Professional Documents

Culture Documents

71859bos57825 Inter P5a

Uploaded by

VishnuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

71859bos57825 Inter P5a

Uploaded by

VishnuCopyright:

Available Formats

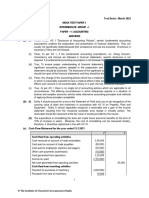

Test Series: October, 2022

MOCK TEST PAPER –2

INTERMEDIATE: GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

1. (a) Surya Ltd.

Balance Sheet (Extract relating to intangible asset) as on 31 st March 2021

Note No. `

Assets

(1) Non-current assets

Intangible assets 1 14,00,000

Notes to Accounts (Extract)

` `

1. Intangible assets

Goodwill (Refer to note 1) 5,00,000

Patents (Refer to Note 2) 5,25,000

Franchise (Refer to Note 3) 3,75,000 14,00,000

Working Notes:

`

(1) Goodwill on acquisition of business

Cash paid for acquiring the business (purchase consideration) 25,00,000

Less: Fair value of net assets acquired (18,75,000)

Goodwill 6,25,000

Less: Amortization. over 5 years (as per SLM) (1,25,000)

Balance to be shown in the balance sheet 5,00,000

(2) Patent 6,00,000

Less: Amortization (over 8 years as per SLM) (75,000)

Balance to be shown in the balance sheet 5,25,000

(3) Franchise 4,50,000

Less: Amortization (over 6 years) (75,000)

Balance to be shown in the balance sheet 3,75,000

(b) As per AS 9 “Revenue Recognition”, in a transaction involving the sale of goods, performance

should be regarded as being achieved when the following conditions are fulfilled:

(i) the seller of goods has transferred to the buyer the property in the goods for a price or all

significant risks and rewards of ownership have been transferred to the buyer and the seller

retains no effective control of the goods transferred to a degree usually associated with

ownership; and

(ii) no significant uncertainty exists regarding the amount of the consideration that will be derived

from the sale of the goods.

© The Institute of Chartered Accountants of India

Case (i)

The sale is complete but delivery has been postponed at buyer’s request. B.S. Ltd. should

recognize the entire sale of ` 50,000 for the year ended 31 st March, 2021.

Case (ii)

In case of consignment sale revenue should not be recognized until the goods are sold to a thir d

party.20% goods lying unsold with consignee should be treated as closing inventory and sales

should be recognized for ` 1,00,000 (80% of ` 1,25,000).

Case (iii)

In case of goods sold on approval basis, revenue should not be recognized until the good s have

been formally accepted by the buyer or the buyer has done an act adopting the transaction or the

time period for rejection has elapsed or where no time has been fixed, a reasonable time has

elapsed. Therefore, revenue should be recognized for the total sales amounting ` 1,00,000 as the

time period for rejecting the goods had expired.

Thus total revenue amounting ` 2,50,000 (50,000 + 1,00,000 + 1,00,000) will be recognized for the

year ended 31 st March, 2021 in the books of B.S. Ltd.

(c) (i) As per AS 5, the adoption of an accounting policy for events or transactions that differ in

substance from previously occurring events or transactions, will not be considered as a

change in accounting policy. Introduction of a formal retirement gratuity scheme by an

employer in place of ad hoc ex-gratia payments to employees on retirement is a transaction

which is substantially different from the previous transaction, will not be treated as change in

an accounting policy.

(ii) Adoption of a new accounting policy for events or transactions which did not occur previously

should not be treated as a change in an accounting policy. Hence the introduction of new

pension scheme is not a change in accounting policy.

(iii) In the given case, company has created 2.5 % provision for doubtful debts till

31st March, 2020. Subsequently from 1 st April, 2020, the company revised the estimates

based on the changed circumstances and wants to create 5% provision. Thus change in rate

of provision of doubtful debt is change in estimate and is not change in accounting policy.

This change will affect only current year.

(iv) Change in cost formula used in measurement of cost of inventories is a change in accounting

policy.

(v) Change in useful life of computers from 5 years to 3 years is a change in estimate and is not

a change in accounting policy.

(d) Provision to be made for warranty under AS 29 ‘Provisions, Contingent Liabilities and Contingent

Assets’

As at 31 st March, 2020 = ` 1,20,000 x .03 + ` 75,000 x .04

= ` 3,600 + ` 3,000 = ` 6,600

As at 31 st March, 2021 = ` 75,000 x .03 + ` 2,70,000 x .04

= ` 2,250 + ` 10,800 = ` 13,050

Amount debited to Profit and Loss Account for year ended 31 st March, 2021

`

Balance of provision required as on 31.03.2021 13,050

Less: Opening Balance as on 1.4.2020 (6,600)

Amount debited to profit and loss account 6,450

© The Institute of Chartered Accountants of India

Note: No provision will be made on 31 st March, 2021 in respect of sales amounting ` 1,20,000

made on 19 th January, 2019 as the warranty period of 2 years has already expired.

2. Journal Entries in the books of A Ltd.

Particulars Debit Credit

` `

Business purchase A/c (W.N.1) Dr. 13,75,000

To Liquidator of B Ltd. 13,75,000

(Being business of B Ltd. taken over)

Land & Building A/c Dr. 8,40,000

Plant and machinery A/c Dr. 5,60,000

Office equipment A/c Dr. 2,10,000

Investments A/c Dr. 3,00,000

Inventory A/c Dr. 4,20,000

Debtors A/c Dr. 3,20,000

Bills receivables A/c Dr. 70,000

Bank A/c Dr. 61,000

To General reserve A/c (W.N.2) 95,000

(2,50,000-1,55,000)

To Export profit reserve A/c 1,20,000

To Investment allowance reserve A/c 60,000

To Profit and loss A/c 1,20,000

To Liability for 9% Debentures A/c (` 100 each) 2,00,000

To Secured Loan 3,60,000

To Trade creditors A/c 2,76,000

To Bills payables A/c 1,00,000

To Other current liabilities A/c 75,000

To Business purchase A/c 13,75,000

(Being assets and liabilities taken over)

Liquidator of B Ltd. Dr. 13,75,000

To Equity share capital A/c 8,00,000

To 10% Preference share capital A/c 4,00,000

To Securities premium A/c 1,75,000

(Being purchase consideration discharged)

General Reserve* A/c Dr. 12,000

To Cash at bank 12,000

(Being expenses of amalgamation paid)

Liability for 9% Debentures in B Ltd. A/c Dr. 2,00,000

To 9% Debentures A/c 2,00,000

(Being debentures in B ltd. discharged by issuing own 9%

debentures)

Bills payables A/c Dr. 60,000

To Bill receivables A/c 60,000

© The Institute of Chartered Accountants of India

(Cancellation of mutual owing on account of bills of

exchange)

*Alternatively, profit & loss A/c may be debited in place of general reserve A/c.

Opening Balance Sheet of A Ltd. (after absorption)

as at 1st April, 2021

Particulars Notes `

Equity and Liabilities

1 Shareholders' funds

a Share capital 1 30,00,000

b Reserves and Surplus 2 14,94,000

2 Non-current liabilities

a Long-term borrowings 3 8,60,000

3 Current liabilities

a Trade Payables 4 7,03,000

b Other current liabilities 5 1,25,000

Total 61,82,000

Assets

1 Non-current assets

a PPE 6 36,35,000

b Investments 7 3,96,000

2 Current assets

a Inventories 8 10,50,000

b Trade receivables 9 8,80,000

c Cash and cash equivalents 10 2,21,000

Total 61,82,000

Notes to accounts

`

1 Share Capital

Equity share capital

2,00,000 Equity shares of ` 10 each

(Out of above, 80,000 shares were issued for 20,00,000

consideration other than cash)

Preference share capital

10,000 10% Preference shares of ` 100 each

(Out of above, 4,000 shares were issued for consideration 10,00,000

other than cash)

Total 30,00,000

2 Reserves and Surplus

General Reserve

Opening balance 3,00,000

Add: Adjustment under scheme of amalgamation 95,000

4

© The Institute of Chartered Accountants of India

Less: Amalgamation expense paid (12,000) 3,83,000

Securities premium (2,40,000+1,75,000) 4,15,000

Export profit reserve

Opening balance 1,80,000

Add: Adjustment under scheme of amalgamation 1,20,000 3,00,000

Investment allowance reserve 60,000

Profit and loss account

Opening balance 2,16,000

Add: Adjustment under scheme of amalgamation 1,20,000 3,36,000

Total 14,94,000

3 Long-term borrowings

Secured

9% Debentures 3,00,000

Add: Adjustment under scheme of amalgamation 2,00,000

Secured loan 3,60,000 8,60,000

4 Trade payables

Creditors: Opening balance 3,12,000

Add: Adjustment under scheme of amalgamation 2,76,000 5,88,000

Bills Payables: Opening balance 75,000

Add: Adjustment under scheme of amalgamation 1,00,000

Less: Cancellation of mutual owning upon

(60,000) 1,15,000

amalgamation

7,03,000

5 Other current liabilities

Opening balance 50,000

Add: Adjustment under scheme of amalgamation 75,000 1,25,000

6 PPE

Land & Building- Opening balance 10,80,000

Add: Adjustment under scheme of amalgamation 8,40,000 19,20,000

Plant and machinery- Opening balance 6,00,000

Add: Adjustment under scheme of amalgamation 5,60,000 11,60,000

Office equipment- Opening balance 3,45,000

Add: Adjustment under scheme of amalgamation 2,10,000 5,55,000

Total 36,35,000

7 Investments

Opening balance 96,000

Add: Adjustment under scheme of amalgamation 3,00,000 3,96,000

8 Inventories

Opening balance 6,30,000

Add: Adjustment under scheme of amalgamation 4,20,000 10,50,000

© The Institute of Chartered Accountants of India

9 Trade receivables

Debtors: Opening balance 4,90,000

Add: Adjustment under scheme of amalgamation 3,20,000 8,10,000

Bills Payables: Opening balance 60,000

Add: Adjustment under scheme of amalgamation 70,000

Less: Cancellation of mutual owning upon

(60,000) 70,000

amalgamation

Total 8,80,000

10 Cash and cash equivalents

Opening balance 1,72,000

Add: Adjustment under scheme of amalgamation 61,000

Less: Amalgamation expense paid (12,000) 2,21,000

Working Notes:

1. Calculation of purchase consideration

`

Equity shareholders of B Ltd. (80,000 x ` 10) 8,00,000

Preference shareholders of B Ltd. (5,00,000 x 115%) 5,75,000

Purchase consideration would be 13,75,000

2. Amount to be adjusted from general reserve

The difference between the amount recorded as share capital issued and the amount of share

capital of transferor company should be adjusted in General Reserve.

Thus, General reserve will be adjusted as follows:

`

Purchase consideration 13,75,000

Less: Share capital issued (` 7,20,000 + ` 5,00,000) (12,20,000)

Amount to be adjusted from general reserve 1,55,000

3. Calculation of balances of Profit & Loss and Sundry Creditors of B Limited to be taken

over by A Limited

P&L Creditors

(`) (`)

Balance as per Balance Sheet of B Limited 1,92,000 2,04,000

Less / Add: Contingent Trade Payable treated as Actual Liability (72,000) 72,000

Taken by A Limited 1,20,000 2,76,000

3. Balance Sheet of M/s ABC & Co. as at 31 st March, 2021

Equity & Liabilities ` Assets `

Capitals: Building

(` 1,10,000 + ` 1,50,000) 2,60,000

A 5,95,350 Plant & machinery (` 2,40,000 +

` 1,90,000) 4,30,000

B 3,96,900 Furniture (` 24,000+` 26,000) 50,000

6

© The Institute of Chartered Accountants of India

C 1,98,450 11,90,700 Stock-in-trade

(` 88,000 +` 1,10,000) 1,98,000

Sundry creditors Sundry debtors

(1,05,300+1,15,000) 2,20,300 (` 1,40,000 +` 1,80,000) 3,20,000

Bank Loan 50,000 Less: Provision for doubtful debts

(` 14,000+` 30,000) (44,000) 2,76,000

Bank balance

(` 45,000 +` 1,65,000) 2,10,000

Cash in hand 37,000

14,61,000 14,61,000

In the books of AB & Co.

Partners’ Capital Accounts

Particulars A B Particulars A B

` ` ` `

To Capital A/cs – 5,32,160 1,95,540 By Balance b/d 3,50,000 1,50,000

M/s ABC & Co. By Reserve (4:1) 31,200 7,800

By Profit on

Realization A/c

(W.N.4) 1,50,960 37,740

5,32,160 1,95,540 5,32,160 1,95,540

In the books of BC & Co.

Partners’ Capital Accounts

Particulars B C Particulars B C

` ` ` `

To Capital A/cs – 4,72,000 2,31,000 By Balance b/d 2,50,000 1,20,000

M/s ABC& Co. By Reserves (2:1) 98,000 49,000

By Profit on

Realization 1,24,000 62,000

(W.N.5)

4,72,000 2,31,000 4,72,000 2,31,000

Working Notes:

1. Computation of purchase considerations

AB & Co. BC & Co.

` `

Assets:

Goodwill 1,50,000 90,000

Building 1,10,000 1,50,000

Plant & machinery 2,40,000 1,90,000

Furniture 24,000 26,000

Stock-in-trade 88,000 1,10,000

` 25,000+ ` 12,000 + ` 1,83,190+ ` 7,450 –` 1,90,640 = ` 37,000.

7

© The Institute of Chartered Accountants of India

Sundry debtors 1,40,000 1,80,000

Bank balance 45,000 1,65,000

Cash in hand 25,000 12,000

Due from BC & Co. 75,000 -

(A) 8,97,000 9,23,000

Liabilities:

Creditors 90,000 1,15,000

Provision for doubtful debts 14,000 30,000

Due to AB& Co. - 75,000

Loan from Bank 50,000 -

Unrecorded liability 15,300 ____

(B) 1,69,300 2,20,000

Purchase consideration (A-B) 7,27,700 7,03,000

2. Computation of proportionate capital

`

M/s ABC & Co. (Purchase Consideration) (` 7,27,700 + ` 7,03,000) 14,30,700

Less: Goodwill adjustment (2,40,000)

Total capital of new firm (Distributed in ratio 3:2:1) 11,90,700

A’s proportionate capital 5,95,350

B’s proportionate capital 3,96,900

C’s proportionate capital 1,98,450

3. Computation of Capital Adjustments

A B C Total

` ` ` `

Balance transferred from AB & Co. 5,32,160 1,95,540 7,27,700

Balance transferred from BC & Co. 4,72,000 2,31,000 7,03,000

5,32,160 6,67,540 2,31,000 14,30,700

Less:Goodwill written off in the ratio of 3:2:1

(1,20,000) (80,000) (40,000) (2,40,000)

Existing capital 4,12,160 5,87,540 1,91,000 11,90,700

Proportionate capital 5,95,350 3,96,900 1,98,450

Amount to be brought in (paid off) 1,83,190 (1,90,640) 7,450

4. In the books of AB & Co.

Realization Account

` `

To Building 1,10,000 By Creditors 90,000

To Plant & machinery 1,80,000 By Bank Loan 50,000

To Furniture 24,000 By M/s AB & Co. 7,27,700

To Stock-in-trade 80,000 (purchase consideration)

To Sundry debtors 1,40,000 (W.N.1)

To Bank balance 45,000

8

© The Institute of Chartered Accountants of India

To Cash in hand 25,000

To Due from BC & Co. 75,000

To Partners’ capital A/cs

A 1,50,960

B 37,740 1,88,700

8,67,700 8,67,700

5. In the books of BC & Co.

Realization Account

` `

To Building 90,000 By Creditors 1,15,000

To Plant & machinery 1,34,000 By Due to AB & Co. 75,000

To Furniture 26,000 By M/s ABC & Co. 7,03,000

To Stock-in-trade 1,00,000 (purchase consideration)

To Sundry debtors 1,80,000 (W.N.1)

To Bank balance 1,65,000

To Cash in hand 12,000

To Partners’ capital A/cs

B 1,24,000

C 62,000 1,86,000

8,93,000 8,93,000

6. Goodwill Computation:

`

AB & Co. Normal profit 5,00,000 × 18% 90,000

Actual Profit 1,20,000

Super Profit 30,000

Goodwill (` 30,000 × 5) 1,50,000

BC & Co. Normal profit 3,70,000 ×18% 66,600

Actual Profit 81,600

Super Profit 15,000

Goodwill (`15,000 × 6) 90,000

Note: The adjustments of partners A, B and C for Goodwill can also be shown in their Capital Accounts

in the Books of AB & Co and BC & Co respectively.

4. Consolidated Balance Sheet of Sun Ltd.and its subsidiary, Star Ltd.

as at 31st March, 2022

Particulars Note No. (`)

I. Equity and Liabilities

(1) Shareholder's Funds

(a) Share Capital 1 10,00,000

9

© The Institute of Chartered Accountants of India

(b) Reserves and Surplus 2 6,17,600

(2) Minority Interest 1,67,200

(3) Current Liabilities

(a) Trade Payables 3 1,29,000

(b) Short term borrowings 4 1,60,000

Total 20,73,800

II. Assets

(1) Non-current assets

(a) Property, Plant and Equipment 5 14,82,000

(b) Intangible assets 6 34,400

(2) Current assets

(a) Inventories 7 3,12,800

(b) Trade receivables 8 1,99,600

(c) Cash & Cash equivalents 9 45,000

Total 20,73,800

Notes to Accounts

1 Share Capital

10,000 shares of ` 100 each

2 Reserves and Surplus

Reserves 4,80,000

Profit & loss (Refer to W.N 8) 1,37,600

Total 6,17,600

3 Trade Payables

Sun Ltd. 94,200

Add: Star Ltd. 34,800 1,29,000

Total

4 Short term borrowings

Bank overdraft 1,60,000

5 Property, plant and equipment

Land and building- Sun Ltd. 3,00,000

Add: Land and building- Star Ltd. 3,60,000 6,60,000

Plant & Machinery (Refer to W.N 7) 8,22,000

Total 14,82,000

6 Intangible assets -

Goodwill (refer to W.N 6) 34,400

7 Inventories

Sun Ltd. 2,40,000

Star Ltd.. 72,800

Total 3,12,800

10

© The Institute of Chartered Accountants of India

8 Trade Receivables

Sun Ltd. 1,19,600

Star Ltd. 80,000

Total 1,99,600

9 Cash & Cash equivalents

Cash of Sun Ltd 29,000

Add: cash of Star Ltd.. 16,000

Total - 45,000

Share holding Pattern

Total Shares of Star Ltd. 4,000 shares

Shares held by Sun Ltd 3,200 shares i.e. 80 %

Minority Shareholding 800 shares i.e. 20 %

Working Notes:

1. The dividend @ 10% on 3,200 shares - `32,000 received by Sun Ltd. should have been credited

to the investment A/c, being out of pre-acquisition profits. Sun Ltd., must pass a rectification entry,

viz.

Profit & Loss Account Dr. ` 32,000

To Investment ` 32,000

2. The Plant & Machinery of Star Ltd. would stand in the books at ` 2,85,000 on 1st Oct, 2021,

considering only six months’ depreciation on ` 3,00,000 total depreciation being ` 30,000. The

value put on the assets being ` 3,60,000, there is an appreciation to the extent of ` 75,000

(3,60,000 – 2,85,000).

3. Capital profits of Star Ltd.

` `

Reserve on 1st April, 2021 (Assumed there is no movement in 2,00,000

reserves during the year and hence balance as on 1 st April 2021 is

same as of 31 st March, 2022)

Profit & Loss Account Balance on 1st April, 2021 60,000

Less: Dividend paid (40,000) 20,000

Profit for 2021-22:

Total ` 1,64,000

Less: (` 20,000)

` 1,44,000

Proportionate upto 1st Oct, 2021 on time basis (` 1,44,000/2) 72,000

Appreciation in value of Plant & Machinery 75,000

3,67,000

Less: 20% due to outsiders (73,400)

Holding company’s share 2,93,600

11

© The Institute of Chartered Accountants of India

4. Revenue profits of Star Ltd.:

Profit after 1st Oct, 2021 [(1,64,000 – 20,000) x ½] 72,000

Less: Depreciation

10% depreciation on ` 3,60,000 for 6 months 18,000

Less: Depreciation already charged for

2nd half year on 3,00,000 (15,000) (3,000)

69,000

Less: 1/5 due to outsiders (13,800)

Share of Sun Ltd. 55,200

5. Minority interest:

Par value of 800 shares (4,00,000 X 20%) 80,000

Add: 1/5Capital Profits [WN 3] 73,400

1/5 Revenue Profits [WN 4] 13,800

1,67,200

6. Cost of Control:

Amount paid for 3,200 shares 6,80,000

Less: Dividend out of pre-acquisition profits (32,000) 6,48,000

Par value of shares 3,20,000 -

Capital Profits –share of Sun Ltd. [WN 3] 2,93,600 (6,13,600)

Cost of Control or Goodwill 34,400

7. Value of Plant & Machinery:

Sun Ltd. 4,80,000

Star Ltd. 2,70,000

Add: Appreciation on 1st Oct, 2021 [3,60,000 – (3,00,000 – 15,000)] 75,000

3,45,000

Add: Deprecation for 2 nd half charged on pre-revalued value 15,000

Less: Depreciation on `3,60,000 for 6 months (18,000) 3,42,000

8,22,000

8. Profit & Loss Account (Consolidated):

Sun Ltd.as given 1,14,400

Less: Dividend transferred to Investment A/c (32,000 ) 82,400

Share of Sun Ltd.in revenue profits of Star Ltd.(WN 4) 55,200

1,37,600

5. (a) (i) Capital Funds - Tier I: (Figures in ` Crores)

Equity Share Capital 950

Statutory Reserve 380

Share Premium 250

Capital Reserve (arising out of sale of assets) 92

12

© The Institute of Chartered Accountants of India

1,672

Less: Intangible assets (20)

1,652

Capital Funds - Tier II:

Capital Reserve (arising out of revaluation of assets) 26

Less: Discount to the extent of 55% (14.3) 11.7

1,663.70

(ii) Risk Adjusted Assets

Funded Risk Assets ` in Percentage Amount

lakhs weight ` in lakhs

Cash Balance with RBI 78 0 0

Balances with other Banks 240 20 48

Other Investments 98 100 98

Loans and Advances:

(i) guaranteed by government 600 0 0

(ii) granted to staff 800 20 160

(iii) Others 6000 100 6000

Premises, furniture and fixtures 100 100 100

Off Balance Sheet Items

Acceptances, Endorsements

and Letters of credit 6000 100 6000

Guarantees & other obligations 1000 100 1000

Risk Adjusted Assets + Off Balance Sheet Items 13,406

Risk Weighted Assets Ratio: Capital Funds (Tier I & Tier II)

×100

Risk Adjusted Assets + off Balance sheet items

1,663.70

= 13,406 x 100

Capital Adequacy Ratio = 12.41%

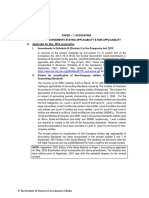

(b) Determination of maximum no. of shares that can be bought back as per the Companies

Act, 2013

1. Shares Outstanding Test

Particulars (Shares)

Number of shares outstanding 1,70,000

25% of the shares outstanding 42,500

13

© The Institute of Chartered Accountants of India

2. Resources Test: Maximum permitted limit 25% of Equity paid up capital + Free Reserves

Particulars

Paid up capital (`) 17,00,000

Free reserves (`) (23,50,000 + 2,50,000 + 2,00,000) 28,00,000

Shareholders’ funds (`) 45,00,000

25% of Shareholders fund (`) 11,25,000

Buy back price per share ` 30

Number of shares that can be bought back (shares) 37,500

Actual Number of shares proposed for buy back 35,000

3. Debt Equity Ratio Test: Loans cannot be in excess of twice the Equity Shareholder’s

Funds post Buy Back

Particulars `

(a) Loan funds (`) (38,00,000+8,50,000) 46,50,000

(b) Minimum equity to be maintained after buy back in the ratio of

2:1 (`) (a/2) 23,25,000

(c) Present equity/shareholders fund (`) 45,00,000

(d) Future equity/shareholders fund (`) (see W.N.) (45,00,000 – 39,56,250

5,43,750)

(e) Maximum permitted buy back of Equity (`) [(d) – (b)] 16,31,250

(f) Maximum number of shares that can be bought back @ 54,375 shares

` 30 per share

(g) Actual Buy Back Proposed 35,000 Shares

Summary statement determining the maximum

number of shares to be bought back

Particulars Number of

shares

Shares Outstanding Test 42,500

Resources Test 37,500

Debt Equity Ratio Test 54,375

Maximum number of shares that can be bought back [least of the above] 37,500

Company qualifies all tests for buy-back of shares and it can buy back maximum 37,500 shares on

1st April, 2022.

However, company wants to buy-back only 35,000 equity shares @ ` 30. Therefore, buy-back of

35,000 shares, as desired by the company is within the provisions of the Companies Act, 2013.

Working Note:

Amount transferred to CRR and maximum equity to be bought back will be calculated by

simultaneous equation method.

Suppose amount transferred to CRR account is ‘x’ and maximum permitted buy -back of equity is

‘y’.

Then

(45,00,000 – x) – 23,25,000 = y (1)

14

© The Institute of Chartered Accountants of India

𝑦

( × 10) = x Or 3x = y (2)

30

by solving the above equation, we get

x = ` 5,43,750

y = ` 16,31,250

6. (a) According to para 11 of AS 19 “Leases”, the lessee should recognise the lease as an asset and a

liability at an amount equal to the fair value of the leased asset at the inception of the finance lease.

However, if the fair value of the leased asset exceeds the present value of the minimum lease

payments from the standpoint of the lessee, the amount recorded as an asset and a liability should

be the present value of the minimum lease payments from the standpoint of the lessee.

In calculating the present value of the minimum lease payments the discount rate is the interest

rate implicit in the lease. Present value of minimum lease payments will be calculated as follows:

Year Minimum Lease Payment Internal rate of return Present value

` (Discount rate @10%) `

1 3,50,000 0.909 3,18,150

2 3,50,000 0.826 2,89,100

3 3,50,000 0.751 2,62,850

4 4,20,000 0.683 2,86,860

Total 14,70,000 11,56,960

Present value of minimum lease payments ` 11,56,960 is more than fair value at the inception of

lease i.e. ` 11,50,000, therefore, the lease liability and machinery should be recognized in the

books at ` 11,50,000 as per AS 19.

(b) Calculation of Total Remuneration payable to Liquidator

Amount in `

5% on Assets realised (13,75,000 x 5%) 68,750

8% on payment made to Unsecured creditors (Refer W.N) 7,080

Total Remuneration payable to Liquidator 75,830

Working Note:

Liquidator’s remuneration on payment to unsecured creditors =

Cash available for unsecured creditors after all payments including liquidation expenses, payment

to secured creditors and liquidator’s remuneration

Total amount realized ` ` 13,75,000

Less: Liquidation expenses paid (13,000)

Payment to secured creditors (1,00,000)

Liquidator’s remuneration on

assets realized (68,750)

` 1,81,750

`11,93,250

Sufficient amount is available for preference creditors (treated as unsecured creditors) therefore

Liquidator’s remuneration on payment to unsecured creditors = 8% x ` 88,500 = ` 7,080

Minimum Lease Payment of 4 th year includes guaranteed residual value amounting i.e. 3,50,000 + 70,000 = 4,20,000.

15

© The Institute of Chartered Accountants of India

There are no unsecured creditors (other than preferential creditors who are treated as unsecured

creditors).

(c) The income recognition shall be based on recognised accounting principles.

(1) Income including interest/ discount or any other charges on NPA shall be recognised only

when it is actually realised. Any such income recognised before the asset became non -

performing and remaining unrealised shall be reversed.

(2) In respect of hire purchase assets, where instalments are overdue for more than 3 months,

income shall be recognised only when hire charges are actually received. Any such income

taken to the credit of profit and loss account before the asset became nonperforming and

remaining unrealized, shall be reversed.

(3) In respect of lease assets, where lease rentals are overdue for more than 3 months, the

income shall be recognised only when lease rentals are actually received. The net lease

rentals taken to the credit of profit and loss account before the asset became non-performing

and remaining unrealised shall be reversed.

(d) Bills for Collection (Assets) Account

` in lacs ` in lacs

To Balance b/d 21 By Bills for collection 141

To Bills for collection 193.5 By Bills dishonoured 16.5

By Balance c/d 57

214.5 214.5

Bills for Collection (Liabilities) Account

` in lacs ` in lacs

To Bills for collection 141 By Balance b/d 21

To Bills dishonoured 16.5 By Bills for collection 193.5

To Balance c/d 57

214.5 214.5

(e) Computation of contract cost

` Lakh ` Lakh

Material cost incurred on the contract (net of closing stock) 21-4 17

Add: Labour cost incurred on the contract (including outstanding 16

amount)

Specified contract cost given 5

Sub-contract cost (advances should not be considered) 7

Cost incurred (till date) 45

Add: further cost to be incurred 35

Total contract cost 80

Percentage of completion = Cost incurred till date/Estimated total cost

= ` 45,00,000/` 80,00,000

= 56.25%

Contract revenue and costs to be recognized

Contract revenue (` 85,00,000x56.25%) = ` 47,81,250

Contract costs = ` 45,00,000

16

© The Institute of Chartered Accountants of India

You might also like

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaRohit SadhukhanNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Particulars Debit Credit: © The Institute of Chartered Accountants of IndiaDocument46 pagesParticulars Debit Credit: © The Institute of Chartered Accountants of IndiaOveyaaNo ratings yet

- CA Ipcc n19p1Document27 pagesCA Ipcc n19p1rachitu2105No ratings yet

- 61089bos49694 Ipc Nov2019 gp1Document93 pages61089bos49694 Ipc Nov2019 gp1iswerya n.sNo ratings yet

- 64713bos51933 FND p1Document22 pages64713bos51933 FND p1un627331No ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 71696bos57679 Inter p5qDocument8 pages71696bos57679 Inter p5qMayank RajputNo ratings yet

- CFS 2023 PyqDocument15 pagesCFS 2023 PyqAnshul JainNo ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- Paper - 1: Financial Reporting Questions Ind AS 103Document30 pagesPaper - 1: Financial Reporting Questions Ind AS 103sam kapoorNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- 23 Account (4) AnswerDocument13 pages23 Account (4) Answertandelautomation6No ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Guideline Answers For Accounting Group - IDocument14 pagesGuideline Answers For Accounting Group - ITrisha IyerNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument22 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDEEPAK ATALNo ratings yet

- MTP - Nov - 20 AccountsDocument19 pagesMTP - Nov - 20 AccountsPartibha GehlotNo ratings yet

- P5 MTP 1 For Nov 23 Answers @CAInterLegendsDocument20 pagesP5 MTP 1 For Nov 23 Answers @CAInterLegendsraghavagarwal2252No ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument12 pages(In Lakhs) : © The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationUsama RajaNo ratings yet

- Analysis of Financial StatementsDocument16 pagesAnalysis of Financial StatementsAlok ThakurNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- © The Institute of Chartered Accountants of India: TH STDocument46 pages© The Institute of Chartered Accountants of India: TH STheikNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument9 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsayushiNo ratings yet

- CFS Test - 1 Set-A 13-2-2022Document2 pagesCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNo ratings yet

- Solution AldineDocument8 pagesSolution AldineAkshay TulshyanNo ratings yet

- Financial Statement of CompaniesDocument35 pagesFinancial Statement of CompaniesTanyaNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- MTP 17 48 Answers 1709809437Document12 pagesMTP 17 48 Answers 1709809437cloudstorage567No ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- 325Document12 pages325Ganesh AgarwalNo ratings yet

- Nov 22-2Document34 pagesNov 22-2Sreerag R NairNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Pakistan Refinery Limited (Annual Report 2008)Document84 pagesPakistan Refinery Limited (Annual Report 2008)Monis Ali100% (1)

- Sheet 1 Cost Concepts and Design EconomicsDocument13 pagesSheet 1 Cost Concepts and Design EconomicsAhmed tarek gaballahNo ratings yet

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- Course Outline Intermediate and Advanced Accounting1 Revised 2Document5 pagesCourse Outline Intermediate and Advanced Accounting1 Revised 2Amde GetuNo ratings yet

- West Fraser Timber Co LTD Is A Forest Products CompanyDocument1 pageWest Fraser Timber Co LTD Is A Forest Products CompanyLet's Talk With HassanNo ratings yet

- EnterpirinarshiippiiDocument82 pagesEnterpirinarshiippiiDhugassa AKeyuNo ratings yet

- Chapter 2 - Statement of Comprehensive IncomeDocument12 pagesChapter 2 - Statement of Comprehensive IncomeVictor TucoNo ratings yet

- Analisis Fundamental WikaDocument5 pagesAnalisis Fundamental WikaAnonymous XoUqrqyuNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Interloop: Investor InformationDocument2 pagesInterloop: Investor InformationALI SHER HaidriNo ratings yet

- IAS AssignmentDocument17 pagesIAS AssignmentImran BalochNo ratings yet

- I. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)Document2 pagesI. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)LuiNo ratings yet

- Finance Solved CasesDocument79 pagesFinance Solved Cases07413201980% (5)

- Homework #2 - CourseraDocument8 pagesHomework #2 - Courserainbarexy67% (6)

- Practice Questions Week 4Document3 pagesPractice Questions Week 4mariliamonfardineNo ratings yet

- All Seatworks PDFDocument14 pagesAll Seatworks PDFLouiseNo ratings yet

- FABM 2 NotesDocument4 pagesFABM 2 NotesShiny Natividad100% (1)

- Cba 2020 Annual Report Print 104 275 PDFDocument172 pagesCba 2020 Annual Report Print 104 275 PDFKelvin ChenNo ratings yet

- 3732 8292 1 PBDocument15 pages3732 8292 1 PBRasly 28No ratings yet

- Ycoa Accdet Docu XXDocument874 pagesYcoa Accdet Docu XXDezan SAPNo ratings yet

- Activity in Inventory Estimation, Retail InventoryDocument2 pagesActivity in Inventory Estimation, Retail InventoryTrisha VillegasNo ratings yet

- Chapter 1 Cost-Volume-Profit RelationshipsDocument51 pagesChapter 1 Cost-Volume-Profit Relationshipspamela dequillamorteNo ratings yet

- Teresita Buenaflor CompanyDocument18 pagesTeresita Buenaflor CompanyLera Acuzar100% (1)

- Financial Reporting Course (Scrib)Document173 pagesFinancial Reporting Course (Scrib)Nguyen Dac ThichNo ratings yet

- Fundamental Analysis: Sunday - March 21, 2021Document52 pagesFundamental Analysis: Sunday - March 21, 2021Johan CahyantoNo ratings yet

- Acc117 Chapter 8Document27 pagesAcc117 Chapter 8Fadilah JefriNo ratings yet

- WSP Levered DCF Model VFDocument5 pagesWSP Levered DCF Model VFBlahNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- CHAPTER - 5 - Exercise & ProblemsDocument6 pagesCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)