Professional Documents

Culture Documents

Group 9 International Accounting Topic 3

Uploaded by

MAI PHAN THỊ HIỀN0 ratings0% found this document useful (0 votes)

1 views12 pagesAston Ltd acquired new solar technology costing $1.5 million with a trade discount of $200,000 that will significantly reduce energy costs, and incurred additional costs of $70,000 for staff training, $20,000 for initial testing, and $30,000 in lost production during implementation for a total capitalized cost of $1,520,000 for the new technology.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAston Ltd acquired new solar technology costing $1.5 million with a trade discount of $200,000 that will significantly reduce energy costs, and incurred additional costs of $70,000 for staff training, $20,000 for initial testing, and $30,000 in lost production during implementation for a total capitalized cost of $1,520,000 for the new technology.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views12 pagesGroup 9 International Accounting Topic 3

Uploaded by

MAI PHAN THỊ HIỀNAston Ltd acquired new solar technology costing $1.5 million with a trade discount of $200,000 that will significantly reduce energy costs, and incurred additional costs of $70,000 for staff training, $20,000 for initial testing, and $30,000 in lost production during implementation for a total capitalized cost of $1,520,000 for the new technology.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 12

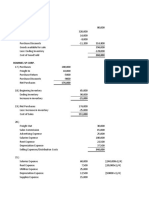

Aston Ltd acquires new energy efficient technology that will significantly reduce its energy costs for

Cost of new solar technology 1500000

Trade discount provided 200000

Training course for staff in new technology 70000

Initial testing of new technology 20000

Losses incurred while other parts of plant shut down during testing and training 30000

The cost that can be recognised and capitalised is:

Cost for capitalized 1500000

New of solar technology (20000)

Initial testing of new technolog 1520000

duce its energy costs for manufacturing. Costs incurred include:

Net asset at acquisition date

Cost capitalized 10000000

Adjustment

- medical research (3000000)

- medical research performed for client (1000000)

- cost for training (500000)

- advertising campaign (2200000)

- license 3000000

- other net assets 20000000

Adjusted net assets 26300000

Cost for capitalized

b, Recipes, secret formulas, models and designs, prototype

h Goodwill purchased in a business combination

i A company-developed patented drug approved for medical use

j, A license to manufacture a steroid by means of a government grant

Required

1/1/x1 DR Taxi license 10000

CR Cash 10000

31/12/x1 DR Depreciation expense 2000

CR Accumulated amortization 2000

31/12/x2 DR Depreciation expense 2000

CR Accumulated amortization 2000

Accumulated armotization = 4000

>>> Carrying amount of license 6000

If the company performs a license reassessment, then

Compare Fair value (in this case is 12000)

with CA = 6000

Asset Increased 6000

31/12/x2 DR Taxi license 6000

CR Revaluation surplus 6000

You might also like

- Extra Shift Decision: IllustrationDocument4 pagesExtra Shift Decision: IllustrationMeghan Kaye LiwenNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Case 3.7Document7 pagesCase 3.7Thái SơnNo ratings yet

- Cma-I Semester-Ii Contract Costing (C.U Sums For Revision) : Compute The Amount Profit ThatDocument13 pagesCma-I Semester-Ii Contract Costing (C.U Sums For Revision) : Compute The Amount Profit Thatvivek kumarNo ratings yet

- REVALUATION MODEL SantosDocument20 pagesREVALUATION MODEL SantosStefany M. SantosNo ratings yet

- PPE (Assistant Class Notes)Document8 pagesPPE (Assistant Class Notes)raj shahNo ratings yet

- Audit of Intangible AssetsDocument8 pagesAudit of Intangible AssetsHira IdaceiNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- Independent Acquisitions: A. Orient Company 285,000.00Document6 pagesIndependent Acquisitions: A. Orient Company 285,000.00JC NicaveraNo ratings yet

- Answer KeysDocument35 pagesAnswer Keyspayos manuelNo ratings yet

- Beauty Salon ParlourDocument6 pagesBeauty Salon ParlourUdit MishraNo ratings yet

- 2014 Final Exam SolutionsDocument6 pages2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- RAPHAEL RANDY 20220211161750 ACCT6133003 LH11 FIN ConfDocument8 pagesRAPHAEL RANDY 20220211161750 ACCT6133003 LH11 FIN ConfAnggur CapOTNo ratings yet

- 104 ReviewDocument4 pages104 ReviewalanNo ratings yet

- Final Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDDocument3 pagesFinal Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDermiasNo ratings yet

- IGNOU MCA MCS-035 Free Solved Assignments 2010Document11 pagesIGNOU MCA MCS-035 Free Solved Assignments 2010Deepti SainiNo ratings yet

- Chapter 7 RevenuesDocument17 pagesChapter 7 RevenuesTiya AmuNo ratings yet

- Answer Key - 1 TermDocument9 pagesAnswer Key - 1 TermsamayaksahuNo ratings yet

- Cañezal Assignment 2 CHECKEDDocument6 pagesCañezal Assignment 2 CHECKEDFeliz Victoria CañezalNo ratings yet

- Ipsas Training - Impairement of AssetsDocument49 pagesIpsas Training - Impairement of AssetsNassib Songoro100% (1)

- This Study Resource Was: Cost of Removing The Old Machine 12,000 Loss On Disposal of The Old Machine 150,000Document9 pagesThis Study Resource Was: Cost of Removing The Old Machine 12,000 Loss On Disposal of The Old Machine 150,000RNo ratings yet

- Property Plant Equipment May SagotDocument9 pagesProperty Plant Equipment May SagotRNo ratings yet

- TP Mms2021 NewDocument13 pagesTP Mms2021 NewChinmay PatelNo ratings yet

- Lesson 8 RevaluationDocument8 pagesLesson 8 RevaluationBeatriz Jade TicobayNo ratings yet

- Pup-Ppe5-Src 2-1Document15 pagesPup-Ppe5-Src 2-1Jerome BaluseroNo ratings yet

- Suggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsRanadeep ReddyNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- Sample ComputationDocument9 pagesSample ComputationJhao Mico TamayoNo ratings yet

- A5 Audit of Ppe Part 1Document10 pagesA5 Audit of Ppe Part 1KezNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Project Report On NurseryDocument6 pagesProject Report On NurseryManju Mysore100% (1)

- ACCT2201 Chapter 9Document8 pagesACCT2201 Chapter 9erinNo ratings yet

- Paul Company: Shutdown Cost 820,000 Shutdown Savings 80,000 Shutdown PointDocument6 pagesPaul Company: Shutdown Cost 820,000 Shutdown Savings 80,000 Shutdown PointBetchang AquinoNo ratings yet

- Activity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Document23 pagesActivity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Bennie KingNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- CAFMDocument22 pagesCAFMEsha Bhardwaj100% (1)

- Topic 4 Revaluation Property Plant and EquipmentDocument6 pagesTopic 4 Revaluation Property Plant and Equipmentjinman bongNo ratings yet

- Tutorial 4 SolutionsDocument5 pagesTutorial 4 SolutionsnaboumilikaNo ratings yet

- J66998bos54006fold p5Document32 pagesJ66998bos54006fold p5Question BankNo ratings yet

- FAR - Financial Liabilities - Debt RestructuringDocument9 pagesFAR - Financial Liabilities - Debt Restructuringmarlout.saritaNo ratings yet

- Chapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeDocument9 pagesChapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeSherri BonquinNo ratings yet

- Differential Analysis: The Key To Decision MakingDocument20 pagesDifferential Analysis: The Key To Decision MakingJean CastroNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020No ratings yet

- Revaluation: To The Treatment of Revaluation SurplusDocument16 pagesRevaluation: To The Treatment of Revaluation SurplusTurks100% (1)

- Fixed Cost Vs Variable CostDocument24 pagesFixed Cost Vs Variable Costsrk_soumyaNo ratings yet

- R4acads Finacc PrefinalDocument4 pagesR4acads Finacc PrefinalChristine Herico CurryNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Ppe ProblemDocument3 pagesPpe ProblemJanuary Ann BeteNo ratings yet

- Tentative Suggested Answer - Nov. 22 ExamDocument20 pagesTentative Suggested Answer - Nov. 22 ExamHemant RathvaNo ratings yet

- Financial Statement2 (Work Sheet)Document6 pagesFinancial Statement2 (Work Sheet)Arham RajpootNo ratings yet

- Lesson 8 Management Science Short Term DecisionsDocument3 pagesLesson 8 Management Science Short Term DecisionsMila Casandra CastañedaNo ratings yet

- 1.5 Recopuements and Deferrals 2022Document11 pages1.5 Recopuements and Deferrals 2022AmogelangNo ratings yet

- 02 Assignment AnswerDocument12 pages02 Assignment AnswerKSNo ratings yet

- Beyond Crisis: The Financial Performance of India's Power SectorFrom EverandBeyond Crisis: The Financial Performance of India's Power SectorNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet