Professional Documents

Culture Documents

Value Capture Instruments

Uploaded by

Obiyo MartinsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Capture Instruments

Uploaded by

Obiyo MartinsCopyright:

Available Formats

ValueCaptureInstruments

Land value capture refers to the ‘creaming off’ of increases in land value by a public body from

the landowner, where the increased land value is the result of rezoning the land or public

infrastructure provision. A large body of literature discusses the legal right of a state body to

take part of the landowner’s development gain and use it for public purposes (for an overview of

that literature, see Alterman 2012; Muñoz-Gielen and van der Krabben 2019). Perhaps the most

documented dispute over taxing land value increase took place in the 1940s in the United

Kingdom after publication of the Uthwatt report in 1942. The Uthwatt Committee discussed,

among other things, the introduction of a betterment levy to capture the planning gain. A 100%

betterment levy was introduced in the 1947 Town and Country Planning Act, and any

development required a payment to the Central Land Board. Sale of land in private ownership to

developers attracted a levy. However, the political controversy about the new regulation became

clear soon after when the subsequent Conservative government immediately decided to abolish

it in the 1954 Planning Act (Muñoz-Gielen and van der Krabben 2019).

Other literature discusses the instruments that can be used for land value capture (for an

overview of that literature, see Alterman 2012; Muñoz-Gielen and van der Krabben 2019). An

often-made distinction is between direct and indirect value capture mechanisms. According to

Alterman (2009, p. 199):

Direct value capture mechanisms refer to an increase in the value of land of private owners

through actions undertaken by public authorities or by the general community. The rationale for

value capture is thus the fact that the increase in value was not caused personally by an

individual and hence should be shared with a broader community.

A classic example would be where services are supplied to an off-grid rural or periurban

property, such as sewer pipes, and the homeowner readily pays the local government a

contribution toward the costs of the connection to the mains and its ongoing maintenance by

way of a sewer betterment fee or charge, as it replaces the old septic tank and the chore of

having it emptied. Often, however, the betterment is not compensated or charged to the

benefitting homeowners, such as where a new stop for a train or bus line is added, increasing

access to the private property.

These types of direct value capture mechanisms are often referred to as betterments,

(unearned) increments, or windfalls. Based on an international review of value capture

mechanisms, Muñoz-Gielen and van der Krabben (2019, p.6) claim that indirect value capture

instruments are now more commonly used: “(n)ext to proposals of land value

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- An Attorney's Liability For The Negligent Infliction of Emotional DistressDocument19 pagesAn Attorney's Liability For The Negligent Infliction of Emotional Distresswhackz100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Income Tax ReturnDocument14 pagesIncome Tax ReturnEugene culpepperNo ratings yet

- Boulez - Derive 2Document169 pagesBoulez - Derive 2LucaNo ratings yet

- RBI Circular On EPBG April 6 2015Document4 pagesRBI Circular On EPBG April 6 2015Sachin JainNo ratings yet

- OpinionDocument4 pagesOpinionMark Hiro NakagawaNo ratings yet

- Establishmentof Marketsfor TransferableDocument1 pageEstablishmentof Marketsfor TransferableObiyo MartinsNo ratings yet

- EvaluationDocument46 pagesEvaluationObiyo MartinsNo ratings yet

- Comparative Method of ValuationDocument1 pageComparative Method of ValuationObiyo MartinsNo ratings yet

- Preliminary PagesDocument9 pagesPreliminary PagesObiyo MartinsNo ratings yet

- This Document Is Discoverable and Free To Researchers Across The Globe Due To The Work of Agecon SearchDocument9 pagesThis Document Is Discoverable and Free To Researchers Across The Globe Due To The Work of Agecon SearchObiyo MartinsNo ratings yet

- 2022 08 17 - 083668 1Document7 pages2022 08 17 - 083668 1Obiyo MartinsNo ratings yet

- Housing, Building and Construction StatisticsDocument8 pagesHousing, Building and Construction StatisticsObiyo MartinsNo ratings yet

- Land Fragmentation and Its Implications For ProducDocument39 pagesLand Fragmentation and Its Implications For ProducObiyo MartinsNo ratings yet

- Housing Defect Research To Learn From The Western by Estate Surveyors and Valuers in LagosDocument50 pagesHousing Defect Research To Learn From The Western by Estate Surveyors and Valuers in LagosObiyo MartinsNo ratings yet

- BuildingDocument10 pagesBuildingObiyo MartinsNo ratings yet

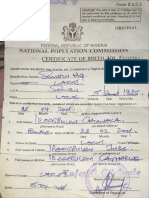

- Scan 10 Jan. 2022Document3 pagesScan 10 Jan. 2022Obiyo MartinsNo ratings yet

- Updates of Cases For Persons and Family Relations 2014 Prepared by Katherine Ababa & Angelo GarciaDocument21 pagesUpdates of Cases For Persons and Family Relations 2014 Prepared by Katherine Ababa & Angelo GarciaJP Murao IIINo ratings yet

- Shils, Edward. Tradicion and Liberty. Article.Document13 pagesShils, Edward. Tradicion and Liberty. Article.David LuqueNo ratings yet

- Bank of America Vs CaDocument7 pagesBank of America Vs CaKleyr De Casa AlbeteNo ratings yet

- SantosDocument9 pagesSantoslalisa lalisaNo ratings yet

- Homework: I. Questions For ReviewDocument16 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Sandoval v. Secretary of The California Department of Corrections and Rehabilitation - Document No. 2Document3 pagesSandoval v. Secretary of The California Department of Corrections and Rehabilitation - Document No. 2Justia.comNo ratings yet

- Bank of Scotland Turriff Branch PosterDocument4 pagesBank of Scotland Turriff Branch PosterMy TurriffNo ratings yet

- AFA IIPl III Question Dec 2016Document4 pagesAFA IIPl III Question Dec 2016HossainNo ratings yet

- Baroness Angela Smith of Basildon, Shadow Leader of The LordsDocument4 pagesBaroness Angela Smith of Basildon, Shadow Leader of The Lordsapi-110464801No ratings yet

- Independent Contractor Agreement SimpleDocument2 pagesIndependent Contractor Agreement SimplePhoebe Grace LopezNo ratings yet

- ECONOMICS ? SSC MTS 2022 G K ALL 57 Sets ECONOMICS Previous YearDocument234 pagesECONOMICS ? SSC MTS 2022 G K ALL 57 Sets ECONOMICS Previous Yearpawan nishalNo ratings yet

- Module 11 - Jose Rizal and Philippine Nationalism-National Symbol Learning OutcomesDocument18 pagesModule 11 - Jose Rizal and Philippine Nationalism-National Symbol Learning OutcomesDarlyn MauricioNo ratings yet

- Ao 2014-05 BCPCDocument3 pagesAo 2014-05 BCPCapi-246926759100% (3)

- Chapter 3 Review QuestionsDocument3 pagesChapter 3 Review QuestionsJason Reed83% (6)

- Adamczuk v. HollowayDocument3 pagesAdamczuk v. HollowayMildred MendozaNo ratings yet

- Surah Humazah (104) - Dream Notes: (Original Talk by Nouman Ali Khan:)Document20 pagesSurah Humazah (104) - Dream Notes: (Original Talk by Nouman Ali Khan:)HARSHITHANo ratings yet

- JJ Nobodys Children2013Document83 pagesJJ Nobodys Children2013Altaf Hussain Wani100% (1)

- Indwdhi 20221130Document11 pagesIndwdhi 20221130Mohd HuzaifahNo ratings yet

- HEC Apptitude Test ChallanDocument1 pageHEC Apptitude Test Challanjunaid javedNo ratings yet

- A Study On Working CapitalDocument7 pagesA Study On Working CapitalkpmazeedNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- Overview of Coast Guard Drug and Migrant Interdiction: HearingDocument90 pagesOverview of Coast Guard Drug and Migrant Interdiction: HearingScribd Government DocsNo ratings yet

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukNo ratings yet

- OUCC Objection To 30-Day Filing No. 50134 - American Suburban Utilities, Inc. - 041918Document6 pagesOUCC Objection To 30-Day Filing No. 50134 - American Suburban Utilities, Inc. - 041918Jeong ParkNo ratings yet

- Judicial Process MCQDocument20 pagesJudicial Process MCQTejas DasnurkarNo ratings yet