Professional Documents

Culture Documents

Accounting For GP of Company 1

Uploaded by

zayyar htooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For GP of Company 1

Uploaded by

zayyar htooCopyright:

Available Formats

Accounting for Groups of Companies

Introduction A group is formed when one company acquires a controlling interest in one or more

companies. This chapter of the workbook focuses on the preparation of consolidated profit and

loss accounts and balance sheets.

Learning targets By the end of this chapter you should be able to:

prepare consolidated balance sheets • prepare consolidated profit and loss accounts.

........

6.1 Definition of key terms

Consolidation is the process of aggregating the amounts shown in the individual accounts of the

parent company and its subsidiaries on a line by line basis and making appropriate adjustments

such as unrealised profit on inter-company transactions and elimination of inter-company

balances.

A group is made up of the parent company and its subsidiaries.

A parent company is the firm that controls the operating and financial policies of the other firms

in the group.

A subsidiary is a company controlled by the parent company,

6.2 Consolidated balance sheets

A consolidated balance sheet is prepared by combining information recorded within the

individual balance sheets of the parent and the subsidiary companies.

The main calculations required are normally in respect of: goodwill consolidated retained

earnings minority interest.

Chapter 6: Accounting for Groups of Companies

6.3 Goodwill

Purchased goodwill is the difference between the cost of investment and the aggregate of the fair

value of the acquired entity's identifiable assets and liabilities (net assets) at the date of

acquisition.

Net assets at the date of acquisition are calculated as follows:

XXX

XXX

Ordinary share capital Pre-acquisition profit/(loss) Share premium Other pre-acquisition reserves

Net assets at the date of acquisition

XXX XXX

XXX

Positive goodwill arises if the cost of investment is greater than the fair value of the net assets of

the acquired entity. Negative goodwill, on the other hand, arises when the cost of investment is

lower than the fair value of the net assets of the acquired entity.

6.4 Consolidated retained earnings

Consolidated retained earnings are the total of the retained earnings of the parent entity and the

group's share of the post-acquisition earnings of the subsidiary. Post-acquisition earnings of the

subsidiary are the retained earnings of the subsidiary at the date of consolidation, less retained

earnings at the date of acquisition.

6.5 Minority interest

Minority interest is the minority shareholders' share of the net assets of the subsidiary at the date

of consolidation.

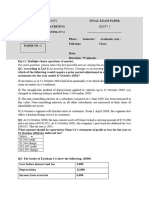

Example 1

X plc paid $270,000 to acquire 100% of the ordinary shares of Y Ltd on 31 December 20X6. Y

Ltd's retained earnings at the date of acquisition were £150 000. The balance sheets of the two

companies at the close of business on 31 December 20X7 were as follows:

Capital and reserves

X plc

Y Ltd

of

650,000

50,000

Ordinary shares of £1 each Reserves Share premium Revaluation reserve Retained earnings

30,000

100,000

40,000 100,000

190,000

240,000 890,000

220,000 270,000

Required Calculate the following: (a) Goodwill at the date of acquisition. (b) Consolidated

retained earnings at 31 December 20X7.

Pearson LCCI Accounting: Level 3

Solution

270,000

(a) Goodwill

Cost of investment Share capital Share premium Pre-acquisition earnings

50,000 30,000 150,000 230,000

Group's share (100% X 230,000) Goodwill

230,000 40,000

100,000

(b) Consolidated retained earnings

Parent company's balance Parent's share of post-acquisition earnings

(100% X (190,000 – 150,000)

40,000 140,000

Example 2

X plc paid £250,000 to acquire 70% of the ordinary shares of Y Ltd on 31 December 20X6. Y

Ltd's retained earnings at the date of acquisition were £120,000. The balance sheets of the two

companies at the close of business on 31 December 20X7 were as follows:

Capital and reserves

X plc

Y Ltd

650,000

50,000

Ordinary shares of £1 each Reserves Share premium Revaluation reserve Retained earnings

30,000

100,000 40,000 110,000

190,000

220,000 270,000

900,000

Required Calculate the following amounts: (a) Goodwill at the date of acquisition. (b)

Consolidated retained earnings at 31 December 20X7. (c) Minority interest at 31 December

20X7.

Chapter 6: Accounting for Groups of Companies

Solution

250,000

(a) Goodwill

Cost of investment Share capital Share premium Pre-acquisition reserves

50,000 30,000 120,000 200,000

Group's share (70% x 200,000) Goodwill

140,000 110,000

110,000

(b) Consolidated retained earnings

Parent company's balance Parent's share of post-acquisition

earnings (70% X (190,000 – 120,000)

49,000 159,000

(c) Minority interest

Share capital Share premium Pre-acquisition earnings Post-acquisition earnings

(190,000 – 120,000)

50,000 30,000 120,000

70,000 270,000

Minority interest (30% x 270,000)

81,000

Example 3

X plc paid £180,000 to acquire 90% of the ordinary shares of Y Ltd on 31 December 20X6. Y

Ltd had a debit balance of £40,000 on its retained earnings account and a credit balance of

£20,000 on its revaluation reserve at the date of acquisition. The balance sheets of the two

companies at the close of business on 31 December 20X7 were as follows:

Capital and reserves

X plc

Y Ltd

650,000

50,000

Ordinary shares of £1 each Reserves Share premium Revaluation reserve Retained earnings

100,000 40,000 90,000

30,000 20,000 10,000

230,000 880,000

60,000 110,000

Hint: a debit balance on the retained earnings account is an accumulated loss.

Required Calculate the following: (a) Goodwill at the date of acquisition. (b) Consolidated

retained earnings at 31 December 20X7. (c) Minority interest at 31 December 20X7.

Pearson LCCI Accounting: Level 3

Solution

180,000

(a) Goodwill

Cost of investment Share capital Share premium Revaluation reserve Pre-acquisition reserves

50,000 30,000 20,000 (40,000) 60,000

Group's share (90% x 60,000) Goodwill

54,000 126,000

90,000

(b) Consolidated retained earnings

Parent company's balance Parent's share of post-acquisition

earnings 90% x (40,000 + 10,000)

45,000 135,000

(c) Minority interest

Share capital Share premium Revaluation reserve Pre-acquisition earnings Post-acquisition

earnings

(40,000 + 10,000)

50,000 30,000 20,000 (40,000)

50,000 110,000

Minority interest (10% X 110,000)

11,000

Example 4

X plc paid £160,000 to acquire 60% of the ordinary shares of Y Ltd on 31 December 20X5. Y

Ltd had a credit balance of £30,000 on its retained earnings account and a credit balance of

£10,000 on its revaluation reserve at the date of acquisition. Goodwill arising on acquisition is

amortised on a straight-line basis over a period of five years. The balance sheets of the two

companies at the close of business on 31 December 20X7 were as follows:

Capital and reserves

X plc

Y Ltd

650,000

50,000

Ordinary shares of £1 each Reserves Share premium Revaluation reserve Retained earnings

100,000 40,000 80,000

60,000 10,000 (20,000)

220,000 870,000

50,000 100,000

Required Calculate the following: (a) Goodwill at 31 December 20X7. (b) Consolidated retained

earnings.

(c) Minority interest.

Chapter 6: Accounting for Groups of Companies

Solution

160,000

(a) Goodwill

Cost of investment Share capital

50,000 Share premium

60,000 Revaluation reserve

10,000 Pre-acquisition reserves

30,000

150,000 Group's share (60% X 150,000) Goodwill at the date of acquisition Goodwill amortised

(70,000 = 5 x 2) Goodwill at 31 December 20X7

90,000 70,000 28,000 42,000

80,000

(b) Consolidated retained earnings

Parent company's balance Group's share of post-acquisition earnings

(60% X (-30,000 – 20,000))

30,000 50,000 28,000 22,000

Less goodwill amortised

(c) Minority interest

Share capital Share premium Revaluation reserve Pre-acquisition earnings Post-acquisition

earnings

50,000 60,000 10,000 30,000 (50,000) 100,000

Minority interest (40% x 100,000)

40,000

Exercise 6.1

On 1 January 20X7, Donna plc issued 10,000 of its ordinary shares to acquire 45,000 of the

issued ordinary shares of Tron plc. The retained earnings of Tron plc on 1 January 20X7 were

£7,000. Donna plc's shares were traded at £5 per share on 1 January 20X7. Tron plc's shares

were traded at £0.50 per share on the same date. Donna plc is yet to record the acquisition of the

shares in Tron plc in its books. At 31 December 20X7, the individual company balance sheets

were as follows:

Donna plc Tron plc

350,000

30,000

Fixed assets Investment in Tron plc Net current assets

60,000 410,000

50,000 80,000

Share capital (Ordinary shares of £0.50 each) Share premium Retained earnings

300,000 100,000

10,000 410,000

30,000

3,000 47,000 80,000

Pearson LCCI Accounting: Level 3

D

.

Goodwill is amortised on a straight-line basis over a period of five years.

Required (a) Prepare journal entries to record the acquisition of shares in Tron plc in

the books of Donna plc. (b) Calculate the following amounts:

(i) Goodwill at the date of acquisition. (ii) Goodwill at 31 December 2007. (iii) Consolidated

retained earnings at 31 December 20X7.

(iv) Minority interest at 31 December 20X7. (c) Prepare a consolidated balance sheet for the

Donna plc group as at

31 December 20X7.

Solution

Dr

(a) The acquisition has to be recorded at the fair value of the consideration

given. The shares will therefore be recorded at the fair value of (10,000 x 5) = £50,000 The

entries are:

Cr Debit Investment in Tron plc (10,000 x 5) 50,000 Credit Ordinary share capital (10,000 x

0.50)

5,000 Credit Share premium

45,000 Calculate the number of equity shares issued by Tron plc: 30,000

- = 60,000 shares 0.5

45,000 X 100 Calculate the percentage acquired: -

=75%

60,000 So, the percentage held by the minority shareholders in Tron plc is 25%.

50,000

(b) Goodwill at date of acquisition

Cost of investment Share capital Share premium Pre-acquisition reserves

30,000 3,000 7,000 40,000

Group's share (75% x 40,000) Goodwill at the date of acquisition

30,000 20,000

Goodwill at 31 December 20X7 Goodwill at the date of acquisition Less amortisation of

goodwill (20,000 = 5 x 1)

20,000

4,000 16,000

10,000

Consolidated retained earnings Parent company's balance Parent's share of post-acquisition

earnings

(75% X (47,000 – 7,000) Less goodwill amortised

30,000 (4,000) 36,000

Chapter 6: Accounting for Groups of Companies

.......

.

.

........

......................

.

....

....

.......................

Minority interest Share capital Share premium Pre-acquisition profit Post-acquisition earnings

30,000 3,000 7,000 40,000 80,000

20,000

Minority interest (25% x 80,000) (c) Consolidated balance sheet

Goodwill Fixed assets (350,000 + 30,000) Net current assets

Share capital Share premium Retained earnings

16,000 380,000 110,000 506,000 305,000 145,000

36,000 486,000

20,000 506,000

Minority interest

6.6 Consolidation adjustments 6.6.1 Inter-company balances

Inter-company balances may arise from the following:

the parent company lends money to a subsidiary or vice versa • the parent company owes the

subsidiary for goods sold by the subsidiary to

the parent on credit or vice versa a dividend proposed by the subsidiary may be recorded as a

liability in the balance sheet of the subsidiary and an asset in the balance sheet of the parent

company.

All inter-company balances have to be eliminated when the consolidated balance sheet is

prepared. The consolidated balance sheet relates to the group (parent and subsidiary). Hence, any

debtors and creditors reported on the balance sheet should relate to amounts receivable by the

combined entity (group) from external parties payable by the combined entity to parties external

to the group. Failure to eliminate inter-company balances will result in the group's assets and

liabilities being inflated.

You might also like

- Day 2 - Group AccountsDocument10 pagesDay 2 - Group Accountskadek_arixNo ratings yet

- QuizDocument5 pagesQuizhappystoneNo ratings yet

- 102 Quiz 1 She 2020Document6 pages102 Quiz 1 She 2020Eunice MartinezNo ratings yet

- Chapter 17Document12 pagesChapter 17Alainne DecylleNo ratings yet

- Unit 3 - IAS 33 KamothoDocument83 pagesUnit 3 - IAS 33 KamothoGrechen UdigengNo ratings yet

- CH 7 Vol 1 Answers 2014Document18 pagesCH 7 Vol 1 Answers 2014Jamie Catherine GoNo ratings yet

- IFRS Chapter 10 The Consolidated Income StatementDocument34 pagesIFRS Chapter 10 The Consolidated Income StatementJuBin DeliwalaNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- IFRS Chapter 9 The Consolidated Statement of Financial PositonDocument44 pagesIFRS Chapter 9 The Consolidated Statement of Financial PositonMahvish Memon0% (1)

- Quiz Chapter-15 Eps 2021-1Document4 pagesQuiz Chapter-15 Eps 2021-1Dale JimenoNo ratings yet

- Ifrs Test 2Document6 pagesIfrs Test 2Ngọc LêNo ratings yet

- Principles of Consolidated Financial Statements Test Your Understanding 1Document17 pagesPrinciples of Consolidated Financial Statements Test Your Understanding 1sandeep gyawaliNo ratings yet

- 04 Fischer10e SM Ch04 FinalDocument79 pages04 Fischer10e SM Ch04 FinalSoc MontemayorNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- Chapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument5 pagesChapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionMixx MineNo ratings yet

- Unit 5: Holding Company Accounts Meaning of A Holding CompanyDocument7 pagesUnit 5: Holding Company Accounts Meaning of A Holding CompanynabhayNo ratings yet

- EXAMPLE ONE: Basic ConsolidationDocument24 pagesEXAMPLE ONE: Basic ConsolidationprasannaNo ratings yet

- Book Keeping & Accounts/Series-4-2007 (Code2006)Document13 pagesBook Keeping & Accounts/Series-4-2007 (Code2006)Hein Linn Kyaw100% (2)

- Advanced Accounts - Consolidated Financial StatementsDocument11 pagesAdvanced Accounts - Consolidated Financial Statementslil telNo ratings yet

- Fischer11e Smchap04 FinalDocument28 pagesFischer11e Smchap04 FinalWilliam Omar VelezNo ratings yet

- The Consolidated Statement of Financial Position: WWW - Xisu.edu - CNDocument44 pagesThe Consolidated Statement of Financial Position: WWW - Xisu.edu - CNmchris91No ratings yet

- Leverages Question BankDocument3 pagesLeverages Question BankQuestionscastle Friend60% (5)

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDocument8 pagesProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNo ratings yet

- Attachment (20) Lesson 4Document22 pagesAttachment (20) Lesson 4Lillian JoyNo ratings yet

- 400 - 812 IntercoTransSubsInvBondsPs 56BDocument5 pages400 - 812 IntercoTransSubsInvBondsPs 56BZenni T XinNo ratings yet

- Chapter 22 Retained Earnings DividendsDocument39 pagesChapter 22 Retained Earnings DividendstruthNo ratings yet

- 06 Activity 1-InterAcct2Document2 pages06 Activity 1-InterAcct2Jomari EscarillaNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- CA Ipcc AssignmentDocument17 pagesCA Ipcc AssignmentjesurajajosephNo ratings yet

- ACCT 310 Fall 2011 Midterm ExamDocument12 pagesACCT 310 Fall 2011 Midterm ExamPrince HakeemNo ratings yet

- Chapter 15 - Bus. Combination Part 3Document8 pagesChapter 15 - Bus. Combination Part 3PutmehudgJasdNo ratings yet

- Consolidation Subsequent To The Date of AcquisitionDocument68 pagesConsolidation Subsequent To The Date of AcquisitionShahrul IzwanNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Questions and SolutionsDocument12 pagesQuestions and SolutionsCris Joy Balandra BiabasNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- A. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareDocument109 pagesA. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareChris Jay LatibanNo ratings yet

- CH 16Document8 pagesCH 16Lex HerzhelNo ratings yet

- Solutions To Chapter 6 Vera CruzDocument9 pagesSolutions To Chapter 6 Vera CruzLuzz Landicho100% (1)

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Fa S24 The Consolidated Statement of Financial PositionDocument16 pagesFa S24 The Consolidated Statement of Financial PositionCharisma CharlesNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Final Requirement ProblemsDocument5 pagesFinal Requirement ProblemsYoite MiharuNo ratings yet

- Partnership Operations - 2021 Online ClassDocument38 pagesPartnership Operations - 2021 Online ClassAnne AlagNo ratings yet

- Practice Set Audit - LiabilitiesDocument12 pagesPractice Set Audit - LiabilitiesKayla MirandaNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- 23 Share Capital s22 - FinalDocument23 pages23 Share Capital s22 - FinalAphelele GqadaNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Corporation ReviewerDocument5 pagesCorporation ReviewerKara GamerNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Marketing Uniqlo Case StudyDocument4 pagesMarketing Uniqlo Case Studyzayyar htooNo ratings yet

- General Formatting Explained KEY (A)Document3 pagesGeneral Formatting Explained KEY (A)zayyar htooNo ratings yet

- Exam Study NoteDocument8 pagesExam Study Notezayyar htooNo ratings yet

- ExP - ACCA F1 - BT - 2021Document39 pagesExP - ACCA F1 - BT - 2021zayyar htooNo ratings yet

- Diffrentiation ImprovedDocument44 pagesDiffrentiation Improvedzayyar htooNo ratings yet

- Similar Area Volume RAGDocument6 pagesSimilar Area Volume RAGzayyar htooNo ratings yet

- Annotated BibliographyDocument5 pagesAnnotated Bibliographyzayyar htooNo ratings yet

- Full List of Approved Sending Organization of MyanmarDocument16 pagesFull List of Approved Sending Organization of Myanmarzayyar htooNo ratings yet

- Case Starbucks Reading UpdatedDocument2 pagesCase Starbucks Reading Updatedzayyar htooNo ratings yet

- Advantage of CookingDocument1 pageAdvantage of Cookingzayyar htooNo ratings yet

- Scarcity and Choice QuestionsDocument2 pagesScarcity and Choice Questionszayyar htooNo ratings yet

- MKT 3 New ProductDocument3 pagesMKT 3 New Productzayyar htooNo ratings yet

- Table of ContentDocument1 pageTable of Contentzayyar htooNo ratings yet

- QuadraticsDocument27 pagesQuadraticszayyar htooNo ratings yet

- PUNCTUATIONDocument1 pagePUNCTUATIONzayyar htooNo ratings yet

- Adidas SegmentationDocument3 pagesAdidas Segmentationzayyar htooNo ratings yet

- Additional Exam Practice - SolutionsDocument7 pagesAdditional Exam Practice - Solutionszayyar htooNo ratings yet

- Accounting For GP of Company 3Document6 pagesAccounting For GP of Company 3zayyar htooNo ratings yet

- Accounting For GP of Company 2Document7 pagesAccounting For GP of Company 2zayyar htooNo ratings yet

- Additional Exam PracticeDocument5 pagesAdditional Exam Practicezayyar htooNo ratings yet

- Advantages and Disadvantages of Leveraged BuyoutDocument3 pagesAdvantages and Disadvantages of Leveraged BuyoutSindy_Kusuma_N_1225No ratings yet

- Presentation 1Document53 pagesPresentation 1Umeshwar singh DhillonNo ratings yet

- Annexure 1Document2 pagesAnnexure 1National HeraldNo ratings yet

- Chapter 1 - Company Account - Accounting For Share CapitalDocument143 pagesChapter 1 - Company Account - Accounting For Share CapitalAvi yadavNo ratings yet

- Part A Corporate Law ChartsDocument62 pagesPart A Corporate Law Chartsphanindra gaddeNo ratings yet

- Fairness Accountability Transparency and StewardsDocument19 pagesFairness Accountability Transparency and StewardsAngel Joy FulledoNo ratings yet

- Cerelia - Information Brochure Employee Shareholding Plan 2020 (English)Document18 pagesCerelia - Information Brochure Employee Shareholding Plan 2020 (English)Razvan ComanNo ratings yet

- 15 New Provisions in The Companies and Allied Matters Act (CAMA) 2020 That Promote Ease of Doing BusinessDocument7 pages15 New Provisions in The Companies and Allied Matters Act (CAMA) 2020 That Promote Ease of Doing BusinessDavid ONo ratings yet

- Chapter 7Document2 pagesChapter 7Mariya BhavesNo ratings yet

- TITLE XIV DissolutionDocument6 pagesTITLE XIV DissolutionRica Elaine LubasanNo ratings yet

- Financial Management Strathmore University Notes and Revision KitDocument411 pagesFinancial Management Strathmore University Notes and Revision KitLazarus Amani100% (1)

- BBLD0919Document93 pagesBBLD0919Syifa Musvita Ul BadriahNo ratings yet

- Chapter 12 - Share CapitalDocument18 pagesChapter 12 - Share CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Assignment Intermediate Accounting 14,15Document4 pagesAssignment Intermediate Accounting 14,15melodi pretNo ratings yet

- RFBT Notes PDFDocument6 pagesRFBT Notes PDFElijah MendozaNo ratings yet

- Company Limited Liability Re Registration FormDocument18 pagesCompany Limited Liability Re Registration FormNathaniel kobina QuainooNo ratings yet

- 07 Activity 4 FINALDocument2 pages07 Activity 4 FINALBae MaxZNo ratings yet

- Corporate Law Manual-Mzumbe U'versityDocument102 pagesCorporate Law Manual-Mzumbe U'versityMerckzedeck DidaceNo ratings yet

- The Battle For Parkway: Case OverviewDocument12 pagesThe Battle For Parkway: Case OverviewCHANG LIU0% (2)

- Stocks, Bonds and Mutual BondsDocument4 pagesStocks, Bonds and Mutual BondsChrisNo ratings yet

- Juridical Personality Under The RCCP That Is Separate and Distinct From Its Persons Composing ItDocument4 pagesJuridical Personality Under The RCCP That Is Separate and Distinct From Its Persons Composing ItEloise Coleen Sulla PerezNo ratings yet

- Tutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133Document15 pagesTutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133HOW BING CHENNo ratings yet

- M&a - Types of AcquisitionsDocument2 pagesM&a - Types of AcquisitionsArijit SahaNo ratings yet

- Zws Iso 9001:2008 Quality Management System: Part (I) Nature of ApplicantDocument7 pagesZws Iso 9001:2008 Quality Management System: Part (I) Nature of ApplicantZIMWASENo ratings yet

- FM Chapter 1 NotesDocument6 pagesFM Chapter 1 NotesMadesh KuppuswamyNo ratings yet

- Ia2 MidtermDocument33 pagesIa2 MidtermEROSNo ratings yet

- Content Dam Eaton Company Investor-Relations Eaton-Complete-Annual-Report-2020Document112 pagesContent Dam Eaton Company Investor-Relations Eaton-Complete-Annual-Report-2020André LUCIONo ratings yet

- Meiditya Larasati - 01017190019 - PR Pertemuan 03Document9 pagesMeiditya Larasati - 01017190019 - PR Pertemuan 03Haikal RafifNo ratings yet

- Example ReportDocument11 pagesExample ReportSiya LimNo ratings yet

- Monroe - 1997 Contrasting Perspectives On Strategic LeadersDocument25 pagesMonroe - 1997 Contrasting Perspectives On Strategic Leaderspatricia.diasNo ratings yet