Professional Documents

Culture Documents

Chapter 21 (IFRS 3rd Edition Manual)

Uploaded by

Kamrul Hassan0 ratings0% found this document useful (0 votes)

25 views99 pagesKeiso, Intermediate Financial Accounting, 3rd Edition, Chapter-21, Lease

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentKeiso, Intermediate Financial Accounting, 3rd Edition, Chapter-21, Lease

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views99 pagesChapter 21 (IFRS 3rd Edition Manual)

Uploaded by

Kamrul HassanKeiso, Intermediate Financial Accounting, 3rd Edition, Chapter-21, Lease

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 99

CHAPTER 21

Accounting for Leases

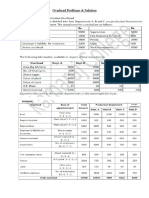

ASSIGNMENT CLASSIFICATION TABLE (BY TOPIC)

Brief Concepts:

Topics Questions Exercises Exercises Problems tor

Analysis

1. Rationale forleasing. §=1,2,3

2. Concepts, and 4567.8, 023.4 2997, 123.4 1.23.45

measurement of 9, 10, 14,12, 5,6.9,95,' 6,9,10,12, 5,8, 9, 10,

leases by lessees. 1374, 15, 23. \97/98,19 14, 15, 16 11, 12, 13,

14,15

3. Finance / Sales 11, 15, 16, 7,8,9,10, 5,7,8,.9,11, 67,911, 2.5

Type Leases. 17, 18, 19, 11, 12, 13, 12, 13, 17 12, 13, 14,

20,21,22,23 1 5

4. Special Issues 26,27 15, 16,21, 9, 16, 17 6,7,8,12, 3,45

22,23, 24 13, 1d

Other lease costs: 25

initial direct costs,

presentation and

disclosure.

"6. Saledeaseback. 28.29 26,27 18.19 6

“This material is dealt with in an Appendix to the chapter.

Copyrget © 2018 Wiky Kiera, FAS, Si, Scubors Manual (For nsbucior Use Only] Bri

ASSIGNMENT CLASSIFICATION TABLE (BY LEARNING OBJECTIVE)

Brief

Learning Questions Exercises

Objectives

Exercises

Problems

Concepts for

Analysis

1. Describethe 1,2,

‘environment

related to

leasing

transactions.

2. Eopleinthe 4,

accounting for 8,

leases by 1

lessees.

3. Explain the 44, 13,

accounting for 14, 15,

leases by 16,17

lessors. 18.19.

4 Discuss the 10,21

accounting and 23,26

reporting for 27

special

features of

lease

arrangements.

"5 Describethe 28, 29

lessee’s

accounting for

sale-leaseback

wansactions.

12347,

8.9, 10.12,

13,14, 18,

19,20

5,6,7,8,9,

10, 11, 12

13,17

6,9, 10, 11,

12, 14, 16,

Ww

18,19

“This material is dealt with in an Appendix to the chapter.

nz

1.2.7.8

12, 13, 14

1.2345

25

345

Copyright® 2018 Wiey Kieso, (FAS, Sie. Solutions Manual (Far insinactor Use Only)

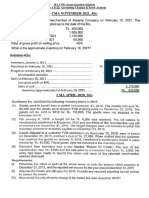

ASSIGNMENT CHARACTERISTICS TABLE

Level of Time

Item___Deseription Difficulty _ (minutes)

E211 Lessee Entries; No Residual Value Moderate 15-20

E212 Lessee Entnes; Lease with Unguaranteed Residual Moderate 15-20

falue

£213 Lessee Computations and Entries; Lease with Moderate 20-25

Guaranteed Residual Value

E214 — Lessee Entries: Lease and Unguaranteed Residual, Moderate 20-30

Value

E215 Computation of Rental; Joumal Entries for Lessor \00 Simple 15-25

E216 Lessor Entries; Sales Type Lease with Option ta Moderate 20-25

Purchase

E217 Type of Lease; Amortization Schedule Moderate 15-20

E218 Lessor Entries: Sales-Type Lease Moderate 15-20

E219 Lessee Entries; Initial Direct Costs Moderate 20-25

£21.10 Lessee Entries with Bargain-Purchase Option Moderate 20-30

£2111 Lessor Entries with Bargain-Purchase Option Moderate 20-30

E2112 Lessee-Lessor Entries; Sales-Type Lease witha Moderate «20-25

Bargain Purchase Option

£21.13 Lessee-Lessor Entries: Sales-Type Lease: Moderate 20-25

Guaranieed Residual Value

£21.14 Lessee Entries; Initial Direct Costs Simple 20-25

£21.15 Amortization Schedule and Journal Entries for Moderate 20-30

Lessee.

E2116 Lessee Accounting Moderate 20-25

£21.17 Lesser Accounting for an Gperating Lease Moderate 25-30

*E21.18 Sale-Leaseback Moderate 20-30

“£21.19 Lessee-Lessor, Sale-Leaseback Moderate 20-30

P211 Lessee Entries Simple 20-25

P212 Lessee Entries and Statement of Financial Position Simple 20-30

Presentation.

P213 Lessee Entries and Statement of Financial Position Moderate 3545

Finance Lease

P214 Lessee Entries, Lease with Monthly Payments. Moderate 30-40

P215 Basic Lessee Accounting with Difficult PV Calculation Moderate 40.50

P21.6 — Lessee-Lessor Entries, Finance Lease with a Simple 25-35

Guaranteed Residual Value.

P217 Lessor Computations and Entries, Sales-Type Lease © Complex 30-40

with Guaranteed Residual Value

Genyeget © 2018 Wey

iasa, FAS, 3a, Selutors Manual

(Fe insbuctsr Ube Only)

23

P21.8 Lessee Computations and Entries, Lease with Complex 3040

Guaranteed Residual Value

P21.9 Lessor Computations and Entries, Sales-Type Lease © Complex 30-40

with Unguaranteed Residual Value.

P21.10 Lessee Computations and Entries, Finance Lease with Complex 30-40

Unguaranteed Residual Value.

P2111 Lessee-Lessor Accounting for Residual Values Complex 30-40

P21.12 Lessee-Lessor Entries, Statement of Financial Position Moderate 36-45

Presentation, Finance and Sales-Type Lease.

P21.13 Statement of Financial Position and Income Statement Moderate 345

Disclosure—Lessee

P2114 Operating lease. Moderate 30-40

P21.15 LesseeLessor Entries, Operating Leage'with an Moderate 30-40

Unguaranteed Residual Value:

CA21.1_ Lessee accounting and reporting. Modarate 15-25

CA212 Lessor and lessee accounting and disclosure Moderate 25-35

CA21.3 Lessee accounting: Moderate 20-30

CA214 Lease capitalization, bargein-purchase option. Moderate 20-25

CA215 Short-Term lease vs. finance lease. Moderate 20-30

*CA21.6 Sale-Leaseback. Moderate 15-25

a Copyright® 2018 Wiley Keso, IFAS, Jie. Solstions Manaal (For insiracter Use Only)

ANSWERS TO QUESTIONS

4. The major lessor groups in the United States are banks, captives, and independents. Banks are the

largest players in the leasing business. Captives are subsidiaries whose prmary business is to perform

leasing operations for the parent company. They have the point of sale advantage in finding leasing

Customers for as soon as 2 parent receives a possible order, a lease financing arrangement can be

developed by its leasing subsidiary. Furthermore, the Captive (lessor) nas the product knowiedge which

gives it an advantage when financing the parents product. The curent trend is for captives to focus om the

Company's products rather than fo do general lease financings Last, independents are ofien good at

developing innovative contracts for lessees.

LE-+ Blane Cinsty Bine Trae EAGER: Retest Thining AICPA BE ene ASPAPE eeatng, ASPAPE-None

2. (2) Possible agvantages of leasing for tne lessee.

1. Leasing may be more flexible in thatthe ease agreement may contain less restrictive

Provisions than the bond indenture.

2. Leasing permits 100% financing of assets; as the lease is often signed without requiring any

money down from tne lessee

3. Leasing may permit maré:rapid changes in equipment, reduce the nsk of obsolescence, and

pass the risk in residual value to tha lessor or 2 third party.

4 Leasing may have favorable tax advantages.

Assuming that funds are readily available through debt financing, there may not be great advantages (in

‘agaon fo me above-mentioned) to sxging a Noncancelabe, fong-term lease. One adatonal acvaniage

of leasing is its availability when other debt financing is unavailsb!

{b) Given the new reporting standard on leasing the financiel statement effects of a long-term

noncancelable lease versus the purchase of the asset are somewhat similar. That i assets under a

longer lease ere capitalized at the present valuie of the future lease payments and this value i=

probably equivalent to the purchase price of the assets. On the liability side. the bond payable amount

would be equivalent to the present value of the future lease payments. in summary, the amounts

presented in the statement of financial positon would bé quite comparable. The descnption of the leased

‘asset (right-ol-use asee!) and related lability would however be different than under a bond financing as

would the general classifications; the specific labels (leased assets and lease labiity) would be different.

2-4 glnee 6. cmcohytinseem, Tone: £12 ANCHE! Retstua Tamang, AIGA: New, AIGPA FO Sugemny, AGFA ED: wee

3. Passible advantages of leasing far a leseor

1. [often provides profitable interest margins.

2 Mt can Stimulate sales of a lessor product whether it be from a daaler (lessor) ar a

manufacturer (lessor).

I offen provides tax benefits which enhances the retum for the lessor and other parties to the

lease,

can provide @ high residual value to the lessor upon the return of the property at the end of the

lease term, which can potentially provide very large profits.

EDA tase: 6, Sma Mee Tine EE ANCHE, Ratestve Tmt, AIA BE Mate, AICPA PE: Recon, ACPA RS. Nene

4. The discount rate used by the lessee in the present value test and for valuing the leaee liability i= the

implicit interest rate used by the lessor. This rate is defined as the discount rate that, at the

Conmencoa oe (oa6s CASE al Sopa Been ES a. eos TONE

residual value to be equal to the fair value of the leased asset. However, if it is

impracticable tor te lessee to determine the impli fala of the leseor tha lessee. Should use ME

incremental borrowing rate. The incremental borrowing rate is the raie of interest the lessee would have

te pay on a similar lease or incur 10 Devrow over @ similar term the funds necessary to purchase the

a

AMEE, Retestet Mununy, AEMARE Nate AIZRA RE: Magan, AIERARE. Nat

Copmnght@ 2018 Wey Kinsa, RS.

‘outers

(Fer instructor Use Only)

Questions Chapter 21 (Continued)

5. Paul Singer is for the most part correct. As long as the lease has a lease term of over 12 months and the

lease is not low value, Paul IS correct that Ine lease must be recognized on tha statement of financial

Position of the lessee. However, the new lease standard allows for @ short-term lease exception. Under

{he short-term lease Or low value lease exCephons for lesseas, rather ihan recording 3 nighl-of-use asset

and lease liabilty, lessees may elect to expense the lease payments as incurred. In this case, the lease

is not capitalized on the statement of financial position as Paul suggested.

LG. Be0n FCN REE Tene Po AACN ReNPaDIe TN ACHALEE Nan AICRA PC Mesby AIDRA RE: NGNE

6. (a) Residual value is the expacted value of the leased ascet af the end of the lease term.

(b) A quarantead residual value Is @ guarantee made to a lessor-that the value of mre leased asset

returned to the lessor at the end of a leas= will be at least s specified mount Any amounts probable to

ba paid undar the residual value guarantee should he included in the present value of payments.

(c) Inital direct costs ara incramantal costs of a jaas@ that would not have been incurred nad te lease

Not been executed, [nitial direct Costs inoured by the lessee are inckided in the cost of fhe right-oFuse

assat but are not recordad as part at the laase liability.

AO Sten K Comet ainnn Tene 7g AGS tain Ae

7. Abargain purchase option is 2 lease purchase option in which the lessee can buy the assel for a price

that is significantly lower than the underlying asset's expected fair value at the date the option becomes

exercisable, thus making the exercise of the oplion reasonably certain. A bargain renewal option i=

essentially the same conceptually as a bargain purchase option, except the option is to renew the lease

5 opposed to purchasing ihe aséel That is, 2 bargain renawal option is an option in which tha peice of

renewal at which the lessee can buy the asset is significantly lower than the underlying assef's expected

‘air value at ine date the option becomes exercisable, thus making the exercise of ine option reasonably

certan.

A bargain purchase option and a bargan renewal option have similar impacts on the initial classification

and measurement of he lease. With respect to classification, the existence of a bargain purchase option

is one way a lessor can meet the finance/sales-type lease classification criteria, In fhe case of a bargain

Fenowal opton, the adional lease term that would be added by exerosing the option should be

included in the lease term when assessing whether or not the lessor meets the lease term test. The

present value of the option price would also be used in assessing whether the lessor meets the present

ue rt fot meseumernnnd purine, 20 pater A Af DOR a Tema RNCTSRS OPROR, Sh

bargain renewal option should be incuded in the initial value of the lease receivable.

LE, Boon Eitealy Eine Tene a AMESE Retain Teking CEASE: None ADEA RS: Recotng, ADEA RE-None

8 The lease liability is recorded at the present value of the lease payments, This includes the periodic

Tantal payments made by the lassee, bargain-purchasa option if any, and amounts probable to be ved

under @ residual velue guarantee. The present value of the lease payments is recorded as a lease

habinty by the lessee

2 Boon Cetnaty Benin Tore Po AMDSS Seteche ese Ace

9. Wonda Stone is correct in her interpretation. For purposes of lease classification by the lessor the

prasent value of the guaranteed residual value is used in determining whether tne present value (90%)

test is met. The amount included in the measurement of the lease liability is only the amount that the

lessee expects to owe under the residual value quaraniee at the end of me lease. For example, if 3

lessee guarantees = residual value of $10,000, but it is also probable that the lessee does not expect to

‘owe any additional monay at the end of the lease, then the guaranteed residual value would nol be

included in the initial measurement af the lease liability

here AGA Fo: Rastmy AISKPG:Nate

Nor MORALES Rast. AISA BC None

hore ADEA ES Racodre AISEKEE-Nonw

rir) Copyright® 2018 Wiley Kiso. FAS,

ola

Manual (Por insiracter Use: Ory)

‘Questions Chapter 21 (Continued)

10. The ngnt-of-use asset is infialy measured as Me Same amount as the lease lability (Le. present value of

lease payments), adjusted for initial direct costs, prepayments and lease incentives. Iniial direct costs

paid by the lessee will increase the initial value of the right-otuse asset. Similarly, prepaid rent paid by

the lessee will increase the amount of the nght-ofuse asset recorded. Lease incentives granted fo the

lessee by the lessor will decrease the inital value of ihe right-of-use asset,

AE. A|Bser = Sitovte Senin Ton £4 AASHE: Aatecton Teng, AICPA BE: in ACSAED rsorng. AIRAE Hone

11. Variable lease payments should be included at the level of the index/rate at the commencement date.

Incteases or decreases in the index should nat be assumad when valuing the lease lability. Thus, for the

lease in this question, the lessee should not assume any changes in the price index. The difference in

‘the monthly payment in the second year from the first year of $100 ($5,100 - $5,000) ts expensed in the

pafiod incurred. Only if he lessee knows the amount of the weriabla payment in subsequent perio ds

‘should it include these payments in the lease liability computaton..The lease payment in the second

year is $5,150 ($5,000 X 1.03).

i er

12. The lessee records a right-of-use asset and lease liability at commencement of the lease. The lessee

then recognizes interest expense on the lease liability over the life of the lease using the eflective

interest method and,records depreciation expense on the right-of-use asset generally on @ straight-line

basis. A lessee therefore reports both interest expense and depreciation of the right to use asset on the

income statement As a result, the total expense for the lease transaction is generally higher in the

earlier years of the lease arrangement under the finance lease method. The lessee continues to

depreciate the nght-of-use asset and decrease the principal of the lease kabiliy unl both are reduced to

zero al the end of the lease. The right-otuse asset should be depreciated over the lease let, unless

there is @ bargain-purchase option or ownership of the asset transfers to the lessee at the end of the

lease. If either of these criteria are met, then the lessee depreciates the right-of-use asset over the

economic ife of the asset

LS, teen Onety Soe Tee De AACER Reteie Tsing AICRALER: Nong ALORA RE: Reset, Masauemen ACHARE Mae

13. A low walue lease Is a lease of an underlying asset with a value of $8,000 of less. Rather tian recording

@ right-oF-use asset and lease lability, a lessee may elect to expense the lease payments as incurred,

Ea, Been AP Comauty ma Tome: 6 ANGE Retest Teeny, CPA RE:Nang WORAS: Rese, AIGPA PC: Nate

44, A short-tenm lease is 3 lease thal, al fhe commencement dale, has lease term of 12 months or less

Rather than recording @ right-ofuse asset and lease liability, lessees may elect to expense lease

payments a incurred.

(Loca. Boom Gftcut: Hoe Tre of AACHE Retecne Trevong. AEALNE: hone. AIGEA Et esoatrg. AISEA EE: Nane

15, If a bargain-purchas® oplion exists, the lessee must increase the present walue of the lease payments by

{the present value of the option price. This is the case for both classification and inital measurement of

the lease liability and right-of-use asset A bargain purchase option also affects the period over which the

Tight-of-use asset is depreciated, since the lessee amorizes the asset over its economic iife rather than

the term of the lease. If the lessee fails to exercise the option, the lessee will recognize a loss to the

extent of the book value of the right-of-use asset in the periad that the option expred

LS: Seer Cio Rin Tree PE AACE: Retncun Tsing ACPALEE: Nena AGFAPE: Rare, MMgaawmes AGPAPE: MEE

16. From the standpoint of the lessor, leases will (with few exceptions) be classified for accounting pumoses as

either (a) operasng leases or (b) fnance (sales-type) leases.

Afinance (sales-type) lease meets one or more of the following five tests

1. The lease transfers ownershp,

2. The leaze contains a bargsin-purchase option,

Capynght® 2012 Wiley eso, FRE,

Questions Chapter 21 (Continued)

The lease term is @ major part of the remaining economic life of the underlying asset (Le. equal to

‘75% OF Mote of the esimated economic life of the prope’

The present value of the lease payments equals or moos ‘substantially all of the underlying asset's

‘air value (Le 90% of the fair value of he

property),

5. The easel is Of such a specielzed nature fiat is Scpected to have no attentive use to tie eas at

the end of the lease

It none of the above five tests are met. the lease will De Teated a5 an operatng lease. The IASB

Concluded thal by meeting any one of the lease classificaton tests, the lessor Vansfers control of he

leased asset and therefore sabsfies a performance obligation, which is required for revenue recognition

under the IASB’s recent standatt on revenue That is, if the lessee takes ovnership or consumes a

acini petan oF fie underiying asset over the lease term, the lessor has in substance transferred

Conte! of Ne nghL-oruse asset and ine lessor Nae 4 Sales hype lease On Me other hand, W Me ase

does ot Wanton contol of the asset over the leave femm, the lessor peneraly uses the opersting

approach in accounting for the lease.

ort 4 Beem x omesty maw, Ter 5s AACE: Renate mpm Woes es: narelAidaNec: atsonng, CRAZE: nae

17. (a) Ita lease is for a major part of the-economic ife of the lease. the lease is classified as a finance

lease. In practice, 75% of the economic life of the asset fs generally used to meet this classification test.

That is, if the lease term is 75% or greater of the economic Ife of the asset, the lease is classified as &

finance lease.

(b) It the jaase term is 12 months or less the lessee may elect to use the short-term lease exception, and

‘thus the lease would not be classified as finance lease, The lessee would expense the lease payment in

‘he applicable year.

(c) If the lease transfers ownership of the asset af the end of the lease, the lease is dassified as a

finance lease. This situation meets one of ihe classification tests for a finance ease

LO-4 noe Cuts Hise Tre HE MAGEE AuSecie Thning, NEHA HE hone ACHAIG: Macetng AICHAAE None

18. A Ree maces etna an fe prement vae t Be pesa el pee e

jaranteed value plus any unguaranieed

indicated in the text, for homework problems, we assume that the present value of the ungusrenteed residu

‘value Should be inciudad as part of the lease recaivanie.

LOU nee Cet Renee Te HE MAGEE: Rtoncne Thong CEA RE None ASEAES:Reroaag AEA BC NONE

19. Under the operating method, each rental receipt of the lessor is recorded as lease revenue. The

indamying ieased asset is still recognized on the statement of financial positon of tha lessor and

ur

depreciated in the normal manner. in addition to depreciation, any other related costs to the lease

arrangement (i.e. insurance, maintenanca, taxes, etc.) are recorded in the period incurred.

LSE oom # iraviy Hime. Troe I AASEE elecne hnong, AGHA hone AGHARE: Reootng,Urtsiemen: AGHARE Noor

20. Under a finance (sales-type) lease. lessors report in the income statement Sales Revenue and Cost of

Goods Sold (and resulta Oss prot) al commencement ofthe lease. Dung he \eaco term Interest

Rewenue on the Lease Receivable is reported. Under an operating lease, lessors report Lease Revenue

{generally when payments ae received; and Depracaton Expense on ha leased aeset

LO-8 Rintm F Cmeuy Smee. Tee PS MAGEE: AEMEENE Tameng, AGFAS: Nene ACPAFS: Restng. UrtRuement ACER EG: uate

ns Copght® 2018 Wie Keno, FRE

Questions Chapter 24 (Continued)

a. Wales Cora ca Ge fhe Seance tse pe) less reo Uh Hee meets oe or ever of ee

(1) The lease transiers ovmership of the property to the lessee,

(2) The lease contains bargain-purchase option,

(3) The lease term is a major part of the remaining economic life of the underlying asset (.¢. equal to:

75% of more of the estimated economic Ife of ine property),

(4) The present value of the lease payments equals or exceeds substantially all of the underlying

asset's fair value (Le. 90% of the fair value of the property),

(5) The asset is of such a specialized nature that it is expected to have no allernative use to the lessor

at the end of the lease term.

soo) Beate omen gee Tre 5 MAcae arte Tees Poeesotns acoso nate

22. “etnany Group should recognize he present value of ne lease paymants (normal Sales prica) as sales:

revenue, and the carving amount (book val) of the asset as cost of goods sod, Thus, the gcse prot

from the lease should be recognizad at the commencement of the jease as the differance between the

‘an

reduce both the sales revenye and id cos of goods ‘50K by the present value of the unguaranteed residual

valua. The gross profi, however, will net change.

G27 ise Coca Benin Tree Ff AAG ate cg CRABS hong ASEAEC Recetng AEA EC None

25. Although not part of the classification tasts, the lessor mus! algo determine whathar the collactibilty of

payments from the lessee is probable, as i has implications for the subsequent accounting of the lease.

Because collection of the lease payments (= not probable for Packer ple, @ should record the receipt of

‘the payments as a depost liability and not derecognize the lensed asset

LE Rteaee i Cet ine Tree ME MASSE Rate Thing MERABE Nong ADRLPC Receding, ADARE-Note

24. (2) (1) The lessees accounting Br 2 lenge wan on wnguarantond resis vitua Re came ae the

iccounting for a lease vath no residual valve. That is, unguaranteed residual values are not

incued'n the lesses'sleace payments, either lr claseincaion or measurement purposes

(2) A quaranteed residual value may be included, depending on how much a lessee expects 10

‘owe under the guarantee.

‘The value of the lease liability may be made up of two components—the periodic rental payments

and amounis probable to be owed under 2 guaranteed residual value. That is, i the expected

residual value at the end of the lease term is less than the guaranteed residual value. then the

lessee will expect to pay in cash a certain amount to the lessor at the end of the lease term, AS

‘such, the lessee should include the present value of the difference between the guaranteed

residual and expected residual if he axpacted residual is less tan the guarantee. If he residual

value at the end of the lease term differs in any way from the expected residual at the

commencement of the lease, tha lessae recognizes a IOS or gain when the final payment of the

guarantesd residual is made

2:4, 6 teem Gimeaty mae, Tine teh MAGEE Meteute Tammy AIC

(b)

AGHA AE Resomng RGA HE ne

25. The amount to be recovered by the lessor is tha same whether the residual value & guaranteed or

unguaranteed. Therefore, the amount of the nerodic rental payments is set the same way by the lessor

Whether the residual value is guaranteed or unguarantaed,

0-1 ener Comtutr Bi. Tree En8, MAGEE! Retest Pinerg. AIGEA EE feng, WORK EC: asoamg awERA=E Nene

Gepynght © 2018 Winy Kiezo, FPS, Se, Souters Manual Ferinstuetor Use Only) 23

‘Questions Chapter 21 (Continued)

26. _Inifial direct costs are the incremental costs of a lease that would not have been incurred had the lease not

been executed. For the lessee, some costs that are included in the night-of-use asset are commissions,

legal fees from the execution of the lease, lease documentation preparation costs incurred afler the

exeoullon of the lease, and consideration paid for a quaraniea of residual value by an unrelated third

party.

For operating leases, the lessor should defer initial direct costs and amortize them as expenses over the

term of the lease. In a sales-type lease transaction, the lessor expenses the inifial direct costs at lease

commencement (in the period ni which it recognizes the prof on the sale), An exception is when there is

No selling proft or loss on the transaction, in which case the inital direct costs are deferred and

recognized over the lease term

(LE: 4, Same Ruy: Re Tree 2 AACR. RENEE Ming, AERABE Nene AIDAA PE: ReseanVlAibeARE: None

27. Lessees and lessors must provide additonal quaiftative and quantitative cisciosures to heip financial

statement users to assess the amount, fiwnd, and uncertainty of future cash flows. Qualitative lease

Gisclosures incude the nature of the leases, how variable lease payments are determined, the existence:

‘and leems and conditions for options to.axtend o# terminate the lease and for residual value guarantees,

and information about significant assumptions and judgments such as discount rates Quantitative

Gsciosures include total lease cast, nance lease cost Segregated between ihe amorlzation of the right-

of-use assets end interest on the lease liabilities, operating and short-term lease cost, weighted-average

remaining lease term and weighted-average discount rate (s between finance and operating

leases), and matunty analysis of fnance and operating lease liabilttes on an annual basis for a minimum

of each of the nex five years and the sum of the undiscounted cash flows for all years thereafter.

ASA. Boon H Gta Eile Tine TE AASES Retecnie hinkng ACPA EE: Ment ACEARE:Resntng AISEARE: None

“28. In a sale-leaseback arrangement, a company (the seller-lessee) transfers an asset to another company

(the buyer-lessar) and then leases thal asset back from the buyer-lessor. In order to qualify for sale-

leaseback treatment, the initial transfer of the asset must be such that the seller-lessee gives up control

of the asset to the uyer-lessor. In this vay, the transaction is = sale, and gain or loss recognition is

appropriate. In addibon, the subsequent leaseback must be dassified as an operating lease for the

Sellet-essee, This is because f any of the lease classification lests are mel, the seller-esses never

‘actually gave up control of the asset, and thus a sale is deemed to never have happened. As long as the

initial ovner of the assel conlinues to control the asset, it should nol record a sala nar recagniza a gain

of logs. instead, the transaction is treated as borrowing money from the ‘buyer-lessor in a financing

arrangement, often labeled a “failed sale.”

LSE Boon Catchy Hine Tine Toh AMSSS: Retncie Tokens ACEALRE: Kory ADSEAEC: Remoting AISEAEC: Note

"29. The sale and subsequent lease will receive sale-leaseback accounting treatment. The inftal transfer of

the asset was a sale, and ine seller-lessee gave control of the asset to ine buyer-lessor. in aggiven, ine

subsequent leaseback is classified as an operating lease, and thus Sanchez never takes control of the

asset back trom Harper. Had the leaseback been classified as a financing lease, tha transaction would.

have been considered @ ‘failed sale’ end would have simply been accounted for as @ borrowing

arrangement. However, because It qualities for sale-leaseback teatment, Sanchez should recognize

the RS4 milion gross profit at the commencement of the lease and record @ nghl-oFuse asset and

lease liabilty at the present value of the lease payments.

AGE SER AE Commu Smiem Tien 5 AAGOS nla Trey AGFA SE NINE ASEAFS Reset AISEAPC MMe

20 Capyeghe® 2018 Wiey Riese, IFAS, die Selsions Manosl (For nevocter Use Oni)

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 21.1

The lease payments in the lease arrangement will include both the annual fixed

payments of $800,000 each year, plus the €11,000,000 bargain purchase option

at the end of the lease term (as it is reasonably certain to be exercised). Thus,

the lease payments for the lease agreement total (€800,000 x 6) + €11,000,000 =

€15,800,000.

Lo: micom: AP, OMe: SMB, Tone: £4 ARCO: CamcaMER, AICRAIMRC dad AIDA re: MeSNA Aitra Po: csmaraneerbon

BRIEF EXERCISE 21.2

The lease payments for years 1 and 2 will be $1,700 ($2,000 annual rental minus

$300 lease incentive). In year 3, Fieger will receive no lease incentive, and will

have a full lease payment of $2,000. Thus, in total over the first 3 years, the lease

payments will be $6,400 ($1,700 + $1,700 + $2,000).

Lest ioam: AP. cama: Bm, tans: 84, ARE: CommeMMAE, Ale

BRIEF EXERCISE 21.3

Variable payments in a lease are not considered in determining the initial value

of the lease liability and right-of-use asset. Because the lease payments are

based on 4% of net sales, these payments are considered variable, as they are

not based on an index or rate, the future level of which in not known at lease

commencement. It does not matter that it is highly certain that Sanders will

achieve a minimum of £1,000,000 in net sales each year. Thus, these variable

lease payments are not included in the initial valuation of the lease liability and

right-of-use asset. Since they are the only payments being made in the lease

agreement, Sanders would record the right-of-use asset at zero and record lease

expense when payments are made.

BRIEF EXERCISE 21.4

12/3118

Right-of-Use Asset ($41,933 X 3.67710") 160,000°~

Lease Liability... 150,000

Lease Liability . 41,833

Cash .. 41,933

Copyrghi@ 2018 Wisy Kisco, AS, Ye, Soutors Manual (Por Instructor Use Only) 2-11

BRIEF EXERCISE 21.4 (Continued)

“Present value of an annuity-due of 1 for 4 periods at 8%.

“Rounded by $1.

12/3449

Interest Expense [($180,000 - $41,833) X a 8,645

33,288

Depreciation Expense... 37,500

Right-of-Use Asset

($150,000 + 4)...

{0:2 eon: AP, Cina: tna, Tne: 4, AAC A ICRA HB: Rone AICPA Raping, ACPA AE: Meme

BRIEF EXERCISE 21.5

42/3419

Interest Expense [(€300,000 - €48,337) X 8%] 20,133

Lease Liabil 28,204

Cash

Depreciation Expense....... 37,500

Right-of-Use Asset

(€300,000 + 8)

16:2 eam: AP, emnay: tle Tame: £7, ARIE: An,

BRIEF EXERCISE 21.6

33,975"

“PV of rentals (£5,300 X 6.20637")

PV bargain purchase option (£2,000 X 0.54027)"

“Present value of an annuity-cue of 4 for 8 periods at 8%.

“Present value of 1 for 8 periods at 8%.

$,300

2-12 Cenyrghe®

Solitons Mancal

41,933

37,500

48,337

37,500

33,975

BRIEF EXERCISE 21.6 (Continued)

42/34/19

Interest Expense [(£33,975 - £5,300) X 6% 2,204

Lease Liability. 2,294

Depreciation Expense... 3,398

Right-of-Use Asset

($33,975 + 10°)... 3,398

“The right-of-use asset is amortized over the economic life of the asset instead

of the lease term because of the bargain-purchase option included in the lease

contract, given that the lessee plans to take ownership of the asset.

$005, Roos: AF, Coty: tela, Tee: 67, AACE: Anat, ALCP EE ch AICPA Raporng, AIDE RC“ Wene

BRIEF EXERCISE 21.7

Fair value of leased asset £70,000

Less: Present value of guaranteed residual value

(£5,000 X .50025") 2,501

Amount to be recovered through lease payments £67,499

Amount of equal annual lease payments (£67,499 + 6.74664") £10,005

“Present value of 1 for 9 periods at 8%.

“Present value of an annuity-due of 1 for 9 periods at 8%.

LON Race AP, Dieu Mla Tne: 7, AACE: Anat, AICPA BE: Mang, IEMA PC Reportng, ACPA RE: None

BRIEF EXERCISE 21.8

Fair value of leased asset $47,000

Less: Present value of lessor’s expected residual value“

($30,000 X .79209"*) 23.763

Amount to be recovered through lease payments $23,237

Amount of equal annual lease payments ($23,237 + 3.46511") $6,706

“The expectation of the residual value of the lessee would not matter in this

case. The lessor uses its own expectation of the residual value in determining

the annual lease payments. The lessor probably would not even be aware of the

lessee’s expectations.

“Present value of 1 for 4 periods at 6%.

"Present value of an or ry annuity for 4 periods at 6%.

Eapyget® 2000 Wiey Wiese, ERS De Saubors Warusl (Bor instructor Use Only 2-13

BRIEF EXERCISE 21.9

Lease Receivable (4.99271* X £30,044) 150,001

Cost of Goods Sold 120,000

Sales Revenue 150,004

Inventory ... 120,000

Cash... 30,044

Lease Receivable 30,044

“Present value of an annuity-due of 1 for 6 periods at 8%.

$0: 2, goon: A, ome tain Trew 3, ‘eeperon GEA He nome

BRIEF EXERCISE 21.10

30,044

20,447

Lease Bevanas] 1iei80, 001 - £30,044) X 8%] 9,597

20:8. se: AP Dest: tna Tena, AACE: Anais, AIGRA ME: NEES, AICPA FO: Razating, NGPA PC: Nome

BRIEF EXERCISE 21.11

Lease Receivable (€40,800 X 4.31213") 175,935

Cost of Goods Sold 120,000

Sales Revenue 175,935

Inventory 420,000

Cash... 40,800

Lease Receivable 40,800

“Present value of an annuity-due of 1 for 6 periods at 8%.

10:5, Bom: AP Diu: tale, Ten: AAC RE Ana ICRA Bane AICPA FO Repaing ICRA PE: Nase

BRIEF EXERCISE 21.12

Cash... 40,800

Deposit Liability*.. 40,800

“When collectibility of lease payments is not probable, the lessor does not

derecognize the asset or recognize selling profit on the lease. Instead, Geiberger

would recognize any cash receipts as a deposit liability.

Lo Bieene Ae, mt: mam Te: 7, AAC HE: Anmyen, MIOBA BE: AUGEA EG nparOng, AUGER: Nom

ae CGosyrght® 2018 Wiey Kissa. PRS, Se. Selvions Maral (Far Ineucior Use On

BRIEF EXERCISE 21.13

Lease Receivable a7

Interest Revenue. 57

Inventory... 1,000

Lease Receivable 1,000

Note to Instructor: The above two entries can be combined into one entry at the

end of the year, as shown below:

Inventory... 4,000

Interest Revenue. 87

Lease Receivabl 343

Lo: exam Fmt: tm, Ten 6.7, 82 Ara Pe ane

BRIEF EXERCISE 21.14

ir

Right-of-Use Asset (2.83339*° X £35,000 98,169

Lease Liability... 99,169

35,000

36,000

“Present value of an annuity-due of 1 for 3 periods at 6%.

Schedule A.

KINGSTON PLC

Lease Amortization Schedule

Annuity-Due Basis:

Reduction

Interest (6%) of Lease

Date Annual Payment on Liability Liability _ Lease Liability

wig £99,169

44g £35,000 £ 0 £35,000 64,169

41/20 35,000 3,850 31,150 33,019

424 35,000 4,981 33,049 0

Eopyepet® 2008 Winy Wiese, FAS, ie, Seuters Manual (Fer nsbuctor Use On) 2-15

BRIEF EXERCISE 21.14 (Continued)

12/34/18

Interest Expense... 3,850

Lease Liability...

Depreciation Expense (£99,169 = 3)... 33,056

Right-of-Use Asset.

LEH Roan: A, Mout: Menge Tne: 8, ASHE: At, Af

Reporting AIEPA Pe Mone

BRIEF EXERCISE 21.15

ing

Cash... 35,000

Unearned Lease Re’

12/34/49

Unearned Lease Revenu: 35,000

Lease Revenue.

Depreciation Expense... 25,000

Accumulated Depreciation -—

Leased Equipment (£200,000 + 8)

68 Some aP, Com: Ama, Tame: 2.6, AACN: Anus, AICPA BE aA, ACP,

aatereng aces Pe-nere

2-16 Conyrght® 2018 Wiey Kesa FRE, die. Selsions Manval

3,850

33,056

35,000

35,000

25,000

(Far insiracter Ua

BRIEF EXERCISE 21.16

Right-of-Use Asset (2.78326" X $12,000)

Lease Liability... 33,399

“Present value of an annuity-due of 1 for 3 periods at 8%.

Lease Liability ..... 42,000

Cash 12,000

Schedule A

RODGERS CORPORATION

Lease Amortization Schedule

Annuity-Due Basis

Reduction

Annual Interest (8%) on of Lease

Date Payment Liability Liability Lease Liability

49 $33,399

Ani $12,000 $ 0 $12,000 24,399

41120 12,000 1,712 10,288 14,441

A241 12,000 889 44,191 O

12/31/49

Interest Expense 4,742

Lease Liability. 1,712

Depreciation Expense ($33,399 + 3) 11,133,

Right-of-Use Asset... 41133

BRIEF EXERCISE 21.17

Cas! 12,000

12,000

Unearned Lease Revenue - 12,000

= 12,000

aie

Ora Wy For natucior Ure

BRIEF EXERCISE 21.17 (Continued)

Depreciation Expense...

Accumulated Depreciation—

Leased Equipment [$60,000 + 10).

61 Boom: AF Cena: Himala, Tamw: £4, ARE RE: Anan. AACE BE: Roe,

BRIEF EXERCISE 21.18

£17,000 X 2.83339" = £48,168

“Present value of an annuity-due of 4 for 3 periods at 6%.

Because the residual value is unguaranteed, Escapee ple does not include it in

its computation of the annual lease payments. If the residual value was

guaranteed, the lessee may or may not be required to include the residual in the

calculation of the lease payments, depending on whether the expected residual

value was higher, equal to, or lower than the guaranteed residual value.

Ler 8 eam: A, Mey: OBST, ane: Bt AAG ANAWDS, AOE, Roe. AICPA Pe: ReBORENG. AICPA PE: an

BRIEF EXERCISE 21.19

(a) The value of the lease liability would remain the same if the only fact changed

from BE21.18 was the guarantee of the expected residual value. Residual

values should only be included in the lease liability when the expected

residual value is less than the guaranteed residual value (i.e. when the lessee

expects to make an additional payment at the end of the lease term to the

lessor).

(b)

Following from the above reasoning, if the expected residual value drops to

£5,000 and Escapee guarantees a residual of £9,000, Escapee will need to

account for the difference between the expected and guaranteed residual

value in calculating the initial lease liability as follows:

PY of lease payments (£17,000 X 2.83339") £48,168

PY of residual value [(£9,000 - £5,000) X 0.83962") 3,356

Lease liability £51,526

*Present value of an annuity-due of 4 for 3 periods at 6%.

“Present value of 1 for 3 periods at 6%.

ais Ganyaghe © 2018 Wiley (pions Mara

BRIEF EXERCISE 21.19 (Continued)

Note to Instructor: The measurement of the lease liability/right-of-use asset

only uses the amount probable to be owed under a residual value guarantee.

The classification test related to the present value test uses the full amount

of the guaranteed residual value to determine whether the finance or

operating method of accounting for the lease is followed by the lessor.

$0: 2 mine: AP, cau: Meena, Tm: 7, AACE: Anan, AICPA REL Ne, AICPA Po: REREPENG. AICPA: Mam

BRIEF EXERCISE 21.20

Right-of-Use Asset

Lease Liability

“PV of rentals (€40,000 X 5.21236*) €208,494

PV of guaranteed

residual value (€20,000 - €10,000°™) X 0.70496" 7,050

Lease liability €215,544

Lease Liability 40,000

Cash

“Present value of an annuity-due of 1 for 6 periods at 6%.

“Present value of 1 for 6 periods at 6%.

“The lessee need only include in the initial lease liability the amount of the

residual value that it expects to pay at the end of the lease term. Thus, in this

case, only the residual value in excess of the expected residual value (up to the

guaranteed residual) should be discounted to present value and included in the

computation of the lease

LG ms Am, Gimout: WeseraM Ta: AAG: Anan, AuD% BE: Noe. AICPA PE: ReRarDN, AIGeA PE: Nam

BRIEF EXERCISE 21.21

12/34/18

222,597"

180,000

Lease Receivable

Cost of Goods Sol

Sales Revenue

Inventory ....

*([€40,000 X 5.21236) + [€20,000 X .70496))

222,593

480,000

D2 Wisy Were, FPS Se, Souters Werusl For instuster Use Only 21-18

BRIEF EXERCISE 21.21 (Continued)

Cash. 40,000

40,000

4234/18

40,000

29,084

10,956

BRIEF EXERCISE 21.22

Lease Liability

In calculating the lease liability, Forrest must determine which of the executory

costs are considered a component of the lease (to be considered in the

measurement of the lease liability).

« The real estate taxes in this case are variable payments and therefore are not

considered in the measurement of the lease liability and related right-of-use

asset.

« The fixed $500 insurance payments are included in the measurement of the

lease liability because the insurance costs are a fixed part of the rental

payments. The lease liability is computed as follows:

PV of rental payments (4.31213° X $4,638): $20,000

PV of insurance payments (4.31213" X $500): 2.156

Initial lease liability: $22,156

“Present value of an annuity-due of 1 for 5 periods at 8%.

Right-of-Use Asset

The right-of-use asset is initially measured the same as the lease liability, though it

is also adjusted for any initial direct costs, prepaid rent, and lease incentives

associated with the lease. The legal fees resulting from the execution of the lease

are considered initial direct costs, and must be included in the calculation of the

right-of-use asset:

27-20 Conmgit® 2018 Wiey Bolations Manca

BRIEF EXERCISE 21.22 (Continued)

Lease liability: $22,156

Legal fees: 4,000

Right-of-use asset: $23,156

Thus, the journal entry to record the initial lease liability and right-of-use asset is

as follows:

Right-of-Use Asset...

Cash (Legal Fees)

Lease Liabili

23,156"

5AM Reals MICRA BE: Ron AICEH ES: Reporong, kiSea BAe

BRIEF EXERCISE 21.23

Answer: $78,998

PV of lease payments: $83,498

Cash incentive received from Badger (lessor): (5,000)

Lease document preparation costs: 500

Measurement of right-of-use asset at 1/1/19: $78,993

Employee salaries are specifically excluded as initial direct costs, and would not

be included in the calculation of the right-of-use asset.

Note to Instructor: The lease liability would not include any adjustments for cash

incentive received, or any included initial direct costs. The lease liability would

only reflect the present value of future lease payments.

Lord Bim: a. combuty: Ama Ti: 62, AACE: Ana AICPA BE: ane, AUCPA FC: mEBEIONY, AICPA PE: Wore

Zopyeget@ 2018 Winy Kiesa, FAS, ie, Sektora Manual (Fer etuctor Use Only 2a

BRIEF EXERCISE 21.24

Answer: €46,554

PV of lease payments: €44,651

Cash incentive received from Highlander (lessor): (2,000)

Commissions for selling agents: 900

Legal fees resulting from the execution ofthe lease: 3,000

Measurement of right-of-use asset at 1/1/19; €46,551

Internal engineering costs are specifically excluded as initial direct costs, and

would not be included inthe calculation of the right-of-use asset.

Note to Instructor: The lease liability would not include any adjustments for cash

incentive received, or any included initial direct costs. The lease liability would

only reflect the present value of future lease payments.

10:4 com: AP, Doma: ti Tem, AAGIRE, Atm, AICPA EL Rane, AICPA Mebutg, AGRA PC: Meme

BRIEF EXERCISE 21.25

Lease Expense 15,000

Cash ......

15,000

“Because the lease term is only 1 year, the lessee treats the lease as a short-

term lease, does not capitalize the asset on its books, and records lease

payments as expenses when paid.

2:4 Blom: AP My: Hangin, Tne 67, ARTE Anan, ICA NE: eg, JUCRA PS: Mapaing, ICRA PC Mese

“BRIEF EXERCISE 21.26

The transaction between Irwin and Peete will qualify as a sale-leaseback, as Irwin

has transferred control of the asset to Peete. That is, the terms of the leaseback

do not meet any of the tests to be classified as a finance lease, and thus does.

not transfer control back to Irwin. Irwin will recognize a gain on the sale of the

asset, and record a right-of-use asset and corresponding lease liability for the

operating lease entered into with Peete. Subsequent accounting treatment will

follow the normal accounting for an operating lease.

2-22

gree 207 FAS, tie Saktions Manual (For kn

BRIEF EXERCISE 21.26 (Continued)

35,000

28,000

7,000

23,245

23,245

“Present value of an ordinary annuity for 3 periods at 6%.

IRWIN ANIMATION

Lease Amortization Schedule

___Ordinary-Annuity Basis

Reduction

Annual Interest (6%) on —of Lease

Date Payment Liability Liability _ Lease Liability

449 €23,245

44/20 €8,696 € 1,385 €7,301 15,944

A241 8,696 967 7,739 8,205

ANI22 8,696 491" 8,205 Qo

“Rounded $1

123119

Interest Expens: 1,395

Lease Liability... 1,396

Depreciation Expense (€23,245 + 3 7,748

Right-of-Use Asset... 7,748.

Note to Instructor: The lease payment on 1/1/20 would be as follows:

Lease Liability .. 8,696

Cash ..

LO: 6 ine: AP, cement: Regt Tome £0

8,696

Gopyege® 2018 Way Kiess, FAS, Sle, Soltions Manual (Fer Insbuctor Use Only 2123

“BRIEF EXERCISE 24.27

With the change of facts, the leaseback meets the lease term and present value

classification tests (5/5 = 100% of asset's economi ; €8,309 x 4.21236 =

€35,000 = 100% of asset's fair value). As a result, the lease is a finance lease.

Consequently, Irwin has control of the asset from the lease arrangement, and

has never given up control of the asset (i.e., a failed sale). Therefore, Irwin will

not recognize any gain on the sale of the asset, but instead record a note

payable to demonstrate the financing-nature of the transaction as shown in the

following entry on January 4, 2019.

anits

Cash

35,000

jotes Payable [! 35,000

*“ Present value of an ordinary annuity for § periods at 6%.

At December 31, 2019, it makes the following entry to record interest on the note

payable.

42/3411

Interest Expens:

Interest Payable [i

2,100

4]

This sale-leaseback arrangement is a financing transaction and is often

referred to as a failed sale.

25: RSS AP, Eb: HE, TH BE, AA RE AS,

2,100

21-24 Copynght® 2018 Wiey Kieso. FAS, aie. Solutions Mancal

SOLUTIONS TO EXERCISES

EXERCISE 21.1 (15-20 minutes)

Note to Instructor: The lease term is 100% of the asset's economic life, and the

present value of the rental payments are 100% of the asset's fair value, as shown

below:

Present value of first payment

(£5,552.82 X .92593) .. £ 6,141.52

Present value of second payment

(£5,830.46 X 85734) .. 4,998.69

Present value of third payment

(26,121.98 X .79383) .. 859.84

Present value of the rental payments........£15,000,00°

“Two cents rounding error.

12/31/18

Right-of-Use Asset, 15,000

Lease Liability .. 15,000

12/3119

Interest Expense (£15,000 X 8%) 4,200.00

Lease Liability 4,352.82

Cash 5,552.82

Depreciation Expense (£15,000 + 3) 5,000.00

Right-of-Use Asset 5,000.00

12/31/20

Interest Expense

[£15,000 . £4,352.82) X 8%] 851.77

Lease Liability 4,978.69

Cash 5,830.46

Depreciation Expense (£15,000 + 3) 6,000.00

Right-of-Use Asset. _ 5,000.00

gh 201H Wiay Kinso, PAS, Be, Setters Manual (Por instructor Use Only) 225

EXERCISE 21.1 (Continued)

(b) The initial valuation of the lease liability and related right-of-use asset should

not include any unknown increases or decreases in lease payments due to

increases or decreases in the CPI. Rather, for the initial measurement of the

lease liability, the lessee assumes that all payments will be made as if the CPI

level at the commencement date of the lease does net change. Thus, DU

Journeys should discount the annual lease payments using the ordinary annuity

factor applied to the first lease payment.

4, Bloom, ity Macarat,Tina 1-28 LACIE: daly AICPA Bone AISAK FC-Resorteg’AGRH RE: Mone

EXERCISE 21.2 (15-20 minutes)

(a) Computation of present value of lease payments:

$8,668 X 4.64595" = $39,404

“Present value of an annuity-due of 4 for § periods at 5%.

12/31/18

(b) Right-of-Use Asse 39,404

Lease Liabili 39,404

Lease Liability 8,668

Cash... 8,668

12/34/19

Depreciation Expense 7,884

Right-of-Use Asset 7,884

($39,404 = 6)

Lease Liability.... TAH

Interest Expense

[($39,404 - $8,668) X .05] 1,537

Cash... 8,668

Lor 2 Bisse an mute Macarate, Tw 6-3, ASHE! Airs, AUGPH.BEE Nowe, aidPa Fo-fasortng AIGPA-PD ene

7-28 Copyright® 2018 Wiey Kao, Fi

EXERCISE 21.3 (20-25 minutes)

(a) The present value of lease payments, for purposes of determining the lease

liability for the lessee, should only include the present value of any

guaranteed residual value probable to be owed under the lease agreement

(i.e. the amount of guaranteed residual value over the expected residual

value). Because the expected residual value is the same as the guaranteed

residual value, no amounts are probable to be owed under the lease

agreement, and the present value of lease payments to determine the lease

liability therefore is:

PV of monthly payment of €200 for 50 months

[£200 X 44.36350*] .. €8,873

“Present value of an annuity-due of 1 for 50 periods at 0.5%.

(b) Right-of-Use Assi 8,873.

Lease Liability 8,873

200

200

157

Interest Expense (0.5% X [€8,873 - €200] a

‘Cash... 200

(e) Amortization Expense 177

Right-of-Use Asset 177

(€8,873 + 50 mor

(f) As explained in part (a), the lessee should include the present value of any

guaranteed residual value probable to be owed under the lease agreement.

Because the expected residual value (€500) is less than the guaranteed residual

walue (€1,180), Delaney should include the present value of the difference in the

initial measurement of the lease liability. Thus, the present value of the lease

payments is calculated as follows:

PV of monthly payment of €200 for 50 months

[€200 X 44.36350°] €8,873

PV of guaranteed residual value probable to be owed

[(€1,180 - €500) X.77929"] 530

PV of lease payments 5,403

“Present value of an annuity-due of 4 for 50 periods at 0.5°

5-2, Boa: A, Cau: Moawate, Ting 28-26, AACE: Analyte, ACSA BE: None, AIDPA FE: Repartng AIGA PE: oe

2OTE Way Winco, RS, lle, Soubona Warual (For Inatucior Use Oy Ti

EXERCISE 21.4 (20-30 minutes)

(a) For purposes of calculating the initial lease liabi the present value of the

lease payments will only include the amount of a residual value guarantee

probable to be owed at the end of the lease term. Thus, the initial lease liability

and right-of-use asset to be recorded on the books of Stora Enso is calculated

as follows:

€ 74,830 Annual rental payment

X_7.24689 = PV of annuity-due of 1 forn = 10,)=8%

€ 520.544 PV of periodic rental payments

€ 3,000 Amount probable to be owed under

residual value guarantee (€10,000 - €7,000)

X__.46319°° PV of 1 for n= 10, Ya

4,390 PV of amount probable to be owed

‘on residual value guarantee

€ 520,544 PV of periodic rental payments

+ 1,390 PV of the residual value

€ 521,934 Lease liability

24-28 See,

Kisze FRE jie Soluions Marusi (Fer mewuser Use Ory

EXERCISE 21.4 (Continued)

123418

Right-of-Use Asset.

Lease Liability

Lease Liability

Gash

12/34/19

Depreciation Expense...

Right-of-Use Ass:

(€521,934 = 10)

Lease Liability ....

Interest Expense

(See Schedule 4).

Cash

12/34/20

Depreciation Expense

Right-of-Use Asset

Lease Liability...

Interest Expense

(See Schedule 1)

Cash...

521,934

74,830

52,193

36,822

36,008

52,193

38,687

33,143

DMS Wisy Wate, FRE Ve, Seusers Warusl (Fer navurtar Use Only

521,934

71,830

52,193

74,830

52,193.

71,830

2-20

EXERCISE 21.4 (Continued)

Schedule 1 Stora Enso

Lease Amortization Schedule (partial)

(Lessee)

Reduction

Annual Lease Interest (8%) on of Lease

Date Payment Liability Liability _ Lease Liability

12/34/18 €521,934

12/34/18 €71,830 € oO €71,830 450,104

12/31/19 71,830 36,008 35,822 414,282

12/31/20 71,830 33,143 38.687 375,595,

eran, AIPA Pa Hee

(b) Initial direct costs and lease incentives do not affect the initial measurement

of the lease liability. Instead, they only affect the measurement of the right-of-use

asset. Initial direct costs incurred by the lessee increase the right-of-use asset,

whereas a lease incentive decreases the value of the right-of-use asset. The

calculation of the right-of-use asset is as follows:

€ 521,934 Lease liability

- 1,000 Lease incentive

+ 6.000 Legal fees

€ 525.934 Right-of-use asset

(¢) The annual insurance payments of €5,000 are considered part of the annual

payments to the lessor similar to the rental payments, as they do not transfer a

separate good or service to the lessee, but rather are part of the payment to use

‘the leased asset and are attributable to the lease component. Therefore, the

Present value of the €5,000 annual payments should be included in the initial

measurement of the lease liability, and thus the right-of-use asset as well. The

calculation is as follows:

Annual rental payment

PV of annuity-due of 1 forn = 10,i= 8%

PV of periodic rental payments

Annual insurance payment

PV of annuity-due of 1 forn = 10,1 = 8%

PV of periodic insurance payments.

Gepyrghe® 2018 Wiley Maze, PRS die Solions Manual

21-30

EXERCISE 21.4 (Continued)

€ 3,000 Amount probable to be owed under

residual value guarantee (€10,000 - €7,000)

X__.46319 = PV of f form = 10,1= 8%

€ 4,390 PV of amount probable to be owed

of residual value guarantee

€ 620,544 PV of periodic rental payments

+ 36,234 PV of periodic insurance payments.

+ 1,390 PV of the residual value

+ __1,390

© 558.168 Lease liability

Note how the inclusion of the executory costs leads to an inflated lease liability

and related right-of-use asset. Additionally, note that had the insurance

payments been variable, they would not have been included at all in the

measurement of the lease liability, which would have led to a very different initial

measurement of the liability and asset.

(d) Because Stora Enso expected the residual value of the asset at the end of the

lease to be €7,000, it expected to owe Sheffield an additional €3,000 in addition to

returning the asset under the residual value guarantee. Thus, Stora Enso has a

lease liability of €3,000 remaining on the books. However, the value of the asset

covers the entire guarantee, and thus no additional cash payment is required by

Stora Enso. As a result, they will book a gain, as shown below:

Lease Liability .. 3,000

Gain on Lease 3,000

Lo Bow AN Sut rae, The EEE AME HE: Anat ICRA BE one Recortng AERA FO: Mont

EXERCISE 21.5 (15-25 minutes)

(a) Fair value of leased asset to lessor £245,000

Less: Present value of unguaranteed

residual value £24,335 X 63017

(present value of 1 at 8% for 6 periods) 15,335

Amount to be recovered through lease payments

Six periodic lease payments £229,665 + 4.99271" £46,000

*Present value of an annuity-due of 4 for 6 periods at 8%.

Rounded to the nearest pound.

eB 2018 Wigy Wiens, HPS Se, Seutens Warusl (Fer nabuetor Use Only 234

EXERCISE 21.5 (Continued)

(b) MORGAN LEASING GROUP (Lessor)

Lease Amortization Schedule

Annual

Lease Interest (8%)on Recovery

Payment Lease of Lease Lease

Date Plus URV Receivable Receivable Receivable

1AMNg £245,000

qA13 £ 46,000 £ -- £ 46,000 139,000

44120 46,000 15,920 30,080 168,920

1/4/24 46,000 13,514 32,486 136,434

141/22 46,000 10,915 35,085 101,349

11123 46,000 8,108 37,892 63,457

1/4124 46,000 5,077 40,923 22,534

12/31/24 24,335 4,801" 22,534 oO

£300,335 £55,335 £245,000

“Rounded by £2.

A119

(c) Lease Receivable 245,000"

Cost of Goods Sol 229,665"

Sales Revenue 229,665"

Inventory .. 245,000

21-32

*The lease receivable will include both the present value of the

rental payments (£46,000 X 4.99274) plus the present value of the

residual value (£24,335 X .63017), as the lessor believes it will

receive both of these amounts over the life of the lease.

“While cost of goods sold normally mirrors the value of the

inventory being sold, in this case it is reduced by the present

value of the residual value [£245,000 - (£24,335 X .63017)], as the

lessor will receive the inventory again at the amount of the

residual value.

Sales revenue represents the present value of the rental

payments (£46,000 X 4.99271), but it does not include the present

value of the residual value. That is, the lessor will get the residual

value back at the end of the lease, and thus has not “sold” that

portion of the asset.

lations Mana Use Oni)

Conprgh

EXERCISE 21.5 (Continued)

1ANg

Cash... 46,000

Lease Receivable 46,000

WBIN9

Lease Receivable... 15,920

Interest Revenue 15,920

1N20

Cash. nee 46,000

Lease Receivable 46,000

12/31/20

Lease Recelvabll 13,514

Interest Revenue .. 13,514

LD: $ Boon: AM, Eien: Moderate, Ting 15, AMEE: Anite. Fo Repotng RERAPE: one

EXERCISE 21.6 (20-25 minutes)

Computation of annual pay Ss

Fair value of leased asset to lessor $160,000

Less: Present value of residual value

($16,000 X .90703") 14,512

Amount to be recovered through lease payments $145,488

Two periodic lease payments ($145,488 + 1.85941") 78,244

“Present value of 1 at 5% for 2 periods

Present value of an ordinary annuity of 1 for 2 periods at 5%

Castle will classify the lease as a sales-type lease, because the agreement meets

both the present value test ($145,488/$160,000 = 91% which is greater than 90%)

and the lease term test (2/2 = 100%) which is greater than 75%. The $16,000

option to purchase does not count as a bargain purchase, the expected residual

value at the end of the lease term is also $16,000.

©2010 Wiay Kiero, AS, de, Soubare Manual

EXERCISE 21.6 (Continued)

CASTLE LEASING COMPANY (Lessor)

Lease Amortization Schedule

Interest (5%) Recovery

Annual Lease on Lease of Lease Lease

Date Payment Receivable Receivable Receivable

1AM9 $160,000

12/31/19 $78,244 $8,000 $70,244 89,756

12/31/20 78.244 4,488 73,756 16,000

12/31/20 16,000 Oo 16,000 o

ang

fa) Lease Receivable 160,000*

Cost of Goods Sold 105,488"

Sales Revenue . 145,488°*

Inventory ... 420,000

“($78,244 X 1.86941) + ($16,000 X .90703), rounded

$120,000 — ($16,000 X .90703), rounded

“=*$460,000 — (16,000 x .90703), rounded

123449

78,244.

70,244

6,000

Cash... 78,244

Lease Receivabl 73,756

Interest Revenue 4,483

12/34/20

(b) Cash... 46,000

Lease Receivable. 16,000

LEH Bess: AN, mou: Meaaiata,Thnd H-28 ACHE. Ase AICPA RE Note AIDPA FE: Mascitng. 10

a Copynghe 8 20 FRE, ie Sela

EXERCISE 21.7 (15-20 minutes)

(a) The lessee accounts for all leases using the finance lease method and

records the right-of-use asset and lease liability at the present value of the

lease payments using the incremental borrowing rate if it is impracticable to

determine the interest rate implicit in the lease. The lessee’s amortization

depends on whether ownership transfers to the lessee or if there is a

bargain purchase option. If one of these conditions is fulfilled, amortization

would be over the economic life of the asset Otherwise, it would be

amortized over the lease term. Because both the economic life of the asset and

the lease term are three years, the leased asset should be depreciated over

this period.

The lessor should account for the lease as a sales-type lease. Because title

to the asset passes to the lessee, the lease term is longer than 75% of the

economic life of the asset (3/3 = 100%), and the present value of the lease

payments is more than 90% of the fair value of the asset (€95,000/€95,000 =

100%), it is a finance (sales-type) lease by the lessor. Assuming collect

of the rents is probable, the lease is accounted for as a sales-type lease to

the lessor.

The lessor should record a lease receivable and sales revenue equal to the

present value of the lease payments of €95,000. In addition, the lessor

should remove the asset (inventory) from its books at $70,000, and the

related cost of goods sold €70,000. Interest is recognized annually at a

constant rate relative to the unrecovered lease receivable (See lease

amortization schedule).

Fair value of leased asset

(Amount to be recovered by lessor through lease

payments! €95,000

Three annual lease payments: €95,000 = 2.57710 €36,863

“Present value of an ordinary annuity of 1 for 3 periods at 8%.

2O1B Wiey Kissa, FRE, aie, Soubona Manual (For Inabuctar Use Only 7-35

EXERCISE 21.7 (Continued)

(b) Amortization Schedule

Interest (8%)

Rent Receipt) Revenue! Reduction of Receivable!

Payment Expense Principal Liability

4AAg - - - €95,000

12/31/19 €36,863 €7,600° €29,263 65,737

412134120 36,863 5,259 34,604 34,133

42/31/24 36,863 2,730 34,133 0

"€95,000 X .08 = €7,600

(c) 49

Lease Receivable 95,000

Cost of Goods Sol 70,000

Sales Revenue 95,000

Inventory. 70,000

(d) 41/19

Right-of-Use Asset. 95,000

Lease Liability 95,000

(e) Ang

Right-of-Use Asset. 103,311

Cash... 10,000

Lease Liability

(€36,863 X 2.83130") ... 93,311

“Present value of an ordinary annuity of 1 for 3 periods at 9%.

5.5 tiicom AM Stay Spl, TH, AME HE: ene, Sovmeraon IGM BE hae, IG RE Rapostng. Meserema MERA AE:

‘Semen

ne Copyrght® 2018 Wiey Kuso, (FAS, Sie, Selsions Manual

EXERCISE 24.8 (15-20 minutes)

(a) $36,004 X 6.58238* = $230,410

“Present value of an annulty-due of 1 for 8 periods at 6%.

(b) Because the lease term test is met (8/10 = 80% > 75%), the lease is classified

as a sales-type lease.

44119

Lease Receivable ... 230,410

Cost of Goods Sold 160,000

Sales Revenue 230,410

Inventory ..... 460,000

Cash... 35,004

Lease Receivable... 35,004

AzS148

Lease Receivable 41,724

Interest Revenue 11,724

[($230,410 - $35,004) X .06]

(c) If the collectibility of lease payments is mot probable for the lessor, the

lessor does not derecognize the asset or recognize selling profit on the

Instead, Crosley would recognize any cash receipts as a deposit liability.

419

Cash

Deposit Liability

35,004

35,004

A lessor does not derecognize the asset and recognize selling profit until

collectibility becomes probable

(4) Inventory... 1,000

Gain on Lease (Re: 1,000

mem AP ome: etn, 5, AACR Anan, ACPA Ena, ICP PO: Mabarg APA. P ane

Copynget 20/8 Winy Manzo, ERS Ye, Seuterssrusl Fer instucter Us 2a?

EXERCISE 21.9 (20-25 minutes)

(a) Lease Liability = $35,004 x 6.20637° = $217,248

Right-of-Use Asset = $217,248 + $15,000 = $232,248

“Present value of an annuity-due of 1 for 8 periods at 8%.

=The right-of-use asset is initially valued at the same amount as the lease

liability, plus the initial direct costs, minus any lease incentives received.

(b) The lease is accounted for using the finance lease method.

Right-of-Use Asset 232,248

Cash... 15,000

Lease Liability 217,248

Lease Liability . 36,004

Cash... 35,004

Interest Expense .. 44,580

Lease Liability 14,580

[($217,248 - $35,004) X .08]

Depreciation Expense

($232,248 = 8) 29,034

Right-of-Use Asset. 29,031

EXERCISE 21.10 (20-30 minutes)

(a) Computation of lease liability:

¥20,471.94 Annual rental payment

X_4.31213 PV of annuity-due of 1 forn = 5,i=8%

¥83,277,.67 PV of periodic rental payments

¥ 4,000.00 Bargain purchase option

X_.68058 PV of 1 forn= 5, i= 8%

¥ 2722.32 PV of bargain-purchase option

¥88,277.67 PV of periodic rental payments

+ 2,722.32 PV of bargain-purchase option

¥91,000.00 —_Lease liability (rounded)

are Capyrght® 2018 Wiley Kieso. FAS,

ie. Sellers Wianus (Fe

EXERCISE 21.10 (Continued)

Choi Group (Lessee)

Lease Amortization Schedule

Annual Lease Interest Reduction

Payment Plus. (8%) on of Lease Lease

Date BPO Liability Liability Liability

8119 ¥91,000.00

8/119) ¥ 20,471.94 ¥20,471,94 70,528.06

5/1/20 20,471.94 ¥ 5,642.24 14,829.70 55,698.36

6/1/21 20,471.94 4,455.87 16,016.07 39,682.29

§/1/22 20,471.94 3,174.58 17,297.36 22,384.93

5/1/23 20,471.94 41,790.79 18,681.15 3,703.78

4/30/24 296.22" 3,703,783 oO

—4,000,00

¥106,359.70 ¥15,359.70 ¥91,000.00

“Rounding error is 8 Yen.

sing

(b) Right-of-Use Asset 91,000.00

Lease Liability 91,000.00

Lease Liability 20,474.94

Cash . 20,471.94

42/34/19

3,761.49

3,761.49

ity

(¥5,642.24 X 8/12 = ¥3,761.49)

Copyrget® 2008 Winy Kieso, FRS, We, Souters Manual (For Insrucmor Use Only 21-39

EXERCISE 21.10 (Continued)

12/31/19

Depreciation Expense

Right-of-Use Asset.

($91,000.00 + 10=

(88,100.00; $9,100.00 X

(8/12 = $6,066.67)

6,066.67

6,066.67

4/1/20

Lease Liability .. 3,761.49

Interest Expenss

3,761.49

5/4/20

5,642.24

14,828.70

Interest Expensi

Lease Liabi

Cash

20,471.94

12/31/20

Depreciation Expense 2,970.58

Lease Liabili

2,970.58

12/31/20

Depreciation Expense

Right-of-Use Ass

($91,000.00 + 10 years

($9,100.00)

Because a bargain-purchase option was involved, the

leased asset is depreciated over its economic life rather than over the lease

term.)

0:5, inane: AP, Doman: Mesaraia, Te: 2038, ACHE: Ama, AUER BE

9,100.00

9,100.00

pa to: Repering wcra Po none

21-40 Comnght © 2018 Wey Kissa Seltions Mana

Instructor Use Orly)

EXERCISE 21.11 (20-30 minutes)

(a) The lease agreement has a bargain-purchase option. The collectibility of the

lease payments by Mooney is probable. The lease, therefore, qualifies as a sales-

type lease from the viewpoint of the lessor.

The lease payments associated with this lease are the periodic annual rents plus

the bargain purchase option. There is no residual value relevant to the lessor's:

accounting in this lease.

The lease receivable is computed as follows:

¥20,474.94 — Annual-rental payment

X_ 4.31213 PV of an annuity-due of 1 forn=5,1= 8%

¥88,277.67 PV of periodic rental payments

¥ 4,000.00 Bargain purchase option

X___.68058 PV of 1 form =5, i= 8%

¥.2.722,32 PV of bargain-purchase option

488,277.88 PV of periodic rental payments

+ 2,722.32 PV of bargain-purchase option

¥87,000.00 Lease receivable at commencement (rounded)

(b) MOONEY LEASING (Lessor)

Lease Amortization Schedule

Annual Lease = Interest (8%) Recovery

Payment Plus. on Lease of Lease Lease

Date BPO Receivable Receivable Receivable

5/1/19 ¥91,000.00

S419 ¥ 20,471.94 ¥20,471.94 70,528.06

5/1/20 20,471.94 ¥ 5,642.24 14,829.70 55,698.36

5/4/24 20,471.94 4,455.87 16,016.07 39,682.29

5/22 20,471.94 3,174.58 17,297.36 22,384.93

5IM123 20,471.94 1,780.79 18,681.15 3,703.78

4/30/24 4,000.00 296,22" 3,703.78 0

¥106,359.70 = ¥15,389.70 = #91,000.00

“Rounding error is 8 Yen.

2018 Wiey Kins, PAS, 3

clutiers Varual (Fer raburtsr Ure Only) 2a

EXERCISE 21.14 (Continued)

S19

(ce) Lease Receivable .. 91,000.00

Cost of Goods Sol 65,000.00

Sales Revenue 94,000.00

Inventory ..... 65,000.00

Cash...... 20,471.94

Lease Receivable... 20,471.94

12/31/19

Lease Receivable . 3,761.43

Interest Revenut 3,761.49

1642.24 X BI

3,761.48)

5/1/20

Gash... 20,471.94

Lease Receivabl 18,591.19

Interest Revenut 1,880.75

(¥5,642,24 — ¥3,761.49)

12/31/20

Lease Receivable . 2,970.58

Interest Revenut 2,970.58

(¥4,455.87 X 8/12 =

(¥2,970.58)

(4) If the collectibility of lease payments is not probable for the lessor, the

lessor does not derecognize the asset or recognize selling profit on the lease.

Instead, Mooney would recognize any cash receipts as a deposit liability.

aaa Copan 201

Wass PRE Se Selnisns Manca

EXERCISE 21.14 (Continued)

Cash...

Deposit Liability

20,471.94

20,474.94

A lessor does not derecognize the asset and recognize selling profit until

collectibility becomes probable.

£9: Rien: AP, maa: Meeerab, Tae: 26-5, ACHE: Ane, AIGhA HE: Mane, AIGPA RG: Maal CRA Rane

EXERCISE 21.12 (20-25 minutes)

(a) This is a finance (sales-type) lease to Benson since the lease term Is 75%

(6 + 8) of the asset's economic life. In addition, although the lease payments

are not provided in the problem facts, the lease will also meet the present

value test, as shown in part (b). There is a bargain-purchase option in the

lease, as Flynn has the option to purchase the asset at the end of the lease

term for a price $4,000 below the expected residual value of the asset, and

thus exercise of the option is reasonably certain. Last, collectibility of the

lease payments is probable.

(b) Computation of annual rental payment (by the lessor):

Fair value of leased asset .. $150,000

Less: Present value of bargain-purchase option

($1,000 X .74622"). 745

PV of lease payments... $149,254

Six annual lease payments: $149,254 + 5.32948"... $28,005

*Present value of $1 at 5% for 6 periods.

“Present value of an annuity-due at 5% for 6 periods.

@201G Wiey Wesa, PRS, ie, Solitons Manual (For nabudiar Use Only 21-43

EXERCISE 21.12 (Continued)

(c) Lease Receivable ...

Cost of Goods Sold

Sales Revenue

Inventory

“($28,005 X 5.32948) + ($1,000 X 74622), rounded

“Sales revenue would also include both the present values of

the rental payments and the bargain-purchase option.

150,000"

120,000

180,000"

120,000

28,005

28,005

12/3149

Lease Receivable...

Interest Revenue

1($150,000 - $21

6,100

6,100

(d) If the collectibility of lease payments is not probable for the lessor, the

lessor does not derecognize the asset or recognize selling profit on the lease.

Instead, Bensen would recognize any cash receipts as a deposit liability.

Aig

Cash...

ose 28,005

Deposit Liability

28,005

A lessor does not derecognize the asset and recognize selling profit until

collectibility becomes probable.

iat Copyrght® 2018 Wiey Wiese. IFAS, Sie Solaions Manual (For heiructor Use Only

EXERCISE 21.12 (Continued)

AMA9

(e) Right-of-Use Asset. 146,677

Lease Liabilit . 146,677

[$28,005 X 5.21236") + ($1,000 X .70496""]]

Lease Liability 28,005

Cash... 26,005

“Present value of an annuity-due at 6% for 6 periods.

“Present value of §1.at 6% for 6 periods.

12/34/49

Depreciation Expense 18,335

Right-of-Use Ass: 18,335

($146,677 + 8" years)

“The lessee uses the economic life of an asset instead of the

lease term for amortization purposes when ownership

transfers or there is a bargain purchase option

Interest Expens:

Lease Liabil

($446,677 -

7,120

7,420

(f) The value of the lease liability for the lessee is unaffected by any initial

direct costs incurred. However, the initial measurement of the right-of-use

asset must be adjusted for initial direct costs incurred. Thus, the initial

right-of-use asset should be measured at $148,677 ($146,677 + $2.000)

148,677

2,000

Lease Liability 146,677

c: Raeng, che AE ane

Copyeght @ 2018 Winy Kuso, FAS. ie, Schutons Manual (Fer Instructor Use Only) 2-85

EXERCISE 21.13 (20-25 minutes)

(a) The lease will be classified as a sales-type lease for Phelps. While

ownership does not transfer at the end of the lease, there is no bargain purchase

option, the asset is not specialized, and the present value test is not met (see

calculation of lease liability for PV of lease payments), the lease term is greater

than 75% of the useful life of the asset (5 + 6 = 83%).

The calculation of the lease receivable for Phelps is done as follows:

Annual rental payments... a

Present value of an annuity-due

for § periods at 8%

Present value of rental payments (rounde

£4,703

“This value should be used in performing the present value test. The lease fails

the present value test because £20,280 + £23,000 = 88.2%, which is less than

80%.

Expected residual value £4,000

Present value of $1 for § periods at 8% 68058

Present value of residual value (rounded) £2,722

Present value of expected residual value £2,722

Present value of annual rental payments 20,280

Lease Receivable £23,000"

“Rounded by £2.