Professional Documents

Culture Documents

Tutorial 3 Tutorial 3

Uploaded by

Andrei Nicole RiveraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 3 Tutorial 3

Uploaded by

Andrei Nicole RiveraCopyright:

Available Formats

lOMoARcPSD|5715963

Tutorial 3

Management Accounting (University of Western Australia)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

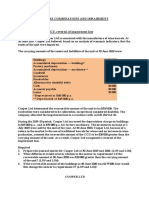

TUTORIAL 3

Exercise 5.11

Depreciation and revaluation of assets

In the 30 June 2016 annual report of Emu Ltd, the equipment was reported as

follows:

Equipment (at cost) $ 500 000

Accumulated depreciation 150 000

350 000

The equipment consisted of two machines, Machine A and Machine B. Machine A

had cost $300 000 and had a carrying amount of $180 000 at 30 June 2016, and

Machine B had cost $200 000 and was carried at $170 000. Both machines are

measured using the cost model, and depreciated on a straight-line basis over a 10-

year period.

On 31 December 2016, the directors of Emu Ltd decided to change the basis of

measuring the equipment from the cost model to the revaluation model. Machine A

was revalued to $180 000 with an expected useful life of 6 years, and Machine B

was revalued to $155 000 with an expected useful life of 5 years.

At 1 July 2017, Machine A was assessed to have a fair value of $163 000 with an

expected useful life of 5 years, and Machine B’s fair value was $136 500 with an

expected useful life of 4 years.

Required

1. Prepare journal entries to record depreciation during the year ended 30 June

2017, assuming there was no revaluation.

2. Prepare the journal entries for Machine A for the period 1 July 2016 to 30 June

2017 on the basis that it was revalued on 31 December 2016.

3. Prepare the journal entries for Machine B for the period 1 July 2016 to 30 June

2017 on the basis that it was revalued on 31 December 2016.

4. Prepare the revaluation journal entries required for 1 July 2017.

5. According to accounting standards, on what basis may management change the

method of asset measurement, for example from cost to fair value?

EMU LTD

1.

30 June, 2017

Depreciation expense – Machine A Dr 30 000

Accumulated depreciation Cr 30 000

(10% x $300 000)

Depreciation expense – Machine B Dr 20 000

Accumulated depreciation Cr 20 000

(10% x $200 000)

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

2.

31 December, 2016

Depreciation expense – Machine A Dr 15 000

Accumulated depreciation Cr 15 000

(1/2 x 10% x $300 000)

Machine A

Cost 300 000

Accum. depreciation 135 000

165 000

Fair value 180 000

Increment 15 000

Accumulated depreciation – Machine A Dr 135 000

Machine A Cr 135 000

(Writing the asset down to carrying amount)

Machine A Dr 15 000

Gain on revaluation of machinery (OCI) Cr 15 000

(Revaluation of machine from $165 000 to $180 000)

Income Tax Expense-OCI Dr 4 500

Deferred Tax Liability CR 4 500

(Tax effect of revaluation of machine)

Gain on revaluation of machinery (OCI) Dr 15 000

Income Tax Expense (OCI) 4 500

Asset revaluation surplus – Machine A Cr 10 500

(Accumulation of net revaluation gain in equity)

30 June, 2017

Depreciation expense – Machine A Dr 15 000

Accumulated depreciation Cr 15 000

(1/2 x $180 000/6yrs)

3.

31 December, 2016

Depreciation expense – Machine B Dr 10 000

Accumulated depreciation Cr 10 000

(1/2 x 10% x $200 000)

Machine B

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Cost 200 000

Accum. depreciation 40 000

160 000

Fair value 155 000

Decrement 5 000

Accumulated depreciation – Machine B Dr 40 000

Machine B Cr 40 000

(Writing the asset down to carrying amount)

Loss – revaluation decrement (P/L) Dr 5 000

Machine B Cr 5 000

(Revaluation of machine from $160 000

to $155 000)

30 June, 2017

Depreciation expense – Machine B Dr 15 500

Accumulated depreciation Cr 15 500

(1/2 x $155 000/5yrs)

4.

Machine A $ Machine B $

Revalued 180 000 Revalued 155 000

Accum. Deprec 15 000 Accum. Deprec 15 500

Carrying amount 165 000 Carrying amount 139 500

Fair value 163 000 Fair value 136 500

Decrement 2 000 Decrement 3 000

Accumulated depreciation – Machine A Dr 15 000

Machine A Cr 15 000

(Writing down to carrying amount)

Loss on revaluation of machinery (OCI) Dr 2 000

Machine A Cr 2 000

(Revaluation downwards)

Deferred Tax Liability Dr 600

Income tax Expense(OCI) Cr 600

(Tax effect of revaluation downwards)

Asset revaluation surplus – Machine A Dr 1 400

Income Tax Expense (OCI) Dr 600

Loss on revaluation of machinery (OCI) Cr 2 000

(Reduction in accumulated equity due

to revaluation decrement)

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Accumulated depreciation – Machine B Dr 15 500

Machine B Cr 15 500

(Writing down to carrying amount)

Loss – revaluation decrement (P/L) Dr 3 000

Machine B Cr 3 000

(Writing down to fair value)

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

5. Basis for change in accounting policy

Consider the cost basis method and the fair value method in relation to the relevance

and reliability of information.

Current information is generally more relevant than past information. Determination

of cost is generally more reliable than determination of fair value.

Consider the trade-off between relevance and reliability, that is, as information

becomes less reliable it also loses its relevance. A fair value measure may, because

of its timeliness, be more relevant but if the measure becomes more unreliable, the

relevance of the information decreases.

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

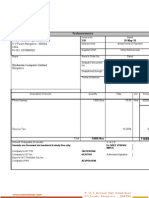

Exercise 5.12

Revaluation of assets

On 30 June 2016, the statement of financial position of Kookaburra Ltd showed the

following non-current assets after charging depreciation:

Building $ 300

Accumulated depreciation 000 $200 000

(100

000)

Motor vehicle 120 000

Accumulated depreciation (40 80 000

000)

The company has adopted fair value for the valuation of non-current assets. This has

resulted in the recognition in previous periods of an asset revaluation surplus for the

building of $14 000. On 30 June 2016, an independent valuer assessed the fair

value of the building to be $160 000 and the vehicle to be $90 000.

Required

1. Prepare any necessary entries to revalue the building and the vehicle as at 30

June 2016.

2. Assume that the building and vehicle had remaining useful lives of 25 years and

4 years respectively, with zero residual value. Prepare entries to record

depreciation expense for the year ended 30 June 2017 using the straight-line

method.

KOOKABURRA LTD

General Journal

1.

Accumulated depreciation – Building Dr 100 000

Building Cr 100 000

(Writing down to carrying amount)

Loss on revaluation of building (P&L) Dr 20 000

Loss on revaluation of building (OCI) Dr 20 000

Building Cr 40 000

(Revaluation downwards of building)

Deferred Tax Liability Dr 6 000

Income Tax Expense (OCI) Cr 6 000

(Being tax effect of revaluation downwards)

Asset revaluation surplus - Building Dr 14 000

Income Tax Expense (OCI) Dr 6 000

Loss on revaluation of building (OCI)Cr 20 000

(Reduction in accumulated equity due to revaluation decrement on building)

Accumulated depreciation – Vehicle Dr 40 000

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Vehicle Cr 40 000

(Writing down to carrying amount)

Vehicle Dr 10 000

Gain on revaluation of vehicle (OCI)Cr 10 000

(Revaluation to fair value)

Income Tax Expense (OCI) Dr 3 000

Deferred Tax Liability Cr 3 000

Gain on revaluation of vehicle (OCI) Dr 10 000

Asset revaluation surplus - vehicle Cr 7 000

Income Tax Expense (OCI) Cr 3 000

2.

Depreciation expense – Building Dr 6 400

Accumulated depreciation – BuildingCr 6 400

($160 000/25)

Depreciation expense – Vehicle Dr 22 500

Accumulated depreciation – VehicleCr 22 500

($90 000/ 4)

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Exercise 5.18

Revaluation model

On 1 July 2016, Peewee Ltd acquired two assets within the same class of plant and

equipment. Information on these assets is as follows.

Cost Expected useful

life

Machine A $100 000 5 years

Machine B 60 000 3 years

The machines are expected to generate benefits evenly over their useful lives. The

class of plant and equipment is measured using fair value.

At 30 June 2017, information about the assets is as follows.

Fair value Expected useful life

Machine A $84 000 4 years

Machine B 38 000 2 years

On 1 January 2018, Machine B was sold for $29 000 cash. On the same day,

Peewee Ltd acquired Machine C for $80 000 cash. Machine C has an expected

useful life of 4 years. Peewee Ltd also made a bonus issue of 10 000 shares at $1

per share, using $8000 from the general reserve and $2000 from the asset

revaluation surplus created as a result of measuring Machine A at fair value.

At 30 June 2018, information on the machines is as follows.

Fair value Expected useful life

Machine A $61 000 3 years

Machine C 68 500 3.5 years

Required

1. Prepare the journal entries in the records of Peewee Ltd to record the events for

the year ended 30 June 2017.

2. Prepare journal entries to record the events for the year ended 30 June 2018.

PEEWEE LTD

1.

1 July 2016

Machine A Dr 100 000

Machine B Dr 60 000

Cash Cr 160 000

30 June 2017

Depreciation expense – Machine A Dr 20 000

Accumulated depreciation – Machine A Cr 20 000

(1/5 x $100 000)

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Depreciation expense – Machine B Dr 20 000

Accumulated depreciation – Machine B Cr 20 000

(1/3 x $60 000)

Accumulated depreciation- Machine A Dr 20 000

Machine A Cr 20 000

(Writing down to carrying amount)

Machine A Dr 4 000

Gain on revaluation of Machine A (OCI) Cr 4 000

(Revaluation increment: $80 000 to $84 000)

Income Tax Expense (OCI) Dr 1 200

Deferred Tax Liability Cr 1 200

(Being tax effect of revaluation increment)

Gain on revaluation of Machine A (OCI) Dr 4 000

Income Tax Expense (OCI) Cr 1 200

Asset revaluation surplus – Machine A Cr 2 800

(Accumulation of net revaluation gain in equity))

Accumulated depreciation – Machine B Dr 20 000

Machine B Cr 20 000

(Writing down to carrying amount)

Loss on revaluation – Machine B (P&L) Dr 2 000

Machine B Cr 2 000

(Revaluation to fair value at 30/6/17)

2.

1 January 2018

Machine C Dr 80 000

Cash Cr 80 000

(Acquisition of machine C)

Depreciation expense – Machine B Dr 9 500

Accumulated depreciation – Machine B Cr 9 500

(1/2 x /1/2 x $38 000)

Cash Dr 29 000

Proceeds on sale of Machine B Cr 29 000

(Sale of Machine B)

Carrying amount of Machine B Sold Dr 28 500

Accumulated depreciation – Machine B Dr 9 500

Machine B Cr 38 000

(Carrying amount of machine sold)

General reserve Dr 8 000

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Asset revaluation surplus – Machine A Dr 2 000

Share Capital Cr 10 000

30 June 2018

Depreciation expense – Machine A Dr 21 000

Accumulated depreciation – Machine A Cr 21 000

(1/4 x $84 000)

Depreciation expense – Machine C Dr 10 000

Accumulated depreciation – Machine C Cr 10 000

(1/4 x ½ x $80 000)

Accumulated depreciation – Machine A Dr 21 000

Machine A Cr 21 000

(Writing down to carrying amount)

Loss on revaluation of Machine A (OCI) Dr 1142

Loss on revaluation of Machine A (P and L) Dr 858

Machine A Cr 2 000

(Write down of plant from $63000 to $61000)

Deferred Tax Liability Dr 342

Income Tax Expense (OCI) Cr 342

(Tax effect of revaluation decrement)

Asset revaluation surplus – Machine A Dr 800

Income Tax Expense (OCI) Dr 342

Loss on revaluation of Machine A (OCI) Cr 1 142

(Accumulation of revaluation loss to equity)

Accumulated depreciation – Machine C Dr 10 000

Machine C Cr 10 000

(Writing down to carrying amount)

Loss on revaluation (P&L) Dr 1 500

Machine C Cr 1 500

(Revaluation to fair value at 30/6/18)

10

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Exercise 5.19

Determining the cost of assets

Magpie Ltd uses many kinds of machines in its operations. It constructs some of

these machines itself and acquires others from the manufacturers. The following

information relates to two machines that it has recorded in the 2017–18 period.

Machine A was acquired, and Machine B was constructed by Magpie Ltd itself.

Machine A

Cash paid for equipment, including GST of $8000 $88

Costs of transporting machine — insurance and transport 000

Labour costs of installation by expert fitter 3 000

Labour costs of testing equipment 5 000

Insurance costs for 2017–18 4 000

Costs of training for personnel who will use the machine 1 500

Costs of safety rails and platforms surrounding machine 2 500

Costs of water devices to keep machine cool 6 000

Costs of adjustments to machine during 2017–18 to make it 8 000

operate more efficiently 7 500

Machine B

Cost of material to construct machine, including GST of $7000 77 000

Labour costs to construct machine 43 000

Allocated overhead costs — electricity, factory space etc. 22 000

Allocated interest costs of financing machine 10 000

Costs of installation 12 000

Insurance for 2017–18 2 000

Profit saved by self-construction 15 000

Safety inspection costs prior to use 4

000

Required

Determine the amount at which each of these machines should be recorded in the

records of Magpie Ltd. For items not included in the cost of the machines, note how

they should be accounted for.

Machine A

Cost of machine $88 000

(8 000) GST

3 000 Transport

5 000 Installation

4 000 Testing

6 000 Safety rails

8 000 Coolers

7 500 Adjustments

$113 500

Expense the insurance costs of $1 500 and training $2 500.

11

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

lOMoARcPSD|5715963

Machine B

Cost of machine $77 000

(7 000) GST

43 000 labour

22 000 overheads

10 000 interest *

12 000 installation

4 000 safety

$161 000

* Under AASB 123 Borrowing Costs interest must be capitalised.

Expense the insurance cost of $2 000. Disregard the profit saved by self-

construction.

12

Downloaded by Andrei Nicole Rivera (andreinicolerivera@gmail.com)

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- ACCT2201 Chapter 9Document8 pagesACCT2201 Chapter 9erinNo ratings yet

- Topic 4 Revaluation Property Plant and EquipmentDocument6 pagesTopic 4 Revaluation Property Plant and Equipmentjinman bongNo ratings yet

- Tutorial 4 SolutionsDocument5 pagesTutorial 4 SolutionsnaboumilikaNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- Depreciation CalculationDocument29 pagesDepreciation CalculationRavineahNo ratings yet

- ACCY200 Tutorial Solutions Week 8Document10 pagesACCY200 Tutorial Solutions Week 8duraton94No ratings yet

- ACW 2491 Financial Accounting Topic 5: Property, Plant and Equipment (Revaluation Model) Workshop Exercises IssuesDocument4 pagesACW 2491 Financial Accounting Topic 5: Property, Plant and Equipment (Revaluation Model) Workshop Exercises IssuesAhsan MasoodNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- Chapter 15 Tutorial Solutions As Discussed On ZOOMDocument7 pagesChapter 15 Tutorial Solutions As Discussed On ZOOMTaufiq AliNo ratings yet

- ACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationDocument8 pagesACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationAhsan MasoodNo ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Murdoch University Bus285 Technology & Accounting Processes Workshop Solutions Manual Session 10 Workhop QuestionsDocument2 pagesMurdoch University Bus285 Technology & Accounting Processes Workshop Solutions Manual Session 10 Workhop QuestionsVivian WongNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- Jawaban Latihan Kasus KelasDocument5 pagesJawaban Latihan Kasus KelasSHYAILA ANISHA DE LAVANDANo ratings yet

- IPFMPSFR - Solutions 3 2023 Final - AADocument31 pagesIPFMPSFR - Solutions 3 2023 Final - AASabNo ratings yet

- Straight Line Method (SLM)Document8 pagesStraight Line Method (SLM)Binod KhatriNo ratings yet

- Tutorial Week 4 Homework Chapter 7 & 9 QuestionsDocument4 pagesTutorial Week 4 Homework Chapter 7 & 9 QuestionsShek Kwun HeiNo ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuinevereNo ratings yet

- Solutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDocument68 pagesSolutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDvcLouisNo ratings yet

- Depreciation Methods and CalculationsDocument5 pagesDepreciation Methods and CalculationsAvox EverdeenNo ratings yet

- IAS 36 Additional Question SolutionsDocument9 pagesIAS 36 Additional Question SolutionsTatenda Webster MushaurwiNo ratings yet

- Group 1 AccountsDocument18 pagesGroup 1 Accountsadityatiwari122006No ratings yet

- Depreciation: by Group 4Document13 pagesDepreciation: by Group 4Shrey KashyapNo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Accounting For Long Term Assets Property Plant and Equipment (Ias 16)Document7 pagesAccounting For Long Term Assets Property Plant and Equipment (Ias 16)ZAKAYO NJONYNo ratings yet

- Audit Property, Plant and Equipment AssignmentDocument2 pagesAudit Property, Plant and Equipment AssignmentDan Andrei BongoNo ratings yet

- 2014 Final Exam SolutionsDocument6 pages2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- Class Practice QsDocument10 pagesClass Practice QsIsha KatiyarNo ratings yet

- 104 ReviewDocument4 pages104 ReviewalanNo ratings yet

- Aud Prob SolutionsDocument10 pagesAud Prob SolutionsAngel AguinaldoNo ratings yet

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- Acct 217 Q &aDocument17 pagesAcct 217 Q &aLeroyNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- Swinburne University ACC10007 Discussion QuestionsDocument5 pagesSwinburne University ACC10007 Discussion QuestionsRenee WongNo ratings yet

- Impairment of Asset: Cash Generating UnitDocument28 pagesImpairment of Asset: Cash Generating UnitLumongtadJoanMaeNo ratings yet

- ACW2491 Lecture 4 Handout SolutionS22016Document4 pagesACW2491 Lecture 4 Handout SolutionS22016林志成No ratings yet

- TGS Kelompok PPEDocument3 pagesTGS Kelompok PPESHYAILA ANISHA DE LAVANDANo ratings yet

- Group 9 International Accounting Topic 3Document12 pagesGroup 9 International Accounting Topic 3MAI PHAN THỊ HIỀNNo ratings yet

- PROCESS COSTING CALCULATIONSDocument7 pagesPROCESS COSTING CALCULATIONSHarshal mevadaNo ratings yet

- CPA 14-Public Sector Accounting & ReportingDocument15 pagesCPA 14-Public Sector Accounting & ReportingManit MehtaNo ratings yet

- Pre-Final Exam in Audit 2-3Document5 pagesPre-Final Exam in Audit 2-3Shr BnNo ratings yet

- CONSOLIDATED FINANCIAL STATEMENTSDocument7 pagesCONSOLIDATED FINANCIAL STATEMENTSMya Hmuu KhinNo ratings yet

- Maynard Solutions Ch10Document21 pagesMaynard Solutions Ch10Anton VitaliNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- December 2019Document20 pagesDecember 2019Kunal GargNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- AccountingDocument4 pagesAccountingAbdallahNo ratings yet

- Financial Accounting Reviewer - Chapter 60Document15 pagesFinancial Accounting Reviewer - Chapter 60Coursehero Premium100% (1)

- Accounting (Modular Syllabus) : Pearson EdexcelDocument20 pagesAccounting (Modular Syllabus) : Pearson EdexcelAsma YasinNo ratings yet

- Solution Chapter 7 Accounting For Non-Current AssetsDocument4 pagesSolution Chapter 7 Accounting For Non-Current AssetsIsmahNo ratings yet

- Solution Chapter 18Document61 pagesSolution Chapter 18KUROKONo ratings yet

- Case 3.7Document7 pagesCase 3.7Thái SơnNo ratings yet

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- E2,3Document12 pagesE2,3hieuluu.31221023224No ratings yet

- Partnership: Fundamentals Guarantee of ProfitsDocument12 pagesPartnership: Fundamentals Guarantee of ProfitsJoshua DevNo ratings yet

- Pdic-Example ComputationDocument9 pagesPdic-Example ComputationAndrei Nicole RiveraNo ratings yet

- MANAGEMENT ADVISORY SERVICES BATCH 90 FINAL PREBOARDDocument25 pagesMANAGEMENT ADVISORY SERVICES BATCH 90 FINAL PREBOARDAndrei Nicole RiveraNo ratings yet

- AfarDocument128 pagesAfarlloyd77% (57)

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- AT.3005-Preliminary Engagement Activities PDFDocument5 pagesAT.3005-Preliminary Engagement Activities PDFAndrei Nicole RiveraNo ratings yet

- Resa Special Laws PDFDocument20 pagesResa Special Laws PDFAndrei Nicole RiveraNo ratings yet

- RFBT Mcqs New TopicsDocument20 pagesRFBT Mcqs New TopicsjexNo ratings yet

- Quick Notes PEZADocument8 pagesQuick Notes PEZAVic FabeNo ratings yet

- Understanding the Key Changes in the TRAIN LawDocument54 pagesUnderstanding the Key Changes in the TRAIN LawMaeNeth GullanNo ratings yet

- Kupdf - Reviewer Kupdf - ReviewerDocument36 pagesKupdf - Reviewer Kupdf - ReviewerAndrei Nicole RiveraNo ratings yet

- RCM TRAIN Vs NIRC PDFDocument138 pagesRCM TRAIN Vs NIRC PDFCrizziaNo ratings yet

- Tax New Topics PDFDocument23 pagesTax New Topics PDFriate03No ratings yet

- Far/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Document2 pagesFar/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Andrei Nicole RiveraNo ratings yet

- Auditing Theory Review Notes PDFDocument136 pagesAuditing Theory Review Notes PDFTricia Mae Fernandez100% (1)

- Digital Notebook - Blue Cover White Paper With HyperlinkDocument24 pagesDigital Notebook - Blue Cover White Paper With HyperlinkAndrei Nicole RiveraNo ratings yet

- Digital Notebook - Pink Paper With Hyperlink PDFDocument24 pagesDigital Notebook - Pink Paper With Hyperlink PDFAndrei Nicole RiveraNo ratings yet

- Candy PDFDocument62 pagesCandy PDFAndrei Nicole RiveraNo ratings yet

- Understanding the Key Changes in the TRAIN LawDocument54 pagesUnderstanding the Key Changes in the TRAIN LawMaeNeth GullanNo ratings yet

- AP - TestbankDocument22 pagesAP - TestbankRamon Jonathan SapalaranNo ratings yet

- Oblicon SummaryDocument13 pagesOblicon SummaryailynvdsNo ratings yet

- Candy 1 PDFDocument62 pagesCandy 1 PDFAndrei Nicole RiveraNo ratings yet

- Begun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenDocument35 pagesBegun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenAllyson VillalobosNo ratings yet

- Managing QualityDocument76 pagesManaging Qualitywahid riyantoNo ratings yet

- Continental Media CaseDocument8 pagesContinental Media Casejpg2riceeduNo ratings yet

- Usha Letter Head CurvedDocument1 pageUsha Letter Head Curvedsales7705No ratings yet

- Transportation Modeling - NWM & LCMDocument16 pagesTransportation Modeling - NWM & LCMkashi nath DebNo ratings yet

- Guiding Principles of Procurement PDFDocument14 pagesGuiding Principles of Procurement PDFSN PanigrahiNo ratings yet

- Accounting IB Course OutlineDocument2 pagesAccounting IB Course OutlineEdwin Mudzamiri04No ratings yet

- Module 2 Understanding Agribusiness ModelsDocument11 pagesModule 2 Understanding Agribusiness ModelsDonna Cece MelgarNo ratings yet

- Sherin - CV UpdatedDocument5 pagesSherin - CV Updatedanon_333386456No ratings yet

- University of London La3021 OctoberDocument6 pagesUniversity of London La3021 OctoberdaneelNo ratings yet

- UrbanClap Case StudyDocument7 pagesUrbanClap Case StudyAniket SanyalNo ratings yet

- Become An Amazon Seller - How To Sell On AmazonDocument12 pagesBecome An Amazon Seller - How To Sell On AmazonFarbodNo ratings yet

- Women Entrepreneurship Factors NepalDocument41 pagesWomen Entrepreneurship Factors NepalDev Bahadur BudhaNo ratings yet

- Strategic Planning - BMW Strategic PlanningDocument26 pagesStrategic Planning - BMW Strategic Planningyasir_irshad100% (4)

- UNIT 4 - Capital BudgetingDocument38 pagesUNIT 4 - Capital BudgetingKrishnan SrinivasanNo ratings yet

- 4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDocument23 pages4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDhivya Lakshmirajan100% (1)

- Abhishek Raj CVDocument4 pagesAbhishek Raj CVSairam VundavilliNo ratings yet

- Evaluation of Effectiveness of TrainingDocument42 pagesEvaluation of Effectiveness of TrainingSarah AzizNo ratings yet

- Total Quality M-WPS OfficeDocument5 pagesTotal Quality M-WPS OfficeChristie SabidorNo ratings yet

- Entrepreneurship Unit 3Document20 pagesEntrepreneurship Unit 3Raj SinghNo ratings yet

- Finding faults in cables through predictive testingDocument8 pagesFinding faults in cables through predictive testingMiguel AngelNo ratings yet

- MMJ 2017 Fall Vol27 Issue2 Coker Flight Baima pp75 87Document13 pagesMMJ 2017 Fall Vol27 Issue2 Coker Flight Baima pp75 87Kokoro JaneNo ratings yet

- Computer Training InstituteDocument10 pagesComputer Training InstituteaefewNo ratings yet

- Differences Between Domestic and Foreign MarketsDocument2 pagesDifferences Between Domestic and Foreign MarketsChandini PriyaNo ratings yet

- How Can We ExportDocument94 pagesHow Can We ExportUdit PradeepNo ratings yet

- Cuet Universities Courses Papers Updated 01 03 2023Document21 pagesCuet Universities Courses Papers Updated 01 03 2023Anupriya AnuNo ratings yet

- BBPP1103Document7 pagesBBPP1103ideal assignment helper 2629No ratings yet

- Capital Today FINAL PPMDocument77 pagesCapital Today FINAL PPMAshish AgrawalNo ratings yet

- Spatial Organization: Circulation Area Service Area Display AreaDocument55 pagesSpatial Organization: Circulation Area Service Area Display AreakartikharishNo ratings yet

- How To Draw The Platform Business Model Map-David RogersDocument5 pagesHow To Draw The Platform Business Model Map-David RogersworkneshNo ratings yet

- Microeconomics (Applied Managerial Economics) :: Petersen, Lewis and Jain Chapter 01Document7 pagesMicroeconomics (Applied Managerial Economics) :: Petersen, Lewis and Jain Chapter 01Aditya ZananeNo ratings yet