Professional Documents

Culture Documents

ElementsBookKeepingAccountancy MS

Uploaded by

Kanya PrakashOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ElementsBookKeepingAccountancy MS

Uploaded by

Kanya PrakashCopyright:

Available Formats

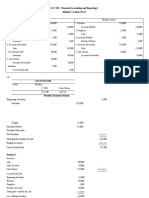

ELEMENTS OF BOOK-KEEPING AND ACCOUNTANCY (254)

SAMPLE QUESTION PAPER 2022 – 23 Answer Key

CLASS X

MM – 70 TIME: 3 HOURS

S.No. Question Marks

1. c) Sale of Fixed Assets 1

Or

d) Salary Paid

2. d) Likely to give benefit for more than one accounting period 1

3. b) ₹ 3,40,000 1

Or

c) ₹ 4,86,000

4. d) Book Value of Equipments in Aqua Ltd. will be ₹ 10,000 less than Batman 1

Ltd.

5. c) True and Fair Financial position 1

Or

a) Both A and R are correct and R is the correct explanation of A

6. c) Cash Book and Pass Book 1

Or

d) Account Holder

7. a) Both the Statement are False 1

8. a) Credit Balance as per Pass Book ₹ 23,000 1

9. b) Subtracted ₹ 35,000 1

10. a) Both A and R are correct and R is the correct explanation of A 1

11. b) Discount the Bills on Exchange 1

12. d) 14 August, 2022 1

Or

b) Santa

13. d) Debit side of Profit and Loss Account 1

Or

b) Credit side of Profit and Loss Account

14. a) Net Profit ₹ 2,20,000 1

Or

d) Discount allowed by Creditors

15. a) Bank Reconciliation Statement 1

16. c) Gross Profit 1

17. c) Only Statement I is true 1

18. b) Capital 1

Or

c) Statement of Affairs

19. (a) Revenue Expenditure = Salaries = ₹ 60,000 3

(b) Capital Expenditure = Office Space + Furniture = 50,000 + 70,000

= ₹ 1,20,000

(c) Deferred Revenue Expenditure = Advertisement for new products

launch = ₹ 40,000

20. Basis Revenue Receipts Capital Receipts 3

Meaning Revenue Receipts are the Capital Receipts are the income

income generated from the generated from investment

operating activities of the and financing activities of the

business. business.

Nature Recurring Non-Recurring

Shown Profit and Loss Account Balance Sheet

in

21. Basis Straight Line Method Written Down Value 3

Basis of charging Original cost Book Value (i.e. original

depreciation cost less depreciation

charged till date

Annual Fixed (Constant) year Declines year after year

depreciation

charge

Suitability It is suitable for assets It is suitable for assets in

in which repair charges which repair charges are

are less more

22. Journal in the Books of Rahul 3

Date Particulars L.F Debit (₹) Credit (₹)

Apr. 20 Mohit’s A/c Dr. 10,000

2022 To Sales A/c 10,000

(Being goods sold to Mohit)

Apr. 20 Bills Receivable A/c Dr. 10,000

2022 To Mohit’s A/c 10,000

(Bill accepted by Mohit)

Aug. 23 Cash A/c Dr. 10,000

2022 To Bills Receivable A/c 10,000

(Bill amount received on due date)

Or

Journal in the Books of Laxman

Date Particulars L.F Debit (₹) Credit (₹)

May 25 Purchase A/c Dr. 15,000

2022 To Ranjan’s A/c 15,000

(Being goods purchased from Ranjan)

May 25 Ranjan’s A/c Dr. 15,000

2022 To Bills Payable A/c 15,000

(Bill accepted in favour of Ranjan)

July 28 Bills Payable A/c Dr. 15,000

2022 To Cash A/c 15,000

(Bill amount paid on due date)

23. Bank Reconciliation Statement 4

As on 31 August, 2022

Particulars Add Subtract

Balance as per Cash Book 35,000

Cheques issued but not yet presented for payment 6,000

Cheques deposited in bank but omitted to be entered 5,000

in Cash Book

Interest credited by Bank 2,000

Balance as per Pass Book 48,000

48,000 48,000

Or

Bank Reconciliation Statement

As on 31 July, 2022

Particulars Add Subtract

Balance as per Pass Book 25,000

Cheques deposited but not yet collected 8,000

Cheques issued but omitted to be entered in Cash 5,000

Book

Bank Charges 1,000

Balance as per Cash Book 39,000

39,000 39,000

24. Journal in the Books of Rahul 4

Date Particulars L.F Debit (₹) Credit (₹)

May 01 Bills Receivable A/c Dr. 50,000

2022 To Sachin’s A/c 50,000

(Bill accepted by Mohit)

June 01 Bank A/c Dr. 48,500

2022 Discounting Charges A/c Dr. 1,500

To Bills Receivable A/c 50,000

(Bill amount received on due date)

Journal in the Books of Sachin

Date Particulars L.F Debit (₹) Credit (₹)

May 01 Rahul’s A/c Dr. 50,000

2022 To Bills Payable A/c 50,000

(Bill accepted in favour of Rahul)

Sep. 04 Bills Payable A/c Dr. 50,000

2022 To Cash A/c 50,000

(Bill amount paid on due date)

25. Basis Direct Expenses Indirect Expenses 4

Meaning Expenses which directly Expenses which are not directly

related to production or related to production or

purchase of goods. purchase of goods.

Incurred Incurred before or at the Incurred after production or at

time of production the time of sales

Shown in Trading Account Profit and Loss Account

Examples Wages, Octroi, Carriage Salaries, Advertisement,

Inward Carriage Outward

26. Statement of Profit and Loss 4

for the year ended March 31, 2022

Particulars Add

Capital at the end of the year 3,70,000

Add :- Drawings during the year (10,000 x 9) + 20,000 1,10,000

Less:- Additional Capital introduced during the year (50,000)

Less:- Capital at the beginning of the year (2,00,000)

Profit made during the year 2,30,000

27. Machinery Account 6

Date Particulars Amt. (₹) Date Particulars Amt. (₹)

1 Oct. To Bank 6,00,000 31 Mar. By Depreciation 30,000

2019 (5,80,000+20,000) 2020 By Balance c/d 5,70,000

6,00,000 6,00,000

1 Apr. To Balance b/d 5,70,000 31 Mar. By Depreciation 57,000

2020 2021 By Balance c/d 5,13,000

5,70,000 5,70,000

1 Apr. To Balance b/d 5,13,000 31 Mar. By Depreciation 51,300

2021 2022 By Balance c/d 4,61,700

5,13,000 5,13,000

28. a) Bank Reconciliation Statement 6

b) ₹ 8,000 will be added

c) ₹ 6,000 will be added

d) ₹ 1,000 will be subtracted

e) ₹ 2,000 will be subtracted

f) ₹ 10,000 will be added

29. Statement of Affairs 6

as on 31 March 2021

Liabilities Amount (₹) Assets Amount (₹)

Creditors 8,000 Cash 10,000

Bills Payable 3,000 Debtors 20,000

Capital (b/f) 64,000 Furniture 40,000

Bills Receivable 5,000

75,000 75,000

Statement of Affairs

as on 31 March 2021

Liabilities Amount (₹) Assets Amount (₹)

Creditors 6,000 Cash 12,000

Bills Payable 4,000 Debtors 25,000

Capital (b/f) 83,000 Furniture 50,000

Bills Receivable 6,000

93,000 93,000

Statement of Profit and Loss

for the year ended March 31, 2022

Particulars Add

Capital at the end of the year 83,000

Add :- Drawings during the year (3,000 x 12) 36,000

Less:- Additional Capital introduced during the year (30,000)

Less:- Capital at the beginning of the year (64,000)

Profit made during the year 25,000

Or

(a) Accounting records, which are not strictly kept according to double

entry system are known as incomplete records. It is a mechanism of

maintaining records whereby some transactions are recorded with

proper debits and credits while in case of others, either one sided or no

entry is made.

(b) Difference between Balance Sheet and Statement of Affairs

Basis Balance Sheet Statement of Affairs

Reliability It is based on sophisticated It is based on estimates;

and well developed hence, it is less reliable.

principles; hence, it is more

reliable

Accounting It is prepared when It is prepared from

Method accounts are maintained incomplete records of

under double entry system. business transactions under

single entry system.

Omission Omission of assets and Omission of assets and

liabilities can be easily liabilities cannot be easily

identified, as omission will identified.

lead to mismatch of either

sides of the balance sheet.

Objective It is prepared to ascertain it is prepared to determine

the true financial position. the amount of capital at a

particular date.

30. Trading Account 6

for the year ended March 31, 2022

Particulars Amount (₹) Particulars Amount (₹)

To Opening Stock 20,000

To Purchase 90,000 By Sales 1,70,000

(-) Returns (5,000) 85,000 (-) Returns (10,000) 1,60,000

To Gross Profit (b/f) 85,000 By Closing Stock 30,000

1,90,000 1,90,000

Profit and Loss Account

for the year ended March 31, 2022

Particulars Amount (₹) Particulars Amount (₹)

To Rent 25,000 By Gross Profit 85,000

To Interest 10,000 By Commission 20,000

To Discount allowed 4,000 By Discount Received 6,000

To Net Profit (b/f) 72,000

1,11,000 1,11,000

Balance Sheet

as at March 31, 2022

Liabilities Amount (₹) Assets Amount (₹)

Creditors 20,000 Land and Building 2,00,000

Bank Overdraft 20,000 Plant and Machinery 1,50,000

Capital 4,10,000 Equipments 50,000

+ Net Profit 72,000 4,82,000 Debtors 30,000

Cash in Hand 32,000

Bank Balance 30,000

Closing Stock 30,000

5,22,000 5,22,000

You might also like

- UST Final CaseDocument4 pagesUST Final Casestrongchong0050% (2)

- FAR - 02 LOANS AND RECEIVABLES With AnswerDocument17 pagesFAR - 02 LOANS AND RECEIVABLES With AnswerAndrei Nicole Mendoza Rivera91% (11)

- Ultimate Accountancy Class 11Document13 pagesUltimate Accountancy Class 11Bhawani Creations100% (3)

- Business Enterprise Simulation Quarter 3 - Module 4 - Introduction of An Enterprise Business PlanDocument18 pagesBusiness Enterprise Simulation Quarter 3 - Module 4 - Introduction of An Enterprise Business PlanYannah LongalongNo ratings yet

- Financial Accounting & Reporting: Answer: A Trade ReceivableDocument17 pagesFinancial Accounting & Reporting: Answer: A Trade ReceivableFerb CruzadaNo ratings yet

- AP - 02 LOANS AND RECEIVALBES With Answer PDFDocument12 pagesAP - 02 LOANS AND RECEIVALBES With Answer PDFJymldy Encln67% (3)

- Fred Tam Trader SystemDocument4 pagesFred Tam Trader Systempriyaked100% (1)

- ElementsBookKeepingAccountancy SQPDocument7 pagesElementsBookKeepingAccountancy SQPKanya PrakashNo ratings yet

- Cbse XI 2019-2020 Annual ExamDocument6 pagesCbse XI 2019-2020 Annual Exammadhavmanoj08No ratings yet

- Revision Accountancy XI Term II 8.12.2022 FinalDocument15 pagesRevision Accountancy XI Term II 8.12.2022 FinalNIRMALA COMMERCE DEPTNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- RKG Accounts (XI) CH 9 To 16 SolDocument3 pagesRKG Accounts (XI) CH 9 To 16 SolJohn WickNo ratings yet

- Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Document2 pagesNulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Shyamal dasNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- 11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDocument13 pages11th Accountancy EM Half Yearly Exam 2023 Question Paper With Answer Keys Madurai District English Medium PDF DownloadDr.ManogaranNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- Solution AldineDocument8 pagesSolution AldineAkshay TulshyanNo ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- Xi See Acc 2021 Set 2 MsDocument5 pagesXi See Acc 2021 Set 2 Mss1672snehil6353No ratings yet

- SolutionDocument23 pagesSolutionKavita WadhwaNo ratings yet

- Ac Test 80 M (1) - Watermark - WatermarkDocument5 pagesAc Test 80 M (1) - Watermark - Watermarkanikeshyadav0700No ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Accountancy Class 11 Final Set ADocument7 pagesAccountancy Class 11 Final Set AmahonidhinareddyNo ratings yet

- +1 Acc Model Hly Ans (EM) 2022Document7 pages+1 Acc Model Hly Ans (EM) 2022BABA AssociatesNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PaperPritika Ghai XI-Humanities RNNo ratings yet

- 1a Millan Solution Manual 2021 1Document259 pages1a Millan Solution Manual 2021 1avilastephjaneNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionCharlene Mae MalaluanNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Chapter 1Document12 pagesChapter 1Kyllar HizonNo ratings yet

- Accounts U1 Spec2022Document41 pagesAccounts U1 Spec2022AbbyNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- Acc Xi See QP With BP, Ms-1-16Document16 pagesAcc Xi See QP With BP, Ms-1-16AmiraNo ratings yet

- 11th AccountancyDocument7 pages11th Accountancygamerbeast367No ratings yet

- 23 Account (4) AnswerDocument13 pages23 Account (4) Answertandelautomation6No ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- Suggested Answers CA Foundation Accounts Round 1Document12 pagesSuggested Answers CA Foundation Accounts Round 1Prerna sewaniNo ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- EV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20Document13 pagesEV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20minita sharmaNo ratings yet

- Class 11 Cbse Assighnment (New)Document3 pagesClass 11 Cbse Assighnment (New)carrotunchainedNo ratings yet

- RISE ITA Model Paper SolutionDocument15 pagesRISE ITA Model Paper Solutionzaffiii.293No ratings yet

- GE 01.FCAB - .L Solution JUNE 2020 ExamDocument5 pagesGE 01.FCAB - .L Solution JUNE 2020 ExamTameemmahmud rokibNo ratings yet

- Sessional 2 Solved Sample 3Document4 pagesSessional 2 Solved Sample 3Fami FamzNo ratings yet

- The Accounting Process: Name: Date: Professor: Section: Score: QuizDocument6 pagesThe Accounting Process: Name: Date: Professor: Section: Score: QuizAllyna Jane Enriquez100% (1)

- DISSLUTIONDocument3 pagesDISSLUTIONomgarg2714No ratings yet

- ElementsBookKeepingAccountancy SQPDocument6 pagesElementsBookKeepingAccountancy SQPMohd JamaluddinNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- Paper6 CmaDocument8 pagesPaper6 CmaRon WeasleyNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- 3 - Recording of Transaction IDocument13 pages3 - Recording of Transaction IMai SalehNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- ReSA B46 FAR Final PB Exam Questions Answers SolutionsDocument28 pagesReSA B46 FAR Final PB Exam Questions Answers SolutionsJohn Gabriel RafaelNo ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- 11th Annual Benedict's PDFDocument15 pages11th Annual Benedict's PDFYugam RathiNo ratings yet

- 1styr 1stMT Financial Accounting and Reporting 2324Document31 pages1styr 1stMT Financial Accounting and Reporting 2324MaryNo ratings yet

- BK - Board Question Paper - March 2023 - 640c2df6aaec0Document6 pagesBK - Board Question Paper - March 2023 - 640c2df6aaec0Priyansh ShahNo ratings yet

- Screenshot 2023-02-21 at 1.23.27 AMDocument12 pagesScreenshot 2023-02-21 at 1.23.27 AMGracy AroraNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Board Question Paper: September 2021: Book Keeping & AccountancyDocument5 pagesBoard Question Paper: September 2021: Book Keeping & AccountancyPriyansh ShahNo ratings yet

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- Fin Acc 2 Assigns 2023Document6 pagesFin Acc 2 Assigns 2023Vinancio ZungundeNo ratings yet

- ElementsBusiness SQPDocument4 pagesElementsBusiness SQPKanya PrakashNo ratings yet

- ElementsBusiness MSDocument5 pagesElementsBusiness MSKanya PrakashNo ratings yet

- 4 PPT Service Sector and Business.Document177 pages4 PPT Service Sector and Business.Kanya PrakashNo ratings yet

- Disaster ManagementDocument10 pagesDisaster ManagementKanya PrakashNo ratings yet

- Types of TsunamiDocument1 pageTypes of TsunamiKanya PrakashNo ratings yet

- Gr. 10 Mathematics - Sec - 2021-22Document9 pagesGr. 10 Mathematics - Sec - 2021-22Kanya PrakashNo ratings yet

- Gr. 10 English - Sec - 2021-22Document3 pagesGr. 10 English - Sec - 2021-22Kanya PrakashNo ratings yet

- Gr. 10 Social - Science - Sec - 2021-22Document14 pagesGr. 10 Social - Science - Sec - 2021-22Kanya PrakashNo ratings yet

- Gr. 10 Science - Sec - 2021-22Document6 pagesGr. 10 Science - Sec - 2021-22Kanya PrakashNo ratings yet

- English PT2Document2 pagesEnglish PT2Kanya PrakashNo ratings yet

- 2ndmonthly Exam - GMDocument2 pages2ndmonthly Exam - GMJonavi Luyong100% (1)

- Paul Sonkin Investment StrategyDocument20 pagesPaul Sonkin Investment StrategyCanadianValueNo ratings yet

- Introduction To Macroeconomics and National Income AccountingDocument7 pagesIntroduction To Macroeconomics and National Income AccountingjomardansNo ratings yet

- ACC 101 - Financial Accounting and Reporting 1Document14 pagesACC 101 - Financial Accounting and Reporting 1Rc RocafortNo ratings yet

- Faraj Adayev: Career ObjectiveDocument4 pagesFaraj Adayev: Career ObjectiveAnonymous VCJRrpxNNo ratings yet

- Vol.4 Issue.1-03 Full TextDocument14 pagesVol.4 Issue.1-03 Full TextrifkiboyzNo ratings yet

- Agreement This Agreement Is Made This Day of June 13, 2007 BetweenDocument3 pagesAgreement This Agreement Is Made This Day of June 13, 2007 BetweenCA Arpit YadavNo ratings yet

- Case (Renminbi) - Discussion QuestionsDocument2 pagesCase (Renminbi) - Discussion QuestionsAnimesh ChoubeyNo ratings yet

- Nikko Spore Divd Fund FactsheetDocument2 pagesNikko Spore Divd Fund FactsheetSivakumar NityanandanNo ratings yet

- Dec 2014Document2 pagesDec 2014Zahiratul QamarinaNo ratings yet

- Aletheia Research and Management's Bankruptcy PetitionDocument35 pagesAletheia Research and Management's Bankruptcy PetitionDealBookNo ratings yet

- NY RIA Summit 2020Document4 pagesNY RIA Summit 2020David GengNo ratings yet

- Uploads Presentations 102 Mr. Lakshminarayana K RDocument12 pagesUploads Presentations 102 Mr. Lakshminarayana K RNaveen ThakurNo ratings yet

- Beneish M-Score - Finbox TemplateDocument6 pagesBeneish M-Score - Finbox Templatemichael odiemboNo ratings yet

- MarketWars Case StudyDocument15 pagesMarketWars Case StudyABILESH R 2227204No ratings yet

- Position of Weaker SectionsDocument25 pagesPosition of Weaker Sectionspulkit magoNo ratings yet

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- Project Concept On EON - MHTESTDDocument12 pagesProject Concept On EON - MHTESTDJusy BinguraNo ratings yet

- Money & You The Money Magnet MentalityDocument114 pagesMoney & You The Money Magnet MentalityRandy Haltiwanger100% (1)

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Resume 4 PageDocument4 pagesResume 4 PageMohiuddin RownakNo ratings yet

- Prof. K. S. Jaiswal: Department of CommerceDocument16 pagesProf. K. S. Jaiswal: Department of CommerceR VNo ratings yet

- Auchi PolyDocument1 pageAuchi PolyESECHIE CEPHASNo ratings yet

- Sap Erp: - Balance Sheet - Income Statement - Statement of Cash FlowsDocument44 pagesSap Erp: - Balance Sheet - Income Statement - Statement of Cash FlowsSAM ANUNo ratings yet

- IDFC First Bank Investor Presentation FY20 UpdatedDocument58 pagesIDFC First Bank Investor Presentation FY20 UpdatedSaksham SinhaNo ratings yet

- Atlantik Confidence-2017 - Deliberate SinkingDocument15 pagesAtlantik Confidence-2017 - Deliberate SinkingRahel RimonNo ratings yet

- 41-Trading The Golden RatioDocument5 pages41-Trading The Golden RatioparirahulNo ratings yet