Professional Documents

Culture Documents

71696bos57679 Inter p5q

Uploaded by

Mayank RajputOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

71696bos57679 Inter p5q

Uploaded by

Mayank RajputCopyright:

Available Formats

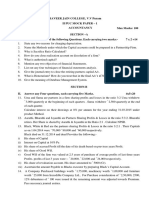

Test Series: September 2022

MOCK TEST PAPER – 1

INTERMEDIATE: GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary, suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

Time Allowed: 3 Hours Maximum Marks: 100

1. (a) Sun Limited leased a machine to Moon Limited on the following terms:

(Amount in `)

Fair value at inception of lease 50,00,000

Lease Term 4 Years

Lease Rental per annum 16,00,000

Guaranteed residual value 3,00,000

Expected residual value 4,50,000

Implicit Interest rate 15%

Discounted rates for 1 st year, 2nd year, 3rd year and 4 th year are 0.8696, 0.7561, 0.6575 and 0.5718

respectively.

Calculate the value of Lease Liability and ascertain Unearned Finance Income as per AS -19.

(b) Net Profit for FY 2020-21 30,00,000

Net Profit for FY 2021-22 50,00,000

No. of shares outstanding prior to rights issue 20,00,000 shares

Rights Issue Price ` 20

Last day to exercise rights 1st June, 2021

Right issue is one new share for each five equity shares outstanding (i.e. 4,00,000 new shares)

Fair value of one equity share immediately prior to exercise of rights on 1st June, 20 21 was

` 26.00.

Compute Basic Earnings Per Share for FY 2020-21, FY 2021-2022 and restated EPS for

FY 2020-21.

(c) State with reasons, how the following events would be dealt with in the financial statements of Hari

Ltd. for the year ended 31 st March, 2022 (accounts were approved on 25 th July, 2022):

(1) Negotiations with another company for acquisition of its business was started on

21st January, 2022. Hari Ltd. invested ` 40 lakh on 22 nd April, 2022.

(2) The company made a provision for bad debts @ 4% of its total debtors (as per trend followed

from the previous years). In the second week of March 2022, a debtor for ` 2,50,000 had

suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy.

In May, 2022 the debtor became bankrupt.

(3) During the year 2021-22, Hari Ltd. was sued by a competitor for ` 13 lakhs for infringement

of a trademark. Based on the advice of the company's legal counsel, Hari Ltd. provided for a

© The Institute of Chartered Accountants of India

sum of ` 8 lakhs in its financial statements for the year ended 31 st March, 2022. On

26th May, 2022, the Court decided in favour of the party alleging infringement of the trademark

and ordered Hari Ltd. to pay the aggrieved party a sum of ` 12 lakhs.

(4) Cashier of Hari Ltd. embezzled cash amounting to ` 3,00,000 during March, 2022. However

the same comes to the notice of Company management during August, 2022.

(5) Cheques dated 31 st March, 2022 collected in the month of April, 2022. All cheques are

presented to the bank in the month of April, 2022 and are also realized in the same month in

the normal course after deposit in the bank.

(d) Honey Ltd. is in the process of developing a new production method. During the financial year

ended 31 st March, 2021, total expenditure incurred on development of this production method was

` 98,00,000. On 1 st Jan, 2021, the production method met the criteria as an intangible asset and

expenditure incurred till this date was ` 68,00,000. Further expenditure incurred on the new method

was ` 72,00,000 for the year ended 31 st March, 2022 and recoverable amount of the know how

embodied in the new method for this financial year is ` 52,00,000.

You are required to calculate:

(1) The carrying amount of the Intangible asset on 31st March, 2021.

(2) The expenditure to be shown in Statement of Profit and Loss for the year ended

31st March, 2022.

(3) The carrying amount of the Intangible asset on 31 st March, 2022.

(4 Parts x 5 Marks = 20 Marks)

2. (a) Black Limited and White Limited have been carrying their business independently from 01/04/2022.

Because of synergy in business, they amalgamated on and from 1 st April, 2022 and formed a new

company Grey Limited to take over the business of Black Limited and White Limited. The

information of Black Limited and White Limited as on 31st March, 2022 are as follows:

Black Ltd. White Ltd.

(`) (`)

Share Capital:

Equity share of ` 10 each 15,00,000 14,50,000

10% Preference shares of ` 100 each 2,00,000 1,40,000

Revaluation Reserve 1,00,000 2,00,000

General Reserve 1,65,000 85,000

Profit & Loss Account:

Opening balance (Credit balance) 1,50,000 1,20,000

Profit for the Year 2,00,000 1,30,000

15% Debentures of ` 100 each (Secured) 4,00,000 5,00,000

Trade payables 3,10,000 1,20,000

Land and Buildings 3,20,000 7,40,000

Plant and Machinery 18,00,000 14,00,000

Investments 1,00,000 60,000

Inventory 2,20,000 1,50,000

Trade Receivables 4,25,000 2,65,000

Cash at Bank 1,60,000 1,30,000

© The Institute of Chartered Accountants of India

Additional Information:

(i) The authorized capital of the new company will be ` 54,00,000 divided into 2,00,000 equity

shares of ` 25 each, and 4,000 preference shares of ` 100 each.

(ii) Trade payables of Black Limited includes ` 15,000 due to White Limited and trade receivables

of White Limited shows ` 15,000 receivable from Black Limited.

(iii) Land & Buildings and inventory of Black Limited and White Limited are to be revalued as

under:

Black Ltd. White Ltd.

(`) (`)

Land and Buildings 5,20,000 10,40,000

Inventory 1,80,000 1,25,000

(iv) The purchase consideration is to be discharged as under:

(a) Issue 1,80,000 equity shares of ` 25 each fully paid up in proportion of their profitability

in the preceding two financial years.

(b) Preference shareholders of two companies are issued equivalent number of 12%

preference shares of Grey Limited at a price of ` 120 per share (face value ` 100).

(c) 15% Debenture holders of Black Limited and White Limited are discharged by Grey

Limited issuing such number of its 18% Debentures of ` 100 each so as to maintain the

same amount of interest.

You are required to prepare the Balance Sheet of Grey Limited after amalgamation. The

amalgamation took place in the nature of purchase.

(b) The following scheme of reconstruction has been approved for Shine Limited:

(i) The shareholders to receive in lieu of their present holding at 2,00,000 shares of ` 10 each,

the following:

(a) New fully paid ` 10 Equity shares equal to 3/5 th of their holding.

(b) 10% Preference shares fully paid to the extent of 1/5 th of the above new equity shares.

(c) ` 80,000, 8% Debentures.

(ii) An issue of ` 2 lakh 10% first debentures was made and allotted, payment for the same being

received in cash forthwith.

(iii) Goodwill which stood at ` 2,80,000 was completely written off.

(iv) Plant and machinery which stood at ` 4,00,000 was written down to ` 3,00,000.

(v) Freehold property which stood at ` 3,00,000 was written down by ` 1,00,000.

You are required to draw up the necessary Journal entries in the Books of Shine Limited for the

above reconstruction. Suitable narrations to Journal entries should form part of your answer.

(15 + 5 = 20 Marks)

3. (a) A & B are partners in AB & Co. sharing Profit/Loss in the ratio of 3:2 and B & C are partners in BC

& Co. sharing Profit/Loss in the ratio of 2: 1 carrying on same type of business. On 1 st April, 2022,

A, B & C decide to form a new Partnership Firm ABC & Co. by amalgamating AB & Co. and BC &

Co. A, B & C will share Profit/Loss in the ratio of 3:2:1 in ABC & Co.

© The Institute of Chartered Accountants of India

Their Balance Sheets on 1 st April, 2022 were as under:

Liabilities AB & Co. BC & Co. Assets AB & Co. BC & Co.

(`) (`) (`) (`)

Capital Building 20,000 10,000

A 66,000 - Plant & Machinery 21,000 29,000

B 67,000 50,000 Vehicles 15,000 5,000

C - 48,000 Furniture 4,000 7,500

Reserves 10,000 5,000 Stock 50,500 19,500

Sundry Creditors Sundry Debtors

- Others 41,000 38,000 - Others 43,500 37,000

- BC &Co. 15,000 - - AB & Co. - 15,000

- XYZ & Co. - 9,000 - XYZ & Co. 25,000 -

Cash at Bank 15,000 18,000

Cash in Hand 5,000 9,000

1,99,000 1,50,000 1,99,000 1,50,000

Following are the terms for the amalgamation:

(a) Goodwill will be valued at ` 25,000 for AB & Co. and ` 18,000 for BC & Co. But same will not

appear in the books of the new firm.

(b) Building was taken over as follows:

• Building of AB & Co. was valued with upward revision of ` 10,000

• Building of BC & Co. valued at ` 16,000.

(c) Plant & Machinery to be taken over with downward valuation by ` 2,000 of AB & Co. and with

new value of ` 32,000 of BC & Co.

(d) Value of vehicles to be taken over was reduced by ` 5,000 of AB & Co. and reduced to

` 2,000 of BC & Co.

(e) Excess/Deficit Capitals for partners taking A's Capital as base with reference to share in

profits are to be transferred to Current Accounts.

You are required to prepare Balance Sheet of the new firm and Capital Accounts of the partners in

the books of old firm.

(b) While closing its books of account on 31 st March, 2022 a Non-Banking Finance Company has its

advances classified as follows:

` in lakhs

Standard assets 53,600

Sub-standard assets 2,680

Secured portions of doubtful debts:

− Up to one year 640

− one year to three years 180

− more than three years 60

Unsecured portions of doubtful debts 194

Loss assets 96

© The Institute of Chartered Accountants of India

Calculate the amount of provision, which must be made against the Advances as per the Non-

Banking Financial Company – Non-Systemically Important Non-Deposit taking Company (Reserve

Bank) Directions, 2016. (16 + 4 = 20 Marks)

4. (a) Consider the following information of subsidiary MNT Ltd.

2020-21 2021-22

Amount in ` Amount in `

Share Capital

Issued and subscribed 7500 Equity Shares of ` 100 each 7,50,000 7,50,000

Reserve and Surplus

Revenue Reserve 2,14,000 5,05,000

Securities Premium 72,000 2,07,000

Current Liabilities and Provisions

Trade Payables 2,90,000 2,46,000

Bank Overdraft - 1,70,000

Provision for Taxation 2,62,000 4,30,000

Non-current assets

Property, Plant and equipment (Cost) 9,20,000 9,20,000

Less: Accumulated Depreciation (1,70,000) (2,82,500)

7,50,000 6,37,500

Investment at Cost - 5,30,000

Current Assets

Inventory 4,12,300 6,90,000

Trade Receivable 2,95,000 3,43,000

Prepaid expenses 78,000 65,000

Cash at Bank 52,700 42,500

Other Information:

(1) MNT Ltd. is a subsidiary of LTC Ltd.

(2) LTC Ltd. values inventory on FIFO basis, while MNT Ltd. used LIFO basis. To bring MNT

Ltd.'s inventories values in line with those of LTC Ltd., its value of inventory is required to be

reduced by ` 5,000 at the end of 2020-21 and increased by ` 12,000 at the end of 2021-22.

(Inventory of 2020-21 has been sold out during the year 2021-22)

(3) MNT Ltd. deducts 2% from Trade Receivables as a general provision against doubtful debts.

(4) Prepaid expenses in MNT Ltd. include Sales Promotion expenditure carried forward of

` 25,000 in 2020-21 and ` 12,500 in 2021-22 being part of initial Sales Promotion expenditure

of ` 37,500 in 2020-21, which is being written off over three years. Similar nature of Sales

Promotion expenditure of LTC Ltd. has been fully written off in 2020-21.

Restate the balance sheet of MNT Ltd. as on 31 st March, 2022 after considering the above

information for the purpose of consolidation. Such restatement is necessary to make the accounting

policies adopted by LTC Ltd. and MNT Ltd. uniform.

© The Institute of Chartered Accountants of India

(b) From the following data, determine Minority Interest on the date of acquisition and on the date of

consolidation in each case:

Case Subsidiary % of Cost Date of Acquisition Consolidation date

Company Share

Owned

01-01-2021 31-12-2021

Share Profit and Share Profit and

Capital Loss A/c Capital Loss A/c

` ` ` `

Case-i X 85% 1,85,000 1,35,000 60,000 1,35,000 70,000

Case-ii Y 70% 1,60,000 1,25,000 45,000 1,25,000 5,000

Case-iii Z 65% 83,000 25,000 5,000 25,000 5,000

Case-iv M 90% 60,000 45,000 20,000 45,000 40,000

Case-v N 100% 85,000 25,000 25,000 25,000 50,000

(c) Under what circumstances, an LLP can be wound up by the Tribunal. (10+5 + 5 =20 Marks)

5. (a) BT Ltd. went into Voluntary Liquidation on 31 st March, 2022. It gives the following information as

on 31st March, 2022:

`

Issued & Subscribed Capital:

10,000 12% cumulative preference shares of ` 100 each, fully paid 10,00,000

10,000 Equity Shares of ` 100 each 75 per share paid up 7,50,000

20,000 Equity Shares of ` 100 each 60 per share paid up 12,00,000

Profit & Loss Account (Dr. balance) 5,25,000

12% Debentures (Secured by a floating charge) 10,00,000

Interest outstanding on Debentures 1,20,000

Creditors 8,50,000

Land & Building 17,60,000

Plant & Machinery 12,50,000

Furniture 4,75,000

Patents 1,45,000

Stock 1,80,000

Trade Receivables 5,09,300

Cash at Bank 75,700

Preference dividends were in arrear for 1 year. Creditors include preferential creditors of

` 75,000. Balance creditors are discharged subject to 5% discount.

Assets are realised as under:

`

Land & Building 24,50,000

Plant & Machinery 9,00,000

© The Institute of Chartered Accountants of India

Furniture 2,85,000

Patents 90,000

Stock 2,80,000

Trade Receivables 3,15,000

Expenses of liquidation amounted to ` 45,000. The liquidator is entitled to a remuneration of 3%

on all assets realised (except cash at bank). All payments were made on 30 th June, 2022.

You are required to prepare the Liquidator's Final Statement of Account as on 30 th June, 2022.

Working Notes should form part of the answer.

(b) Astha Bank has the following Capital Funds and Assets as at 31 st March, 2022:

` in crores

Capital Funds:

Equity Share Capital 600.00

Statutory Reserve 470.00

Profit and Loss Account (Dr. Balance) 30.00

Capital Reserve (out of which ` 25 crores were due to revaluation of assets and 130.00

balance due to sale of assets)

Assets:

Balance with other banks 15.00

Cash balance with RBI 35.50

Claim on Banks 52.50

Other Investments 70.00

Loans and Advances:

(i) Guaranteed by government 22.50

(ii) Guaranteed by DICGC/ECGC 110.00

(iii) Other 9,365.00

Premises, furniture and fixtures 92.50

Leased assets 40.00

Off-Balance Sheet items:

(i) Acceptances, endorsements and letters of credit 1,100.00

(ii) Guarantees and other obligations 6,200.00

You are required to:

(i) Segregate the capital funds into Tier I and Tier II capitals.

(ii) Find out the risk-adjusted assets and risk weighted assets ratio. (10 + 10 = 20 Marks)

6. Answer any four of the following:

(a) “The company has not made provision for warrantee in respect of certain goods considering that

the company can claim the warranty cost from the original supplier”.

You are required to comment in line with the provisions of AS 29.

© The Institute of Chartered Accountants of India

(b) From the following information of Royal 'Bank, compute the amount of provisions to be made in the

Profit and Loss account.

Assets ` (In Lakhs)

Standard Assets 25,000

Sub-Standard Assets (including Unsecured ` 8,000 lakhs) 15,000

Doubtful Assets

a. Upto 1 year [Realisable value of Security ` 2,200) 4,500

b. 1 to 3 years [Realisable value of Security ` 1,200) 3,200

c. More than 3 years (no Security) 1,300

Loss Assets · 530

(c) On 1st December, 2019, Mahindra Construction Co. Ltd. undertook a contract to construct a building

for ` 170 lakhs. On 31st March, 2020, the company found that it had already spent ` 1,29,98,000

on the construction. Prudent estimate of additional cost for completion was ` 64,02,000. Calculate

total estimated loss on contract and what should be shown in statement of profit and loss account

as contract revenue and contract cost in the final accounts for the year ended 31 st March, 2020, as

per provision of Accounting Standard 7 (Revised).

(d) At the beginning of year 1, an enterprise grants 10,000 stock options to a senior executive,

conditional upon the executive remaining in the employment of the enterprise until the end of year

3. The exercise price is ` 40. However, the exercise price drops to ` 30 if the earnings of the

enterprise increase by at-least an average of 10 per cent per year over the three-year period.

On the grant date, the enterprise estimates that the fair value of the stock options, with an exerc ise

price of ` 30, is ` 16 per option. If the exercise price is ` 40, the enterprise estimates that the stock

options have a fair value of ` 12 per option.

During year 1, the earnings of the enterprise increased by 12 per cent, and the enterprise expects

that earnings will continue to increase at this rate over the next two years. The enterprise, therefore,

expects that the earnings target will be achieved, and hence the stock options will have an exercise

price of ` 30.

During year 2, the earnings of the enterprise increased by 13 per cent, and the enterprise continues

to expect that the earnings target will be achieved.

During year 3, the earnings of the enterprise increased by only 3 per cent, and therefore the

earnings target was not achieved. The executive completes three years’ service, and therefore

satisfies the service condition. Because the earnings target was not achieved, the 10,000 vested

stock options have an exercise price of ` 40.

You are required to calculate the amount to be charged to Profit and Loss Account every year on

account of compensation expenses.

(e) Identify the related parties in the following cases as per AS-18:

Maya Ltd. holds 61% shares of Sheetal Ltd.

Sheetal Ltd. holds 51% shares of Fair Ltd.

Care Ltd. holds 49% shares of Fair Ltd.

Give your answer - Reporting Entity wise for Maya Ltd., Sheetal Ltd., Care Ltd. and Fair Ltd.

(4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Accounting MTP Question Series I 1676966561047406Document9 pagesAccounting MTP Question Series I 1676966561047406Tushar MittalNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument9 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsayushiNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- 71859bos57825 Inter P5aDocument16 pages71859bos57825 Inter P5aVishnuNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- Paper 17Document5 pagesPaper 17VijayaNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Accounts QPDocument9 pagesAccounts QPHARSHIT DHANWANINo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- Accounting New Syllabus Question PaperDocument7 pagesAccounting New Syllabus Question Paperpradhiba meenakshisundaramNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- 12 Acs (S) - Set A 19.7.2021Document3 pages12 Acs (S) - Set A 19.7.2021Sakshi NagotkarNo ratings yet

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- Paper - 1: Financial Reporting Questions Ind AS 103Document30 pagesPaper - 1: Financial Reporting Questions Ind AS 103sam kapoorNo ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument27 pagesDisclaimer: © The Institute of Chartered Accountants of IndiaVVR &CoNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaRohit SadhukhanNo ratings yet

- 03-22-2022 - 121512 Book Keeping and Accountancy Test PaperDocument5 pages03-22-2022 - 121512 Book Keeping and Accountancy Test Papertestestestest54No ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- Gold InvestmentDocument4 pagesGold InvestmentvinitclairNo ratings yet

- Bodie Investments 12e IM CH03Document6 pagesBodie Investments 12e IM CH03lexon_kbNo ratings yet

- Lim Tay vs. Court of Appeals 293 SCRA 634Document12 pagesLim Tay vs. Court of Appeals 293 SCRA 634morningmindsetNo ratings yet

- The Ultimate Options Trading ST - Roji AbrahamDocument170 pagesThe Ultimate Options Trading ST - Roji Abrahamcodingfreek007No ratings yet

- SIP ReportDocument111 pagesSIP ReportDesarollo OrganizacionalNo ratings yet

- Shooting Stocks v5Document21 pagesShooting Stocks v5saipavan999No ratings yet

- Alternative Liquidity Index Announces Offer To Purchase Shares in TreeCon Resources, Inc.Document2 pagesAlternative Liquidity Index Announces Offer To Purchase Shares in TreeCon Resources, Inc.PR.comNo ratings yet

- Formation of Private Equity FundsDocument39 pagesFormation of Private Equity FundsJim Macao100% (1)

- Market Update: Corporate Action - Fund Raising by Khazanah Nasional - 05/08/2010Document3 pagesMarket Update: Corporate Action - Fund Raising by Khazanah Nasional - 05/08/2010Rhb InvestNo ratings yet

- QSO 600 Midterm Exam and HWDocument22 pagesQSO 600 Midterm Exam and HWChristian N MagsinoNo ratings yet

- 30 Contributed CapitalDocument12 pages30 Contributed CapitalJohn FloresNo ratings yet

- Jewellers Block Proposal FormDocument4 pagesJewellers Block Proposal Formm_dattaias100% (1)

- Project KMMLDocument95 pagesProject KMMLJijo ThomasNo ratings yet

- Debt Funding in IndiaDocument54 pagesDebt Funding in IndiaAbhinay KumarNo ratings yet

- Stochastic Proportional DividendsDocument21 pagesStochastic Proportional Dividendsmirando93No ratings yet

- Corporation Law Cases and DigestsDocument12 pagesCorporation Law Cases and DigestsJoshua LanzonNo ratings yet

- National Stock Exchange of India Limited Department: Futures & OptionsDocument56 pagesNational Stock Exchange of India Limited Department: Futures & OptionsPrince GardenNo ratings yet

- Concepts of Financial Management 2014Document9 pagesConcepts of Financial Management 2014blokeyesNo ratings yet

- Investment-Case-Study-Final - FinalDocument29 pagesInvestment-Case-Study-Final - Finalapi-305968653No ratings yet

- Stockholders' Equity: Paid-In Capital: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesDocument46 pagesStockholders' Equity: Paid-In Capital: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesRosenna99No ratings yet

- Bandhan-AMC-AR 28 7 2023Document135 pagesBandhan-AMC-AR 28 7 2023Yuvraj BhuraNo ratings yet

- Accounting - StandardsDocument9 pagesAccounting - StandardsJohn NdasabaNo ratings yet

- Quarter 2 - Module 8 GENERAL MATHEMATICSDocument3 pagesQuarter 2 - Module 8 GENERAL MATHEMATICSKristine AlcordoNo ratings yet

- NISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationDocument7 pagesNISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationAugustus PrimeNo ratings yet

- HBS Private Equity Study PDFDocument66 pagesHBS Private Equity Study PDFanton88be100% (1)

- Di Ds PracticeDocument22 pagesDi Ds Practicenits_wazzupNo ratings yet

- DKNG 2Q 2023 Business Update - VFDocument15 pagesDKNG 2Q 2023 Business Update - VFrchatabNo ratings yet

- Legaspi V PeopleDocument3 pagesLegaspi V PeoplenilesrevillaNo ratings yet

- Intro To Beh. FinanceDocument35 pagesIntro To Beh. FinanceAnonymous YKmreGjNo ratings yet