Professional Documents

Culture Documents

Miran Park Tax - Certificate - 2021-03-31

Uploaded by

Miran PARKOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Miran Park Tax - Certificate - 2021-03-31

Uploaded by

Miran PARKCopyright:

Available Formats

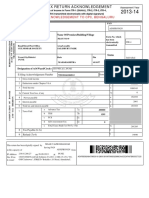

Withholding Tax Certificate

1 APRIL 2020 TO 31 MARCH 2021

01 April 2021 Auckland

203 Queen Street

Auckland

PO Box 1393

MRS MIRAN PARK 0102 Wellington

23B KONINI RD

GREENLANE Ph: 0800 18 18 18

AUCKLAND 1061

*S139936Q1*

*S139936Q1P140316*

*IP*1

The following interest has been paid and withholding tax deducted from your interest bearing account(s) with ANZ.

Name MRS MIRAN PARK

Customer IRD Number Not provided

Current Withholding Rate 45.0%

Summary by Account

Account Number Tax Type Gross Interest Earned Tax Rate Tax Deducted Net Interest

06-0225-0339443-01 RESIDENT WITHHOLDING TAX $9.89 45.0% $4.44 $5.45

*I2*00000071772395*000-000-000*31/03/2021*FORM=NBRWT1,*0225-0339443-01

Total $9.89 $4.44 $5.45

Important information about tax on joint accounts

If you have a joint account, the interest and tax amounts on this certificate might not be the same as Inland Revenue have recorded for you. This is

because we allocate all interest to the primary account holder, but Inland Revenue splits the interest income equally between each joint account

holder (where their IRD number is known).

If required, you can check and update the split of interest in your myIR Secure Online Services account. More information is available at

ird.govt.nz/interest.

Look on the Inland Revenue website www.ird.govt.nz for more information, contact your financial or tax advisor, or contact Inland Revenue on

0800 227 774.

PLEASE RETAIN THIS CERTIFICATE FOR TAX PURPOSES.

Customer No. 00000071772395

Bank IRD Number: 020-453-729 Page 1 of 1

You might also like

- Inv73854 (CHS1701224) (Sacpcmp) (2023 12 06)Document1 pageInv73854 (CHS1701224) (Sacpcmp) (2023 12 06)vicNo ratings yet

- General Journal 01/04/2019 To 30/04/2019: 07/05/2020 9.31.38 ID# Acct# Account Name Debit Credit Job NoDocument1 pageGeneral Journal 01/04/2019 To 30/04/2019: 07/05/2020 9.31.38 ID# Acct# Account Name Debit Credit Job NoAnnisaaugiNo ratings yet

- 2015 Property Tax Statement: Due Date Total DueDocument1 page2015 Property Tax Statement: Due Date Total DueDeron BrownNo ratings yet

- PDF 006347 PDFDocument6 pagesPDF 006347 PDFCafesur MarceloNo ratings yet

- Your InvoiceDocument14 pagesYour InvoiceFareed KhanNo ratings yet

- PDF Payment Summary 2022 - 2023Document1 pagePDF Payment Summary 2022 - 2023Ashley RouxNo ratings yet

- Your Electricity Bill at A Glance: Total Due 198.32Document2 pagesYour Electricity Bill at A Glance: Total Due 198.32rodrigo batistaNo ratings yet

- WCE InvoiceDocument1 pageWCE InvoiceAdriany RangelNo ratings yet

- Self Assessment Chapter 4 of Part 41A TCA 1997 Income Tax For The Year Ending 31/12/2022Document3 pagesSelf Assessment Chapter 4 of Part 41A TCA 1997 Income Tax For The Year Ending 31/12/2022socej67962No ratings yet

- Videoton Autoelektronika KFTDocument2 pagesVideoton Autoelektronika KFTAleksandar BjelicaNo ratings yet

- Tax Invoice/Receipt: Khizar HayatDocument1 pageTax Invoice/Receipt: Khizar HayatxyzabcutubeNo ratings yet

- Payment 60 Days Statement Net: Tax Invoice 1412327392Document2 pagesPayment 60 Days Statement Net: Tax Invoice 1412327392stephgate87No ratings yet

- E-Bill: Lloyd Okwiri KampungaDocument2 pagesE-Bill: Lloyd Okwiri Kampungalloyd kampunga100% (1)

- Attachment PDFDocument6 pagesAttachment PDFYILDRANo ratings yet

- TD Statement Mar To AprrDocument4 pagesTD Statement Mar To Aprrslimple Smiles100% (2)

- 3-Month Statement PDFDocument7 pages3-Month Statement PDFConrad Thamsanqa Sqede Mthunzi100% (2)

- Govindaraju TelecomDocument1 pageGovindaraju Telecomsoupboysanjay12No ratings yet

- LLLLLLLLLDocument1 pageLLLLLLLLLinfo4margoNo ratings yet

- Payment Summary 2022 - 2023Document1 pagePayment Summary 2022 - 2023vinniekbuchananNo ratings yet

- NYCHA PG DevelopmentDocument112 pagesNYCHA PG DevelopmentlklepnerNo ratings yet

- RGDooo 005110220000 R 6804 D109946621Document1 pageRGDooo 005110220000 R 6804 D109946621Nasif KhanNo ratings yet

- Bill 19467660Document1 pageBill 19467660Ion IovuNo ratings yet

- Invoice: Item Part Number Description Quantity Unit Price Goods Value OriginDocument2 pagesInvoice: Item Part Number Description Quantity Unit Price Goods Value Originsandi hasariNo ratings yet

- Mainfre InvDocument1 pageMainfre InvDragoslav DzolicNo ratings yet

- Attachment 1Document1 pageAttachment 1Akhmed TemaevNo ratings yet

- Final Dividend: SRN WithheldDocument1 pageFinal Dividend: SRN WithheldMartin PotterNo ratings yet

- Ener ConDocument3 pagesEner Conengineer47No ratings yet

- Downloadable Bank Statement ExampleDocument5 pagesDownloadable Bank Statement ExampleJovica CaricicNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceVikram Singh100% (1)

- E-Statement of Account: Meezan Bank LTDDocument1 pageE-Statement of Account: Meezan Bank LTDkhalidjaniNo ratings yet

- InvoiceDocument1 pageInvoiceYui IzayoiNo ratings yet

- Invoice INV-4286Document1 pageInvoice INV-4286Gift M HlanguNo ratings yet

- 77-949-267 - INC - Grace Period For Late Payment - 20170711Document1 page77-949-267 - INC - Grace Period For Late Payment - 20170711JY146No ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 289381Document2 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 289381shrikant mishraNo ratings yet

- Carphone Warehouse Ip11 Pro 256GBDocument1 pageCarphone Warehouse Ip11 Pro 256GBDupe EliseNo ratings yet

- Inv69116728 45926324Document1 pageInv69116728 45926324dany.cantaragiuNo ratings yet

- Securities Transaction NoticeDocument1 pageSecurities Transaction NoticeNicoleta ZidaruNo ratings yet

- PDF Rekening Koran Bni AulaDocument10 pagesPDF Rekening Koran Bni Aularance WongkarNo ratings yet

- PDF Payment Summary 2022 - 2023Document1 pagePDF Payment Summary 2022 - 2023Izzy BaeNo ratings yet

- Sef HelpDocument1 pageSef HelpDhinesh PeriyasamyNo ratings yet

- UNI 20220103220330235592 003338036 uniROB IpayobDocument2 pagesUNI 20220103220330235592 003338036 uniROB IpayobKenny WongNo ratings yet

- ListDocument4 pagesList76xzv4kk5vNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDiazNo ratings yet

- Account Summary: MR Mohamed Shafeek 5 35 Ashley Street Reservoir Vic 3073Document2 pagesAccount Summary: MR Mohamed Shafeek 5 35 Ashley Street Reservoir Vic 3073Quang huy HoàngNo ratings yet

- SKCPDocument2 pagesSKCPIMAM SAPIINo ratings yet

- April 2016Document15 pagesApril 2016Mukesh dhakaNo ratings yet

- Neto $924 I.V.A. (19%) $175 Exento $0 Monto Total $1,099 Cuota $0 Total A Pagar $1,099Document5 pagesNeto $924 I.V.A. (19%) $175 Exento $0 Monto Total $1,099 Cuota $0 Total A Pagar $1,099Graciela ParedesNo ratings yet

- Statement of Account: Tran Date Value Date CHQ/Ref No Particulars Debit Credit BalanceDocument1 pageStatement of Account: Tran Date Value Date CHQ/Ref No Particulars Debit Credit BalanceCjjcmj LauronNo ratings yet

- Electricity: Your Bill at A GlanceDocument1 pageElectricity: Your Bill at A GlanceJohnNo ratings yet

- Trafalgar Residences Cts 48716: Amount Payable Payment Required byDocument1 pageTrafalgar Residences Cts 48716: Amount Payable Payment Required byManish JaiswalNo ratings yet

- Meter 1Document2 pagesMeter 1Faisal IzharNo ratings yet

- IRS Form 1099 12 - 31 - 2015Document4 pagesIRS Form 1099 12 - 31 - 2015vinod papaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoicepersonalagencyworkNo ratings yet

- Base DocumentDocument2 pagesBase DocumentPrime Lending Service100% (1)

- Your RBC Personal Banking Account StatementDocument7 pagesYour RBC Personal Banking Account Statementmansoj777No ratings yet

- Nr. Crt. Incasat Suma Document Data Emitere: S.C. Eco Intensity SRLDocument3 pagesNr. Crt. Incasat Suma Document Data Emitere: S.C. Eco Intensity SRLTomus NicolaeNo ratings yet

- SLSB - Inv 3Document2 pagesSLSB - Inv 3Shaifful RidzuanNo ratings yet

- E.O Disposal CommitteeDocument2 pagesE.O Disposal CommitteeJessie MendozaNo ratings yet

- Acg Module 9 Thc5-LathDocument10 pagesAcg Module 9 Thc5-LathMeishein FanerNo ratings yet

- Vinati Organics: AccumulateDocument7 pagesVinati Organics: AccumulateBhaveek OstwalNo ratings yet

- Chapter 1 A Strategic Management Model HRDDocument10 pagesChapter 1 A Strategic Management Model HRDJanrhey EnriquezNo ratings yet

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaNo ratings yet

- Code For Interview: Amcat Reading Comprehension Previous Papers QuestionsDocument7 pagesCode For Interview: Amcat Reading Comprehension Previous Papers QuestionsPraneetNo ratings yet

- Ra Bill 12-WDocument4 pagesRa Bill 12-WDass DassNo ratings yet

- Customer Perceptions Towards The Service Quality: A Case Study of Bonchon Chicken Restaurant, Olongapo BranchDocument45 pagesCustomer Perceptions Towards The Service Quality: A Case Study of Bonchon Chicken Restaurant, Olongapo Branchmarichu apiladoNo ratings yet

- UntitledDocument10 pagesUntitledmehvishNo ratings yet

- UNIT - 4 CAPITALs - TreDocument20 pagesUNIT - 4 CAPITALs - Treetebark h/michaleNo ratings yet

- 2014-GE Leap Nozzle PaperDocument2 pages2014-GE Leap Nozzle PaperRamji RaoNo ratings yet

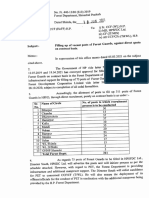

- Forest Guard Recruitment, 2021Document3 pagesForest Guard Recruitment, 2021Abishek SharmaNo ratings yet

- Civic Swat 1 & 2Document10 pagesCivic Swat 1 & 2Daniel GomaNo ratings yet

- Investment Behaviour of College TeachersDocument62 pagesInvestment Behaviour of College TeachersAlok MonayNo ratings yet

- Volunteers and Cyber Security - Options For Georgia. Mikheil BasilaiaDocument72 pagesVolunteers and Cyber Security - Options For Georgia. Mikheil BasilaiaMikheil BasilaiaNo ratings yet

- Chapter 1Document25 pagesChapter 1Nhi Thanh LêNo ratings yet

- The Joint Distribution of Value and Profitability: International EvidenceDocument17 pagesThe Joint Distribution of Value and Profitability: International EvidenceVincyNo ratings yet

- SDM Case Analysis: CISCO Systems: Managing The Go-to-Market EvolutionDocument12 pagesSDM Case Analysis: CISCO Systems: Managing The Go-to-Market Evolutionmahtaabk100% (17)

- Note For ISO 27001Document6 pagesNote For ISO 27001Piiseth KarPearNo ratings yet

- No842 Licences For MiningDocument2 pagesNo842 Licences For MiningimmanuelvinothNo ratings yet

- Most Important - Income TaxDocument97 pagesMost Important - Income TaxAkhil BaijuNo ratings yet

- Testing The Product Prototype: Asian Institute of Technology and EducationDocument18 pagesTesting The Product Prototype: Asian Institute of Technology and EducationElixa HernandezNo ratings yet

- Nei VacanciesDocument4 pagesNei Vacanciesmayur madaniaNo ratings yet

- Hyderabad Consulate QuestionsDocument3 pagesHyderabad Consulate QuestionsBhavna MuthyalaNo ratings yet

- AllcargotodDocument12 pagesAllcargotodNikhil kumarNo ratings yet

- Marks of A Successful EntrepreneurDocument4 pagesMarks of A Successful Entrepreneuremilio fer villaNo ratings yet

- Aide-Memoire Inspection IndDocument10 pagesAide-Memoire Inspection Indmorcos mikhailNo ratings yet

- D365AXUG TM and FP Projects Webinar 21Document16 pagesD365AXUG TM and FP Projects Webinar 21Bharat NathanNo ratings yet

- 2022SC Lecture Notes Topic1.1 OrientationDocument12 pages2022SC Lecture Notes Topic1.1 OrientationAsadvirkNo ratings yet

- NASSCOM Annual Report 2015 0Document100 pagesNASSCOM Annual Report 2015 0hareshNo ratings yet