0% found this document useful (0 votes)

2K views8 pagesACCT2201 Chapter 9

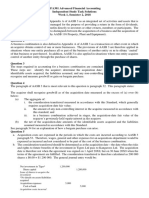

The document discusses revaluation of non-current assets for Miss Congeniality Ltd and Payback Ltd.

For Miss Congeniality Ltd, entries are presented to revalue a building and vehicle as of June 30, 2016 based on an independent valuation. Depreciation entries are also shown for the year ended June 30, 2017.

For Payback Ltd, entries change the measurement of equipment from cost to revaluation model as of December 31, 2016 based on revaluations. Further entries record depreciation and revaluation changes for the equipment for the year ended June 30, 2017.

Uploaded by

erinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views8 pagesACCT2201 Chapter 9

The document discusses revaluation of non-current assets for Miss Congeniality Ltd and Payback Ltd.

For Miss Congeniality Ltd, entries are presented to revalue a building and vehicle as of June 30, 2016 based on an independent valuation. Depreciation entries are also shown for the year ended June 30, 2017.

For Payback Ltd, entries change the measurement of equipment from cost to revaluation model as of December 31, 2016 based on revaluations. Further entries record depreciation and revaluation changes for the equipment for the year ended June 30, 2017.

Uploaded by

erinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd