Professional Documents

Culture Documents

Dokumen Tips Advanced Accounting Test Bank Chapter 07 Susan Hamlen

Uploaded by

amira samirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dokumen Tips Advanced Accounting Test Bank Chapter 07 Susan Hamlen

Uploaded by

amira samirCopyright:

Available Formats

TEST BANK

CHAPTER 7

Foreign Currency Transactions and Hedging

MULTIPLE CHICE

1. To!ic" #a$uation o% %or&ard contracts

L '

A U.S. company invests in a forward purchase contract for 100,000,000 yen with a

purchase price of $0.009/yen, for delivery in 4 days. !he spot rate at the time the

contract is initiated is $0.00"/yen. At the end of the accountin# year, the forward

contract is still outstandin#. !he yearend spot rate is $0.00""/yen. !he yearend forward

rate for delivery at the contract date is $0.009%/yen. &ow is the forward contract

reported on the U.S. company's (alance sheet)

a. $%0,000 asset

(. $%0,000 lia(ility

c. $*0,000 asset

d. $*0,000 lia(ility

A+S a

-$0.009% $0.009 100,000,000 $%0,000

%. To!ic" Cas( %$o& (edge

L )

n Au#ust 1, a U.S. company enters into a forward contract, in which it a#rees to (uy

1,000,000 euros from a (an2 at a rate of $1.11 on 3ecem(er 1. han#es in the value of

the forward contract will (e reported in other comprehensive income on the (alance sheet

in which one of the followin# situations)

a. !he U.S. company has receiva(les denominated in euros, with payment to (e

received on 3ecem(er 1.

(. !he U.S. company sold merchandise to a customer in 5el#ium on Au#ust 1, and

epects payment of 1,000,000 euros on 3ecem(er 1.

c. !he U.S. company plans to sell merchandise to a customer in 5el#ium on Au#ust

1, with payment of 1,000,000 euros epected on 3ecem(er 1.

d. !he U.S. company plans to purchase merchandise from a supplier in 5el#ium, with

payment of 1,000,000 euros epected to (e paid on 3ecem(er 1.

A+S d

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 1

Use the followin# information on the U.S. dollar value of the euro to answer 6uestions * 7 8

(elow

For&ard rate %or

A!ri$ '*+ ,*--

S!ot rate de$i.ery

cto(er *0, %010 $ 1.% $ 1.*0

3ecem(er *1, %010 1.%" 1.*%

April *0, %011 1.% 1.%

n cto(er *0, %010, a company enters a forward contract to sell :100,000 on April *0, %011.

!he company's accountin# year ends 3ecem(er *1.

*. To!ic" Hedge o% e/!ort transaction

L 0

!he forward contract hed#es an outstandin# :100,000 account receiva(le due on April *0.

;hat is the net effect on income in %010 and %011)

,*-* ,*--

a. $1,000 #ain $4,000 #ain

(. $1,000 loss $4,000 #ain

c. $*,000 #ain $,000 #ain

d. $%,000 loss $,000 #ain

A+S a

%010 <ain on receiva(le, -$1.%" $1.% :100,000 $*,000

=oss on forward, -$1.*% $1.*0 :100,000 $%,000

+et #ain $1,000

%011 =oss on receiva(le, -$1.%" $1.% :100,000 $%,000

<ain on forward, -$1.*% $1.% :100,000 $,000

+et #ain $4,000

©Cambridge Business Publishers, 2010

2 Advanced Accounting, 1st

dition

4. To!ic" Hedge o% %ir1 co11it1ent

L 2

!he forward contract hed#es a sales order for :100,000, received cto(er *0. !he sale

was made and the :100,000 collected on April *0, %011. Sales revenue recorded on April

*0 is

a. $1%,000

(. $1%%,000

c. $1*0,000

d. $1%4,000

A+S c

-:100,000 $1.% > -$1.*0 $1.% :100,000 $1*0,000

. To!ic" Hedge o% %ir1 co11it1ent

L 2

!he forward contract hed#es a sales order for :100,000, received cto(er *0. !he sale

was made and the :100,000 collected on April *0, %011. !he net effect on %010 income

is

a. +o effect

(. $%,000 loss

c. $*,000 #ain

d. $1,000 #ain

A+S a

!he #ain on the firm commitment and loss on the forward contract are -$1.*% $1.*0

:100,000 $%,000, and they offset for a ?ero effect on %010 income.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !

. To!ic" Hedge o% %orecasted transaction

L )

!he forward contract hed#es a forecasted sale for :100,000, epected at the end of April

%011. !he net effect on %010 income is

a. +o effect

(. $%,000 loss

c. $*,000 #ain

d. $1,000 #ain

A+S a

!he loss on the forward contract is reported in other comprehensive income.

8. To!ic" Hedge o% %orecasted transaction

L )

!he forward contract hed#es a forecasted sale for :100,000, epected at the end of April

%011. !he sale ta2es place on April *0, %011, :100,000 is collected, and the forward

contract is closed. ;hich statement is true, concernin# the sale on April *0, %011)

a. !he $1,000 total loss on the forward contract is reclassified from other

comprehensive income as an ad@ustment to sales revenue.

(. !he $4,000 total #ain on the forward contract is reclassified from other

comprehensive income as an ad@ustment to sales revenue.

c. !he %011 $,000 #ain on the forward contract is reco#ni?ed as a hed#in# #ain on

the %011 income statement.

d. !he %010 $%,000 loss on the forward contract is reco#ni?ed as a hed#in# loss on

the %010 income statement.

A+S (

!he total #ain on the forward contract is -$1.*0 $1.% :100,000 $4,000. han#es

in the value of the forward are reported in other comprehensive income until the hed#ed

forecasted transaction is reported in income. n this case, the forecasted transaction

results in sales revenue, reported in %011.

©Cambridge Business Publishers, 2010

" Advanced Accounting, 1st

dition

". To!ic" E/!ort transaction

L ,

n Bay %0, %01%, when the spot rate is $1.*0/:, a company sells merchandise to a

customer in taly. !he spot rate is $1.*1/: on Cune *0, the company's yearend. Dayment

of :100,000 is received on Culy *0, %01%, when the spot rate is $1.%"/:. ;hat is the effect

on fiscal %01% and %01* income)

Fisca$ ,*-, Fisca$ ,*-'

a. $1,000 echan#e loss $*,000 echan#e #ain

(. $1,000 echan#e #ain $*,000 echan#e loss

c. +o effect $%,000 echan#e loss

d. +o effect $%,000 echan#e #ain

A+S (

Eiscal %01% echan#e #ain -$1.*1 $1.*0 :100,000 $1,000

Eiscal %01* echan#e loss -$1.*1 $1.%" :100,000 $*,000

9. To!ic" I1!ort transaction

L ,

n Bay %0, %01%, when the spot rate is $1.*0/:, a company purchases merchandise from

a supplier in taly. !he spot rate is $1.*1/: on Cune *0, the company's yearend. Dayment

of :100,000 is made on Culy *0, %01%, when the spot rate is $1.%"/:. ;hat is the effect on

fiscal %01% and %01* income)

Fisca$ ,*-, Fisca$ ,*-'

a. $1,000 echan#e loss $*,000 echan#e #ain

(. $1,000 echan#e #ain $*,000 echan#e loss

c. +o effect $%,000 echan#e loss

d. +o effect $%,000 echan#e #ain

A+S a

Eiscal %01% echan#e loss -$1.*1 – $1.*0 :100,000 $1,000

Eiscal %01* echan#e #ain -$1.*1 – $1.%" :100,000 $*,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 #

3ata for 6uestions 10 and 11 are as follows

n Septem(er ", the Sealy ompany purchased cotton at an invoice price of :%0,000, when the

echan#e rate was $1.*%/:. Dayment was to (e made on +ovem(er ". n +ovem(er ", Sealy

purchased the :%0,000 for $1.*0/:, and paid the invoice.

10. To!ic" I1!ort transaction

L ,

!he cotton should (e valued in SealyFs inventory at

a. $%0,000

(. $%,00

c. $%,000

d. $%,400

A+S d

€%0,000 $1.*% $%,400

11. To!ic" I1!ort transaction

L ,

!he echan#e #ain or loss reco#ni?ed (y Sealy as a result of this transaction is

a. +o #ain or loss

(. $400 #ain

c. $400 loss

d. $1,8 #ain

A+S (

€%0,000 -$1.*% $1.*0 $400 #ain

©Cambridge Business Publishers, 2010

$ Advanced Accounting, 1st

dition

3ata for 6uestions 1% and 1* are as follows

n Cune , !eneco orporation sold merchandise at an invoice price of :100,000, when the

echan#e rate was $1.*/:. Dayment was to (e received on Au#ust 1. n Au#ust 1, the

customer paid the :100,000. !he echan#e rate on that date was $1.*9/:.

1%. To!ic" E/!ort transaction

L ,

!he sale should (e reported on !enecoFs (oo2s at

a. $1*,000

(. $1*9,000

c. $ 8*,*0

d. $ 81,94%

A+S a

:100,000 $1.* $1*,000

1*. To!ic" E/!ort transaction

L ,

!he echan#e #ain or loss reco#ni?ed (y !eneco as a result of this transaction is

a. 0

(. $*,000 #ain

c. $*,000 loss

d. $*,919 loss

A+S (

:100,000 -$1.*9 1.* $*,000 #ain

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 7

14. To!ic" Ana$ysis o% %oreign currency ris3s

L '

A U.S. eporter has made a sale to a customer in another country. !he customer is

o(li#ated to remit payment in his local currency in 90 days. !he direct spot rate is now

$1.4. !he 90day forward rate is $1.0. At which spot rate at the time the customer

remits payment would the company have (een (etter off not hed#in# the eport

transaction with a forward contract)

a. $1.%

(. $1.4

c. $1.9

d. $1.%

A+S d

Any rate a(ove $1.0 leads to hi#her U.S. dollar value of payment received than under the

forward contract.

1. To!ic" Foreign currency o!tions

L '

A company invests $%00 in a forei#n echan#e option with the followin# terms !he

company may purchase 1,000,000 ?loty at a price of $.%/?loty on 3ecem(er %0, %014.

;hich statement is true)

a. f the spot price for ?loty is $.* on 3ecem(er %0, the company will #ain $*9,"00

on the option.

(. f the spot price for ?loty is $.%4 on 3ecem(er %0, the company will lose $%00 on

the option.

c. f the spot price for ?loty is $.%8 on 3ecem(er %0, the company will lose $%0,%00

on the option.

d. f the spot price for ?loty is $.*0 on 3ecem(er %0, the company will #ain $%4,"00

on the option.

A+S (

!he option #ives the holder the option to (uy 1,000,000 ?loty for $%0,000. At a spot

price of $.%4/?loty, the option has no value and the holder loses its $%00 investment.

©Cambridge Business Publishers, 2010

% Advanced Accounting, 1st

dition

1. To!ic" Hedge o% i1!ort transaction

L 0

A U.S. import company purchases (oomeran#s from an Australian supplier on cto(er 1,

%01* for 100,000 Australian dollars -A$, paya(le Ee(ruary 1, %014. n cto(er 1, %01*,

the company enters into a forward contract to hed#e the forei#n currency ris2 resultin#

from this purchase. Gchan#e rates are as follows

For&ard

rate %or ,4-

S!ot rate de$i.ery

cto(er 1, %01* $0."9 $0."

3ecem(er *1, %01* 0."" 0."4

Ee(ruary 1, %014 0."% 0."%

Eor the import company, what is the income statement effect of the a(ove information)

a. +o effect in %01*, $4,000 #ain in %014

(. $1,000 #ain in %01*, $,000 #ain in %014

c. $1,000 loss in %01*, $,000 loss in %014

d. +o effect in %01*, $4,000 loss in %014

A+S a

%01*

forward contract -$." $."4 A$100,000 $1,000 loss

paya(le -$."9 $."" A$100,000 1,000 #ain

0

%014

forward contract -$."4 $."% A$100,000 $%,000 loss

paya(le -$."" $."% A$100,000 ,000 #ain

$4,000 #ain

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 &

18. To!ic" Hedge o% %ir1 co11it1ent

L 2

A5 orporation issues a purchase order for 1,000,000 semiconductors to a forei#n

supplier. !he a#reed upon total price is E1,%00,000, and the current spot rate is $1/E.

Suppose a forward contract is ta2en out when the purchase order is issued, at a rate of

$0.9/E, for delivery when the semiconductors are received. f the spot rate rises to

$1.0 when the semiconductors are received and paid for (y A5, at what value will the

semiconductors (e reported on A5's (oo2s)

a. $1,0%0,000

(. $1,140,000

c. $1,%00,000

d. $1,%0,000

A+S (

$1.0 E1,%00,000 $1,%0,000

-$1.0 $.9 E1,%00,000 -1%0,000

$1,140,000

Use the followin# information to answer 6uestions 1" and 19 (elow.

A U.S. company purchases a 0day certificate of deposit from an talian (an2 on cto(er 1.

!he certificate has a face value of :1,000,000, costs $1,%00,000 -the spot rate is $1.%0/:, and

pays interest at an annual rate of percent. n 3ecem(er 14, the certificate of deposit matures

and the company receives principal and interest of :1,010,000. !he spot rate on 3ecem(er 14 is

$1.1"/:. !he avera#e spot rate for the period cto(er 1 7 3ecem(er 14 is $1.19/:.

1". To!ic" Foreign currency $ending

L ,

!he echan#e #ain or loss on this investment is

a. $%0,%00 #ain

(. $%0,%00 loss

c. $%0,000 #ain

d. $%0,000 loss

A+S d

:1,000,000 -$1.%0 $1.1" $%0,000 loss

©Cambridge Business Publishers, 2010

10 Advanced Accounting, 1st

dition

19. To!ic" Foreign currency $ending

L ,

nterest income on the investment is reported at

a. $0

(. $11,"00

c. $11,900

d. $1%,000

A+S (

€10,000 $1.1" $11,"00

Use the followin# information to answer 6uestions %0 7 %% (elow

A U.S. company anticipates that it will purchase merchandise for €10,000,000 at the end of Culy,

and pay for it at the end of Septem(er. n Barch 1, it enters a forward contract to (uy

€10,000,000 on Septem(er *0. !he forward contract 6ualifies as a cash flow hed#e. !he

company's accountin# year ends 3ecem(er *1. !he company actually purchases the merchandise

on Culy *0 and closes the forward contract and pays for the merchandise on Septem(er *0. t still

holds the merchandise at the end of the year. Gchan#e rates are as follows

For&ard rate

%or 54'* de$i.ery

S!ot rate

Barch 1 $1.40 $1.41

Culy *0 1.4% 1.41

Septem(er *0 1.4* 1.4*

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 11

%0. To!ic" Hedge o% %orecasted transaction

L )

!he merchandise is reported on the yearend (alance sheet at

a. $14,100,000

(. $14,10,000

c. $14,%00,000

d. $14,*00,000

A+S c

C(anges in t(e .a$ue o% t(e %or&ard contract re1ain in ot(er co1!re(ensi.e inco1e

unti$ t(e 1erc(andise is so$d . !he merchandise is reported at the spot rate at the date of

purchase, $1.4%.

%1. To!ic" Hedge o% %orecasted transaction

L )

;hat is the net effect on income for the year)

a. +o effect

(. $100 loss

c. $100 #ain

d. $0 #ain

A+S a

C(anges in t(e .a$ue o% t(e %or&ard are re!orted in ot(er co1!re(ensi.e inco1e6

!he $100 loss on the paya(le is eactly offset (y a reclassification of $100 out of other

comprehensive income, so there is no net effect on income.

©Cambridge Business Publishers, 2010

12 Advanced Accounting, 1st

dition

%%. To!ic" Hedge o% %orecasted transaction

L )

;hen the merchandise is sold, what amount is reported for cost of #oods sold)

a. $14,100,000

(. $14,10,000

c. $14,%00,000

d. $14,*00,000

A+S a

At the end of the year, other comprehensive income has a credit (alance of $100. ;hen

the merchandise is sold, it is reclassified as a reduction in cost of #oods soldH $14,100,000

$14,%00,000 $100,000.

ourna$ entries re$ated to 8uestions ,* 9 ,, (in thousands)"

Culy *0

nventory 14,%00

Accounts paya(le 14,%00

nvestment in forward 0

ther comprehensive income 0

Septem(er *0

Gchan#e loss 100

Accounts paya(le 100

nvestment in forward 10

ther comprehensive income 10

ther comprehensive income 100

Gchan#e #ain 100

Accounts paya(le 14,*00

ash 14,100

nvestment in forward %00

:(en 1erc(andise is so$d"

ost of #oods sold 14,100

ther comprehensive income 100

nventory 14,%00

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 1!

Use the followin# information on the U.S. dollar value of the euro to answer 6uestions %* 7 %

For&ard rate %or

Marc( ,*+ ,*-,

S!ot rate de$i.ery

+ovem(er *0, %011 $ 1.*0 $ 1.%9

3ecem(er *1, %011 1.** 1.*1

Barch %0, %01% 1.* 1.*

%*. To!ic" S!ecu$ati.e %or&ard !urc(ase contract

L 7

n +ovem(er *0, %011, a U.S. company, with a 3ecem(er *1 yearend, enters a forward

!urc(ase contract for :100,000 to (e delivered on Barch %0, %01%. !he forward

contract does not 6ualify as a hed#e. !he company closes the contract at its epiration

date. ;hich statement is true)

a. +o #ain or loss is reported until the forward is closed on Barch %0

(. A #ain of $%,000 is reported in %01%

c. A #ain of $4,000 is reported in %01%

d. A #ain of $,000 is reported in %01%

A+S c

!he chan#e in value of the forward is reported in income as the forward rate chan#es. Eor

%01%, the #ain is -$1.* $1.*1 :100,000 $4,000.

%4. To!ic" S!ecu$ati.e %or&ard sa$e contract

L 7

n +ovem(er *0, %011, a U.S. company, with a 3ecem(er *1 yearend, enters a forward

sa$e contract for :100,000 to (e delivered on Barch %0, %01%. !he forward contract

does not 6ualify as a hed#e. !he company closes the forward contract on 3ecem(er *1.

;hich statement is true)

a. +o #ain or loss is reported

(. A loss of $1,000 is reported in %011

c. A loss of $*,000 is reported in %011

d. A loss of $%,000 is reported in %011

A+S d

!he chan#e in value of the forward is reported in income as the forward rate chan#es. Eor

%011, the loss is -$1.*1 $1.%9 :100,000 $%,000

©Cambridge Business Publishers, 2010

1" Advanced Accounting, 1st

dition

%. To!ic" IFRS %or (edge o% a %orecasted !urc(ase

L ;

n +ovem(er *0, %011, a U.S. company, with a 3ecem(er *1 yearend, enters a forward

!urc(ase contract for :100,000 to (e delivered on Barch %0, %01%. !he contract hed#es

a forecasted purchase of e6uipment. !he forward is closed and the e6uipment purchased

on Barch %0. f the company follows EIS and reports #ains and losses on hed#es of

forecasted transactions as (asis ad@ustments, total de!reciation e/!ense over the life of

the e6uipment is

a. $1%9,000

(. $1*0,000

c. $1*1,000

d. $1*,000

A+S a

!he e6uipment is recorded at the spot rate of $1.* :100,000 $1*,000, ad@usted for

the $,000 J $1.* $1.%9 :100,000K #ain on the forward contract.

%. To!ic" E/c(ange rates

L -

!he value of the euro chan#es from $1.*9 to $1.4*. ;hich statement is true concernin#

chan#es in the value of the euro in relation to the U.S. dollar)

a. Gach U.S. dollar can (e echan#ed for more euros.

(. Gach euro can (e echan#ed for fewer U.S. dollars.

c. !he U.S. dollar has stren#thened with respect to the euro.

d. A $10 product can (e purchased with fewer euros.

A+S d

%8. To!ic" E/c(ange rates

L -

nformal mar2ets contractin# for future delivery of forei#n currencies are called

a. Spot mar2ets

(. Eorward mar2ets

c. Eutures mar2ets

d. 3irect mar2ets

A+S (

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 1#

%". To!ic" For&ard sa$e (edging %oreign currency recei.a<$e

L 0

A U.S. company has eurodenominated receiva(les that it hed#es with a forward sale of

euros. !he euro wea2ens a#ainst the U.S. dollar. ;hich statement is true)

a. !he #ain on the receiva(les and the loss on the forward are reported on the income

statement.

(. !he #ain on the receiva(les and the loss on the forward are reported in other

comprehensive income.

c. !he loss on the receiva(les and the #ain on the forward are reported on the income

statement.

d. !he loss on the receiva(les and the #ain on the forward are reported in other

comprehensive income.

A+S c

%9. To!ic" For&ard !urc(ase (edging %oreign currency !aya<$e

L 0

A U.S. company has paya(les to suppliers denominated in euros, and hed#es these

paya(les with forei#n currency forward purchase contracts. !he euro stren#thens a#ainst

the U.S. dollar. ;hich statement is true)

a. !he #ain on the paya(les and the loss on the forward are reported on the income

statement.

(. !he #ain on the paya(les and the loss on the forward are reported in other

comprehensive income.

c. !he loss on the paya(les and the #ain on the forward are reported on the income

statement.

d. !he loss on the paya(les and the #ain on the forward are reported in other

comprehensive income.

A+S c

©Cambridge Business Publishers, 2010

1$ Advanced Accounting, 1st

dition

*0. To!ic" For&ard sa$e (edging %orecasted transaction

L )

A U.S. company sells its products to customers in Capan, priced in yen. t hed#es a

forecasted sale to a Capanese customer with a forward sale of yen. han#es in the value of

the hed#e investment are

a. Ieported in other comprehensive income until the products are produced

(. Ieported as ad@ustments to sellin# and administrative epenses when the products

are sold

c. Ieported in income as the chan#es occur

d. Ieported in other comprehensive income until the products are sold

A+S d

*1. To!ic" S!ecia$ (edge accounting+ cas( %$o& (edges

L '+ )

han#es in the mar2et value of forward forei#n currency contracts used to hed#e

forecasted sales of merchandise to customers are

a. Ieported on the income statement if the forwards 6ualify for special hed#e

accountin# and in other comprehensive income if they don't 6ualify.

(. Ieported as a direct ad@ustment to retained earnin#s if they 6ualify for special

hed#e accountin# and on the income statement if they don't 6ualify.

c. Ieported in other comprehensive income if they 6ualify for special hed#e

accountin# and on the income statement if they don't 6ualify.

d. +ot reported if they 6ualify for special hed#e accountin# and reported on the

income statement if they don't 6ualify.

A+S c

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 17

*%. To!ic" Cas( %$o& (edges

L '+ )

;hich one of the followin# is a cash flow hed#e for a U.S. company)

a. A hed#e of eurodenominated receiva(les

(. A hed#e of a planned purchase of inventory, denominated in pesos

c. A hed#e of a sales order from a customer in the U.L., denominated in pounds

d. A hed#e of paya(les denominated in U.S. dollars

A+S (

**. To!ic" Identi%ication o% (edge in.est1ents

L '

;hich of the followin# is not a hed#e investment)

a. A U.S. company issues a purchase order to a supplier in Beico who re6uires

payment in pesos, and invests in a put option in pesos.

(. A U.S. company has de(t denominated in euros, and invests in a forward purchase

of euros.

c. A U.S. company's customers owe it several million pesos from credit sales, and the

company invests in a forward sale of pesos.

d. A U.S. company invests in corporate (onds denominated in euros and enters a put

option in euros.

A+S a

*4. To!ic" Identi%ication o% (edge in.est1ents

L '

Mou are a U.S. investor and you epect that the value of the euro, in U.S. dollar terms,

will increase. ;hich of the followin# investments would you ma2e)

a. Short position in euro futures.

(. Dut option in euros.

c. 5orrow from a (an2 in taly, payment denominated in euros.

d. Eorward purchase of euros.

A+S d

©Cambridge Business Publishers, 2010

1% Advanced Accounting, 1st

dition

*. To!ic" =eri.ati.es disc$osures

L 7

SFAS 161, effective at the end of %00", provides that

a. &ed#es reported as assets (e com(ined with hed#es reported as lia(ilities.

(. All hed#ed items (e carried at mar2et value.

c. Additiona$ %ootnote disc$osures detai$ (edging gains and $osses <y (edge ty!e .

d. &ed#in# #ains and losses (e separately displayed on the income statement and not

com(ined with other accounts.

A+S c

*. To!ic" Identi%ication o% (edge in.est1ents

L '

;hich of the followin# is the real hed#e)

a. A call option in euros, used to hed#e a forecasted sale to a customer, denominated

in euros

(. A call option in euros, used to hed#e an investment in securities, denominated in

euros

c. A put option in euros, used to hed#e a receiva(le denominated in euros

d. A forward sale in euros, used to hed#e de(t denominated in euros

A+S c

*8. To!ic" Hedge accounting

L '

n Au#ust 1, a U.S. company enters into a forward contract, in which it a#rees to (uy

1,000,000 euros from a (an2 at a rate of $1.4 on 3ecem(er 1. han#es in the value of

the forward contract will (e reported on the income statement in which one of the

followin# situations)

a. !he U.S. company uses the forward contract to hed#e a loan denominated in

euros.

(. !he U.S. company uses the forward contract to hed#e a forecasted purchase of

merchandise from a Erench supplier.

c. !he U.S. company uses the forward contract to hed#e a planned purchase of

commodities from an talian supplier.

d. !he U.S. company uses the forward contract to hed#e an epected ac6uisition of

commodities from a 5el#ian company.

A+S a

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 1&

*". To!ic" Hedging %inancia$ ris3

L -+ '

;hich statement (elow (est descri(es the process of hed#in# usin# financial derivatives)

a. Mou have inside information that the $/yen rate is #oin# to rise, so you invest in a

financial derivative that allows you to #ain if the $/yen rate rises.

(. Mou have inside information that the $/euro rate is #oin# to fall, so you invest in a

financial derivative that allows you to #ain if the $/euro rate falls.

c. As part of your normal (usiness transactions, you are eposed to financial ris2.

Mou invest in financial derivatives to increase potential #ains from financial ris2.

d. As part of your normal (usiness transactions, you are eposed to financial ris2.

Mou invest in financial derivatives to reduce that ris2.

A+S d

*9. To!ic" Hedging %inancia$ ris3

L -+ '

A U.S. manufacturin# company imports parts from a supplier in <ermany. !he company is

re6uired to pay the supplier in euros. ;hich investment will hed#e the manufacturin#

companyFs forei#n echan#e ris2)

a. all option in euros

(. Short position in euros

c. Eorward sale of euros

d. 5orrowin# from a <erman (an2

A+S a

40. To!ic" #a$uation o% %or&ard contracts

L '

&ow are investments in financial derivatives valued on the (alance sheet)

a. Mar3et .a$ue

(. ost

c. =ower of cost or mar2et value

d. +ot reported

A+S a

©Cambridge Business Publishers, 2010

20 Advanced Accounting, 1st

dition

41. To!ic" #a$uation o% %or&ard contracts

L '

n 3ecem(er 1, a U.S. company a#rees to (uy euros on Ee(ruary 1 at a contract price of

$1.40. !he company did not pay anythin# for this contract. !he echan#e rate for euros

declines to $1.*" -U.S. dollar stren#thens (etween 3ecem(er 1 and 3ecem(er *1, when

the company's reportin# year ends. &ow is this contract reported on the company's year

end (alance sheet)

a. n the asset section

(. In t(e $ia<i$ity section

c. As a contra asset

d. !he contract is not reported on the (alance sheet

A+S (

4%. To!ic" Hedges o% %ir1 co11it1ents

L 2

n Culy 10, %01%, a U.S. company with a 3ecem(er *1 yearend enters a forward contract

that loc2s in the sellin# price of won, for delivery on Au#ust 1. !he forward contract

hed#es a firm commitment to sell merchandise to a customer in Lorea, with payment

denominated in won. !he sale is made on Au#ust 1, %01% and payment is received from

the customer on Au#ust 1. ;here is the value of the firm commitment to sell reported in

the yearend financial statements for %01%)

a. Asset or lia(ility on the (alance sheet

(. ncrease or decrease in other comprehensive income

c. Ad@ustment to sales revenue

d. Ad@ustment to cost of #oods sold

A+S c

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 21

4*. To!ic" Foreign currency <orro&ing

L ,

!he NMO ompany (orrows 100,000,000 euros (y issuin# (onds to <erman investors

when the spot rate is $1.%/:. !he interest rate is 10 percent per annum. ;hen NMO

accounts for this loan, which of the followin# will not (e true)

a. A decrease in the echan#e rate will #enerate an echan#e #ain on the (onds

paya(le

(. f the spot rate rises to $1.*/: one year hence, when the interest payment is

accrued, the interest epense will (e recorded at $1*,00,000

c. f NMO desires to hed#e these (onds, it will have to purchase euros forward

d. !he (onds paya(le will (e carried at $1%,000,000 until they mature

A+S d

44. To!ic" Foreign currency <orro&ing

L ,

nterest epense on a loan denominated in another currency is translated at

a. !he avera#e spot rate for the period the interest covers

(. !he spot rate when the loan was made

c. !he spot rate when the interest is recorded

d. !he forward rate for delivery when the interest must (e paid

A+S c

4. To!ic" Hedging strategy

L '

U.S. manufacturers that sell to customers in other countries, priced in the currency of the

customer's country, often ad@ust their hed#in# strate#y dependin# on which way they

(elieve forei#n currency rates are headed. ;hich statement (est represents the ad@ustment

they ma2e, if the U.S. dollar is epected to wea2en)

a. Ieduce the percenta#e of receiva(les hed#ed

(. Ieduce the percenta#e of paya(les hed#ed

c. ncrease the percenta#e of receiva(les hed#ed

d. ncrease the percenta#e of paya(les hed#ed

A+S a

©Cambridge Business Publishers, 2010

22 Advanced Accounting, 1st

dition

4. To!ic" Hedge accounting

L '

!wo ma@or #oals of SFAS 133 are

a. 3isclose the fair values of derivatives investments in the footnotes of the financial

statements, and report hed#ed assets and lia(ilities at fair value on the (alance

sheet.

(. Ieport the fair values of derivatives investments on the (alance sheet, and report

hed#ed assets and lia(ilities at fair value on the (alance sheet.

c. Ieport the fair values of derivatives investments on the (alance sheet, and match

#ains and losses on hed#e investments and hed#ed assets and lia(ilities on the same

income statement.

d. Ieport hed#ed assets and lia(ilities at fair value on the (alance sheet, and match

#ains and losses on hed#e investments and hed#ed assets and lia(ilities on the same

income statement.

A+S c

48. To!ic" Hedge o% %orecasted transaction

L )

A U.S. company hed#es an anticipated sale of merchandise to a forei#n customer. ;hen

are #ains and losses on the hed#e investment reported on the income statement)

a. ;hen the customer pays for the merchandise

(. ;hen the anticipated sale (ecomes a firm commitment

c. ;hen the hed#e investment is determined to (e an effective hed#e

d. ;hen the merchandise is sold

A+S d

4". To!ic" S!ecu$ati.e in.est1ents

L 7

A U.S. company enters a forward purchase contract that does not 6ualify as a hed#e

investment. ;hen are #ains and losses on the hed#e investment reported on the income

statement)

a. ;hen the forward contract chan#es in mar2et value

(. ;hen the forward contract is closed

c. ;hen the forward contract is determined to (e an effective hed#e

d. ;hen the merchandise is sold

A+S a

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 2!

49. To!ic" Hedge o% %oreign>currency>deno1inated !aya<$e

L 0

A U.S. company has entered into a forward purchase contract to hed#e a reported forei#n

currency o(li#ation. f the U.S. dollar wea2ens a#ainst the forei#n currency

a. !he forward contract appears as a current asset on the company's (alance sheet.

(. !he forward contract's reported value eactly offsets the reported forei#n currency

o(li#ation, with no net (alance sheet disclosure.

c. !he #ain on the forward contract adds to other comprehensive income.

d. !he #ain on the forei#n currency o(li#ation adds to other comprehensive income.

A+S a

0. To!ic" IFRS %or %oreign currency (edging

L ;

EIS allows which reportin# practice, not allowed under U.S. <AAD)

a. Ieportin# forei#n currency derivative positions at cost rather than at mar2et value

(. Ieportin# #ains and losses on cash flow hed#es as ad@ustments to the carryin#

value of related asset ac6uisitions

c. Ieportin# #ains and losses on firm commitment hed#es as ad@ustments to the

carryin# value of related asset ac6uisitions

d. Ieportin# forei#n currency derivative positions at mar2et rather than at cost

A+S (

©Cambridge Business Publishers, 2010

2" Advanced Accounting, 1st

dition

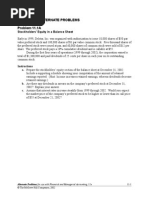

PRBLEMS

1. To!ic" Fair .a$ue (edge o% recei.a<$es and !aya<$es+ cas( %$o& (edge o%

%orecasted transaction

L 0+ )

Use the followin# echan#e rates for the anadian dollar to answer the three 6uestions

(elow concernin# a U.S. company's forei#n echan#e activities. !he company's

accountin# year ends 3ecem(er *1.

For&ard rate %or

S!ot rate Marc( '-+ ,*-- de$i.ery

cto(er *1, %010 $ 0."% $ 0."1

3ecem(er *1, %010 0." 0."

Barch *1, %011 0."* 0."*

Required

Answer the followin# 6uestions.

a. !he company sells merchandise to a anadian customer for $100,000 on cto(er

*1, %010, and receives payment from the customer, in anadian dollars, on Barch

*1, %011. ;hat are the followin# (alances)

i. Sales revenue for %010

ii. Accounts receiva(le, 3ecem(er *1, %010

iii. Gchan#e #ain or loss for %011

(. !he company sells merchandise to a anadian customer for $100,000 on cto(er

*1, %010, and receives payment from the customer, in anadian dollars, on Barch

*1, %011. n cto(er *1, %010 it enters a forward contract to loc2 in the sellin#

price of anadian dollars, for Barch *1, %011 delivery. n Barch *1, %011, it

delivers the anadian dollars and closes the forward contract. ;hat are the

(alances)

i. nvestment in forward , 3ecem(er *1, %010

ii. Amount of U.S. dollars received Barch *1, %011

c. !he company enters a forward contract on cto(er *1, %010 to hed#e a forecasted

purchase of merchandise for $100,000 on Barch *1, %011. n Barch *1 it ta2es

delivery of the merchandise, closes the forward and pays for the merchandise. t

sells the merchandise in Bay. ;hat are the (alances)

i. nvestment in forward, 3ecem(er *1, %010

ii. ost of #oods sold on Bay sale

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 2#

A+S

a. i. $100,000 $."% $"%,000

ii. $100,000 $." $",000

iii. $100,000 -$." $."* $%,000 loss

(. i. $100,000 -$."1 $." $,000 lia(ility

ii. $100,000 $."1 $"1,000

c. i. $100,000 -$."1 $." $,000 asset

ii. $"*,000 7 -$."* $."1-$100,000 $"1,000

%. To!ic" Un(edged %oreign currency transactions+ (edges o% %ir1 co11it1ents

L ,+ 0+ 2

A U.S. company (uys merchandise from suppliers in the U.L., and pays for the

merchandise in pounds sterlin#. ts accountin# year ends 3ecem(er *1. Use the followin#

information on $/P to answer the 6uestions (elow.

For&ard rate %or de$i.ery

S!ot rate Marc( -+ ,*-'

cto(er 1, %01% $1.%9 $1.%"

+ovem(er 1, %01% 1.*0 1.*%

3ecem(er *1, %01% 1.* 1.*4

Barch 1, %01* 1.*8 1.*8

Required

Answer the followin# 6uestions

a. !he U.S. company ta2es delivery of merchandise costin# P1,000,000 on +ovem(er

1, %01%. !he company pays for the merchandise, in pounds, on Barch 1, %01*.

+o hed#in# is involved. !he company sells the merchandise on Cune 1, %01*.

;hat amounts will appear on the financial statements of the U.S. company for

i. Accounts paya(le, 3ecem(er *1, %01% (alance sheet

ii. Gchan#e #ain or loss, %01% income statement

iii. ost of #oods sold, %01* income statement

(. Assume the same facts as in a. a(ove, (ut the U.S. company issues a purchase

order on cto(er 1, %01% (efore ta2in# delivery on +ovem(er 1. n cto(er 1

the company also enters a forward contract to hed#e its EN ris2, for delivery of

pounds on Barch 1, %01*. ;hat amounts will appear on the financial statements

of the U.S. company for

i. nvestment in forward contract, 3ecem(er *1, %01% (alance sheet

ii. ost of #oods sold, %01* income statement

©Cambridge Business Publishers, 2010

2$ Advanced Accounting, 1st

dition

A+S

a. i. P1,000,000 $1.* $1,*0,000

ii. P1,000,000 -$1.*0 $1.* $0,000 loss

iii. P1,000,000 $1.*0 $1,*00,000

(. i. P1,000,000 -$1.%" $1.*4 $0,000 asset

ii. P1,000,000 $1.*0 7 JP1,000,000 -$1.%" $1.*%K $1,%0,000

*. To!ic" Un(edged %oreign currency transactions+ (edges o% i1!ort and

%orecasted transactions

L ,+ 0+ )

Eollowin# are echan#e rates for the euro -U.S. $/: . mport Gpress is a U.S. company

whose accountin# year ends on 3ecem(er *1.

For&ard rate %or

May '-+ ,*--

S!ot rate de$i.ery

+ovem(er *0, %010 $ 1.% $ 1.*0

3ecem(er *1, %010 1.%" 1.*%

Bay *1, %011 1.% 1.%

Required

Answer the followin# 6uestions.

a. n +ovem(er *0, %010, mport Gpress ta2es delivery of merchandise on credit

from an talian supplier for :1,000. t pays for the merchandise on Bay *1, %011.

t sells the inventory to a U.S. customer durin# %011. ;hat are the correct

amounts that will appear on mport Gpress' financial statements for each of the

followin# items)

i. Accounts paya(le, 3ecem(er *1, %010 (alance sheet

ii. ost of #oods sold, %011 income statement

iii. Eorei#n echan#e loss, %010 income statement

(. n +ovem(er *0, %010, mport Gpress ta2es delivery of merchandise on credit

from an talian supplier for :1,000. n the same day, it a#rees to (uy :1,000

-forward purchase for delivery on Bay *1, %011. mport Gpress closes the

forward on Bay *1 and pays for the merchandise. t sells the inventory to a U.S.

customer durin# %011. ;hat are the correct amounts that will appear on mport

Gpress' financial statements for each of the followin# items)

i. nvestment in forward contract, 3ecem(er *1, %010 -asset

ii. =oss on forward contract, %011

<ain on accounts paya(le, %011

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 27

c. n +ovem(er *0, %010, mport Gpress forecasts that it will need to (uy

merchandise for :1,000 from an talian supplier at the end of Bay, %011. t plans

to pay for the merchandise as soon as it is delivered. n +ovem(er *0, %010,

mport Gpress a#rees to (uy :1,000 -forward purchase for delivery on Bay *1,

%011. !he forward contract 6ualifies as a cash flow hed#e of the forecasted

purchase of merchandise. !he merchandise is actually delivered on Bay *1, %011.

mport Gpress closes the forward and immediately pays the supplier. !he

merchandise is su(se6uently sold to a U.S. customer later in %011. Ba2e the

@ournal entries necessary to record these events

i. 3ecem(er *1, %010 Ad@ust the investment in forward contract.

ii. Bay *1, %011

-1 Ad@ust the investment in forward contract.

-% lose out the forward contract.

-* !a2e delivery of the merchandise and pay for it.

iii. Iecord cost of sales for %011.

A+S

a. Gntries -not re6uired

11/*0

nventory 1,%0

Accounts paya(le 1,%0

1%/*1

Gchan#e loss *0

Accounts paya(le *0

/*1

Accounts paya(le %0

Gchan#e #ain %0

Accounts paya(le 1,%0

ash 1,%0

i. Accounts paya(le, 3ecem(er *1, %010 (alance sheet $1,%"0

ii. ost of #oods sold, %011 income statement $1,%0

ii. Gchan#e loss, %010 income statement $ *0

©Cambridge Business Publishers, 2010

2% Advanced Accounting, 1st

dition

(. Gntries -not re6uired

11/*0

nventory 1,%0

Accounts paya(le 1,%0

1%/*1

Gchan#e loss *0

Accounts paya(le *0

nvestment in forward %0

Gchan#e #ain %0

/*1

Accounts paya(le %0

Gchan#e #ain %0

Gchan#e loss 0

nvestment in forward 0

Eorei#n currency 1,%0

nvestment in forward 40

ash 1,*00

Accounts paya(le 1,%0

Eorei#n currency 1,%0

i. nvestment in forward contract, 3ecem(er *1, %010 -asset $%0

ii. =oss on forward contract, %011 $0

<ain on accounts paya(le, %011 $%0

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 2&

c. i.

nvestment in forward %0

ther comprehensive income %0

ii. -1

ther comprehensive income 0

nvestment in forward 0

-%

Eorei#n currency 1,%0

nvestment in forward 40

ash 1,*00

-*

nventory 1,%0

Eorei#n currency 1,%0

iii.

ost of #oods sold 1,*00

ther comprehensive income 40

nventory 1,%0

©Cambridge Business Publishers, 2010

!0 Advanced Accounting, 1st

dition

4. To!ic" For&ard !urc(ase+ cas( %$o& (edge t(at <eco1es a %air .a$ue (edge

L 0+ 2+ )

Use the followin# information on echan#e rates for the euro to answer the 6uestion

(elow.

For&ard

rate %or

S!ot 04'*4-,

rate de$i.ery

cto(er 1, %011 $1.4 $1.4"

3ecem(er *1, %011 1.0 1.*

Canuary *1, %01% 1.% 1.

Barch *1, %01% 1. 1."

April *0, %01% 1.0 1.0

n cto(er 1, %011, a U.S. company forecasts that it will ta2e delivery of merchandise

from a supplier in Dortu#al for :10,000,000 around the end of Barch, %01%, with payment

epected to (e made, in euros, a(out one month later. !he company closes its (oo2s on

3ecem(er *1. !he followin# events occur

1. cto(er 1, %011 !he company enters a forward purchase a#reement for delivery

of :10,000,000 on April *0, %01%. !his position 6ualifies as a hed#e of the

forecasted transaction descri(ed a(ove. +o initial investment is re6uired.

%. 3ecem(er *1, %011 !he company closes its (oo2s.

*. Canuary *1, %01% !he company issues a purchase order to the supplier for

:10,000,000 in merchandise, to (e delivered Barch *1, %01%.

4. Barch *1, %01% !he company ta2es delivery of the merchandise.

. April *0, %01% !he company closes the forward contract and pays the supplier

:10,000,000.

. Bay 1, %01% !he company sells the merchandise to a U.S. customer for

$%%,00,000.

Required

Drepare the @ournal entries to record the a(ove events on the indicated dates.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !1

A+S

3ecem(er *1, %011 Gnd of year ad@ustin# entry

nvestment in forward 00,000

ther comprehensive

income 00,000

Canuary *1, %01% Ad@ust the investment

nvestment in forward %00,000

ther comprehensive

income %00,000

Barch *1, %01% Ad@ust for the period Canuary *1 Barch *1, and ta2e delivery of

the merchandise.

nvestment in forward *00,000

ther comprehensive

income *00,000

Gchan#e loss *00,000

Eirm commitment *00,000

ther comprehensive income *00,000

Gchan#e #ain *00,000

nventory 1,*00,000

Eirm commitment *00,000

Accounts paya(le 1,00,000

©Cambridge Business Publishers, 2010

!2 Advanced Accounting, 1st

dition

April *0, %01% Ad@ust for the period Barch *1 to April *0, close the forward

contract and pay the supplier.

nvestment in forward %00,000

ther comprehensive

income %00,000

Gchan#e loss 400,000

Accounts paya(le 400,000

ther comprehensive income 400,000

Gchan#e #ain 400,000

Eorei#n currency 1,000,000

nvestment in forward 1,%00,000

ash 14,"00,000

Accounts paya(le 1,000,000

Eorei#n currency 1,000,000

ost of #oods sold 14,"00,000

ther comprehensive income 00,000

nventory 1,*00,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !!

. To!ic" Hedge o% %ir1 co11it1ent

L 2

Eollowin# is information on $/: echan#e rates

For&ard rate %or de$i.ery

S!ot rate August -2+ ,*-,

Barch 1, %01% $1.0 $1.

Cune *0, %01% 1.0 1.%

Au#ust 1, %01% 1. 1.

A U.S. company (uys from suppliers in <ermany, and pays the suppliers in euros. !he

U.S. company's accountin# year ends Cune *0. n Barch 1, %01%, the company sends a

purchase order to a <erman supplier for :1,000,000 in merchandise, paya(le in euros,

delivery to ta2e place Au#ust 1, %01%. n the same day the company enters into a

forward contract for delivery of :1,000,000 on Au#ust 1. !he forward 6ualifies as a

hed#e of a firm commitment. n Au#ust 1, the company closes the forward contract,

ta2es delivery of the merchandise, and pays the supplier. !he company sells the

merchandise to its customers on Au#ust *1, %01%.

Required

;hat amounts will appear on the financial statements of the U.S. company for

a. nvestment in forward contract, Cune *0, %01% (alance sheet

(. ost of #oods sold, fiscal %01* income statement

A+S

a. :1,000,000 -$1.% $1. $80,000

b. Qalue of firm commitment :1,000,000 -$1. $1. $100,000 credit

urrency paid $1,0,000 firm commitment offset $100,000 $1,0,000

©Cambridge Business Publishers, 2010

!" Advanced Accounting, 1st

dition

. To!ic" Hedge o% %ir1 co11it1ent

L 2

n +ovem(er 1, %01%, a U.S. company issues a purchase order to (uy merchandise for

:1,000,000. !he company epects to ta2e delivery of the merchandise on Canuary 10,

%00", and will pay the supplier on Barch 1, %01*. !o hed#e its EN ris2, on +ovem(er 1,

%01% the company invests in a forward contract for delivery of :1,000,000 on Barch 1,

%01*. !he company sells the merchandise to a U.S. customer for $%,000,000 in cash on

April 1, %01*. Assume the forward contract 6ualifies as a fair value hed#e of the firm

commitment to (uy merchandise.

Gchan#e rates for the euro -$/: are (elow.

For&ard rate %or

S!ot rate Marc( -+ ,*-' de$i.ery

+ovem(er 1, %01% $ 1.40 $1.4%

3ecem(er *1, %01% 1.41 1.4*

Canuary 10, %01* 1.44 1.4*

Barch 1, %01* 1.4 1.4

Required

Eor each date (elow, prepare the necessary @ournal entries to record the events and/or

ad@ustments needed.

a. 3ecem(er *1, %01% -end of year closin#

(. Canuary 10, %01* -ta2es delivery of merchandise

c. Barch 1, %01* -closes the forward and pays the (ill

d. April 1, %01* -sells the merchandise to a U.S. customer. Assume the company

uses the perpetual inventory method.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !#

A+S

a. 3ecem(er *1, %01%

nvestment in forward 10,000

Gchan#e #ain 10,000

Gchan#e loss 10,000

Eirm commitment 10,000

Iate chan#es from $1.4% to $1.4*.

(. Canuary 10, %01*

nvestment in forward ,000

Gchan#e #ain ,000

Gchan#e loss ,000

Eirm commitment ,000

Iate chan#es from $1.4* to $1.4*.

nventory 1,4%,000

Eirm commitment 1,000

Accounts paya(le 1,440,000

c. Barch 1, %01*

Gchan#e loss 10,000

Accounts paya(le 10,000

Iate chan#es from $1.44 to $1.4.

nvestment in forward 1,000

Gchan#e #ain 1,000

Iate chan#es from $1.4* to $1.4.

Eorei#n currency 1,40,000

ash 1,4%0,000

nvestment in forward *0,000

Accounts paya(le 1,40,000

Eorei#n currency 1,40,000

d. April 1, %01*

ash %,000,000

Sales revenue %,000,000

ost of #oods sold 1,4%,000

nventory 1,4%,000

©Cambridge Business Publishers, 2010

!$ Advanced Accounting, 1st

dition

8. To!ic" I1!ort and e/!ort transactions

L ,

Eollowin# is information on $/: echan#e rates

S!ot rate

+ovem(er 1, %01* $1.4%

3ecem(er *1, %01* 1.*"

Ee(ruary 1, %014 1.*

Barch 1, %014 1.*

Required

Answer the followin# 6uestions

a. A U.S. company sells merchandise to customers in euro countries, with payment to

(e received in euros. Sales totalin# :1,000,000 occur on +ovem(er 1, %01*.

Dayment is made on Barch 1, %014. !he U.S. company's accountin# year ends

3ecem(er *1. ;hat amounts will appear on the financial statements of the U.S.

company for

i. Sales revenue, %01* income statement

ii. Accounts receiva(le, 1%/*1/1* (alance sheet

iii. Gchan#e #ain or loss, %01* income statement

(. A U.S. company (uys merchandise from suppliers in euro countries, paya(le in

euros. Durchases of :1,000,000 are made on +ovem(er 1, %01*. !he U.S.

company pays the suppliers on Ee(ruary 1, %014. !he U.S. company sells the

merchandise to its customers on Barch 1, %014. !he U.S. company's accountin#

year ends 3ecem(er *1. ;hat amounts will appear on the financial statements of

the U.S. company for

i. Accounts paya(le, 1%/*1/1* (alance sheet

ii. Gchan#e #ain or loss, %014 income statement

iii. ost of #oods sold, %014 income statement

A+S

a. i. :1,000,000 $1.4% $1,4%0,000

ii. :1,000,000 $1.*" $1,*"0,000

iii. :1,000,000 -$1.*" $1.4% $40,000 loss

(. i. :1,000,000 $1.*" $1,*"0,000

ii. :1,000,000 -$1.*" $1.* $%0,000 #ain

iii. :1,000,000 $1.4% $1,4%0,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !7

". To!ic" Hedges o% e/!ort transactions

L 0

A U.S. company sells merchandise to a <ree2 customer on Ee(ruary 1, %010 for

:1,000,000. !he customer pays the (ill on Bay 1, %010. !o hed#e forei#n echan#e ris2,

on Ee(ruary 1, %010 the U.S. company enters a forward sale contract for :1,000,000 with

a Bay 1 delivery date. n Bay 1 the company collects the :1,000,000 from the customer

and closes the forward contract. Ielevant rates are as follows

S!ot 24- For&ard

Ee(ruary 1, %010 $1.*4 $1.*4"

Bay 1, %010 1.**0 1.**0

Required

Ba2e the @ournal entries to record the followin# transactions, includin# appropriate

ad@ustin# entries

a. Ee(ruary 1 sale to the <ree2 customer.

(. Bay 1 collection of the receiva(le and closin# of the contract.

A+S

a.

Accounts receiva(le 1,*4,000

Sales revenue 1,*4,000

(.

Gchan#e loss 1,000

Accounts receiva(le 1,000

nvestment in forward 1",000

Gchan#e #ain 1",000

Eorei#n currency 1,**0,000

Accounts receiva(le 1,**0,000

ash 1,*4",000

nvestment in forward 1",000

Eorei#n currency 1,**0,000

©Cambridge Business Publishers, 2010

!% Advanced Accounting, 1st

dition

9. To!ic" Hedge o% %ir1 co11it1ent

L 2

n Ee(ruary 1, %010, a U.S. company issues a purchase order to (uy merchandise from a

<ree2 supplier for :1,000,000. n Ee(ruary 1, %010 the U.S. company enters a forward

purchase contract for :1,000,000 with a Culy 1 delivery date. !he forward 6ualifies as a

hed#e of the firm commitment to (uy the merchandise. n Bay 1, %010, the company

ta2es delivery of the merchandise. n Culy 1, %010, the company closes the forward and

pays the (ill. Ielevant echan#e rates are as follows

74- %or&ard

S!ot rate rate

Ee(ruary 1, %010 $1.*4 $1.*0

Bay 1, %010 1.*40 1.*44

Culy 1, %010 1.**0 1.**0

Required

a. Ba2e the @ournal entries to record the followin# transactions, includin#

appropriate ad@ustin# entries

i. Bay 1 delivery of merchandise.

ii. Culy 1 closin# of forward contract and payment of (ill.

(. Assume the U.S. company sells the merchandise to a U.S. customer for

$1,00,000. ;hat is the reported #ross mar#in -sales revenue minus cost of #oods

sold on the sale)

A+S

a. i.

Gchan#e loss ,000

nvestment in forward ,000

Eirm commitment ,000

Gchan#e #ain ,000

nventory 1,*4,000

Eirm commitment ,000

Accounts paya(le 1,*40,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 !&

ii.

Gchan#e loss 14,000

nvestment in forward 14,000

Accounts paya(le 10,000

Gchan#e #ain 10,000

Eorei#n currency 1,**0,000

nvestment in forward %0,000

ash 1,*0,000

Accounts paya(le 1,**0,000

Eorei#n currency 1,**0,000

(. $1,00,000 $1,*4,000 $%4,000

10. To!ic" Hedge o% %orecasted transaction

L )

A U.S. corporation purchases merchandise from a <erman supplier on a re#ular (asis. n

+ovem(er ", %01%, the corporation purchased :100,000 for delivery on Barch ", %01*,

in anticipation of an epected purchase of merchandise for :100,000 at the (e#innin# of

Barch. !he forward contract 6ualifies as a hed#e of a forecasted transaction. !he

corporation too2 delivery of the merchandise, settled the forward contract, and paid the

<erman supplier :100,000 on Barch ", %01*. !he merchandise was su(se6uently sold on

April 10, %01* to a U.S. customer for $%00,000. !he corporation's accountin# year ends

on 3ecem(er *1. Ielevant echan#e rates are as follows

For&ard rate %or de$i.ery

S!ot rate Marc( ;+ ,*-'

+ovem(er ", %01% 1.% 1.%

3ecem(er *1, %01% 1.%8 1.%"

Barch ", %01* 1.%4 1.%4

April 10, %01* 1.%* +/A

Required

a. Drepare the ad@ustin# entry necessary to update the investment in forward at

3ecem(er *1, %01%.

(. Drepare the entries necessary to ta2e delivery of the merchandise and close the

forward on Barch ", %01*.

c. Drepare the entry necessary to record cost of #oods sold on April 10, %01*.

©Cambridge Business Publishers, 2010

"0 Advanced Accounting, 1st

dition

A+S

a.

nvestment in forward %,000

ther comprehensive income %,000

(.

ther comprehensive income 4,000

nvestment in forward 4,000

Eorei#n currency 1%4,000

nvestment in forward %,000

ash 1%,000

nventory 1%4,000

Eorei#n currency 1%4,000

c.

ost of #oods sold 1%,000

nventory 1%4,000

ther comprehensive income %,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 "1

11. To!ic" #a$uation o% %or&ard contracts+ (edging entries

L '+ 0+ )

A U.S. company enters into the followin# forward contracts on cto(er 1, %011

1. A#reement to sell 100,000,000 yen on Canuary 1, %01% at $0.00""

%. A#reement to (uy 1,000,000 new she2els on Ee(ruary 1, %01% at $0.%%1

Eorward and spot rates for yen and she2els are as follows

For&ard rate

For&ard rate S!ot rate %or ,4-24-,

S!ot rate %or -4-24-, %or ne& de$i.ery o% ne&

%or yen de$i.ery o% yen s(e3e$s s(e3e$s

cto(er 1, %011 $ .00" $ .00"" $.%%0 $ .%%1

3ecem(er *1,%011 .00"4 .00" .%%% .%19

!he company's accountin# year ends 3ecem(er *1.

Required

a. &ow are the forward contracts valued on the company's 3ecem(er *1, %011

(alance sheet) Eor each contract, specify the amount and whether it is a current

asset or a current lia(ility.

(. Assume that the forward contract to sell yen is an effective hed#e of a 100,000,000

yen forecasted sale to customers in Capan. Ba2e the ad@ustin# entry for this

contract at 3ecem(er *1, %011.

c. Assume the forward contract to (uy new she2els is an effective hed#e of a

1,000,000 new she2el o(li#ation currently on the company's (oo2s. Ba2e the

ad@ustin# entry for this contract at 3ecem(er *1, %011.

A+S

a. Eorward sale in yen -$.00"" $.00" 100,000,000 $*0,000 current asset

Eorward purchase in new she2els -$.%%1 $.%19 1,000,000 $%,000 current

lia(ility

(.

nvestment in forward *0,000

ther comprehensive income *0,000

c.

Gchan#e loss %,000

nvestment in forward %,000

©Cambridge Business Publishers, 2010

"2 Advanced Accounting, 1st

dition

1%. To!ic" Hedge o% %ir1 co11it1ent

L 2

n Barch 1, %011, a U.S. company issued a purchase order to a supplier in the ayman

slands for #oods with a price of LM3 ,000,000. !he #oods will (e delivered Culy 1,

%011, and payment will (e made on Septem(er 1, %011. n Barch 1, %011, the company

purchased LM3 ,000,000 for delivery Septem(er 1, %011. !he forward contract is an

effective hed#e of the firm commitment to purchase #oods from the ayman slands. !he

#oods are delivered as epected on Culy 1, and the company follows throu#h on the

forward contract and ma2es the payment to the supplier on Septem(er 1. !he company's

accountin# year ends on 3ecem(er *1.

Spot and forward rates are as follows -$/LM3

For&ard rate %or de$i.ery

S!ot Rate on Se!te1<er -+ ,*--

Barch 1, %011 $1.%% $1.%1

Culy 1, %011 1.%1 1.%0

Septem(er 1, %011 1.19 1.19

Required

Answer the followin# 6uestions re#ardin# how the a(ove information is reported on the

company's financial statements

a. ;hat is the net hed#in# #ain or loss for %011)

(. Suppose the #oods purchased from the ayman slands are sold to a U.S.

customer for $",000,000. ;hat is the #ross mar#in -sales revenue less cost of

#oods sold on the sale) Show calculations clearly.

A+S

a. =oss on forward -$1.%1 $1.19 ,000,000 $100,000 loss

<ain on firm commitment -$1.%1 $1.%0 ,000,000 0,000 #ain

<ain on accounts paya(le -$1.%1 $1.19 ,000,000 100,000 #ain

+et $ 0,000 #ain

(. nventory is recorded as follows when the #oods are delivered on Culy 1

nventory ,100,000

Eirm commitment 0,000

Accounts paya(le ,00,000

!he #ross mar#in on the sale is

Sales $",000,000

ost of #oods sold ,100,000

<ross mar#in $1,900,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 "!

1*. To!ic" For&ard !urc(ase+ cas( %$o& (edge t(at <eco1es a %air .a$ue (edge

L 0+ 2+ )

A U.S. company purchases merchandise from a &on# Lon# supplier on a re#ular (asis.

!he followin# events occur

< cto(er 1, %01% !he company purchased $&1,000,000 for delivery on Bay 1,

%01*, in anticipation of an epected payment of $& for a forecasted merchandise

purchase.

< 3ecem(er 1, %01% !he company issued a purchase order for $&1,000,000 in

merchandise from the supplier.

< Barch 1, %01* !he company too2 delivery of the merchandise.

< Bay 1, %01* !he company closed the forward contract and paid the supplier.

< Bay *1, %01* !he company sold the merchandise to a U.S. customer for

$%00,000.

!he company's accountin# year ends 3ecem(er *1.

Gchan#e rates -$/& are as follows

For&ard rate %or

S!ot rate de$i.ery 24-4-'

cto(er 1, %01% $0.1% $0.1%8

3ecem(er 1, %01% 0.1%8 0.1%9

3ecem(er *1, %01% 0.1%" 0.1*1

Barch 1, %01* 0.1*1 0.1*1

Bay 1, %01* 0.1*% 0.1*%

Required

Drepare the @ournal entries to record the a(ove transactions, includin# necessary ad@ustin#

entries. Assume the hed#e 6ualifies for special hed#e accountin#.

©Cambridge Business Publishers, 2010

"" Advanced Accounting, 1st

dition

A+S

Ad@ustin# entries at 3ecem(er *1, %01%

nvestment in forward 4,000

ther comprehensive income 4,000

!o record increase in value of forward contract -$.1%8 to $.1*1

Gchan#e loss %,000

Eirm commitment %,000

!o record loss on firm commitment -$.1%9 to $.1*1

ther comprehensive income %,000

Gchan#e #ain %,000

!o reclassify other comprehensive income to income to match a#ainst loss on firm

commitment.

Barch 1, %01*

nvestment in forward 00

ther comprehensive income 00

!o mar2 the forward to mar2et -$.1*1 to $.1*1

Gchan#e loss 00

Eirm commitment 00

!o mar2 the firm commitment to mar2et -$.1*1 to $.1*1

ther comprehensive income 00

Gchan#e #ain 00

!o reclassify other comprehensive income to income to match a#ainst firm commitment

loss.

nventory 1%",00

Eirm commitment %,00

Accounts paya(le 1*1,000

!o record delivery of merchandise, ad@usted for firm commitment (alance.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 "#

Bay 1, %01*

nvestment in forward 00

ther comprehensive income 00

!o mar2 the forward to mar2et -$.1*1 to $.1*%

Gchan#e loss 1,000

Accounts paya(le 1,000

!o mar2 accounts paya(le to mar2et -$.1*1 to $.1*%

ther comprehensive income 1,000

Gchan#e #ain 1,000

!o reclassify other comprehensive income to income to match a#ainst accounts paya(le

loss.

Eorei#n currency 1*%,000

nvestment in forward ,000

ash 1%8,000

!o close forward contract.

Accounts paya(le 1*%,000

Eorei#n currency 1*%,000

!o pay the supplier.

Bay *1, %01*

ost of #oods sold 1%8,000

ther comprehensive income 1,00

nventory 1%",00

+ote Iemainin# other comprehensive income (alance is $4,000 $%,000 > $00 $00 >

$00 $1,000 $1,00 #ain.

©Cambridge Business Publishers, 2010

"$ Advanced Accounting, 1st

dition

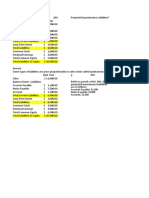

14. To!ic" Cas( %$o& (edge accounting .ersus regu$ar accounting

L '+ )

Eollowin# is information on echan#e rates for the euro

S!ot rate For&ard rate %or 04'*4-, de$i.ery

cto(er 1, %011 $1.4 $1.4"

3ecem(er *1, %011 1.0 1.*

Canuary *1, %01% 1.% 1.

Barch *1, %01% 1. 1."

April *0, %01% 1.0 1.0

n cto(er 1, %011, a U.S. company forecasts that it will (uy merchandise from a

supplier in Dortu#al for :10,000,000 around the end of Barch, %01%, with payment

epected to (e made, in euros, a(out one month later. !he company closes its (oo2s on

3ecem(er *1. !he followin# events occur

1. cto(er 1, %011 !he company enters a forward purchase a#reement for delivery

of €10,000,000 on April *0, %01%. +o initial investment is re6uired.

%. 3ecem(er *1, %011 !he company closes its (oo2s.

*. Canuary *1, %01% !he company issues a purchase order to the supplier for

€10,000,000 in merchandise, to (e delivered Barch *1, %01%.

4. Barch *1, %01% !he company ta2es delivery of the merchandise.

. April *0, %01% !he company closes the forward contract and pays the supplier

€10,000,000.

. Bay 1, %01% !he company sells the merchandise to a U.S. customer for

$%%,00,000.

Required

Eill in the schedule (elow, showin# the amounts related to the a(ove events that will (e

reported in the company's annual reports for %011 and %01%. Show related @ournal entries

in the net schedule. Show lia(ilities and #ains in parenthesis.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 "7

A+S

For&ard contract 8ua$i%ies as a

(edge o% t(e %orecasted T(e %or&ard contract does not

Account tit$e transaction 8ua$i%y as a (edge

,*-- ,*-, ,*-- ,*-,

nvestment in forward $ 00,000 $ 00,000

-(alance sheet

ther comprehensive -00,000

income -5alance sheet

-<ains and losses -income -00,000 $ -%00,000

statement -*00,000

-%00,000

400,000

$ -*00,000

ost of #oods sold -income $14,"00,000 $1,00,000

statement

©Cambridge Business Publishers, 2010

"% Advanced Accounting, 1st

dition

For&ard contract is a 8ua$i%ied (edge For&ard contract is not a 8ua$i%ied (edge

3ecem(er *1

nvestment in forward 00,000 nvestment in forward 00,000

00,000 Gchan#e #ain 00,000

Canuary *1

nvestment in forward %00,000 nvestment in forward %00,000

%00,000 Gchan#e #ain %00,000

Barch *1

nvestment in forward *00,000 nvestment in forward *00,000

*00,000 Gchan#e #ain *00,000

Gchan#e loss *00,000

Eirm commitment *00,000

*00,000

<ain *00,000

nventory 1,*00,000 nventory 1,00,000

Eirm commitment *00,000 A/D

A/D 1,00,000 1,00,000

April *0

nvestment in forward %00,000

%00,000 nvestment in forward %00,000

Gchan#e loss 400,000 Gchan#e #ain

A/D 400,000 %00,000

400,000 Gchan#e loss 400,000

Gchan#e #ain 400,000 A/D

Eorei#n currency 1,000,000 400,000

ash 14,"00,000

nvestment in for. 1,%00,000

A/D 1,000,000 Eorei#n currency 1,000,000

Eorei#n currency 1,000,000 ash

14,"00,000

Bay 1 nvestment in for. 1,%00,000

<S 14,"00,000 A/D 1,000,000

00,000 Eorei#n currency 1,000,000

nventory 1,*00,000

<S 1,00,000

nventory

1,00,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 "&

1. To!ic" Cas( %$o& (edge accounting .ersus regu$ar accounting

L '+ )

Eollowin# are echan#e rates for the anadian dollar.

For&ard rate %or Marc( '-+

S!ot rate ,*-, de$i.ery

cto(er *1, %011 $ 0."0 $ 0."1

3ecem(er *1, %011 0."4 0."

Barch *1, %01% 0."% 0."%

A U.S. company enters a forward contract on cto(er *1, %011 to hed#e a forecasted

purchase of merchandise for $1,000,000 on Barch *1, %01%. n Barch *1 it ta2es

delivery of the merchandise, closes the forward and pays for the merchandise. t sells the

merchandise in Bay. !he company's accountin# year ends 3ecem(er *1.

Required

;hat are the (alances for the followin# accounts, assumin# the forward contract 6ualifies

as a hed#e of the forecasted transaction for the period cto(er *1, %011 to Barch *1,

%01%, and also if the forward contract does not 6ualify as a hed#e)

a. ther comprehensive income (alance, 3ecem(er *1, %011

(. <ain/loss on forward contract, %011 income statement

c. <ain/loss on forward contract, %01% income statement

d. %01% cost of #oods sold

A+S

?ua$i%ies as (edge =oes not 8ua$i%y

ther comprehensive income, 3ecem(er

*1, %011 -#ain $ 0,000 $ 0

%011 income statement

#ain on forward contract 0 0,000

%01% income statement

loss on forward contract 0 40,000

%01% cost of #oods sold "10,000 "%0,000

©Cambridge Business Publishers, 2010

#0 Advanced Accounting, 1st

dition

1. To!ic" Hedge o% %ir1 co11it1ent+ i1!ort transaction+ s!ecu$ation

L ,+ 2+ 7

Glectronic mporters, a U.S. company, has the followin# outstandin# (alances as of

3ecem(er *1, %011, its accountin# yearend.

For&ard !urc(ase contract dated 3ecem(er 1, %011 for %0,000,000 yen to hed#e a firm

commitment to purchase computer hardware for %0,000,000 yen in 90 days endin# on

Barch 1, %01%.

Account !aya<$e for 80,000,000 yen for unpaid merchandise ac6uired on 3ecem(er 1,

%011 and due on Canuary 1, %01%.

For&ard sa$e contract dated 3ecem(er 1, %011 for *0,000,000 yen to speculate in

echan#e rate chan#es and due on Canuary 1, %01%.

Gchan#e rates 6uoted in the U.S. for Capanese yen are

-,4-4-- -,4-)4-- -,4'-4-- -4-24-, '4-4-,

Spot rate $.00%0 $.0010 $.0000 $.009* $.00"0

90day forward .00*0 .00%0 .0010 .0000 .0090

0day forward .00%0 .0010 .000* .0090 .00"0

*0day forward .0010 .0000 .0090 .00"0 .0080

1day forward .001 .000 .009 .00" .008

Required

a. alculate the #ain or loss on Glectronic mportersF %011 income statement due to

the a(ove items. Specify the amount and whether it is a #ain or loss.

(. alculate the (alances at which the forward purchase contract and the forward sale

contract would (e reported in the 3ecem(er *1, %011 (alance sheet.

c. At what amount -U.S. dollars should the computer hardware (e valued on Barch

1, %01%)

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 #1

A+S

a. Eorward purchase contract no income effect due to offsettin# #ain and loss on

contract and firm commitment.

Accounts paya(le 80,000,000 -$.0010 $.0000 $8,000 #ain

Eorward sale *0,000,000 -$.0000 $.009 1,00 #ain

$",00 #ain

(. Eorward purchase contract

-$.00* $.000* %0,000,000 $,400 current lia(ility

Eorward sale contract

-$.00 $.009 *0,000,000 $1,00 current asset

c.

-$.00" %0,000,000 $11,000

Dlus firm commitment (alance

-$.00* $.00" %0,000,000 10,000

&ardware (alance, */1/1% $1%,000

©Cambridge Business Publishers, 2010

#2 Advanced Accounting, 1st

dition

18. To!ic" I1!ort transactions+ (edge o% %ir1 co11it1ent+ (edge o% %orecasted

transaction+ s!ecu$ation

L ,+ 2+ )+ 7

Gach of the followin# situations is independent of the others. Acme mporters is a U.S.

company with a 3ecem(er *1 yearend. Use the followin# information on echan#e rates

-US$/$anadian to answer each 6uestion.

For&ard rate

%or de$i.ery on

S!ot rate ,4-4-'

Septem(er 1, %01% $."0 $."%

cto(er 1, %01% .8" .89

3ecem(er *1, %01% .8 .84

Ee(ruary 1, %01* .9 .9

Required

Eor each situation, -1 ma2e the @ournal entries necessary to record the events, includin#

yearend ad@ustments, and -% calculate the effect on AcmeFs income in the year %01%, and

in the year %01*. Show the amounts and whether they are #ains or losses.

a. n Septem(er 1, %01% Acme mporters a#rees to (uy merchandise from Bontreal

Suppliers. 3elivery will ta2e place on cto(er 1, %01%, and Acme will pay

Bontreal Suppliers $,000 on Ee(ruary 1, %01*.

(. n Septem(er 1, %01%, Acme mporters ma2es a firm commitment to (uy

merchandise from Bontreal Suppliers. 3elivery will ta2e place on cto(er 1,

%01%, and Acme will pay Bontreal Suppliers $,000 on Ee(ruary 1, %01*. n

cto(er 1, %01%, Acme enters into a forward purchase contract with A5

Gchan#e 3ealers for the purchase of $,000, to (e delivered Ee(ruary 1, %01*.

c. n Septem(er 1, %01%, Acme mporters ma2es a firm commitment to (uy

merchandise from Bontreal Suppliers. 3elivery will ta2e place on cto(er 1,

%01%, and Acme will pay Bontreal Suppliers $,000 on Ee(ruary 1, %01*. n

Septem(er 1, %01%, Acme enters into a forward purchase contract with A5

Gchan#e 3ealers for the purchase of $,000, to (e delivered Ee(ruary 1, %01*.

!he merchandise remains in AcmeFs inventory as of 3ecem(er *1, %01*.

d. !he E at Acme mporters (elieves that the U.S. dollar will continue to

stren#then with respect to the anadian dollar. n cto(er 1, %01%, he enters into

a speculative forward sale contract with A5 Gchan#e 3ealers for delivery of

$,000 on Ee(ruary 1, %01*.

e. n Septem(er 1, %01%, Acme mporters forecasts that it will (uy merchandise

from a anadian supplier. 3elivery and payment of $,000 is epected to ta2e

place on cto(er 1, %01%. n Septem(er 1, %01%, Acme enters into a forward

purchase contract with A5 Gchan#e 3ealers for the purchase of $,000 for

$0.8, to (e delivered cto(er 1, %01%. !he merchandise purchase occurs as

forecasted, and the merchandise remains in Acme's inventory as of 3ecem(er *1,

%01*.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 #!

A+S

1a.

10/1 Berchandise *,900

Accounts paya(le *,900

-,000 $.8"

1%/*1 Accounts paya(le 10

10/1

Gchan#e #ain 10

J-$.8" $.8 ,000K

%/1 Accounts paya(le *00

Gchan#e #ain *00

J-$.8 $.9 ,000K

%/1 Accounts paya(le *,40

ash *,40

-,000 $.9

(.

10/1 Berchandise *,900

Accounts paya(le *,900

1%/*1 Accounts paya(le 10

Gchan#e #ain 10

1%/*1 Gchan#e loss %0

nvestment in forward %0

J-$.89 $.84 ,000K

%/1 Accounts paya(le *00

Gchan#e #ain *00

%/1 Gchan#e loss %0

nvestment in forward %0

J-$.84 $.9 ,000K

%/1 Eorei#n currency *,40

nvestment in forward 00

ash *,90

%/1 Accounts paya(le *,40

Eorei#n currency *,40

©Cambridge Business Publishers, 2010

#" Advanced Accounting, 1st

dition

c.

10/1 Gchan#e loss 10

nvestment in forward 10

J-$."% $.89 ,000K

10/1 Eirm commitment 10

Gchan#e #ain 10

10/1 Berchandise *,900

Accounts paya(le *,900

10/1 Berchandise 10

Eirm commitment 10

1%/*1 Gchan#e loss %0

nvestment in forward %0

1%/*1 Accounts paya(le 10

Gchan#e #ain 10

%/1 Gchan#e loss %0

nvestment in forward %0

Accounts paya(le *00

%/1

Gchan#e #ain *00

%/1 Eorei#n currency *,40

%/1

nvestment in forward 00

ash *,90

Accounts paya(le *,40

%/1

Eorei#n currency *,40

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 ##

d.

1%/*1 nvestment in forward %0

Gchan#e #ain %0

J-$.89 $.84 ,000K

%/1 nvestment in forward %0

Gchan#e #ain %0

J-$.84 $.9 ,000K

%/1 Eorei#n currency *,40

ash *,40

ash *,90

%/1

Eorei#n currency *,40

nvestment in forward 00

e.

10/1 nvestment in forward 100

ther comprehensive

income 100

J-$.8".8 ,000K

10/1 Eorei#n currency *,900

nvestment in forward 100

ash *,"00

Berchandise *,900

10/1

Eorei#n currency *,900

%. Income efects:

%01% %01*

-a $10 #ain $*00 #ain

-( 100 loss 0 #ain

-c 100 loss 0 #ain

-d %0 #ain %0 #ain

-e 0 0

©Cambridge Business Publishers, 2010

#$ Advanced Accounting, 1st

dition

1". To!ic" Borro&ing in %oreign currency

L ,

A U.S. company purchases a 0day certificate of deposit from a <erman (an2 on cto(er

1. !he certificate has a face value of :10,000,000, costs $1*,"00,000 -the spot rate is

$1.*"/: on cto(er 1, and pays interest at an annual rate of " percent. n 3ecem(er

14, the certificate of deposit matures and the company receives principal and interest due

to it. !he spot rate on 3ecem(er 14 is $1.40/:. !he avera#e spot rate for the period

cto(er 1 3ecem(er 14 is $1.*9/:.

Required

Drepare all necessary @ournal entries to record the a(ove events on the U.S. companyFs

(oo2s.

A+S

10/1

!emporary investments 1*,"00,000

ash 1*,"00,000

1%/14

!emporary investments %00,000

Gchan#e #ain %00,000

$%00,000 -$1.40 $1.*" €10,000,000.

Eorei#n currency 14,1",8

!emporary

investments 14,000,000

nterest income 1",8

$1",8 -10,000,000 "R %/1% $1.40

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 #7

19. To!ic" S!ecu$ation in %or&ard contracts

L 7

n +ovem(er 1, %01*, a U.S. company thin2s the echan#e rate for the euro will fall, so it

enters into a forward contract in the amount of :1,000,000, for delivery on Barch 1,

%014. !his is a speculative contract. !he company's accountin# year ends 3ecem(er *1.

!he company closes the contract on Ee(ruary 1, %014. Gchan#e rates are as follows -$/

:

For&ard rate %or

S!ot rate Marc( -2+ ,*-0 de$i.ery

+ovem(er 1, %01* $ 1.4% $ 1.4*

3ecem(er *1, %01* 1.4 1.4

Ee(ruary 1, %014 1.48 1.4"

Barch 1, %014 1.0 1.0

Required

a. 3oes the company enter a forward purchase or a forward sale contract) Gplain.

(. Drepare the @ournal entries necessary on 3ecem(er *1, %01* and Ee(ruary 1, %014

to record the a(ove events.

A+S

a. A forward sale loc2s in the sellin# price. f the rate falls, as the company epects,

it will #ain (y (uyin# euros at the lower price and sellin# at the hi#her contract

price.

(. 3ecem(er *1, %01*

=oss %0,000

nvestment in forward %0,000

!o ad@ust the forward contract to fair valueH $%0,000 -$1.4 $1.4*

:1,000,000.

Ee(ruary 1, %014

=oss *0,000

nvestment in forward *0,000

!o ad@ust the forward contract to fair valueH $*0,000 -$1.4" $1.4

:1,000,000.

!he company closes the forward (y enterin# a forward purchase for delivery on Barch 1,

%014, at $1.4"/:. So the company sells at $1.4* and (uys at $1.4", for a net cash outflow

of -$1.4" $1.4* :1,000,000 $0,000.

nvestment in forward 0,000

ash 0,000

!o close the forward contract on Ee(ruary 1, %014.

©Cambridge Business Publishers, 2010

#% Advanced Accounting, 1st

dition

%0. To!ic" IFRS %or (edging %orecasted transactions

L ;

n Ee(ruary 1, %011, an talian company, with a Cune *0 yearend, enters a forward

purchase contract for $1,000,000 to (e delivered on Au#ust 1, %011. !he contract hed#es