalize through FDI:

Ownership-specific advantages An MNE should hold

knowledge, skills, capabilities, key relationships, and other

advantages that it owns and that allow it to compete effectively in

foreign markets. To ensure international success, the firm’s

competitive advantage must be substantial enough to offset the

costs that it incurs in establishing and operating foreign

operations. It should also be specific to its own organization and

not readily transferable to other firms. Competitive advantage

may incorporate proprietary technology, managerial skills,

trademarks or brand names, economies of scale, or access to

substantial financial resources. The more valuable the firm’s

ownership-specific advantages, the more likely it is to

internationalize by FDI.

Location-specific advantages The second condition that

determines whether a firm will internationalize by FDI is the

presence of location-specific advantages. These are the

comparative advantages available in individual foreign countries

that may be translated into firm competitive advantages. These

may include natural resources, skilled labor, low-cost labor, or

inexpensive capital.

Internalization advantages The third condition that determines

FDI-based internationalization is the presence of internalization

advantages. The firm gains these benefits from internalizing

foreign-based manufacturing, distribution, or other value chain

activities. When profitable, the firm will transfer its ownership-

specific advantages across national borders within its own

organization rather than dissipating them to independent, foreign

entities. The FDI decision depends on which is the best option -

internalization versus using external partners and whether they

are licensees, distributors, or suppliers. Internalization

advantages include the ability to control how the firm’s products

are produced or marketed, greater control of its proprietary

knowledge, and greater buyer certainty about product value.

Non-FDI-Based Explanations

• International Collaborative Ventures. A collaborative venture is a

form of cooperation between two or more firms. There are two major

types: equity-based joint ventures that result in a new legal entity and

non-equity-based (project-based) strategic alliances in which the firms’

partner, for a finite duration, to collaborate on projects related to R&D,

design, manufacturing, or any other value-adding activity. In both cases,

collaborating firms pool resources and capabilities and generate

synergy. In other words, collaboration allows the partners to carry out

activities that each might be unable to perform on its own. Collaborating

firms share the risk of their joint efforts, which reduces vulnerability for

any one partner. Collaboration is critical in international business. A firm

sometimes has no choice but to partner with other companies to gain

access to resources and capabilities unavailable within its own

organization. In addition, occasionally a government will restrict

companies from entering its national market through wholly owned FDI.

A collaborative venture can give a company access to foreign partners’

expertise, capital, distribution channels, marketing assets, or the ability

to overcome government-imposed obstacles. By collaborating, the firm

can position itself better to create new products and enter new markets.

• Networks and Relational Assets. Networks and relational assets

represent the economically beneficial long-term relationships the firm

undertakes with other business entities. These include manufacturers,

distributors, suppliers, retailers, consultants, banks, transportation

suppliers, governments, and any other organization that can provide

needed capabilities. Firm-level relational assets represent a distinct

competitive advantage in international business.

Self-Help: You can also refer to the sources below to help you further

understand the lesson

Cavusgil, S.T., Knight, G., & Riesenberger, J. (2017). Intenational business: the new

realities. (4th Ed.). England: Pearson Education Limited

Hariharaputhrian, S. (n.d.). International business. India: Banglore University

Sinha, P.K. & Mittal, V. (2012). International business. Lovely professional University,

New Delhi India: Excel Private Books Limited.

You might also like

- Project Completion Report For Eco-Agric UgandaDocument19 pagesProject Completion Report For Eco-Agric UgandajnakakandeNo ratings yet

- The Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsFrom EverandThe Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsNo ratings yet

- Regional economic groupings promote trade and economic growthDocument37 pagesRegional economic groupings promote trade and economic growthNikhil Jain85% (20)

- International Product Life CycleDocument6 pagesInternational Product Life CyclehmghodkeNo ratings yet

- Evolution of Trade TheoriesDocument44 pagesEvolution of Trade TheoriesAndrea ValdezNo ratings yet

- Chapter 4 International Trade Theory and Factor MovementsDocument43 pagesChapter 4 International Trade Theory and Factor MovementsJungsuk KimNo ratings yet

- International Trade Theory and Development Strategy HandoutsDocument3 pagesInternational Trade Theory and Development Strategy HandoutsHazell D100% (2)

- Global TradeDocument26 pagesGlobal TradeCrystal TitarNo ratings yet

- Module 3. Modern Theories of International TradeDocument9 pagesModule 3. Modern Theories of International TradePrince CalicaNo ratings yet

- L3 - Theories of International Trade & InvestmenDocument9 pagesL3 - Theories of International Trade & InvestmenMaskter ArcheryNo ratings yet

- Bases For Why Country Has To Enter Into International Trading With Other Country?Document5 pagesBases For Why Country Has To Enter Into International Trading With Other Country?mae abegail obispoNo ratings yet

- Theories of International Trade PDFDocument16 pagesTheories of International Trade PDFDianneEsposo RomeroNo ratings yet

- Palconite 3bsma A Reflection Paper4Document1 pagePalconite 3bsma A Reflection Paper4Hella Mae RambunayNo ratings yet

- Internationaltrade 11Document5 pagesInternationaltrade 11Bisrat MekonenNo ratings yet

- International Trade Theories ExplainedDocument13 pagesInternational Trade Theories ExplainedphươngNo ratings yet

- Theories of International Trade and InvestmentDocument2 pagesTheories of International Trade and InvestmentJessa BallonNo ratings yet

- Heckscher-Ohlin Theory (Factor Proportions Theory)Document4 pagesHeckscher-Ohlin Theory (Factor Proportions Theory)Mikeairah BlanquiscoNo ratings yet

- International Trade Theories ExplainedDocument12 pagesInternational Trade Theories ExplainedAinee DisaNo ratings yet

- Unit 1- International Trade - Part 1 - To Sts-đã GộpDocument113 pagesUnit 1- International Trade - Part 1 - To Sts-đã GộpMinh Huyen NguyenNo ratings yet

- The Benefit of Trade: Great Strength With Their Theory WasDocument6 pagesThe Benefit of Trade: Great Strength With Their Theory WasladipmaNo ratings yet

- Chapter 2 Evolution of TradeDocument44 pagesChapter 2 Evolution of Tradefrancis albaracinNo ratings yet

- International Business TradeDocument2 pagesInternational Business TradeReign TambasacanNo ratings yet

- TH THDocument26 pagesTH THAnkush SharmaNo ratings yet

- The Theory of International TradeDocument33 pagesThe Theory of International TradeJubayer 3DNo ratings yet

- International Business 7th Edition Griffin Solutions Manual DownloadDocument16 pagesInternational Business 7th Edition Griffin Solutions Manual DownloadJanet Wright100% (26)

- Ibt ReviewerDocument15 pagesIbt ReviewerJm Almario BautistaNo ratings yet

- Free TradeDocument9 pagesFree TradePatrick Jake DimapilisNo ratings yet

- Chapter 6 Theories of International TradeDocument8 pagesChapter 6 Theories of International TradealimithaNo ratings yet

- Government Trade PoliciesDocument3 pagesGovernment Trade Policiesmunezalyssa1No ratings yet

- Comparative Advantage and Gains From TradeDocument27 pagesComparative Advantage and Gains From TradeMikylla Rodriguez VequisoNo ratings yet

- Be - IiDocument14 pagesBe - IiSai kiran VeeravalliNo ratings yet

- 1 Theoretical ITDocument2 pages1 Theoretical ITAlmira Cadena OmbacNo ratings yet

- Ibm Unit 2Document17 pagesIbm Unit 2Anchal PawadiaNo ratings yet

- Answer All Question: NO PagesDocument30 pagesAnswer All Question: NO Pageszakuan79No ratings yet

- International Trade Theories ModernDocument13 pagesInternational Trade Theories Moderntannubana810No ratings yet

- Week 2 SlideDocument4 pagesWeek 2 Slideshriabhatia19No ratings yet

- Firm-Based Trade Theories: Unit 4 SectionDocument4 pagesFirm-Based Trade Theories: Unit 4 SectionBabamu Kalmoni JaatoNo ratings yet

- Firm-Based Trade Theories: Unit 4 SectionDocument4 pagesFirm-Based Trade Theories: Unit 4 SectionBabamu Kalmoni JaatoNo ratings yet

- International business theory overviewDocument15 pagesInternational business theory overviewguptasoniya247No ratings yet

- Pertemuan 4Document29 pagesPertemuan 4syilaNo ratings yet

- Module 3 - International TradeDocument22 pagesModule 3 - International TradeKareem RasmyNo ratings yet

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryWindhea VendanovaNo ratings yet

- FINAL ContemporaryDocument36 pagesFINAL Contemporaryelie lucidoNo ratings yet

- International Trade TheoryDocument19 pagesInternational Trade TheoryangellaizabatolinoNo ratings yet

- Current Global Challenges and Comparative AdvantageDocument4 pagesCurrent Global Challenges and Comparative AdvantageanonymousninjatNo ratings yet

- Assumptions Underlying The Concept of Comparative AdvantageDocument7 pagesAssumptions Underlying The Concept of Comparative AdvantagekiranaishaNo ratings yet

- International BusinessDocument150 pagesInternational Businessshivamhero746No ratings yet

- Explain The Modern Theory of International TradeDocument13 pagesExplain The Modern Theory of International TradeLeenaa Nair100% (1)

- International Trade Theories 1. MercantilismDocument3 pagesInternational Trade Theories 1. MercantilismAshab HashmiNo ratings yet

- Prelim Assignment 3Document3 pagesPrelim Assignment 3richard jarabeNo ratings yet

- Structure of GlobalizationDocument6 pagesStructure of GlobalizationRachel Ann VelascoNo ratings yet

- Melani Montiel - Theories of International TradeDocument8 pagesMelani Montiel - Theories of International TradeMelani MontielNo ratings yet

- 12 PaperDocument3 pages12 PaperMaria AngelNo ratings yet

- International Business Theories and DifferencesDocument47 pagesInternational Business Theories and DifferencesShipra HadaNo ratings yet

- IB Chapter TwoDocument44 pagesIB Chapter TwoPanda BeruNo ratings yet

- BUSN3500 Midterms - Personal UseDocument8 pagesBUSN3500 Midterms - Personal UseAndrea AragonNo ratings yet

- 12 HighlightDocument12 pages12 HighlightMaria AngelNo ratings yet

- Ibt M3Document4 pagesIbt M3AlisonNo ratings yet

- Comparitive Managment SystemDocument15 pagesComparitive Managment SystemAhsan Ul HaqNo ratings yet

- Section 3.1 International Trade 6Document82 pagesSection 3.1 International Trade 6swssNo ratings yet

- Global Trade and Investment.Document20 pagesGlobal Trade and Investment.Chintan RamnaniNo ratings yet

- Fast Second (Review and Analysis of Markrides and Geroski's Book)From EverandFast Second (Review and Analysis of Markrides and Geroski's Book)No ratings yet

- Sec 7.2 New 2020Document14 pagesSec 7.2 New 2020muazNo ratings yet

- National Income & Occupational Structure: India's Changing ProfileDocument22 pagesNational Income & Occupational Structure: India's Changing ProfileAbhishekNo ratings yet

- Effect of mergers on Rwanda Development BankDocument52 pagesEffect of mergers on Rwanda Development BankCuthbert MunhupedziNo ratings yet

- GS02 PDF ENG en InglesDocument13 pagesGS02 PDF ENG en InglesJosué Abanto MasgoNo ratings yet

- Comparative Analysis PH and JPNDocument37 pagesComparative Analysis PH and JPNYla Zennia VistavillaNo ratings yet

- Importance of Training and Career Development for Organizational EffectivenessDocument3 pagesImportance of Training and Career Development for Organizational EffectivenessalexcelcasanaNo ratings yet

- Mob Unit 1Document41 pagesMob Unit 1mba departmentNo ratings yet

- Sleep HealthDocument6 pagesSleep HealthJ CNo ratings yet

- Empowering Workers To Meet Global CompetitionDocument11 pagesEmpowering Workers To Meet Global CompetitionvenkatNo ratings yet

- Engineering Management: Lecture by Prof. Dr. Naseer Ahmed Email: Naseer@cecos - Edu.pkDocument50 pagesEngineering Management: Lecture by Prof. Dr. Naseer Ahmed Email: Naseer@cecos - Edu.pkhillaryNo ratings yet

- Azman Ismail, Siti Mashani Ahmad, Zuraihan Sharudin - Unknown - Labour Productivity in The Malaysian Oil Palm Plantation SectorDocument10 pagesAzman Ismail, Siti Mashani Ahmad, Zuraihan Sharudin - Unknown - Labour Productivity in The Malaysian Oil Palm Plantation SectorSuekey FarhahNo ratings yet

- Training and DevelopmentDocument5 pagesTraining and DevelopmentPiche Marie EstacionNo ratings yet

- Service Supply Relationships (Som)Document60 pagesService Supply Relationships (Som)Saurabh DhumalNo ratings yet

- GrowingUnited (Informe Banco Mundial)Document158 pagesGrowingUnited (Informe Banco Mundial)RichardNo ratings yet

- History of Human Resources ManagementDocument12 pagesHistory of Human Resources ManagementSetthawut SathueanwongsaNo ratings yet

- Dissertation E-LearningDocument60 pagesDissertation E-Learningmaryam sherazNo ratings yet

- OSCM McqsDocument3 pagesOSCM Mcqssundeep chaudhariNo ratings yet

- Chapter 24 ConceptDocument4 pagesChapter 24 Conceptanon_406045620No ratings yet

- Tax Incentives Report 2 Dti SANEDIDocument44 pagesTax Incentives Report 2 Dti SANEDITobie Nortje100% (1)

- FRP Acceptance Form and Guidelines - Docx1109223410Document12 pagesFRP Acceptance Form and Guidelines - Docx1109223410Kimberly Binay-anNo ratings yet

- MGT613 Mid Term Past Paper 1Document9 pagesMGT613 Mid Term Past Paper 1Umer FarooqNo ratings yet

- Gabion Chapter 2 and 3Document10 pagesGabion Chapter 2 and 3Patrick Ray TanNo ratings yet

- MAKALAH KEL6-dikonversiDocument20 pagesMAKALAH KEL6-dikonversisumbarhijab storeNo ratings yet

- Employee Engagement Among The Employees in A Airtel CompanyDocument37 pagesEmployee Engagement Among The Employees in A Airtel CompanySiva gNo ratings yet

- Effects of MusicDocument15 pagesEffects of MusicJosipa LikerNo ratings yet

- Abm 801Document20 pagesAbm 801All in OneNo ratings yet

- Frederick Wilson TaylorDocument3 pagesFrederick Wilson TaylorabdulsaqibNo ratings yet

- POM Tata Motors PSDA1Document15 pagesPOM Tata Motors PSDA1nikki bhadana100% (1)