0% found this document useful (0 votes)

376 views11 pagesMatz Usry (Process Costing, Chapter-5) Questions

Process Costing Questions

Uploaded by

Kamrul HassanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0% found this document useful (0 votes)

376 views11 pagesMatz Usry (Process Costing, Chapter-5) Questions

Process Costing Questions

Uploaded by

Kamrul HassanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

/ 11

o

CHAPTERS

DISCUSSION QUESTIONS

1 Whtare the posible effects on units and coats

in process when materials are added: in sub-

sequent departments? :

Ofsnguth between the fifo and average meth-

ods of process costing. '

Why are units completed and on hand in a pro-

cessing department included in the depart-

ment’s work in process? °

4. How are equivalent production figures’ com-

puted when fifo costing is used?

. The Wiring- Department is the second stage of

Flem Company's production cycle. On May 1,

‘the beginning work in process contained

25,000 units which were 60% complete as to con

version costs..During May, 100,000 units were

transferred in fromthe first stage of Flem’s pro-

duction cycle. On May 31, the ending work in

Process contained 20,000 units which were'60%

complete as to conversion costs. Material costs

are added at the end of,the process. Using the

average method, compute the equivalent units

of production, (AICPA adapted)

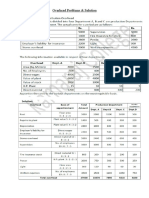

slew 1 production report; materals added. Oloroso, inc.’ produces. a

"8 departments. In the'third department,

a5 re te-

‘als are added, doybling the umber of units. The folowing dat 1 the operations

Deparment Tera 7 org dla pane be operations,

‘Sudo, which fequirés processing in’

pee, << 2 gee

. PROCESS COSTING; AVERAGE AND FIFO COSTING

~ Management must decide whether economy and low operational cost are

compatible with increased information, based on additional cost com

putations and procedures. Some companies use both job order and process

costing procedures for various purposes in different departments. The basis

for using either method should be reliable production and performance data

which, when combined with output, budget, or standard cost data, will pro-

vide the foundation fot effective cost control and analysis,

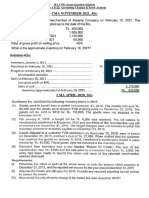

6. Ace Company computed the: flow of physical

units for Department A for April, as follows:

Units completed:

From work in-process on

April 1...

From April production. .

10,000

‘Materials are added at the beginning of the pro- /

cess. Units of work in process at April 30 were»

8,000. The work in process at April 1 was

80% complete as to conversion costs and

the work in process at April 30 was 60% com- if

plete as to conversion costs. What are the /1 |

equivalent units of production for April, usin

thesfifo method? (AICPA adapted

7, What are some of the disadvantages of the fifo

costing method? 5 ot

8. Enumerate several of the basic ‘difficulties fre-

quently encountered in process. costing.

9. Express an opinion as to the usefulness of data,

Gerived from process costing, for the control

of costs. +

Cologne,

fw —

{ a an,

es COST ACCUMULATION PROCEDURES ee

‘Unity recetved trom Department

Unis trated to Hrishod goods

\ The tance of te units ave BH in process —

ras, BO complete as olebor and ovehed. gan gop

Cost ransterred trom Department 2 » “ Ro

t - $000

9,000.

1200 $25,000

Propare’a cost of production report for Department 3 for March,

A : A ded. Pore, Inc.

‘Computation of equivalent production fo method; materials adtled. Poore, Inc. pro.

‘duces a chemicel compound in two departments, Aand B, using te following procedure:

The chemical compound requites one pound of Chemical X and one Pound-of Chemi-

a! ¥. One pound of Cttemical x is processed ‘in Department A and transferred to

Department B, where one pound of Chemical Y is added when the process is 50%

conplcte Wher Repreceetng compe m Deparment 6, (he in6U-cherica

$eoiuns Tansee ed gee Me ess 2 thn 2 Foy aay

& rat ‘fal spoilage occursin Department A, Wels jemical X is lost in

.the first 180 minus: 6F processing. Department A's conversion cost is incurred”

1

x pte {throughout the process and is allocated to good pounds produced, sincy

Y ° ¢ ‘spolane's coral Deparment 8's conversion costs alocated equally fo each eau

r° eg pound of euou No spolage occurs in Deparment.

Data available for October-are:

to materais in process at end

Uns one dep?’® Mee as to lab end

Scanned with CamScanner

CHARTERS PROCESS COSTING) AVERAGE AND FIFO COSTING

\

|

,

{c) Bopnnng invent, 2000 vrs, Vs complete ns to males, ccnp I |

‘or end lacy overoad,Pasfred ut, 2,000 nt: is tt bag Of |

‘production, 500, a normal quantity; In process al end of poriod, 2,500 units, Com

pplete'as to materials, Ve complete as to labor and factory overhoad.

; Compute the equivalent Hom figures In each etuation, using (1) avor

vid (2) Mo cottng production figures in each sing (1) avorage

i

\UEomputation of equivalent production. Tho data originate tom thvoo oH

ferent situations flout a |

{a) Started in process, 18,000 units; n process at end of poriod, 6,000 units, comploto |

as 1 materials % complete as to conversion cost tansforied 12,06 units (0

finished goods /

2) Beginning inventory, 11,000 unis, v4 complete fo ‘materials, Ye complot 05 t0

“ponversion Gost, ranslerred out, 12,000 units; units tion, 1,00; ‘

in process at end of period, 6,200 unlls Ve Gomplote as (0 ‘materials, Ys completa

7 as to conversion cost ~~ ;

A) ‘Beginning inventory, 4,500 units, completo as to materials, 1%, complete 1s to con-

version cost; started in-process, 12,500 units; in process. at.ond of period, 2.100

units, el i anAETON cos, an T TOC,

‘i 5 ials, 7 completo as to conversion cost unis 1s

Required: Compute the equivalent production figures in each situation, using) average

and (2) flo costing.

fon of equivalent production. T & A Company operates 0, producing de- 4

ose qantiy repos appear @s IQHS'., + es |

Depo} Dap” ”

rr |

Department Bo! Toby Company it as flows:

‘s

ho ~ a

Scanned with CamScanner

=

\ ei ef in Materials Conversion. fan

; «en, Meats, eI

Beatin verity $290 =, Spano $8000

Units transtered in oS

a : ‘and 40% complete

+ Conversion costs weie 20% complete as 0 ine beginning re yoceS. Toby uses

8 fo the ending inventory. All materials are added at the \

average costing. ,

aed for conversion cosis, rounded to the near-

(7) Compute the cost per equivalent unit

Fol wate ributable to transferred

(2) Deterrne the portion of the total cost of ending inventor a CPA adasied)

05 of production report-average costing. 'A’product called Aggregate iS Mant,

(Ctured in one départment of West Corpotation. Materials are added at the beginning ol

//he process. Shrinkage of 10% to 14%, all ccurting at the beginnl ore

's consicered nonmal_ Labor and Factory overhead are added continudusly. throughout,

The process E Sauron = :

; ~The following information relates to November production:

‘Work in process, November 1 (4,000 pounds, 75% complete)

fatenials $22,800 <7

Labor 24,650

Factory overhead. 21,860

November costs:

Materia (fifo costing): .

Inventory November 1, 2,000 pounds... 40,000 ’

Purchase, November 3, 10,000 pounds ... 51,000 |.

, November 18,10 51,500

"403,350 >

93,340,

‘Transferred out, 15.000 pounds ‘

‘Workin process, November 30, 3,000 pounds, 3314%

‘complete (average casting).

“Prepate @ cos of production repo for November. =. (CMA deed:

of production report average costing. Cipepper Corpora p

"nat uses average costing t0 account for costs of oat Caepna ‘Samanufacturer

product thats produced in twee separate departments: Mol

ing. The following information was obtained for the Asst

‘Work in process, June (000 units, compos

‘raster inom be Moling Departmen.

Cost added by the’Assembling Departmont:

Direct materials: ,

Scanned with CamScanner

CHAPTERS. ; PROCESS COSTING; AVERAGE AND FIFO COSTING

lowing activity occurred during June: :

(0,000 units were transferred in from the Molding epedint ‘at a cost of $160,000. *

{$150,000 of costs were added by the Assembling Department: drect materials,

$96,000; direct labor, $36,000; and factory overhead, $18,000.

A 8,000 units were completed and transferred to the Frishrg Dopartment.

$000 units were Stil i work in-pi igreas of

copier: direct ‘materials, 90%, direct labor, 70%; aa lactoy overhead 35%.

Facured: Prepare the June cost of production report for’ the Assembling Department.

(AICPA‘adapted)

focess Costing —fito method. Ohm Motors is engaged in the production of a oe

ndard type of electric inotr. Manufacturing costs for Api totaled $66,000, At the

/ paginirg of Apnl, inventories appeared as folows:

$82,000 |

Apt iene ye :

Motors in prticnvestd on complat ‘

goods...

The company uses fifo costing for production and godds'sld. In costing finished

90005, the unt cast for units completed from beginning work in process inventory is Kept

separate from the unit cost of motors started and completed ing te month. » i

bei of production report —fifo costing

breakable 1 5; using three ‘Mixing, Molding, and Finish: .

f containers for cosmetics; us shalt Saat scr eae

‘a. On a 1, the work in

ersion costs, ly 31 Work in process 4

ele as to materia arid Conversion Costs.

Relevant cost data are as follows: t

Work n process, duty - : $3000

“rm 76a

16,200

28509

‘ara

Resuired:. Using the fi sg ea inc et te,

“ey nip cs ran et ‘

t ae . ,

ee 3 :

Scanned with CamScanner

{oan fan

8 ‘COST ACCUMULATION PROCEDURES

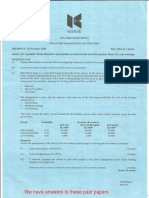

| PROBLEMS bese pact wld ate He |

, poet Lip. ;

‘ Aeon ot rod pt ihalerlaly added A coplanar

‘departments. Materials ate added in ench department, ny’s first month of

lature. A summary of the cost information fo the compas th 9

‘operations (January) is as follows: oy wh 7

} Dept. 2 .

} $ 67,500

é te 41,400 Wt

t ~ 20,700

in Sa am

ip Factory overhead leat

Sf . Total 3.1

~* TY reduction superiso? repos that 300,000 pits! were put into production jg

iM lx Departinent'1. Of this quantity 75,000; a flormal Tube wee foal if production, ‘and

| Y 180,000 were completed and transferred to Department Z, The units in process at the end

FIRE Month were complete as to mater, but only one-third complete as to labor and

} faclory overhead. . 7 = z

«In Departinent 2, 45,000 units of materials were’ piirchabel! outside and added to the

units ‘réceived from Department J; 1953 ind transferre

in inventory: The units in Process atthe end of the month were

to materials, but only 40% colmplete as to labor and factory overhead,

y

Required, Prepare a os of production report for January for both departments. (Cary

unit cost computations to three decimal places.) _

t of production tepott-fifo costing; materials added,

res a product knoivn as Prep. The manufactirig process

Grading and Saturating, in which fic iat

Adept ‘Company mafu-

covers two departments,

fo costing is

The manufacturis ins\in the Grading Department, where raw i

t, materials

started ferted/to the Sat ing Department for

luction process,

= November 39°”

7 4 2 “Quantity —---*

Work in process inventoties: ™ . Amount Bain}

Grading Department,

Saturating Department

Scanned with CamScanner

7 Bor

cuarTERS wor PROCESS COSTING; AVERAGE AND FIFO COSTING 13

Qa

Fea of production report— avenge costing. Edmorien Company uses avenge

costing in accounting for its three manufacturing departments. Department 2 receives

2s from Department 1 and applies conversion costs to these unis at a uniform rate.

7 ted ad muterial then added tothe

considered normal.

weilable:

(a) 3000 units were in process on December I, estimated to be 30% complete, with :

cust from Department 1 of $16,000 and Department ¥ costs of $2.600-—S, wn g athe

{132.00 units were roveined from Department 1 at a cost of $180,000. .. 1 ao 20

ate 2 cas were ately SIL. soarerson M4 «fer? tes

(a) RIND writs were transferred to Department 3.

(¢) 430 waits were in process D&xember 31, estimated to be 60% complete. Ae

= ae

it : : sper) ©

ores Treare the Depatent 2 cost of production rept for Decemibec ek Da

{@) Prepare the journal entry to record the transfer of cost from Department 2 to (art

tment 3. (CGAA adapted) ape 8

cg

£47 Cost of production report —average costing. Sporfic Company produces steeping, Ko

iz two departments: Mixing, and Compounding and Packaging. The company wses W

average costing. For ia the Moving Department, the-ending inventory is com-

ple astamateral and v5 complete as to labor and factory overhead, and lost units orrur

nd of the ment’s ing. In he Compounding and Packaging Depart-

3 complete as to labor and ov

bet eeniginenoy eB empte sib sd asonvee, oe

= Mixing ees ae

a

2 Department Department pS

r

3 4 5 i *

Required: Prepare a cos of proc report fr bh pang for Febreay

$5. Process costing — average method. Chalam Papet Company manulactures a high

qulty paper bun. The Box Department applies Iwo separate ‘operations ~ cutting and

: Trim tothe dimensions of a box (orm by one

Th pager I fit et an It fout bos frens The trim

ine group. foot of paper is equiv’ ings

ym hy re scrap value’ Bor fo ee ‘then crised and foldal tie,,,

‘ompleted) by a secilid machine group Any tally processed bows inthe Box Dex > 1

—

Scanned with CamScanner

4 PART2

COST ACCUMULATION pRocrDURES %

fartmentarecutbox forms that are ready forcreasing an foldin Phare!

Aate-considered 505, complete ato abor and facory ove permit continuous

*partment maintains an inventory of paper in suliient pe tdieed Immediately ater

Fane Mg and transfers tothe Box Department aré made as Department

folding all satisfactory boxes are transferred tothe Finished Goods are feet of uy

uring June, the Materials Department purchased 1,210,000 Aaualtty cea

rocessed paper for $244,000. Conversion cost forjune aa eara ere pala dune,

0,000 boxes was spoiled during paper cutng, a

Talding all spetaye hee on Uohige wee Considered normal, and cannot be

» Process All spoilage loss is allocated between. the completed units and partial

Processed boxes. The compan applies the wei thted average costing method to all inven.

* tories. Inventory data for June are: {

June 1 ‘

: is

' ical ‘on June 30

Of ici tt Pin whe scan ual Bad

Materials Department” '

Paper ‘ vooe Square feet 390,000. $76,000 200,000

\ shox Department, * : via

_ Boxes cut {not folded) oo... number 800,000, 35,000" 300,000

—Fihished Goods Departinent: ¥ vine

omleted boxes on hand... “number 28000 18,960" 505000

“Materials

Conversion’cost.

Requjred: Prepare the following:

~», AB)_Azepart of cost of paper used in June by the Materials Department),

Greet edule 3 ving ete 1 of sng being and ening

inventories) in the

iy laterals Department, in thé Bo Be B and er

Finished Ge atime 2% Department, ‘and in the

; nent |A schedule showin

sy

i the computation of equi

Materials and conversion cast inthe Bos

Ai Sedat ofthe computation of un csistar ig

port inventory ost 2nd cist of competed oan nn ox Deve fag

‘X schedule showing the computation of wo Eat

it costs i ,

J tment. (Carry computation to ive decimal places.) the Finished Goods De

STN report invemory cost and cot of unk eg thé Finished. Goods

Departs (AICPA adapted)

. SM oventory costing; average method. In atter

ling to vetty the

tory of work Costing of the Decem-

OZ a tg Fl pel ol ew

ivalent units

Produced in June! for

artment

Finished goods, 200,000 units .

_ Work in process, 300,000

factory overhead

company uses average costing Mili mane

~, J echate meee tad bat whens Sto producti sig

> He rit’ inventory cost records disc :

\

ri osed rer

3d the following additional information for 19a,

ani

Scanned with CamScanner

as PROCESS COSTING: AVERAGE AND FIFO COSTING biel

Costs

Unity: Materials

workin process, January 1 (80% complete sala =

to laborand factory overhead ecco $ 20000 § 315,00

issued in prc Loom 7

Labor cost. S900 $1,995,000

unas completed: s0,c00 7

Regt

ined: 3 ‘

(Compute the equivalent units of production

Compute the unit production costs of materials, labor and factory overhead

) Cos the endif finished goods and wok Ta process Sventores pare

— P ‘inventories and com) to

re the necessary journal entry to correctly state the finished goods and work

process ending inventories oy (AICPA adapted)

tha of production report—filo vs average costing. Detera, Inc. uses thnie de-

partments to produce a detergent. The Finishing Department is the third and last step

infor the product is transferred to storage.

Al materials needed to give the detergent its final composition are added at the

in the Finishing Department. Any lost units occur only at

pli and are considered to be normal. .

The company uses fifo costing. The following data for the Finishing Departmeft for

Orober have been made available:

Production data: > - .

In process, October I (labor and factory overhead, % complete)... — 10,000 gals.

_ Transferred in from preceding depattment.;..... 40,000 gals.

Fished and transferred to storage - 4 35,000 pls.

"10,600 gals.

Ir process, October 31 (labor and factory overhead, ¥: complete)

Additional data: bond al

Work in process inventory, October

Cost Te poeling depart —

3 from this department:

‘Materials . .

Labor oo

Factory overhead

Total work in process invenory.

Transferred in during October.

Cost added im this

a

rtment for October, :

Be fare a cost of production report (or the Finishing Depar . \

f costing. me ‘ y

oaeetsent a production report for the Finishing Department for October, Te

it cost computations to three decimal places, and }

bared fourth vectra place ) {AICPA adapted) .

Scanned with CamScanner

Using average:

rivera Uf costing. Zaranka Corporation

report rent ing Inthe Fabricating Depart

In the Finishing Department, each,

es and three Uniplexes. Service Sepa

eet nd ee es St

Finishing Departments use process cost procedures, Actua,

\ Auction costs, ining factory overhead, are allocated monthly. ai

i Service department expenses ate allocated to producing departments as follows!

l * Bepehver , Eiblating Fishing

: $30,000 $15,000

16,500 11,000,

19500. 19,500

Matra inventory and work in process are costéd ina fifo basis,

‘The Fabricating Department's records for December show: “28

ani taba > = aus

Balance, December a =—— Orme

Paseo Baye Gast Asa

December 12 " 65.000 $15,580 +

December 20 .

Hetecatog Uxporiones vigy SO ons

Bry

a any ty xm

+ HE for materials and converso®

othe yt

Scanned with CamScanner

rr

4 "PROCESS COSTING; AVERAGE AND FIFO COSTING ‘ v Rap

our

/ ‘fh mine the total Fabricating Department cost to be accounted for,

Veempute the unit ar mae np eae the

nbcating Department.

‘Compute the cost of units transferred to the Fi

cast of the ending work in process inventor

f conflee| raqanemens (hand Ie ee

inishing Department, and the

in the Fabrieating

assuming that workin process inventory

is costed using the average method. (Round unit

ast of production report—average and fifo meth

Ost to the nearest gent.)

(AICPA adapted)

'ods, Relaxo Company manu: * .

senstanquilizrs. Productions divided into thre processes Mo

ist

iing, Compoundi

Average costing is used in wo departments, and fifo costing is

and Peskaging. i ——ee

oop he faclaging Department

: 4 following data are available for September:

‘Quai seule:

. py Loe OE Mixing. Compound

‘atin process at beginning. 000 = "735999

Tessar in process. 0,000 =

‘asserted from preceding

epuent

loistanfered to next department...

Ueistansered to finished gods ......

‘hist during process” .

Les iniprocess...

‘ses within normal tolerance limits. ;

“Ssisssumed toe entirely from units tansftvd in iis

‘Eonpiton of units in

sa beginning of

leas ne 7

tid lca overhes &

* ar pleton of units in i:

2nd of petiod: th

He a Me

gal or overhead 4

department

fy oo :

«equivalent units of production for ;

k ef ined cost of production report for September. (Carry unit cost

"0S 0 five decimal places.) ’

w

i sayy! bx? bins

Crt ig lg info

te es

period ah

Mixing ~ Compounding Packaging

$ 2,260 $3,000

{ 0

$ a 80

a

my toe tao

FD

10,430: 13,400; 2470 a

15700. nb, oo 0s ;

ip

cach department,

Scanned with CamScanner