Professional Documents

Culture Documents

Problems - Non-Current Assets Held For Sale

Uploaded by

Christine Alysza AnquilanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems - Non-Current Assets Held For Sale

Uploaded by

Christine Alysza AnquilanCopyright:

Available Formats

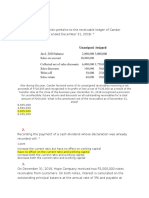

NON- CURRENT ASSETS HELD FOR SALE

On April 23, 2019, Tine Company classified a non-current asset held for sale in accordance with IFRS 5,

Non-current Assets Held for Sale and Discontinued Operations. At that time, the asset’s carrying amount

was P64,000, its fair value was estimated at P48,000 and the costs to sell at P3,800. On June 19, 2019, the

asset was sold for net proceeds of P40,000. The company accounts for non-current assets using the cost

model.

1. In accordance with IFRS 5, what amount should be included as an impairment loss in Tine Company’s

statement of comprehensive income for the year ended June 30, 2019?

2. What amount should be reported as loss on disposal for the year ended June 30, 2019?

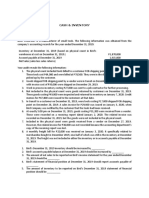

3. On January 1, 2016, an entity acquired an item of property, plant and equipment at a cost of P100,000.

The asset had an estimated residual value of P10,000 and a useful life of 10 years. The company uses

straight-line method of depreciation, computed to the nearest month. On October 1, 2019, the asset was

reclassified as “held for sale” under the strict criteria of IFRS 5. Its fair value on this date was P50,000 and

the cost to sell was estimated at P2,000. These estimates were considered valid on December 31, 2019. In

January 2020, the asset was sold for P50,000 and disposal costs incurred amounted to P3,000. How much

is the impairment loss reported in profit or loss for the year 2019?

4. On July 16, 2019, Sarawat Company classified a non-current asset as held for sale in accordance with

IFRS 5. At that date, the asset’s carrying amount was P45,000, its fair value was estimated at P33,000 and

the costs to sell at P4,500. On October 20, 2019, the asset was sold for net proceeds of P27,000. If Sarawat

Company accounts for non-current assets using the cost model, what amount should be included as

impairment loss and loss on disposal, respectively for the year ended Dec. 31, 2019?

5. On September 30, 2019, 2gether Company decided to dispose its manufacturing plant located in Batanes.

The plant is carried at a cost of P8,000,000 with accumulated depreciation of P3,200,000 at December 31,

2018. Annual depreciation on the plant since it was acquired was consistently provided at 8% per year

based on cost. The company has not yet recorded depreciation for 2019. The company undertook all the

necessary actions to be able to classify the asset as held for sale. On September 30, 2019, 2gether Company

estimated that it could sell the plant at its fair value of P4,900,000 after incurring estimated selling costs of

P400,000. On December 20, 2019, 2gether Company sold the plant for P4,950,000 and paid disposal costs

of P350,000. How much is the gain on sale of Batanes plant?

6. Thai Company purchased an equipment for P5,000,000 on January 1, 2021. The equipment had a useful

life of 5 years with no residual value. On December 31, 2021, the entity classified the asset as held for sale.

On such date, the fair value less cost of disposal of the equipment was P3,500,000.

On December 31, 2022, the entity believed that the criteria for classification as held for sale can no longer

be met. Accordingly, the entity decided not to sell the asset but to continue to use it. On December 31, 2022,

the fair value less cost of disposal of the equipment was P2,700,000.

What amount of impairment loss should be recognized in 2021?

What amount should be included in profit or loss in 2022 as a result of the reclassification of the

equipment to property, plant and equipment?

What is the depreciation for 2023?

/NaBergonia Page 1 of 1

You might also like

- An Attorney's Liability For The Negligent Infliction of Emotional DistressDocument19 pagesAn Attorney's Liability For The Negligent Infliction of Emotional Distresswhackz100% (1)

- Twitter's Lawsuit Against Elon MuskDocument62 pagesTwitter's Lawsuit Against Elon MuskGMG EditorialNo ratings yet

- EXAM About INTANGIBLE ASSETS 4Document3 pagesEXAM About INTANGIBLE ASSETS 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Washington Military ManualsDocument10 pagesWashington Military ManualsPALLIKARASNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Child Pornography and Its Legal Framework in IndiaDocument8 pagesChild Pornography and Its Legal Framework in IndiaAdv (Dr.) Prashant MaliNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Cloak Dagger Compendium Volume 1Document22 pagesCloak Dagger Compendium Volume 1euqehtbNo ratings yet

- Power Point Criminal Litigation-2Document190 pagesPower Point Criminal Litigation-2Farukullahi YusufNo ratings yet

- Auditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Document16 pagesAuditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Moira C. Vilog100% (1)

- The Silence of GodDocument6 pagesThe Silence of GodAira Adaya ArsolonNo ratings yet

- Boulez - Derive 2Document169 pagesBoulez - Derive 2LucaNo ratings yet

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- Physical Planning FinalDocument10 pagesPhysical Planning FinalJhosh Llamelo RafananNo ratings yet

- Rafe Blaufarb - The Great DemarcationDocument305 pagesRafe Blaufarb - The Great DemarcationJena Morelli100% (1)

- Stock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!From EverandStock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!No ratings yet

- IA 3 MidtermDocument9 pagesIA 3 MidtermMelanie Samsona100% (1)

- ACCTG 104 Quiz Answer Review - MidtermsDocument6 pagesACCTG 104 Quiz Answer Review - MidtermsJyNo ratings yet

- Tombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14Document15 pagesTombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14rashid kNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- FAR MOCK Edited PDFDocument21 pagesFAR MOCK Edited PDFKorinth BalaoNo ratings yet

- Seatwork On Investment PropertyDocument2 pagesSeatwork On Investment PropertyMinetquemaNo ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- Reviewer - Exam 5 To 6Document30 pagesReviewer - Exam 5 To 6ZalaR0cksNo ratings yet

- Quiz Inventories and InvestmentsDocument13 pagesQuiz Inventories and InvestmentsRinconada Benori ReynalynNo ratings yet

- Quizzer - Accounting For Notes ReceivableDocument5 pagesQuizzer - Accounting For Notes ReceivableLuisitoNo ratings yet

- Ma PrelimDocument2 pagesMa PrelimLouisse Jeofferson TolentinoNo ratings yet

- Problem 38Document1 pageProblem 38YukidoNo ratings yet

- Test I Journalizing of Adjusting Entries (22 Points)Document4 pagesTest I Journalizing of Adjusting Entries (22 Points)Jonathan Dela CruzNo ratings yet

- Investments Problem 1Document9 pagesInvestments Problem 1Rex AdarmeNo ratings yet

- Toaz - Info Auditing PRDocument22 pagesToaz - Info Auditing PRAlbert pendangNo ratings yet

- Quiz 12 FarDocument6 pagesQuiz 12 FarLeane MarcoletaNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- PFRS 5 QuizzerDocument1 pagePFRS 5 QuizzerRhea LalasNo ratings yet

- PFRS 5 QuizzerDocument1 pagePFRS 5 QuizzerJedaiah CruzNo ratings yet

- Accounting For ReceivableDocument2 pagesAccounting For ReceivableJEFFERSON CUTENo ratings yet

- INTACC2 Liabilities Questions ARALJPIADocument3 pagesINTACC2 Liabilities Questions ARALJPIAKiba YuutoNo ratings yet

- Problem 1Document3 pagesProblem 1Beverly MindoroNo ratings yet

- NCAHS & Discontinued OperationsDocument2 pagesNCAHS & Discontinued Operations夜晨曦No ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Comprehensive Exam QuestionsDocument33 pagesComprehensive Exam QuestionsTrisha Mae LandichoNo ratings yet

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- Conso Drill PDFDocument1 pageConso Drill PDFTk KimNo ratings yet

- Activity 7 - Equity InvestmentsDocument1 pageActivity 7 - Equity InvestmentsMa. Alexandra Teddy BuenNo ratings yet

- Noncurrent Asset Held For Sale Multiple Choice: A. B. C. DDocument5 pagesNoncurrent Asset Held For Sale Multiple Choice: A. B. C. Dlinkin soyNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Afar First TakeDocument14 pagesAfar First TakePau CaisipNo ratings yet

- ACTIVITY 4 - NCA Held For SaleDocument3 pagesACTIVITY 4 - NCA Held For SaleEstiloNo ratings yet

- Print q3 Nca Held For Salediscontinued Operation Accounting ChangeDocument4 pagesPrint q3 Nca Held For Salediscontinued Operation Accounting ChangeJenelle Acedillo ReyesNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity SecuritiesNicole Galnayon100% (1)

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- Handout in Financial AssetsDocument4 pagesHandout in Financial AssetsMicaella GrandeNo ratings yet

- SynthesisDocument19 pagesSynthesisMej AgaoNo ratings yet

- Quiz # 4 Cash & InventoryDocument1 pageQuiz # 4 Cash & InventoryChristine CarmonaNo ratings yet

- Module 1 Quiz 2Document3 pagesModule 1 Quiz 2Jm BalessNo ratings yet

- Equity and Debt Investment On Securities ProblemsDocument5 pagesEquity and Debt Investment On Securities ProblemsPepperNo ratings yet

- The Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.Document6 pagesThe Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.JamesNo ratings yet

- Intermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Document2 pagesIntermediateaccounting2 Debt Investments - Fafvoci 793 1665904389Annie MalinaoNo ratings yet

- Chapter 6 Noncurrent Asset Held For SaleDocument6 pagesChapter 6 Noncurrent Asset Held For SaleCarrie DangNo ratings yet

- Quiz 4Document3 pagesQuiz 4Christine CarmonaNo ratings yet

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersDocument21 pagesAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- Finals Q1 - Investment in Equity PDFDocument4 pagesFinals Q1 - Investment in Equity PDFCzerielle QueensNo ratings yet

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)MABI ESPENIDONo ratings yet

- FAR - Learning Assessment 2 - For PostingDocument6 pagesFAR - Learning Assessment 2 - For PostingDarlene JacaNo ratings yet

- True or False: - Write True If The Statement Is Correct. Otherwise, Write FalseDocument3 pagesTrue or False: - Write True If The Statement Is Correct. Otherwise, Write FalseElaine Joyce GarciaNo ratings yet

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- Scholarships ExamDocument9 pagesScholarships ExamShikhar GuptaNo ratings yet

- 123projectlab - Com - 228 Loan Management System ProjectDocument10 pages123projectlab - Com - 228 Loan Management System ProjectArockiasamy ArockiamNo ratings yet

- Surah Humazah (104) - Dream Notes: (Original Talk by Nouman Ali Khan:)Document20 pagesSurah Humazah (104) - Dream Notes: (Original Talk by Nouman Ali Khan:)HARSHITHANo ratings yet

- Bank of Scotland Turriff Branch PosterDocument4 pagesBank of Scotland Turriff Branch PosterMy TurriffNo ratings yet

- Amco Republic of Resubmitted Decision: Indonesia: Case On JurisdictionDocument13 pagesAmco Republic of Resubmitted Decision: Indonesia: Case On JurisdictionKylie Kaur Manalon DadoNo ratings yet

- Homework: I. Questions For ReviewDocument16 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Registration of Engineers Regulations 1990: Lembaga Jurutera MalaysiaDocument21 pagesRegistration of Engineers Regulations 1990: Lembaga Jurutera MalaysiaDavid LimNo ratings yet

- Form 7 Managers Charge ReportDocument3 pagesForm 7 Managers Charge ReportSafety Bharatpur OCPNo ratings yet

- Mention The Point-Based Immigration Systems Canada AustraliaDocument1 pageMention The Point-Based Immigration Systems Canada AustraliaRishi PinjaniNo ratings yet

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Ar JayNo ratings yet

- SHODAN - Computer Search EngineDocument3 pagesSHODAN - Computer Search Engineleo_valenNo ratings yet

- Brigada Eskwela Certificate of AppreciationDocument5 pagesBrigada Eskwela Certificate of AppreciationFatima Jane DaquizNo ratings yet

- Overview of Coast Guard Drug and Migrant Interdiction: HearingDocument90 pagesOverview of Coast Guard Drug and Migrant Interdiction: HearingScribd Government DocsNo ratings yet

- CUETPGAdmitCard 243510266618Document2 pagesCUETPGAdmitCard 243510266618Manasi singhNo ratings yet

- Referee SignalsDocument5 pagesReferee SignalsArdenz Emrey LagascaNo ratings yet

- Procurement - Oracle R12 AP-PO Changes OverviewDocument49 pagesProcurement - Oracle R12 AP-PO Changes OverviewKiran KumarNo ratings yet

- NZ Coast Guard MOSS Module (Maritime Operator Safety System)Document6 pagesNZ Coast Guard MOSS Module (Maritime Operator Safety System)alejoNo ratings yet